Market Overview

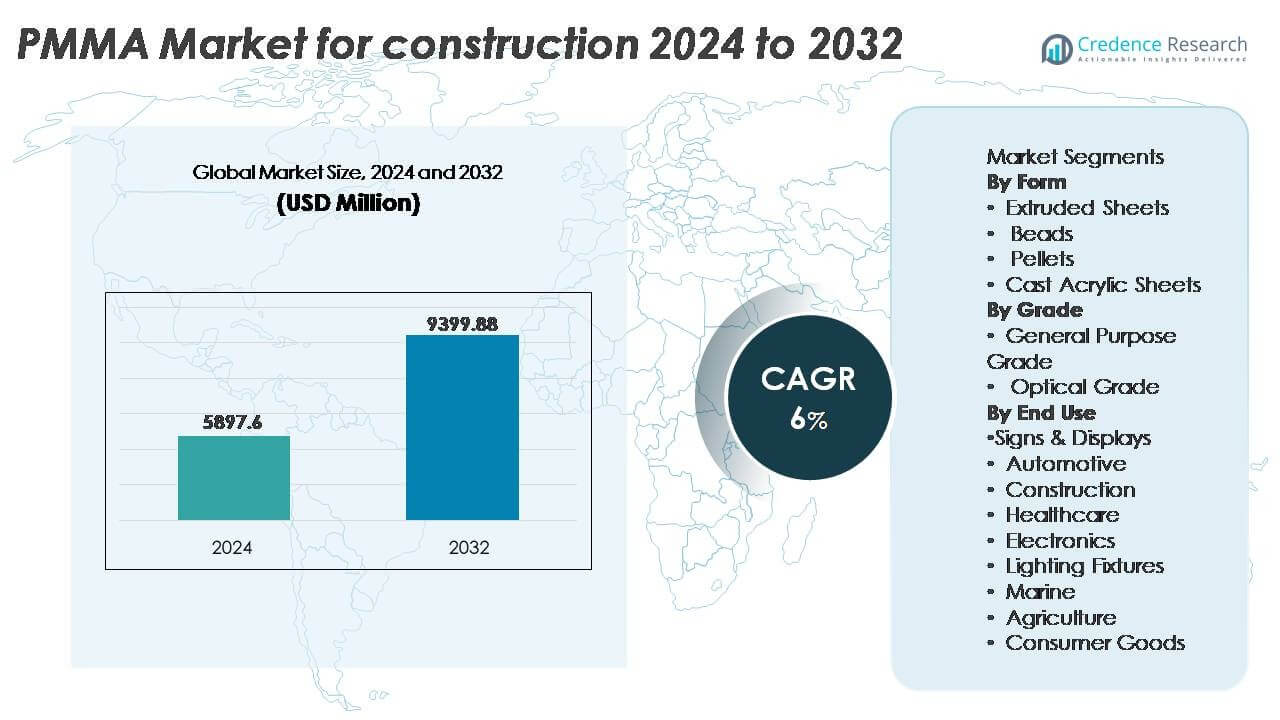

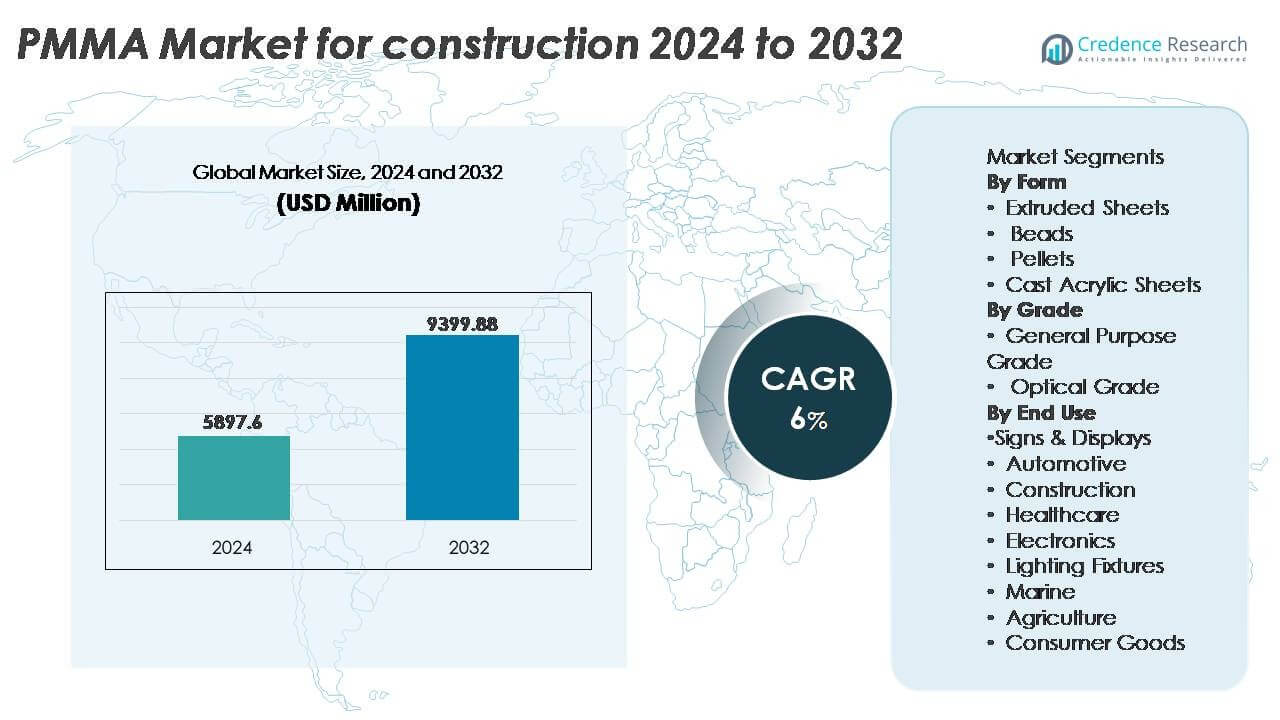

The PMMA (Polymethyl Methacrylate) market for construction applications was valued at USD 5,897.6 million in 2024 and is projected to reach USD 9,399.88 million by 2032, reflecting a compound annual growth rate (CAGR) of 6% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PMMA Market For Construction Market Size 2024 |

USD 5,897.6 Million |

| PMMA Market For Construction Market, CAGR |

6% |

| PMMA Market For Construction Market Size 2032 |

USD 9,399.88 Million |

The PMMA market for construction is shaped by major chemical and material manufacturers such as Röhm GmbH, CHIMEI, Mitsubishi Chemical Group, LG Chem, Asahi Kasei Corporation, SK Geo Centric Co. Ltd., Trinseo, LOTTE Chemical Corporation, SABIC, and Dymatic Chemicals, Inc. These companies compete through innovations in optical-grade clarity, lightweight glazing solutions, and sustainability-driven recycled or bio-based PMMA formulations. Asia-Pacific leads the global market with 38% market share, driven by large-scale commercial construction, industrial capacity, and rapid urbanization. North America and Europe follow, supported by infrastructure upgrades and stringent green building standards that accelerate demand for energy-efficient PMMA applications in architectural glazing and signage solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The PMMA market for construction was valued at USD 5,897.6 million in 2024 and is expected to reach USD 9,399.88 million by 2032, registering a 6% CAGR during the forecast period.

- Rising demand for lightweight, energy-efficient glazing materials is driving adoption of PMMA as a substitute for glass in façades, skylights, signage, and roof installations across commercial and residential buildings.

- Key market trends include the growing use of PMMA in modular construction, LED lighting diffusers, and retail signage upgrades, supported by innovations in recycled and UV-resistant formulations.

- The market is moderately consolidated with leading players focusing on sustainability strategies, capacity expansions, and specialty grades to strengthen portfolio differentiation against competitive engineered plastics such as polycarbonate.

- Asia-Pacific leads with 38% market share, followed by North America at 28% and Europe at 26%; extruded sheets remain the dominant PMMA form segment due to their application in façades and architectural glazing across infrastructure development.

Market Segmentation Analysis:

By Form

Extruded sheets represent the dominant form-based sub-segment in the PMMA market for construction, accounting for the largest market share due to their superior impact resistance, design flexibility, and suitability for large-surface architectural installations. Their extensive use in skylights, façades, transparent roofing, and noise-reducing highway barriers supports widespread adoption. Cast acrylic sheets follow as a strong sub-segment in premium-grade architectural glazing, while pellets and beads primarily serve as feedstock for molding applications, including sanitary ware and decorative elements. Customized color, UV resistance, and lightweight characteristics continue to drive usage of extruded sheets across commercial building projects.

- For instance,Röhm’s PLEXIGLAS® Soundstop panels used in highway barriers are engineered to achieve noise reduction index values (DLR) of up to 33 dB (depending on thickness and test standard).

By Grade

General-purpose grade PMMA holds the dominant share in the construction sector, driven by its cost-effectiveness and versatile performance in non-critical architectural components such as partition panels, acrylic furniture elements, and interior décor installations. Optical grade PMMA, although holding a smaller share, is gaining prominence in specialized applications requiring superior light transmission and clarity, including high-transparency sound barriers, premium glazing, and modern daylighting systems. Increasing architectural preference for visually appealing structures and demand for alternative materials to glass further support general-purpose grade PMMA growth in mainstream construction workflows.

- For instance, Mitsubishi Chemical Group’s optical-grade PMMA exhibits light transmission rates of approximately 92%, making it suitable for daylighting panels and illumination-driven architectural glazing.

By End Use

Signs and displays represent the leading end-use sub-segment in the PMMA construction market, capturing the largest share due to expanding commercial infrastructure, retail branding renovation, and demand for UV-stable, weather-resistant advertising structures. Construction applications follow closely, driven by the growing replacement of traditional glass with PMMA in façades, skylights, and canopies. Lighting fixtures also gain momentum as modern illumination designs increasingly incorporate PMMA diffusers. Meanwhile, the automotive, marine, electronics, healthcare, agriculture, and consumer goods segments utilize PMMA for durability and formability across specialized construction-integrated components and environments.

Key Growth Drivers

Rising Adoption of PMMA as a Lightweight and Energy-Efficient Substitute to Glass

The expanding preference for modern architectural designs and stringent energy-efficiency goals strongly accelerate the adoption of PMMA in construction. Compared to traditional glass, PMMA offers nearly half the weight, higher impact resistance, and superior thermal insulation, enabling easier installation and reduced structural load on buildings. Its enhanced UV stability and optical clarity provide a long-lasting solution for skylights, façades, canopies, and greenhouses, supporting high daylight penetration without excessive heat transfer. Additionally, PMMA’s flexibility in shaping, coloring, and surface finishing aligns with evolving aesthetic demands in commercial and residential infrastructure. The combination of sustainability targets and the rise of advanced construction materials positions PMMA as a preferred substitute to conventional glazing, especially in high-traffic urban developments where durability and safety are critical performance criteria.

· For instance, Röhm GmbH’s PLEXIGLAS® Optical Grade achieves light transmission up to 92% and offers a service life exceeding 30 years under outdoor exposure, supported by its UV resistance technology that limits UV transmittance to below 1% in wavelengths under 380 nanometers.

Expansion of Smart Construction, Modular Infrastructure, and Prefabricated Building Systems

The growth of modular construction, prefabricated structures, and smart building ecosystems fuels increased PMMA consumption as manufacturers seek lightweight, pre-engineered, and adaptable materials. PMMA sheets, panels, and molded components integrate efficiently into modular facades, wall separations, and acoustic barriers, enabling fast assembly and customization. Its compatibility with CNC machining, 3D fabrication, and advanced polymer processing supports precision-based construction workflows that shorten project timelines and reduce waste. The integration of smart lighting, embedded sensors, and digital signage within infrastructure also boosts the need for PMMA, given its optical properties, electrical insulation, and clarity for housing sensor-driven interfaces. Increasing urban densification and demand for off-site construction fabrication reinforce PMMA’s relevance as a ready-to-install material supporting future-focused building models.

- For instance, Trinseo’s ALTUGLAS™ PMMA grades support CNC fabrication tolerances below 0.1 mm, enabling precision-fit modular components for façades and signage structures.

Growth in Commercial Branding, Retail Infrastructure, and Decorative Architectural Solutions

PMMA’s versatility in signage, display systems, and aesthetic architecture positions it as a critical material supporting the global expansion of retail spaces, transportation terminals, hospitality units, and public-facing commercial facilities. Its ability to retain color vibrancy, resist weathering, and disperse lighting uniformly drives adoption in backlit signboards, mall directories, branding installations, and illuminated façades. The rising influence of experiential commercial design and corporate identity expression increases demand for customizable polymer-based architectural features. PMMA’s smooth finish and molding flexibility enable designers to create unique, visually immersive environments that differentiate physical spaces from digital-first retail competition. This driver is reinforced by growing investments in commercial renovation, infrastructure upgrades, and urban beautification programs led by governmental redevelopment initiatives.

Key Trends & Opportunities

Development of Bio-Based and Recyclable PMMA for Sustainable Construction

Advancements in circular-economy-driven material science create significant opportunities for PMMA manufacturers serving the construction sector. The emergence of bio-based PMMA formulations and closed-loop recycling techniques aligns with global directives aimed at reducing carbon footprints and plastic waste. Construction developers increasingly seek low VOC, recyclable, and environmentally responsible materials for green certification compliance. The ability to chemically recycle PMMA back into its monomer state opens pathways for sustainable lifecycle management in architectural glazing, signage, and interior décor applications. Sustainability-driven procurement frameworks and ESG reporting obligations further expand opportunities for eco-friendly PMMA variants, particularly in large-scale commercial and public infrastructure.

- “For instance, Röhm’s PLEXIGLAS® proTerra molding compounds use certified recycled feedstock or mass-balanced sustainable raw materials and deliver a documented reduction in product carbon footprint, enabling measurable sustainability performance in construction components”.

Integration of PMMA in Advanced Lighting Design and Smart Illumination Infrastructure

Evolving lighting designs in buildings create opportunities for PMMA as an optical-grade material for LED diffusers, decorative luminaries, and architectural light panels. The transition toward smart lighting systems and energy-optimized illumination supports PMMA adoption due to its capacity to diffuse light evenly, enhance brightness, and minimize glare. Urban landscape lighting, theme-based hospitality design, and ambient interior installations incorporate PMMA for functional and aesthetic performance. Growing investments in façade illumination, under-cabinet lighting, and outdoor pathway lighting provide a fertile pipeline for PMMA-driven product innovation. As designers pursue dynamic lighting layouts integrated with building automation, PMMA-based components serve as a core material for next-generation visual architecture.

- For instance, SABIC’s LEXAN™ Light Diffusion portfolio demonstrates tested optical diffusion with light transmission levels above 85% while achieving haze values exceeding 90, enabling uniform LED output with reduced hotspot visibility in architectural lighting modules.

Key Challenges

Volatility in Raw Material Prices and Supply Chain Disruptions

PMMA production relies heavily on petrochemical derivatives, making the supply chain vulnerable to fluctuations in crude oil prices and disruptions in global chemical sourcing. Changes in feedstock availability, refinery outages, trade tariffs, and geopolitical uncertainties increase cost pressures for manufacturers and construction procurement teams. Additionally, transportation bottlenecks, extended lead times, and shortages in specialty chemical intermediates create planning challenges for large architectural projects with strict timelines. These factors impact pricing stability, supplier predictability, and budget allocation posing challenges for PMMA’s market competitiveness against alternative materials such as glass, polycarbonate, and emerging bio-composites.

Increasing Competitive Pressure from Alternative Engineering Plastics

While PMMA offers numerous strengths, it faces increasing competition from polycarbonate and advanced polymer composites that deliver higher impact resistance and heat tolerance for demanding construction environments. In applications involving fire safety compliance, structural stress, or extreme temperature exposure, alternative materials may exhibit superior regulatory performance or cost benefits. Continuous advancements in multilayer polymer films, hybrid façade solutions, and reinforced composites further challenge PMMA’s dominance in specific architectural roles. As material innovation accelerates, PMMA manufacturers are required to enhance formulation performance, improve fire ratings, and develop differentiated solutions to retain market relevance amid shifting construction standards and customer expectations.

Regional Analysis

North America

North America holds approximately 28% market share in the PMMA market for construction, supported by significant infrastructure refurbishment, commercial signage upgrades, and the adoption of energy-efficient architectural materials. The U.S. leads regional demand, driven by growth in commercial real estate, airport modernization, and LED-based signage installations. Strong compliance with green building standards, combined with an accelerated shift toward lightweight glazing alternatives, further enhances PMMA utilization. The presence of advanced manufacturing capabilities and design-oriented urban development strategies continues to position North America as a consistent consumer of PMMA in façades, skylights, and branded construction features.

Europe

Europe accounts for nearly 26% market share, driven by strict sustainability regulations, expanding modular housing construction, and rising investment in daylight-optimized façades. Germany, France, and the U.K. lead consumption, supported by energy-efficiency mandates and strong emphasis on façade sound barriers and noise-attenuating materials. PMMA adoption is reinforced by renovation projects across aging urban infrastructure and commercial centers. Growth in retail and hospitality design upgrades further fuels demand for aesthetically refined PMMA-based architectural elements. The region’s push toward circular construction materials is likely to accelerate interest in recycled and low-emission PMMA formulations.

Asia-Pacific

Asia-Pacific dominates the PMMA market with 38% market share, primarily driven by rapid urbanization, commercial infrastructure expansion, and government-led smart city programs. China, India, and Southeast Asian nations generate large-scale demand for PMMA in signage, transparent roofing, rail station upgrades, and mall infrastructures. The region’s cost-effective manufacturing ecosystem, access to raw materials, and high-volume construction output encourage PMMA adoption. Growing middle-class consumer expectations for visually appealing structures and retail environments further stimulate market expansion. Asia-Pacific remains the fastest-growing region, driven by infrastructure capitalization and industrial-scale capacity additions.

Latin America

Latin America holds around 5% market share, with growth influenced by expanding commercial construction, tourism-sector investments, and rising adoption of acrylic-based architectural décor. Mexico and Brazil lead regional demand as urban retail formats and transportation terminals integrate modern signage and translucent roofing systems. However, market development remains sensitive to economic cycles and construction funding volatility. Increasing presence of global retail chains and mall refurbishments offers incremental opportunities for PMMA sheets and molded components. Gradual modernization of city infrastructure and lighting projects across public spaces continues to support demand in select urban clusters.

Middle East & Africa

The Middle East & Africa region represents approximately 3% market share, driven by premium commercial and hospitality projects across the Gulf region. PMMA integration is visible in architectural glazing, illuminated signage, luxury interiors, and large-scale façade installations in tourism-driven economies such as the UAE, Qatar, and Saudi Arabia. Harsh climatic conditions reinforce demand for UV-stable, weather-resistant PMMA structures. In Africa, adoption remains nascent but increasing through urban redevelopment initiatives in key economies. Limited manufacturing infrastructure and reliance on imports influence pricing and supply, making the region a specialized yet opportunity-driven market.

Market Segmentations:

By Form

- Extruded Sheets

- Beads

- Pellets

- Cast Acrylic Sheets

By Grade

- General Purpose Grade

- Optical Grade

By End Use

- Signs & Displays

- Automotive

- Construction

- Healthcare

- Electronics

- Lighting Fixtures

- Marine

- Agriculture

- Consumer Goods

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the PMMA market for construction is characterized by the presence of multinational chemical manufacturers, regional acrylic sheet producers, and vertically integrated suppliers that focus on downstream fabrication and value-added architectural components. Leading companies compete through product quality, enhanced optical properties, UV resistance, customized thickness formats, and recycled PMMA formulations aligned with sustainability mandates. Strategic investments in R&D, chemical recycling technologies, and bio-based polymer development are shaping competitive differentiation as the construction industry shifts toward environmentally compliant materials. Partnerships with construction firms, signage system integrators, and manufacturers of glazing and lighting products support market penetration. Furthermore, players are expanding production capacity in Asia-Pacific and Europe to address demand from modular building, commercial infrastructure, and façade engineering segments. Mergers, acquisitions, and material innovation remain central strategies, allowing companies to broaden application portfolios and maintain pricing competitiveness amid increased demand for lightweight, durable, and design-flexible PMMA solutions in the construction sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Mitsubishi’s recycling initiative the company is working on chemical recycling technology that uses microwaves to depolymerize used acrylic resin back into MMA monomer, enabling circular reuse of PMMA material.

- In 15 October 2024, Röhm further reaffirmed its global growth strategy announcing expanded capacity across Europe, North America, and Asia, and highlighting PLEXIGLAS® molding compounds (including proTerra bio-footprint-reduced variants) as key materials for construction, lighting and signage markets.

- In February 2024, Röhm commissioned a new production line and colored-PMMA compounding facility in Worms, Germany to expand its capacity for PMMA molding compounds under the PLEXIGLAS® brand.

Report Coverage

The research report offers an in-depth analysis based on Form, Grade, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- PMMA will increasingly replace conventional glass in architectural glazing due to its lightweight structure and improved safety profile.

- Adoption of UV-resistant and impact-modified PMMA grades will expand for outdoor façades, canopies, and commercial signage.

- Bio-based and recycled PMMA will gain traction as sustainability regulations influence construction materials procurement.

- Technological collaboration between material suppliers and façade engineering firms will accelerate customized PMMA solutions.

- Modular and prefabricated construction projects will drive demand for pre-cut PMMA panels and molded components.

- Smart building applications will enhance usage of PMMA in lighting diffusers and embedded digital displays.

- Growth in retail modernization and branding upgrades will boost PMMA consumption in signage and visual display systems.

- Chemical recycling infrastructure will support circular PMMA usage across large construction corporations.

- PMMA demand will rise in markets influenced by tourism-driven infrastructure projects.

- Emerging economies will contribute significantly to new construction-driven PMMA consumption.