Market overview

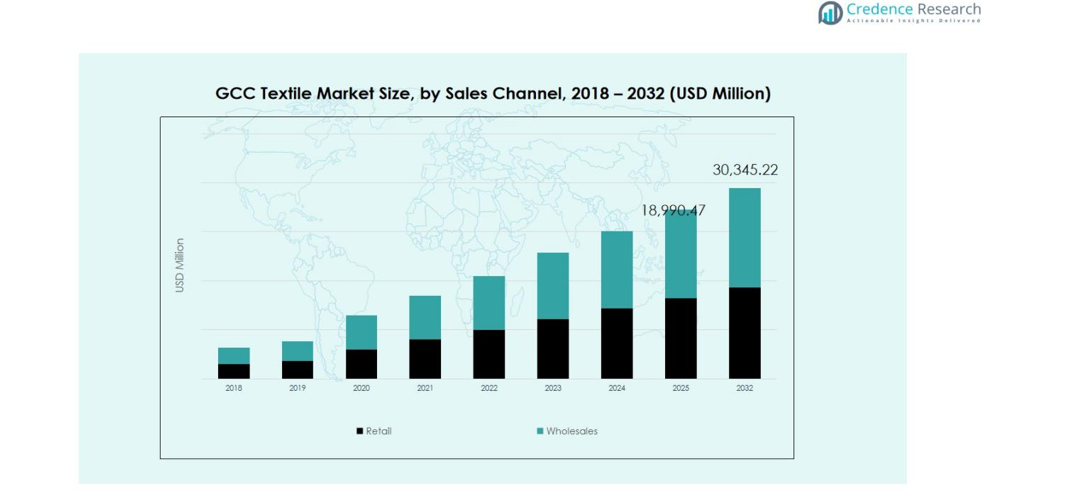

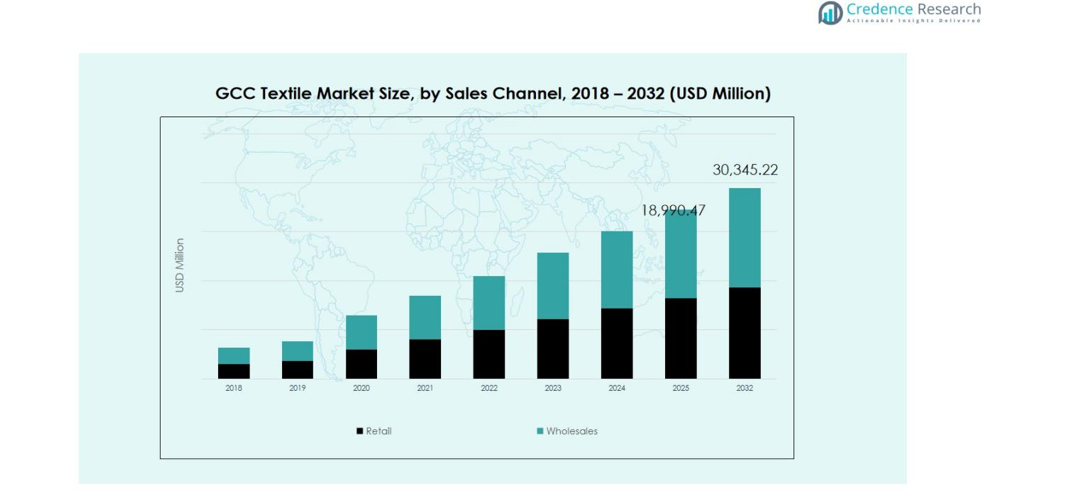

The GCC Textile Market was valued at USD 11,767.9 million in 2018 and is projected to reach USD 17,777.2 million by 2024, growing at a CAGR of 6.92%. It is expected to continue its growth trajectory, reaching USD 30,345.2 million by 2032 during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| GCC Textile Market Size 2024 |

USD 17,777.2 million |

| GCC Textile Market, CAGR |

6.92% |

| GCC Textile Market Size 2032 |

USD 30,345.2 million |

The GCC Textile Market is marked by robust leadership from companies such as Ajlan & Bros, FPC Industrial Co., Al‑Khaleej Textile Co. and Pearl Global Industries, each actively expanding production capacities and innovating their product offerings. The region’s most dominant market is Saudi Arabia with a share of 33.5 %, followed by the United Arab Emirates at 29.2 %. These leading companies leverage regional leadership and the favourable conditions in these two countries to capture high volumes, scale operations, and steer the textile market’s growth across the GCC.

