Market Overview

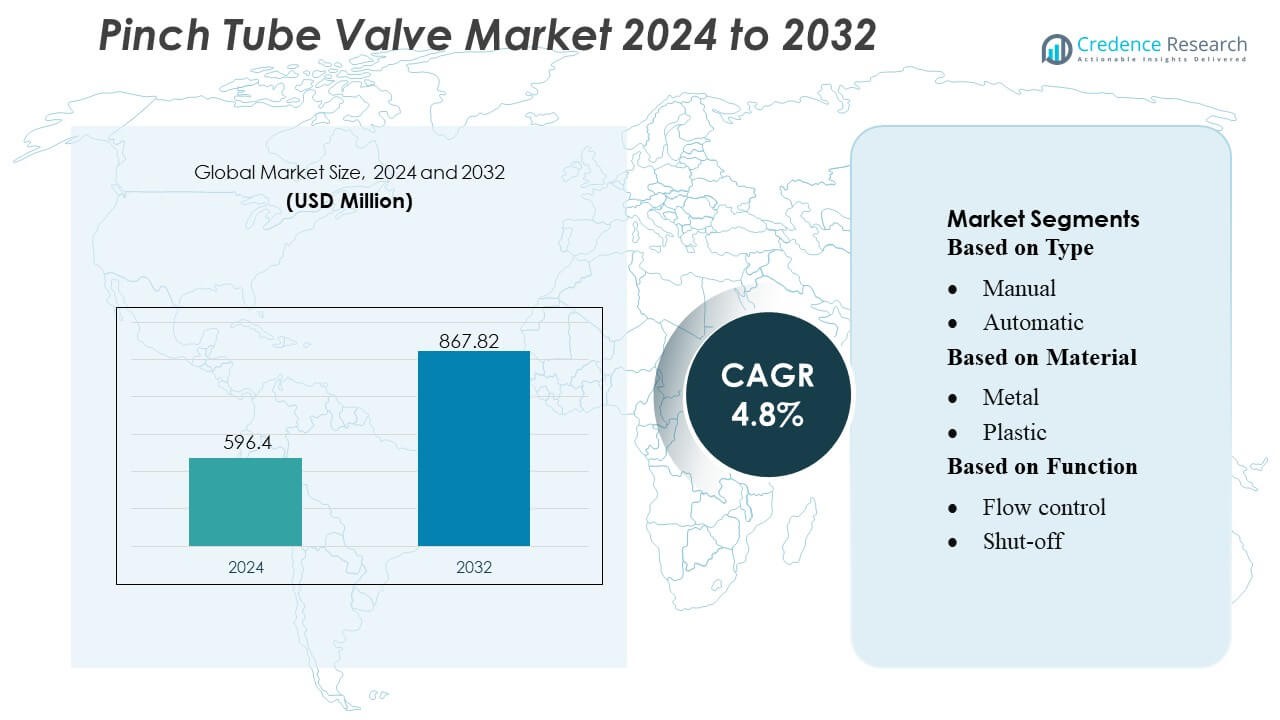

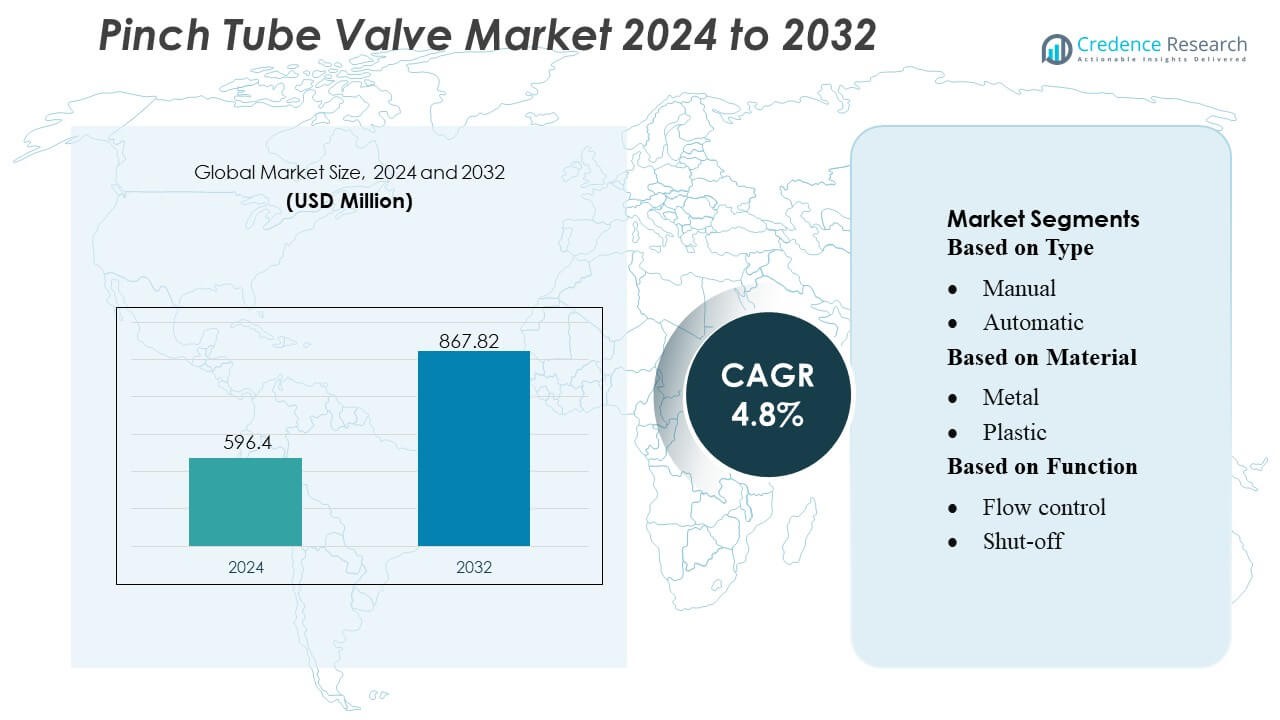

Pinch Tube Valve Market size was valued USD 596.4 million in 2024 and is anticipated to reach USD 867.82 million by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pinch Tube Valve Market Size 2024 |

USD 596.4 Million |

| Pinch Tube Valve Market, CAGR |

4.8% |

| Pinch Tube Valve Market Size 2032 |

USD 867.82 Million |

The Pinch Tube Valve Market is characterized by strong participation from global manufacturers specializing in sterile fluid handling, automated dispensing, and precision flow-control technologies. Competitors focus on enhancing valve cycle life, improving compatibility with single-use tubing, and integrating compact actuators suited for medical, laboratory, and industrial applications. North America leads the global market with an exact 38% share, supported by its advanced biotechnology ecosystem, high adoption of diagnostic instrumentation, and strong investment in automation. Continuous innovation in miniaturized and digitally enabled pinch valves further strengthens regional dominance and drives competitive differentiation across the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Pinch Tube Valve Market reached USD 596.4 million in 2024 and is projected to hit USD 867.82 million by 2032, advancing at a 8% CAGR through the forecast period.

- Rising demand for sterile fluid handling, single-use systems, and precision-controlled dispensing in biotechnology, diagnostics, and pharmaceuticals continues to accelerate market expansion.

- Key trends include growing adoption of miniaturized pinch valves, improved tubing materials, and increased integration of digital monitoring for real-time flow control and predictive maintenance.

