Market Overview

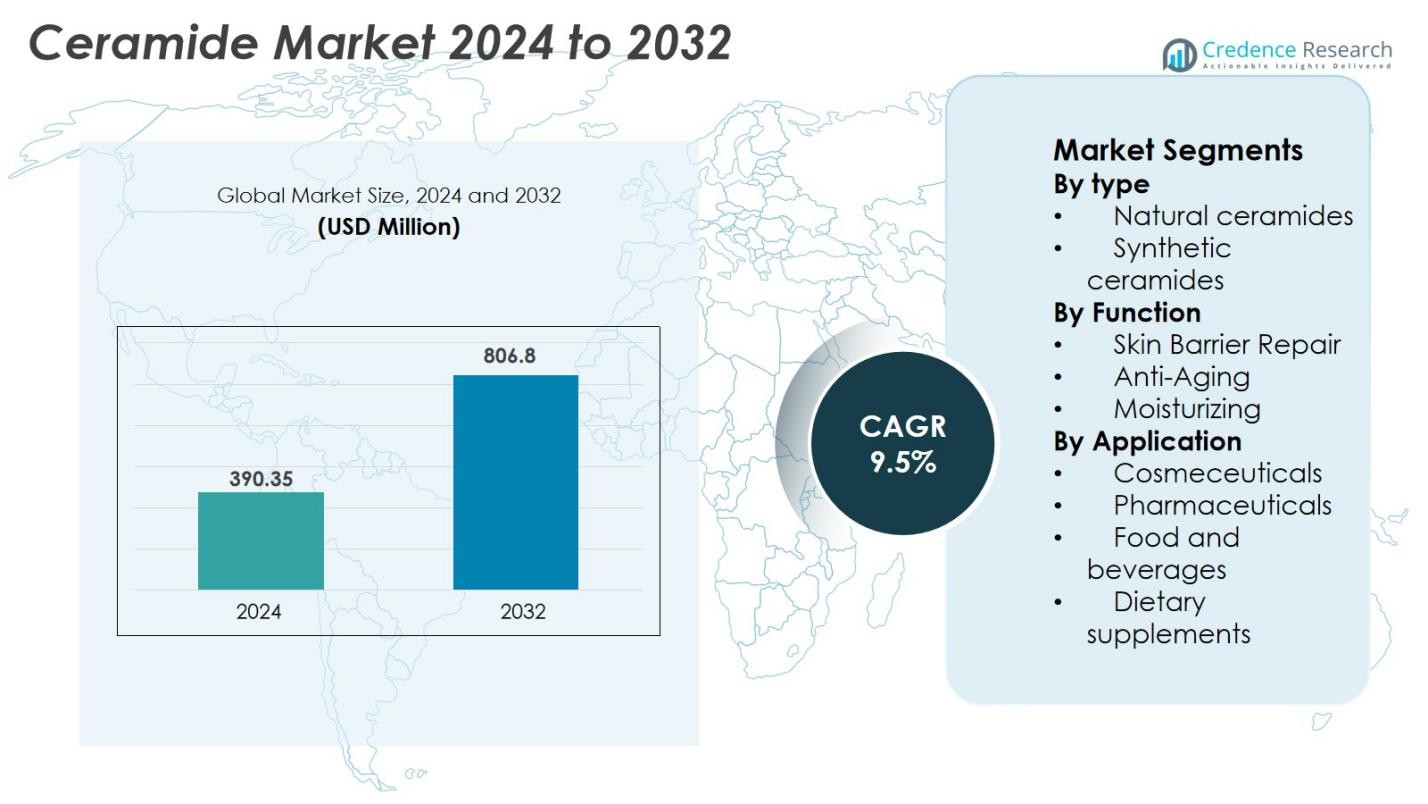

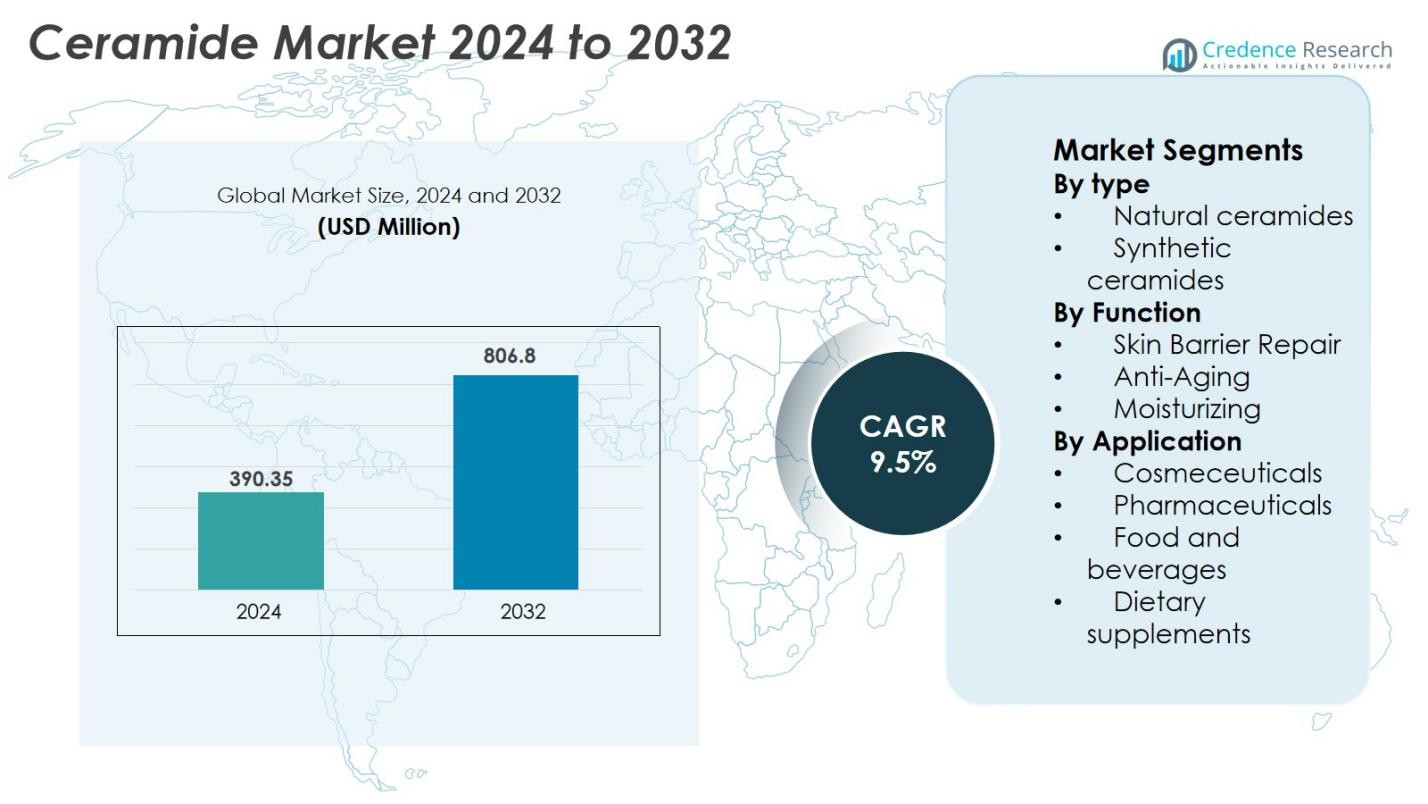

The Ceramide Market size was valued at USD 390.35 million in 2024 and is anticipated to reach USD 806.8 million by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ceramide Market Size 2024 |

USD 390.35 Million |

| Ceramide Market, CAGR |

9.5% |

| Ceramide Market Size 2032 |

USD 806.8 Million |

The Ceramide market features leading players including Evonik Industries AG and Croda International Plc, both recognised for their extensive product portfolios and innovation in natural and fermentation-derived ceramide formulations. Other key participants such as Ashland Global Holdings Inc., Doosan Corporation, TOYOBO Co., Ltd., Kao Corporation, Arkema S.A. and Vantage Specialty Chemicals also hold strategic positions. Regionally, the market is led by the Asia-Pacific region, commanding 38% of total market share, powered by rapid beauty and wellness growth across China, Japan and India. Increasing investments in advanced skin barrier repair solutions and rising demand for premium anti-aging products further amplify the region’s dominance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ceramide market was valued at USD 390.35 million in 2024 and is projected to reach USD 806.8 million by 2032, growing at a CAGR of 9.5% during the forecast period.

- Key market drivers include increasing consumer demand for skin health solutions, rising preference for natural and clean-label products, and advancements in ceramide production technologies.

- Trends such as personalized skincare solutions and the growing dietary supplement segment present significant opportunities, with ceramides gaining popularity for their skin benefits in both topical and oral forms.

- The market is competitive, with key players like Evonik Industries, Croda International, Ashland, and Kao Corporation, focusing on product innovation, sustainability, and regional expansion to capture market share.

- Regionally, Asia-Pacific leads the market with a share of 38%, followed by North America (30%) and Europe (22%), with cosmeceuticals dominating the largest application segment at 60%.

Market Segmentation Analysis

By Type

The Ceramide market is segmented into natural and synthetic ceramides. Natural ceramides dominate the market, accounting for 65% of the market share due to their high demand in the skincare and cosmetics industries. These ceramides are derived from natural sources like plants and animals, offering skin-repairing and moisturizing benefits. Synthetic ceramides are also growing in popularity, driven by their cost-effectiveness and ease of production. The increasing adoption of natural ceramides is largely driven by rising consumer preference for clean-label and plant-based products, which align with the demand for sustainable and organic formulations.

- For instance, Evonik Industries has made strides in bio‑fermentation technology to produce natural ceramides, achieving a higher yield and quality for their skincare applications, utilizing sustainable raw materials derived from natural oils.

By Function

The Ceramide market functions across three main categories: skin barrier repair, anti-aging, and moisturizing. The skin barrier repair segment holds the dominant share of around 45% of the market, driven by growing concerns about skin conditions such as eczema and dryness. This sub-segment benefits from ceramides’ ability to restore the skin’s natural protective barrier. The anti-aging function is also experiencing growth due to increasing consumer demand for age-defying solutions, capturing 35% of the market. Ceramides’ moisturizing properties continue to drive their usage in both personal care and medical applications, contributing to the remaining 20%.

- For instance, Evonik Industries has developed ceramide-based solutions that are particularly effective in restoring the skin’s natural barrier, supported by their advanced fermentation techniques that ensure product efficacy in treating compromised skin.

By Application

The Ceramide market’s application segment includes cosmeceuticals, pharmaceuticals, food and beverages, and dietary supplements. The cosmeceuticals segment holds the largest market share, around 60%, driven by the rising popularity of skincare products formulated with ceramides to promote skin health and restore moisture. The pharmaceuticals segment is expanding, capturing20% of the market, with ceramides being incorporated into treatments for various skin conditions. The growing demand for natural wellness products is fueling the use of ceramides in food, beverages, and supplements, which together hold the remaining 20% of the market share.

Key Growth Drivers

Rising Demand for Skin Health Solutions

The increasing awareness of the importance of skin health is one of the major growth drivers in the Ceramide market. Ceramides, known for their ability to restore the skin’s natural moisture barrier, are in high demand, particularly in the skincare and cosmeceuticals sectors. With a rising focus on protecting skin from environmental damage, the need for effective moisturizing and barrier-repair ingredients has skyrocketed. Ceramide-based products are particularly appealing due to their ability to treat dry skin, eczema, and other dermatological issues. As consumers become more educated about the importance of maintaining healthy skin, they are increasingly turning to products containing ceramides, which has fueled significant market growth.

- For instance, the Ordinary Soothing & Barrier Support Serum, which combines ceramides with niacinamide and vitamin B12 to calm irritated skin and strengthen the barrier, offering targeted relief for dryness and uneven texture.

Consumer Preference for Natural and Clean-label Products

A significant shift in consumer preferences toward natural and clean-label products has propelled the growth of natural ceramides in the market. With an increasing focus on sustainability and health-conscious living, consumers are demanding safer, eco-friendly products that align with their values. Natural ceramides, which are derived from plant-based or animal-derived sources, meet this demand by offering an ingredient that is both effective and aligned with natural beauty trends. This shift has driven manufacturers to innovate and develop ceramide formulations that are free from harmful additives and artificial chemicals, which further enhances their market appeal. The growing influence of clean beauty trends is leading to the rapid adoption of ceramides, not only in skincare products but also in dietary supplements and wellness solutions. The rising popularity of plant-based and sustainable ingredients is expected to continue to drive demand for natural ceramides across various applications.

- For instance, Evonik Industries has developed sustainable ceramide production processes using natural plant-based sources, aligning with the rising consumer demand for eco-friendly, clean-label skincare products.

Technological Advancements in Ceramide Production

The development of new production technologies has significantly contributed to the growth of the Ceramide market. As manufacturing techniques become more efficient and scalable, the cost of producing ceramides—especially synthetic ones—has decreased, making them more accessible to a broader range of consumers. Advancements in biotechnology have led to the creation of ceramides with enhanced stability and efficacy, allowing manufacturers to offer more powerful formulations that cater to various skincare needs, from anti-aging to moisture restoration. The integration of technologies such as fermentation and enzymatic processes has also enabled the production of ceramides in a more sustainable and environmentally friendly manner, which appeals to eco-conscious consumers. As these technological innovations continue to reduce production costs and increase product effectiveness, they are expected to drive substantial growth in both the skincare and pharmaceutical segments of the Ceramide market.

Key Trends & Opportunities

Rise of Personalized Skincare Solutions

Personalized skincare has become a major trend in the Ceramide market, driven by advances in consumer data and customized formulations. With the increasing availability of skin analysis tools and personalized skincare products, consumers are seeking more tailored solutions that address their specific skin concerns. Ceramides play a key role in these customized skincare regimens, as they are essential for repairing and maintaining the skin’s barrier function. The ability to offer personalized formulations with the right concentrations of ceramides allows brands to cater to individual skin types, whether it be dry, oily, sensitive, or aging skin. This trend is gaining traction as consumers seek products that cater to their unique needs, presenting a lucrative opportunity for ceramide manufacturers to innovate in the development of personalized skincare lines. Additionally, the rise of online platforms offering customized products further supports the growth of this trend.

- For instance, CeraVe has integrated its three essential ceramides (types 1, 3 and 6‑II) into formulations that employ its trademarked MultiVesicular Emulsion (MVE) delivery technology, offering sustained release of actives over 24 hours and allowing brands to tailor moisturizer routines based on individual skin barrier needs.

Growth of the Dietary Supplements Segment

As consumers become more health-conscious and interested in holistic wellness, the demand for ceramide-based dietary supplements is increasing. Ceramides, known for their skin benefits when applied topically, are also gaining attention for their potential to improve skin health when ingested. With growing interest in supplements that promote skin hydration, elasticity, and overall appearance, ceramides are becoming a popular ingredient in oral supplements. This trend is supported by the rising demand for functional foods and beverages, as well as the increasing awareness of the connection between diet and skin health. As more clinical studies highlight the benefits of ceramides in promoting skin wellness, the dietary supplements market offers a significant growth opportunity. The ability to market ceramides as a skin-health supplement, in combination with other complementary ingredients, can drive both new product development and sales in this segment.

- For instance, Evonik Industries is a global leader in producing highly effective, skin-identical ceramide ingredients primarily for topical cosmetic and personal care products (such as creams, lotions, and serums), not typically for oral ingestion as a dietary supplement.

Key Challenges

High Production Costs for Natural Ceramides

Despite the growing demand for natural ceramides, the production costs for these ingredients remain a significant challenge. Natural ceramides are more expensive to extract and refine compared to their synthetic counterparts, limiting their widespread use, particularly in mass-market products. The extraction process often involves sophisticated techniques, such as enzymatic conversion or plant-based extraction, which can be resource-intensive and costly. As a result, the high production costs of natural ceramides pose a barrier to manufacturers aiming to keep product prices competitive while ensuring high-quality formulations. This challenge is particularly pressing as the demand for natural and sustainable ingredients grows, pushing manufacturers to balance cost and quality.

Regulatory and Market Entry Barriers

Another key challenge in the Ceramide market is the complex regulatory environment, especially for new product formulations and market entry. The global regulatory landscape for skincare and pharmaceutical ingredients varies significantly across regions, which creates hurdles for companies looking to expand their product offerings internationally. In some markets, ceramide-based products must undergo extensive testing and approval processes to ensure they meet safety standards, particularly for use in pharmaceuticals and dietary supplements. This regulatory complexity can delay product launches and increase operational costs, especially for small and medium-sized enterprises that lack the resources to navigate these challenges.

Regional Analysis

North America

North America holds a sizeable portion of the ceramide market, estimated 30% of global revenue. The region benefits from high consumer awareness of skin‑health ingredients, mature cosmetic and pharmaceutical industries, and strong demand for premium formulations. Key drivers include an ageing population seeking anti‑aging solutions and well‑established dermatological channels. However, despite its strong base, growth is relatively moderate compared to emerging regions owing to market saturation and regulatory rigor.

Europe

Europe commands 22% of the global ceramide market. The region’s growth is underpinned by robust skincare markets in Western European nations, a strong tradition of dermocosmetics, and increasing environmental and clean‑label demands that favour natural ceramide formulations. Regulatory frameworks and high consumer standards support quality but also introduce complexity. Growth is steady, with innovation in plant‑derived ceramides and premium products shaping future expansion.

Asia‑Pacific

Asia‑Pacific is the largest regional market for ceramides, accounting for 38% of global share. Rapid growth stems from rising disposable incomes, increasing beauty and wellness awareness, thriving skincare routines, and strong manufacturing bases—especially in countries like China, Japan, South Korea and India. The region also benefits from early adoption of new formulations and a large younger demographic. As a result, Asia‑Pacific presents the most dynamic growth opportunity for ceramide suppliers and product innovators.

Latin America

Latin America contributes around 8% of the global ceramide market. Growth is driven by expanding beauty and personal‑care consumption, increasing awareness of skin‑health ingredients and improvement in distribution networks. However, economic volatility, variable regulatory environments, and lower per‑capita spend compared to developed markets temper overall growth. Nonetheless, the region offers incremental opportunities for mass‑market ceramide‑infused products.

Middle East & Africa

The Middle East & Africa region represents 6% of the global ceramide market. Growth is modest but improving, as rising beauty consciousness, younger populations and increased penetration of international skincare brands open new avenues. Infrastructure and regulatory frameworks are still catching up, and price sensitivity remains higher in many markets — factors that may limit rapid scaling. Nonetheless, premium segment growth and import of advanced formulations provide emerging potential.

Market Segmentations

By Type

- Natural ceramides

- Synthetic ceramides

By Function

- Skin Barrier Repair

- Anti-Aging

- Moisturizing

By Application

- Cosmeceuticals

- Pharmaceuticals

- Food and beverages

- Dietary supplements

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global Ceramide market is defined by a mix of well-established specialty chemical and ingredient suppliers and emerging niche players focusing on novel production techniques and sustainability credentials. Leading the field are Evonik Industries AG and Croda International Plc, which dominate the market thanks to expansive product portfolios, global manufacturing footprints, and deep customer relationships. Other significant players include Ashland Global Holdings Inc., Kao Corporation, Arkema S.A., Doosan Corporation, Vantage Specialty Chemicals, and TOYOBO Co., Ltd., each leveraging their niche strengths in raw materials, bio-based processes, or regional presence. These companies compete on multiple fronts, including innovation in fermentation- or plant-extract production of ceramides, purity, and bio-mimicry of the molecules, sustainable sourcing, and regional customer reach. Strategic actions such as mergers & acquisitions, partnerships with cosmetic and pharmaceutical OEMs, and investment in R&D to scale production and reduce costs are prevalent. As competition intensifies, manufacturers differentiate by delivering higher purity grades, tailored ceramide blends for specific skin or health functions, and certification of natural/clean-label status, thus positioning themselves to capture growth across personal care, pharmaceutical, and nutraceutical end-use markets.

Key Player Analysis

- Arkema

- Ashland

- Evonik Industries

- Vantage Specialty Chemicals

- Croda International Plc

- TOYOBO CO., LTD.

- Kao Corporation

- Doosan Corporation

- Mitsubishi Chemical Group Corporation

- Aurorium

Recent Developments

- In March 2025, Croda also unveiled Sphingo HAIR Drypure, a natural fermentation‑derived ceramide formulated for scalp barrier repair and hair care applications, reflecting growing interest in ceramide usage beyond skincare.

- In April 2025, Evonik introduced SKINLIPIX® HydraShield, a plant‑oil‑based ceramide stabilising system combining ceramides NP and NG with hydrators for skin barrier and moisture benefits.

- In April 2024, Syensqo completed the acquisition of JinYoung Bio, a South Korean specialist in biotech‑produced ceramides, expanding its renewable skincare ingredients portfolio.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Function, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The ceramide market is expected to grow significantly as demand for skin‑barrier repair and moisturizing formulations intensifies, particularly in both mature and emerging regions.

- Manufacturers will increasingly focus on developing plant‑derived and bioengineered ceramides to meet clean‑label and sustainable ingredient trends.

- Personalized skincare solutions that incorporate ceramides tailored to individual skin types will become more prevalent, increasing consumer engagement and premium pricing opportunities.

- Expansion into oral supplements and functional foods using ceramides will widen the range of applications beyond traditional cosmeceuticals, creating new revenue streams.

- Advances in production technology and fermentation processes will help reduce costs and improve supply chain scalability for ceramide ingredients.

- Partnerships between skincare brands and biopharma companies will accelerate development of ceramide‑based therapeutic formulations for dermatological and barrier‑related conditions.

- E‑commerce and direct‑to‑consumer channels will drive faster adoption in regions like Asia‑Pacific and Latin America, supported by digital marketing and ingredient transparency.

- Premiumization of skincare products featuring ceramides, especially in anti‑aging and sensitive‐skin segments, will bolster margins and brand differentiation.

- Regulatory harmonization and increased clinical validation of ceramide benefits will enhance trust and expand mainstream uptake across personal care and health sectors.

- Price pressure from synthetic alternatives and ingredient commoditization will challenge manufacturers, necessitating innovation and value‑added differentiation to sustain growth.