Market Overview:

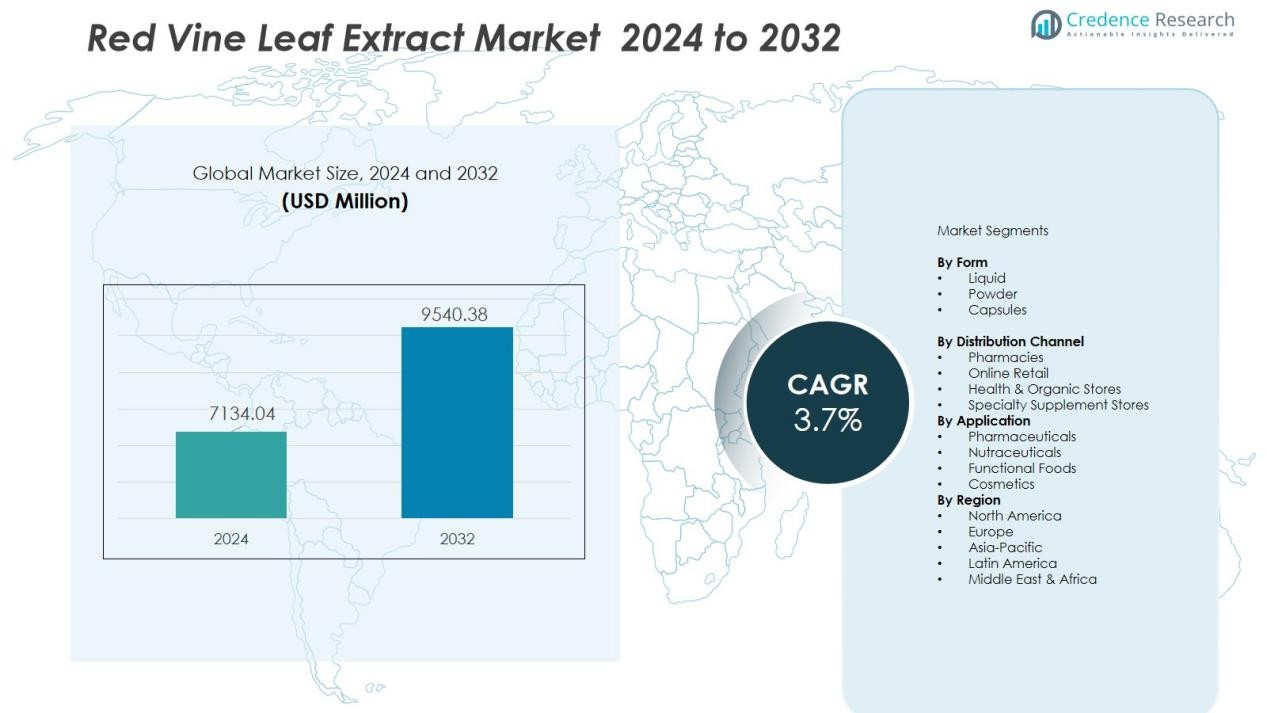

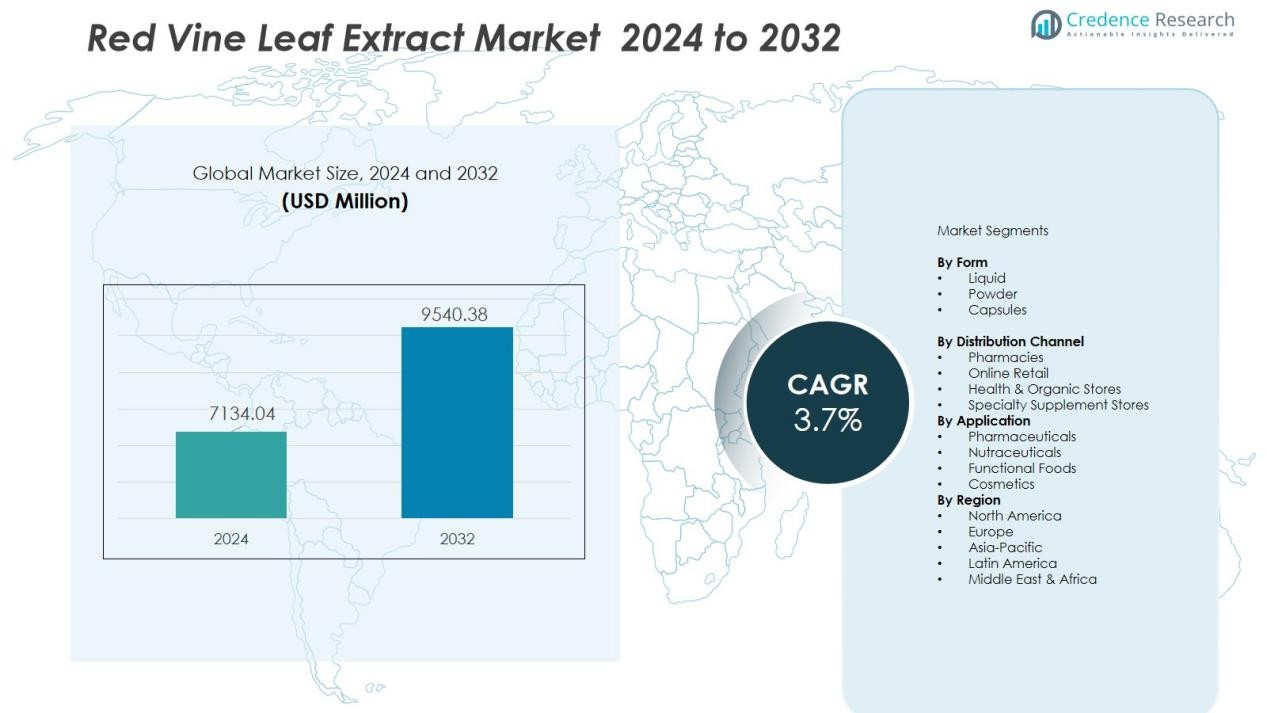

The Red Vine Leaf Extract Market size was valued at USD 7134.04 million in 2024 and is anticipated to reach USD 9540.38 million by 2032, at a CAGR of 3.7 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Red Vine Leaf Extract Market Size 2024 |

USD 7134.04 Million |

| Red Vine Leaf Extract Market, CAGR |

3.7 % |

| Red Vine Leaf Extract Market Size 2032 |

USD 9540.38 Million |

Strong market drivers include growing awareness of venous health and increasing use of natural solutions for managing leg discomfort, heavy-leg syndrome, and circulation disorders. Red vine leaf extract is valued for its rich flavonoid content, particularly quercetin and resveratrol, supporting its use in pharmaceutical preparations designed for vascular health. Rising preference for clean-label ingredients and expanding research on botanical compounds also elevate demand. Application potential broadens across anti-aging skincare, mobility supplements, and formulations that target inflammatory disorders, encouraging new investments in the industry.

Regionally, Europe leads the market due to its long tradition of herbal medicine usage, strong regulatory support for botanical active ingredients, and high consumer adoption of natural venous-health supplements. North America registers increasing demand led by supplement manufacturers and wellness brands focusing on botanical alternatives. Asia-Pacific shows notable growth as herbal supplement consumption accelerates, supported by improving nutraceutical manufacturing capacity and rising awareness of plant-based healthcare solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Red Vine Leaf Extract Market was valued at USD 7,134.04 million in 2024 and is projected to reach USD 9,540.38 million by 2032, growing at a CAGR of 3.7% during the forecast period.

- Europe leads with a 41.8% share, driven by a strong tradition of herbal medicine, widespread consumer use of venous-health supplements, and regulatory support for standardized botanical ingredients; North America follows with 28.6%, supported by demand from nutraceutical and skincare sectors; Asia-Pacific holds 21.4%, with growth backed by rising plant-based supplement consumption and improving production capabilities.

- Asia-Pacific is the fastest-growing region with a CAGR above 4.5%, fueled by increasing awareness of natural health solutions, expansion of herbal supplement manufacturing, and rising demand in skincare applications across China, India, Japan, and South Korea.

- By application, the pharmaceutical segment accounts for 44.9% of the market, driven by increased use of red vine leaf extract in vascular support formulations and leg discomfort treatments.

- The personal care and cosmetics segment holds 26.2% share, supported by the ingredient’s growing use in anti-aging, microcirculation-enhancing, and anti-inflammatory skincare products.

Market Drivers:

Market Drivers:

Escalating Demand for Natural Venous Health Solutions Drives Market Adoption

Red vine leaf extract gains strong acceptance for its role in supporting venous health and circulation improvement. The Red Vine Leaf Extract Market experiences rising usage in nutraceutical products designed to alleviate leg swelling, varicose discomfort, and heavy-leg syndrome. Its flavonoid-rich composition, particularly quercetin and resveratrol, strengthens credibility among healthcare practitioners. The growing interest in botanical treatments encourages pharmaceutical companies to expand formulations targeting vascular support. Strong consumer trust in herbal therapeutics helps sustain market penetration.

- For instance, Indena developed Leucoselect Phytosome, a bioavailable form of grape seed flavonoids (specifically oligomeric proanthocyanidins, or OPCs) that achieves significantly higher plasma absorption compared to standard extracts. The specific ‘3.5 times higher’ metric was identified in studies relating to Indena’s Oleaselect Phytosome (olive polyphenols)

Clean-Label and Plant-Based Movements Strengthen Commercial Growth

Growing preference for clean-label products creates demand for naturally sourced extracts with minimal processing. Consumers seek plant-based functional ingredients that align with transparency standards and chemical-free formulations. Red vine leaf extract meets these expectations through its recognizable botanical origin and bioactive content. It finds increasing deployment in dietary supplements, functional beverages, and organic wellness products. Brands benefit from marketing it as a natural substitute for synthetic vascular support compounds.

- For instance, Naturex (now part of Givaudan) developed a proprietary red vine leaf extract using aqueous extraction technology, achieving 95% purity of key flavonoids without solvents.

Expanding Research on Antioxidant and Anti-Inflammatory Properties Enhances Value Proposition

Scientific studies continue to validate red vine leaf extract’s benefits linked to inflammation reduction and oxidative stress control. Its flavonoids deliver measurable outcomes in supporting microcirculation, strengthening capillary walls, and enhancing tissue resilience. These outcomes attract investment from pharmaceutical and nutraceutical developers exploring plant-based vascular therapies. Research-backed positioning improves labeling strength and consumer acceptance. New clinical evidence boosts its relevance in both preventive and therapeutic markets.

Rising Integration in Skincare and Cosmetic Formulations Creates New Revenue Opportunities

Red vine leaf extract gains visibility in cosmetics due to its antioxidant capacity and microcirculation support. Skincare manufacturers use it in anti-aging serums, toners, and creams aimed at reducing redness, puffiness, and dull appearance. Its natural profile aligns with growing consumer expectations for herbal skincare ingredients. The cosmetic industry leverages its bioactive compounds to enhance product performance and claim differentiation. Growing utilization across beauty portfolios expands market diversification.

Market Trends:

Growing Commercial Penetration of Bioactive-Rich Extracts Reinforces Premium Product Positioning

The Red Vine Leaf Extract Market observes a shift toward standardized bioactive formulations with defined flavonoid concentrations. Manufacturers focus on optimizing extraction purity to enhance efficacy in circulation and vascular health products. Standardized extracts create dependable quality benchmarks for pharmaceutical and nutraceutical developers. It supports formulation consistency, enabling brands to justify premium pricing for high-potency supplements. Increased visibility of ingredients such as quercetin and resveratrol strengthens their association with clinical-grade value. The market witnesses rising interest in evidence-backed labeling to satisfy consumer expectations for measurable results. Demand for quality certification and traceable sourcing strengthens trust in branded red vine leaf ingredients.

- For instance, the AS195 extract (a proprietary red vine leaf extract, often associated with the brand name Antistax and manufacturer Boehringer Ingelheim or Sanofi) is standardized to contain a specific amount of total flavonoids (typically administered as 360 mg or 720 mg of extract daily in studies), and it has demonstrated efficacy in supporting relief for symptoms of chronic venous insufficiency across over 20 clinical studies.

Expansion Across Multi-Functional Applications Encourages Diversified Product Portfolios

Market players explore broader applications in functional foods, dermo-cosmetics, and mobility supplements to expand commercial opportunities. It gains utilization in anti-aging skincare due to antioxidant and microcirculation benefits that address skin fatigue and sensitivity. Formulators adopt the extract to strengthen product claims associated with swelling reduction, redness improvement, and enhanced tissue vitality. The trend toward preventative wellness encourages integration into daily-use nutritional blends instead of only therapeutic supplements. Emerging product formats include capsules, effervescent tablets, gummies, beauty beverages, and topical serums. This diversification allows brands to target multiple consumer groups, including aging populations, athletes, and beauty-focused consumers. Multi-functional positioning supports continued market expansion and long-term demand stability.

- For Instance, Nestlé’s NESVITA line primarily uses dairy and cereal-based ingredients, such as skimmed milk powder and whole grains, and typically offers around 3g of protein per serving to support daily nutrition.

Market Challenges Analysis:

Limited Global Recognition and Low Standardization Restrict Wider Market Penetration

The Red Vine Leaf Extract Market faces challenges due to varying awareness levels among global consumers. Many markets still prioritize well-known alternatives such as ginkgo biloba and horse chestnut for circulatory support. Lack of standardized active ingredient levels creates inconsistent product efficacy across brands. It leads to difficulties in establishing strong clinical positioning in pharmaceutical and nutraceutical channels. Limited consumer education on venous health limits demand in emerging economies. Regulatory differences across regions further slow recognition and delay stronger brand adoption.

Supply Constraints and High Production Costs Challenge Competitive Pricing Strategies

Red vine leaf extract production depends heavily on cultivated vine sources and seasonal harvesting cycles. Supply fluctuations affect extract yields and disrupt consistent pricing for manufacturers. High extraction and purification costs elevate product prices within dietary supplement and cosmetic categories. It restricts cost competitiveness against more economical botanical ingredients. Producers face pressure to optimize processing methods without compromising bioactive concentration. Managing stable supply chains remains essential to maintain long-term market sustainability.

Market Opportunities:

Growing Demand for Natural Vascular Support and Preventive Wellness Creates Expansion Potential

The Red Vine Leaf Extract Market can capitalize on rising consumer interest in preventive health solutions and plant-based therapeutic ingredients. Growing awareness of venous disorders and leg discomfort among working professionals and aging populations presents strong commercial potential. It can gain wider acceptance through targeted education focusing on its flavonoid benefits for circulation and microvascular support. Supplement brands have opportunities to develop specialized formulations that address mobility, swelling, and vascular resilience. Preventive wellness trends encourage inclusion in long-term lifestyle products rather than short-term symptom relief. Expanded clinical research can further strengthen claim-based marketing and drive stronger product differentiation.

Diversification into Functional Beverages, Dermo-Cosmetics, and Nutraceutical Delivery Formats

Market opportunities expand with innovative delivery formats such as beauty drinks, effervescent tablets, gummies, and serum-based skincare. It supports premium positioning in cosmetics targeting redness reduction, puffiness control, and microcirculation enhancement. Functional beverage brands can integrate the extract to attract consumers seeking antioxidant-rich drinkable supplements. Personal care manufacturers may leverage its natural appeal to strengthen claims around anti-aging and skin vitality. Growing demand for clean-label ingredients supports its application in organic formulations across wellness categories. Collaboration among nutraceutical, cosmetic, and food companies can accelerate product diversification and improve global market visibility.

Market Segmentation Analysis:

By Form

The Red Vine Leaf Extract Market is segmented into liquid, powder, and capsule forms. Powder extract holds a significant share due to its flexible use in nutraceutical blends, tablets, and functional beverages. It offers ease of transportation and longer shelf life, supporting high-volume manufacturing. Liquid extract gains demand in cosmetic formulations and tincture-based supplements targeting fast absorption. Capsules maintain steady adoption among consumers seeking convenient dosage formats. It benefits from clear labeling and standardized concentration, which strengthens trust in premium supplement products.

- For instance, researchers (Magdalena Paczkowska-Walendowska, et al.) created electrospun nanofibers using an Inovenso Ltd. NS+ NanoSpinner Plus electrospinning machine and a specific formulation involving 5.0 mL of optimized red vine leaf extract with PVP and HPβCD as carriers, achieving over five-fold improved resveratrol dissolution in dissolution studies.

By Application

Key applications include nutraceuticals, pharmaceuticals, functional foods, and cosmetics. Nutraceuticals dominate market share due to rising interest in vascular and mobility support among aging and working populations. Pharmaceutical usage increases with growing clinical emphasis on circulation disorders and venous health solutions. Cosmetics gain traction for their antioxidant and microcirculation effects, supporting anti-aging and skin revitalization claims. Functional foods remain an emerging segment with potential for beauty beverages and circulation-enhancing formulations. It helps broaden product portfolios targeting preventive health and lifestyle wellness.

- For instance, Maolac’s Maolactin FMR, a colostrum-based ingredient, reduced creatine kinase markers of muscle damage by 25% and C-reactive protein inflammation by 30% following intense resistance exercise in healthy adults at a 360 mg daily dose.

By Distribution Channel

Distribution channels include pharmacies, health stores, online retail, and specialty supplement outlets. Online retail shows strong growth driven by digital brand marketing and increasing preference for direct-to-consumer purchase models. Pharmacies maintain relevance for clinically positioned supplements with venous support claims. Health and organic stores attract consumers focused on natural wellness ingredients. Specialty supplement outlets offer personalized product recommendations, which support premium pricing. It benefits from diversified channels that target both convenience buyers and medically informed consumers.

Segmentations:

By Form

By Application

- Pharmaceuticals

- Nutraceuticals

- Functional Foods

- Cosmetics

By Distribution Channel

- Pharmacies

- Online Retail

- Health & Organic Stores

- Specialty Supplement Stores

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe Maintains Strong Market Leadership with Widespread Herbal Supplement Adoption

Europe leads the Red Vine Leaf Extract Market due to strong consumer awareness of venous health solutions and long-standing herbal medicine usage. High prevalence of leg discomfort and varicose disorders among aging populations drives steady demand. Countries such as Germany, France, and Italy show strong preference for clinically supported botanical supplements. Pharmaceutical regulations in the region support standardized extracts with defined flavonoid content, which enhances product reliability. It strengthens demand for premium formulations promoted through pharmacies and medical practitioners. European cosmetics manufacturers also contribute to segment growth by using red vine leaf extract in anti-aging and microcirculation-enhancing skincare products.

North America Shows Growing Demand Driven by Nutraceutical and Skincare Innovation

North America demonstrates rising product usage through expanding nutraceutical, wellness, and cosmetic segments. Consumers show increased interest in plant-based vascular support supplements due to growing awareness of sedentary lifestyle-related circulation issues. Supplement brands promote red vine leaf extract through targeted digital marketing focused on preventive wellness and mobility support. Skincare manufacturers adopt the extract in anti-redness and anti-inflammatory formulations aimed at sensitive and aging skin. Retail penetration is supported by strong e-commerce adoption and direct-to-consumer wellness brands. It creates opportunities for premium positioning backed by clean-label and bioactive-rich ingredient claims.

Asia-Pacific Displays Strong Growth Potential Supported by Rising Herbal Product Consumption

Asia-Pacific exhibits rapid expansion driven by increasing acceptance of natural therapeutic ingredients in nutraceuticals and functional foods. Growing urban populations and changing lifestyles elevate demand for preventive healthcare products addressing vascular health. China, India, Japan, and South Korea emerge as key markets with strong herbal supplement manufacturing capacity. Cosmetic brands in the region integrate the extract into beauty products targeting dark circles, puffiness, and skin fatigue. Online retail and specialty wellness stores play crucial roles in product distribution across developing economies. It benefits from growing interest in antioxidant-rich solutions that support both internal wellness and dermo-cosmetic benefits.

Key Player Analysis:

- Indena S.p.A.

- Hangzhou GreenSky Biological Technology Co., Ltd

- Activ’Inside

- Xi’an Haoze Biotechnology Co., Ltd.

- Croda International Plc

- Actives Ltd

- LAC Global Pte. Ltd.

Competitive Analysis:

The Red Vine Leaf Extract Market features a competitive landscape led by specialized botanical ingredient manufacturers and nutraceutical suppliers. Key companies include Indena S.p.A., Hangzhou GreenSky Biological Technology Co., Ltd, Activ’Inside, Xi’an Haoze Biotechnology Co., Ltd., Croda International Plc, Actives Ltd, and LAC Global Pte. Ltd. Market players focus on standardized extracts with high flavonoid content to secure differentiation in pharmaceutical and nutraceutical channels. It drives investment in purification technologies and clinical evidence to enhance efficacy claims for circulation and venous support. The competitive strategy emphasizes product traceability, clean-label positioning, and global distribution partnerships. Companies expand their presence across cosmetics and functional food segments to capture demand for antioxidant-rich ingredients. Branding initiatives highlight the extract’s quercetin and resveratrol concentration to strengthen credibility among formulators. Firms also leverage regional partnerships to ensure consistent raw material sourcing and maintain quality benchmarks that support premium pricing.

Recent Developments:

- In August 2025, Indena and TCG GreenChem formed a partnership to advance next-generation ADC technologies by combining expertise in high-potent payloads and green chemistry processes.

- In April 2025, Indena launched PUREBKALE™, a Tuscan black kale seed extract for detox and skin health, and CRONILIEF™, a P·E·A Phytosome for chronic ache relief, presented at Vitafoods 2025.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Form, Application, Distribution Channel and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Rising integration of red vine leaf extract in vascular and mobility supplements will broaden product penetration in preventive wellness markets.

- Increasing clinical evidence supporting flavonoid benefits will strengthen its adoption among nutraceutical and pharmaceutical formulators.

- Growing use of antioxidant-rich extracts in anti-aging and dermo-cosmetic products will support premium positioning in skincare portfolios.

- Innovative delivery formats such as effervescent tablets, gummies, beauty beverages, and tinctures will diversify consumer choices.

- Expansion of direct-to-consumer brands and online retail channels will accelerate global visibility and product accessibility.

- Greater focus on clean-label and plant-based ingredients will support its demand in natural health, beauty, and functional nutrition categories.

- Strategic partnerships between extract manufacturers and supplement brands will improve sourcing consistency and value-added formulation opportunities.

- Increased attention to venous health disorders in working and aging populations will drive new clinical marketing strategies.

- Advancements in extraction and standardization technologies will improve bioactive concentration and reliability across premium products.

- Extended market expansion in Asia-Pacific and Latin America will create new revenue streams for companies targeting herbal wellness trends.

Market Drivers:

Market Drivers: