Market Overview

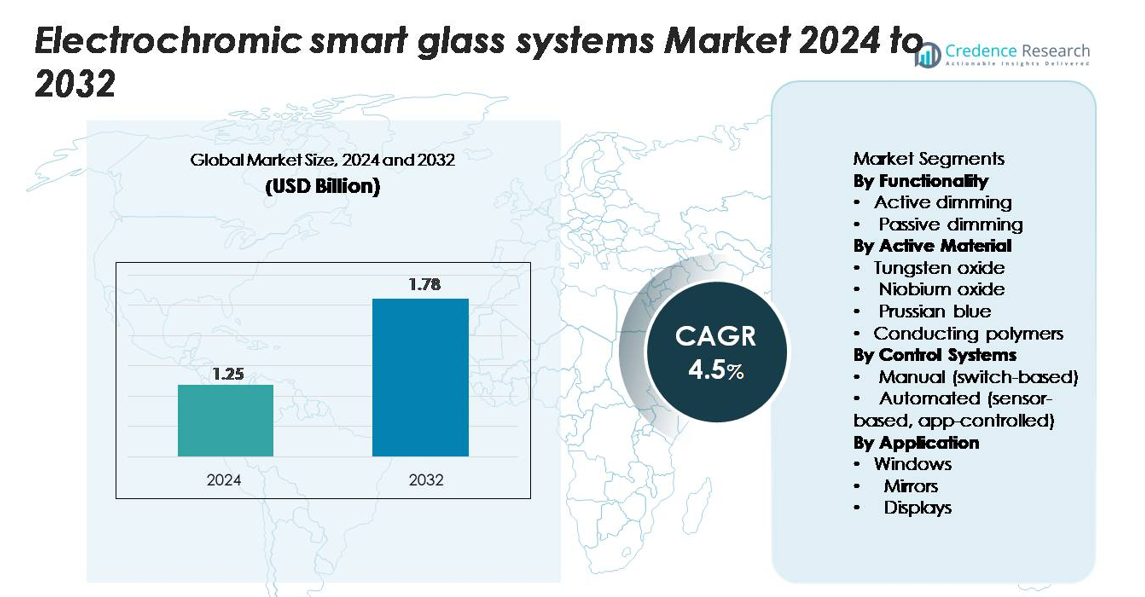

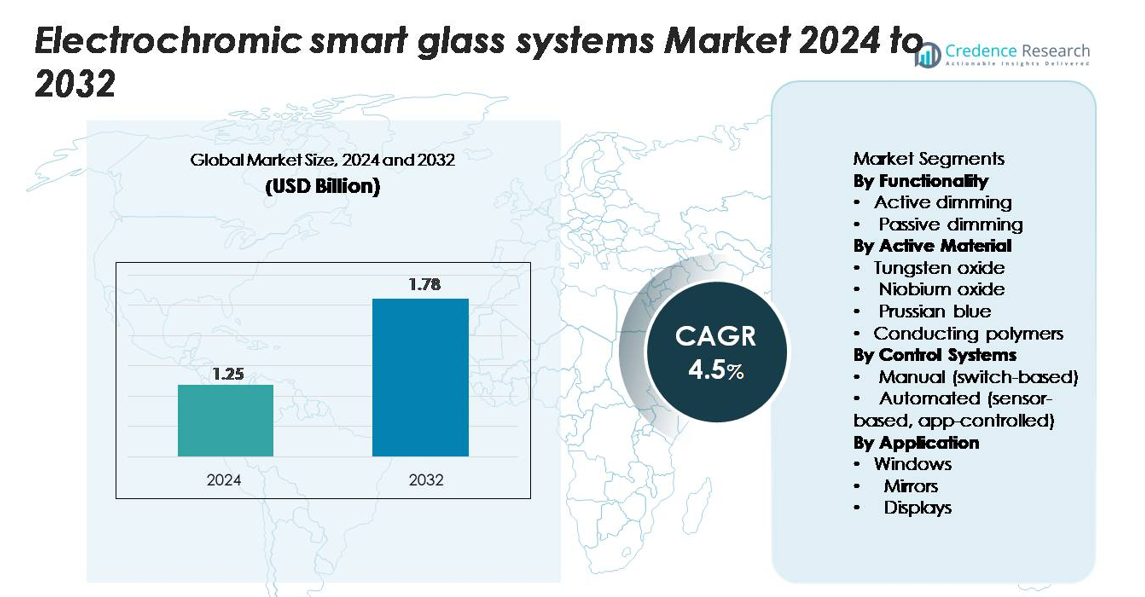

The electrochromic smart glass systems market was valued at USD 1.25 billion in 2024 and is projected to reach USD 1.78 billion by 2032, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrochromic Smart Glass Systems Market Size 2024 |

USD 1.25 billion |

| Electrochromic Smart Glass Systems Market, CAGR |

4.5% |

| Electrochromic Smart Glass Systems Market Size 2032 |

USD 1.78 billion |

North America leads the electrochromic smart glass systems market with around 40% market share, driven by strong adoption in commercial buildings, smart infrastructure, and high-end automotive applications. Major companies—including Guardian Glass, Gentex Corporation, Compagnie de Saint-Gobain S.A., Asahi Glass Co. (AGC), Halio, Kinestral Technologies, Innovative Glass Corporation, Diamond Glass, ChromoGenics AB, and AGG Inc.—compete by enhancing switching performance, durability, and system integration capabilities. Europe holds approximately 30% market share, supported by strict energy-efficiency regulations and widespread commercial adoption, while Asia-Pacific accounts for about 20%, emerging as the fastest-growing region due to rapid urbanization, EV expansion, and rising investment in advanced architectural glazing.

Market Insights

- The electrochromic smart glass systems market was valued at USD 1.25 billion in 2024 and is projected to reach USD 1.78 billion by 2032, registering a CAGR of 4.5% over the forecast period.

- Market growth is driven by rising demand for energy-efficient buildings, increased integration of smart automation, and expanding adoption in automotive applications, with active dimming maintaining the dominant segment share due to its superior control capabilities.

- Key trends include advancements in faster-switching electrochromic materials, wider use of sensor-based automated systems, and increasing applications across healthcare, hospitality, and premium residential environments.

- Competitive dynamics involve leading players such as Guardian Glass, Saint-Gobain, AGC, Halio, Gentex, and Kinestral Technologies focusing on material innovation, improved durability, and large-scale architectural deployment while navigating high installation costs and integration complexities.

- Regionally, North America leads with about 40% share, followed by Europe at around 30%, while Asia-Pacific holds nearly 20% and remains the fastest-growing region due to rapid urban expansion and rising EV adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Functionality:

Active dimming dominates the electrochromic smart glass systems market, accounting for an estimated majority share due to its precise light-modulation capability and compatibility with advanced architectural and automotive applications. This segment leads because it enables dynamic, user-controlled tint adjustment that enhances energy efficiency and occupant comfort. Growing integration of automated shading solutions in commercial buildings and premium vehicles further strengthens demand for active dimming technologies. Passive dimming continues to find niche use where cost sensitivity and simpler installation are priorities, but its adoption remains slower due to limited control options and lower performance flexibility compared to active systems.

- For instance, View, Inc. describes its dynamic glass panes as able to transition from clear to up to 99 % tint for visible wavelengths.

By Active Material:

Tungsten oxide represents the leading active material segment, holding the largest market share owing to its high coloration efficiency, stability, and fast switching response. Its strong suitability for large-area architectural glazing and transportation applications drives widespread adoption. Manufacturers prefer tungsten oxide for its proven durability and ability to achieve deeper tint levels under varied environmental conditions. Niobium oxide and Prussian blue materials follow as emerging alternatives offering improved cycling performance and color neutrality, while conducting polymers gain traction in lightweight and flexible smart glass systems, though they remain secondary due to shorter lifespan and lower environmental resistance.

- For instance, flexible thin films of Nb₂O₅ on ITO-coated PET substrates demonstrated a maximum coloration efficiency of 30 cm²/C and reversibility of 96 % after deposition.

By Control Systems:

Automated control systems lead the market, capturing the dominant share as buildings and vehicles increasingly adopt sensor-based and app-controlled electrochromic glass for seamless daylight management and enhanced energy savings. These systems automatically adjust tint levels based on ambient light, temperature, and user preferences, reducing HVAC loads and improving occupant comfort. Their integration with smart home and building automation platforms accelerates adoption in high-performance construction projects. Manual switch-based systems remain relevant in cost-constrained applications, but their limited functionality and lack of integration features keep their market share comparatively lower.

