Market Overview

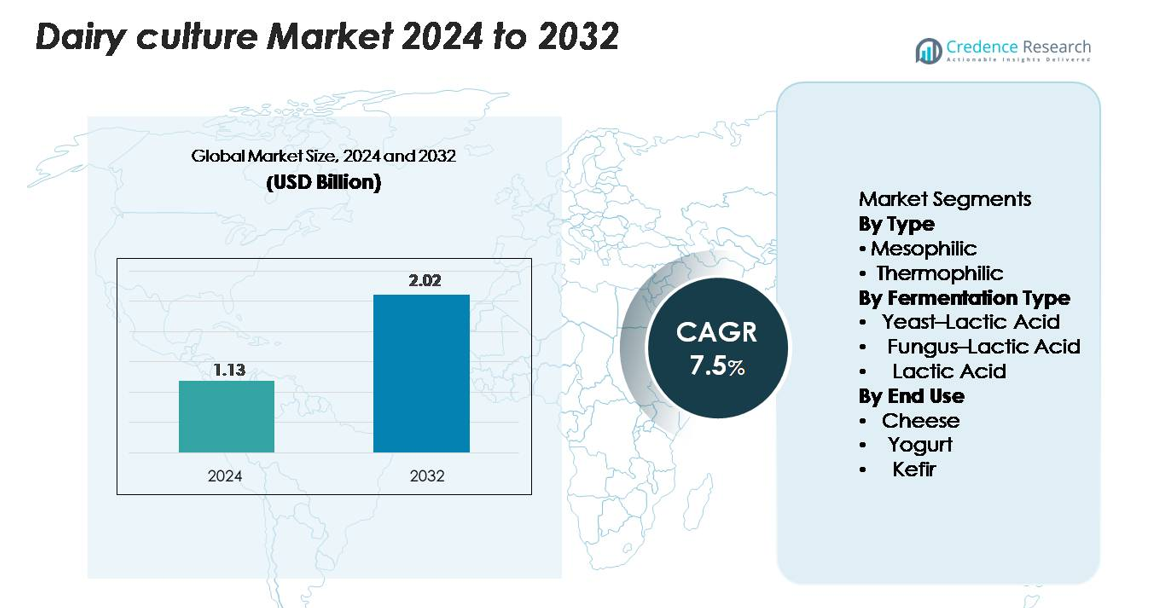

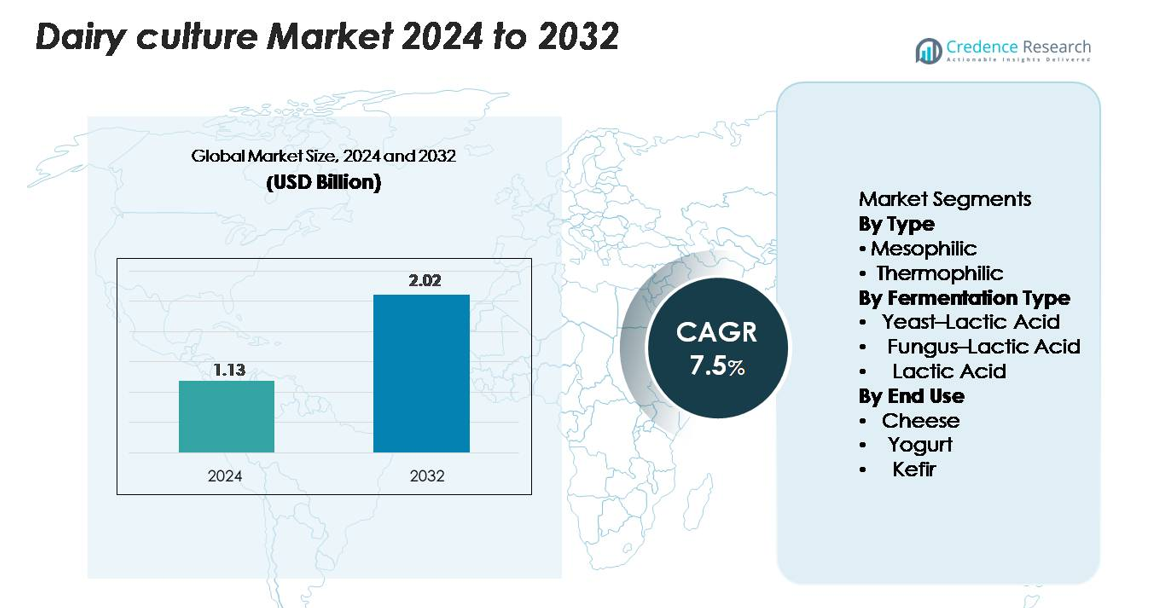

The global dairy culture market was valued at USD 1.13 billion in 2024 and is projected to reach USD 2.02 billion by 2032, expanding at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dairy Culture Market Size 2024 |

USD 1.13 billion |

| Dairy Culture Market, CAGR |

7.5% |

| Dairy Culture Market Size 2032 |

USD 2.02 billion |

The dairy cultures market is shaped by leading players such as Chr. Hansen Holding A/S, DuPont Nutrition & Biosciences (IFF), DSM-Firmenich, Lallemand Inc., and Sacco System, each leveraging advanced microbial strain development, phage-resistant culture technologies, and tailored fermentation solutions to support global dairy production. These companies maintain strong collaborations with dairy processors to enhance cheese yield, yogurt texture, and probiotic functionality. North America leads the market with a 32% share, supported by high consumption of fermented dairy products and advanced processing capabilities, followed by Europe at 28%, driven by its established cheese industry and strong clean-label culture innovation.

Market Insights

- The global dairy cultures market was valued at USD 1.13 billion in 2024 and is projected to reach USD 2.02 billion by 2032, expanding at a 7.5% CAGR throughout the forecast period.

- Strong market drivers include rising demand for probiotic-rich yogurt, kefir, and functional dairy products, along with expanding cheese production requiring reliable mesophilic cultures, which hold 58% of the type segment share.

- Key trends include the growth of clean-label, non-GMO cultures and rapid adoption of customized fermentation strains for premium dairy, supported by advancements from leading players such as Chr. Hansen, DSM-Firmenich, and Lallemand.

- Competitive pressures intensify as companies focus on phage-resistant cultures and high-stability formulations, while market restraints include regulatory complexity and dependence on stable cold-chain systems in emerging regions.

- Regionally, North America leads with 32%, followed by Europe at 28% and Asia-Pacific at 25%, supported by expanding yogurt, cheese, and probiotic beverage consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Mesophilic cultures dominate the dairy cultures market, accounting for approximately 58% of the total share, driven by their extensive use in cheese, cultured butter, and fermented milk production. Their ability to operate efficiently at moderate temperatures makes them suitable for large-scale dairy processing and artisanal manufacturing. Thermophilic cultures continue to grow steadily as demand rises for yogurt, mozzarella, and long-fermentation products requiring higher-temperature processing. The expansion of functional dairy categories and improved starter culture stability further strengthens mesophilic culture adoption across both traditional and value-added dairy applications.

- For instance, Chr. Hansen’s FRESHQ® mesophilic culture series has demonstrated the ability to extend the shelf life of fermented dairy products by up to 7 additional days by suppressing yeast and mold growth, while DSM-Firmenich’s Delvo®Cheese mesophilic cultures support cheese yield improvements of 1–3 kg per 1,000 liters of milk.

By Fermentation Type

The lactic acid fermentation segment holds the largest share at around 62%, supported by its essential role in acidification, texture development, and microbial safety across multiple dairy products. Lactic acid cultures offer high reliability, consistency, and compatibility with industrial-scale fermentation systems, making them the preferred choice for major dairy processors. Yeast–lactic acid and fungus–lactic acid fermentations are gaining traction in specialized applications such as kefir, probiotic drinks, and artisanal cheeses. Growing interest in diverse flavor profiles and functional cultures is accelerating innovation in mixed-fermentation solutions.

- For instance, Lallemand’s LactoB® lactic acid cultures have demonstrated a consistent pH reduction of 1.2–1.6 units within 6 hours in controlled fermentation trials.