Market Insights

- The GCC Textile Market is valued at USD 17,777.2 million in 2024 and is expected to reach USD 30,345.2 million by 2032, growing at a CAGR of 6.92% during the forecast period.

- The demand for sustainable and eco-friendly textiles is a major driver, with increasing consumer preference for organic and recycled materials.

- Technological advancements in textile production, such as automated weaving and digital printing, are reshaping the market by improving efficiency and quality.

- The UAE and Saudi Arabia lead the market with shares of 29.2% and 33.5%, respectively, driven by strong retail sectors, growing fashion trends, and increasing investments in local manufacturing.

- Raw material cost fluctuations and intense competition from low-cost textile-producing countries pose significant challenges to the region’s textile manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

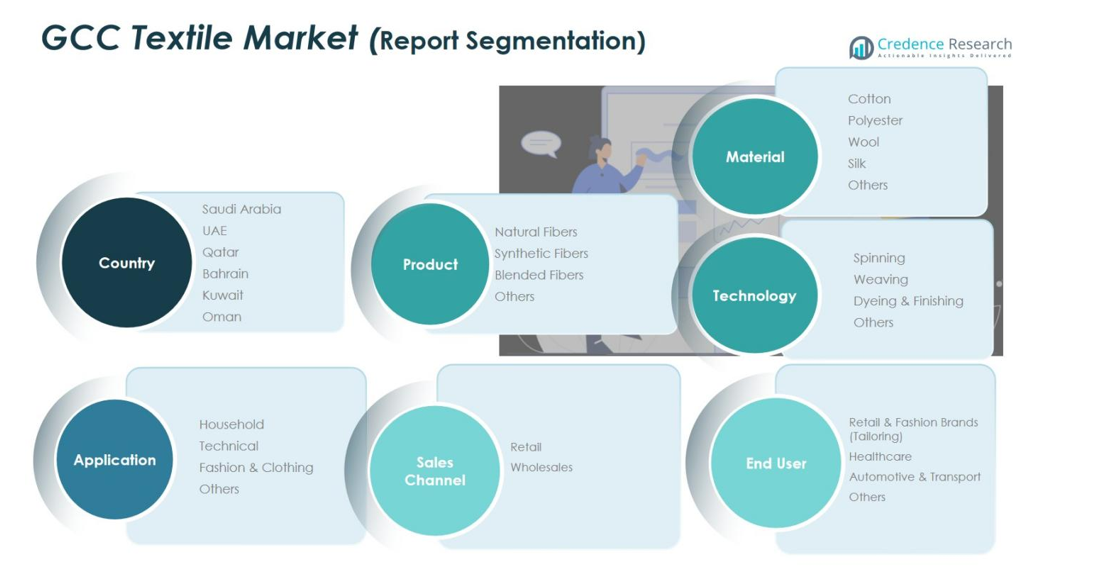

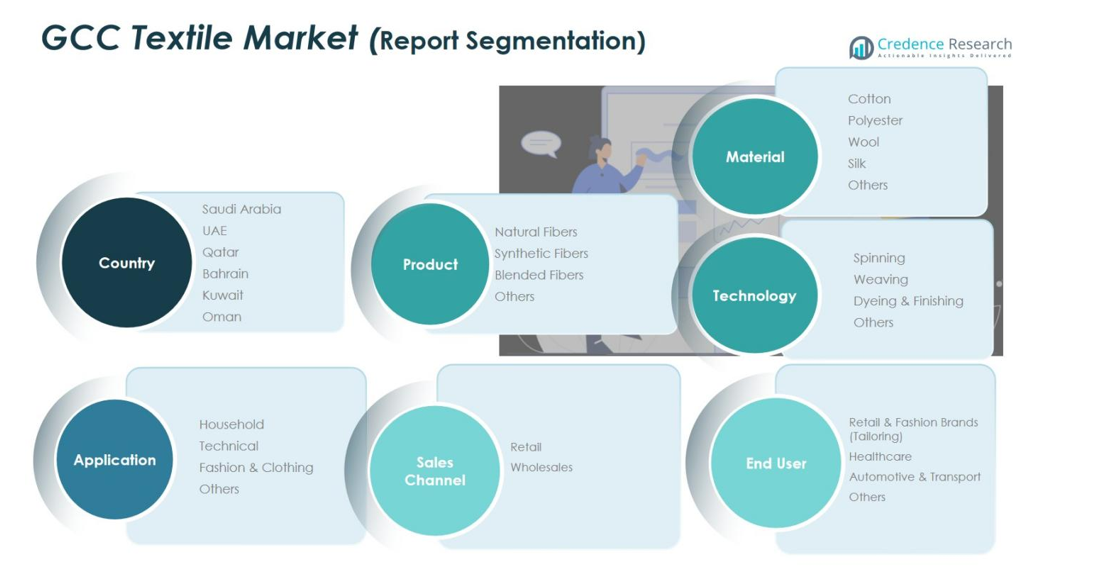

Market Segmentation Analysis:

By Product Type:

In the GCC Textile Market, the Synthetic Fibers segment holds the largest share, commanding 45.3% of the market. Synthetic fibers, such as polyester and nylon, are extensively used due to their durability, cost-effectiveness, and versatile applications in various textile products. The Natural Fibers segment follows with a 34.1% market share, driven by the rising consumer demand for eco-friendly and sustainable materials. Blended Fibers hold 17.6%, as they combine the benefits of both natural and synthetic fibers, catering to a broad range of applications. Others contribute the remaining 3% share, which includes innovative fiber types.

- For instance, Saudi Basic Industries Corporation (SABIC), a leading petrochemical company in Saudi Arabia, is a key producer of synthetic fibers, leveraging its strong petrochemical integration to supply polyester fibers widely used in the GCC textile industry.

By Technology:

The Spinning technology segment leads the GCC Textile Market with a dominant market share of 38.7%. This technology is crucial for converting raw fibers into yarn, which forms the foundation for textile production, especially in the production of synthetic and natural fibers. Weaving follows with a 29.4% share, playing a critical role in fabric production for various applications. The Dyeing & Finishing segment accounts for 23.5%, as it adds value to fabrics, enhancing color, texture, and performance. Others hold the remaining 8.4% share, representing less common techniques.

- For instance, Huntsman Corporation supplies eco-friendly reactive dyes and digital finishing chemicals to textile processors in the UAE to support sustainable coloration processes.

By Application:

The Fashion & Clothing segment holds the largest share of the GCC Textile Market at 51.2%, driven by the growing demand for diverse and trendy apparel in the region. This segment benefits from both domestic consumption and the regional fashion industry’s expansion. The Household application segment follows with 30.6%, fueled by the continuous demand for textile products in bedding, curtains, and home décor. The Technical segment, with a 14.5% market share, is expanding due to increasing demand for textiles used in automotive, medical, and industrial applications. Others contribute the remaining 3.7%, encompassing niche applications.

Key Growth Drivers

Increasing Demand for Sustainable Textiles

One of the major growth drivers in the GCC Textile Market is the rising consumer preference for sustainable and eco-friendly textiles. As environmental awareness grows, there is a significant shift towards materials that are biodegradable, recyclable, or made from natural fibers. This trend is further supported by government initiatives promoting green practices and sustainable manufacturing processes. The demand for organic cotton, recycled polyester, and other environmentally friendly materials continues to rise, driving growth within the natural fibers segment and leading to the adoption of green technologies in production.

- For instance, the Austrian company Lenzing produces Tencel fibers derived from sustainably sourced wood pulp, known for their eco-friendly and biodegradable properties.

Technological Advancements in Textile Production

The GCC textile industry is witnessing rapid advancements in textile production technologies, which significantly enhance production efficiency and fabric quality. Innovations such as automated weaving, advanced dyeing techniques, and smart textiles are revolutionizing the sector. These technologies enable manufacturers to produce high-quality fabrics at lower costs while meeting increasing consumer expectations for durability, functionality, and customization. The rise of digital printing and IoT applications for textile monitoring also contributes to growth, as they improve design processes and enable faster turnaround times for products.

- For instance, the adoption of automated weaving technology with computerized machine control has increased machine speeds up to 1000 revolutions per minute and enabled faster style changes, resulting in higher productivity and consistent fabric quality.

Growing Demand for Fashion & Clothing

The fashion and clothing sector continues to be a primary growth driver in the GCC Textile Market, accounting for a substantial share of overall textile consumption. This is due to a thriving fashion industry supported by a large population, rapid urbanization, and a burgeoning middle class in the region. Fashion-conscious consumers seek a wide range of apparel, including luxury and ready-to-wear options, fueling demand for diverse fabrics. The increase in regional and international fashion events further boosts market growth, making the GCC a hub for textile production and retail.

Key Trends & Opportunities

Shift Toward Smart and Technical Textiles

There is an emerging trend in the GCC Textile Market towards the development and adoption of smart textiles and technical textiles. These fabrics, embedded with advanced technologies such as sensors, conductive materials, and integrated electronics, are finding applications in sectors like healthcare, automotive, and defense. The growing demand for wearables, including health-monitoring garments, smart uniforms, and protective clothing, presents significant opportunities for textile manufacturers to innovate and diversify. As these textiles gain traction, they are expected to drive growth in the technical segment of the market.

- For instance, AiQ Smart Clothing Inc. develops smart garments integrated with conductive textile cables for health monitoring and sports performance, catering to growing markets in the GCC and beyond.

Expansion of E-commerce in Textile Sales

E-commerce has emerged as a key opportunity for the GCC Textile Market, particularly as more consumers shift to online shopping for apparel and home textiles. The convenience, variety, and personalized shopping experiences offered by e-commerce platforms make them highly attractive to the region’s digitally savvy consumers. Textile companies are increasingly leveraging online channels to reach a wider audience, expand their market presence, and offer customized products. The growth of online retailing, coupled with advancements in digital marketing, is expected to further accelerate the sales of textile products across the GCC.

- For instance, Beyoung, an Indian fashion brand, partnered with Noon.com in November 2024 to enter the GCC online market, focusing on affordable premium fashion tailored to the UAE’s consumer base.

Key Challenges

Rising Raw Material Costs

A significant challenge faced by the GCC Textile Market is the fluctuation in the cost of raw materials, particularly synthetic fibers and cotton. As global supply chains face disruptions and the cost of key materials rises, manufacturers in the region are experiencing pressure on their profit margins. This issue is exacerbated by the volatility in international commodity prices, which affects not only the cost of production but also the competitiveness of GCC textile products in the global market. Companies need to adopt cost-efficient production techniques to manage this challenge.

Intense Competition from Low-Cost Markets

The GCC Textile Market faces stiff competition from low-cost textile manufacturing countries such as China, India, and Bangladesh. These regions have the advantage of lower labor costs, which enables them to produce textiles at competitive prices. As a result, GCC textile companies must focus on differentiating their products through quality, innovation, and sustainable practices to maintain a competitive edge. Additionally, trade barriers, tariffs, and fluctuations in exchange rates further complicate the market environment for regional manufacturers.

Regional Analysis

Saudi Arabia

Saudi Arabia dominates the GCC Textile Market with a market share of 33.5%. The country benefits from its large population, strong economic growth, and rising disposable incomes, leading to an increased demand for textiles across various sectors. The fashion and clothing segment, in particular, drives substantial demand, supported by the country’s vibrant retail landscape and large fashion events. Additionally, Saudi Arabia’s initiatives to diversify its economy, including the development of its manufacturing sector, are boosting textile production capabilities, making it a key player in the regional market.

United Arab Emirates (UAE)

The UAE holds a 29.2% share of the GCC Textile Market, emerging as a major textile hub due to its strategic location as a trade and logistics center. The UAE is recognized for its luxury fashion sector, fueling demand for high-end textile products. Additionally, the country’s growing e-commerce sector plays a significant role in market expansion, with more consumers opting for online textile purchases. The UAE’s commitment to innovation and adoption of new textile technologies is further boosting the production of technical textiles and smart fabrics, driving the country’s textile sector growth.

Kuwait

Kuwait accounts for 12.4% of the GCC Textile Market. The country’s well-established retail infrastructure and strong purchasing power contribute significantly to its market share. The demand for textiles in Kuwait is predominantly driven by fashion and clothing applications, with an increasing preference for high-quality, luxury products. Additionally, Kuwait’s government has been investing in infrastructure development, which supports the textile industry. The growing interest in sustainability and eco-friendly products in the country is expected to further boost the demand for organic and natural fibers in the coming years.

Qatar

Qatar holds an 8.6% share of the GCC Textile Market. The country benefits from rapid economic development, particularly due to its booming construction and infrastructure sectors, which drive demand for textiles used in technical and industrial applications. Fashion and household textiles are also significant contributors to the market, with rising consumer demand for high-quality, luxury products. The growing popularity of e-commerce in Qatar is expected to enhance market dynamics, providing opportunities for textile companies to expand their digital presence and reach a broader consumer base.

