Market Overview

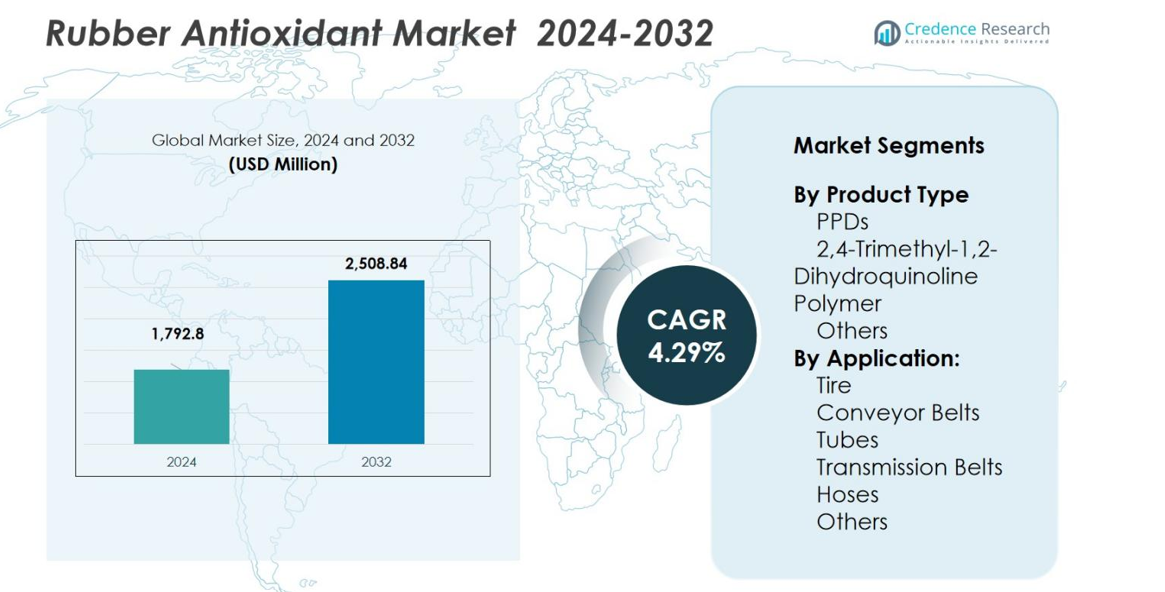

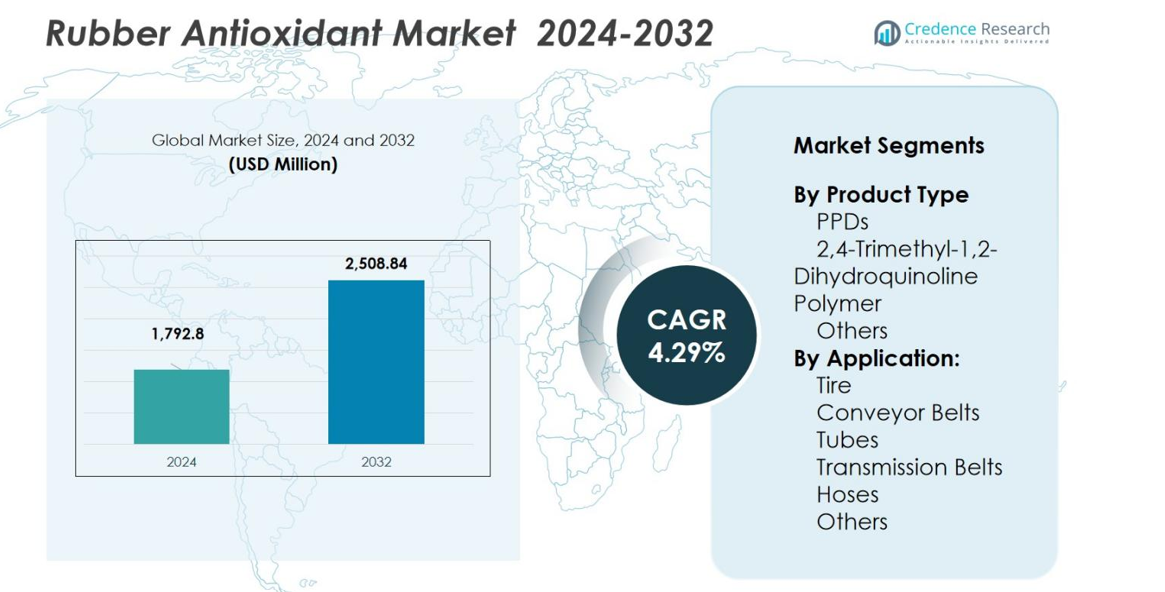

The Rubber Antioxidant Market size was valued at USD 1,792.8 Million in 2024 and is anticipated to reach USD 2,508.84 Million by 2032, at a CAGR of 4.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rubber Antioxidant Market Size 2024 |

USD 1,792.8 Million |

| Rubber Antioxidant Market, CAGR |

4.29% |

| Rubber Antioxidant Market Size 2032 |

USD 2,508.84 Million |

The Rubber Antioxidant Market involves leading players such as Eastman Chemical Company, Kumho Petrochemical Co., Ltd., Lanxess AG, Agrofert (Duslo) and NOCIL Limited who shape the market through broad product portfolios and global reach. These companies invest heavily in R&D to develop high‑performance antioxidants tailored for tire, hose and tube applications, thereby securing significant market positions. Among regions, the Asia Pacific region leads with 48.3% of the global market share, owing to strong tire manufacturing, industrial rubber production and cost‑effective chemical manufacturing in countries like China and India.

Market Insights

- The Rubber Antioxidant Market size was valued at USD 1,792.8 Million in 2024 and is projected to reach USD 2,508.84 Million by 2032, growing at a CAGR of 4.29% during the forecast period.

- Increasing demand for tires, particularly in the automotive sector, is a primary driver, as antioxidants enhance the durability and performance of rubber products, with the tire segment holding a 45% share in 2024.

- A key trend is the growing shift towards eco-friendly and sustainable rubber antioxidants, driven by rising environmental awareness and regulatory pressures, leading to innovations in biodegradable formulations.

- Competitive dynamics are shaped by key players like Eastman Chemical Company, Kumho Petrochemical, and NOCIL, who maintain strong market presence through R&D, strategic expansions, and tailored product offerings.

- Asia Pacific leads the market with a 48.3% share in 2024, followed by North America and Europe, where automotive and industrial applications are driving substantial demand for high-performance rubber antioxidants.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

The Rubber Antioxidant Market is segmented into PPDs, 2,4-Trimethyl-1,2-Dihydroquinoline Polymer, and Others. Among these, PPDs (Phenolic Antioxidants) dominate the market, accounting for 55% of the total share in 2024. This dominance is driven by the high demand for PPDs in tire manufacturing due to their superior performance in preventing oxidative degradation. Their widespread use in enhancing the durability and performance of rubber products, especially under extreme conditions, makes them a critical component in the industry.

- For instance,Lanxess introduced Vulkanox HS Scopeblue, a sustainable rubber additive based on TMQ, to help tire manufacturers produce longer-lasting and more eco-friendly tires with low volatility and migration tendencies.

By Application:

The market for Rubber Antioxidants is significantly driven by the Tire segment, which holds a major share of 45% in 2024. Tires require antioxidants to prevent degradation from heat, UV light, and ozone exposure, thereby extending their life and improving performance. The increasing demand for tires, particularly in the automotive sector, is fueling the growth of this segment. Additionally, rising awareness of safety and sustainability standards, alongside advancements in tire technologies, contributes to the ongoing dominance of the tire application within the Rubber Antioxidant Market.

- For instance, Indian startup Biopole introduced Biozone 200, a bio-based antiozonant, and Biovive 300, a bio-based antioxidant, derived from cotton stalks to enhance rubber product durability in the tire industry.

Key Growth Drivers

Increasing Demand for Tires

The Rubber Antioxidant Market is experiencing significant growth due to the rising demand for tires, which constitutes the largest application segment. Tires require antioxidants to improve their performance and longevity by preventing oxidative degradation from heat, ozone, and UV exposure. The global increase in vehicle production, coupled with the growing automotive industry, especially in emerging markets, continues to drive the demand for high-performance tires. This, in turn, fuels the need for effective rubber antioxidants, supporting market growth.

- For instance, Continental has pioneered the use of a certified biocircular antioxidant called TMQ, made from recycled cooking oil, which reduces the carbon footprint of its tires by over 30% while maintaining antioxidant performance.

Advancements in Rubber Industry Technology

Technological advancements in the rubber industry, particularly in the manufacturing of high-performance rubber products, are another key driver. Innovations such as the development of eco-friendly antioxidants and the incorporation of antioxidants in various rubber applications, including industrial hoses and conveyor belts, are boosting market growth. The demand for durable, high-quality rubber products across industries like automotive, manufacturing, and aerospace is pushing the adoption of advanced antioxidant solutions that enhance product performance and durability, further propelling the market.

- For instance, Suzano and Behn Meyer have partnered to incorporate Suzano’s lignin-based bioproduct Ecolig as a multifunctional sustainable additive in Behn Meyer’s rubber portfolio, positioning it as a partial replacement for fossil-based antioxidants to improve oxidation resistance in industrial and tire rubber compounds.

Regulatory and Environmental Initiatives

Environmental regulations that encourage the use of safer, non-toxic chemicals in manufacturing processes are driving the growth of the Rubber Antioxidant Market. As governments worldwide impose stricter regulations to reduce the environmental impact of rubber products, the demand for green antioxidants has increased. Companies are focusing on producing more sustainable rubber antioxidants, which are safer for the environment and comply with global regulatory standards, helping to expand the market share of eco-friendly antioxidant solutions.

Key Trends & Opportunities

Sustainability and Eco-friendly Solutions

A significant trend in the Rubber Antioxidant Market is the shift towards sustainable and eco-friendly products. As consumers and industries become more environmentally conscious, there is a growing preference for rubber antioxidants that are biodegradable, non-toxic, and produced with minimal environmental impact. This trend presents significant opportunities for companies to innovate and develop green antioxidant solutions that meet sustainability standards, opening up new markets and attracting eco-conscious customers.

- For instance, Synthomer established an ISCC PLUS-certified value chain integrating bio-based feedstock materials linked to at least 20% bio content through mass balance approach, manufacturing certified sustainable products at its Pasir Gudang facility in Malaysia while maintaining equivalent quality and performance characteristics as fossil fuel-based alternatives.

Growth in Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, are showing strong growth potential for the Rubber Antioxidant Market. Rapid industrialization, urbanization, and increased demand for vehicles in these regions are driving the demand for rubber products such as tires, belts, and hoses. The expanding manufacturing sector in countries like China and India presents an opportunity for market players to expand their footprint and cater to the growing demand for high-performance rubber antioxidants.

- For instance, LANXESS India completed an expansion of its Rhenodiv® production plant at the Jhagadia site in February 2024. This new production line uses advanced technology to improve efficiency in producing tire release agents, supporting the growing tire and rubber goods market in the region.

Key Challenges

Price Volatility of Raw Materials

One of the major challenges facing the Rubber Antioxidant Market is the price volatility of raw materials. The production of rubber antioxidants depends on various petrochemical derivatives, and fluctuations in the prices of raw materials like petroleum can lead to increased production costs. This uncertainty can affect the profitability of manufacturers and hinder the overall market growth, particularly when raw material prices rise unexpectedly due to geopolitical factors or supply chain disruptions.

Health and Safety Concerns

Health and safety concerns associated with the use of certain rubber antioxidants, especially those containing toxic components, pose a challenge to market growth. Strict health and safety regulations, along with increased scrutiny from regulatory bodies, are pushing manufacturers to shift toward safer alternatives. However, the transition to non-toxic antioxidants requires significant investment in research and development, and any delay in compliance could result in market restrictions, affecting industry growth.

Regional Analysis

Asia Pacific

The Asia Pacific region held 48.3% of the global rubber antioxidant market in 2024, led by high industrial and automotive demand, particularly from countries such as China and India. Rapid expansion in tire manufacturing and rubber goods production underpins this share, while cost-effective chemical manufacturing in the region further strengthens its dominance. The strong growth trajectory in infrastructure, construction, and automotive sectors continues to drive antioxidant uptake in rubber applications across the region.

North America

North America accounted for 20.0% of the global rubber antioxidant market in 2024, supported by a mature automotive industry and robust industrial rubber goods demand. The region’s high standards for performance and durability in rubber products, together with significant replacement tire demand, fuel consistent antioxidant consumption. Innovation in eco-friendly antioxidant solutions and growing usage in high-performance sectors such as electric vehicles also contribute to the region’s stable position in the market.

Europe

Europe held 18.0% of the global rubber antioxidant market in 2024, driven by a strong automotive manufacturing base and stringent environmental and regulatory norms. German, French, and UK tire and industrial rubber manufacturers heavily rely on advanced antioxidant additives to meet longevity and compliance requirements. The transition toward sustainable and green-certified antioxidant formulations is reshaping the region’s product landscape and reinforcing its distinctive market share.

Latin America

Latin America secured 8.0% of the global rubber antioxidant market in 2024. The region’s growth is propelled by rising automotive production and expanding industrial rubber goods manufacturing, especially in Brazil and Mexico. However, lower industrial maturity, supply-chain constraints, and economic instability moderate its share. Chemical suppliers targeting partnership models and capacity expansion stand to capture rising downstream demand in hoses, conveyor belts, and tubes.

Middle East & Africa

The Middle East & Africa region captured 5.7% of the global rubber antioxidant market in 2024. Infrastructure development, construction, and mining-related rubber product requirements drive demand for antioxidant-treated hoses, tubes, and belts. Nonetheless, the region’s fragmented manufacturing base, geopolitical uncertainties, and lower chemical processing capabilities restrain broader growth and limit its share relative to other regions.

Market Segmentations:

By Product Type

- PPDs

- 2,4-Trimethyl-1,2-Dihydroquinoline Polymer

- Others

By Application:

- Tire

- Conveyor Belts

- Tubes

- Transmission Belts

- Hoses

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the global rubber antioxidant market is shaped by key players such as Eastman Chemical Company, Kumho Petrochemical Co., Ltd., Lanxess AG, Agrofert (Duslo) and NOCIL Limited who dominate the market through extensive product portfolios and global reach. These firms leverage strong R&D capabilities to develop high‑performance antioxidants tailored for applications in tires, hoses, tubes and conveyor systems, thereby maintaining their leadership. In addition, these enterprises pursue strategic partnerships, capacity expansions and regional manufacturing footprints to secure supply chain resilience and regional responsiveness. Meanwhile, the market also features a fragmented layer of mid‑tier and regional players vying for niche specialty segments and green antioxidant formulations. Competitive pressure from these players exerts downward pricing trends, compelling leaders to focus on operational efficiency, product differentiation and sustainability credentials to preserve margin and market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Lanxess AG launched its sustainable rubber additive Vulkanox HS Scopeblue to support tyre manufacturers in producing longer‑lasting, environmentally‑friendly tyres.

- In November 2025, Safic-Alcan expanded its partnership with SI Group to extend the distribution of SI Group’s antioxidant portfolio for various markets starting January 1, 2026. This partnership strengthens their market presence in antioxidant solutions.

- In May 2023, Kumho Petrochemical Co., Ltd. introduced an eco‑friendly antioxidant series compatible with high‑performance synthetic rubber, targeting automotive and industrial applications in Europe and North America.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing demand from automotive tire production will continue to drive rubber antioxidant consumption as manufacturers seek longer‑lasting, high‑performance rubber compounds.

- Expansion in electric vehicle (EV) manufacturing will boost need for advanced antioxidants that can withstand higher torque, load and thermal stress in EV tire and rubber applications.

- Rising infrastructure and industrial development, especially in Asia‑Pacific, will increase demand for rubber products such as conveyor belts, hoses and tubes, thereby elevating antioxidant usage.

- Regulatory pressure for low‑toxicity, eco‑friendly additives will push producers to invest in sustainable antioxidant formulations and expand green product portfolios.

- Adoption of smart manufacturing and automation in chemical production will improve efficiency, quality and reliability of antioxidant supply, supporting market growth.

- Raw‑material price volatility and supply‑chain disruptions will encourage manufacturers to optimise sourcing strategies and diversify feedstock origins.

- Emerging economies will present strong growth opportunities as industrialisation, urbanisation and rubber goods manufacturing expand in these regions.

- Formulation innovation will accelerate, with development of synergistic antioxidant blends and bio‑based alternatives that offer improved durability and environmental compliance.

- Competitive pressure will intensify as global leaders and regional players expand capacity, pursue M&A and tailor regionalised manufacturing to capture market share.

- Market expansion may face constraints from regulatory hurdles on chemical usage and disposal, prompting the industry to focus on circular‑economy practices and end‑of‑life rubber product recycling.