Market Overview

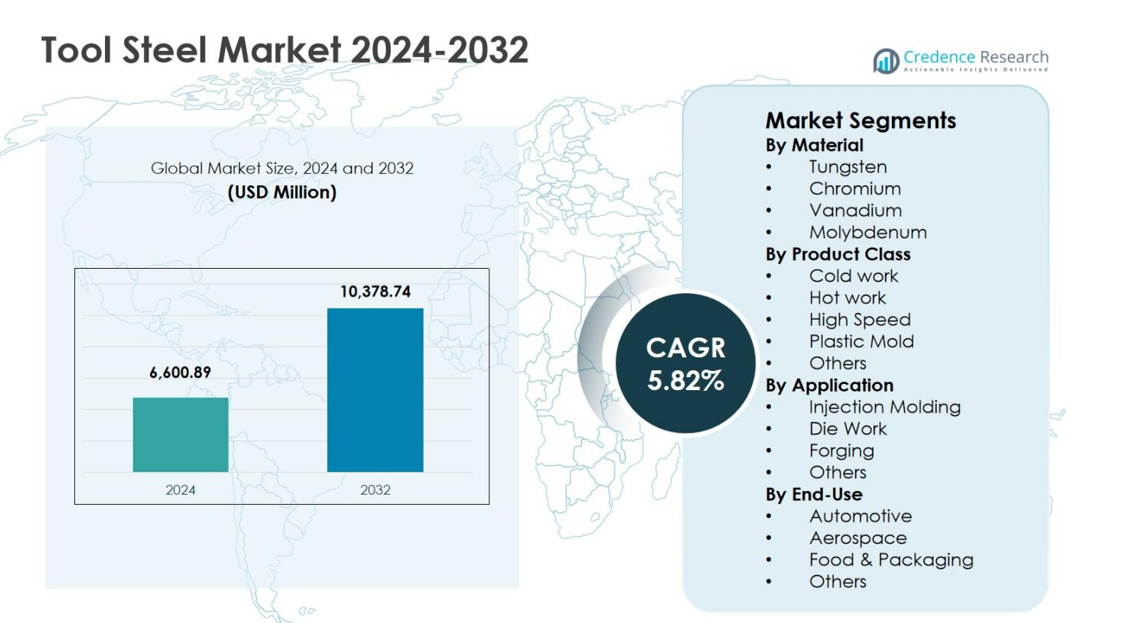

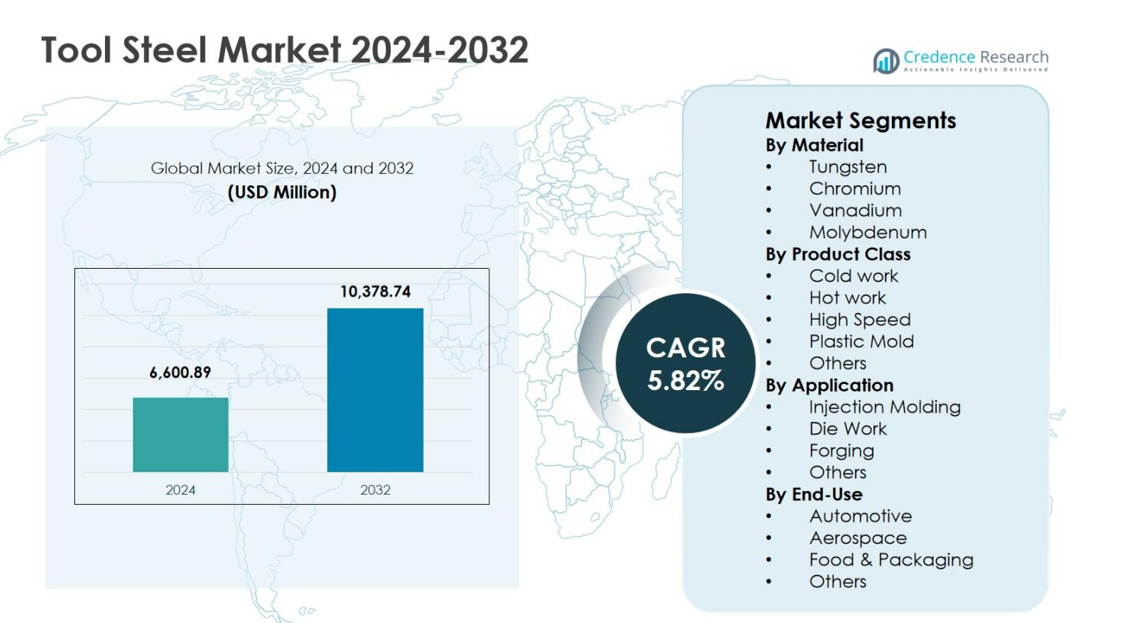

Tool Steel Market size was valued at USD 6,600.89 million in 2024 and is anticipated to reach USD 10,378.74 million by 2032, registering a CAGR of 5.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tool Steel Market Size 2024 |

USD 6,600.89 million |

| Tool Steel Market, CAGR |

5.82% |

| Tool Steel Market Size 2032 |

USD 10,378.74 million |

Tool Steel Market demonstrates strong presence of established global manufacturers including Swiss Steel Group, Voestalpine High Performance Metals, Daido Steel Co., Ltd., Proterial, Ltd., Nachi-Fujikoshi Corp., GMH Gruppe, Saarschmiede GmbH, Samuel, Son & Co., Vested Metals, and Remblay Tool Steels. These players focus on alloy innovation, advanced heat treatment capabilities, and application-specific tool steel grades to support automotive, industrial machinery, plastic processing, and metalworking industries. Asia Pacific leads the Tool Steel Market with a 46.2% market share in 2024, supported by large-scale manufacturing activity in China, Japan, India, and South Korea. Europe and North America follow due to strong automotive, aerospace, and precision engineering demand, reinforcing stable global tool steel consumption.

Market Insights

- The Tool Steel Market was valued at USD 6,600.89 million in 2024 and is projected to reach USD 10,378.74 million by 2032, growing at a CAGR of 5.82% during the forecast period, driven by rising demand across automotive, industrial machinery, and plastic processing industries.

- Market growth is supported by expanding automotive and transportation manufacturing, where tool steel is widely used in die work, stamping, forging, and molds, with the die work application segment holding 41.5% share in 2024 due to high durability and thermal stability requirements.

- Increasing adoption of high-performance and customized tool steel grades is a key trend, with cold work tool steel leading product classes at 38.2% share in 2024, supported by extensive use in cutting, forming, and mass-production tooling operations.

- Market players focus on alloy optimization, advanced heat treatment, and value-added services, while challenges include raw material price volatility and competition from carbide tools and advanced coatings impacting traditional tool steel demand.

- Asia Pacific dominated with 2% regional share in 2024, followed by Europe at 24.8% and North America at 19.1%, driven by strong manufacturing bases, tooling replacement demand, and industrial modernization initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material:

The Tool Steel Market by material shows chromium-based tool steel as the dominant sub-segment, accounting for 34.6% market share in 2024. Chromium tool steels lead due to their superior hardness, corrosion resistance, and wear performance, making them suitable for high-stress industrial tooling applications. Tungsten-based steels follow, driven by demand for high-temperature strength in cutting tools, while vanadium and molybdenum contribute to toughness and grain refinement. Growth in automotive, aerospace, and heavy engineering sectors continues to drive chromium tool steel adoption, supported by longer tool life and reduced replacement costs.

- For instance, H13 chromium tool steel (5% Cr content) is widely used by manufacturers for die casting automotive components, where its thermal fatigue resistance maintains structural integrity during repeated high-heat cycles.

By Product Class:

By product class, cold work tool steel dominates the Tool Steel Market with a 38.2% share in 2024, driven by extensive use in cutting, stamping, and forming operations. Cold work steels offer high wear resistance and dimensional stability, making them essential for mass-production tooling. Hot work tool steels gain traction in die casting and forging applications, while high-speed steel benefits from precision machining demand. Plastic mold steels expand with rising injection molding activities, especially in packaging and consumer goods manufacturing, reinforcing overall segment growth.

- For instance, Daido Steel’s H13 hot work tool steel excels in die-casting dies for aluminum and zinc alloys, offering high thermal conductivity and resistance to heat checking.

By Application:

In terms of application, die work represents the leading sub-segment, capturing 41.5% market share in 2024. This dominance is driven by increasing demand for metal forming, stamping, and die-casting processes across automotive, construction, and industrial machinery industries. Injection molding follows, supported by growth in plastics processing for packaging and electronics. Forging applications benefit from infrastructure and heavy equipment production. Die work applications continue to drive tool steel consumption due to high durability requirements, thermal stability needs, and the rising adoption of advanced manufacturing techniques.

Key Growth Drivers

Expanding Automotive and Transportation Manufacturing

The Tool Steel Market continues to benefit from expanding automotive and transportation manufacturing, driven by rising vehicle production, lightweighting initiatives, and platform diversification. Tool steel plays a critical role in stamping dies, forging tools, molds, and cutting components used in engine parts, transmission systems, and structural assemblies. Growth in electric vehicle manufacturing further accelerates demand for precision tooling required for battery housings, motor components, and thermal management systems. Continuous investments in advanced forming technologies and high-volume production facilities reinforce sustained tool steel consumption across global automotive hubs.

- For instance, Presrite Corporation developed seven specialized forging dies to produce drive axle components for an automotive OEM, reducing machining time per part from 3.5 minutes to 1 minute. This tooling solution cut overall cycle times and costs by up to 67%, enabling optimized production of transmission-related gears.

Growth of Industrial Machinery and Metalworking Activities

Rising industrialization and infrastructure development are significantly increasing demand for industrial machinery and metalworking tools, directly supporting tool steel consumption. Tool steel is widely used in cutting tools, dies, punches, and forming equipment essential for fabrication, machining, and heavy engineering operations. Expansion of manufacturing capacity across emerging economies, coupled with modernization of legacy facilities, drives replacement demand for high-performance tooling. Increased focus on productivity, dimensional accuracy, and tool longevity further encourages adoption of advanced tool steel grades across metal processing industries.

- For instance, SSAB’s Toolox 33 replaced traditional tool steel 2738 for manufacturing brackets, enabling oxycutting near the final shape from 60 mm thick plates instead of full machining from squares, which reduced production time significantly.

Rising Demand from Plastic Processing and Injection Molding

Rapid growth in plastic processing industries is emerging as a key driver for the Tool Steel Market, particularly for plastic mold tool steels. Rising demand for consumer goods, packaging, medical devices, and electronics increases reliance on injection molding processes that require high-quality mold materials. Tool steel offers superior polishability, corrosion resistance, and thermal stability, enabling consistent part quality and extended mold life. Increasing use of complex mold designs and high-cycle production further drives adoption of premium tool steel grades.

Key Trends & Opportunities

Adoption of High-Performance and Customized Tool Steel Grades

Manufacturers increasingly focus on high-performance and customized tool steel grades to meet application-specific requirements. Demand is growing for steels offering enhanced wear resistance, toughness, and thermal stability to support high-speed machining and extreme operating conditions. Tailored alloy compositions and heat treatment solutions enable optimized performance for niche applications such as aerospace tooling, precision molds, and advanced forging. This trend creates opportunities for suppliers to differentiate through value-added services, technical support, and application-driven product development.

- For instance, D2 tool steel from producers like Titus Steel serves in precision plastic injection molding dies, leveraging its high wear resistance (HRC 60-62 post-heat treatment) and dimensional stability for high-volume parts without deformation.

Growth Opportunities in Emerging Manufacturing Economies

Emerging manufacturing economies present significant growth opportunities for the Tool Steel Market due to rapid industrial expansion and increasing domestic production. Investments in automotive, consumer goods, construction equipment, and metal fabrication facilities drive demand for reliable and cost-efficient tooling materials. Government-led manufacturing initiatives and foreign direct investments further support tooling infrastructure development. As local manufacturers upgrade production capabilities, demand for higher-grade tool steels with improved durability and performance continues to rise.

- For instance, Tata Steel in India expanded its Kalinganagar facility with a Hot Strip Mill capable of producing hot rolled steel up to 1200 MPa, supporting automotive manufacturers in weight reduction for safety and emission compliance.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in raw material prices present a major challenge for the Tool Steel Market, directly impacting production costs and profit margins. Alloying elements such as chromium, molybdenum, vanadium, and tungsten are subject to supply constraints and price volatility influenced by geopolitical factors and mining output. Sudden cost increases limit pricing flexibility and create uncertainty for manufacturers and end users. Managing inventory, sourcing stability, and cost pass-through mechanisms remains a persistent challenge across the value chain.

Availability of Alternative Materials and Coatings

The increasing availability of alternative materials and advanced surface coatings poses a challenge to tool steel adoption. Carbide tools, ceramics, and coated steels offer extended tool life and improved performance in specific applications, reducing reliance on traditional tool steel in certain segments. Advances in coating technologies such as PVD and CVD enhance wear resistance and thermal stability, intensifying competition. Tool steel manufacturers must continue innovation to maintain performance relevance and application competitiveness.

Regional Analysis

Asia Pacific

Asia Pacific leads the Tool Steel Market with a 46.2% market share in 2024, driven by strong manufacturing activity across China, Japan, India, and South Korea. High demand from automotive production, industrial machinery, electronics manufacturing, and plastic processing supports sustained consumption of tool steel across the region. Rapid expansion of injection molding, die casting, and metal forming industries further accelerates growth. Government-backed manufacturing initiatives, rising exports of industrial components, and continuous investments in tooling infrastructure strengthen Asia Pacific’s dominant position in global tool steel demand.

Europe

Europe accounts for 24.8% market share in 2024, supported by its strong base of automotive, aerospace, and precision engineering industries. Countries such as Germany, Italy, France, and Sweden maintain high demand for premium tool steel used in forging, stamping, and high-performance tooling applications. Emphasis on advanced manufacturing, automation, and quality-driven production drives demand for alloyed and high-speed tool steels. Strict quality standards and continuous innovation in tooling materials further reinforce Europe’s position as a key contributor to global tool steel consumption.

North America

North America holds 19.1% market share in 2024, driven by robust demand from automotive manufacturing, industrial machinery, aerospace, and oil and gas equipment production. The United States leads regional consumption due to high tooling replacement rates and adoption of advanced machining processes. Growth in electric vehicle manufacturing and plastic injection molding supports steady demand for high-performance tool steels. Strong presence of metalworking industries, focus on productivity enhancement, and investments in advanced manufacturing technologies continue to support the regional tool steel market.

Latin America

Latin America represents 5.6% market share in 2024, supported by growing industrial activity in Brazil, Mexico, and Argentina. Expansion of automotive assembly plants, metal fabrication units, and construction equipment manufacturing drives tool steel demand. Mexico benefits from its integration into global automotive supply chains, increasing consumption of dies and molds. Infrastructure development and gradual industrial modernization further contribute to market growth. Although smaller in scale, rising manufacturing investments and tooling upgrades support steady demand across the region.

Middle East & Africa

The Middle East & Africa region captures 4.3% market share in 2024, driven by demand from oil and gas equipment manufacturing, construction activities, and emerging industrial sectors. Countries such as Saudi Arabia, the UAE, and South Africa contribute through investments in metalworking, forging, and infrastructure projects. Industrial diversification initiatives and local manufacturing development support gradual tool steel adoption. Growth remains steady as regional industries increase focus on equipment durability, tooling efficiency, and localized production capabilities across key end-use sectors.

Market Segmentations:

By Material

- Tungsten

- Chromium

- Vanadium

- Molybdenum

By Product Class

- Cold work

- Hot work

- High Speed

- Plastic Mold

- Others

By Application

- Injection Molding

- Die Work

- Forging

- Others

By End-Use

- Automotive

- Aerospace

- Food & Packaging

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Swiss Steel Group, Voestalpine High Performance Metals, Daido Steel Co., Ltd., Proterial, Ltd., Nachi-Fujikoshi Corp., GMH Gruppe, Saarschmiede GmbH, Samuel, Son & Co., Vested Metals, and Remblay Tool Steels operate within a highly structured Tool Steel Market focused on performance differentiation and application-specific solutions. Leading companies emphasize alloy optimization, advanced heat treatment capabilities, and value-added services to strengthen customer retention across automotive, industrial machinery, and plastic processing sectors. Continuous investments in capacity expansion, digitalized production, and quality assurance systems enhance operational efficiency and product consistency. Strategic partnerships with end-use manufacturers and tooling specialists support customized grade development and faster time-to-market. Global players leverage strong distribution networks and regional manufacturing footprints to ensure supply reliability, while mid-sized participants focus on niche applications and specialized tooling requirements to maintain competitive positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Voestalpine High Performance Metals LLC

- Daido Steel Co., Ltd.

- Remblay Tool Steels, LLC

- Swiss Steel Group

- Nachi-Fujikoshi Corp.

- Samuel, Son & Co.

- Saarschmiede GmbH

- Proterial, Ltd.

- GMH Gruppe

- Vested Metals

Recent Developments

- In December 2025, Dörrenberg Edelstahl GmbH acquired approximately 9,000 tonnes of tool steel stock from DEW, expanding its partnership and distribution for tool steel products.

- In August 2025, Sandvik launched a new tool steel powder, Osprey MAR 55, optimized for additive manufacturing, cold spray, and metal injection molding to enhance wear resistance and weldability in tooling applications.

- In August 2025, GMH Gruppe acquired two business units from Buderus Edelstahl GmbH, expanding its rolled steel portfolio and enhancing machining and heat treatment capacities in the tool steel sector.

- In 2024, Xact Metal partnered with Voestalpine’s Uddeholm to supply Corrax tool steel for additive manufacturing, expanding tooling and molding support at Formnext 2025

Report Coverage

The research report offers an in-depth analysis based on Material, Product Class, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Tool Steel Market will continue expanding due to sustained growth in automotive, industrial machinery, and metalworking industries.

- Increasing adoption of electric vehicles will drive demand for high-precision dies, molds, and forming tools.

- Advanced manufacturing techniques will accelerate the use of high-performance and customized tool steel grades.

- Rising plastic processing and injection molding activities will support steady demand for plastic mold tool steels.

- Manufacturers will focus on improving wear resistance, toughness, and thermal stability through alloy innovation.

- Growing industrialization in emerging economies will create long-term opportunities for tool steel suppliers.

- Automation and digital machining will increase demand for consistent, high-quality tooling materials.

- Sustainability initiatives will encourage optimization of production efficiency and material utilization.

- Competition will intensify as alternative materials and advanced coatings gain wider adoption.

- Strategic collaborations and regional capacity expansions will strengthen supply resilience and market presence.