Market Overview

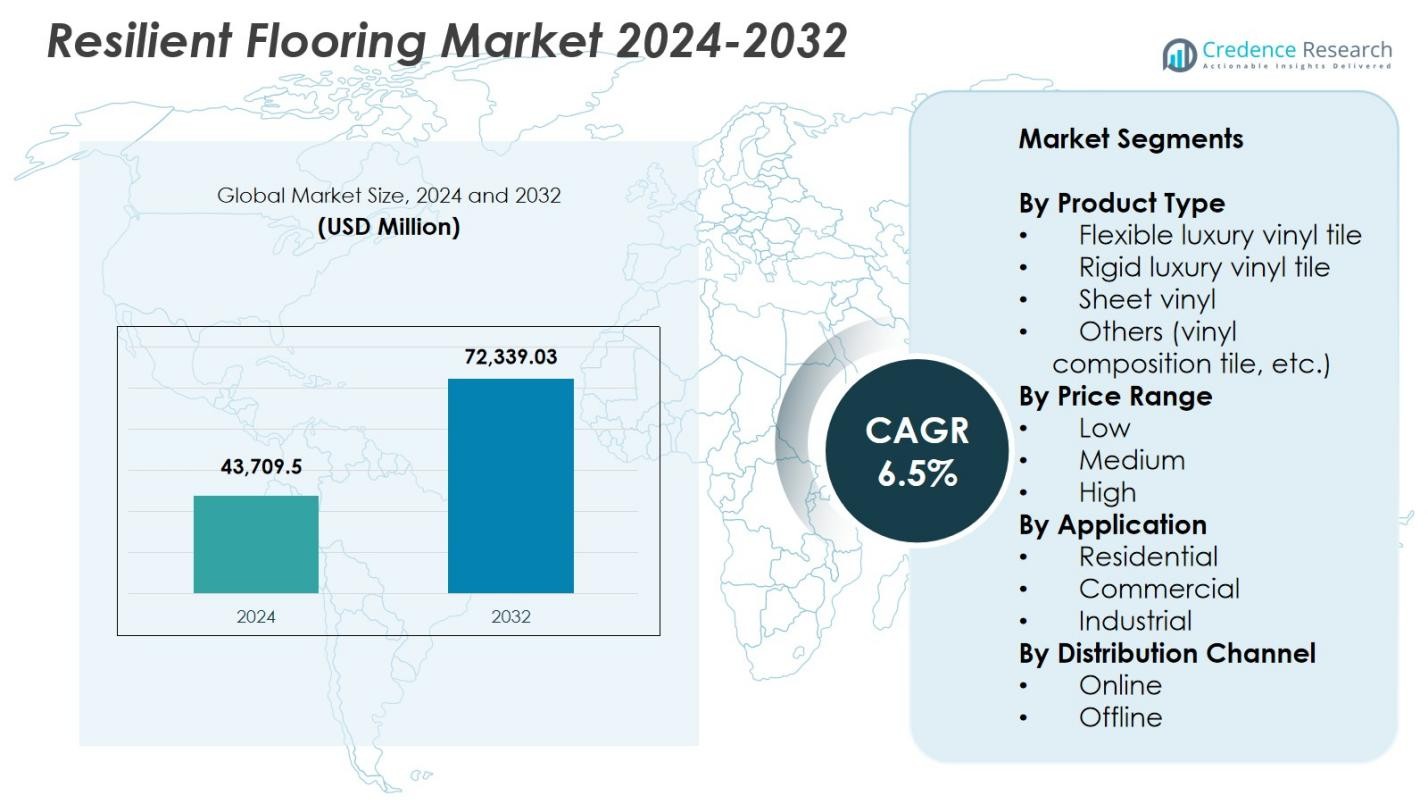

Resilient Flooring Market size was valued at USD 43,709.5 million in 2024 and is anticipated to reach USD 72,339.03 million by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Resilient Flooring Market Size 2024 |

USD 43,709.5 Million |

| Resilient Flooring Market, CAGR |

6.5% |

| Resilient Flooring Market Size 2032 |

USD 72,339.03 Million |

Resilient Flooring Market features leading players such as Gerflor, Beaulieu, COREtec, Karndean, Interface, Armstrong Flooring, LG Hausys, Forbo, Amtico, and Congoleum, all driving growth through advanced product innovation and expansion of luxury vinyl tile, sheet vinyl, and rigid-core flooring portfolios. These companies focus on design versatility, durability enhancements, and sustainable material development to meet rising demand across residential, commercial, and institutional environments. Regionally, Asia Pacific dominated the market with 34.8% share in 2024, supported by rapid urbanization, large-scale construction, and strong adoption of cost-effective flooring solutions. North America and Europe follow, driven by renovation trends and preference for high-performance, low-maintenance flooring materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Resilient Flooring Market was valued at USD 43,709.5 million in 2024 and is projected to grow at a CAGR of 6.5% through 2032.

