Market Overview

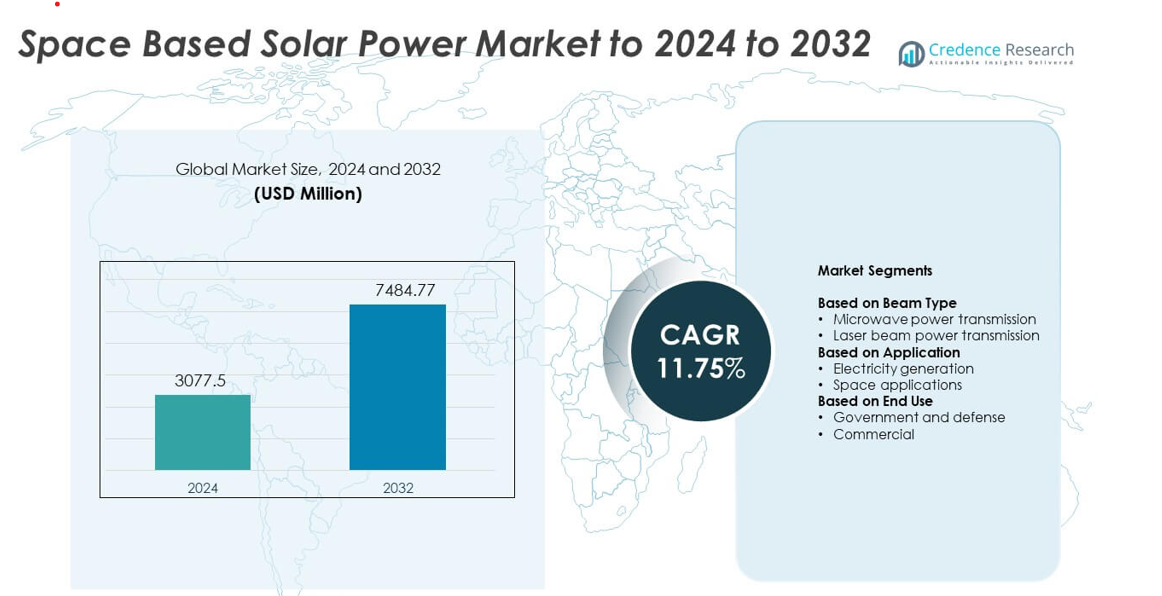

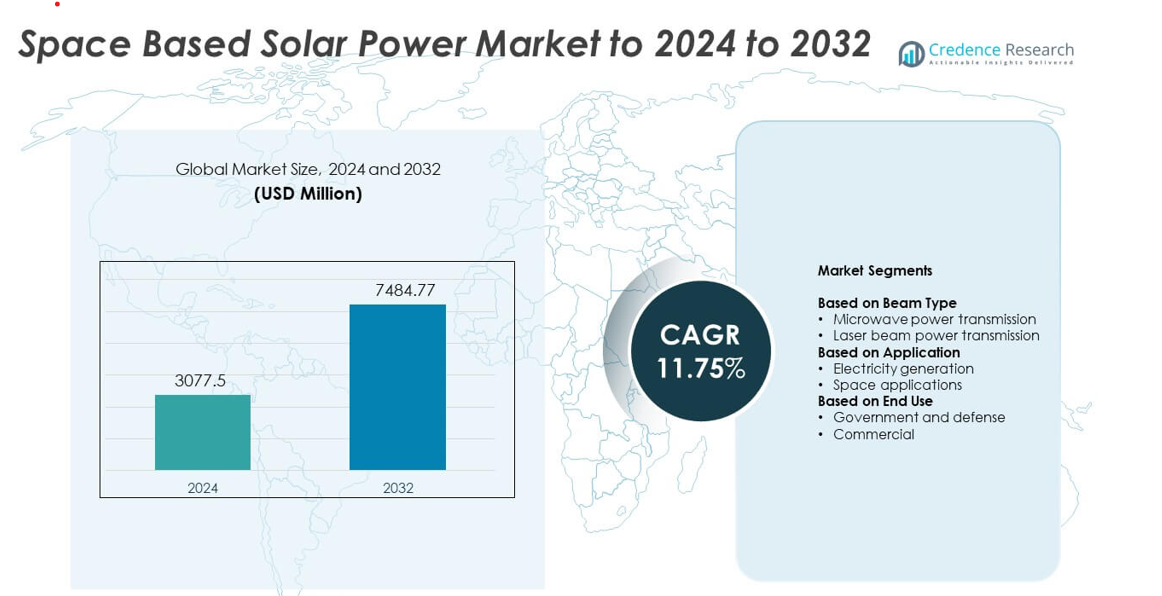

Space Based Solar Power Market size was valued at USD 3077.5 million in 2024 and is anticipated to reach USD 7484.77 million by 2032, at a CAGR of 11.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Space Based Solar Power Market Size 2024 |

USD 3077.5 million |

| Space Based Solar Power Market, CAGR |

11.75% |

| Space Based Solar Power Market Size 2032 |

USD 7484.77 million |

The Space Based Solar Power Market features leading participants such as Thales Alenia Space, Emrod, Northrop Grumman, Celestia Energy, Japan Aerospace Exploration Agency, Sirin Orbital Systems, Airbus, China Academy of Space Technology, SpaceTech, and Metasat. These organizations advance wireless power transmission, orbital solar array development, and modular satellite platforms to support large-scale space energy systems. North America remained the leading region in 2024 with a 38% share, supported by strong government programs, high investment levels, and advanced aerospace capabilities. Asia Pacific followed with rising momentum driven by national demonstration projects and expanding launch infrastructure.

Market Insights

- The Space Based Solar Power Market reached USD 3077.5 million in 2024 and is projected to hit USD 7484.77 million by 2032, growing at a CAGR of 11.75%.

- Rising demand for uninterrupted clean energy and advances in microwave transmission systems drive adoption across government and commercial sectors.

- Key trends include large-scale demonstration missions, lightweight solar array innovations, and modular satellite architectures gaining wider implementation.

- Competitive activity intensifies as major aerospace and energy technology developers accelerate testing of power-beaming systems and expand global partnerships.

- North America led with 38% share, followed by Asia Pacific at 30% and Europe at 27%, while microwave transmission held 68% share among beam types and electricity generation led applications with 72% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Beam Type

Microwave power transmission led the Space Based Solar Power Market in 2024 with about 68% share. Strong adoption came from its higher energy transfer efficiency, lower atmospheric loss, and proven use in long-distance wireless power trials. Developers favored microwave systems because they operate reliably in varied weather and support large-scale power beaming. Laser beam power transmission grew at a steady pace due to rising interest in high-precision applications and compact transmission hardware, but microwave systems remained dominant due to safety maturity and broader technology readiness.

- For instance, JAXA transmitted 1.8 kilowatts by microwaves to a receiver 55 meters away.

By Application

Electricity generation dominated this segment in 2024 with nearly 72% share. Growth came from rising demand for continuous, space-based renewable energy supply that avoids night-time and weather variability seen on Earth. National space agencies and private developers invested in orbital power satellites to support grid-scale energy needs. Space applications advanced as well, supported by interest in powering spacecraft, lunar bases, and deep-space missions, but electricity generation held the largest share due to stronger commercial viability and government-backed pilot programs.

- For instance, Emrod beamed 550 watts over 36 meters with 95% transmission efficiency inside an Airbus facility.

By End Use

Government and defense held the leading position in 2024 with about 64% share. Defense agencies drove investment in resilient, uninterrupted power supply from orbit to support strategic energy independence and remote operations. Governments supported large demonstration projects, policy frameworks, and long-term research partnerships that strengthened early adoption. Commercial use grew as private firms explored orbital solar platforms for future clean-energy supply, but remained smaller due to high initial costs and long development cycles.

Key Growth Drivers

Rising demand for uninterrupted clean energy

Global focus on stable renewable energy supply drives strong interest in orbital solar platforms. Nations aim to reduce reliance on fossil fuels and expand high-availability clean power sources that bypass limits such as weather shifts and night-time loss. This shift pushes investment into high-efficiency photovoltaic systems that operate continuously in space. Governments support feasibility studies, while private firms explore large-scale demonstrations. The ability to deliver steady power to remote regions strengthens adoption and positions space-based solar power as a long-term strategic energy asset.

- For instance, Enel Green Power operates 67.2 gigawatts of renewables, generating 74.5 terawatt-hours in one year.

Advancements in wireless power transmission technologies

Progress in microwave and laser-based power beaming enhances efficiency, safety, and reliability across long distances. Engineering improvements allow higher accuracy in beam steering, reduced atmospheric loss, and stronger ground-receiver performance. These gains help developers scale orbital power stations and reduce energy waste. Defense agencies and space research groups continue to test advanced rectennas and phased-array systems, expanding commercialization potential. Higher technology readiness levels attract new partnerships and funding, supporting rapid market expansion across both government and commercial sectors.

- For instance, Xidian University built a 75-meter-high steel structure ground verification facility named the “Chasing the Sun” project to simulate power generation and transmission technologies for a space solar power station.

Growing national and private-sector space investments

Governments increase spending on orbital energy research, satellite manufacturing, and launch capabilities. National space agencies fund multi-year programs to explore large solar arrays and modular power satellites. Private companies enter the sector through new innovations in lightweight structures, deployable panels, and low-cost launch services. This rising investment strengthens the supply chain and accelerates prototype deployment. Growing global interest in space sustainability further boosts development, making high-capacity space solar systems a priority for long-term energy strategy.

Key Trends & Opportunities

Large-scale demonstration projects and international partnerships

Countries expand collaborative missions to test multi-megawatt space solar designs and validate power-beaming performance. Joint programs between space agencies and defense groups accelerate testing timelines and reduce development risk. Cross-border research focuses on orbital assembly, high-efficiency photovoltaic materials, and precision beam control. These partnerships create strong opportunities for technology suppliers and new service providers. Expansion of testbeds and in-orbit demonstrations positions the market for large-scale deployment through the next decade.

- For instance, Airbus beamed energy 36 meters in Munich to power lights and green hydrogen equipment.

Shift toward lightweight materials and modular satellite architectures

Manufacturers adopt ultra-light solar arrays, foldable structures, and modular platform designs to reduce launch mass and lower project costs. New materials improve radiation resistance and enhance power density. Modular satellites offer scalable build-out and simplified maintenance, which supports both early pilots and future large constellations. This trend opens strong opportunities for aerospace suppliers, material innovators, and propulsion system developers. Lower launch costs and improved design flexibility help accelerate commercial interest.

- For instance, Northrop Grumman’s (formerly Orbital ATK) MegaFlex arrays are a high-performance, tensioned-blanket solar array technology with a current high-TRL (Technology Readiness Level) design typically around a 10-meter diameter, which has demonstrated specific powers up to 200 W/kg.

Expansion of commercial use cases in remote and energy-poor regions

Private firms explore selling orbital clean power to regions with limited grid stability or poor infrastructure. Advances in wireless energy receivers, ground rectenna stations, and secure beam-management systems support commercial models. This trend creates openings for energy developers seeking long-term contracts and governments aiming to improve energy access. Growing interest in off-grid industrial operations, military bases, and island nations further widens opportunity for early deployments.

Key Challenges

High cost of development, launch, and orbital deployment

Large initial investment remains a major barrier for widespread adoption. Space-based solar systems need heavy funding across satellite manufacturing, launch services, in-orbit assembly, and long-term maintenance. Even with declining launch costs, total program expenses remain high for most commercial players. Governments lead early funding efforts, but private firms face difficulty securing financing for multi-year projects. These economic hurdles slow large-scale deployment and extend commercialization timelines.

Technical complexity and safety concerns in power beaming

Wireless transmission requires precise beam alignment, stable atmospheric conditions, and advanced receiver technology. Ensuring safe operation without unintended energy dispersion poses engineering challenges. Regulatory agencies also monitor beam safety, orbital placement, and frequency allocation, which can delay approvals. The complexity of assembling and maintaining large solar arrays in orbit increases technical risk. These challenges demand rigorous testing, specialized infrastructure, and long-term coordination between governments and industry partners.

Regional Analysis

North America

North America led the Space Based Solar Power Market in 2024 with about 38% share. The region benefited from strong government-backed research programs, expanding defense investments, and rising interest in orbital clean-energy initiatives. Agencies advanced large demonstration projects focused on microwave power transmission and high-efficiency solar arrays. The presence of major aerospace companies and launch service providers supported faster technology development. Growing emphasis on resilient energy systems for remote bases and disaster-prone areas further increased adoption. Public–private partnerships strengthened the region’s leadership through continuous funding and early deployment efforts.

Europe

Europe accounted for nearly 27% share in 2024, supported by rising collaboration among national space agencies and strong commitments toward renewable energy independence. The region advanced feasibility studies on orbital solar platforms and invested in lightweight photovoltaic materials to reduce launch mass. The European Union promoted long-term research programs that aimed to diversify clean-energy sources. Aerospace manufacturers contributed through innovations in solar array design and in-orbit assembly concepts. Growing interest in sustainable power for defense and civilian applications positioned Europe as a key contributor to global technology development and future deployments.

Asia Pacific

Asia Pacific held about 30% share in 2024, driven by significant investments from China, Japan, and South Korea in large-scale orbital energy systems. Regional governments accelerated prototype testing, beam-control research, and modular satellite design. China advanced multi-megawatt demonstration plans, while Japan pursued precision laser transmission studies under its national space initiatives. Rapid growth in manufacturing capabilities and falling launch costs strengthened Asia Pacific’s competitive position. Expanding energy needs across densely populated regions increased interest in uninterrupted space-based power, supporting rapid technology development and long-term deployment potential.

Latin America

Latin America captured around 3% share in 2024, reflecting early-stage adoption supported by growing interest in renewable power diversification. Several countries explored partnerships with global space agencies to evaluate feasibility for remote energy supply. Rising demand for stable, off-grid electricity in isolated regions encouraged long-term studies. Limited aerospace infrastructure slowed near-term deployment, yet academic and research groups initiated small-scale wireless power projects. As regional energy policies shift toward sustainability, opportunities for collaboration and technology transfer are expected to expand.

Middle East and Africa

Middle East and Africa held about 2% share in 2024, driven mainly by interest in long-term clean-energy strategies and future orbital power imports. High solar demand, remote industrial sites, and energy-intensive operations encouraged exploration of advanced renewable options. Several governments evaluated partnerships for beam-receiver infrastructure and long-distance transmission concepts. Limited domestic space capabilities slowed early progress, yet investment momentum continued due to strong energy security goals. Growing interest in next-generation power technologies positions the region for gradual adoption as global deployment costs decline.

Market Segmentations:

By Beam Type

- Microwave power transmission

- Laser beam power transmission

By Application

- Electricity generation

- Space applications

By End Use

- Government and defense

- Commercial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features Thales Alenia Space, Emrod, Northrop Grumman, Celestia Energy, Japan Aerospace Exploration Agency, Sirin Orbital Systems, Airbus, China Academy of Space Technology, SpaceTech, and Metasat as the primary participants shaping the Space Based Solar Power Market. Developers focus on advancing wireless power transmission, lightweight solar array engineering, and modular satellite designs to strengthen technology readiness. Companies invest in high-efficiency photovoltaic structures, precision beam-control systems, and scalable orbital platforms to support future multi-megawatt deployments. Strategic partnerships between aerospace firms, research institutes, and government programs enhance technical capabilities and reduce project risks. Industry players also emphasize cost reduction through improved manufacturing processes and next-generation launch solutions. Growing interest in clean orbital power encourages continuous innovation across engineering, testing, and system integration, leading to broader adoption opportunities over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thales Alenia Space

- Emrod

- Northrop Grumman

- Celestia Energy

- Japan Aerospace Exploration Agency

- Sirin Orbital Systems

- Airbus

- China Academy of Space Technology

- SpaceTech

- Metasat

Recent Developments

- In 2024, Japan Space Systems with JAXA and university partners achieved the world’s first long-range wireless power transmission from an aircraft at about 7 km altitude to a ground rectenna roughly 5.5 km below, using microwaves.

- In September 2022, Airbus, ESA and Emrod carried out a microwave power-beaming demonstration at Airbus’ X-Works facility in Munich. The setup converted solar electricity to RF and beamed it across a hangar to a rectenna, illustrating a key link needed for future space-based solar power architectures.

- In 2022, Emrod announced a joint demo with Airbus and ESA where its wireless power technology beamed RF energy indoors as part of an ESA SOLARIS-related test

Report Coverage

The research report offers an in-depth analysis based on Beam Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Space-based solar systems will shift from small pilots to larger multi-megawatt demonstrations.

- Microwave transmission will gain wider adoption due to higher efficiency and safety maturity.

- Falling launch costs will accelerate deployment of modular power satellites.

- Governments will increase funding for orbital clean-energy programs and feasibility studies.

- Private space companies will enter commercial power-beaming projects at a faster pace.

- Advances in lightweight materials will improve power density and reduce system mass.

- International collaborations will expand to share testing facilities and technical standards.

- Ground receiver stations will evolve to support higher accuracy and safer beam alignment.

- Remote regions will emerge as early adopters of space-derived clean energy.

- Regulatory frameworks will strengthen to manage beam safety, orbital use, and energy delivery.