By End Use

Cheese represents the largest end-use segment, capturing roughly 48% of the market, driven by the global expansion of specialty, aged, and processed cheese varieties. The segment benefits from the critical role cultures play in flavor development, texture formation, and maturation processes. Yogurt remains a fast-growing category as demand for probiotic and high-protein formulations increases. Kefir is also expanding due to rising consumer interest in gut-health-focused fermented beverages. The diversification of dairy applications and the premiumization of cultured products continue to support strong adoption across all end-use segments.

Key Growth Drivers

Rising Demand for Functional and Probiotic Dairy Products

The growing consumer focus on gut health, immunity, and functional nutrition continues to strongly drive the adoption of dairy cultures worldwide. Probiotic-rich products such as yogurt, kefir, cultured beverages, and fortified cheeses increasingly appeal to health-conscious consumers seeking daily digestive and wellness benefits. Food manufacturers are expanding product lines with high-potency and multi-strain cultures to differentiate offerings and meet clean-label expectations. Scientific evidence linking lactic acid bacteria and live microbial cultures to improved metabolism, immune modulation, and reduced gastrointestinal disorders has further accelerated demand. As supermarkets, specialty stores, and online platforms allocate more shelf space to functional dairy items, demand for advanced, stable, and tailored cultures strengthens, positioning dairy cultures as a core bio-functional ingredient in modern nutrition.

- For instance, Chr. Hansen’s LGG® (Lactobacillus rhamnosus GG) probiotic strain is used in fermented dairy products globally and delivers 1×10⁹ CFU per serving, while Yakult incorporates 6.5 billion live Lactobacillus casei Shirota cells in each 65-ml bottle to ensure clinically supported probiotic functionality.

Technological Advancements in Culture Formulations and Fermentation Processes

Innovation in freeze-dried cultures, microencapsulation, and strain-specific fermentation is significantly enhancing yield consistency, shelf stability, and performance under varying processing conditions. Dairy processors increasingly rely on thermophilic and mesophilic cultures engineered for improved acidification rates, robust flavor development, and resistance to bacteriophages—common challenges in large dairy plants. Automation in fermentation, coupled with precision-controlled starter systems, has reduced production downtime and strengthened batch uniformity. Moreover, advancements in DNA sequencing and microbial screening are enabling manufacturers to create custom blends optimized for regional taste profiles, fat levels, and texture specifications. These innovations allow dairy producers to maintain high-quality standards while scaling efficiently, directly driving increased adoption of advanced dairy cultures across global markets.

- For instance, DSM-Firmenich’s Delvo®Guard cultures are marketed as bioprotective cultures that delay yeast and mold growth to naturally extend the shelf life of fresh dairy products.

Expansion of Cheese and Yogurt Manufacturing Capacity Worldwide

The rapid increase in global cheese consumption—especially specialty, aged, and fresh varieties—continues to fuel the need for diverse, high-performance dairy cultures. As emerging markets expand industrial dairy capabilities, processors invest in reliable starter cultures to ensure flavor consistency and reduced fermentation variability. Similarly, yogurt production has seen strong global expansion, driven by rising demand for protein-rich, low-sugar, and probiotic variants. This manufacturing growth requires specialized cultures that deliver precise texture, viscosity, and clean sensory profiles. The shift toward premium dairy categories, including artisanal cheeses and fermented beverages, further supports market expansion. This growing industrial base ensures a steady rise in culture demand across commercial, artisanal, and hybrid dairy production models.

Key Trends & Opportunities

Increasing Adoption of Clean-Label, Non-GMO, and Natural Culture Solutions

The global transition toward clean-label foods presents a major opportunity for culture suppliers. Manufacturers are investing in non-GMO, allergen-free, and additive-free starter cultures that support transparent product labeling and meet stringent regulatory expectations. Natural cultures that enhance shelf life, reduce the need for synthetic stabilizers, and improve safety align with consumer-driven reformulation trends. This shift offers suppliers opportunities to develop cultures tailored for organic dairy processing, minimal-ingredient products, and slow-fermentation methods. As premiumization rises in yogurt, cheese, and fermented beverages, demand for natural and minimally processed cultures provides substantial market headroom, especially among artisanal and specialty dairy producers.

- For instance, Chr. Hansen’s FRESHQ® bioprotective cultures have demonstrated the ability to extend the shelf life of fermented dairy products by up to 7 additional days by suppressing yeast and mold growth without the use of artificial preservatives, while DSM-Firmenich’s Delvo®Fresh cultures achieve consistent pH stability within ±0.05 units during fermentation to support clean-label yogurt production.

Growth of Plant-Based and Hybrid Fermented Products

Although dairy cultures traditionally serve animal-based dairy, the growing popularity of plant-based alternatives has created a new opportunity for culture manufacturers. Producers of almond, coconut, oat, and soy-based yogurts and cheeses increasingly use lactic cultures to improve texture, acidity, and flavor profiles. The expansion of hybrid dairy products—combining dairy with plant ingredients—further broadens culture applicability. This trend is driving demand for specialized strains capable of fermenting plant substrates, overcoming challenges such as low protein content and varying sugar compositions. Companies developing multi-strain cultures for plant-based fermentation are successfully tapping into a rapidly expanding segment seeking functional, probiotic-enhanced alternatives.

- For instance, Chr. Hansen’s VEGA™ culture range has demonstrated the ability to achieve a pH reduction of 1.4–1.8 units within 6 hours in soy and oat bases, while maintaining probiotic viability above 1×10⁹ CFU per gram in finished plant-based yogurts enabling texture and flavor development comparable to dairy fermentation.

Key Challenges

High Sensitivity to Bacteriophage Contamination in Large-Scale Fermentation

Bacteriophage infections pose one of the most significant challenges for dairy processors relying on starter cultures. Phages can rapidly disrupt fermentation, reduce acidification efficiency, compromise texture, and result in large-scale production losses. The increasing scale and automation of dairy plants create environments where phage circulation becomes more likely, especially in cheese and yogurt lines with repeated use of specific cultures. While phage-resistant strains and rotating culture systems help, they require continuous monitoring and high investment in hygiene infrastructure. Managing these risks demands stringent process controls, air filtration, cleaning protocols, and rapid detection technologies, making phage management a costly and complex challenge across global facilities.

Regulatory Complexity Surrounding Culture Approvals and Labeling Standards

The dairy cultures market faces regulatory inconsistencies across regions, especially concerning microbial strain approvals, GRAS status, labeling requirements, and permissible claims related to probiotics. Manufacturers must navigate varying standards from regulatory bodies such as the FDA, EFSA, and regional food safety authorities, which often interpret probiotic efficacy and culture functionality differently. This complexity slows product launches, increases compliance costs, and limits the ability to market health benefits openly. Additionally, stricter guidelines on live culture counts, permissible microbial species, and documentation requirements place additional burdens on suppliers and producers, particularly smaller manufacturers seeking to expand into multiple countries.

Regional Analysis

North America

North America holds approximately 32% of the global dairy cultures market, driven by strong consumption of yogurt, cheese, kefir, and probiotic-rich dairy products. The region benefits from advanced dairy processing infrastructure, widespread adoption of functional foods, and rising demand for premium and organic cultured dairy items. Major manufacturers leverage high R&D capabilities to develop specialized starter cultures tailored for clean-label, low-sugar, and high-protein formulations. Expanding artisanal cheese production, along with the growing popularity of Greek yogurt and fermented beverages, continues to strengthen market demand across the U.S. and Canada.

Europe

Europe accounts for around 28% of the market, supported by its long-established dairy culture tradition and advanced cheese manufacturing expertise. The region hosts strong dairy cooperatives and industrial processors that rely heavily on mesophilic and thermophilic cultures for producing aged cheeses, specialty yogurts, and cultured creams. Regulatory emphasis on natural, non-GMO, and high-quality fermentation processes drives continuous innovation in culture strains. Countries such as France, Germany, and Denmark lead consumption, while Eastern European markets expand due to rising interest in kefir and probiotic beverages. Overall, the region maintains a stable, innovation-driven market outlook.

Asia-Pacific

Asia-Pacific represents the fastest-growing region, holding roughly 25% of the global share, fueled by rising urbanization, increasing disposable incomes, and accelerated adoption of Western-style dairy products. China, India, Japan, and Southeast Asian countries are experiencing strong expansion in yogurt, probiotic drinks, and fresh cheese consumption. Investments in cold-chain facilities and modern dairy processing plants support the widespread use of advanced cultures. The surge in functional foods and digestive health awareness further boosts demand. Local manufacturers increasingly collaborate with global culture suppliers to produce customized formulations suitable for regional taste profiles and heat-stable dairy applications.

Latin America

Latin America captures approximately 8% market share, driven by growing dairy consumption across Brazil, Mexico, Argentina, and Chile. The region’s expanding cheese and yogurt industries rely heavily on robust lactic acid cultures to improve product consistency and shelf stability under varying climatic conditions. Increased investments in modern dairy farms and processing units are enabling adoption of higher-quality starter cultures. Health-oriented consumer trends are boosting demand for probiotic drinks, kefir, and fortified dairy products. However, production scalability challenges and import dependence for specialized cultures moderately affect market growth.

Middle East & Africa

The Middle East & Africa region holds nearly 7% of the global market, supported by rising demand for yogurt, laban, processed cheese, and cultured dairy beverages. Countries such as Saudi Arabia, UAE, and South Africa are accelerating dairy sector modernization, creating new opportunities for advanced culture solutions. Growing health awareness is driving the introduction of probiotic and fortified dairy products in retail channels. Despite increasing adoption, reliance on imported ingredients, limited cold-chain infrastructure, and higher production costs pose growth constraints. Nonetheless, expanding dairy investments and population growth are expected to support steady market development.

Market Segmentations:

By Type

By Fermentation Type

- Yeast–Lactic Acid

- Fungus–Lactic Acid

- Lactic Acid

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the dairy cultures market is defined by a concentrated group of global biotechnology and ingredient suppliers that compete on strain innovation, product performance, and application-specific culture solutions. Leading companies such as Chr. Hansen Holding A/S, DSM-Firmenich, DuPont Nutrition & Biosciences (IFF), Lallemand Inc., and Sacco System invest heavily in microbial R&D to develop robust mesophilic and thermophilic cultures with enhanced acidification rates, improved phage resistance, and superior flavor-forming properties. These players leverage advanced fermentation technologies, proprietary strain libraries, and long-term partnerships with dairy processors to maintain competitive differentiation. The landscape also features regional manufacturers specializing in customized cultures for artisanal cheeses, probiotic beverages, and traditional fermented dairy products. Competition increasingly centers on clean-label, non-GMO, and high-stability cultures that support premium and functional dairy innovations. As global dairy consumption rises and processing facilities modernize, leading suppliers continue expanding capacity, strengthening technical support, and pursuing strategic acquisitions to broaden their culture portfolios and global footprint.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Alltech Inc.

- Grupo Lala

- ADM

- Clover S.A. Proprietary Limited

- DSM

- Amul

- Cargill

- Arla Foods Amba

- Dean Foods Company

- Balletic Inc.

Recent Developments

- In November 2024, Grupo Lala launched its LALA Gold high-protein yogurts featuring active probiotics, 20 – 25 g protein per serving and no added sugar.

- In November 2024, Clover S.A. Proprietary Limited introduced two new dairy innovations in South Africa: a 1-litre UHT flavoured milk (chocolate & strawberry) and a Tropika drinking yoghurt under its Tropika brand.

- In August 2022, ADM announced a strategic partnership with New Culture to scale up commercialization of animal-free dairy products including precision-fermented casein and mozzarella

Report Coverage

The research report offers an in-depth analysis based on Type, Fermentation type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for probiotic-rich dairy products will accelerate adoption of advanced culture strains.

- Manufacturers will increase development of phage-resistant and high-stability cultures for large-scale processing.

- Clean-label and non-GMO dairy cultures will gain stronger preference across mainstream and premium products.

- Customized culture blends will expand to support regional flavor profiles and specialty cheese varieties.

- Growth in kefir and fermented beverages will drive demand for mixed yeast–lactic acid culture systems.

- Precision fermentation technologies will enhance production efficiency and strain performance.

- Expanding dairy processing capacity in Asia-Pacific will create new opportunities for culture suppliers.

- Functional and fortified dairy products will stimulate innovation in multi-strain probiotic cultures.

- Plant-based fermented dairy alternatives will open a growing niche for specialized fermentation cultures.

- Strategic collaborations between culture producers and dairy processors will strengthen global supply capabilities.