Oman

Oman captures a 7.1% share of the GCC Textile Market. The country’s textile demand is driven by both household and fashion applications. With its strong tourism and retail sectors, Oman has seen a steady increase in textile consumption, especially in clothing and home décor. The Omani government’s initiatives to diversify its economy and promote manufacturing are creating favorable conditions for the textile industry. Additionally, Oman’s focus on sustainability and the growing interest in eco-friendly products align with the increasing demand for natural fibers and sustainable textiles, contributing to market growth.

Bahrain

Bahrain accounts for 5.5% of the GCC Textile Market. The country’s market growth is fueled by its established retail sector and growing interest in fashion and clothing. Bahrain’s small yet affluent population, along with its strategic location, allows it to serve as a significant consumer market for high-quality textiles. Additionally, the country’s commitment to economic diversification and increasing investments in manufacturing sectors is positively influencing the textile market. The rising demand for eco-friendly textiles and sustainable practices is also expected to drive growth in Bahrain’s textile industry in the coming years.

Market Segmentations:

By Product Type

- Natural Fibers

- Synthetic Fibers

- Blended Fibers

- Others

By Technology

- Spinning

- Weaving

- Dyeing & Finishing

- Others

By Application

- Household

- Technical

- Fashion & Clothing

- Others

By Sales Channel Type

By End User

- Retail & Fashion Brands (Tailoring)

- Healthcare

- Automotive & Transport

- Others

By Material

- Cotton

- Polyester

- Wool

- Silk

- Others

By Geography

- Saudi Arabia

- Oman

- Kuwait

- UAE

- Bahrain

- Qatar

Competitive Landscape

The GCC Textile Market is highly competitive, with major players such as Ajlan & Bros, FPC Industrial Co., Al-Khaleej Textile Co., and Pearl Global Industries leading the way. These companies dominate the market by leveraging advanced manufacturing technologies, broad product portfolios, and strong brand recognition. The market is characterized by a mix of established local players and international textile companies, both of which are expanding their presence in the region. Companies are focusing on product innovation, particularly in the areas of sustainable and eco-friendly textiles, as consumers demand more sustainable options. Additionally, the growing e-commerce segment has prompted several companies to invest in digital transformation to reach wider consumer bases. Key players are also exploring partnerships and joint ventures to expand their production capacities and access new markets. With the region’s increasing demand for high-quality, fashionable, and technical textiles, competition is expected to intensify as companies strive to meet evolving consumer needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ajlan & Bros

- FPC Industrial Co.

- Al-Khaleej Textile Co.

- Pearl Global Industries

- AMCO Apparel Manufacturing Company

- Sirus

- Oman Textile Mills LLC

- Fabriclore

- The ODD Factory

- Rk Garment

- Other Key Players

Recent Developments

- In March 2025, Apparel Group opened the region’s first mono‑branded store of BCBG at The Avenues Mall in Bahrain, marking a strategic expansion in the GCC textile and apparel retail sector.

- In November 2025, KAST GmbH & Co. (Germany) and Khalifa A. Abdulrahman Algosaibi Investment Company (Saudi Arabia) announced a joint venture to establish KAST W.L.L. in Bahrain, aimed at producing advanced reinforcing technical textiles for construction and industrial applications.

- In November 2025, the Fashion Commission announced the launch of “Saudi Fabric of the Future: Sustainability, Innovation and Investment” in collaboration with Collateral Good, IE University and Proaltus Capital Partners, set to take place at Misk City in Riyadh on 25 November 2025.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Application, Sales Channel Type, End User, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The GCC Textile Market is expected to experience steady growth driven by the increasing demand for sustainable and eco-friendly textiles.

- Technological advancements in textile production, including automation and digital printing, will continue to enhance manufacturing efficiency and product quality.

- The fashion and clothing segment will remain the dominant driver, with a growing preference for luxury and high-quality textile products.

- E-commerce will play a crucial role in market expansion, offering consumers more convenient access to textile products and personalized shopping experiences.

- The demand for smart textiles, including wearable technology and technical textiles, will grow as industries such as healthcare and automotive adopt advanced fabric solutions.

- The expansion of retail infrastructure and the rise of shopping malls in the GCC will support the growth of the textile market.

- Increasing interest in sustainable manufacturing practices will push companies to adopt green technologies and reduce environmental impact.

- The UAE and Saudi Arabia will continue to lead the market due to their large consumer bases and significant investments in the textile industry.

- Consumer trends focusing on comfort, durability, and versatility will drive demand for functional and high-performance textiles.

- Regional government initiatives to diversify the economy will result in increased investments in local textile production capabilities, supporting industry growth.