Market Overview

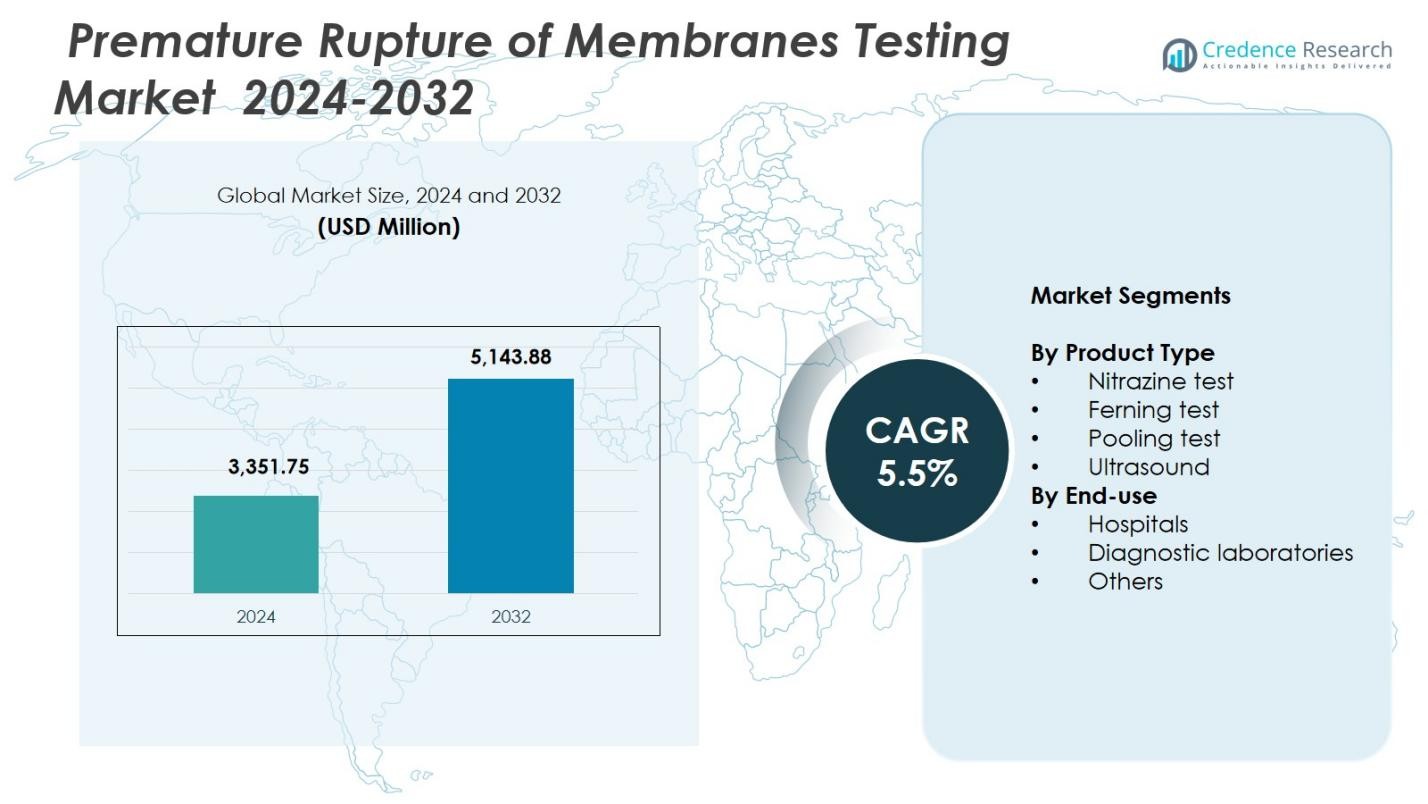

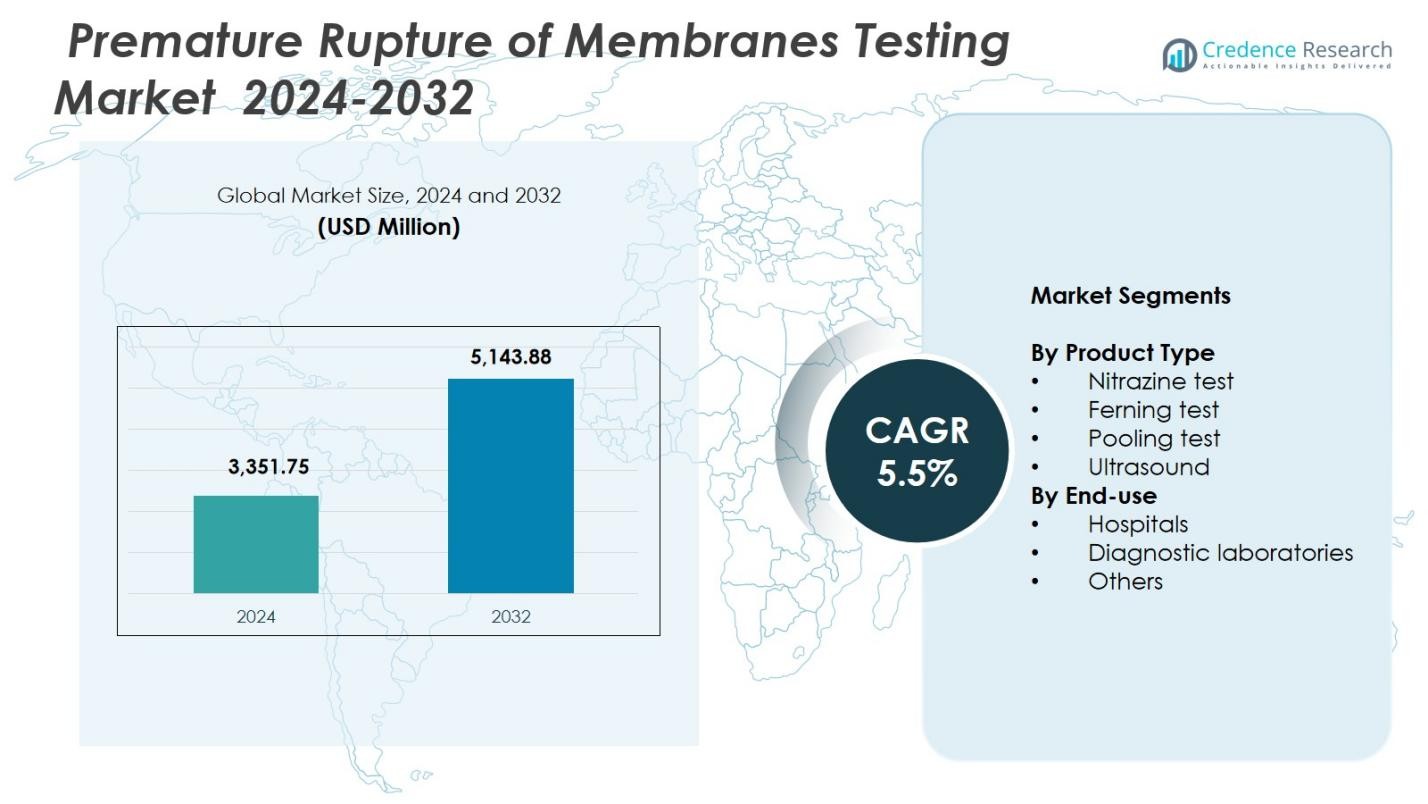

Premature Rupture of Membranes Testing Market size was valued at USD 3,351.75 Million in 2024 and is anticipated to reach USD 5,143.88 Million by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Premature Rupture of Membranes Testing Market Size 2024 |

USD 3,351.75 Million |

| Premature Rupture of Membranes Testing Market, CAGR |

5.5% |

| Premature Rupture of Membranes Testing Market Size 2032 |

USD 5,143.88 Million |

Premature Rupture of Membranes Testing Market features leading players such as Clinical Innovations LLC, Hologic Inc., Medix Biochemica, NX Prenatal Inc., Sera Prognostics Inc., Abbott Laboratories, The Cooper Companies Inc., QIAGEN, Biosynex, and IQ Products, all driving advancements in PROM diagnostics through biomarker innovation, rapid point-of-care solutions, and expanded clinical accessibility. These companies focus on enhancing test accuracy and supporting standardized obstetric workflows across hospitals and laboratories. Regionally, North America led the market with a 39.8% share in 2024, followed by Europe at 29.4%, owing to strong maternal health infrastructure, high adoption of advanced diagnostic assays, and increased emphasis on early detection of PROM-related complications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Premature Rupture of Membranes Testing Market was valued at USD 3,351.75 Million in 2024 and will reach USD 5,143.88 Million by 2032, growing at a CAGR of 5.5%.

- The market grows as rising preterm birth rates and increased focus on maternal–fetal health drive strong demand for accurate PROM diagnostic tools across hospitals and laboratories.

- A major trend is the shift toward rapid, biomarker-based and point-of-care PROM tests, supported by digital integration and improved diagnostic consistency across clinical settings.

- Key players including Clinical Innovations LLC, Hologic Inc., Abbott Laboratories, Medix Biochemica, and NX Prenatal Inc. strengthen their positions through product innovation and expanded distribution networks; nitrazine testing led product adoption with a 38.6% share in 2024

- North America led with a 39.8% share in 2024, followed by Europe at 29.4% and Asia-Pacific at 21.7%, supported by growing healthcare modernization and broader adoption of PROM diagnostic solutions.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

The Premature Rupture of Membrsanes Testing Market shows strong adoption across multiple diagnostic methods, with the nitrazine test dominating the segment with a 38.6% share in 2024. Its leadership stems from rapid result delivery, low cost, and widespread clinical acceptance in both primary and advanced maternity care settings. The ferning test and pooling test continue to serve as complementary methods, while ultrasound grows steadily due to its non-invasive nature and improved diagnostic accuracy. Increasing emphasis on early PROM detection further supports uptake across all test types, reinforcing demand for reliable and scalable diagnostic tools.

- For instance, the ROM Plus test (Laborie) uses a monoclonal/polyclonal antibody approach to simultaneously detect alpha-fetoprotein and IGFBP-1, with analytical validation showing 100% positive visual results at IGFBP-1 concentrations up to 400,000 ng/mL and AFP up to 200,000 ng/mL, supporting rapid point-of-care decision-making.

By End-Use

Within the end-use landscape, hospitals held the largest share at 57.4% in 2024, driven by high patient inflow, advanced obstetric care capabilities, and routine PROM screening during emergency and antenatal evaluations. Diagnostic laboratories accounted for a significant share due to the increasing shift toward confirmatory testing and access to specialized personnel. Other settings, including maternity clinics and birthing centers, show consistent growth as point-of-care PROM tests become more accessible. Rising awareness of preterm birth risks and the need for accurate membrane-rupture differentiation continue to strengthen hospital and laboratory testing demand.

- For instance, maternity clinics and birthing centers benefit from rapid immunoassay kits such as Actim PROM (detecting IGFBP-1), which has shown sensitivity above 90% in published evaluations, enabling decentralized point-of-care assessment for timely referral and intervention.

Key Growth Drivers

Rising Incidence of Preterm Birth and PROM-Related Complications

The increasing global incidence of preterm birth and pregnancy-related complications is a major driver for the Premature Rupture of Membranes Testing Market. PROM remains a leading cause of neonatal morbidity, requiring accurate and timely diagnosis to reduce risks such as infections, fetal distress, and adverse perinatal outcomes. As healthcare systems prioritize maternal and fetal health, demand for reliable diagnostic tools strengthens. Hospitals and maternity centers integrate PROM testing into routine obstetric assessments, fueling consistent market expansion across developed and developing regions.

- For instance, QIAGEN’s AmniSure ROM test identifies PAMG-1 protein marker in vaginal discharge using a sterile swab and solvent vial, providing results in minutes without gestational age restrictions.

Growing Adoption of Rapid and Point-of-Care Diagnostic Solutions

The shift toward rapid and point-of-care testing has significantly accelerated market growth, enabling clinicians to diagnose PROM with greater accuracy and reduced turnaround time. Traditional methods such as nitrazine and ferning tests are increasingly supplemented by advanced biochemical assays that improve detection sensitivity. Point-of-care kits support immediate decision-making in emergency and rural healthcare settings, minimizing delays in managing high-risk pregnancies. Rising awareness of improved patient outcomes associated with early diagnosis further boosts adoption of portable and user-friendly PROM testing solutions.

- For instance, Abbott’s Actim PROM test delivers results in 5 minutes using a one-step dipstick on a vaginal swab sample, even in the presence of blood, semen, or vaginal discharge. This bedside tool detects IGFBP-1 from amniotic fluid reliably across all gestational ages.

Advancements in Diagnostic Technologies and Biomarker Research

Innovation in biomarker-based testing enhances diagnostic precision in PROM, driving healthcare providers to shift toward more reliable and standardized tools. Companies are investing in assays that detect specific amniotic fluid proteins, improving differentiation between true membrane rupture and false positives. These advancements reduce reliance on subjective methods and promote more consistent clinical decision-making. Growing R&D initiatives, regulatory approvals for advanced PROM kits, and integration of automated laboratory technologies collectively strengthen the market’s technological landscape and long-term growth trajectory.