Key Growth Drivers

Rising Demand for Energy-Efficient Building Solutions

The adoption of electrochromic smart glass is strongly driven by global initiatives to reduce building energy consumption and meet increasingly stringent green-building regulations. Commercial buildings, in particular, rely on dynamic glazing to lower HVAC loads, optimize daylight utilization, and enhance occupant comfort. Electrochromic glass actively modulates heat and light transmission, enabling measurable reductions in cooling demand and operational expenses. Government incentives for net-zero and LEED-certified construction further accelerate integration in offices, airports, hospitals, and institutional projects. Growing urbanization and smart infrastructure development sustain long-term demand, as developers seek technologies that simultaneously elevate energy performance, aesthetics, and user experience. As environmental targets become stricter across the U.S., Europe, and Asia, dynamic façade systems such as electrochromic glass emerge as strategic enablers of sustainability.

- For instance, SAGE Electrochromics, Inc.’s SageGlass® electrochromic glazing system was modelled to reduce incident solar energy by up to 81 W per m² of façade under specified climate and control scenarios.

Expansion of Smart and Connected Building Ecosystems

The proliferation of IoT-enabled buildings and automated climate-control systems significantly boosts demand for electrochromic smart glass. Integration with smart sensors, building management systems (BMS), and app-based controls transforms glazing into an active component of intelligent infrastructure. Electrochromic systems automatically regulate glare, light transmission, and thermal comfort, reducing the need for manual blinds or shading devices. This seamless connectivity is especially attractive to high-end commercial spaces, luxury residential complexes, and energy-efficient industrial facilities. As demand for occupant-centric environments grows, electrochromic glass plays a key role in enhancing productivity and wellness through adaptive indoor environments. The shift toward fully digital, sensor-driven buildings—with unified control of lighting, ventilation, and shading—firmly positions smart glazing as a foundational technology within the modern smart-building ecosystem.

- For instance, View, Inc.’s “View Dynamic Glass” system implements individual addressability for each glazed pane (each pane given a unique IP address in the network).

Growing Automotive Adoption for Comfort and Privacy Enhancements

The automotive sector increasingly integrates electrochromic smart glass to improve cabin comfort, reduce glare, and enhance passenger privacy. Premium OEMs incorporate dimmable sunroofs, side windows, and rearview mirrors that adjust automatically based on ambient conditions or driver preferences. These systems contribute to thermal regulation, decreasing air-conditioning usage and improving vehicle efficiency—an important advantage for electric vehicles. Advancements in glazing durability, switching speed, and optical clarity enable automakers to expand applications beyond mirrors toward panoramic roof systems and display-integrated glazing. As automotive design trends shift toward minimalism, digital functionality, and advanced user experience, electrochromic glass technologies support both aesthetic differentiation and functional performance. Growing consumer preference for personalized comfort and reduced heat load strengthens the long-term outlook for smart glass integration in the mobility sector.

Key Trends & Opportunities

Growing Adoption of Multi-Functional and Integrated Smart Glass Solutions

A key market trend involves the evolution of electrochromic glass from standalone dimming technology to a multi-functional platform integrating thermal control, glare management, and embedded digital features. Manufacturers develop hybrid systems that combine electrochromic layers with sensors, self-cleaning coatings, and photovoltaic elements to enhance value across architectural and automotive applications. The integration of electrochromic glass with AR/VR-ready displays, HUDs, and transparent digital signage creates new opportunities in next-generation mobility cabins and commercial interiors. Increased R&D investment drives improvements in switching speed, color neutrality, and long-term durability, enabling broader adoption across climates and façade designs. As industries prioritize multi-functionality and design flexibility, electrochromic smart glass positions itself as a premium, technology-centric solution.

- For instance, Gentex Corporation’s automotive smart-glass platform pairs electrochromic dimming with an embedded HUD projection layer capable of displaying graphics at luminance levels exceeding 12,000 cd/m², ensuring legibility under direct sunlight conditions.