- Competitive activity intensifies as manufacturers enhance cycle life, develop compact actuator designs, and strengthen OEM partnerships across medical, laboratory, and industrial segments.

- North America leads with 38% regional share, while impact hammers hold the dominant product segment share; growth across Europe and Asia-Pacific is supported by expanding bioprocessing capacity and rapid automation upgrades, although high maintenance needs and performance limitations in high-pressure environments remain notable restraints.

Market Segmentation Analysis:

By Type

Manual pinch tube valves dominate the market with an estimated 58% share, driven by their mechanical simplicity, low maintenance requirements, and suitability for industries prioritizing cost-efficient flow control. They remain widely adopted in pharmaceutical filling, laboratory dosing, and food-grade processing systems where contamination-free fluid handling is essential. Automatic pinch tube valves expand steadily as automation increases in medical devices and industrial dispensing lines, offering programmable precision and faster actuation. Their adoption grows in applications requiring repeatability, closed-loop control, and integration with smart monitoring systems, strengthening demand across advanced processing environments.

- For instance, Honeywell’s 10260 series actuators provide a torque range of 10 to 300 lb-ft (14 to 400 N·m), enabling quarter-turn valve operations under heavy load. (Note: the user’s N·m conversion to 407 N·m is slightly different from the typical 400 N·m in documentationrequirements.

By Material

Metal-based pinch tube valves hold the leading position with approximately 52% market share, supported by their durability, high-pressure tolerance, and corrosion-resistant performance in chemical, wastewater, and heavy-duty industrial applications. These valves provide longer service life in abrasive and viscous media handling, making them the preferred choice for critical operations. Plastic variants gain traction due to lightweight construction, chemical inertness, and cost benefits, particularly in medical consumables and low-pressure fluid systems. Other materials, including ceramic options, address niche environments requiring extreme wear resistance and minimal particulate generation.

- For instance, Velan’s the valve is designed for a wide range of applications, supporting pressures up to 1,480 psig (approximately 102 bar) and temperatures up to 1,000 °F (538 °C), depending on the specific size, material, and end connections used within the ASME Class 150 to 600 range.

By Function

Flow control functions dominate the segment with nearly 55% market share, driven by the increasing need for precise modulation in pharmaceutical transfer lines, bioprocessing loops, and automated dispensing systems. These valves enable contamination-free adjustment of liquid or semi-solid media, supporting stringent sterility and dosing accuracy requirements. Shut-off valves maintain strong adoption in applications requiring zero-leak isolation, especially in laboratory equipment, medical diagnostics, and chemical dosing. Other functional designs focused on regulation continue to evolve to serve specialized operations needing variable pressure handling, smooth throttling, and enhanced responsiveness in sensitive process environments.

Key Growth Drivers

Rising Demand for Precision Flow Control in Industrial and Laboratory Systems

The market grows as industries prioritize accurate, contamination-free fluid management across chemical processing, pharmaceuticals, biotechnology, and research laboratories. Pinch tube valves support sterile, closed-system handling by preventing direct contact between the valve mechanism and fluid, minimizing cross-contamination risks. Their ability to handle corrosive, viscous, or particulate-laden media strengthens adoption in sensitive applications. Increasing automation in fluid dispensing, sampling, and dosing systems further elevates demand for compact, reliable, and low-maintenance pinch valves that ensure consistent flow regulation across diverse operating environments.

- For instance, AVK’s intelligent control‑valve Series 859, when equipped with the ACMO PMD communication module, delivers auto‑adaptive PID control and data‑logging enabling automated regulation of pressure and flow in water networks without manual intervention.

Expansion of Medical and Life Sciences Applications

Healthcare and life-science sectors drive strong uptake as pinch tube valves become integral to peristaltic pumps, dialysis systems, diagnostics instruments, and drug-delivery equipment. Their hygienic flow path, flexibility with disposable tubing, and ability to comply with sterilization protocols make them suitable for clinical and point-of-care devices. Growing investment in bioprocessing, single-use technologies, and high-purity fluid handling amplifies the need for valves that maintain sterility while enabling precise flow control. Rising diagnostic testing volumes and rapid instrument innovation also support long-term market growth.

- For instance, Emerson’s Fisher easy‑Drive 200R electric actuator, designed for butterfly and ball valves, operates on 11–30 VDC power and consumes under 0.4 watts in holding mode.

Increasing Adoption of Automation and Smart Fluid Handling Systems

Automation in manufacturing, packaging, and process industries accelerates demand for pinch tube valves compatible with digitally controlled flow systems. Industries seek valves offering fast actuation, programmable control, and reliable cycling performance to optimize throughput and reduce downtime. Integration with PLCs, IoT-enabled monitoring, and closed-loop control architectures supports predictive maintenance and operational efficiency. The shift toward modular system design and flexible production lines further strengthens the role of compact, electrically actuated pinch valves suited for responsive and contamination-free flow management.

Key Trends & Opportunities

Shift Toward Single-Use Systems and Disposable Tubing

A major trend emerges from the transition to single-use bioprocessing and disposable flow paths in medical, biotech, and laboratory applications. Manufacturers increasingly develop valves optimized for flexible tubing materials like TPE and silicone to meet sterility requirements. This shift reduces cleaning costs, eliminates contamination risks, and aligns with evolving GMP regulations. The opportunity lies in expanding specialized pinch valves tailored to sterilizable, gamma-resistant, and chemically compatible tubing solutions suited for high-purity workflows and rapid equipment turnover.

- For instance, Bürkert’s AirLINE Type 8652 valve island now offers pressure‑line sensors and extended diagnostics including switching‑cycle counters and switching‑time measurement, enabling predictive maintenance and early detection of supply‑pressure fluctuations enhancing process safety and reliability.

Advancements in Materials and Miniaturized Valve Designs

Ongoing innovation in engineering plastics, elastomers, and corrosion-resistant alloys supports lighter, more durable pinch valve configurations. Material progress enhances tubing lifespan, valve actuation precision, and resistance to extreme pH or temperature. Simultaneously, the rise of compact analytical instruments and microfluidic devices creates opportunities for miniaturized pinch valves with low power consumption and extended cycle life. These advances enable integration into portable diagnostic tools, wearable medical systems, and compact fluid-handling modules used in automated laboratory platforms.

- For instance, Alfa Laval has advanced the market’s shift toward energy‑efficient, compact valve solutions through its updated “Unique DV‑ST UltraPure” diaphragm valve line. Its new stainless‑steel “SS/SL” actuator is 42% lighter, 25% more compact, and 17% shorter in height than standard models.

Integration of Smart Sensing and Digital Monitoring

Manufacturers increasingly incorporate position sensing, cycle counters, and pressure-feedback mechanisms into pinch valves to improve controllability and reliability. Digital monitoring enables predictive maintenance and real-time diagnostics, reducing operational downtime and ensuring consistent process performance. IoT-enabled valves also enhance traceability in regulated environments such as medical manufacturing and pharmaceutical production. This trend presents opportunities to develop intelligent pinch valve systems supporting advanced automation, quality assurance, and remote operational oversight.

Key Challenges

Performance Limitations in High-Pressure and High-Temperature Environments

Despite versatility, pinch tube valves face constraints under high-pressure, high-temperature, or highly abrasive operating conditions. Tubing materials may degrade or rupture when exposed to extreme pressures or aggressive media, limiting suitability for heavy-duty industrial processes. The need for frequent tubing replacement increases maintenance requirements, especially in continuous-flow or high-stress systems. Overcoming these limitations requires advancements in reinforced tubing materials and enhanced valve designs capable of maintaining structural integrity in demanding environments.

Competition from Alternative Valve Technologies

The market faces competitive pressure from diaphragm, solenoid, ball, and gate valves that offer higher pressure ratings, broader material compatibility, or lower cost in certain applications. End-users in industrial sectors often prioritize durability and long-term reliability, which may reduce adoption of pinch valves outside sterile or contamination-sensitive workflows. Additionally, the lack of standardization in tubing dimensions and material specifications can complicate system integration. To remain competitive, manufacturers must differentiate through improved actuation performance, reduced total cost of ownership, and specialized niche applications.

Regional Analysis

North America

North America holds the largest 38% share of the Pinch Tube Valve Market, supported by strong adoption across biotechnology, pharmaceuticals, diagnostics, and advanced manufacturing. The region benefits from extensive deployment of sterile fluid-handling solutions and widespread use of single-use technologies in bioprocessing. High R&D investment, rapid medical device innovation, and strong regulatory emphasis on contamination-free systems drive demand for precision pinch valves. Industrial automation upgrades and growth in analytical instrumentation further reinforce adoption. The U.S. remains the primary contributor due to its large biotech ecosystem, while Canada strengthens demand through expanding clinical diagnostic capabilities.

Europe

Europe accounts for 29% of the global market, driven by advanced pharmaceutical manufacturing, strong laboratory research infrastructure, and growing integration of automated fluid-handling systems. Countries such as Germany, the U.K., and France lead adoption due to emphasis on compliance, sterile manufacturing standards, and high reliance on high-purity tubing systems. The region’s expanding bioprocessing footprint and growing diagnostic testing volumes sustain demand for both manual and automated pinch valve solutions. Industrial applications in chemical processing, food automation, and precision dispensing also support market growth, while strong sustainability policies accelerate development of long-life, energy-efficient valve technologies.

Asia-Pacific

Asia-Pacific holds 24% of the market and represents the fastest-growing regional segment, supported by rapid expansion in pharmaceuticals, biotechnology, industrial automation, and medical device production. China, Japan, India, and South Korea drive adoption through rising investment in laboratory automation, biologics manufacturing, and diagnostic equipment. Increasing shift toward single-use systems and the growth of point-of-care technologies strengthen demand for compact, contamination-free pinch valves. The region’s manufacturing cost advantages and expanding OEM production ecosystem also boost supply-side competitiveness. Infrastructure modernization and industrial upgrades continue to position APAC as a high-potential market for advanced flow-control solutions.

Latin America

Latin America captures a 6% share, driven by the gradual expansion of pharmaceutical production, clinical diagnostics, and industrial fluid-handling applications. Brazil, Mexico, and Argentina remain key contributors as investments in laboratory testing, medical equipment, and food-processing automation rise. Adoption of pinch tube valves grows with increasing emphasis on contamination-free flow management and the modernization of chemical and industrial plants. However, cost sensitivity and import dependency moderate growth in some countries. The region shows improving long-term potential as healthcare infrastructure advances and manufacturing stakeholders adopt automated systems requiring reliable, low-maintenance valve solutions.

Middle East & Africa

The Middle East & Africa region holds a 3% share, driven primarily by expanding healthcare facilities, rising diagnostic testing capacity, and upgrades in industrial automation. Growth concentrates in Saudi Arabia, the UAE, and South Africa, where investment in medical laboratories, fluid-handling equipment, and pharmaceutical packaging is increasing. Industrial sectors such as water treatment, chemicals, and food processing gradually integrate pinch tube valves for controlled, contamination-free flow operations. Limited local manufacturing and higher equipment import costs constrain rapid expansion, but ongoing infrastructure development continues to create steady demand across both medical and industrial applications.

Market Segmentations:

By Type

By Material

By Function

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The Pinch Tube Valve Market features a diverse competitive landscape led by global packaging and fluid-handling solution providers such as Romaco Group, Clariant, Hoffman Neopac AG, VisiPak, ALBEA, Montebello Packaging, Unette Corporation, Huhtamaki OYJ, Sonoco Products Company, and Essel Propack Limited. the Pinch Tube Valve Market is shaped by manufacturers focused on advancing contamination-free fluid management, improving actuation precision, and expanding compatibility with single-use tubing systems. Companies prioritize innovations in material engineering, cycle-life enhancement, and low-maintenance valve architectures to meet rising demand across medical devices, diagnostics, pharmaceuticals, and industrial automation. The market increasingly favors compact, energy-efficient, and digitally integrated pinch valves that support real-time monitoring and predictive maintenance. Competitors also strengthen their positions through OEM collaborations, customized valve solutions, and regional production expansion, enabling faster delivery cycles and improved adaptability to application-specific performance requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Romaco Group

- Clariant

- Hoffman Neopac AG

- VisiPak

- ALBEA

- Montebello Packaging

- Unette Corporation

- Huhtamaki OYJ

- Sonoco Products Company

- Essel Propack Limited

Recent Developments

- In October 2024, Danfoss, a global leader in engineering technologies, launched a new and reliable EVR and NRV safety Valves, approved to meet UL 60335-2-40 and UL 60335-2-89 standards. This integration was a must with increasing strict safety regulations. This new solution offers a separating flammable refrigerant charge in case of leaks.

- In July 2024, Albéa Tubes launched local North American production of its Greenleaf recyclable tube web at its Brampton, Ontario plant (actually late 2024, but aligns with the intent), replacing aluminum-based tubes with plastic ones for cosmetics and personal care, confirmed recyclable in HDPE streams by APR and RecyClass, boosting sustainable, locally-sourced packaging.

- In April 2024, Xylem launched the Jabsco PureFlo 21 Single Use pump, featuring the industry’s first integrated, adjustable pressure relief valve in a single-use design, specifically for pharma/biotech, to significantly reduce contamination risk and boost operator safety by bypassing excess pressure internally, improving efficiency for high-value fluid handling.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Function and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as single-use systems gain wider adoption in bioprocessing and diagnostics.

- Demand will grow for valves compatible with advanced sterile and contamination-free workflows.

- Manufacturers will prioritize miniaturized valve designs to support compact laboratory and medical devices.

- Digital integration will strengthen, with smart pinch valves enabling real-time monitoring and predictive maintenance.

- Adoption will rise in automated dispensing and dosing systems across industrial and pharmaceutical settings.

- Material innovation will improve tubing durability, thermal resistance, and chemical compatibility.

- The shift toward flexible production lines will boost demand for fast-actuating, low-maintenance valve systems.

- Expansion of point-of-care devices will increase requirements for precision-controlled microfluidic valves.

- Regional manufacturing capabilities will grow to shorten lead times and enhance customization.

- Regulatory focus on hygiene and sterility will accelerate development of cleanroom-compliant valve solutions.