Market Overview:

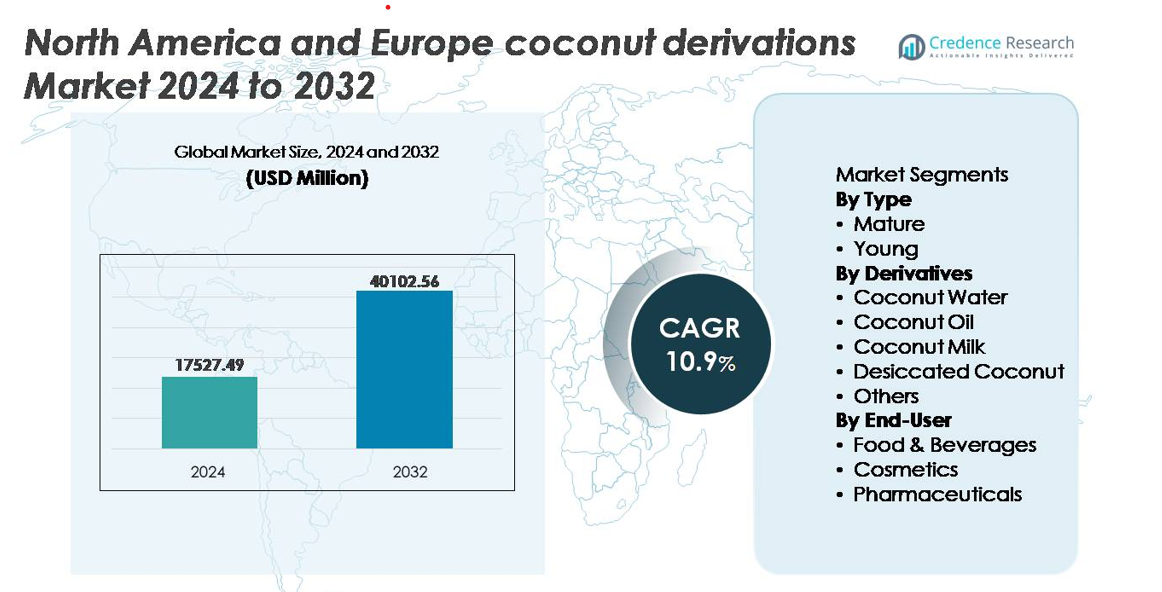

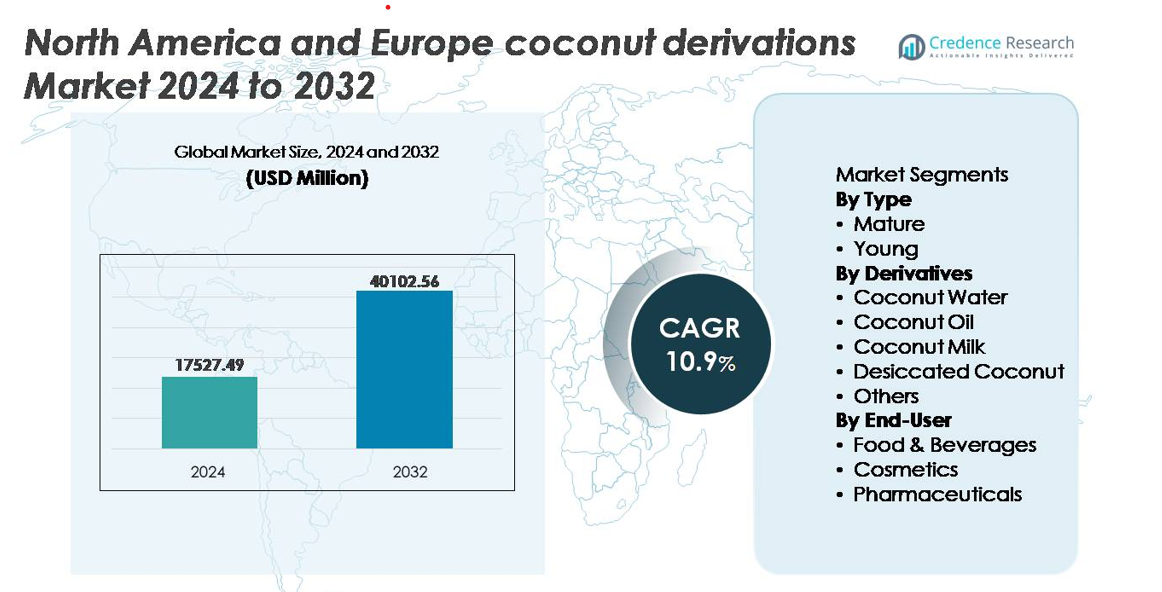

The North America and Europe coconut derivatives market was valued at USD 17,527.49 million in 2024 and is projected to reach USD 40,102.56 million by 2032, registering a compound annual growth rate (CAGR) of 10.9% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America and Europe Coconut Derivations Market Size 2024 |

USD 17,527.49 million |

| North America and Europe Coconut Derivations Market, CAGR |

10.9% |

| North America and Europe Coconut Derivations Market Size 2032 |

USD 40,102.56 million |

The competitive landscape of the North America and Europe coconut derivatives market features a mix of global beverage companies, large food-and-wellness firms, and specialized ingredient suppliers. Prominent players such as Vita Coco, McCormick & Company, Inc., Hain Celestial Group, Inc., and Danone S.A. lead in finished products, while companies like Axelum Resources Corp. and Celebes Coconut Corporation supply raw materials and bulk derivatives for food, cosmetics, and nutraceutical applications.

Regionally, North America accounts for roughly 35% of the coconut-derivatives demand in the combined North America-Europe market, driven by high consumer adoption of plant-based foods and natural ingredient personal-care products. Western Europe follows closely with an estimated 30% share, supported by strong clean-label demand, regulatory focus on natural sourcing, and rising interest in vegan-friendly beverages and dairy alternatives.These players leverage robust sourcing networks, diversified product portfolios, and broad distribution channels to cater to growing demand across food & beverages, cosmetics, and health-oriented segments-consolidating their leadership while exerting pressure on smaller niche suppliers.

Market Insights

- The North America and Europe coconut derivatives market was valued at USD 17,527.49 million in 2024 and is projected to reach USD 40,102.56 million by 2032, reflecting a CAGR of 10.9% during the forecast period.

- Growing consumer shift toward plant-based diets, clean-label products, and functional wellness beverages drives demand for coconut milk, oil, and water across food and personal care industries.

- Emerging trends include sustainable sourcing, organic-certified variants, dairy-alternative innovation, and rising use of coconut-based ingredients in nutraceutical formulations.

- The market remains moderately fragmented with key players expanding through product diversification, branding, and long-term sourcing partnerships to maintain competitive advantage.

- North America accounts for approximately 35% of demand, while Western Europe holds around 30%, with the food and beverages segment capturing the largest share due to its dominant use in plant-based foods, functional drinks, and bakery applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The mature coconut segment dominates the North America and Europe coconut derivatives market, accounting for the largest share as manufacturers prefer its higher oil yield, richer nutrient density, and suitability for large-scale processing. Mature coconuts are extensively utilized for coconut oil, desiccated coconut, and coconut milk applications, ensuring steady supply for food processing and cosmetics end users. Young coconuts are gaining traction due to rising consumption of natural beverages and minimally processed ingredients; however, their lower extractable content and shorter shelf life limit industrial adoption compared to mature varieties, preserving the latter’s leadership position.

- For instance, Axelum Resources Corp. operates processing capabilities that handle over 600 metric tons of coconuts dailyat its fully integrated Medina, Misamis Oriental facility, enabling stable export volumes for coconut milk, cream, and desiccated coconut.

By Derivatives

Coconut oil represents the dominant derivative, driven by its versatile application in food preparation, plant-based ingredient formulations, organic personal care, and aromatherapy products. Demand for cold-pressed and virgin coconut oil continues to accelerate owing to clean-label preferences and expansion of plant-based consumer categories. Coconut water and coconut milk remain fast-growing segments supported by hydration beverages and dairy-alternative demand. Desiccated coconut holds steady demand from bakery, confectionery, and packaged food producers, while “others,” including coconut flour and sugar, gain momentum as gluten-free and natural sweetener substitutes become mainstream.

- For instance, Hain Celestial Group produces branded coconut-derived grocery and personal care products through operations serving more than 70 countries, supported by manufacturing capabilities across North America and Europe that enable large-scale coconut oil distribution for retail and wholesale channels.

By End-User

The food and beverages segment holds the largest market share, driven by the rising integration of coconut ingredients into bakery goods, dairy alternatives, snacks, sports drinks, and functional beverages. Health-conscious consumers continue to drive demand for coconut-based hydration and plant-derived ingredients. The cosmetics sector demonstrates strong growth as manufacturers incorporate coconut derivatives into haircare, skincare, and natural emollient products. Pharmaceutical end users expand steadily, leveraging coconut oil and medium-chain triglyceride ingredients in drug delivery, dermatological formulations, and nutraceutical products, supported by the sector’s shift toward botanical and biocompatible raw materials.

Key Growth Drivers:

Growing Consumer Shift Toward Plant-Based, Functional, and Clean-Label Ingredients

The increasing adoption of plant-derived and nutritionally enriched ingredients stands out as a key driver for coconut derivatives demand across North America and Europe. Consumers prioritize products perceived as natural, allergen-free, and minimally processed, benefiting segments such as coconut water, milk, flour, and virgin oil. The rise of veganism and flexitarian diets further accelerates the use of coconut derivatives as dairy alternatives in yogurt, ice cream, and creamers. Functional nourishment trends drive coconut water’s use in hydration beverages due to its naturally occurring electrolytes, while coconut-based oils gain traction as alternatives to trans-fat heavy ingredients in food applications. Clean-label mandates and the removal of synthetic additives push manufacturers to utilize coconut derivatives as natural flavor carriers, emulsifiers, and moisturizers in F&B and personal care formulations. This plant-forward preference aligns with sustainability-linked procurement, strengthening the market outlook.

- For instance, Danone North America operates large-scale plant-based and dairy manufacturing facilities. For instance, its Minster, Ohio plant alone has the capacity to produce over 5 million total yogurt cups or bottle servings a dayacross over 200 different products, including major plant-based brands like Silk and So Delicious, reinforcing strong market demand for both dairy and plant-based alternatives.

Expanding Utilization Across Cosmetic and Personal Care Product Formulations

Cosmetic and personal care manufacturers increasingly integrate coconut-based derivatives due to their emollient, moisturizing, antimicrobial, and conditioning properties. Coconut oil remains a staple ingredient in haircare, skincare, and natural cosmetics, driven by consumer perception of botanical solutions being gentler and safer than synthetic alternatives. The premiumization of personal grooming products reinforces demand for virgin, cold-pressed, and organic coconut oils and extracts. Growth in bar soaps, solid shampoos, and sustainable packaging formats enhances the use of coconut-derived surfactants and fats in anhydrous formulations. Additionally, coconut-based MCTs and bioactive compounds contribute to high-value cosmeceuticals targeting anti-aging and scalp health. Rising clean beauty standards, reduced paraben usage, and traceability requirements further improve adoption rates in Europe’s regulated cosmetic industry.

- For instance, Axelum Resources Corp. supplies coconut-derived ingredients to several global personal-care brands, backed by manufacturing capabilities that process over 600 metric tons of raw coconuts dailyto support large-scale skincare and haircare production requirements.

Growing Adoption in Pharmaceutical, Nutraceutical, and Therapeutic Applications

Pharmaceutical and nutraceutical segments leverage coconut derivatives for excipient, carrier oil, and functional health applications. Medium-chain triglycerides derived from coconut oil are used in controlled drug delivery systems owing to their rapid absorption and metabolization characteristics. Nutraceuticals incorporate coconut derivatives into immunity-supporting supplements, digestive aids, and brain-health formulations, aligning with preventive wellness trends. In topical therapeutics, coconut oil’s antimicrobial and anti-inflammatory attributes support dermatological and wound-care products. As the pharmaceutical sector shifts toward biocompatible and plant-origin excipients, coconut-based materials offer compatibility with regulatory and sustainability expectations. Product development initiatives in medical nutrition and ketogenic therapies further reinforce long-term demand.

Key Trends & Opportunities:

Rising Demand for Sustainable, Ethical, and Traceable Ingredient Supply Chains

Sustainability-led branding strategies unlock opportunities for coconut derivative manufacturers that emphasize ethical sourcing, reduced carbon impact, and smallholder farmer partnerships. Europe’s evolving ESG criteria and North America’s growing awareness of environmental footprints encourage companies to certify origin, reduce waste, and adopt circular packaging formats. Opportunities arise in regenerative farming, water-efficient processing, and co-product valorization such as coconut husk fiber for industrial applications. Traceability platforms leveraging blockchain or digital supply chain mapping provide transparency, enabling brand differentiation. This trend positions coconut derivatives favorably compared to synthetic and petroleum-based alternatives, especially in premium F&B and cosmetic categories.

- For instance, Vita Coco’s long-term farmer-support initiative has distributed more than 1,000,000 coconut seedlings globally and funded the construction of over 30 clean water facilities in farming communities, improving sustainability credentials and securing long-term coconut supply.

Innovation in Value-Added Derivatives, Specialty Ingredients, and Product Differentiation

A shift toward specialty and premiumized coconut derivatives creates opportunities for product innovation, including coconut-based sweeteners, concentrates, protein powders, and fermented products. Demand for lactose-free, gluten-free, and allergen-friendly applications supports coconut flour and milk powder proliferation in bakery mixes and ready-to-eat foods. The evolving plant-based foods sector drives the requirement for enhanced texture and flavor profiles that coconut derivatives can deliver in dairy analogs and frozen desserts. Specialty-grade oils and tailored MCT compositions present high-margin opportunities in sports nutrition, nootropic supplements, and medical diets. Manufacturers innovating in formulation-friendly, shelf-stable, and organic-certified variants are positioned for accelerated uptake.

- For instance, Axelum Resources Corp. expanded its product portfolio to include coconut-derived MCT oil ingredients, enabling the production of more than 3,000 metric tons annually for use in sports nutrition and ketogenic product formulations.

Key Challenges:

Volatility in Raw Material Availability and Procurement Costs

Supply chain instability poses a major challenge, as production is heavily concentrated in tropical regions prone to changing climate patterns, cyclones, and seasonal fluctuations. Price volatility impacts procurement budgets for North American and European manufacturers, especially for premium categories such as extra-virgin and organic-certified variants. Dependence on smallholder farming introduces variability in production quality, yield consistency, and traceability. Currency fluctuations and export-dependent logistics create cost unpredictability, while freight disruptions magnify lead times. Mitigating these risks requires diversification of sourcing, contract farming models, and investment in farmer capacity building to ensure stable supply.

Regulatory Complexity and Quality Standard Compliance Across Markets

Manufacturers operating in North America and Europe face stringent regulations related to food safety, cosmetics labeling, organic certification, and environmental compliance. Differing market standards complicate cross-border distribution of coconut derivatives, especially powdered and fortified products. Claims regulations, allergen labeling, and clean beauty standards impose documentation and testing requirements that raise entry barriers for new suppliers. Cosmetics and nutraceutical manufacturers must validate purity, pesticide residues, and heavy metal thresholds, increasing operational overhead. Regulatory misalignment around sustainability certifications and fair-trade labeling further pressures producers to maintain multipronged compliance frameworks while managing cost competitiveness.

Regional Analysis:

North America

The North American region remains a leading contributor within the North America-Europe coconut derivatives market, estimated to account for roughly 35% of the combined regional value. This dominance reflects robust demand across the United States and Canada for coconut-based oils, waters, milks and healthier alternatives, driven by rising health consciousness, plant-based dietary trends, and strong retail and e-commerce distribution networks. Nutritional awareness, lactose intolerance, and growing interest in functional and clean-label products propel expanded consumption of coconut derivatives. As a result, North America continues to serve as a growth engine for the broader market.

Western Europe

Western Europe – led by countries such as Germany, the United Kingdom, France, Italy and Spain -captures the largest share of the European portion of the market, with Germany alone accounting for approximately 18% and the UK around 16.7% as of 2024. The region benefits from high consumer awareness around health, sustainability, and natural ingredients, leading to strong uptake of coconut-derived products in food & beverages, cosmetics, and nutraceuticals. Demand for organic, ethically-sourced, and clean-label products boosts coconut water, oil, and milk consumption. Mature retail infrastructures, regulatory familiarity with plant-based ingredients, and high disposable incomes cement Western Europe’s leadership in the market.

Eastern & Other European Markets

Eastern Europe and other emerging European markets presently hold a smaller portion of the regional market -likely under 10-15% – yet offer strong growth potential. Rising disposable incomes, urbanisation, and shifting dietary and lifestyle preferences toward Western-style diets and wellness products drive gradual adoption of coconut derivatives. Growth in niche sectors like natural cosmetics, plant-based foods, and functional beverages fosters new demand. As distribution networks expand and import infrastructure improves, these markets may progressively narrow the gap with more mature Western European markets, representing an important growth corridor for suppliers looking to diversify their European footprint.

Market Segmentations:

By Type

By Derivatives

- Coconut Water

- Coconut Oil

- Coconut Milk

- Desiccated Coconut

- Others

By End-User

- Food & Beverages

- Cosmetics

- Pharmaceuticals

By Geography

- North America

- Western Europe

- Eastern & Other European Markets

Competitive Landscape:

The competitive landscape in the North America and Europe coconut derivatives market remains moderately fragmented but increasingly shaped by a handful of large, well-established players competing on scale, product breadth, and supply-chain strength. Leading firms such as Vita Coco, McCormick & Company, Inc., Hain Celestial Group, Inc., Celebes Coconut Corporation, and Axelum Resources Corp. dominate distribution channels across food & beverages, cosmetics, and nutraceutical segments. These players leverage strong sourcing relationships in coconut-producing countries, established logistics networks, and brand equity to deliver coconut oil, water, milk, desiccated products, and specialty ingredients across multiple markets. Their broad product portfolios and ability to scale operations give them a competitive advantage over smaller niche suppliers. Meanwhile, smaller regional and specialty suppliers stay relevant by focusing on niche segments-such as organic-certified, fair-trade, virgin coconut oil, or ice-cream and vegan dairy substitutes -where they differentiate on quality, sustainability credentials, or formulation flexibility. However, high entry barriers related to compliance, certification, and supply-chain consistency in Europe and North America reinforce the dominance of major players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Danone S.A. (Paris, France)

- PT Global Coconut (North Sulawesi, Indonesia)

- Superstar Coconut Products Co., Inc. (Quezon, Philippines)

- Vita Coco (New York, United States)

- JAKA Investment Corp. (Makati, Philippines)

- Hain Celestial Group, Inc. (New York, United States)

- Agrim Pte Ltd. (Singapore)

- Axelum Resources Corp. (Northern Mindanao, Philippines)

- McCormick & Company, Inc. (Maryland, United States)

- Celebes Coconut Corporation (Butuan, Philippines)

Recent Developments:

- In November 2025, Axelum Resources Corp.The company reported a sharp rebound, with net income rising to ₱636 million in the first nine months of 2025- marking an 88 % increase year-on-year -driven by robust volume growth and higher average selling prices across coconut product categories.

- In March 2025, Vita Coco the company rolled out an Orange & Creme coconut milk drink supported by a Y2K-themed launch event in New York City, boosting brand visibility and extending its coconut-based “Treats” line in the U.S.

- In March 2023, Danone-owned So Delicious Dairy Free (Danone North America) launched a 0g Added Sugar Coconutmilk Yogurt Alternative in the U.S., expanding its coconut-based dairy-free portfolio and strengthening its positioning in the plant-based yogurt aisle.

Report Coverage:

The research report offers an in-depth analysis based on Type, Derivatives, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for coconut derivatives will continue rising as plant-based, vegan, and clean-label diets become mainstream across both regions.

- Coconut milk and yogurt alternatives will experience strong traction in dairy-free formulations and functional beverages.

- Sustainable and ethical sourcing practices will become a core requirement rather than a differentiator.

- Companies will invest in transparent ingredient traceability to meet regulatory and consumer expectations.

- Premium organic and fair-trade coconut derivatives will expand faster than conventional variants.

- Coconut-based ingredients will grow in cosmeceuticals and dermatological applications.

- Value-added derivatives like coconut flour, protein powders, and sweeteners will diversify product portfolios.

- Regional partnerships and contract manufacturing will strengthen supply resilience.

- Branding strategies will shift toward environmental, health, and origin storytelling.

- Technological processing advancements will improve quality consistency and reduce waste, supporting scalable growth.