Key Trends & Opportunities

Expansion of Digital and Connected Diagnostic Platforms

A key trend shaping the market is the integration of digital tools and connectivity into PROM testing workflows. Digitally enabled diagnostic devices enhance accuracy through standardized interpretation, data recording, and remote clinician consultation. Integration with electronic health records improves continuity of care and supports real-time monitoring in high-risk pregnancies. This trend opens opportunities for manufacturers to develop smart PROM testing systems, particularly for telemedicine-driven maternal care programs in remote and underserved regions where access to specialized obstetric expertise is limited.

- For instance, Hologic’s Actim PROM test provides rapid bedside detection of premature rupture of fetal membranes in 5 minutes, even with blood or interfering substances present, aiding timely decisions in clinical settings.

Increasing Market Potential in Emerging Healthcare Economies

Growing investments in maternal healthcare infrastructure across Asia-Pacific, Latin America, and Africa create significant opportunities for PROM testing expansion. Rising awareness of perinatal risks and improvements in diagnostic accessibility support broader adoption of both basic and advanced PROM tests. Governments and NGOs are strengthening antenatal programs, encouraging routine membrane integrity assessments. As healthcare facilities upgrade diagnostic capabilities, demand for cost-effective test kits and rapid screening tools increases, enabling companies to expand their reach and establish strong market presence in high-growth regions.

- For instance, Novocuff secured $26 million in Series A funding in July 2024 to advance its preterm birth prevention device targeting PPROM, with plans for global market introduction including low- and middle-income countries in Africa and Asia-Pacific.

Key Challenges

High Rate of False Positives and Diagnostic Inconsistency in Traditional Tests

Despite widespread use, traditional PROM diagnostic methods such as nitrazine and ferning tests face limitations due to contamination, user interpretation variability, and lower specificity. These inconsistencies can lead to false positives, unnecessary interventions, or mismanagement of pregnancy complications. Providers increasingly seek reliable alternatives, yet accessibility to advanced biomarker-based tests remains restricted in many regions due to cost or infrastructure barriers. This diagnostic gap continues to challenge uniform adoption of accurate PROM testing protocols globally.

Limited Access to Advanced Diagnostics in Low-Resource Settings

Although improved technologies enhance PROM detection accuracy, many low- and middle-income regions lack adequate laboratory infrastructure, trained personnel, and financial resources to implement advanced diagnostic solutions. Reliance on basic, less reliable tests persists, creating disparities in maternal and neonatal care outcomes. High procurement costs, insufficient reimbursement policies, and weak supply chains further hinder market penetration. Addressing these challenges requires expanded point-of-care manufacturing, subsidized test availability, and capacity-building initiatives to improve diagnostic equity across global healthcare systems.

Regional Analysis

North America

North America dominated the Premature Rupture of Membranes Testing Market with a 39.8% share in 2024, driven by advanced maternal healthcare infrastructure, high adoption of biomarker-based PROM diagnostics, and strong presence of leading manufacturers. Hospitals and diagnostic laboratories increasingly rely on standardized testing methods to manage rising preterm birth rates. Favorable reimbursement policies and continual technological innovations further strengthen regional growth. The U.S. leads the market due to high testing volumes and rapid integration of point-of-care solutions, while Canada benefits from expanding prenatal screening programs and improved access to specialized obstetric care.

Europe

Europe accounted for a 29.4% share in 2024, supported by strong clinical guidelines for PROM management, widespread use of advanced diagnostic assays, and substantial investment in maternal health programs. Countries such as Germany, the U.K., and France prioritize early detection of pregnancy complications, promoting adoption of accurate and rapid PROM tests. The region benefits from robust laboratory networks and rising preference for standardized biomarker-based methods. Increasing regulatory approvals and collaborations between research institutions and diagnostic companies further enhance the development and utilization of modern PROM testing solutions across European healthcare systems.

Asia-Pacific

Asia-Pacific held a 21.7% share in 2024, emerging as one of the fastest-growing regions due to rising preterm birth prevalence, expanding healthcare infrastructure, and increasing awareness of maternal complications. Countries such as China, India, and Japan are witnessing higher demand for accessible and cost-effective PROM testing solutions. Government initiatives aimed at strengthening prenatal care, along with expanding private maternity hospitals, support broader adoption of rapid diagnostic kits. Growing penetration of point-of-care devices and enhanced laboratory capabilities further contribute to market expansion, positioning Asia-Pacific as a major growth engine for PROM diagnostics.