- Rising renovation and remodeling activities across residential and commercial sectors drive demand, with the flexible LVT segment holding 41.8% share due to its durability, design versatility, and ease of installation.

- Key trends include accelerating adoption of sustainable, low-VOC flooring solutions and advanced digital printing technologies that enhance customization and aesthetic realism.

- Leading players such as Gerflor, Beaulieu, COREtec, Karndean, Interface, Armstrong Flooring, LG Hausys, Forbo, Amtico, and Congoleum expand product portfolios and strengthen manufacturing capabilities to meet evolving market demands.

- Asia Pacific led with 34.8% share in 2024, followed by North America at 32.4% and Europe at 27.1%, while the commercial application segment dominated with 48.5% share driven by high-traffic facility requirements.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type:

The Resilient Flooring Market is led by the flexible luxury vinyl tile (LVT) segment, which accounted for 41.8% share in 2024, driven by its superior design versatility, ease of installation, and strong performance in moisture-prone environments. Flexible LVT continues gaining traction in both residential and commercial renovations due to its comfort underfoot, wide aesthetic range, and cost efficiency. Rigid LVT follows with strong adoption in high-traffic areas for its dimensional stability, while sheet vinyl and other formats such as VCT remain relevant in budget-sensitive applications requiring durable and low-maintenance surfaces.

- For instance, Armstrong’s StrataMax Pro vinyl sheet handles heavy traffic and high-moisture areas, while its Standard Excelon VCT uses 85% limestone in 12×12-inch tiles for economical commercial use in schools and retail.

By Price Range:

The medium price range segment dominated the Resilient Flooring Market with 46.3% share in 2024, supported by its balanced value proposition of enhanced durability, wider design options, and suitability for both residential and commercial spaces. This segment attracts consumers seeking premium performance without the high cost of luxury variants. The high-price range continues expanding due to rising demand for upscale interior finishes and advanced waterproofing technologies, while the low-price range remains preferred for large-scale projects prioritizing affordability over long-term performance benefits.

- For instance, Welspun Flooring’s MultiStile™ vinyl tiles feature ScrapeGuard™ technology with UV coating for scratch protection and easy stick-on installation, ideal for residential upgrades in high-traffic areas.

By Application:

The commercial segment led the Resilient Flooring Market with 48.5% share in 2024, driven by extensive use in retail spaces, offices, healthcare facilities, and education buildings seeking durable, easy-to-clean, and aesthetically adaptable flooring solutions. Commercial users prefer resilient flooring for its long lifecycle, stain resistance, and ability to withstand heavy foot traffic. Residential applications continue to grow with increasing home renovation activities and preference for waterproof surfaces, whereas the industrial segment gains traction in light-industrial spaces requiring slip-resistant and impact-resistant flooring materials.

Key Growth Drivers

Rising Renovation and Remodeling Activities

Growing global investment in residential and commercial renovation significantly drives the Resilient Flooring Market. Consumers increasingly prefer durable, moisture-resistant, and visually appealing flooring options like LVT for modernizing interiors. The surge in home improvement spending, expansion of commercial real estate, and upgrades in hospitality and retail spaces reinforce demand. Resilient flooring’s ease of installation, lower lifecycle cost, and compatibility with underfloor heating systems further accelerate adoption. Developers also favor resilient flooring for its ability to replicate natural materials while offering superior performance under heavy foot traffic.

- For instance, Havasu Regional Medical Center renewed its worn resilient flooring using Bona’s Commercial System, completing the project in 18 hours instead of over 72 hours required for full replacement, while saving $20,000 plus labor costs.

Technological Advancements Enhancing Performance

Innovations in surface coatings, rigid core technology, embossing techniques, and digital printing are strengthening product performance and design diversity across the market. Advanced protective layers now deliver improved scratch resistance, waterproofing, and stain protection, making resilient flooring suitable for a broader array of applications. Manufacturers are investing in sustainable production technologies and recyclable materials, aligning with global green building standards. These advancements enhance product lifespan and aesthetic realism, attracting both commercial and residential buyers seeking long-lasting, high-performance flooring solutions.

- For instance, Engineered Floors’ PureGrain Direct Digital Print DLVT uses digital emboss technology on a high-density SPC core, achieving high-resolution designs with five times greater color clarity and perfectly registered textures for realistic wood visuals.

Growing Adoption in Commercial and Institutional Facilities

The rapid expansion of retail, healthcare, education, and hospitality sectors fuels strong adoption of resilient flooring due to its durability, hygiene benefits, and ease of maintenance. Commercial spaces require materials that withstand heavy foot traffic while maintaining consistent visual quality, making LVT, sheet vinyl, and rigid core products preferred choices. The rise of modern office layouts, increased construction of clinics, and demand for slip-resistant flooring in public facilities further boost market growth. Additionally, resilient flooring supports faster installation, reducing operational downtime for high-traffic environments.

Key Trends & Opportunities

Shift Toward Sustainable and Low-Emission Flooring Solutions

Sustainability is emerging as a defining trend as manufacturers introduce low-VOC, phthalate-free, and recyclable resilient flooring products. Green building certifications such as LEED and BREEAM are strengthening the demand for environmentally responsible materials across commercial and residential projects. Bio-based backing materials, energy-efficient manufacturing, and closed-loop recycling programs present lucrative opportunities for innovation. With consumers and businesses prioritizing eco-friendly interiors, brands offering transparent environmental declarations and circular flooring models gain a competitive edge in the evolving market landscape.

- For instance, Tarkett has pioneered ultra-low VOC flooring since 2011, with emissions 10 to 100 times below stringent global standards and verified by Eurofins at Gold and Platinum levels for indoor air quality.

Expansion of Digital Printing and Customizable Designs

Advanced digital printing technologies are enabling highly realistic textures, enhanced color accuracy, and personalized flooring designs, unlocking substantial opportunities across hospitality, retail, and premium residential interiors. Custom patterns that mimic wood, stone, and ceramic with precision are driving preference for LVT and sheet vinyl. This shift allows architects and designers greater creative flexibility, supporting unique branding and thematic interior concepts. As personalization becomes a key purchasing factor, manufacturers offering agile design capabilities and faster production turnaround are expected to capture growing market demand.

- For instance, Mannington Commercial’s Northern Wonder LVT collection leverages digital printing for very long pattern repeats and stretched-out colors that are exceptionally difficult to achieve with traditional rotogravure methods.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of PVC, plasticizers, stabilizers, and other petrochemical-derived inputs create significant cost uncertainty for manufacturers in the Resilient Flooring Market. Any rise in crude oil prices impacts material procurement, production costs, and profit margins. Manufacturers often struggle to balance cost pressures without compromising quality or affordability for consumers. Additionally, supply chain disruptions and tightening environmental regulations on chemical components can further intensify volatility, making long-term pricing strategies and inventory planning increasingly challenging for market players.

Environmental Concerns and Recycling Limitations

Despite progress in sustainable product development, resilient flooring faces challenges related to end-of-life recycling and waste management. Many multilayer flooring structures are difficult to recycle due to mixed material compositions, limiting circularity and raising environmental concerns. Regulations targeting plastic waste reduction and strict emission standards add compliance burdens for manufacturers. Consumers and institutional buyers are increasingly scrutinizing environmental footprints, pushing companies to innovate with recyclable materials and cleaner manufacturing processes. However, scaling such technologies remains complex and cost-intensive for the industry.

Regional Analysis

North America

North America held a 32.4% share of the Resilient Flooring Market in 2024, driven by strong demand across residential renovations, commercial offices, retail spaces, and institutional buildings. The region benefits from high adoption of luxury vinyl tile due to its durability, moisture resistance, and design flexibility. Growth is further supported by rising home improvement spending, expanding multifamily housing construction, and increasing preference for low-maintenance flooring solutions. Manufacturers continue to invest in technologically advanced and eco-friendly product lines that align with sustainability standards, strengthening resilient flooring penetration across the United States and Canada.

Europe

Europe accounted for 27.1% share of the Resilient Flooring Market in 2024, supported by stringent environmental regulations and strong demand from commercial and industrial facilities. The region’s emphasis on sustainable building materials and low-VOC flooring fuels adoption of advanced vinyl formats and recyclable resilient flooring solutions. Rising refurbishment activities in residential and hospitality sectors further enhance market expansion. Countries such as Germany, the United Kingdom, and France lead consumption due to high investments in modern infrastructure and energy-efficient interiors, while southern Europe experiences growing uptake driven by increased construction and tourism-related facility upgrades.

Asia Pacific

Asia Pacific dominated the global Resilient Flooring Market with 34.8% share in 2024, propelled by rapid urbanization, expanding residential construction, and large-scale commercial development. Strong economic growth in China, India, and Southeast Asia continues to accelerate demand for cost-effective, durable, and stylish flooring materials. The region increasingly adopts luxury vinyl tile and sheet vinyl for modern housing, retail chains, and educational facilities. Rising disposable incomes, government housing initiatives, and growing investments in smart cities further strengthen market momentum. Additionally, the presence of major manufacturing hubs ensures competitive pricing and widespread product availability across the region.

Latin America

Latin America captured 3.4% share of the Resilient Flooring Market in 2024, with demand largely influenced by infrastructure modernization and increasing adoption of vinyl flooring in commercial and residential projects. Brazil and Mexico dominate consumption due to urban development and rising preference for economical, moisture-resistant flooring options. Growth is supported by expanding retail, hospitality, and healthcare construction activities. The shift toward low-maintenance interior materials and the availability of imported LVT and sheet vinyl products also contribute to market expansion. However, economic fluctuations and limited local manufacturing capacity present challenges to broader market penetration.

Middle East & Africa

The Middle East & Africa region accounted for 2.3% share in 2024, driven by rising construction of commercial complexes, hospitality properties, and premium residential communities. Countries such as the UAE, Saudi Arabia, and South Africa are key consumers, driven by investments in modern infrastructure and interior upgrades. The region increasingly adopts resilient flooring for its durability, heat resistance, and suitability for high-traffic environments. Growing tourism and retail expansion further support demand. However, market growth is moderated by price sensitivity and dependency on imports, although the long-term outlook remains positive with ongoing urban development initiatives.

Market Segmentations:

By Product Type

- Flexible luxury vinyl tile

- Rigid luxury vinyl tile

- Sheet vinyl

- Others (vinyl composition tile, etc.)

By Price Range

By Application

- Residential

- Commercial

- Industrial

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Resilient Flooring Market features leading players such as Gerflor, Beaulieu, COREtec, Karndean, Interface, Armstrong Flooring, LG Hausys, Forbo, Amtico, and Congoleum, all driving innovation through product diversification, advanced technologies, and sustainability-focused strategies. These companies prioritize expanding their luxury vinyl tile, sheet vinyl, and rigid-core flooring portfolios to meet growing demand across residential, commercial, and institutional sectors. Many manufacturers invest heavily in digital printing, embossing techniques, and eco-friendly materials to enhance product realism and performance. Strategic initiatives such as mergers, capacity expansions, and distribution partnerships strengthen their global market presence. Additionally, ongoing R&D efforts focus on improving recyclability, strengthening wear layers, and developing low-VOC products aligned with green building standards. As consumer preferences shift toward durable, design-flexible, and cost-efficient flooring solutions, key players continue to enhance brand visibility, optimize supply chains, and expand offerings tailored to evolving end-user requirements.

Key Player Analysis

Recent Developments

- In November 2025, Beaulieu International Group (via its subsidiary New Congol LLC) acquired the assets of Congoleum Flooring, significantly expanding its U.S. presence and resilient flooring portfolio.

- In 2025, Gerflor Group completed the acquisition of Matter Surfaces, a U.S.-based provider of entrance systems and architectural surface products, broadening Gerflor’s commercial flooring and surface offerings.

- In December 2023, Karndean Designflooring acquired Go Resilient (Canada), strengthening its North American footprint and distribution capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Price Range, Application, Distribution Channel Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising renovation and remodeling activities across residential and commercial sectors.

- Luxury vinyl tile demand will continue strengthening as consumers shift toward durable, waterproof, and design-rich flooring solutions.

- Technological advancements in rigid-core construction and digital printing will enhance product performance and aesthetic realism.

- Sustainability initiatives will accelerate adoption of low-VOC, recyclable, and bio-based resilient flooring materials.

- Commercial spaces will increasingly prefer resilient flooring for high-traffic durability and low maintenance benefits.

- Manufacturers will expand investments in eco-friendly production processes and circular recycling programs.

- Emerging economies will drive significant demand due to rapid urbanization and expanding construction activities.

- Customizable designs and advanced embossing will support premiumization trends across hospitality and retail environments.

- Distribution networks will strengthen through strategic partnerships and omnichannel retail expansion.

- Innovation in acoustic performance, impact resistance, and underfoot comfort will enhance long-term market adoption.

Market Segmentation Analysis:

Market Segmentation Analysis: