Market Overview

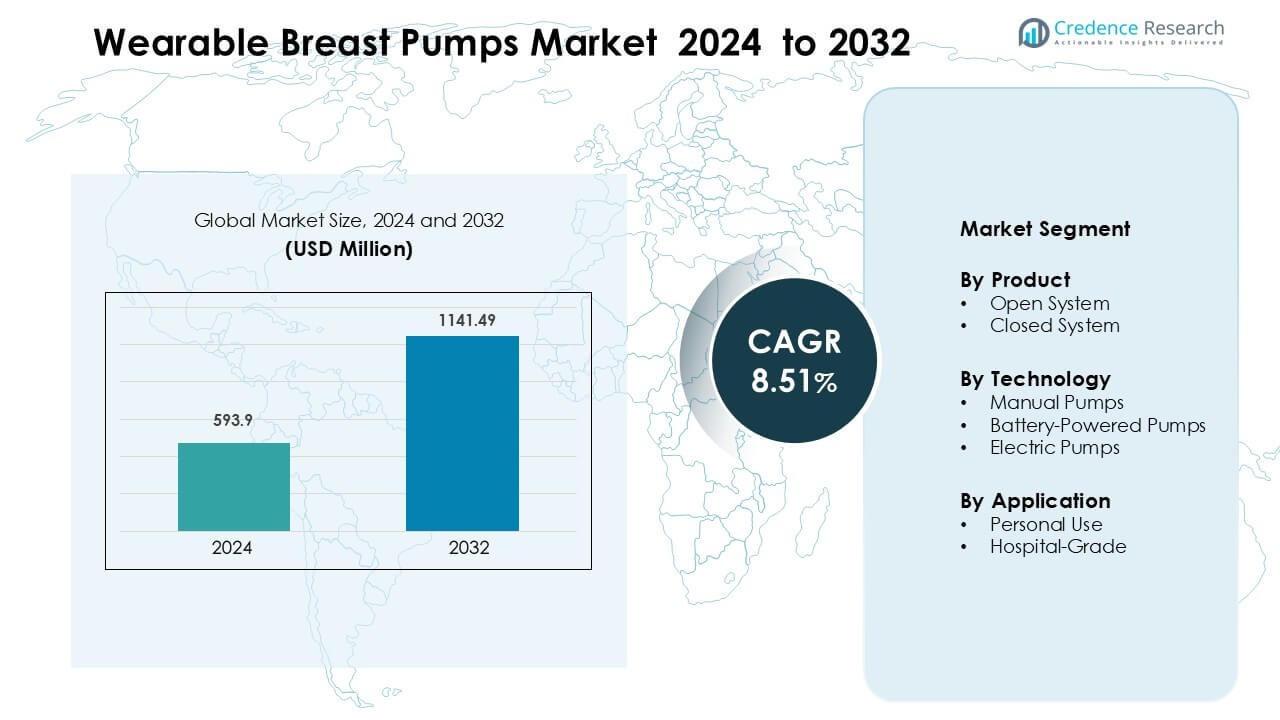

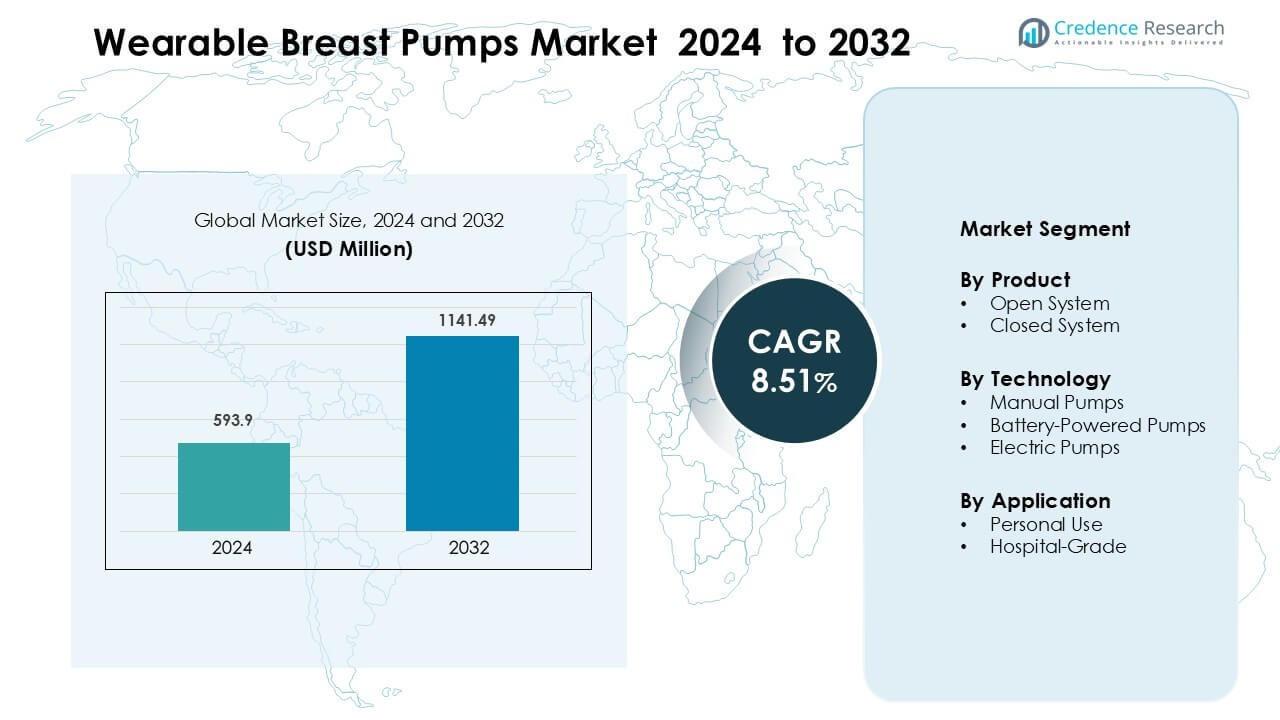

Wearable Breast Pumps Market was valued at USD 593.9 million in 2024 and is anticipated to reach USD 1141.49 million by 2032, growing at a CAGR of 8.51 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wearable Breast Pumps Market Size 2024 |

USD 593.9 Million |

| Wearable Breast Pumps Market, CAGR |

8.51 % |

| Wearable Breast Pumps Market Size 2032 |

USD 1141.49 Million |

The Wearable Breast Pumps Market is shaped by strong competition among Momcozy, Ameda, Inc., Motif Medical, Chemco Group, Medela, Ardo Medical AG, Luvlap Store, Elvie, Lansinoh Laboratories Inc., and Accelleron Medical Products. These companies focus on quiet operation, mobility, smart tracking, and improved comfort to meet rising demand from working mothers. North America leads the market with about 41% share, supported by high adoption of app-enabled pumps, strong retail availability, and workplace breastfeeding support programs. Continuous product innovation and wide digital distribution strengthen the leadership of major brands and expand global market penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Wearable Breast Pumps Market was valued at USD 593.9 million in 2024 and is projected to reach USD 1141.49 million by 2032, growing at a CAGR of 8.51 %.

- Demand rises as working mothers prefer hands-free, portable, and quiet pumps supported by improving breastfeeding awareness and better workplace lactation policies.

- Smart, app-connected features and lightweight battery-powered designs shape major trends, while closed-system pumps lead product share due to higher hygiene and ease of use.

- Competition intensifies as brands enhance comfort, suction control, and pricing strategies, though high device cost remains a key restraint in emerging markets.

- North America holds about 41% share, while battery-powered pumps dominate technology share at around 58%, supported by strong digital retail presence and early adoption of advanced designs.

Market Segmentation Analysis:

By Product

Closed system pumps hold the dominant share at about 72% in 2024 due to their sealed design, which prevents milk contamination and supports safer long-term use. Parents choose closed systems because they reduce cleaning time and lower hygiene risks in daily feeding. Demand rises as working mothers favor compact, reliable pumps that maintain milk purity during frequent sessions. Open system pumps keep a niche presence but face slower growth because many caregivers now prioritize sterile pathways and safer storage.

- For instance, Philips Avent’s Comfort Single Electric Pump weighs just 393 g, has a closed-system design that ensures milk never enters the tubing or motor, and all milk-contact parts (except the motor) are fully sterilizable.

By Technology

Battery-powered pumps lead this segment with nearly 58% share in 2024, driven by strong adoption among working mothers who need portable and hands-free devices. Users select battery models for flexible use in offices, travel, and commutes. Growing demand for discreet wearable designs also supports wider acceptance. Electric pumps hold steady use for higher suction strength, while manual pumps remain common for occasional needs. The shift toward mobility and quiet operation keeps battery-powered pumps ahead.

- For instance, Medela Freestyle Flex features a built‑in rechargeable lithium‑ion battery that delivers up to eight double-pumping sessions per full USB‑C charge.

By Application

Personal-use pumps dominate with around 81% share in 2024, supported by rising breastfeeding awareness and higher adoption of convenient wearable models at home and work. Many parents choose personal-use pumps because they offer privacy, comfort, and continuous availability without hospital constraints. Hospital-grade pumps remain essential in maternity wards and NICUs for mothers needing stronger suction or clinical support. However, personal-use designs grow faster as lightweight, cordless, and silent features meet daily feeding demands.

Key Growth Drivers

Rising Demand for Mobility and Hands-Free Pumping

Mothers seek greater freedom during daily routines, which pushes strong demand for hands-free wearable pumps. Working women value compact devices that fit inside clothing and allow discreet pumping while commuting, attending meetings, or moving around at home. This shift reflects lifestyle changes where rigid pumping schedules are less practical. Many parents now choose cordless pumps that offer comfort, quiet use, and constant mobility without tubes or external units. As more workplaces support breastfeeding policies, the need for portable pumping solutions grows. This demand encourages companies to release lighter, more ergonomic models that align with active routines.

- For instance, Elvie’s wearable breast pump weighs just 225 g, fits entirely into a nursing bra, and operates at 32 dB letting women pump quietly during meetings, commuting, or while moving around.

Growing Breastfeeding Awareness and Health Benefits

Awareness programs highlight the health value of exclusive breastfeeding, which boosts adoption of efficient wearable pumps. Many caregivers need support to maintain milk supply after returning to work or while managing busy schedules, and wearable systems provide a simple way to continue breastfeeding goals. Hospitals and lactation consultants now recommend device-assisted pumping for mothers facing supply issues or latch challenges. This increased guidance encourages early device purchases. As more families learn about immune support and nutritional benefits linked to breast milk, demand for user-friendly pumping devices rises. Market growth accelerates as parents prioritize infant health and convenience.

- For instance, the Lansinoh Wearable Breast Pump offers 8 adjustable suction levels up to 280 mmHg, which lactation experts say helps stimulate milk expression for mothers facing supply challenges.

Advances in Quiet, Smart, and Comfortable Pumping Technologies

Manufacturers invest in improved suction control, noise reduction, and soft silicone shields to enhance comfort and reduce stress during pumping. These upgrades help mothers maintain consistent use without discomfort or disruptions. Smart features such as app-based tracking, customizable suction cycles, and automatic shutoff improve performance and reduce guesswork for new parents. Many users now expect pumps that integrate with digital health tools, monitor milk volume, and store usage data. The shift toward seamless and intuitive technology pushes brands to release advanced models that meet modern expectations and drive repeat purchases.

Key Trends and Opportunities

Rise of Smart Features and App-Connected Devices

Wearable pumps now include Bluetooth connectivity and mobile apps that track milk output, suction levels, and pumping patterns. These features help mothers personalize sessions, monitor supply changes, and manage schedules with greater accuracy. The data supports better lactation planning, especially for working women balancing pumping routines with office hours. Companies use this trend to differentiate products and raise convenience. Continuous improvements in sensors and automation provide more reliable results, making smart pumping a key opportunity for new product launches and premium pricing in the market.

- For instance, Elvie Pump offers seven intensity settings for both Stimulation and Expression modes and, via its app, provides access to different SmartRhythms™ modes to tailor the pumping experience. The app also lets users view real-time volume estimates and track their pumping history on their phone.

Expanding Opportunities in Workplace-Supportive Breastfeeding Policies

More companies now create lactation rooms and flexible pumping breaks, which increases acceptance of wearable pumps. Supportive laws in many regions push employers to maintain breastfeeding-friendly environments. This shift encourages demand for discreet and silent pumping devices that help mothers combine career and infant care. As remote and hybrid work models grow, many mothers invest in portable pumps suited for varied work locations. Brands gain opportunities to partner with employers, insurers, and wellness programs to promote pump adoption and broaden market reach.

- For instance, under the U.S. PUMP Act, employers must provide nursing parents with adequate break time and a private non‑bathroom space to pump for up to one year after childbirth.

Key Challenges

High Device Cost Limits Adoption in Lower-Income Groups

Wearable pumps often cost more than traditional electric or manual pumps, making them less accessible to families with limited budgets. The premium pricing reflects advanced technology, compact design, and battery components, but it also slows adoption in emerging markets. Many caregivers still choose cheaper alternatives despite reduced convenience. Lack of widespread reimbursement programs in many regions further challenges affordability. This cost barrier limits penetration among first-time mothers and reduces replacement purchases, forcing companies to explore cost-effective materials and flexible pricing models.

Inconsistent Suction Performance and Reliability Concerns

Some wearable pumps struggle to match the suction power of hospital-grade models, which raises concerns for mothers who need strong, consistent output. Variability in fit, shield size, and motor strength can reduce milk flow and cause discomfort. These issues create hesitation among new users who depend on predictable results to maintain supply. Reports of battery degradation, leakage, or connectivity problems in earlier models also affect trust. Manufacturers must refine design quality and ensure reliable performance to overcome these barriers and support broader market acceptance.

Regional Analysis

North America

North America holds the leading position with about 41% share in 2024, driven by high adoption of hands-free pumping devices among working mothers and strong insurance support for breastfeeding products. The region benefits from advanced designs, smart app-linked features, and early launches by major brands. Wider workplace lactation programs and rising awareness of breastfeeding benefits also increase usage. Hospitals and lactation consultants recommend wearable pumps for convenience, which boosts repeat purchases. Strong retail channels, including online platforms offering flexible payment options, help maintain the region’s dominant presence.

Europe

Europe accounts for around 27% share in 2024, supported by strong maternal healthcare standards and wide acceptance of breastfeeding-friendly initiatives. Mothers value quiet, comfortable, and compact devices for daily mobility. Countries such as Germany, France, and the U.K. show high adoption due to supportive parental leave policies that encourage sustained breastfeeding. The market grows further as hospitals promote hygienic closed-system pumps and app-enabled designs. Demand also rises through expanding e-commerce platforms and increasing awareness of lactation support programs across major European nations.

Asia Pacific

Asia Pacific captures about 22% share in 2024, with rapid growth driven by rising female workforce participation, urban lifestyles, and expanding retail access to premium pumps. Countries like China, Japan, South Korea, and India show strong interest in lightweight, battery-powered wearable devices suited for long commutes and busy routines. Growing awareness of infant nutrition and government-led breastfeeding campaigns accelerate demand. Expanding middle-income populations choose smart, portable designs for flexible use. Local manufacturers also introduce affordable options, increasing market penetration.

Latin America

Latin America holds nearly 6% share in 2024, supported by gradual improvements in maternal health awareness and expanding online retail channels that offer modern wearable pumps. Brazil, Mexico, and Argentina lead adoption as working mothers look for discreet and comfortable pumping options. Economic constraints limit high-end pump purchases, but mid-range products grow steadily. Breastfeeding education campaigns by public health agencies encourage device use to maintain milk supply. Urban families increasingly choose compact, hands-free designs suited for flexible routines.

Middle East & Africa

The Middle East & Africa region accounts for around 4% share in 2024, with rising traction in urban areas where mothers seek convenient and hygienic wearable pumping solutions. Wealthier Gulf countries lead adoption due to strong healthcare infrastructure and preference for premium products. Breastfeeding initiatives in hospitals and maternity centers support wider acceptance. However, limited affordability and lower awareness in several African nations slow expansion. Gradual improvements in retail access and digital health education are expected to support steady future growth.

Market Segmentations:

By Product

- Open System

- Closed System

By Technology

- Manual Pumps

- Battery-Powered Pumps

- Electric Pumps

By Application

- Personal Use

- Hospital-Grade

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Wearable Breast Pumps Market features strong competition among global and emerging brands that focus on comfort, mobility, and smart functionality. Companies such as Momcozy, Ameda, Inc., Motif Medical, Chemco Group, Medela, Ardo Medical AG, Luvlap Store, Elvie, Lansinoh Laboratories Inc., and Accelleron Medical Products invest heavily in design improvements that offer quieter operation, better suction control, and enhanced fit for daily use. Many players expand product lines with app-connected features that track milk volume and support personalized pumping settings. Direct-to-consumer models strengthen brand visibility through online platforms, while partnerships with hospitals and lactation consultants increase trust and adoption. Firms also differentiate by offering multiple shield sizes, lightweight materials, and long-lasting batteries. Competitive intensity grows as companies release affordable mid-range models to reach wider income groups, pushing continuous innovation in comfort, portability, and smart usability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Medela launched the Motion In Bra™, a new wearable, in-bra breast pump that combines Medela 2-Phase Expression™ technology with a plug-and-play, discreet design aimed at everyday, hands-free use.

- In June 2025, Ameda launched the GLO Wearable Breast Pump, a hospital-strength, fully hands-free in-bra device now available through Ameda, Amazon, and other retail partners.

- In 2024, LuvLap Store actively marketed and sold its Glory hands-free/wearable electric breast pump across Indian retail channels (official site, Amazon/Flipkart listings and social promotions), showing broad marketplace availability and consumer promotion through social reels and product demo videos.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as more working mothers choose hands-free pumping for daily mobility.

- Smart tracking features will expand, with pumps offering better data insights and automated settings.

- Battery life and motor efficiency will improve, supporting longer and quieter pumping sessions.

- Comfort-focused designs will grow, with softer shields and customizable fit options.

- More companies will enter the mid-range segment, increasing affordability and wider adoption.

- Hospitals will recommend wearable designs more often, boosting trust and clinical acceptance.

- Insurers may broaden coverage for advanced pumps, increasing access for first-time mothers.

- Hybrid work models will support continued uptake of discreet portable pumping solutions.

- Manufacturers will invest in eco-friendly materials and more sustainable production practices.

- Regional growth will accelerate in Asia Pacific as urbanization and female workforce participation increase.