Latin America

Latin America captured a 5.6% share in 2024, driven by improving healthcare access, growing adoption of emergency obstetric care, and rising emphasis on reducing maternal and neonatal morbidity. Brazil and Mexico lead the region due to expanding public health programs and increasing investment in diagnostic technologies. While resource limitations persist, demand for rapid and affordable PROM tests is rising, particularly in urban healthcare facilities. Efforts to strengthen maternal health education and enhance diagnostic capabilities across hospitals and clinics continue to support steady regional growth and improved PROM detection outcomes.

Middle East & Africa

The Middle East & Africa region accounted for a 3.5% share in 2024, influenced by gradual improvements in maternal healthcare systems and increasing focus on early detection of pregnancy complications. Gulf countries demonstrate higher adoption levels due to improved hospital infrastructure and greater access to advanced diagnostics, while many African nations rely predominantly on basic PROM testing methods. International health initiatives and investments in maternal and neonatal programs support incremental growth. Expanding availability of point-of-care testing devices and workforce training efforts are helping the region overcome diagnostic gaps and enhance PROM management standards.

Market Segmentations:

By Product Type

- Nitrazine test

- Ferning test

- Pooling test

- Ultrasound

By End-use

- Hospitals

- Diagnostic laboratories

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Premature Rupture of Membranes Testing Market features key players such as Clinical Innovations LLC, Hologic Inc., Medix Biochemica, NX Prenatal Inc., Sera Prognostics Inc., Abbott Laboratories, The Cooper Companies Inc., QIAGEN, Biosynex, and IQ Products, all contributing to advancements in PROM diagnostics. These companies focus on enhancing test accuracy, expanding biomarker research, and developing rapid point-of-care solutions to meet rising clinical demand. Strategic initiatives such as product launches, regulatory approvals, and collaborations with maternal health institutions strengthen their market presence. Leading manufacturers prioritize innovation in biochemical assays and integrated digital diagnostic platforms, supporting more reliable and standardized PROM detection. Market participants also expand their global distribution networks to increase access to PROM testing across hospitals, diagnostic laboratories, and maternity clinics. Growing investment in R&D and the adoption of more sensitive diagnostic technologies continue to intensify competition while improving clinical outcomes for high-risk pregnancies.

Key Player Analysis

- Clinical Innovations LLC

- Hologic Inc.

- Medix Biochemica

- NX Prenatal Inc.

- Sera Prognostics Inc.

- Abbott Laboratories

- The Cooper Companies Inc.

- QIAGEN

- Biosynex

- IQ Products

Recent Developments

- In July 2024, Novocuff secured $26 million in Series A funding to develop a device aimed at preventing preterm births caused by preterm premature rupture of membranes (PPROM) and cervical shortening.

- In January 2023, QIAGEN partnered with Helix for development and commercialization of companion diagnostics for several hereditary diseases. Through this partnership, Helix Laboratory Platform will create companion diagnoses in the United States while QIAGEN will utilize the QIASeq Human Exome Kits in the rest of the globe for the diagnosis of a variety diseases.

- In June 2022, Medix Biochemica acquired Bioresource Technology Inc. a prominent player in critical raw materials for IVD quality control products production. This acquisition broadened the company’s offerings in the in-vitro diagnostics business.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as maternal health awareness and early diagnosis of pregnancy complications continue to rise.

- Adoption of advanced biomarker-based tests will increase as healthcare providers seek higher diagnostic accuracy.

- Point-of-care PROM testing will gain wider traction across hospitals, clinics, and emergency care settings.

- Digital integration and automated result interpretation will enhance reliability and reduce clinical variability.

- Emerging economies will experience strong growth due to improved healthcare infrastructure and prenatal screening initiatives.

- Companies will invest more in developing rapid, non-invasive, and cost-effective PROM diagnostic solutions.

- Collaborations between diagnostic firms and maternal health research institutions will accelerate innovation.

- Reimbursement improvements and clinical guideline updates will support broader use of standardized PROM tests.

- Portable and user-friendly PROM testing kits will see rising adoption in rural and resource-limited areas.

- Market competition will intensify as new entrants introduce advanced assays and expand global distribution networks.

Market Segmentation Analysis:

Market Segmentation Analysis: