Market Overview

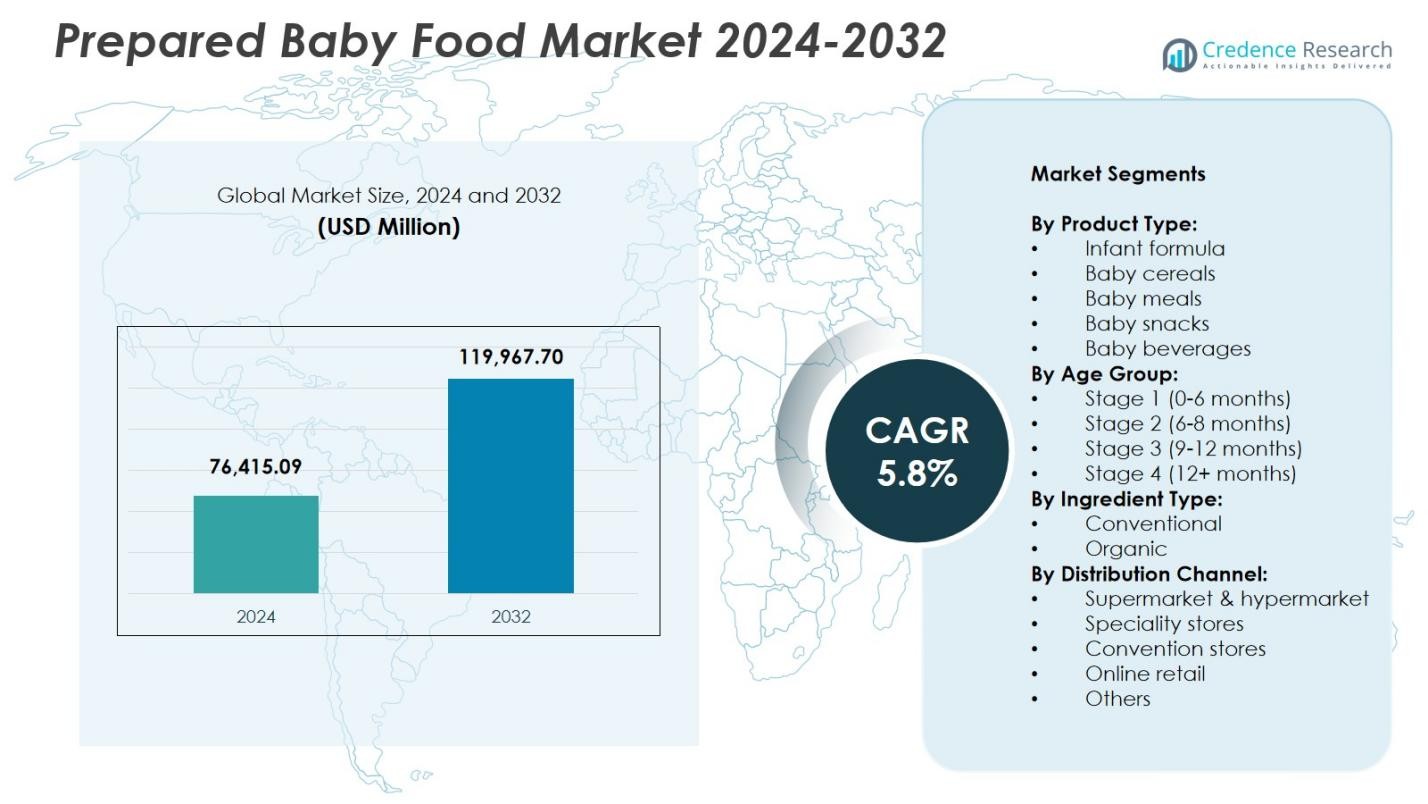

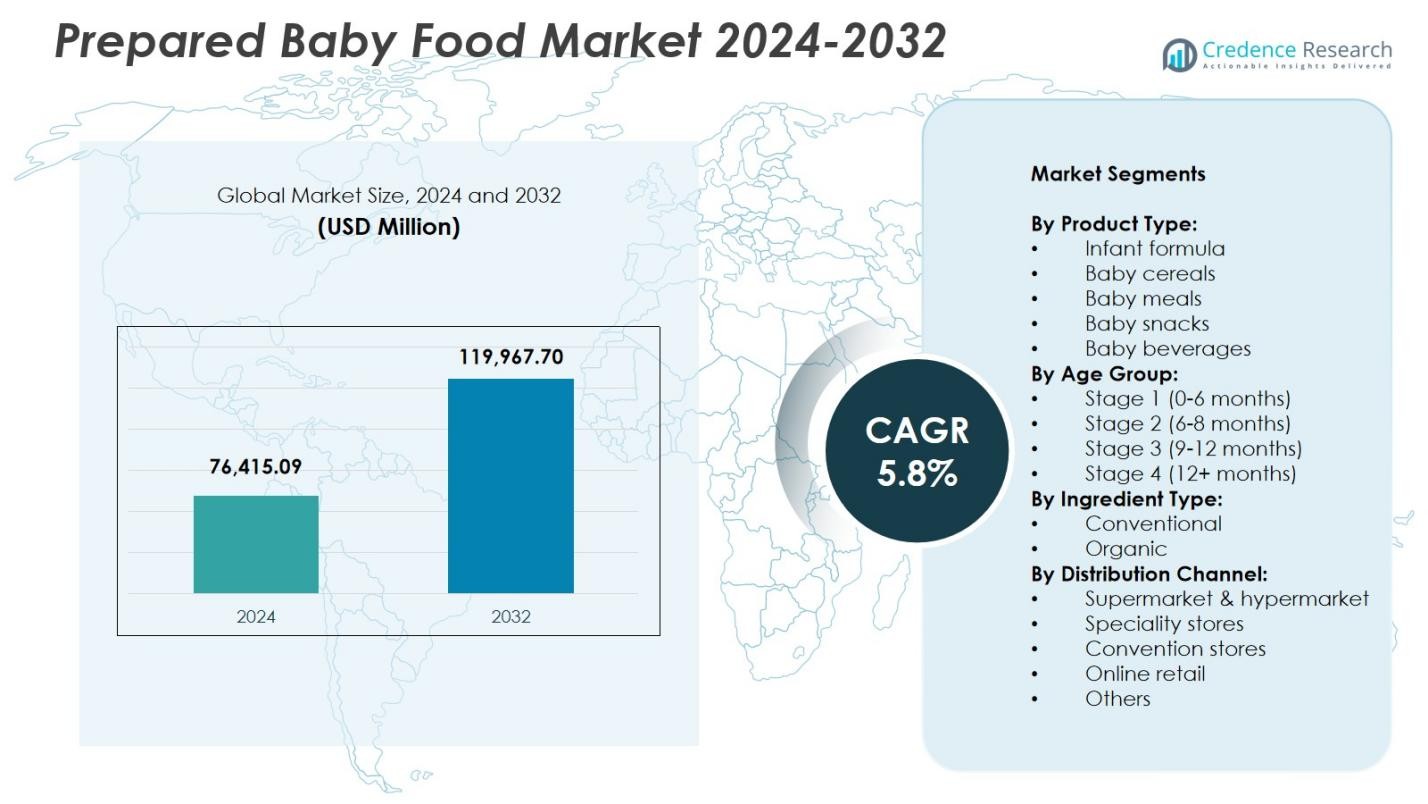

Prepared Baby Food Market size was valued at USD 76,415.09 Million in 2024 and is anticipated to reach USD 119,967.70 Million by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Prepared Baby Food Market Size 2024 |

USD 76,415.09 Million |

| Prepared Baby Food Market, CAGR |

5.8% |

| Prepared Baby Food Market Size 2032 |

USD 119,967.70 Million |

Prepared Baby Food Market is shaped by leading players such as Nestlé S.A., Danone S.A., Abbott Laboratories, Hero Group, HiPP GmbH & Co. Vertrieb KG, Beech-Nut Nutrition Corporation, Bellamy’s Organic, Hain Celestial Group, Little Spoon, and DMK Deutsches Milchkontor GmbH, all of whom focus on expanding high-quality product portfolios across infant formula, cereals, meals, snacks, and organic offerings. These companies emphasize nutritional innovation, clean-label formulations, and wider retail and online distribution to strengthen global presence. Regionally, North America led the Prepared Baby Food Market with a 34.7% share in 2024, driven by strong demand for fortified and premium baby food products, followed by Europe and Asia-Pacific as rapidly expanding markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Prepared Baby Food Market reached USD 76,415.09 Million in 2024 and will grow at a CAGR of 5.8% through 2032.

- Rising demand for convenient and fortified infant nutrition drives the Prepared Baby Food Market, with infant formula holding a 41.6% share supported by strong healthcare recommendations.

- The market experiences growing trends in organic, clean-label, and minimally processed products, along with increasing adoption of e-commerce and subscription-based baby food services.

- Key players like Nestlé, Danone, Abbott, Hero Group, and HiPP expand product portfolios and focus on safety, innovation, and wider distribution to capture evolving consumer preferences.

- North America led the Prepared Baby Food Market with a 34.7% share in 2024, followed by Europe at 28.5% and Asia-Pacific at 24.3%, while conventional products held a dominant 67.2% share across ingredient types.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type:

The Prepared Baby Food Market shows strong diversification across product categories, with infant formula dominating the segment with a 41.6% share in 2024. Its leadership stems from rising demand for convenient, nutritionally balanced alternatives to breastfeeding and increasing awareness of fortified formulations supporting infant development. Baby cereals and meals continue to gain traction as parents prioritize wholesome, easily digestible options that simplify feeding routines. Growth in baby snacks and beverages is driven by the trend toward on-the-go nutrition and clean-label offerings. Regulatory approvals for enhanced formulations and expanding retail availability further support product adoption.

- For instance, Nestlé’s Gerber Organic Single Grain Oatmeal Baby Cereal is fortified with zinc, vitamin B6, and vitamin C to support infant brain development and immune function, while the Else Baby Super Cereal differentiates itself with buckwheat as the primary grain alongside almond and tapioca for nutritionally balanced protein and fortified vitamins.

By Age Group:

Within the age-based segmentation, Stage 1 (0–6 months) accounted for 38.4% of the market in 2024, making it the leading sub-segment. This dominance is fueled by the high reliance on infant formula during early infancy, coupled with increased healthcare recommendations supporting adequate nutritional intake in the first six months. Stage 2 and Stage 3 categories show steady expansion as parents introduce diverse textures and fortified meals aligned with developmental needs. Stage 4 products witness rising adoption due to busy lifestyles and preference for ready-to-eat toddler meals, reinforcing the market’s sustained growth across age groups.

- For instance, Abbott’s Similac Stage 1 provides iron-fortified nutrition with whey protein concentrate, taurine, L-carnitine, and a blend of vegetable oils like soy and coconut for infants from birth to 6 months.

By Ingredient Type:

In the ingredient-based segmentation, conventional baby food maintained a 67.2% share in 2024, driven by its affordability, wider product assortment, and strong penetration across emerging markets. However, the organic segment is expanding rapidly as parents increasingly prioritize chemical-free, non-GMO, and sustainably sourced ingredients. Growth in organic prepared baby foods is further supported by premium brand offerings, clean-label trends, and rising consumer trust in certified organic nutrition. Manufacturers continue to innovate with preservative-free formulations and eco-friendly packaging, enhancing both categories’ contributions to overall market growth.

Key Growth Drivers

Rising Demand for Convenient and Nutritious Infant Food Solutions

The Prepared Baby Food Market benefits significantly from parents’ increasing preference for convenient, ready-to-consume nutritional products that reduce meal-preparation time. Dual-income households and fast-paced lifestyles drive strong demand for infant formula, cereals, and meals offering balanced nutrition with minimal effort. Brands introducing fortified, science-backed formulations for cognitive and physical development further accelerate adoption. Enhanced availability across supermarkets, pharmacies, and online platforms broadens reach, while premiumization trends encourage parents to opt for high-quality, specialized baby food products.

- For instance, Nestlé’s CERELAC Infant Cereal is fortified with iron to support cognitive development, alongside probiotics, vitamins, and minerals that aid overall growth, making it a quick-prep option for infants from 6 months.

Growing Awareness of Infant Nutrition and Health Benefits

Improving parental understanding of early-life nutrition plays a pivotal role in market expansion. Healthcare professionals emphasize nutrient-rich baby foods fortified with DHA, probiotics, iron, and vitamins to support immunity and developmental milestones. Governments and pediatric associations advocate structured feeding practices and regulate nutritional standards, supporting broader product acceptance. This shift encourages consumers to choose fortified prepared foods over homemade alternatives, especially as manufacturers introduce transparent labeling, allergen-free offerings, and science-based claims. Such initiatives continue strengthening consumer trust and market penetration.

- For instance, Earth’s Best Organic Dairy Infant Formula includes DHA and ARA fatty acids from organic sources, plus iron for red blood cell development and brain support. It features prebiotics, lutein, and essential vitamins to mimic breast milk nutrients while meeting FDA infant standards.

Expansion of E-Commerce and Premium Baby Food Offerings

Rapid digitalization has transformed consumer purchasing behavior, making online channels a major growth driver for the Prepared Baby Food Market. E-commerce platforms offer product variety, subscription models, and personalized nutrition suggestions that attract tech-savvy parents. At the same time, premium offerings such as organic meals, minimally processed snacks, and biodynamic ingredients gain momentum as consumers prioritize purity and safety. Strong marketing campaigns, influencer endorsements, and subscription-based delivery services further enhance brand visibility and repeat purchases, fueling sustained market growth.

Key Trends & Opportunities

Shift Toward Organic, Clean-Label, and Fresh Baby Food Products

The market is experiencing a strong shift toward organic, preservative-free, and clean-label formulations as parents increasingly value ingredient transparency and safety. This trend opens opportunities for brands to introduce cold-pressed meals, additive-free snacks, and nutrient-dense blends aligned with wellness-focused consumer preferences. Manufacturers capitalizing on eco-friendly packaging, sustainable sourcing, and allergen-free recipes are gaining traction. As regulatory bodies tighten food safety standards, companies investing in natural ingredients and certified organic lines are positioned to benefit from accelerated demand.

- For instance, Once Upon a Farm uses cold-pressure processing on its organic baby food pouches to lock in nutrients and flavor without added sugars, preservatives, or additives.

Innovation in Functional and Personalized Baby Nutrition

Advancements in nutritional science are enabling companies to develop functional baby food enriched with probiotics, omega fatty acids, plant proteins, and immune-supporting blends. Personalization is emerging as a major opportunity, with brands offering age-specific, development-driven, and dietary-need-based formulations. AI-powered meal-planning tools and customized subscription kits are gaining popularity, boosting direct-to-consumer adoption. As parents seek tailored nutrition that aligns with growth milestones, companies focusing on specialized and functional offerings can differentiate themselves and capture premium market segments.

- For instance, Kerry offers Eupoly-3, a natural omega-3 source from fish or algae designed for infant formula to support eye and brain development with high stability and organoleptic properties.

Key Challenges

Concerns Over Product Safety, Contaminants, and Recalls

Despite the sector’s growth, safety concerns remain a critical challenge, with occasional reports of heavy metals, contaminants, or improper ingredient handling affecting consumer confidence. Product recalls trigger heightened scrutiny and push parents toward homemade alternatives or trusted premium brands. Companies must invest heavily in stringent quality control, transparent sourcing, and advanced testing to mitigate risks. Regulatory pressures continue to intensify, requiring manufacturers to meet rigorous standards across all markets to maintain credibility and safeguard brand reputation.

High Price Sensitivity and Limited Accessibility in Emerging Markets

Prepared baby food products especially organic and premium categories often face resistance in price-sensitive regions where affordability drives purchasing decisions. Limited retail penetration, inadequate cold-chain infrastructure, and cultural preferences for homemade meals further restrict adoption in developing economies. Manufacturers encounter distribution challenges and must balance pricing strategies with rising production costs. To overcome this barrier, companies need localized manufacturing, cost-efficient formulations, and educational campaigns to demonstrate nutritional value and promote market uptake.

Regional Analysis

North America

North America leads the Prepared Baby Food Market with a 34.7% share in 2024, driven by strong consumer preference for fortified infant formula, organic meals, and clean-label products. High purchasing power, widespread retail availability, and robust healthcare guidance on early nutrition further support demand. The U.S. remains the dominant contributor due to rapid adoption of premium products and innovative offerings from major brands. Growing reliance on e-commerce channels and subscription-based baby food services enhances accessibility, while ongoing product innovations tailored to dietary needs strengthen the region’s long-term market position.

Europe

Europe captured a 28.5% share in 2024, supported by stringent food safety regulations, strong consumer inclination toward organic and biodynamic ingredients, and rising trust in certified high-quality nutrition. Countries such as Germany, France, and the U.K. exhibit strong demand for clean-label baby meals, snacks, and cereals. The region’s well-established distribution network, combined with growing interest in sustainable packaging and allergen-free formulations, drives market expansion. Increasing parental focus on balanced nutrition during early childhood and broad product awareness across retail channels further reinforce Europe’s substantial contribution to the global market.

Asia-Pacific

Asia-Pacific held a 24.3% share in 2024 and remains the fastest-growing region due to rising birth rates, expanding urbanization, and increasing adoption of packaged nutritional products among young parents. China leads the regional market, supported by strong demand for premium infant formula and fortified cereals, while India and Southeast Asia show rapid uptake in affordable ready-to-eat baby foods. Growth is strengthened by improving disposable incomes and expanding modern retail infrastructure. Heightened nutritional awareness and greater acceptance of convenient feeding solutions continue to drive the region’s accelerating market momentum.

Latin America

Latin America accounted for a 7.1% share in 2024, with growth driven by increasing awareness of infant nutrition and rising urban middle-class populations seeking convenient baby food solutions. Brazil and Mexico lead consumption due to expanding retail penetration and growing acceptance of fortified formulas and cereals. However, price sensitivity influences product choices, creating opportunities for competitively priced offerings. Gradual shifts toward organic and clean-label categories are emerging as consumers prioritize safety and ingredient transparency. Strengthening distribution networks and promotional initiatives further support the region’s steady market expansion.

Middle East & Africa

The Middle East & Africa region registered a 5.4% share in 2024, supported by improving economic conditions, rising expatriate populations, and increasing preference for packaged baby foods among working parents. The UAE and Saudi Arabia drive demand with strong adoption of premium formulas and imported organic products. In Africa, urbanization and enhanced retail access contribute to gradual market growth, though affordability remains a key constraint. Efforts by global and regional manufacturers to expand distribution networks and introduce cost-effective nutritional solutions continue to support the region’s evolving market landscape.

Market Segmentations:

By Product Type:

- Infant formula

- Baby cereals

- Baby meals

- Baby snacks

- Baby beverages

By Age Group:

- Stage 1 (0-6 months)

- Stage 2 (6-8 months)

- Stage 3 (9-12 months)

- Stage 4 (12+ months)

By Ingredient Type:

By Distribution Channel:

- Supermarket & hypermarket

- Speciality stores

- Convention stores

- Online retail

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Prepared Baby Food Market features prominent players such as Nestlé S.A., Danone S.A., Abbott Laboratories, Hero Group, HiPP GmbH & Co. Vertrieb KG, Beech-Nut Nutrition Corporation, Bellamy’s Organic, Hain Celestial Group, Little Spoon, and DMK Deutsches Milchkontor GmbH driving strong industry competitiveness. These companies focus on expanding their portfolios across infant formula, cereals, meals, snacks, and organic offerings to meet diverse parental preferences. Innovation remains central, with brands investing heavily in clean-label formulations, fortified blends, and developmental nutrition. Many players strengthen market presence through strategic mergers, partnerships, and regional expansions, while e-commerce and subscription-based delivery models enhance accessibility and customer loyalty. Premiumization trends push companies to develop organic, allergen-free, and minimally processed products, supported by sustainable packaging initiatives. A strong emphasis on product safety, transparent sourcing, and advanced quality testing further defines competition as brands strive to reinforce consumer trust and differentiate in a rapidly evolving market.

Key Player Analysis

- Hero Group

- Little Spoon

- Danone S.A.

- Beech-Nut Nutrition Corporation

- Nestlé S.A.

- HiPP GmbH & Co. Vertrieb KG

- DMK Deutsches Milchkontor GmbH

- Bellamy’s Organic

- Abbott Laboratories

- Hain Celestial Group

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In July 2025 Danone S.A. completed acquisition of Kate Farms to expand its plant-based and organic infant nutrition portfolio.

- In September 2025 Earth’s Best® (under Hain Celestial Group) earned the Clean Label Project Purity Awards for its infant formula lines, highlighting commitment to purity and safety.

- In April 2022 Gerber (Gerber, part of Nestlé S.A.) introduced a new line of organic, plant-based baby foods enriched with probiotics and omega-3s.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Age Group, Ingredient Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Prepared Baby Food Market will experience steady growth as parents increasingly rely on convenient, nutritionally balanced feeding solutions.

- Demand for organic, clean-label, and preservative-free baby foods will continue to expand across global markets.

- Premium product categories will gain momentum as consumers prioritize safety, transparency, and high-quality ingredients.

- Functional baby food fortified with probiotics, DHA, and immune-supporting nutrients will see rising adoption.

- E-commerce and subscription delivery models will play a larger role in shaping purchasing behavior.

- Innovation in sustainable and eco-friendly packaging will influence brand differentiation.

- Emerging markets will witness increased consumption driven by urbanization and rising disposable incomes.

- Companies will strengthen regional footprints through strategic partnerships, acquisitions, and product diversification.

- Regulatory frameworks will tighten, prompting manufacturers to enhance testing, sourcing, and quality control processes.

- Personalization and age-specific nutrition solutions will become a key driver of product development and market expansion.

Market Segmentation Analysis:

Market Segmentation Analysis: