Market Overview

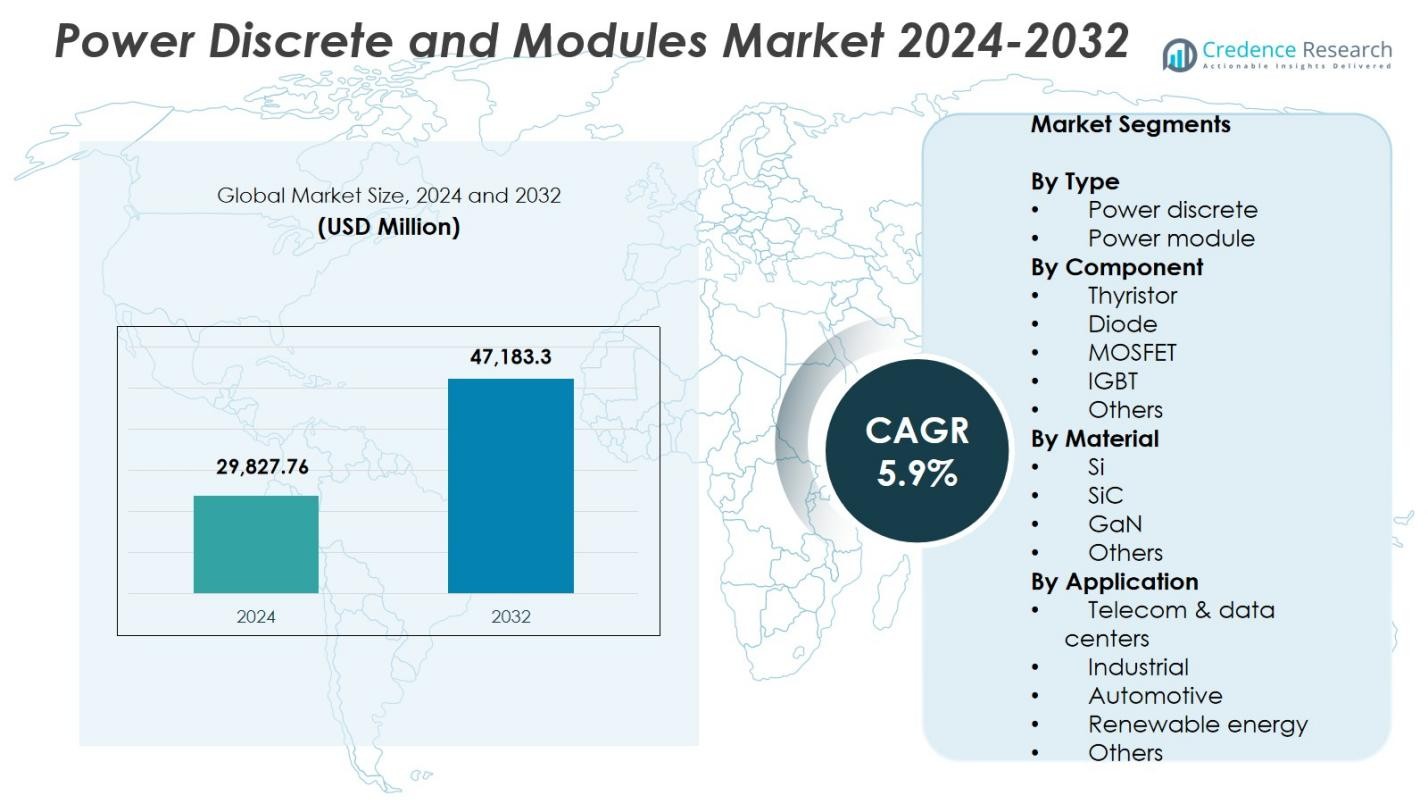

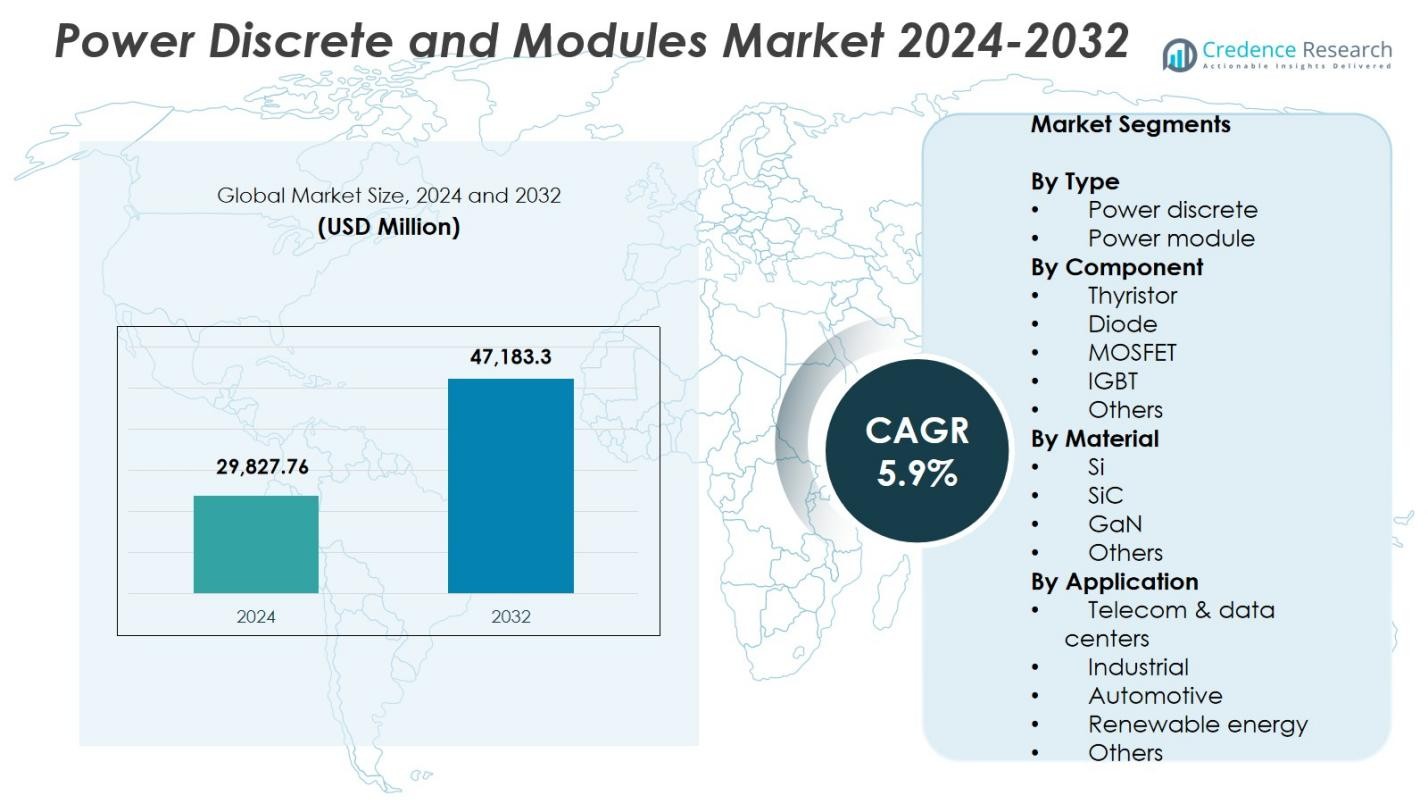

Power Discrete and Modules Market size was valued at USD 29,827.76 million in 2024 and is anticipated to reach USD 47,183.3 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power Discrete and Modules Market Size 2024 |

USD 29,827.76 Million |

| Power Discrete and Modules Market, CAGR |

5.9% |

| Power Discrete and Modules Market Size 2032 |

USD 47,183.3 Million |

Power Discrete and Modules Market features strong participation from leading companies such as Infineon Technologies, Mitsubishi Electric, ROHM Semiconductor, ON Semiconductor, Renesas Electronics, Microchip Technology, Powerex, Danfoss, Fuji Electric, and Littelfuse, each advancing innovation in high-efficiency power devices and wide-bandgap technologies. These players strengthen their positions through product development, capacity expansion, and strategic partnerships across automotive, industrial, and renewable energy applications. Regionally, Asia Pacific leads the Power Discrete and Modules Market with a 38.9% share, driven by large-scale electronics manufacturing, strong EV adoption, and robust semiconductor production ecosystems in China, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Power Discrete and Modules Market was valued at USD 29,827.76 million in 2024 and will reach USD 47,183.3 million by 2032, registering a CAGR of 5.9% during the forecast period.

- The market grows as demand accelerates for high-efficiency power electronics across EVs, industrial automation, and renewable energy systems, strengthening adoption of MOSFETs and IGBTs.

- Key trends include rapid penetration of SiC and GaN devices and rising integration of smart power modules, with the power discrete segment holding 58.3% share and MOSFETs leading with 42.6% share.

- Major players such as Infineon Technologies, Mitsubishi Electric, ROHM Semiconductor, ON Semiconductor, and Renesas Electronics expand capacity and develop advanced wide-bandgap solutions despite restraints like high material costs and thermal management challenges.

- Asia Pacific dominates with a 38.9% share, followed by North America at 28.4% and Europe at 24.7%, supported by strong EV adoption, electronics manufacturing, and renewable energy expansion.

Market Segmentation Analysis:

By Type:

The Power Discrete and Modules Market is segmented into power discrete and power modules, with the power discrete segment accounting for 58.3% of the market share in 2024, making it the dominant category. Its leadership is driven by widespread adoption in consumer electronics, automotive systems, and industrial power supplies, where compact designs, fast switching, and high efficiency are critical. The demand for discrete MOSFETs and diodes continues to grow as manufacturers prioritize cost-effective power management solutions. Furthermore, rising investments in EVs, renewable energy systems, and data-center power architectures reinforce the strong growth trajectory of power discretes.

- For instance, Infineon’s OptiMOS™ power MOSFETs deliver ultra-low switching losses in EV power supplies, enabling higher power density through the industry’s best figure-of-merit while supporting top-side-cooled packages like Q-DPAK for thermal reliability.

By Component:

Among thyristors, diodes, MOSFETs, IGBTs, and others, the MOSFET segment held the largest share at 42.6% in 2024, reflecting its dominant role in low- to medium-voltage applications requiring high switching speeds and energy efficiency. MOSFETs benefit from strong demand across automotive electronics, battery-powered devices, and renewable energy inverters, where efficiency gains directly reduce system-level energy consumption. Their superior thermal performance, compact footprint, and compatibility with next-generation SiC and GaN technologies continue to enhance adoption. Industry expansion in robotics, automation, and portable devices further supports MOSFET market leadership.

- For instance, Infineon’s OptiMOS™ 7 40V MOSFETs target automotive 12V and 48V systems, including electric power steering, braking systems, and battery management, delivering high power density and low on-resistance to minimize energy losses.

By Material:

In the material segmentation Si, SiC, GaN, and others the silicon (Si) segment dominated with a 67.4% market share in 2024, driven by its mature supply chain, cost efficiency, and extensive use in consumer electronics, industrial drives, and automotive components. Silicon remains the preferred material for high-volume production due to established manufacturing processes and broad device compatibility. However, SiC and GaN continue gaining traction in fast-growing applications such as EV powertrains and high-frequency power supplies. The stability, reliability, and affordability of silicon technologies sustain its leading position across global power semiconductor markets.

Key Growth Drivers

Rising Demand for High-Efficiency Power Electronics

The Power Discrete and Modules Market experiences strong growth as industries prioritize high-efficiency power conversion to reduce energy loss and enhance overall system performance. Rapid expansion of EVs, industrial automation, and renewable energy infrastructure continues to elevate demand for advanced MOSFETs, IGBTs, and SiC/GaN devices. Manufacturers increasingly invest in energy-efficient power architectures to meet stringent global efficiency regulations. This shift accelerates adoption of discrete and modular power components, particularly in automotive onboard chargers, solar inverters, and power supplies across industrial and commercial applications.

- For instance, STMicroelectronics offers ACEPACK IGBT modules with 650V or 1200V ratings and current up to 75A, supporting industrial motor drives and solar inverters from 3kW to 30kW by balancing conduction and switching losses.

Acceleration of Electric Vehicle and Charging Infrastructure

Widespread EV adoption significantly drives demand for power discretes and modules used in traction inverters, onboard chargers, battery management systems, and DC fast-charging stations. High-voltage IGBTs and SiC MOSFETs are essential for improving vehicle range, reducing charging times, and enhancing thermal performance. Governments worldwide support EV expansion through incentives and emissions regulations, creating a robust ecosystem for high-power semiconductor technologies. Automakers and Tier-1 suppliers increasingly rely on advanced power modules to meet performance expectations, reinforcing sustained market growth across mobility applications.

- For instance, SiC MOSFETs provide superior thermal conductivity and higher temperature tolerance over silicon devices, enabling compact onboard chargers and DC-DC converters. Operating at ratings like 900V/100A, they reduce cooling needs and support high-frequency operation for improved vehicle efficiency.

Expansion of Renewable Energy and Industrial Automation

Growing investment in solar, wind, and smart-grid systems fuels the need for efficient power conversion devices capable of handling high switching frequencies and harsh operating environments. Power modules and discretes are central to inverter systems, energy storage converters, and grid-stabilization units, driving substantial adoption. Parallel growth in robotics, factory automation, and process control further boosts demand for reliable high-power components. Productivity goals, decarbonization initiatives, and Industry 4.0 adoption strengthen the market’s momentum as industries upgrade to advanced semiconductor-based power management technologies.

Key Trends & Opportunities

Rapid Transition Toward Wide-Bandgap Materials

A major trend reshaping the market is the accelerated shift toward SiC and GaN power devices, which offer superior switching efficiency, higher thermal conductivity, and compact system design. These materials provide significant performance benefits in EVs, renewable inverters, aerospace power systems, and high-density data-center power supplies. Manufacturers see strong commercial opportunity in developing SiC-based power modules and GaN-based fast-switching discretes. As production scales and costs decline, wide-bandgap adoption expands across both high-power and consumer-level applications, opening new growth avenues.

- For instance, ON Semiconductor has introduced SiC MOSFETs that operate reliably at temperatures above 175°C, making them ideal for aerospace and industrial power electronics.

Growth of Smart Power Modules and Integrated Solutions

Integration of sensing, protection, and control capabilities into power modules represents a rising opportunity as industries move toward digitalized and intelligent power systems. Smart power modules enable real-time monitoring, fault diagnostics, and thermal management, helping improve system reliability and reduce downtime. Their adoption expands rapidly in EV traction systems, HVAC equipment, industrial drives, and motor-control applications. Advancements in embedded intelligence, IoT connectivity, and compact packaging designs enhance value propositions for end users, generating strong potential for market differentiation and premium product offerings.

- For instance, Infineon Technologies’ EASY™ power modules integrate advanced sensing and control features that enhance efficiency and diagnostic capabilities in EV applications.

Key Challenges

High Cost and Limited Supply of Wide-Bandgap Materials

Despite strong performance advantages, SiC and GaN devices face challenges related to high production costs, limited wafer availability, and complex fabrication processes. These obstacles restrict widespread adoption, particularly in cost-sensitive markets such as consumer electronics and low-power applications. Supply chain constraints and dependency on specialized manufacturing equipment further intensify pricing pressures. As demand surges in automotive and renewable sectors, material shortages and long lead times pose risks to scalability. Addressing these issues requires major investments in manufacturing capacity and process innovation.

Thermal Management and Reliability Constraints at High Power

Power discretes and modules used in high-power and high-frequency environments face significant challenges related to heat dissipation, long-term reliability, and performance degradation. Applications such as EV inverters, industrial drives, and grid converters require robust thermal solutions to maintain efficiency and prevent device failure. Inadequate cooling systems, packaging limitations, and material fatigue under thermal cycling increase the risk of operational downtime. Manufacturers must innovate advanced packaging, cooling techniques, and reliability testing frameworks to ensure consistent performance in demanding conditions.

Regional Analysis

North America

North America held 28.4% market share in 2024, driven by strong adoption of advanced power electronics across electric vehicles, industrial automation, aerospace, and renewable energy systems. The United States leads regional demand due to rapid expansion of EV charging networks, data centers, and distributed energy resources requiring high-performance MOSFETs, IGBTs, and power modules. Growing investments by automotive OEMs and semiconductor manufacturers support technological advancement and supply chain resilience. Favorable regulatory frameworks promoting energy efficiency and carbon reduction further accelerate the integration of wide-bandgap materials, strengthening North America’s position in the global market.

Europe

Europe accounted for 24.7% market share in 2024, propelled by strong EV penetration, strict emission regulations, and large-scale renewable energy deployments. Germany, France, and the Nordic countries drive adoption of SiC-based power modules for EV inverters and grid infrastructure. Industrial automation initiatives under Industry 4.0 spur additional demand for high-efficiency power discretes in robotics, drives, and factory equipment. The region’s focus on sustainability, electrified transportation, and energy transition strengthens long-term growth prospects. Collaborative R&D programs and semiconductor manufacturing expansion continue to reinforce Europe’s technological leadership in next-generation power electronics.

Asia Pacific

Asia Pacific dominated the global market with 38.9% market share in 2024, supported by large-scale electronics manufacturing, rapid industrialization, and strong EV and renewable energy investments. China, Japan, and South Korea remain central to global semiconductor production, creating a robust ecosystem for power discrete and module technologies. The region’s expanding automotive sector and substantial growth in solar and energy-storage projects increase demand for high-efficiency IGBTs, MOSFETs, and power modules. Government incentives for domestic semiconductor capacity and rising adoption of wide-bandgap technologies further accelerate market expansion across APAC.

Latin America

Latin America captured 4.6% market share in 2024, driven by growing adoption of renewable energy installations, industrial automation upgrades, and expanding EV infrastructure in countries such as Brazil, Mexico, and Chile. Demand for power discretes and modules increases as utilities modernize grid systems and industrial operators integrate energy-efficient drives and converters. Solar and wind energy projects continue gaining traction, supporting Si and SiC device penetration. Although market maturity remains developing, rising foreign investments and supportive clean-energy policies are strengthening regional opportunities for power semiconductor suppliers.

Middle East & Africa

The Middle East & Africa region held 3.4% market share in 2024, supported by expanding solar power projects, infrastructure modernization, and industrial diversification initiatives. Gulf countries deploy large-scale solar farms and smart-grid programs that require advanced inverter and power module technologies. Industrial automation in mining, oil and gas, and utilities increases demand for high-reliability power discretes. Emerging EV adoption and government-led clean-energy commitments gradually boost semiconductor consumption. While growth remains nascent compared to other regions, ongoing digitalization and renewable investments enhance long-term opportunities in MEA’s power electronics landscape.

Market Segmentations:

By Type

- Power discrete

- Power module

By Component

- Thyristor

- Diode

- MOSFET

- IGBT

- Others

By Material

By Application

- Telecom & data centers

- Industrial

- Automotive

- Renewable energy

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Competitive Landscape of the Power Discrete and Modules Market is shaped by leading players such as Infineon Technologies, Mitsubishi Electric, ROHM Semiconductor, ON Semiconductor, Renesas Electronics, Microchip Technology, Powerex, Danfoss, Fuji Electric, and Littelfuse, each contributing to strong innovation and global market expansion. Competition intensifies as companies focus on advancing SiC and GaN technologies, improving thermal performance, and developing compact, high-efficiency modules for EVs, renewable energy systems, and industrial automation. Strategic initiatives include capacity expansion, vertical integration, and partnerships with automotive OEMs and power system manufacturers to secure long-term supply agreements. Key players invest heavily in R&D to enhance wide-bandgap device reliability, packaging efficiency, and manufacturing scale, enabling differentiated product portfolios across voltage classes and application segments. The competitive environment continues to evolve with mergers, long-term wafer supply agreements, and technology collaborations that strengthen global leadership in next-generation power electronics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Infineon Technologies and ROHM Semiconductor expanded collaboration on SiC-based power modules to enable energy-efficient solutions for EV charging, renewable energy systems, and AI data centers.

- In September 2025, Mitsubishi Electric launched its new Compact DIPIPM power modules (models PSS30SF1F6 and PSS50SF1F6), with sample shipments starting September 22, ideal for compact inverter substrates in air conditioning and other equipment.

- In March 2025, Mitsubishi Electric began sample shipments of its new 1.2 kV LV100-type IGBT module designed for industrial and renewable energy power systems, enhancing inverter efficiency and reliability.

Report Coverage

The research report offers an in-depth analysis based on Type, Component, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth as EV adoption accelerates and requires advanced power modules for traction inverters and fast-charging systems.

- Wide-bandgap materials such as SiC and GaN will gain rapid penetration across automotive, renewable energy, and data-center applications.

- Manufacturers will expand production capacity to reduce supply shortages and improve global semiconductor resilience.

- Smart power modules with integrated sensing, diagnostics, and control features will become standard in industrial and automotive systems.

- Renewable energy expansion will increase demand for high-efficiency power discretes used in solar inverters and energy-storage converters.

- Industrial automation and robotics adoption will drive sustained demand for high-reliability IGBTs and MOSFETs.

- Packaging innovations will enhance thermal performance and support higher power density requirements across sectors.

- Electrification of transportation beyond EVs, including rail and marine systems, will create new revenue opportunities.

- Digital power management and IoT-enabled monitoring will strengthen the shift toward intelligent power systems.

- Strategic partnerships among OEMs, semiconductor firms, and material suppliers will accelerate technology advancement and commercialization.