Market overview

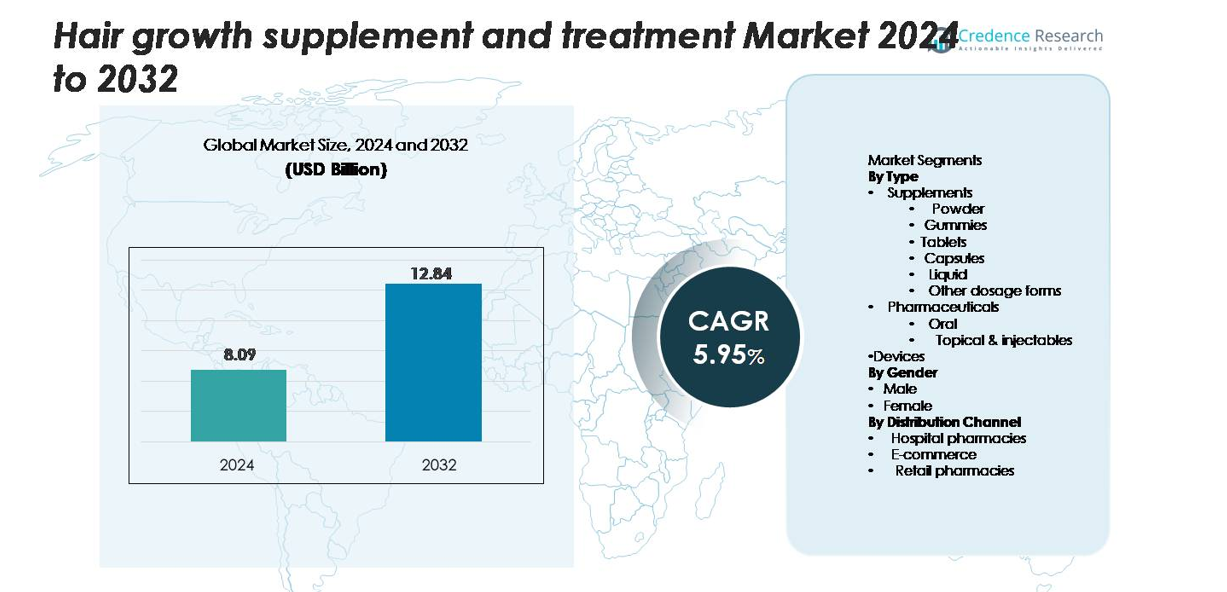

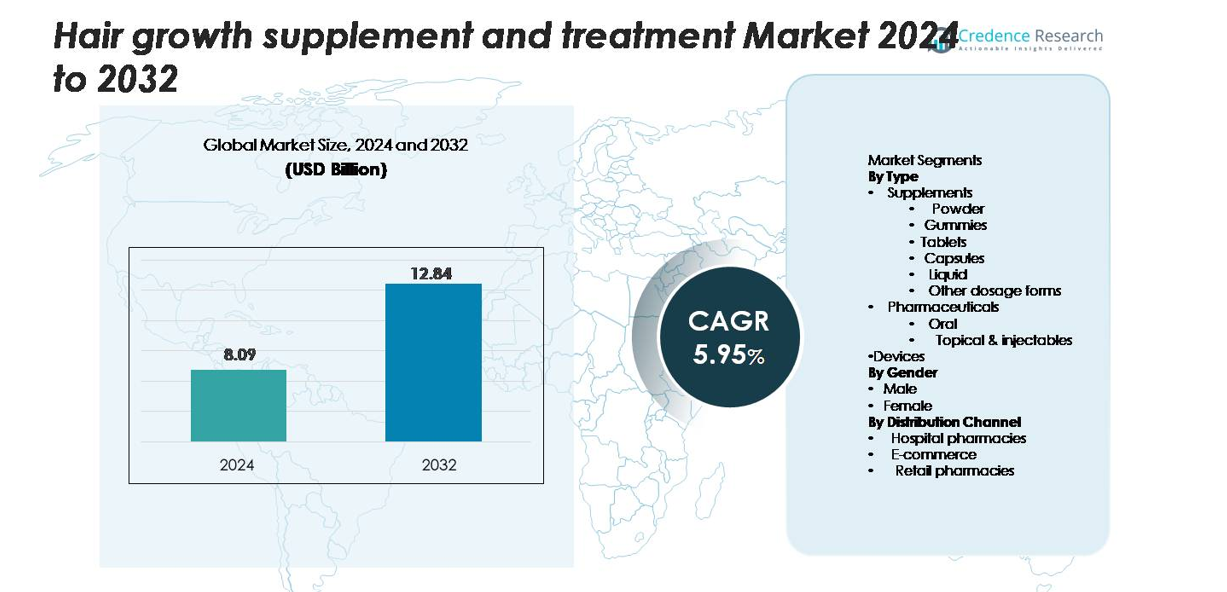

Hair Growth Supplements and Treatment Market size was valued at USD 8.09 billion in 2024 and is anticipated to reach USD 12.84 billion by 2032, at a CAGR of 5.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hair Growth Supplement and Treatment Market Size 2024 |

