Market Overview

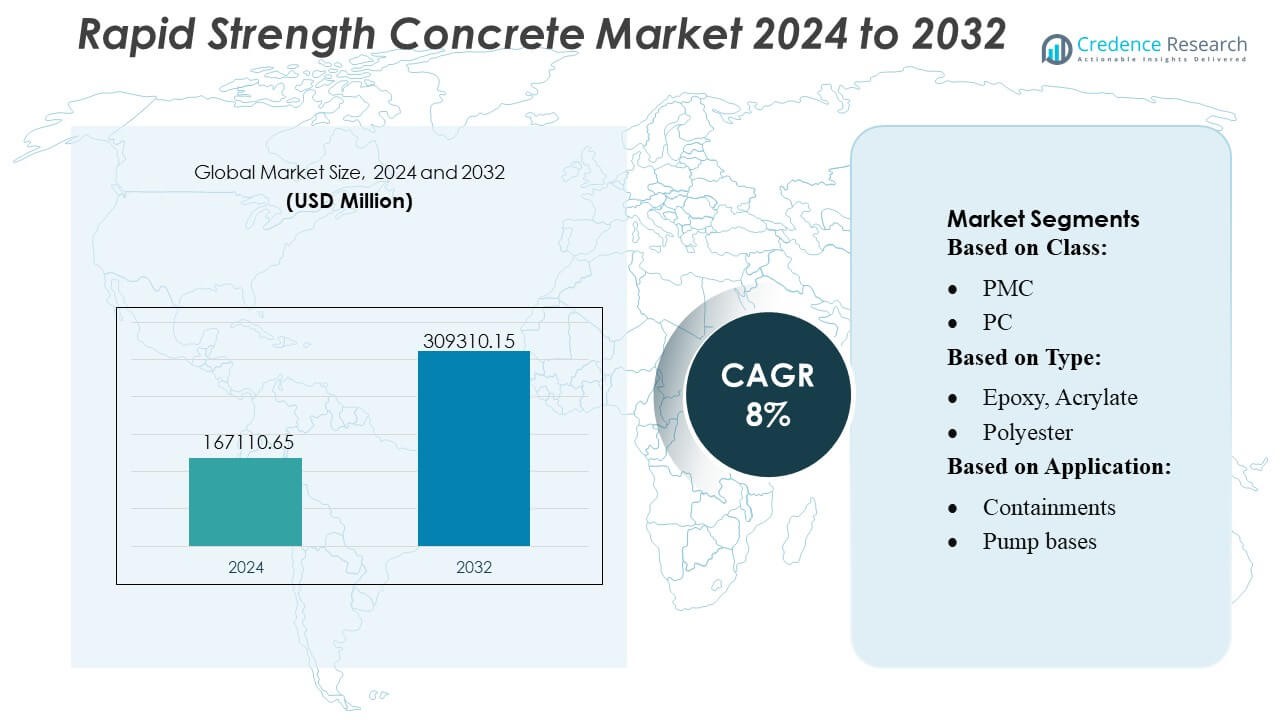

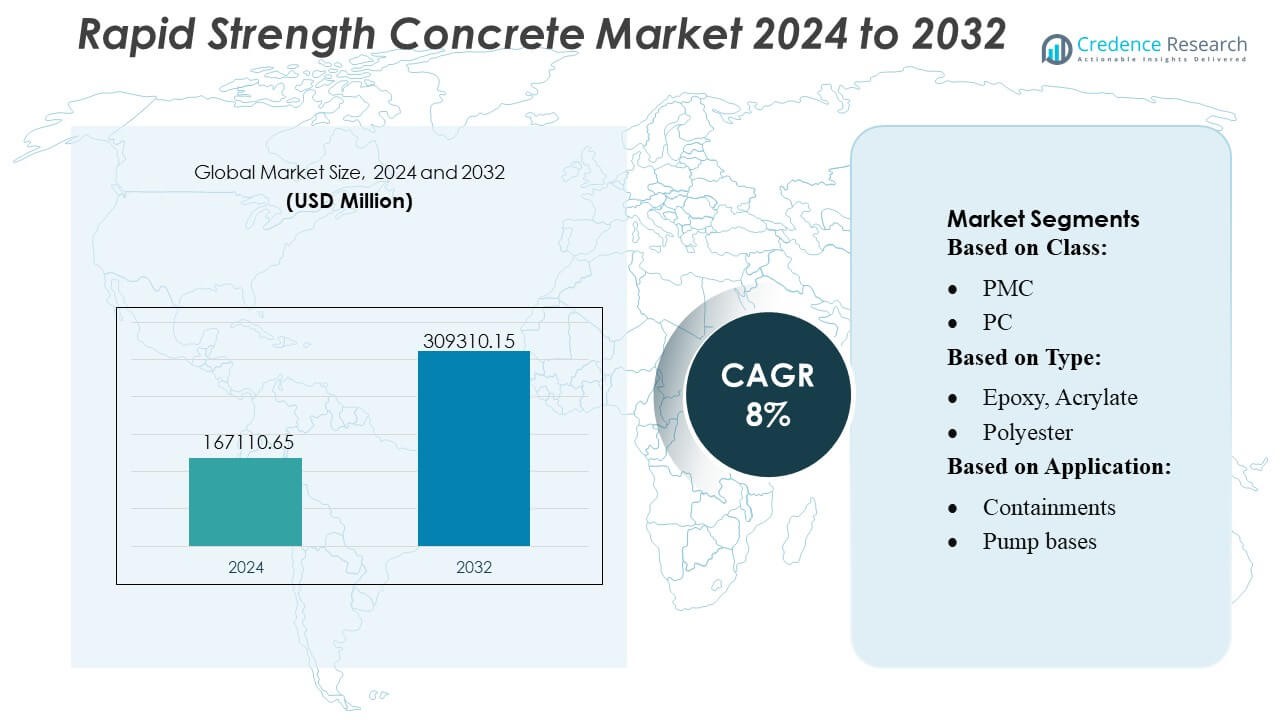

Rapid Strength Concrete Market size was valued USD 167110.65 million in 2024 and is anticipated to reach USD 309310.15 million by 2032, at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rapid Strength Concrete Market Size 2024 |

USD 167110.65 Million |

| Rapid Strength Concrete Market, CAGR |

8% |

| Rapid Strength Concrete Market Size 2032 |

USD 309310.15 Million |

The Rapid Strength Concrete Market is shaped by major players such as Heidelbergcement AG, Holcim, CEMEX, S.A.B. de C.V., CRH, Sika AG, Forterra, Votorantim S.A., Wells Concrete, Shay Murtagh Precast Ltd, and Weckenmann Anlagentechnik GmbH & Co. KG, all of which focus on advanced admixture technologies, sustainable formulations, and high-performance mixes tailored for time-critical construction. These companies strengthen their positions through R&D investment, precast integration, and performance-driven product portfolios. Asia-Pacific leads the global market with an exact 30% share, driven by rapid urbanization, large-scale infrastructure programs, and widespread adoption of fast-curing construction materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Rapid Strength Concrete Market size reached USD 167,110.65 million in 2024 and is projected to hit USD 309,310.15 million by 2032, expanding at a CAGR of 8%.

- Market growth is driven by rising demand for fast-curing materials supporting accelerated infrastructure development, repair projects, and precast construction, with high-strength mixes gaining strong adoption across commercial and transportation segments.

- Key trends include the shift toward sustainable, low-carbon formulations and the increasing integration of digital mix-optimization and automated quality-monitoring technologies across large construction sites.

- Competitive intensity grows as leading players enhance R&D, expand precast capabilities, and launch advanced admixture systems that strengthen early performance while enabling cost efficiency in time-sensitive projects.

- Asia-Pacific dominates with an exact 30% regional share, followed by North America and Europe, while high-usage segments such as infrastructure rehabilitation and precast components represent the largest contributors to overall market demand.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Class

The Rapid Strength Concrete Market is led by the PMC segment, which holds an exact 46% share due to its superior early-strength gain, durability, and compatibility with high-performance admixtures. PMC adoption accelerates as infrastructure agencies prioritize rapid repair cycles, reduced project downtime, and enhanced load-bearing capability. PC follows as a preferred class for structural applications requiring balanced strength and workability, while PIC gains traction in specialized projects needing impact resistance. The overall segment growth reflects rising reliance on engineered concrete formulations that support faster construction timelines and improved lifecycle performance.

- For instance, Heidelbergcement AG demonstrated measurable performance gains through its Rapidcem technology, which reaches a compressive strength of 25 MPa within 4 hours and exceeds 60 MPa at 24 hours, enabling contractors to reopen critical infrastructure sections on the same day of placement.

By Type

Epoxy-based formulations dominate the market with a 38% share, driven by strong adhesion, chemical resistance, and reliable curing behavior under varying environmental conditions. These materials support rapid structural rehabilitation, anchoring, and industrial flooring projects where bond strength and dimensional stability are critical. Polyester and vinyl types expand steadily due to cost efficiency and adaptability in medium-duty construction tasks. Furan and latex mixes serve niche requirements, particularly in corrosive or flexible application environments. The segment benefits from increased demand for high-performance binders that enable fast setting, reduced labor costs, and long-term structural reliability.

- For instance, Wells Concrete reported enhanced durability outcomes in its precast elements by integrating high-performance epoxy bonding systems that achieve a tensile bond strength of 3.4 MPa and withstand freeze–thaw cycles exceeding 300 repetitions, as documented in its PCI-certified production assessments.

By Application

Pump bases represent the leading application area with a 34% market share as industries prioritize rapid foundation stabilization and vibration-resistant installations for heavy machinery. Their demand rises with modernization of industrial plants and the adoption of equipment requiring precise alignment. Containments and water containers follow closely, supported by the need for leak-proof, high-strength concrete in utility and municipal infrastructure. Flooring blocks also gain adoption in commercial and residential projects requiring quick turnaround and high compressive strength. Overall growth reflects expanding use of rapid-strength solutions to accelerate commissioning timelines and extend service life across critical installations.

Key Growth Drivers

1. Rising Demand for Accelerated Construction Timelines

Rapid urbanization, infrastructure upgrades, and tight project schedules drive demand for rapid strength concrete, as contractors seek materials that enable quicker formwork removal, reduced downtime, and faster load-bearing readiness. Governments prioritize time-bound highway rehabilitation, airport runway extensions, and emergency repair projects, reinforcing the shift toward high-performance mixes. The material helps optimize labor productivity, minimize onsite delays, and support continuous construction cycles, making it a preferred solution for large infrastructure and commercial developments that require consistent performance under compressed timelines.

2. Increasing Adoption in Repair and Rehabilitation Projects

A growing emphasis on structural restoration fuels the adoption of rapid strength concrete across bridges, pavements, industrial floors, and utility structures. Its ability to achieve early compressive strength supports rapid reopening of critical transportation corridors and minimizes operational disruptions. Municipal agencies and industrial operators rely on such formulations to extend asset life and reduce long-term maintenance costs. The push toward proactive infrastructure management, combined with budget allocations for refurbishment programs, encourages the use of materials designed for speed, durability, and long-term load-bearing performance across public and private sectors.

- For instance, Shay Murtagh Precast Ltd documented that its prestressed bridge beam systems manufactured with accelerated-strength concrete routinely achieve a release strength of 55 MPa during the same production day and maintain dimensional tolerances within ±2 mm across segments up to 42 meters in length, as verified through its ISO-accredited quality control reports.

3. Advancements in Material Formulation and Additive Technologies

Innovations in admixture chemistry, fiber reinforcement, and nano-modification significantly enhance the mechanical performance and curing efficiency of rapid strength concrete. Manufacturers develop mixes that maintain early strength without compromising long-term durability, enabling broader application in heavy-load environments. Additives that improve hydration kinetics and thermal stability support placement in diverse climatic conditions. Rising R&D investments and collaborations between chemical suppliers and concrete producers lead to customized formulations optimized for automation, precast elements, and high-precision construction methods, strengthening market expansion globally.

Key Trends & Opportunities

1. Expansion of Precast and Modular Construction

The increasing shift toward modular buildings and precast components creates strong opportunities for rapid strength concrete, which supports accelerated production cycles and reliable early curing. Manufacturers capitalize on the need for uniform quality, reduced factory floor times, and higher output efficiency. As automated precast plants expand in capacity, demand rises for mixes that offer consistent setting profiles and compatibility with mechanized casting systems. This trend aligns with the industry’s focus on productivity, waste reduction, and scalable construction technologies that meet urban infrastructure and housing requirements.

- For instance, Votorantim S.A., through Votorantim Cimentos, validated significant gains in precast throughput using its high-early-strength concrete formulations that reach 30 MPa in under 8 hours and maintain thermal curing stability within a ±4°C envelope in automated casting chambers, enabling continuous 24-hour production cycles documented in its industrial performance reports.

2. Growing Integration of Sustainable and Low-Carbon Formulations

Sustainability initiatives encourage the adoption of rapid strength concrete mixes incorporating supplementary cementitious materials, recycled aggregates, and low-emission binders. Stakeholders prioritize solutions that balance early strength development with reduced carbon footprints. Green building certifications and government-led environmental mandates accelerate the shift toward eco-optimized formulations. Producers explore opportunities in bio-based admixtures, carbon-mineralization technologies, and high-efficiency curing processes that lower energy consumption. This trend positions rapid strength concrete as a key enabler of sustainable construction practices across commercial, municipal, and industrial sectors.

- For instance, Sika AG reported that its Sika® ViscoCrete and SikaGrind® technologies enabled concrete mixes to achieve a reduction of 52 kg of CO₂ per cubic meter while still attaining a compressive strength of 35 MPa within 12 hours; additionally, its carbon-mineralization integration process permanently bound 87 kg of CO₂ per tonne of treated material, as documented in its EPD-certified low-carbon concrete portfolio.

3. Increasing Use of Digital Tools for Mix Optimization

Digital simulation, real-time monitoring, and AI-driven mix design platforms gain traction as companies refine rapid strength concrete properties for specific load and curing conditions. These tools optimize binder ratios, predict performance outcomes, and support data-driven decision-making during onsite application. Contractors use digital curing sensors and IoT-based evaluation systems to validate early strength development, enhance quality control, and reduce rework. The integration of such technologies presents opportunities for customized offerings and performance-based contracting in infrastructure and high-precision construction projects.

Key Challenges

1. Higher Material Costs and Limited Cost Competitiveness

Rapid strength concrete typically involves premium additives, high-grade binders, and specialized curing requirements, contributing to elevated material costs compared with conventional mixes. Budget-sensitive projects may hesitate to adopt these solutions despite their time-saving benefits. The challenge intensifies in emerging markets where cost optimization remains a priority. Producers must balance performance with affordability while developing formulations that deliver early strength at competitive price points, or risk slower adoption across residential and small-scale construction segments.

2. Performance Variability Under Extreme Environmental Conditions

Rapid curing mechanisms can face challenges under high-temperature, low-temperature, or highly humid environments, where hydration reactions may deviate from expected performance levels. Contractors must manage risks related to shrinkage, cracking, and inconsistent strength gain if environmental controls are inadequate. Specialized curing practices and climate-optimized formulations become necessary, increasing operational complexity. These environmental sensitivities present adoption barriers in regions with extreme climates or limited access to controlled curing infrastructure, requiring additional training, quality assurance, and monitoring protocols.

Regional Analysis

North America

North America holds nearly 32% of the global market, supported by strong investment in transportation upgrades, commercial redevelopment, and rapid maintenance programs for bridges, highways, and airport infrastructure. The region benefits from advanced admixture technologies, high contractor awareness, and early adoption of performance-based construction standards. Municipal agencies increasingly specify rapid strength formulations to reduce lane closures and accelerate project turnover. Market growth is reinforced by industrial facility expansions and cold-climate applications where quick-setting properties minimize weather-related delays, strengthening regional demand across both public and private construction segments.

Europe

Europe accounts for around 27% of the market, driven by stringent construction regulations, rising infrastructure rehabilitation needs, and widespread adoption of sustainable and high-performance materials. Countries such as Germany, the U.K., and France prioritize rapid-curing concretes for roadway repair, rail upgrades, and industrial retrofitting to minimize operational downtime. The region’s focus on low-carbon binders and circular construction practices encourages the development of enhanced rapid-strength formulations. Strong engineering expertise, coupled with increased deployment in precast manufacturing, supports consistent market expansion across residential, commercial, and government-funded projects.

Asia-Pacific

Asia-Pacific commands nearly 30% of the global share, fueled by large-scale urban development, extensive transportation megaprojects, and rapid industrialization. China, India, and Southeast Asian nations adopt rapid strength concrete to accelerate expressway construction, smart city programs, and high-density commercial projects. The region benefits from expanding precast production capabilities and rising public investment in disaster-resilient infrastructure, which necessitates materials that deliver early compressive strength. Growing construction automation and rising demand for high-output building processes further strengthen APAC’s position as a fast-growing and strategically influential market for rapid strength solutions.

Latin America

Latin America captures roughly 6% of the market, with growth influenced by ongoing urban expansion, transportation modernization, and industrial facility upgrades in Brazil, Mexico, and Chile. Governments increasingly use rapid strength concrete for bridge maintenance, port rehabilitation, and airport enhancements to reduce disruptions and improve service efficiency. Adoption remains gradual due to cost sensitivity, but expanded collaboration with global material suppliers improves access to advanced formulations. Rising investment in resilient infrastructure and public–private construction partnerships supports steady market traction across commercial, municipal, and logistics-related applications.

Middle East & Africa

The Middle East & Africa region holds close to 5% of the global market, driven by large infrastructure programs, urban megaprojects, and accelerated time-bound construction schedules in the GCC. Rapid strength concrete is increasingly preferred for highways, metro systems, and industrial structures where fast curing supports high-temperature construction cycles. Africa’s adoption grows as governments invest in critical transportation networks and urban revitalization efforts. Despite procurement constraints, the region benefits from international contractor involvement and rising demand for durable, quick-setting materials suitable for challenging climatic and operational environments.

Market Segmentations:

By Class:

By Type:

- Epoxy, Acrylate

- Polyester

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Rapid Strength Concrete Market features a competitive landscape shaped by leading global and regional manufacturers, including Heidelbergcement AG, Wells Concrete, Shay Murtagh Precast Ltd, Votorantim S.A., Sika AG, Forterra, Holcim, Weckenmann Anlagentechnik GmbH & Co. KG, CRH, and CEMEX, S.A.B. de C.V. The Rapid Strength Concrete Market displays a competitive landscape defined by continuous innovation, performance optimization, and strategic expansion across global construction ecosystems. Manufacturers focus on developing advanced admixture systems, fiber-reinforced formulations, and low-carbon binders that accelerate curing while maintaining structural integrity under demanding conditions. Precast and modular construction players increasingly adopt rapid-curing mixes to shorten production cycles and enhance output efficiency. Companies strengthen competitiveness through digital batching technologies, automated quality monitoring, and partnerships with infrastructure developers to meet stringent performance specifications. The market also reflects growing investment in sustainable materials, enhanced hydration control, and climate-resilient concrete solutions, reinforcing strong differentiation among producers.

Key Player Analysis

- Heidelbergcement AG

- Wells Concrete

- Shay Murtagh Precast Ltd

- Votorantim S.A.

- Sika AG

- Forterra

- Holcim

- Weckenmann Anlagentechnik GmbH & Co. KG

- CRH

- CEMEX, S.A.B. de C.V.

Recent Developments

- In May 2025, HOLCIM, in collaboration with the architectural firm ELEMENTAL, announced a novel biochar-based technology that enables concrete to function as a carbon sink. This innovation integrates biochar, a charcoal-like material made from organic waste, to significantly reduce CO₂ emissions without compromising performance.

- In December 2024, DAW Construction and Qatar General Projects Company (likely Qatar German Polymer Company, QGPC, per recent reports) introduced Polymer Resin Concrete (PRC) solutions for urban development in corrosive Gulf environments. This innovative material offers significant advantages over traditional concrete, primarily in durability, chemical resistance, and sustainability.

- In April 2024, Sika acquired Kwik Bond Polymers (KBP), a U.S. company known for its high-performance polymer systems for concrete restoration, particularly bridge decks, significantly boosting Sika’s infrastructure refurbishment offerings and strengthening its presence in the North American market, aligning perfectly with US infrastructure investment trends.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Class, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as governments accelerate infrastructure renewal programs and prioritize quicker project delivery.

- Adoption will rise in precast and modular construction due to the need for faster production cycles and reliable curing performance.

- Manufacturers will focus on developing low-carbon and environmentally optimized rapid-strength formulations to meet sustainability mandates.

- Digital mix-design tools and real-time curing monitoring systems will increasingly support precision and quality assurance.

- Demand will grow in maintenance and rehabilitation projects that require rapid reopening of roads, bridges, and industrial facilities.

- Advancements in admixture chemistry and fiber reinforcement will enhance material durability and early-strength efficiency.

- Emerging markets will adopt rapid strength concrete more widely as urbanization and infrastructure expansion accelerate.

- Automated construction technologies will drive demand for mixes compatible with high-speed placement and controlled curing.

- Collaboration between material producers and engineering firms will support customized solutions for specialized applications.

- Climate-resilient rapid-curing formulations will gain importance as construction activity expands into extreme-temperature environments.

Market Segmentation Analysis:

Market Segmentation Analysis: