Market Overview:

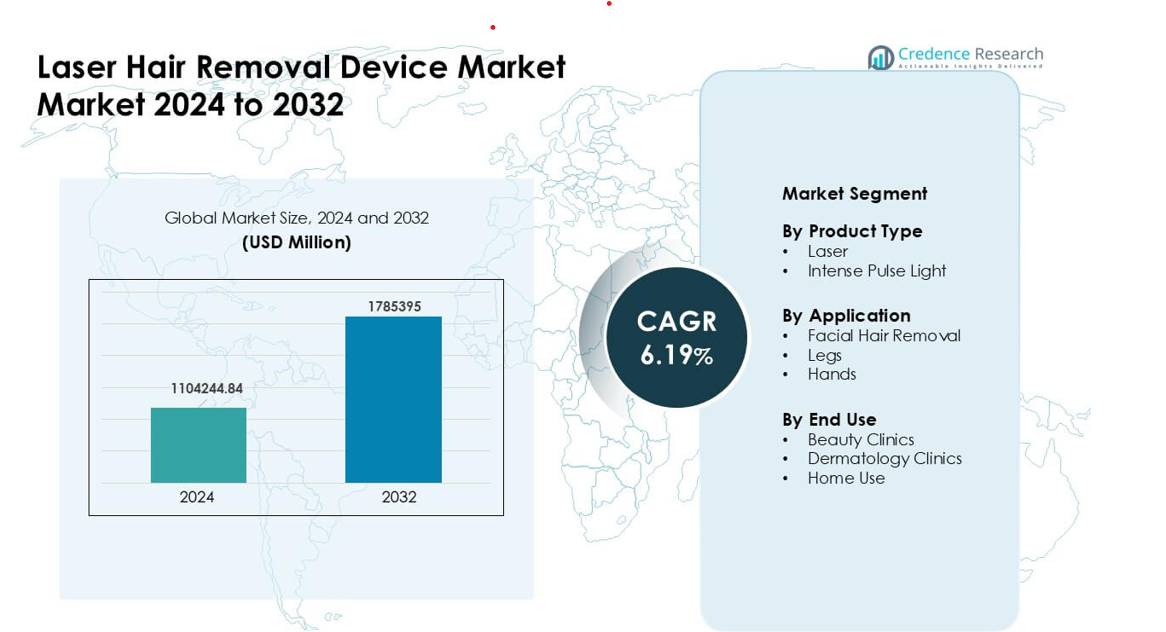

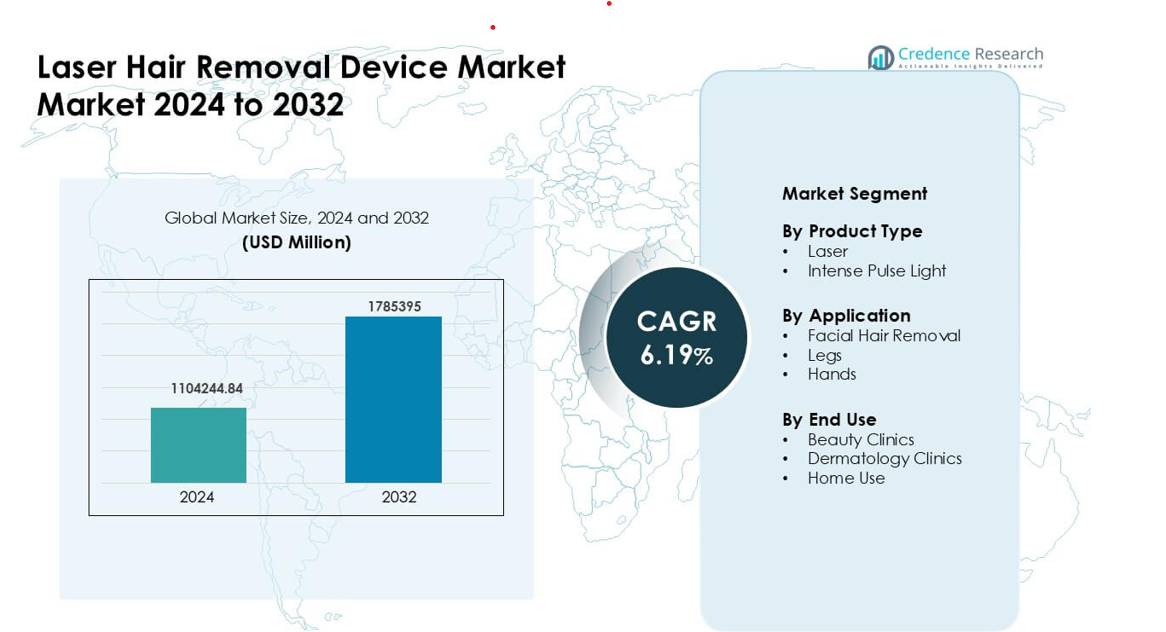

Laser Hair Removal Device Market was valued at USD 1104244.84 million in 2024 and is anticipated to reach USD 1785395 million by 2032, growing at a CAGR of 6.19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Laser Hair Removal Device Market Size 2024 |

USD 1104244.84 million |

| Laser Hair Removal Device Market, CAGR |

6.19% |

| Laser Hair Removal Device Market Size 2032 |

USD 1785395 million |

Top players in the Laser Hair Removal Device Market include Viora, Cutera, Alma Lasers, Cynosure, Sciton, Syneron Medical, Lutronic, Solta Medical, Lumenis, and Venus Concept Canada Corp. These companies compete through advanced diode, alexandrite, and Nd:YAG platforms that offer higher precision, stronger safety, and faster treatment cycles. Many providers also expand global training, service networks, and device upgrades to meet rising demand across clinics and home-use segments. North America emerged as the leading region in 2024 with a 36% share, supported by strong aesthetic procedure adoption, high spending on premium technologies, and a dense clinic network.

Market Insights:

- The Laser Hair Removal Device Market reached a significant value at USD 1104244.84 million in 2024 and is projected to grow steadily by 2032 at a strong CAGR of 6.19%, supported by rising demand for long-term grooming solutions.

- Growing preference for non-invasive hair reduction drives adoption, with laser systems leading the product segment at about 62% share due to higher precision and consistent results.

- Smart, multi-skin-tone devices and compact home-use platforms shape key trends, improving accessibility and expanding consumer reach across younger groups.

- Market competition remains strong as players like Viora, Cutera, Alma Lasers, and Cynosure invest in advanced cooling, safety features, and training programs to sustain clinic and retail adoption.

- North America led the market with a 36% share, followed by Europe at 29% and Asia-Pacific at 24%, driven by dense clinic networks and expanding home-use device penetration across major economies

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Laser systems led the product type segment in 2024 with about 62% share. Laser devices gained strong demand due to higher precision, deeper follicle targeting, and better results on both light and dark skin tones. Many clinics adopted diode and Nd:YAG platforms because these systems reduced treatment time and improved comfort. Intense Pulse Light expanded in budget and home-use categories but lacked the consistency offered by laser units. Wider adoption of professional-grade laser technology and rising focus on long-term hair reduction supported the dominant position of laser devices.

- For instance, Lumenis’s LightSheer QUATTRO a diode‑laser work‑station features a large 22 × 35 mm spot‑size handpiece, enabling rapid treatment of larger areas and reducing session duration compared to older devices.

By Application

Facial hair removal dominated the application segment in 2024 with nearly 48% share. Users preferred facial treatments due to higher visibility concerns, quick results, and strong demand among women and men seeking grooming solutions. Clinics promoted targeted laser protocols that reduced regrowth and improved skin clarity, driving strong uptake. Legs and hands also grew as full-body grooming trends increased across younger groups. Higher spending on personal care and rising awareness of non-invasive aesthetic solutions helped facial hair removal maintain its leading position.

- For instance, a leading global device maker, Cynosure, offers laser hair‑removal platforms that dermatology clinics deploy for whole‑body sessions enabling a typical under‑arm or leg treatment in as little as 10–30 minutes depending on the area, thus making it practical for clients seeking full‑body grooming beyond just the face.

By End Use

Beauty clinics held the dominant end-use share in 2024 with around 52%. These centers attracted clients due to trained technicians, advanced laser platforms, and flexible treatment packages. Dermatology clinics grew as demand rose for medically supervised procedures, especially for sensitive skin and complex cases. Home-use devices gained traction in compact and low-energy formats but remained secondary due to limited power and slower results. Strong interest in professional-grade safety and better long-term outcomes kept beauty clinics ahead in most markets.

Key Growth Drivers:

Growing Demand for Long-Term Hair Reduction Solutions

Global users now seek long-term grooming methods that reduce repetitive shaving or waxing. Laser hair removal devices meet this need by offering durable results, shorter treatment cycles, and fewer skin issues. Beauty centers promote diode and Nd:YAG systems for consistent outcomes across many skin types, which builds confidence among new users. Rising awareness through social media, influencer reviews, and clinic marketing also speeds adoption. Men’s grooming demand adds new volume, especially for facial, chest, and back hair removal. As consumers look for non-invasive and time-saving options, long-term reduction becomes a strong growth engine for advanced devices.

- For instance, clinics deploying Lumenis’ diode‑laser system LightSheer DUET have benefited from its large spot‑size handpiece (22 × 35 mm) that enables rapid treatment of large body areas like back or legs in as little as ~15 minutes per session significantly cutting down on repetitive visits.

Advancements in Laser Technology and Treatment Precision

Laser engineering now provides improved cooling, stable energy delivery, and higher pulse accuracy. These upgrades help clinics achieve better results with less discomfort and lower risk of burns. New-generation diode and alexandrite systems also suit a wider range of tones, which expands the user base. Many brands integrate AI-assisted settings, skin sensors, and automated calibration to refine treatment precision. Mobile platforms and compact systems further support flexible use. As performance improves, clinics deliver faster sessions and higher throughput, raising revenue potential. This steady shift toward smarter and safer technology drives broader acceptance in both professional and home settings.

- For instance, the multi-wavelength platform Soprano ICE from Alma Lasers combining 755 nm (Alexandrite), 810 nm (diode), and 1064 nm (Nd:YAG) wavelengths uses continuous contact‑cooling (ICE™) and in-motion delivery at up to 10 Hz repetition rate, making treatments safer and practically painless even on tanned or darker skin tones, and enabling clinically proven hair reduction across all skin types.

Expansion of Beauty Clinics and At-Home Aesthetic Devices

Urban centers now host many advanced beauty clinics offering affordable treatment packages, EMI plans, and quick procedures. These clinics use premium laser units that attract a wide mix of clients seeking quality services. Meanwhile, at-home devices grow due to rising comfort with DIY grooming and interest in cost-effective solutions. Compact IPL and low-energy diode units appeal to first-time buyers who want privacy and convenience. Strong retail expansion, online sales channels, and influencer promotions boost visibility. Combined growth across professional and home segments increases overall device penetration and supports steady market expansion.

Key Trends & Opportunities:

Rising Popularity of Multi-Skin-Tone and Multi-Area Devices

Manufacturers now design systems that adjust to different skin tones and hair densities using automatic detection tools. These devices offer stronger versatility, which suits clinics handling diverse customer groups. Broader compatibility across facial, leg, and underarm areas also improves utility. Home-use devices reflect the same trend, with preset modes for beginners. This shift ensures safer outcomes and reduces dependency on manual settings. As inclusive grooming solutions gain attention, the trend supports larger buyer segments and improves product adoption across global markets.

- For instance, the Philips Lumea 9000 Series BRI958/00 uses a SmartSkin sensor to automatically detect skin tone and adjust light intensity accordingly this makes it usable across a wide range of skin tones and reduces risk of over‑treatment. The device comes with four different attachments (for face, underarms, bikini, and legs), making it practical for full‑body grooming beyond just one area.

Growing Integration of Smart Features and Digital Interfaces

Laser hair removal technology now includes mobile apps, treatment tracking tools, and guided safety prompts. These features help users follow correct routines, schedule follow-ups, and track skin response. Clinics benefit from digital dashboards that manage patient history and optimize device calibration. Smart connectivity improves user experience and reduces errors, especially for home devices. This digital enhancement builds trust among new users and encourages repeat sessions. As smart aesthetics grow, device value increases and supports stronger competitive differentiation.

- For instance, many modern home‑use IPL and laser devices (like those from leading brands) bundle a companion app that guides users step‑by‑step: it may prompt you to run a patch test, choose appropriate intensity based on skin tone/hair type, remind you of upcoming sessions, and log each session’s results (hair regrowth, skin sensitivity, etc.). This digital interface lowers the barrier for first‑time users and reduces human error in settings, making hair‑removal safer and more user‑friendly particularly for non‑professional consumers.

Key Challenges:

High Initial Device Cost and Limited Access in Developing Regions

Professional laser units require large capital investments, which challenges small clinics in emerging markets. Maintenance fees, part replacements, and training costs add pressure. Home-use devices remain cheaper but still exceed mass-market affordability in many regions. Limited financing options and weak clinic density restrict availability, especially in rural zones. These barriers slow adoption and reduce overall penetration rates. Without lower-cost models or better financing support, many users remain dependent on temporary grooming options, affecting long-term market expansion.

Safety Concerns and Need for Skilled Technicians

Laser treatments require knowledge of skin response, energy levels, and contraindications. Inadequate training can lead to burns, pigmentation changes, or ineffective results. Many regions lack strict regulatory standards, which increases operator risk. Users also hesitate to adopt home devices due to fear of improper use or skin sensitivity. Clinics must invest in certification and training programs to minimize complications. As safety expectations rise, brands must deliver clearer guidance, better sensors, and automated controls. Failure to address safety challenges may limit trust and slow adoption across both professional and home segments.

Regional Analysis:

North America

North America led the Laser Hair Removal Device Market in 2024 with about 36% share. Strong demand came from high spending on aesthetic treatments, early adoption of professional laser platforms, and a dense network of beauty and dermatology clinics. Users preferred diode and alexandrite systems due to proven precision and faster results. Home-use devices also gained traction through large e-commerce channels. Rising interest among men and younger consumers supported steady treatment volume. Continuous technology upgrades and clear regulatory pathways helped North America maintain its leadership across both professional and personal-use segments.

Europe

Europe held nearly 29% share in 2024, supported by strong acceptance of medical-grade aesthetics and wide access to certified dermatology clinics. Consumers favored safe, high-performance laser systems aligned with strict EU safety standards. Demand increased across Germany, the U.K., France, and Italy due to rising interest in long-term grooming and wellness. Expansion of med-spa chains and broader training programs strengthened service quality. Home-use IPL units also saw steady growth through pharmacy and online retail channels. Europe’s focus on regulated technology, skilled operators, and premium treatments helped the region retain a strong position.

Asia-Pacific

Asia-Pacific accounted for around 24% share in 2024 and showed the fastest growth due to rising disposable income, urban lifestyle shifts, and expanding beauty clinic networks. Countries such as China, Japan, South Korea, and India led demand for diode and Nd:YAG systems suited to diverse skin tones. Social-media influence and wider acceptance of non-invasive grooming boosted adoption among younger buyers. Home-use devices expanded rapidly through online platforms. Lower treatment costs and increasing clinic availability improved accessibility, allowing Asia-Pacific to emerge as a high-potential market with strong future expansion prospects.

Latin America

Latin America captured about 7% share in 2024, driven by growing interest in aesthetic procedures across Brazil, Mexico, and Argentina. Beauty clinics expanded their offerings using mid-range diode and IPL systems that balanced performance and affordability. Rising influence of beauty culture and social media pushed higher demand among women and men seeking long-term grooming. Economic fluctuations limited premium device penetration, but installment plans and competitive clinic pricing supported steady uptake. Home-use devices gradually gained visibility through online retail. These factors helped Latin America develop as a developing yet promising market.

Middle East & Africa

The Middle East & Africa region held around 4% share in 2024, supported by strong cosmetic procedure demand in the UAE, Saudi Arabia, and South Africa. Clinics invested in advanced diode and Nd:YAG platforms capable of treating darker skin tones with higher safety. High-income urban centers drove most adoption, while rural areas saw limited penetration due to cost barriers. Medical tourism further boosted demand in select countries offering premium treatments. Home-use devices posted gradual growth. Despite smaller share, rising beauty awareness and expanding clinic networks position MEA as an emerging opportunity zone.

Market Segmentations:

By Product Type

- Laser

- Intense Pulse Light

By Application

- Facial Hair Removal

- Legs

- Hands

By End Use

- Beauty Clinics

- Dermatology Clinics

- Home Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the Laser Hair Removal Device Market features strong participation from leading companies such as Viora, Cutera, Alma Lasers, Cynosure, Sciton, Syneron Medical, Lutronic, Solta Medical, Lumenis, and Venus Concept Canada Corp. These manufacturers compete through advanced diode, alexandrite, and Nd:YAG systems designed for higher precision, faster sessions, and safer outcomes across multiple skin tones. Many brands focus on integrated cooling, AI-assisted settings, and ergonomic designs that improve user comfort and treatment efficiency. Companies also expand after-sales support, technician training, and global distribution to strengthen clinic adoption. In the home-use segment, compact IPL and low-energy diode devices widen reach through retail and e-commerce platforms. Continuous R&D investment, regulatory approvals, and strategic partnerships help players maintain strong market visibility and respond to rising demand for non-invasive grooming solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Viora

- Cutera

- Alma Lasers

- Cynosure, Inc.

- Sciton, Inc.

- Syneron Medical Ltd.

- Lutronic

- Solta Medical, Inc.

- Lumenis

- Venus Concept Canada Corp.

Recent Developments:

- In April 2025, Lumenis unveiled an enhanced SPLENDOR X laser hair removal solution at the ASLMS conference, adding new preset parameters for hair removal and vascular work plus digital capabilities for better uptime and data services in the US and Canada.

- In October 2024, Research and Markets’ Laser Hair Removal Devices Global Strategic Business Report profiled Solta Medical as one of a small group of focus players in the global laser hair removal devices market, underlining its continued role in professional energy-based hair removal systems.

- In April 2024, Cutera announced the North America launch of the redesigned xeo+ platform (updated handpieces, faster treatment times and usability improvements for multi-application devices including hair removal).

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market

Future Outlook:

- Demand for long-term hair reduction will rise as grooming habits shift toward non-invasive solutions.

- Advanced diode and alexandrite systems will gain wider use for higher precision and safer outcomes.

- Home-use devices will expand due to stronger e-commerce presence and improving device safety.

- AI-enabled treatment settings will improve accuracy and reduce operator errors in clinics.

- Multi-skin-tone compatibility will broaden adoption across diverse global populations.

- Beauty clinics will invest more in premium platforms to increase treatment speed and improve revenue.

- Dermatology clinics will adopt upgraded systems for sensitive-skin treatments and medical-grade procedures.

- Hybrid devices with cooling and smart sensors will enhance comfort and reduce complications.

- Emerging regions will see faster adoption due to rising awareness and competitive clinic pricing.

- Strong competition among leading brands will drive continuous innovation and product refinement.