USD 8.09 billion |

| Hair Growth Supplement and Treatment Market, CAGR |

5.95% |

| Hair Growth Supplement and Treatment Market Size 2032 |

USD 12.84 billion |

The Hair Growth Supplement and Treatment market includes leading brands specializing in nutraceuticals, pharmaceuticals, and low-level laser devices. Major players focus on biotin gummies, collagen capsules, peptide serums, and dermatologist-recommended topical solutions to address thinning and pattern hair loss. Companies strengthen their position through clinical testing, influencer partnerships, and subscription-based delivery models. North America dominates the market with a 34% share, led by strong spending on premium hair wellness and easy access through e-commerce and pharmacy channels. Europe holds 27%, driven by high demand for clinically proven and clean-label formulas, while Asia Pacific expands rapidly due to rising urban hair loss and affordable online offerings.

Market Insights

- Hair growth supplement and treatment market size was valued at USD 8.09 billion in 2024 and is projected to reach USD 12.84 billion by 2032 at a CAGR of 5.95%.

- Rising hair fall linked to stress, hormonal imbalance, and nutritional deficiency drives demand for supplements, peptides, and scalp therapies across all age groups.

- Clean-label, vegan gummies and personalized treatment plans gain traction, while laser caps and topical serums show strong adoption through e-commerce.

- Competition intensifies as nutraceutical brands, pharmaceutical companies, and device manufacturers invest in clinical claims, influencer marketing, and subscription-based models.

- North America holds 34% share, followed by Europe at 27% and Asia Pacific at 23%, while supplements lead the type segment with 62% share, supported by growing preference for non-invasive solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

Supplements lead the Hair Growth Supplements and Treatment market with a market share of 62%, driven by rising preference for nutrition-based hair solutions. Gummies and capsules are the most popular dosage forms because they offer convenient intake and appealing flavors for daily use. Tablets and powders gain traction among consumers seeking targeted blends with vitamins, biotin, and collagen. Pharmaceutical solutions such as oral and topical formulations are used in cases of medical hair loss, while devices grow steadily due to laser-based scalp therapies. The dominance of supplements reflects strong consumer trust in nutraceutical approaches for non-invasive hair improvement.

- For instance, InVite Health formulates its Biotin 5000 µg capsules with a daily serving measured at 5 mg, and Cipla manufactures topical minoxidil solutions in concentrations of 2% and 5% for regulated medical treatment.

By Gender:

The female segment holds a market share of 58%, supported by higher demand for beauty-focused hair health products and increased prevalence of stress-related and hormonal hair thinning. Women frequently purchase supplements, serums, and laser-based home devices to manage breakage, alopecia, and postpartum hair loss. The male segment is expanding due to lifestyle changes and growing awareness of early-stage baldness treatment, including oral formulas and topical growth stimulants. Marketing campaigns targeting self-care and appearance enhancement also contribute to the rising adoption across both genders.

- For instance, Curallux markets the CapillusUltra cap with 82 medical-grade laser diodes designed for six-minute daily sessions, commonly recommended for female pattern hair loss.

By Distribution Channel:

Retail pharmacies dominate with a market share of 46%, as consumers prefer trusted outlets offering dermatologist-recommended products and prescription solutions. E-commerce is the fastest-growing channel, boosted by online health stores, direct-to-consumer brands, subscription packs, and social-media-driven marketing. Hospital pharmacies maintain relevance for pharmaceutical treatments and dermatologist-prescribed therapies, especially for clinical alopecia and post-chemotherapy hair loss. The shift toward digital purchasing, influencer promotions, and doorstep delivery continues to accelerate online demand across regions.

Key Growth Drivers

Growing Focus on Nutrition-Based Hair Health

Consumers now link hair strength to daily nutrition and inner wellness. This shift pushes demand for biotin, collagen, zinc, and herbal extracts inside gummies, capsules, and tablets. Brands promote clean-label, sugar-free, and allergen-free formulas to attract health-conscious buyers. Social media plays a major role, as influencers show “before-and-after” results and push monthly subscription packs. Many users repeat purchases because they view supplements as safe for long-term use. Clinics and dermatologists also recommend nutraceuticals to support hair regrowth alongside topical and oral therapies. Together, these factors make nutrition-based solutions the fastest-growing part of the market.

- For instance, InVite Health formulates its Biotin 5000 supplementation at a dosage of 5 mg per capsule, and the product is sold in 60-count bottles designed for a two-month daily regimen.

Rising Hair Loss Caused by Stress and Lifestyle Changes

Hair loss cases continue to increase across all age groups. Stress, pollution, chemical hair treatments, and nutrient-poor diets damage scalp health and slow regrowth. Men and women now seek early treatment, rather than waiting for visible baldness. This increases sales of preventive supplements, strengthening serums, and laser-based home devices. Demand also rises among young users who face hair thinning from fast lifestyles and hormonal imbalance. Clinics and online portals support growth by offering personalized regrowth plans and scalp tests. As awareness improves, more people treat hair loss as a wellness issue, not a cosmetic concern.

- For instance, Lexington International markets the Hairmax LaserBand 82 with 82 medical-grade lasers designed for treatment sessions lasting 90 seconds, and the device is cleared under FDA 510(k) K142573 for androgenetic alopecia.

Innovation in Topical and Device-Based Therapies

Advances in topical ingredients and device technology support strong market expansion. Scalp serums now include peptides, keratin boosters, and botanical actives for safe daily use. Dermatologists also adopt microneedling, PRP kits, and low-level laser therapy devices for faster results. Home-use laser caps and combs boost convenience because customers avoid frequent clinic visits. Many devices include smart sensors, usage reminders, and mobile apps that guide treatment routines. Clinics, salons, and pharmacies promote combined therapy plans, where supplements work with topical products and devices to improve outcomes. This multi-action approach drives adoption in advanced and emerging markets.

Key Trends & Opportunities

Shift Toward Clean, Vegan, and Plant-Based Formulas

Vegan gummies, plant oils, and cruelty-free serums expand quickly, especially among young buyers. Users prefer formulas without gluten, artificial colors, sulfates, or parabens. Herbal ingredients such as saw palmetto, pumpkin seed oil, and ashwagandha gain traction due to mild and natural action. Brands invest in clinical testing to prove safety and visible results. This trend opens strong opportunities for premium products made from natural ingredients and sustainable packaging.

- For instance, ExoCoBio’s ASCE+™ HRLV vial contains 10 billion exosomes per milliliter, delivered via its patented ExoSCRT™ isolation technology, packaged as a 20-mg lyophilized powder per vial.

Personalized Hair Treatment Plans and Subscription Models

Consumers now expect solutions made for age, gender, hair type, and medical condition. Online platforms offer digital scalp tests and recommend custom supplement packs or serum blends. Subscription delivery plans raise repeat purchases and customer retention. AI-based apps that track usage and show progress photos improve customer confidence. Companies that combine personalization with digital convenience gain a competitive edge.

- For instance, Nutrafol includes its “myNutrafol” digital dashboard bundled with subscriptions and delivers a 120-capsule bottle (4 capsules daily for 30 days) through monthly auto-refill.

Key Challenges

Limited Clinical Proof and Slow Results

Many supplements and serums take months to show visible improvement. Users often switch brands when results appear slow, reducing loyalty. Lack of strong clinical trials or dermatologist backing makes some shoppers doubt product claims. Counterfeit products sold online also reduce trust. Manufacturers need controlled studies, transparency in ingredient lists, and clear usage guidelines to overcome hesitancy.

High Cost of Premium Treatments and Devices

Laser caps, PRP kits, and advanced topical solutions can be costly, making them less accessible for price-sensitive buyers. Clinics charge high fees for repeated sessions, pushing customers to cheaper alternatives with weaker results. Insurance rarely covers hair loss treatment, even for medical cases. Companies that offer flexible pricing, installment plans, or budget product lines can tap a wider audience.

Regional Analysis

North America

The North America holds a market share of 34%, driven by high consumer spending on wellness and premium beauty products. The United States accounts for most revenue due to strong adoption of supplements, laser devices, and dermatologist-recommended topical solutions. Pharmacies, e-commerce platforms, and direct-to-consumer brands promote personalized plans, subscription packs, and clinical testing support. Rising stress-related hair loss among young adults also strengthens demand. Celebrity endorsements and social media marketing further accelerate product acceptance. Growing interest in vegan, clean-label, and sugar-free formulas positions North America as a leading market focused on science-backed and lifestyle-driven hair restoration.

Europe

Europe captures a market share of 27%, supported by high awareness of preventive hair care and strong regulatory standards for supplements and pharmaceuticals. Consumers prefer clinically tested, herbal, and cruelty-free formulations. Germany, the United Kingdom, France, and Italy drive demand for topical serums and oral biotin blends sold through pharmacies and dermatology clinics. Device-based treatments, including laser caps and scalp therapy tools, gain momentum due to rising salon and clinic adoption. Product innovation in botanical ingredients and sustainability strengthens brand value. The region continues to expand through e-commerce and controlled claims backed by clinical studies.

Asia Pacific

Asia Pacific holds a market share of 23%, emerging as the fastest-growing region due to rising urbanization, hair fall linked to pollution, and lifestyle stress. Consumers in China, Japan, South Korea, and India adopt supplements, botanically enriched oils, scalp tonics, and derma-roller devices. K-beauty brands promote peptide serums and herbal blends with strong marketing appeal. E-commerce platforms offer wide product access with competitive pricing, making online sales a major channel. The youth population drives grooming and preventive care usage. Increasing dermatologist clinics and salon-based treatments further support demand across developing cities.

Latin America

Latin America accounts for a market share of 9%, with Brazil and Mexico leading demand for affordable supplements, herbal oil blends, and salon-based maintenance treatments. High humidity, chemical hair treatments, and heat styling habits increase breakage, boosting preventive care usage. E-commerce adoption grows steadily, offering imported and local products at competitive prices. Brand expansion in vegan, sulfate-free, and clean formulas targets young consumers focused on natural beauty care. Clinics also promote PRP and vitamin therapy, though price sensitivity limits premium device adoption. Marketing through influencers and beauty retailers continues to strengthen market penetration.

Middle East & Africa

Middle East & Africa holds a market share of 7%, supported by rising grooming habits, urban lifestyles, and awareness of hair loss caused by heat, hard water, and scalp disorders. The Gulf region shows strong demand for premium serums, supplements, and dermatology-guided treatments. Retail pharmacies and online platforms expand product access, especially in Saudi Arabia and the UAE. In Africa, adoption grows for herbal oils and affordable supplement options. Clinics offering PRP, laser treatment, and mesotherapy expand in major cities. While spending remains lower than other regions, increasing awareness and product availability drive steady growth.

Market Segmentations:

By Type

- Supplements

- Powder

- Gummies

- Tablets

- Capsules

- Liquid

- Other dosage forms

- Pharmaceuticals

- Oral

- Topical & injectables

- Devices

By Gender

By Distribution Channel

- Hospital pharmacies

- E-commerce

- Retail pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Hair Growth Supplement and Treatment market features a mix of nutraceutical companies, pharmaceutical brands, and device manufacturers focusing on non-invasive solutions. Leading players invest in biotin-rich gummies, collagen capsules, peptide-based serums, and low-level laser devices to target thinning and pattern hair loss. Many brands promote clean-label, vegan, and clinically tested formulas to gain consumer trust. Dermatologist partnerships and subscription-based online sales strengthen customer retention, while influencers drive awareness across younger users. Pharmaceutical companies focus on topical and oral therapies for medical hair loss, supported by clinical evidence and prescription channels. Device manufacturers expand through home-use laser caps and combs that reduce clinic dependency. Companies also compete on personalization, offering digital scalp tests and customized treatment packs. Growing demand across global e-commerce platforms encourages aggressive product launches, regional expansion, and celebrity endorsements, creating a highly competitive and innovation-driven market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Merck & Co., Inc.

- EXOCOBIO

- Curallux, LLC

- Johnson & Johnson Services, Inc

- Lexington International, LLC (Hairmax)

- Cipla Inc.

- WON TECH Co., Ltd.

- Alma Lasers

- InVite Health

- iRestore Hair Growth System

Recent Developments

- In October 2025, Merck & Co., Inc. faces scrutiny for its long-standing hair-loss drug (finasteride/Propecia) amid a review linking the drug to mental-health risks, revealed.

- In November 2022, Curallux, LLC (under the Capillus brand) released the Capillus MD cap with 320 laser diodes, the most powerful home-use hair-restoration cap.

- In April 2022, EXOCOBIO announced the launch of ASCE+™ HRLV, an exosome-based scalp rejuvenation product for hair loss treatment.

Report Coverage

The research report offers an in-depth analysis based on Type, Gender, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise due to higher awareness of early-stage hair thinning across young adults.

- Brands will invest in clean-label, vegan, and plant-based formulas to attract health-focused buyers.

- Home-use laser devices will gain traction as users prefer non-invasive and clinic-free treatments.

- Personalized treatment plans and subscription models will improve customer retention.

- Digital scalp analysis and AI-driven progress tracking will enhance treatment accuracy.

- Dermatologist partnerships will support credibility and clinical adoption.

- E-commerce will continue to expand as online platforms promote global product access.

- Combined therapy using supplements, serums, and devices will deliver faster visible results.

- Product innovation will increase in peptides, herbal extracts, and microbiome-friendly serums.

- Emerging markets will show strong growth due to rising grooming habits and affordable product launches.