Strong Growth Potential in Healthcare, Hospitality, and High-End Residential Sectors

Electrochromic smart glass systems gain momentum across healthcare and hospitality environments where privacy, patient comfort, and ambient control are essential. Hospitals increasingly adopt smart glazing to replace traditional curtains or blinds, supporting infection control and reducing maintenance. Hotels implement dynamic glass for premium guest experience, automated glare control, and energy-efficient room management. High-end residential developers also integrate smart glazing to differentiate luxury apartments and villas with advanced comfort features. These emerging segments present significant opportunities for manufacturers to tailor solutions that offer instant privacy, improved hygiene, and personalized lighting ambience. As user expectations shift toward seamless automation and enhanced well-being, demand for electrochromic solutions extends beyond traditional commercial real estate into diversified, high-value applications.

- For instance, SageGlass reports that their smart windows help healthcare buildings “achieve views and light without glare and heat.”

Key Challenges

High Upfront Costs and Complex Installation Requirements

Despite rising interest, the adoption of electrochromic smart glass faces challenges associated with high initial costs for materials, power systems, and installation. Compared with conventional glazing, electrochromic systems require additional wiring, controllers, and integration with building automation platforms, increasing overall project expenses. These factors can slow adoption in price-sensitive construction markets, particularly in developing regions. Installation complexity also requires specialized labor, raising operational and maintenance costs. The financial barrier remains significant for small-scale residential applications and retrofit projects. Manufacturers continue to reduce production costs, but widespread cost parity with traditional glazing is yet to be achieved—creating a key restraint to broader market penetration.

Slow Switching Speed and Performance Variability in Extreme Conditions

Electrochromic smart glass performance varies depending on temperature, tint depth, and material type, presenting reliability challenges in certain environments. Switching speed—especially for large-area façades—can be slow compared to user expectations, particularly in colder climates. Color uniformity and haze levels sometimes fluctuate across panels, affecting visual quality in high-visibility architectural applications. Durability concerns, such as cycling fatigue or degradation of active materials, also impact long-term performance. These technical limitations hinder adoption in sectors requiring rapid response and consistent optical clarity. Continuous innovation is essential to improve switching efficiency, expand temperature tolerance, and ensure stable long-term performance across diverse applications.

Regional Analysis

North America

North America maintains the largest market share at around 40%, driven by strong adoption of electrochromic smart glass in commercial buildings, healthcare facilities, airports, and premium residential developments. The U.S. leads due to advanced smart-building deployment, strict energy-efficiency mandates, and strong investments in sustainable façades. Growing integration of electrochromic glazing in luxury automotive models—especially EVs—further accelerates demand. Presence of major innovators and manufacturers reinforces regional dominance through continuous R&D and large-scale project implementation. As green infrastructure initiatives expand, North America is expected to retain a substantial portion of global market share over the forecast period.

Europe

Europe accounts for the second-largest market share of approximately 30%, supported by robust sustainability regulations and high penetration of energy-efficient architectural solutions. Countries such as Germany, France, the U.K., and the Nordics lead adoption across commercial offices, public buildings, and transportation hubs. Strong regional presence of global glass manufacturers and rising investments in retrofitting projects strengthen market expansion. Europe’s commitment to carbon-neutral construction and dynamic façade technologies ensures continued demand for electrochromic glazing. The region’s established automotive industry also integrates smart glass in premium vehicle segments, contributing to its solid overall market position.

Asia-Pacific

Asia-Pacific holds around 20% of the global market share and represents the fastest-growing region, driven by rapid urbanization, smart-city development, and increasing construction of high-performance commercial buildings. China, Japan, South Korea, and Australia lead adoption, supported by expanding EV manufacturing and rising demand for advanced glazing solutions. Government-led green building initiatives propel the use of electrochromic façades in modern infrastructure. As technology costs decline and awareness of energy-efficient materials increases, Asia-Pacific is projected to capture a significantly larger share, supported by strong market momentum across both architectural and transportation applications.

Latin America

Latin America accounts for approximately 5% of the market share, with growth led by Brazil, Mexico, and Chile. Adoption is increasing in commercial complexes, luxury hotels, shopping centers, and premium residential developments where energy efficiency and modern aesthetics are prioritized. Although economic constraints limit large-scale deployment, rising investment in high-end infrastructure and gradual adoption of green construction practices support steady growth. Growing interest from international suppliers and government initiatives encouraging sustainable building technologies are helping the region strengthen its presence in the global electrochromic smart glass market.

Middle East & Africa

The Middle East & Africa region holds around 5% of the market share, driven primarily by the Middle East’s demand for advanced heat- and glare-control solutions in extreme climates. The UAE, Saudi Arabia, and Qatar dominate installation across luxury hotels, commercial towers, and smart-city megaprojects. Electrochromic glazing offers significant cooling-energy savings, making it an attractive feature in premium developments. While adoption in Africa remains limited, increasing urbanization and sustainability-focused investments create emerging opportunities. Continued growth in high-end construction and government-backed smart infrastructure ensures a steady rise in regional market participation.

Market Segmentations:

By Functionality

- Active dimming

- Passive dimming

By Active Material

- Tungsten oxide

- Niobium oxide

- Prussian blue

- Conducting polymers

By Control Systems

- Manual (switch-based)

- Automated (sensor-based, app-controlled)

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the electrochromic smart glass systems market is characterized by a mix of established glass manufacturers, technology innovators, and emerging dynamic glazing specialists competing to advance performance, scale production, and expand application reach. Leading companies focus on improving switching speed, color uniformity, durability, and energy efficiency to meet the stringent demands of architectural and automotive sectors. Strategic partnerships between material suppliers, façade system integrators, and smart building solution providers are accelerating commercialization and enabling seamless system integration. Companies are also investing heavily in automated production lines, nanocoating technologies, and advanced control systems to reduce costs and enhance reliability. As sustainability-driven construction and premium mobility applications grow, major players compete through differentiated product portfolios, expanded geographic presence, and long-term contracts with builders, automakers, and infrastructure developers. Continuous R&D investment, patents in electrochromic materials, and the shift toward IoT-enabled and AI-assisted dynamic glazing further intensify competition across the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Guardian Glass

- Diamond Glass

- Kinestral Technologies, Inc.

- AGG Inc.

- Halio, Inc.

- Gentex Corporation

- Compagnie de Saint-Gobain S.A.

- ChromoGenics AB

- Innovative Glass Corporation

- Asahi Glass Co., Ltd. (AGC)

Recent Developments

- In August 2025, the company Guardian Glass introduced smart automotive glazing solutions featuring switchable tint and UV-protection designed for electric vehicles, enhancing cabin comfort and energy efficiency.

- In January 2025, Gentex unveiled its next-generation dimmable film-based electrochromic sunroofs and smart visors designed for panoramic vehicle glazing, alongside its existing production of over 50 million electrochromic devices per year in automotive markets.

- In April 2022, the group Compagnie de Saint‑Gobain S.A. announced its Faribault, Minnesota manufacturing facility for its electrochromic glazing subsidiary was committed to recycling over 1,000 tons of glass per year, marking a significant step in sustainable-manufacturing for its smart-glass business.

Report Coverage

The research report offers an in-depth analysis based on Functionality, Active material, Control systems, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Electrochromic smart glass systems will see rising adoption as governments strengthen energy-efficiency mandates across commercial and residential construction.

- Integration with IoT platforms and automated building management systems will become standard, enhancing intelligent daylight and heat control.

- Advancements in switching speed, color neutrality, and long-term durability will drive broader use in large façades and high-visibility applications.

- Automotive adoption will accelerate, especially in electric vehicles, with expanding use in sunroofs, side windows, and digital display glazing.

- Production costs are expected to decline as manufacturers scale up and improve material processing efficiency.

- Hybrid smart glazing solutions combining electrochromic, thermochromic, and photovoltaic technologies will gain traction.

- Growing demand for sustainable premium architecture will push adoption in airports, hospitals, hotels, and high-end residential projects.

- Emerging markets in Asia-Pacific and the Middle East will significantly expand installation volumes due to rapid urbanization and climate-driven needs.

- Increased collaboration between glass manufacturers, tech firms, and construction companies will accelerate innovation and commercialization.

- Enhanced design flexibility and customizable tint ranges will support wider acceptance in interior partitions, smart displays, and next-generation mobility cabins.