Market Overview

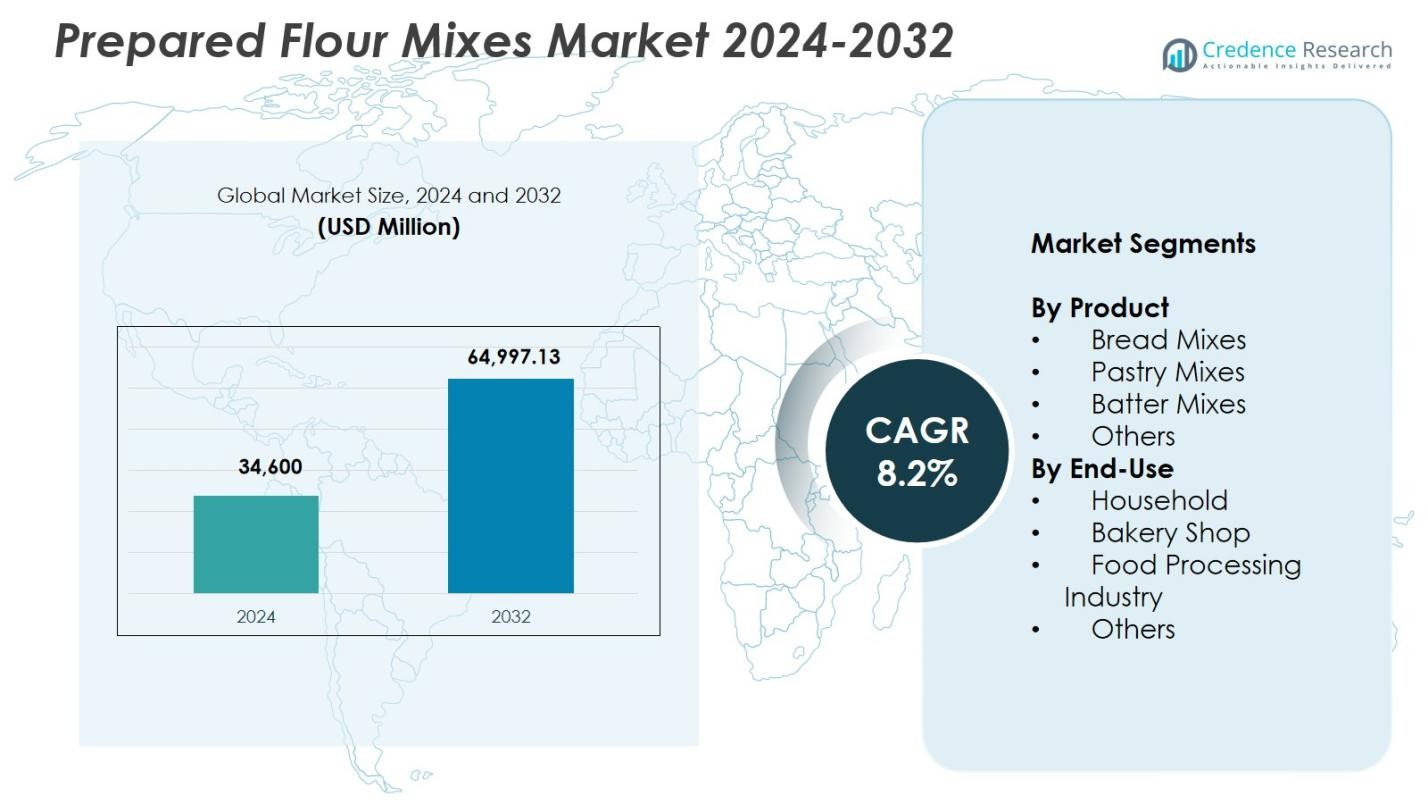

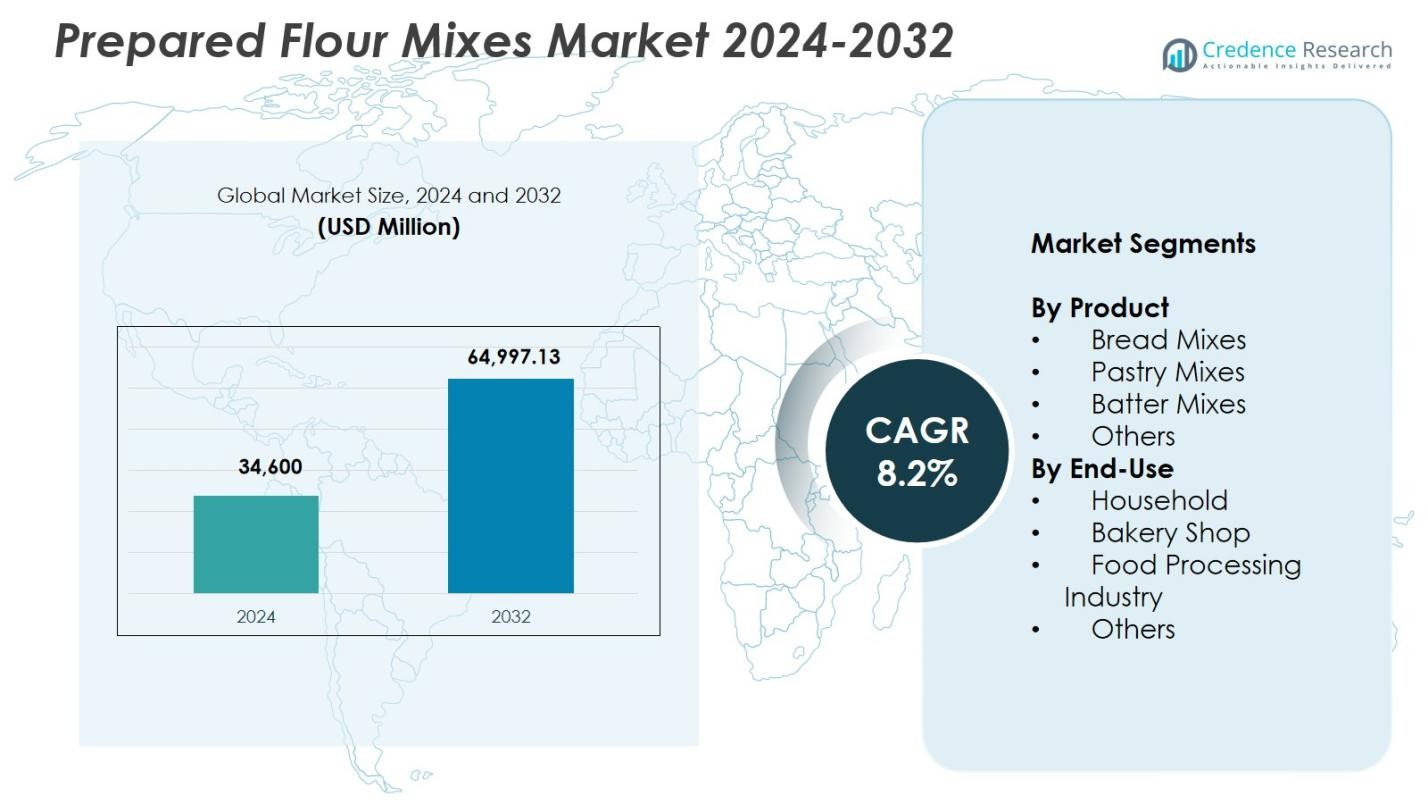

Prepared Flour Mixes Market size was valued at USD 34,600 Million in 2024 and is anticipated to reach USD 64,997.13 Million by 2032, at a CAGR of 8.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Prepared Flour Mixes Market Size 2024 |

USD 34,600 Million |

| Prepared Flour Mixes Market, CAGR |

8.2% |

| Prepared Flour Mixes Market Size 2032 |

USD 64,997.13 Million |

Prepared Flour Mixes Market is shaped by key players such as Interflour, CJ Foods Milling Vietnam LLC, Archer Daniels Midland Company (ADM), Puratos, Lesaffre, Bakels Worldwide, International Mix J.V. (Intermix), Enchance Proteins, Luscombe, and Echema Technologies, each focusing on product innovation, improved formulations, and expanding global reach. These companies support rising demand from industrial bakeries, foodservice sectors, and households through versatile and high-performance flour blends. Europe leads the market with a 31.7% share in 2024, driven by strong bakery traditions, advanced processing capabilities, and increased adoption of clean-label and specialty mixes across commercial and artisanal baking segments.

Market Insights

Market Insights

- Prepared Flour Mixes Market reached USD 34,600 Million in 2024 and will grow at a CAGR of 8.2% through 2032, reaching USD 64,997.13 Million.

- Rising demand for ready-to-use baking solutions and strong adoption of bread mixes, which held a 42.6% share in 2024, drives steady market expansion across commercial and household segments.

- Clean-label, fortified, and gluten-free product innovations shape emerging trends as consumers increasingly prefer functional and healthier flour mix formulations.

- Key players strengthen their presence through product enhancement, wider distribution, and partnerships with bakeries, food processors, and foodservice operators to meet evolving market needs.

- Europe led the market with a 31.7% share in 2024, followed by North America at 28.4% and Asia-Pacific at 26.1%, reflecting strong bakery culture and rising demand for standardized, high-performance flour mixes across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

The Prepared Flour Mixes Market shows strong differentiation across product categories, with bread mixes dominating the segment with a 42.6% share in 2024. Their leadership is driven by rising demand for consistent baking quality, convenience-based formulations, and the rapid expansion of commercial bakeries seeking standardized dough performance. Pastry mixes and batter mixes continue to gain traction due to the growth of ready-to-bake desserts and quick-service food chains. The “others” category, including specialty and fortified mixes, benefits from increasing consumer preference for premium, healthier bakery options enriched with proteins, fibers, and clean-label ingredients.

- For instance, Puratos offers Tegral Soft’r, a complete bread mix requiring only water and yeast, suitable for buns, sweet bread, brioche, panettone, and donuts while delivering freshness, taste, and texture.

By End-Use:

Within the end-use segmentation, the food processing industry leads with a 46.3% share in 2024, supported by large-scale adoption of flour mixes for mass bakery production, frozen baked goods, and high-throughput automated processing lines. Bakery shops follow as a rapidly expanding sub-segment driven by urban café culture and demand for artisanal yet consistent-quality products. Household usage continues to rise, fueled by home baking trends and easy-to-prepare mixes. The “others” category, including institutional kitchens and hospitality, benefits from the need for standardized ingredients that ensure uniform taste, texture, and time efficiency.

- For instance, Macphie provides Country Cake Mix in 25kg bags, a versatile option that holds high percentages of inclusions like fruit for traditional cakes with a soft, moist crumb.

Key Growth Drivers

Rising Demand for Convenient and Consistent Baking Solutions

A major growth driver for the Prepared Flour Mixes Market is the accelerating demand for convenient, ready-to-use baking ingredients that deliver consistent results across commercial and household applications. Busy lifestyles, expanding café culture, and the rise of home baking have increased reliance on standardized mixes that reduce preparation time and minimize skill variability. Commercial bakeries and foodservice operators adopt these mixes to improve operational efficiency, maintain uniform product quality, and reduce labor dependency. This shift toward convenience and consistency continues to push manufacturers to innovate clean-label, fortified, and multifunctional flour blends.

- For instance, Dawn Foods supplies Exceptional Danish Mix in 50 lb bags, enabling bakeries to produce consistent Danish pastries with reduced preparation steps and uniform texture for high-volume foodservice operations.

Expansion of Industrial Baking and Food Processing Activities

Growth in industrial baking facilities and large-scale food processing operations significantly boosts demand for prepared flour mixes. Automated production lines require predictable, high-performance inputs, and prepared mixes ensure uniform dough characteristics, improved texture, and stable baking behavior. The increasing production of frozen bakery goods, ready-to-eat snacks, and packaged confectionery reinforces the need for mixes optimized for volume, shelf life, and recipe repeatability. Manufacturers benefit from long-term supply contracts with processing companies, while continuous modernization within food manufacturing strengthens market penetration of these specialized formulations.

- For instance, Bunge North America, Inc. offers prepared flour mixes such as rich creme cake mix in chocolate and vanilla flavors, pudding cake mix, and red velvet cake mix. These products support consistent performance in high-volume cake production for industrial baking operations.

Rising Adoption of Specialty and Health-Focused Flour Mixes

The shift toward healthier, premium, and specialty bakery products represents another strong driver for market expansion. Consumers increasingly seek gluten-free, high-protein, fiber-enriched, and clean-label products, prompting manufacturers to develop innovative mixes tailored to specific dietary preferences. Demand for natural ingredients, reduced additives, and functional benefits accelerates the uptake of fortified flour blends in both retail and foodservice channels. This trend enables companies to differentiate through value-added formulations, premium pricing strategies, and expanded product portfolios that meet evolving nutritional and lifestyle expectations.

Key Trends & Opportunities

Innovation in Clean-Label, Fortified, and Functional Mixes

A major trend shaping the Prepared Flour Mixes Market is the integration of clean-label, fortified, and functional ingredients that align with evolving consumer preferences. Manufacturers increasingly explore natural enhancers, enzymatic improvers, and plant-based additives to reduce synthetic components and improve nutritional profiles. Opportunities arise in developing mixes that support digestive health, protein enrichment, or energy claims, targeting both retail and commercial segments. This shift enables strong differentiation and caters to premium markets where consumers actively seek transparency, wellness benefits, and ingredient authenticity.

- For instance, Ardent Mills introduced the Ancient Grains Plus Baking Flour Blend, made from whole-food ancient grains and chickpeas to deliver higher protein than traditional flours, supporting clean-label protein goals without major US allergens.

Growth of E-Commerce and Direct-to-Consumer Bakery Solutions

Expanding e-commerce platforms and direct-to-consumer channels provide significant opportunities for prepared flour mix brands. Online retail enables wider product visibility, subscription models, and personalized offerings tailored to home bakers, small businesses, and niche consumer groups. The rise of DIY baking kits, specialty mixes, and influencer-led bakery trends further boosts digital sales. Manufacturers leverage online engagement, recipe support, and flexible packaging to strengthen customer loyalty and expand into new geographies. This digital transformation enhances market accessibility while enabling faster adoption of innovative product formats.

- For instance, Manresa Bread introduced a Cinnamon Roll Baking Kit sold directly online, containing scalded flour mix, dry ingredients, filling, icing, instant yeast, rolling pin, and cake pan for six rolls, complete with a 60-minute video tutorial by founder Avery Ruzicka.

Key Challenges

Volatility in Raw Material Prices and Supply Chain Constraints

The Prepared Flour Mixes Market faces challenges due to fluctuating raw material prices, particularly wheat, specialty grains, and functional additives. Climate variability, global trade disruptions, and geopolitical tensions contribute to inconsistent availability, impacting production costs and supply stability. Manufacturers must continuously adjust sourcing strategies and optimize formulations to maintain profitability without compromising quality. Supply chain bottlenecks in milling, storage, and transportation further complicate operations, making inventory planning and risk management essential for sustained market performance.

Rising Competition and Pressure for Product Differentiation

Growing industry participation from multinational food companies, regional millers, and specialized mix producers intensifies competition, creating pressure to differentiate through product innovation, pricing, and branding. Customers increasingly demand versatile, health-oriented, and high-performance mixes, pushing companies to invest in R&D and new formulations. However, maintaining unique value propositions in a crowded marketplace remains challenging, particularly as private-label brands expand rapidly. This competitive environment requires continuous improvement in quality, packaging, and product positioning to retain market share and attract new customers.

Regional Analysis

North America

North America holds a strong presence in the Prepared Flour Mixes Market, accounting for 28.4% share in 2024, supported by a well-established bakery industry and widespread adoption of convenience-driven food products. Rising demand for specialty and fortified mixes, alongside growing home-baking culture, strengthens market expansion across the U.S. and Canada. Commercial bakeries increasingly rely on standardized mixes to enhance product consistency and operational efficiency. The region also benefits from strong R&D capabilities and rapid product innovation, enabling manufacturers to introduce clean-label, allergen-free, and value-added formulations tailored to evolving consumer preferences.

Europe

Europe represents a significant regional market with a 31.7% share in 2024, driven by deeply rooted bakery traditions and high consumption of bread, pastries, and confectionery items. Industrial bakeries across Germany, France, Italy, and the U.K. increasingly adopt prepared flour mixes to support large-scale automated production while maintaining consistent quality. Demand continues to rise for organic, non-GMO, and fortified mixes aligned with regional sustainability and clean-label standards. The growth of premium artisanal bakeries and interest in gluten-free and specialty formulations further propels product diversification and strengthens Europe’s market leadership.

Asia-Pacific

Asia-Pacific emerges as the fastest-growing region, capturing 26.1% share in 2024, fueled by rapid urbanization, expanding foodservice networks, and rising Western-style bakery adoption in China, India, Japan, and Southeast Asia. Increasing disposable incomes and the flourishing café and bakery chains drive demand for ready-to-use flour mixes suited for high throughput and consistent quality. The region also sees strong growth in household baking, supported by e-commerce penetration and broader access to premium mixes. Manufacturers capitalize on regional opportunities by introducing localized flavors and cost-effective formulations tailored to diverse consumer preferences.

Latin America

Latin America holds a 7.9% share in 2024, supported by expanding bakery production and rising consumption of packaged bread, cakes, and dessert items across Brazil, Mexico, and Argentina. Small and mid-sized bakeries increasingly adopt prepared flour mixes to enhance productivity, reduce labor dependency, and maintain product uniformity. Growth in quick-service restaurants and café chains further boosts demand for batter and pastry mixes. Manufacturers gain opportunities by offering value-driven, versatile formulations suited for both artisanal and industrial baking environments, while rising interest in healthier, fortified mixes adds momentum to market penetration.

Middle East & Africa

The Middle East & Africa region accounts for 5.9% share in 2024, driven by growing urban populations, expanding retail bakery chains, and rising demand for premium baked goods. Countries such as Saudi Arabia, the UAE, and South Africa experience increased adoption of prepared flour mixes due to their consistency, ease of use, and suitability for large-scale production environments. Tourism-driven foodservice expansion and the growth of modern supermarkets support broader product availability. Demand for specialty mixes, including high-fiber, fortified, and gluten-free variants, continues to rise as consumers shift toward more diverse and health-conscious bakery options.

Market Segmentations:

By Product

- Bread Mixes

- Pastry Mixes

- Batter Mixes

- Others

By End-Use

- Household

- Bakery Shop

- Food Processing Industry

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Prepared Flour Mixes Market is shaped by the presence of major players such as Interflour, CJ Foods Milling Vietnam LLC, Archer Daniels Midland Company (ADM), Puratos, Lesaffre, Bakels Worldwide, International Mix J.V. (Intermix), Enchance Proteins, Luscombe, and Echema Technologies. These companies focus on expanding product portfolios, enhancing mix functionality, and strengthening distribution networks to meet rising global demand across commercial and household segments. Innovation remains central, with leading manufacturers investing in clean-label formulations, fortified blends, and specialty mixes tailored to evolving dietary preferences. Strategic partnerships with bakeries, foodservice chains, and processing industries help improve market penetration, while acquisitions enable quick access to new technologies and regional markets. Many companies emphasize supply chain optimization and advanced milling capabilities to deliver consistent performance across large-scale industrial applications. As competition intensifies, firms differentiate through quality, texture enhancements, localized flavor development, and digital engagement targeting retail and professional customers.

Key Player Analysis

- Purato

- Interflour

- Lesaffre

- Archer Daniels Midland Company (ADM)

- Luscombe

- Bakels Worldwide

- International Mix J.V. (Intermix)

- CJ Foods Milling Vietnam LLC

- Enchance Proteins

- Echema Technologies

Recent Developments

- In March 2024, Pillsbury Baking introduced its Creamy Cake Mix Line and innovative Stuffed Cookie Kits, expanding its premium prepared flour mixes range to target home-baking consumers globally.

- In March 2023, South Bakels completed the acquisition of Orley Foods, strengthening its sweet ingredient and flour-mix formulation capabilities while expanding its footprint across bakery, confectionery, and foodservice applications.

- In March 2024, Bob’s Red Mill launched a fresh assortment of baking mixes designed to meet rising clean-label, high-quality, easy-to-prepare flour-based product demand across retail and specialty channels.

- In March 2024, King Arthur Baking Company released its Savory Bread Mix Kits, offering convenient artisan-style bread solutions that cater to evolving consumer interest in gourmet, flavorful, versatile home-baking formats.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as demand for convenient, ready-to-use baking solutions increases across households and commercial bakeries.

- Adoption of fortified, functional, and clean-label flour mixes will rise as consumers prioritize health and ingredient transparency.

- Industrial bakeries will drive strong demand for standardized mixes that support high-volume automated production.

- E-commerce and direct-to-consumer channels will significantly boost sales of specialty and premium flour mixes.

- Manufacturers will invest more in localized flavors and region-specific formulations to enhance market penetration.

- Sustainability-driven product development will grow, with emphasis on natural ingredients and reduced additives.

- Advanced milling and formulation technologies will improve consistency, texture performance, and shelf stability.

- Partnerships between mix manufacturers and foodservice chains will strengthen distribution capabilities.

- Competitive intensity will increase as global and regional players expand product portfolios.

- Demand will rise for gluten-free, high-protein, and allergen-friendly mixes aligned with evolving dietary trends.

Market Insights

Market Insights