Market Overview:

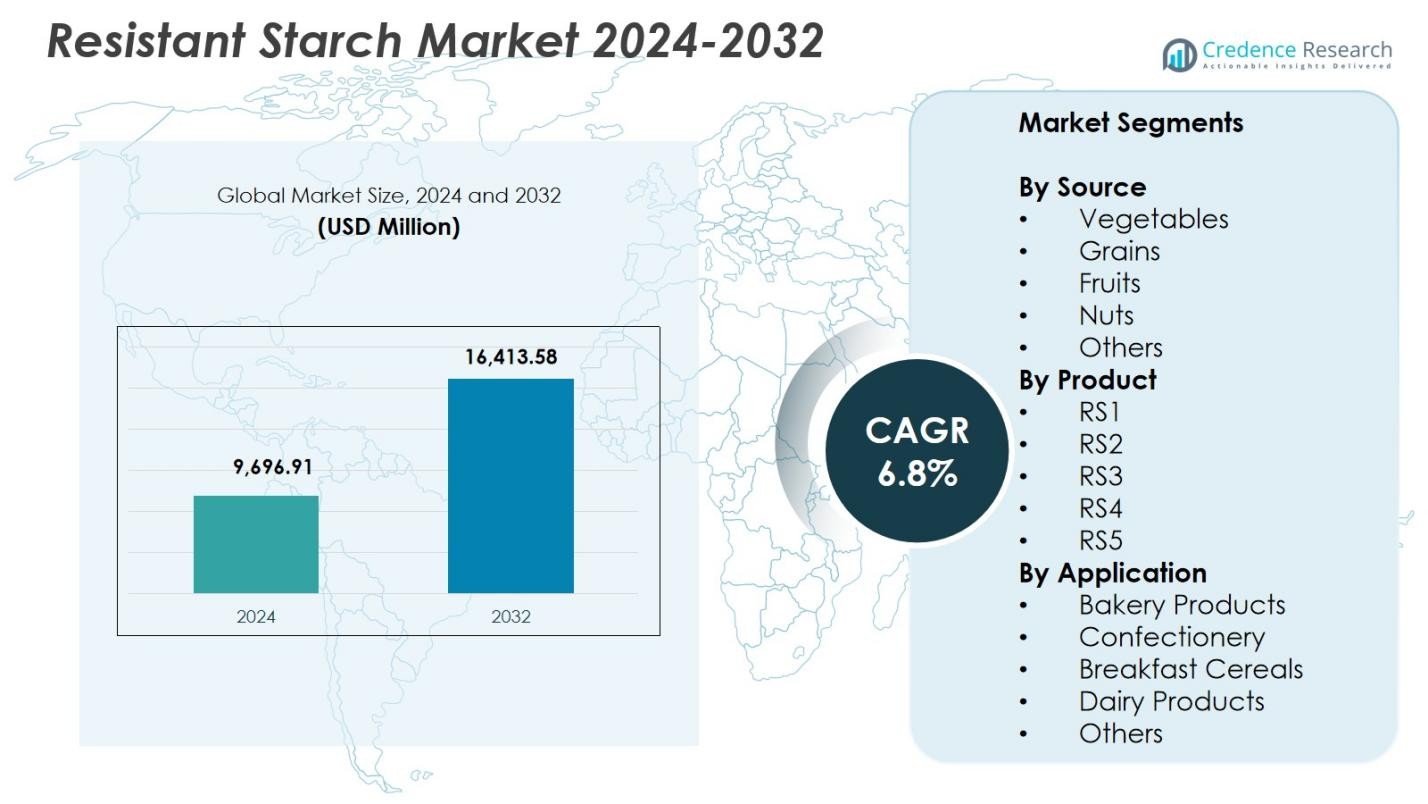

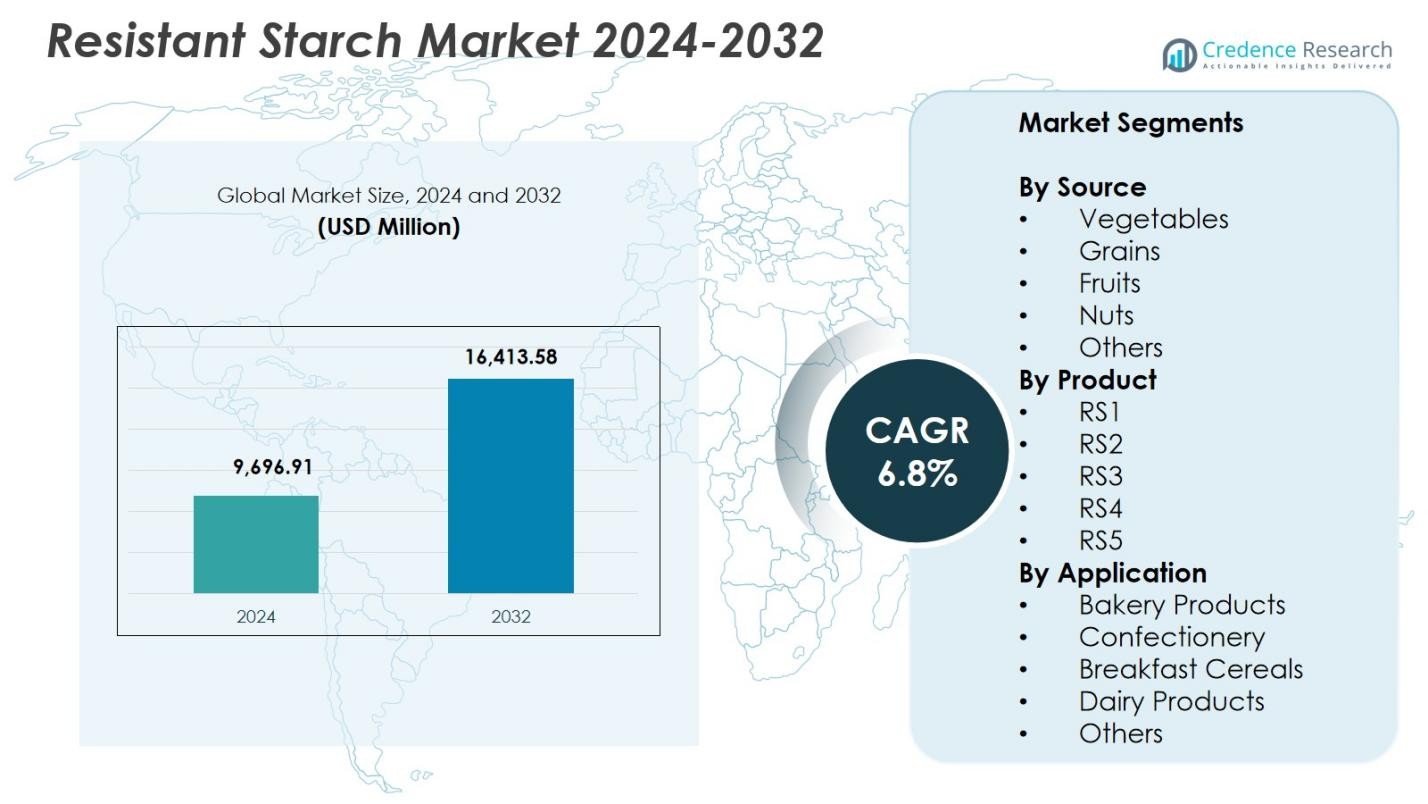

Resistant Starch Market size was valued at USD 9,696.91 million in 2024 and is anticipated to reach USD 16,413.58 million by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Resin Capsule Market Size 2024 |

USD 9,696.91 Million |

| Resin Capsule Market, CAGR |

6.8% |

| Resin Capsule Market Size 2032 |

USD 16,413.58 Million |

Resistant Starch Market features strong participation from major players such as Cargill, Roquette Frères, SunOpta, AGRANA Beteiligungs, MGP Ingredients Inc., MSPrebiotics, Natural Stacks, Sheekharr Starch Private Limited, Xian Kono Chem, and Gut Garden, each focusing on expanding their functional ingredient portfolios and advancing starch-processing technologies. These companies emphasize high-purity formulations, clean-label solutions, and application versatility across bakery, cereals, dairy, and nutrition products. Regionally, North America led the Resistant Starch Market with 38.4% share in 2024, driven by high consumer demand for digestive-health ingredients and strong innovation pipelines across the food and nutraceutical industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Resistant Starch Market reached USD 9,696.91 million in 2024 and will grow at a 8% CAGR through 2032.

- Strong demand for digestive-health and clean-label nutrition drives the Resistant Starch Market, with vegetables leading by source at 6% share and RS2 dominating the product segment at 37.8% share.

- A key trend shaping the Resistant Starch Market is rising adoption in low-glycemic, weight-management, and prebiotic food formulations across bakery, cereals, and dairy applications, with bakery holding 3% share in 2024.

- Major players including Cargill, Roquette Frères, SunOpta, and AGRANA focus on expanding functional ingredient portfolios and enhancing processing technologies to strengthen market presence.

- North America led the Resistant Starch Market with 4% share, followed by Europe at 27.6% and Asia-Pacific at 23.9%, supported by strong food innovation ecosystems and rising consumer preference for fiber-enriched, gut-health-focused products.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Source:

The vegetables segment dominated the Resistant Starch Market with 34.6% share in 2024, driven by the high natural starch content in ingredients such as potatoes, legumes, and green bananas, which are widely used in functional foods and dietary supplements. Demand continues to rise as manufacturers increasingly incorporate vegetable-derived resistant starch to enhance fiber content, glycemic control, and digestive benefits. Clean-label positioning and strong consumer preference for plant-based nutritional additives further strengthen this segment. Ongoing innovation in extraction technologies also supports greater utilization of vegetable sources, reinforcing its leadership in the market.

- For instance, Ingredion provides NOVELOSE resistant starches, including potato-based options alongside tapioca and wheat variants, enabling manufacturers to boost fiber content with minimal effects on taste, color, or texture in bakery items and snacks.

By Product:

RS2 led the product segment with 37.8% share in 2024, supported by its abundant availability in raw potatoes, high-amylose maize, and green bananas, along with superior physiological benefits linked to digestive health and slow carbohydrate absorption. Its thermal stability and suitability for incorporation into snacks, cereals, and bakery formulations encourage widespread adoption across the food and nutrition industries. Manufacturers favor RS2 due to its proven efficacy in supporting weight management and reducing glycemic response, driving its use in functional foods. Rising consumer demand for high-fiber formulations continues to reinforce the dominance of RS2 in the product landscape.

- For instance, International Agriculture Group’s NuBana N200 green banana flour delivers at least 65% RS2, suited for raw applications like vegan foods to promote digestive health and low glycemic response.

By Application:

Bakery products accounted for the largest share, holding 42.3% of the Resistant Starch Market in 2024, propelled by the increasing integration of resistant starch into bread, pastries, tortillas, and baked snacks to improve texture, reduce calories, and enhance fiber enrichment. Food manufacturers actively reformulate bakery lines to meet rising consumer interest in healthier, low-glycemic, and gut-friendly baked goods. Resistant starch enables fat replacement, improved dough handling, and extended shelf life, making it a preferred functional ingredient in bakery applications. Strong demand for clean-label, nutrient-dense bakery offerings continues to drive the expansion of this segment.

Key Growth Drivers

Rising Demand for Digestive Health and Functional Foods

The Resistant Starch Market experiences strong growth as consumers increasingly prioritize digestive wellness, weight management, and metabolic health. Resistant starch supports gut microbiota, reduces glycemic response, and improves satiety, making it a preferred ingredient in functional foods and dietary supplements. Food manufacturers leverage these benefits to reformulate products with clean-label, high-fiber claims. Growing awareness of prebiotic advantages and the shift toward preventive health nutrition significantly accelerates adoption across bakery, cereals, snacks, and beverages.

- For instance, Arcadia Biosciences developed GoodWheat high-fiber wheat varieties containing up to 94% amylose resistant starch 10 times more dietary fiber than traditional wheat for use in pasta, bread, pizza, and pastries to support gut health and lower glycemic impact.

Expansion of Clean-Label and Plant-Based Product Formulations

A major driver for the market is the widespread transition toward clean-label, natural, and plant-derived ingredients. Resistant starch, sourced from vegetables, grains, and fruits, aligns perfectly with consumer expectations for minimally processed and fiber-rich foods. Brands incorporate resistant starch to enhance nutritional profiles without compromising taste or texture. The growing popularity of vegan and plant-based diets amplifies demand, particularly in categories such as bakery, dairy alternatives, and nutrition bars, fueling sustained market expansion.

- For instance, MGP Ingredients offers Fibersym RW, a resistant wheat starch used in bakery products like breads, muffins, cookies, and tortillas, providing a smooth texture, neutral flavor, and white color as an invisible fiber source.

Technological Advancements in Food Processing and Ingredient Innovation

Innovations in starch modification, enzymatic processing, and fiber-enhancement technologies significantly boost resistant starch production and performance. These advancements improve stability, digestibility, and formulation compatibility across various applications. Food manufacturers benefit from improved ingredient functionality, enabling use in heat-processed foods, low-carb formulations, and high-fiber product lines. Enhanced R&D investment supports the development of RS3 and RS4 types with tailored nutritional and functional properties, opening new opportunities across mainstream and specialty food product categories.

Key Trends & Opportunities

Growing Adoption in Low-Glycemic and Weight-Management Products

A major trend shaping the Resistant Starch Market is the rising incorporation of resistant starch into low-glycemic, diabetic-friendly, and weight-management food products. These formulations appeal to health-conscious consumers seeking alternatives that regulate blood sugar and support metabolic balance. As global obesity and diabetes rates increase, product developers prioritize resistant starch to create healthier versions of bread, snacks, and breakfast cereals. This trend offers substantial opportunities for brands offering clinically backed, functional formulations.

- For instance, ADM’s resistant tapioca starch, with 90% dietary fiber content, replaces flour in low-carb bakery and snacks while supporting glycemic health. Its low water-holding capacity delivers crisp textures in grain-free, gluten-free products without altering flavor.

Increasing Use in Prebiotic and Gut-Health-Focused Innovations

The expanding focus on gut health generates new opportunities for resistant starch as a key prebiotic ingredient. Research-backed evidence demonstrating its role in enhancing beneficial gut bacteria encourages broader adoption in functional beverages, supplements, and high-fiber foods. Manufacturers launch digestive-health product portfolios highlighting resistant starch as a scientifically supported ingredient. With rising consumer interest in microbiome wellness and natural digestive aids, this trend continues to open avenues for innovation in clean-label and fortified food categories.

- For instance, CSIRO-developed BARLEYmax wholegrain features elevated resistant starch levels and appears in products like Coles Happy Gut bread range and Bakers Delight Prebiotic Cape Seed loaf to promote gut bacteria fermentation and bowel health.

Key Challenges

Limited Consumer Awareness of Resistant Starch Benefits

Despite strong functional advantages, limited consumer understanding of resistant starch reduces its full market potential. Many consumers remain unfamiliar with its prebiotic properties or its role in glycemic control, leading to lower adoption compared to other fiber ingredients. This knowledge gap requires extensive marketing, educational campaigns, and clearer product labeling. Brands must invest in awareness programs to communicate health benefits effectively, which may slow initial market penetration in certain regions.

Formulation Constraints and Variability Across Food Applications

Resistant starch types differ in stability, processing tolerance, and performance, creating challenges for consistent integration into diverse food matrices. Heat sensitivity, textural changes, and compatibility issues may arise during bakery, extrusion, or dairy processing. Manufacturers must invest in R&D to optimize formulations and ensure that resistant starch retains its functional properties throughout production. These technical constraints increase development costs and limit seamless application across all product categories, affecting broader industry adoption.

Regional Analysis

North America

North America dominated the Resistant Starch Market with 38.4% share in 2024, driven by strong consumer demand for functional foods, clean-label ingredients, and gut-health-focused products. The region benefits from advanced food processing technologies, high awareness of dietary fibers, and rapid adoption of low-glycemic and weight-management formulations. Manufacturers actively reformulate bakery, snacks, and cereals with resistant starch to meet rising health-conscious preferences. The U.S. remains the primary contributor due to extensive product innovation, established nutrition brands, and growing applications in fortified foods and supplements, reinforcing the region’s market leadership.

Europe

Europe captured 27.6% share in 2024, supported by strict nutritional regulations, high consumer preference for natural and plant-based ingredients, and strong demand for fiber-enriched foods. The region’s mature food and beverage industry integrates resistant starch across bakery, dairy, and cereal applications to enhance fiber content while maintaining product quality. Growing interest in digestive health solutions and prebiotic ingredients continues to accelerate adoption. Countries such as Germany, the U.K., and France lead in functional food innovation, driven by health-conscious consumers and supportive regulatory frameworks encouraging cleaner formulations and improved nutritional profiles.

Asia-Pacific

Asia-Pacific accounted for 23.9% share in 2024, emerging as one of the fastest-growing regions due to rising awareness of digestive health, expanding middle-class consumption, and increasing use of resistant starch in bakery, snacks, and dairy categories. The region benefits from abundant raw material availability, particularly from grains and vegetables used in RS2 and RS3 production. Manufacturers in China, India, Japan, and Australia invest heavily in functional food development to meet evolving dietary preferences. The growing demand for low-glycemic and high-fiber foods, coupled with urbanization and lifestyle shifts, fuels rapid market expansion.

Latin America

Latin America held 6.7% share in 2024, driven by increasing adoption of functional and fiber-enhanced foods across bakery, confectionery, and cereal products. Rising health awareness and the growing prevalence of obesity and diabetes encourage consumers to choose low-glycemic and gut-friendly formulations. Brazil and Mexico lead regional consumption due to expanding food manufacturing industries and rising demand for enriched packaged foods. Manufacturers integrate resistant starch to improve texture, fiber content, and caloric reduction, aligning products with wellness-focused consumer trends. Strengthening regulatory emphasis on nutrition labeling further supports market growth.

Middle East & Africa

The Middle East & Africa region accounted for 3.4% share in 2024, supported by gradual adoption of functional foods, increased urbanization, and rising consumer awareness about digestive health benefits. Demand is growing for fiber-rich bakery products, fortified foods, and low-glycemic diets, particularly in Gulf countries with higher lifestyle-related health concerns. Food producers incorporate resistant starch to enhance nutritional value while maintaining desirable product characteristics. Although the market remains in an early growth stage, improving retail infrastructure and increasing investment in health-oriented food innovations contribute to expanding regional uptake.

Market Segmentations:

By Source

- Vegetables

- Grains

- Fruits

- Nuts

- Others

By Product

By Application

- Bakery Products

- Confectionery

- Breakfast Cereals

- Dairy Products

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Resistant Starch Market reflects strong participation from leading players such as Cargill, Roquette Frères, SunOpta, AGRANA Beteiligungs, MGP Ingredients Inc., MSPrebiotics, Natural Stacks, Xian Kono Chem, Sheekharr Starch Private Limited, and Gut Garden. These companies actively expand their resistant starch portfolios through innovation, strategic partnerships, and advancements in extraction and formulation technologies. Industry leaders focus on developing high-purity RS2, RS3, and RS4 ingredients tailored for bakery, cereals, snacks, and functional nutrition. Growing demand for clean-label, plant-based, and prebiotic ingredients drives players to enhance supply chain efficiency and increase investments in R&D to improve product stability, nutritional performance, and application versatility. Companies also emphasize sustainability and transparent sourcing to align with evolving consumer expectations. New product launches featuring enhanced digestive health benefits and improved texture performance are accelerating market penetration, while regional expansions and collaborations strengthen competitive positioning across global markets.

Key Player Analysis

- Gut Garden

- SunOpta

- AGRANA Beteiligungs

- Natural Stacks

- Roquette Freres

- Sheekharr Starch Private Limited

- Cargill

- MGP Ingredients Inc.

- MSPrebiotics

- Xian Kono Chem

Recent Developments

- In October 2025, Roquette Frères launched AMYSTA™ L 123 a thermally soluble, plant-based pea starch designed for label-friendly, clean-label formulations in beverages, sauces and dry mixes.

- In October 2025, MSP Starch Products Inc. highlighted new research on its potato-derived resistant starch brand Solnul, showing improved nutrient absorption (vitamins A & E, choline) and enhanced gut barrier function.

- In March 2025, Cargill Incorporated opened a new corn-milling facility in Gwalior, India, expanding capacity to supply starch derivatives (including resistant starch) for dairy, baby food, and confectionery sectors.

- In November 2025, SolEdits and Lyckeby announced plans to launch CRISPR-edited potatoes delivering storage-stable resistant starch, eliminating the need for chemical modifications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Source, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Resistant Starch Market will experience steady growth as demand for digestive-health and prebiotic ingredients accelerates globally.

- Adoption will rise across bakery, snacks, cereals, and dairy as manufacturers reformulate products toward high-fiber profiles.

- Technological advancements will enhance the stability and functionality of RS2, RS3, and RS4 in diverse food applications.

- Clean-label and plant-based nutrition trends will continue to strengthen the use of naturally derived resistant starch.

- Growing interest in low-glycemic and weight-management diets will expand product integration across mainstream food categories.

- Supplement and nutraceutical applications will increase as consumers seek gut-health-focused functional ingredients.

- Emerging markets in Asia-Pacific and Latin America will witness rapid adoption driven by rising health awareness.

- Ingredient manufacturers will invest more in sustainable sourcing and improved processing efficiencies.

- Partnerships between food companies and ingredient suppliers will accelerate innovation in application development.

- Ongoing clinical research on metabolic and gut-health benefits will support broader consumer acceptance and long-term market expansion.

Market Segmentation Analysis:

Market Segmentation Analysis: