Market Overview:

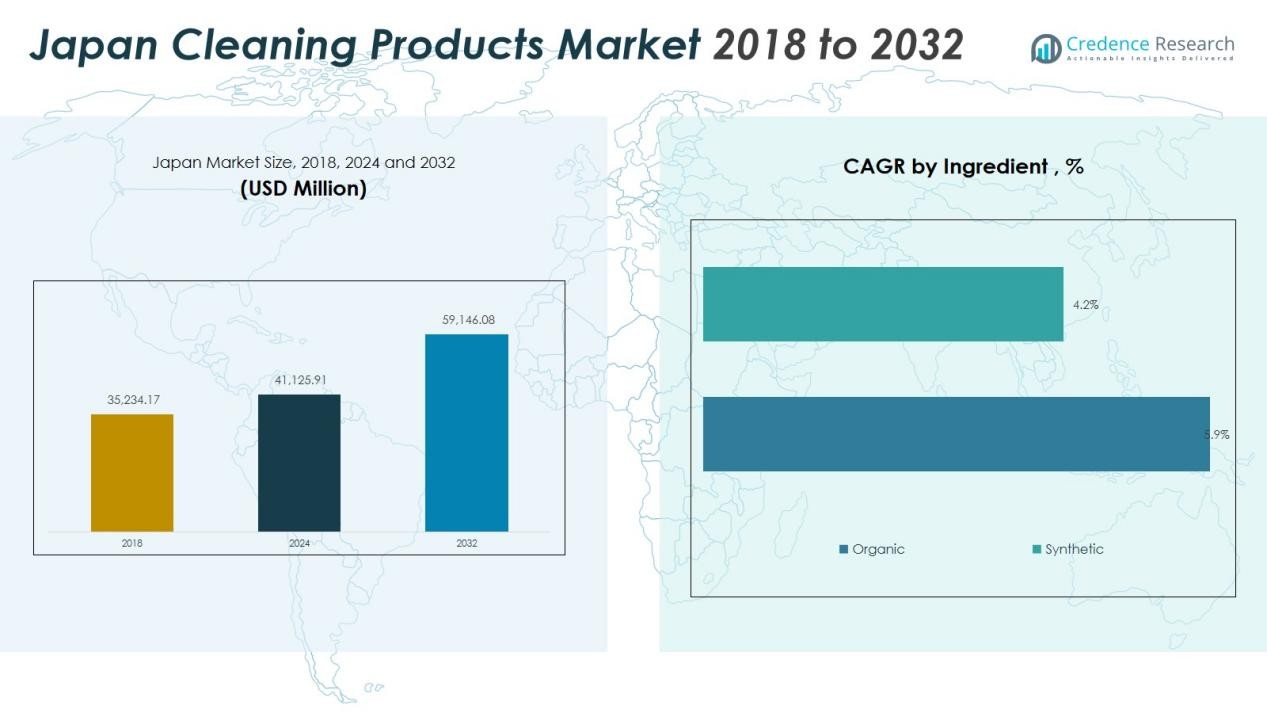

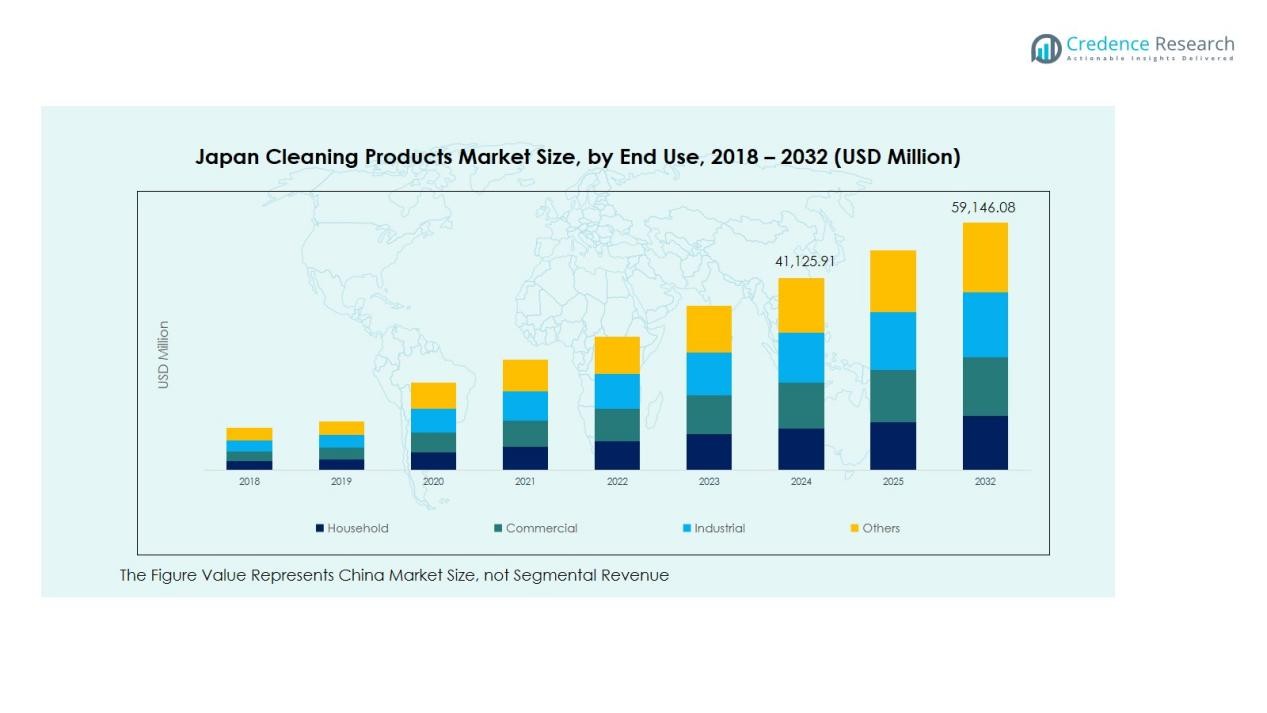

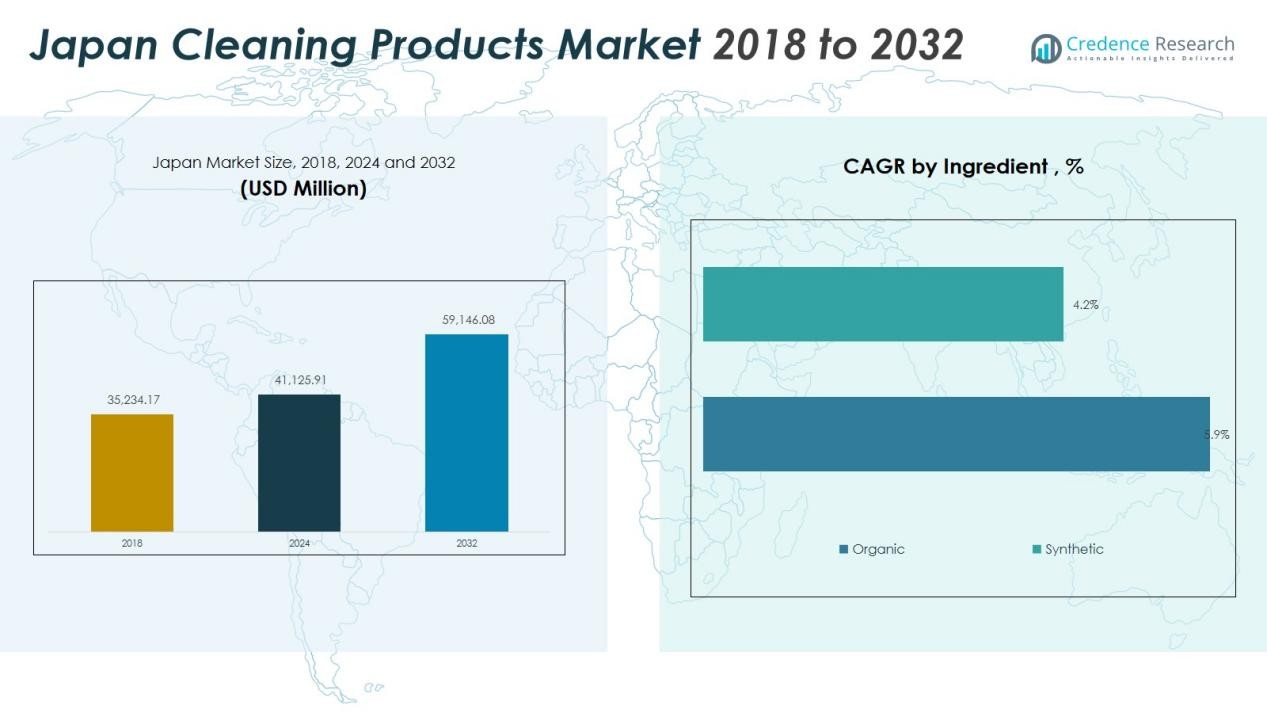

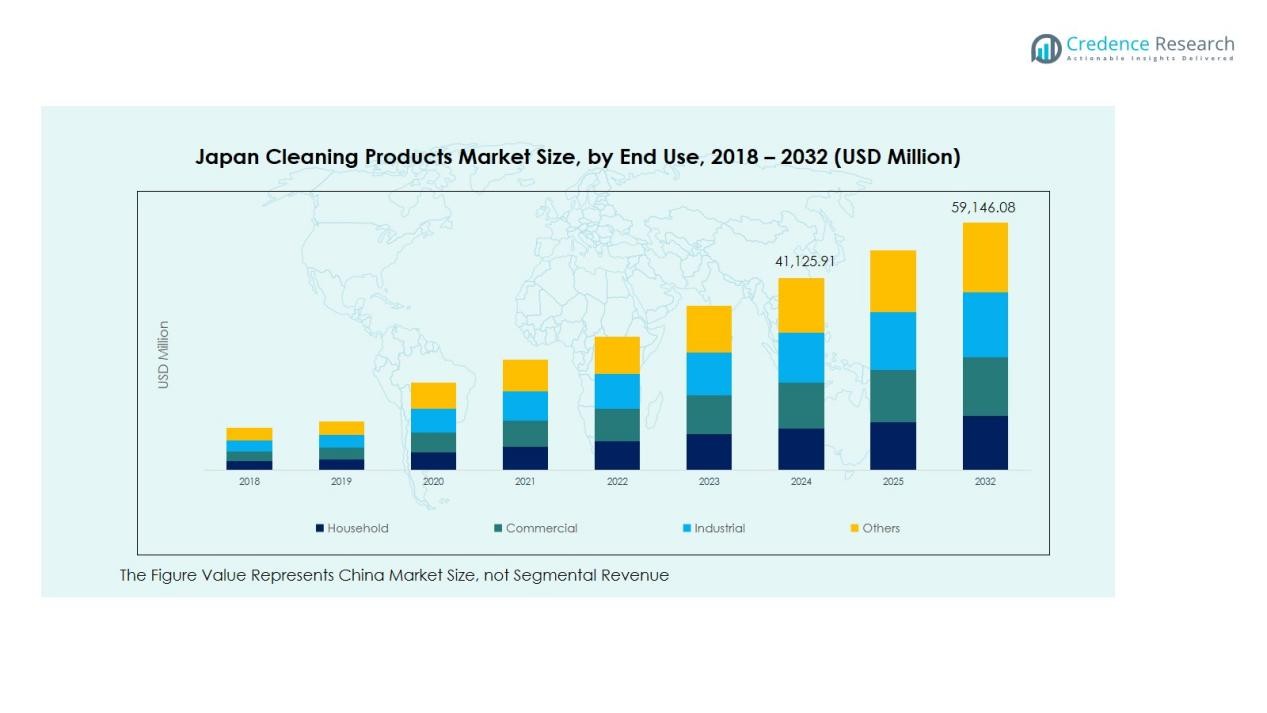

The Japan Cleaning Products Market size was valued at USD 35,234.17 million in 2018 to USD 41,125.91 million in 2024 and is anticipated to reach USD 59,146.08 million by 2032, at a CAGR of 4.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Cleaning Products Market Size 2024 |

USD 41,125.91 Million |

| Japan Cleaning Products Market, CAGR |

4.65% |

| Japan Cleaning Products Market Size 2032 |

USD 59,146.08 Million |

Key drivers shaping the market include heightened health consciousness, driven partly by post-pandemic habits and ongoing public focus on sanitation. The industry benefits from rapid innovation in biodegradable, low-chemical, and fragrance-free products, appealing to Japan’s environmentally conscious consumers. Demand for specialized cleaning agents for appliances, electronics, and high-touch surfaces also fuels growth. Strong penetration of e-commerce platforms enables wider product access, supporting premiumization and brand diversification across consumer segments.

Regionally, urban centers such as Tokyo, Osaka, and Yokohama lead market uptake due to dense populations, high disposable incomes, and faster adoption of advanced home-care technologies. Rural areas exhibit gradual growth as expanding retail infrastructure and rising awareness broaden product reach. Overall, Japan’s balanced regional distribution and mature retail landscape support sustained market growth across household and institutional cleaning categories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan Cleaning Products Market was valued at USD 41,125.91 million in 2024 and is projected to reach USD 59,146.08 million by 2032, expanding at a CAGR of 4.65%, driven by strong hygiene awareness and sustained demand for high-performance formulations.

- Tokyo accounts for approximately 28% of total sales, Osaka holds around 17%, and Yokohama captures nearly 11%, supported by dense populations, higher disposable incomes, and rapid adoption of premium and eco-friendly home-care solutions.

- The fastest-growing region is the suburban belt with an estimated 9% share, driven by rising family households, increasing retail penetration, and higher demand for cost-effective multifunctional cleaners.

- Surface cleaners lead the product type segment with close to 32% share, supported by daily-use demand and product innovation in antibacterial and low-chemical formulations.

- Household end-use dominates with nearly 58% share due to frequent cleaning routines and strong consumer preference for convenient, multifunctional cleaning solutions.

Market Drivers:

Rising Health and Hygiene Priorities

The Japan Cleaning Products Market gains strong momentum from heightened hygiene awareness. Consumers maintain strict cleaning habits due to long-standing cultural preferences for sanitation and reinforced public health guidelines. Demand rises for high-performance disinfectants, surface cleaners, and antibacterial solutions. Brands respond with advanced formulations that offer safety, convenience, and reliability.

- For instance, H. IKEUCHI & CO., LTD., a prominent Japanese manufacturer, launched the “Dry-Fog HIGHNOW” backpack disinfection device using patented nozzles to dispense disinfectant as dry fog droplets measuring 10 micrometers or less, significantly improving disinfectant coverage in various environments.

Shift Toward Eco-Conscious Household Solutions

Sustainability shapes purchasing decisions, and it drives product innovation across the industry. The market experiences a clear move toward biodegradable, plant-based, and low-chemical products. Consumers show interest in fragrance-free and sensitive-skin-friendly variants that reduce environmental impact. Companies invest in green chemistry and responsible packaging to strengthen brand loyalty.

- For instance, Solugen’s Bioforge technology, recognized by the EPA’s Green Chemistry Challenge Award in 2023, utilizes a first-of-its-kind manufacturing platform that converts plant-derived substances into essential materials. An independent life cycle analysis indicates this platform eliminates over 20 million pounds of hazardous chemicals and mitigates over 35,000 tons of CO2 equivalents annually compared to traditional facilities.

Growth in Convenience-Focused and Specialized Products

Urban lifestyles encourage the adoption of fast-acting and multifunctional cleaning solutions. The Japan Cleaning Products Market sees rising demand for products designed for appliances, electronics, and high-touch surfaces. It supports growth for wipes, spray-based cleaners, and compact formats that deliver efficiency. Manufacturers introduce smart dispensing systems to improve user experience and reduce waste.

Expansion of Digital Retail and Premium Product Adoption

Online retail plays a key role in reshaping consumer access to home-care products. E-commerce platforms enable wider assortment, quick delivery, and price transparency. The market benefits from increased interest in premium, high-efficiency cleaning solutions supported by targeted digital marketing. It encourages stronger competition among brands and expands opportunities for niche and value-added product lines.

Market Trends:

Growing Preference for Sustainable, Low-Chemical, and Functional Cleaning Solutions

The Japan Cleaning Products Market reflects a strong shift toward eco-friendly and health-conscious formulations. Consumers increasingly seek plant-based, biodegradable, and low-VOC products that align with strict environmental values. It supports wider adoption of fragrance-free and sensitive-skin-safe solutions, especially among families and aging populations. Brands introduce concentrated liquids, refill packs, and reduced-plastic formats to meet sustainability goals. Innovation in antibacterial and antiviral capabilities strengthens product appeal in households and commercial facilities. Companies enhance transparency by highlighting ingredient safety and product certifications. Demand continues to rise for multifunctional cleaners that reduce effort while maintaining high hygiene standards.

- For Instance, Kao Corporation has introduced concentrated laundry detergents, such as the Attack ZERO line and the solid stick detergent Attack ZERO Perfect Stick, as part of its commitment to sustainability. The company aims to reduce plastic waste by offering numerous refillable products, which constitute approximately 80% of its lineup in Japan.

Rapid Acceleration of Premiumization, Digital Retail, and Technology-Driven Products

A clear trend toward premium and specialized solutions shapes the competitive landscape. The Japan Cleaning Products Market benefits from rising interest in smart dispensing systems, high-efficiency sprays, and appliance-specific cleaners. It encourages manufacturers to develop targeted solutions for electronics, kitchens, and bathrooms with advanced stain-removal and deodorizing performance. E-commerce platforms accelerate product discovery and expand access to niche and imported brands. Online reviews influence consumer choices and reinforce trust in premium offerings. Subscription models gain traction by offering convenience and consistent supply of daily-use cleaning items. Growth in robotic cleaning devices and complementary liquid or spray products further elevates innovation momentum.

- For instance, the iRobot Roomba i3+ robot vacuum incorporates connected mapping (via iRobot OS) and automatic dirt disposal, which enhances cleaning efficiency and user convenience, contributing to increased adoption rates in residential and commercial sectors.

Market Challenges Analysis:

Rising Competition, Pricing Pressure, and Shifts in Consumer Expectations

The Japan Cleaning Products Market faces strong competition from global and domestic brands that compete on price, innovation, and convenience. It creates pressure on manufacturers to deliver value while maintaining quality and compliance with safety standards. Fluctuating raw material costs challenge profit margins and complicate long-term planning. Consumers expect high-performance, low-chemical, and eco-friendly formulations, which increases production complexity. Retailers push for competitive pricing, and private-label products intensify margin strain. Brands must balance sustainability commitments with affordability to retain customer trust.

Regulatory Constraints, Supply Chain Strains, and Slow Adoption in Certain Regions

Stricter environmental regulations require ongoing reformulation and consistent investment in safer ingredients. The Japan Cleaning Products Market must navigate detailed compliance frameworks that influence production and packaging decisions. It faces supply chain risks linked to import dependency for raw materials and packaging components. Limited awareness in rural areas slows adoption of premium or specialized cleaning products. Distribution inefficiencies in less urbanized regions restrict product visibility and delay market penetration. Companies must strengthen logistics, regulatory alignment, and consumer education to overcome these structural challenges.

Market Opportunities:

Expansion of Eco-Friendly, Premium, and Specialized Product Portfolios

The Japan Cleaning Products Market presents strong opportunities through innovation in sustainable and low-chemical formulations. Consumers show high interest in plant-based, biodegradable, and refillable products that reduce environmental impact. It creates space for brands to expand premium ranges that offer advanced stain removal, deodorizing capability, and antibacterial performance. Demand for specialized cleaners for appliances, electronics, and bathrooms continues to rise. Companies can strengthen value by introducing concentrated formats that reduce waste and transportation costs. Private-label partnerships and premium sub-brands offer further room to diversify product portfolios.

Growth Potential in Digital Retail, Smart Home Integration, and Rural Market Penetration

Digital platforms create new pathways for engagement, tailored promotions, and subscription models. The Japan Cleaning Products Market can benefit from e-commerce expansion that supports access to niche, imported, and high-efficiency solutions. It encourages companies to leverage data-driven marketing to reach younger and urban consumers. Smart home adoption opens opportunities for products that complement robotic cleaning devices and automated dispensers. Rural regions offer untapped potential for affordable, easy-to-use cleaning solutions supported by stronger retail networks. Growth in hospitality, healthcare, and commercial sectors further expands opportunities for institutional-grade products.

Market Segmentation Analysis:

By Product Type

The Japan Cleaning Products Market demonstrates strong diversification across product categories that cater to household and commercial needs. Surface cleaners hold a leading position due to consistent daily-use demand and innovation in antibacterial and eco-friendly formulations. Toilet, glass, and floor cleaners follow with steady adoption supported by hygiene priorities in urban homes. It benefits from rising demand for fabric cleaners and dishwashing products driven by lifestyle upgrades and higher expectations for convenience. Niche categories such as appliance-specific and personal care cleaners gain traction with expanding consumer awareness.

- For instance, 3M Co. offers advanced synthetic steel wool pads that are durable and designed to effectively remove stubborn dirt and grime, significantly enhancing cleaning efficiency.

By Ingredient

The Japan Cleaning Products Market shows a clear shift toward organic and low-chemical ingredients driven by sustainability goals and health-conscious consumer behavior. Organic formulations gain popularity in sensitive-skin households and premium product ranges. Synthetic ingredients continue to dominate volume share due to cost efficiency and strong cleaning performance in high-use applications. It encourages producers to balance traditional formulations with safer, compliant alternatives. The segment reflects ongoing investment in green chemistry to meet regulatory and consumer expectations.

- For instance, Saraya’s Yashinomi Detergent uses RSPO-certified sustainable palm oil in its plant-based surfactants, balancing strong cleaning power with skin-friendliness, and has maintained this eco-conscious approach since the early 2000s.

By End-use

The Japan Cleaning Products Market expands across household, commercial, and industrial environments with distinct demand patterns. Household users drive the largest share due to frequent cleaning routines and interest in multifunctional, easy-to-use products. Commercial facilities such as offices, hotels, and healthcare centers create steady demand for high-strength and disinfectant-grade solutions. Industrial applications require specialized formulations designed for machinery, large facilities, and safety compliance. It benefits from growing adoption of targeted cleaning systems across all end-use categories.

Segmentations:

By Product Type

• Surface cleaners

• Toilet cleaners

• Glass & metal cleaners

• Floor cleaners

• Fabric cleaners

• Dishwashing products

• Others (personal care cleaners, building cleaner, etc.)

By Ingredient

• Organic

• Synthetic

By End-use

• Household

• Commercial

• Industrial

• Others

By Price Range

• Economy

• Medium

• High

Regional Analysis:

Strong Demand Concentration in Major Urban Centers

Metropolitan regions such as Tokyo, Osaka, and Yokohama lead consumption in the Japan Cleaning Products Market. Dense populations, higher disposable incomes, and busy lifestyles support strong reliance on convenient, high-performance cleaning solutions. It benefits from rapid adoption of premium and eco-friendly products that align with urban living standards. Retail networks in these areas offer diverse product availability and promote frequent brand switching. Innovation uptake accelerates in major cities, driven by strong engagement with digital platforms and advanced retail formats.

Steady Expansion Across Suburban and Mid-Tier Cities

Suburban regions maintain consistent demand supported by growing family households and steady modernization of residential spaces. Consumers in these areas show interest in cost-effective cleaning solutions that balance performance and value. The Japan Cleaning Products Market gains traction through improved retail penetration, including supermarkets, drugstores, and online channels. It sees rising interest in refill packs and multifunctional cleaners that meet everyday needs. Brand loyalty strengthens in these regions due to stable purchasing patterns and trust in established brands.

Gradual Growth Opportunities in Rural and Less Urbanized Regions

Rural markets remain less penetrated but offer significant long-term potential. Demand centers around essential cleaning products with strong emphasis on affordability, accessibility, and practicality. The Japan Cleaning Products Market experiences slower adoption of premium or specialized formulations in these areas due to limited awareness. It benefits from broader distribution expansion and targeted marketing tailored to local needs. Enhanced logistics, regional promotions, and partnerships with local retailers can elevate product visibility and support steady market development.

Key Player Analysis:

- Kao Corporation

- Lion Corporation

- Unicharm Corporation

- The Procter & Gamble Company

- Unilever plc

- Henkel AG & Co. KGaA

- The Clorox Company

- S. C. Johnson & Son, Inc.

Competitive Analysis:

The Japan Cleaning Products Market features strong competition led by established domestic and global brands that influence product innovation, pricing strategies, and distribution efficiency. Kao Corporation, Lion Corporation, Unicharm Corporation, and The Procter & Gamble Company hold significant market presence and shape consumer preferences through extensive portfolios and strong marketing capabilities. It demonstrates high brand loyalty, especially in categories linked to hygiene, fabric care, and home maintenance. Companies focus on eco-friendly formulations, premium product lines, and multifunctional solutions to secure differentiation in a mature market. Digital retail acceleration encourages firms to strengthen online visibility and direct-to-consumer models. Competitive strategies emphasize research, sustainability goals, and expansion into niche cleaning categories to capture emerging demand across household and commercial segments.

Recent Developments:

- In January 2025, Kao Corporation announced an exclusive partnership with Pilot Chemical Company to commercialize Bio IOS® biobased internal olefin sulfonates in North America, targeting sustainable technologies for household, personal care, and industrial products.

- In March 2025, Unicharm Corporation entered a strategic partnership with Kimberly-Clark to co-develop plant-fiber sustainable wet wipes for the Asia-Pacific market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Ingredient, End-use and Price Range. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Japan Cleaning Products Market will see stronger demand for eco-friendly, biodegradable, and low-chemical formulations that align with national sustainability goals.

- Consumer preference for premium, high-performance cleaners will increase due to rising hygiene expectations and lifestyle modernization.

- Digital retail will expand its influence, and brands will strengthen direct-to-consumer channels to improve reach and engagement.

- Smart dispensing systems and technology-enhanced cleaning solutions will gain wider traction in urban households.

- Refillable formats and concentrated products will attract more consumers who seek value and reduced environmental impact.

- Commercial facilities will adopt advanced disinfectant-grade solutions to support stricter sanitation standards.

- Rural regions will show gradual but steady adoption as product awareness and retail accessibility improve.

- Brands will invest in ingredient transparency and safety-focused communication to build long-term consumer trust.

- Product diversification will accelerate, driven by demand for specialized cleaners for appliances, electronics, and high-touch surfaces.

- Strategic partnerships, sustainability initiatives, and digital integration will shape competitive advantages across the market.