Market Overview

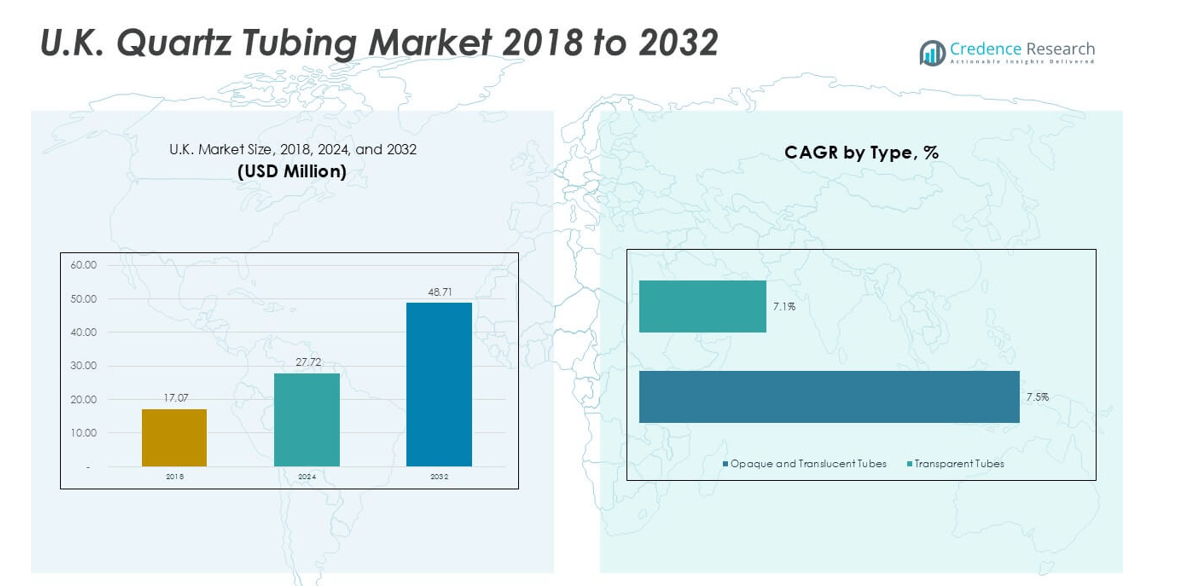

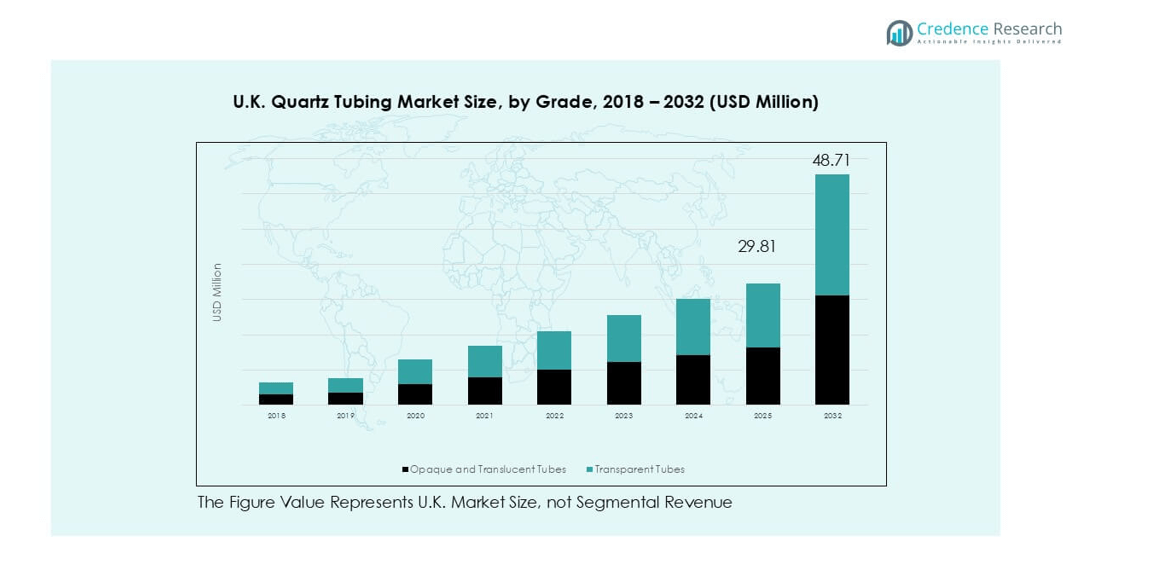

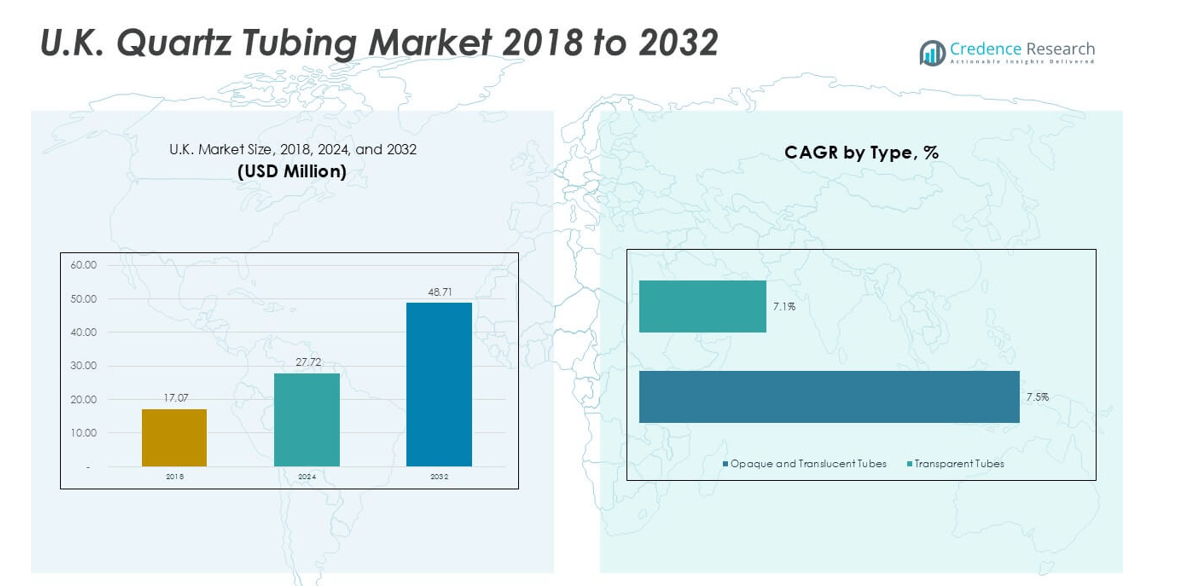

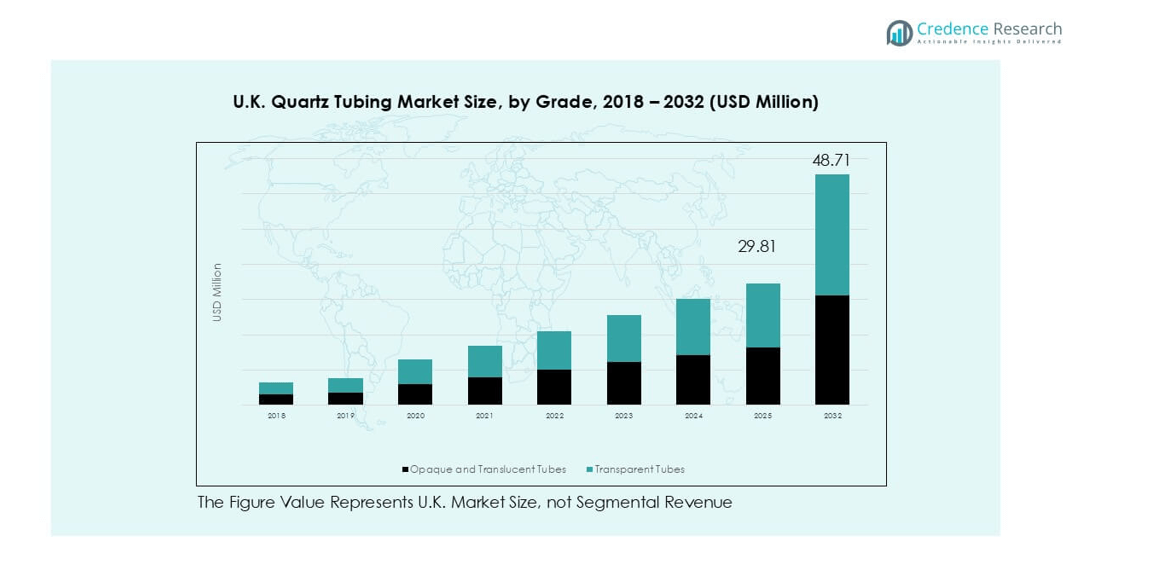

UK Quartz Tubing market size was valued at USD 17.07 million in 2018 to USD 27.72 million in 2024 and is anticipated to reach USD 48.71 million by 2032, at a CAGR of 7.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Quartz Tubing Market Size 2024 |

USD 27.72 million |

| UK Quartz Tubing Market, CAGR |

7.30% |

| UK Quartz Tubing Market Size 2032 |

USD 48.71 million |

The UK quartz tubing market is led by a mix of global specialists and regional manufacturers. Key players include Heraeus, TOSOH, WONIK Quartz Europe, John Moncrieff Ltd, proQuarz GmbH, and Multi-Lab Ltd, which compete on purity, dimensional accuracy, and customization depth. Global suppliers dominate semiconductor-grade tubing, while UK firms focus on made-to-order industrial and laboratory applications. Regionally, England, including Greater London and the South East, leads the market with a 49% share, supported by semiconductor research, advanced manufacturing, and laboratory demand. Scotland and Northern England follow with a 23% share, driven by electronics and industrial processing. Wales, the West Midlands, and other regions account for the remaining share, supported by diversified industrial use.

Market Insights

- The UK quartz tubing market grew from USD 17.07 million in 2018 to USD 27.72 million in 2024 and is projected to reach USD 48.71 million by 2032, registering a CAGR of 7.30% during the forecast period, supported by steady industrial and semiconductor demand.

- Market growth is driven by rising use in high-temperature industrial furnaces and semiconductor diffusion processes, where quartz tubing offers superior thermal stability, chemical resistance, and purity, increasing replacement and upgrade cycles across manufacturing facilities.

- Key market trends include growing demand for transparent quartz tubing, which holds around 60–65% segment share, driven by semiconductor and laboratory use, alongside increasing customization for wall thickness, diameter, and purity grades.

- The competitive landscape features global players and regional specialists competing on quality, purity assurance, and lead times, with differentiation increasingly based on technical support, digital quality control, and application-specific engineering.

- Regionally, England leads with about 49% market share, followed by Scotland and Northern England at 23%, Wales and the West Midlands at 17%, and other regions accounting for the remaining share, supported by diversified industrial demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The UK quartz tubing market shows clear dominance by transparent tubes, which account for an estimated 60–65% market share. Transparent tubes benefit from superior optical clarity, high thermal stability, and precise dimensional control. These properties support use in semiconductor processing, laboratory equipment, and high-temperature industrial systems. Demand rises from applications requiring visual process monitoring and ultra-high purity performance. Opaque and translucent tubes hold the remaining share, driven by furnace linings and insulation uses. However, transparent variants gain faster adoption due to advanced manufacturing, tighter tolerance needs, and premium pricing potential.

- For instance,QSIL supplies transparent fused-quartz tubes globally, including through distributors in the UK. These products typically feature a low hydroxyl content, often below 10 ppm for high-purity, electrically fused grades, and exhibit a low coefficient of thermal expansion near 0.55 × 10⁻⁶/K.

By Application

Industrial applications dominate the UK quartz tubing market, representing roughly 45–50% of total demand. This segment benefits from sustained use in high-temperature furnaces, chemical processing, and thermal equipment. The semiconductor segment follows closely, driven by wafer fabrication, diffusion, and oxidation processes requiring high-purity quartz tubing. Semiconductor growth outpaces other uses due to node scaling and fab upgrades. Lighting applications hold a smaller share, supported by specialty lamps and UV systems. Overall, industrial reliability needs and semiconductor purity requirements remain the strongest demand drivers.

- For instance, Heraeus supplies semiconductor-grade quartz tubes used in diffusion furnaces operating above 1,050 °C, with certified metallic impurities below 1 ppm, supporting clean wafer processing in UK-based research fabs and pilot lines.

Key Growth Drivers

Expansion of Semiconductor Manufacturing and Equipment Upgrades

The expansion of semiconductor manufacturing is a major growth driver for the UK quartz tubing market. Quartz tubing plays a critical role in diffusion, oxidation, and deposition processes. Chip fabrication requires ultra-high purity and thermal stability. Advanced nodes demand tighter impurity limits and dimensional precision. UK fabs continue investing in equipment upgrades and pilot production lines. These upgrades increase consumption of premium quartz tubing grades. Domestic and European semiconductor supply-chain resilience further supports demand. Government incentives and private investments encourage localized chip production. Process automation also raises tubing replacement rates. As semiconductor tools operate at higher temperatures, material reliability becomes essential. These dynamic supports sustained growth for high-performance quartz tubing suppliers.

- For instance, Heraeus supplies semiconductor-grade quartz tubes with metallic impurities below 1 ppm and continuous-use stability above 1,050 °C, supporting diffusion and LPCVD tools used in UK research fabs.

Rising Demand from High-Temperature Industrial Applications

High-temperature industrial operations strongly support quartz tubing demand in the UK. Industries rely on quartz tubing for furnaces, reactors, and thermal processing systems. Quartz withstands extreme heat without deformation or contamination. Chemical resistance also makes quartz suitable for corrosive environments. Growth in specialty chemicals, advanced ceramics, and materials processing increases usage. Industrial operators prioritize longer equipment lifecycles and process consistency. Quartz tubing supports stable thermal profiles and reduced downtime. Energy-efficient furnace designs also favor quartz components. Replacement demand remains steady due to harsh operating conditions. Industrial diversification across metallurgy, glass, and energy systems sustains long-term market growth.

- For instance, QSIL manufactures fused-silica industrial tubes with thermal expansion near 0.55 × 10⁻⁶/K and verified resistance to repeated heat-quench cycles above 1,000 °C, enabling reliable use in UK chemical and materials-processing furnaces.

Increasing Adoption of High-Purity and Customized Tubing

Demand for high-purity and customized quartz tubing continues to rise. End users increasingly require application-specific dimensions and purity grades. Semiconductor and laboratory users seek tighter tolerance control. Customized wall thickness improves thermal efficiency and process outcomes. Small-batch production capabilities create supplier differentiation. Engineering collaboration adds value beyond standard products. Customers prefer suppliers offering testing and metrology support. Premium customized tubing commands higher margins. Custom solutions also strengthen long-term client relationships. As UK manufacturers move toward precision processes, demand shifts from commodity products. This trend directly supports value growth in the quartz tubing market.

Key Trends & Opportunities

Adoption of Advanced Manufacturing and Digital Quality Control

Advanced manufacturing represents a key trend and opportunity in the UK quartz tubing market. Automation improves dimensional accuracy and yield rates. Inline inspection detects micro-defects earlier in production cycles. Digital quality control enhances traceability and compliance. Semiconductor customers favor suppliers with data-driven quality systems. Smart manufacturing also reduces scrap and energy use. Process analytics support consistent purity performance. These capabilities improve operational efficiency and pricing power. Suppliers investing in smart factories gain competitive advantage. Digital integration also supports faster customization cycles. This trend opens opportunities for premium positioning and export competitiveness.

- For instance, QSIL uses laser-based inline metrology in its European plants to control tube diameter within ±0.1 mm and detect surface defects down to 50 µm, supporting semiconductor-grade quartz production.

Growth in UV, Specialty Lighting, and Scientific Applications

Specialty lighting and scientific uses create incremental growth opportunities. Quartz tubing supports UV, infrared, and specialty lamp applications. Demand persists in medical, analytical, and environmental systems. UV sterilization and analytical instrumentation drive niche consumption. Research laboratories require consistent optical and thermal properties. Although LED adoption limits general lighting demand, specialty segments remain resilient. These applications favor high-quality transparent quartz tubing. Longer service life supports repeat orders. Custom geometries also create differentiation opportunities. This segment offers stable margins despite lower overall volume.

- For instance, Heraeus supplies UV-grade quartz tubes with transmission above 85% at 254 nm and verified thermal stability above 1,000 °C, enabling long-life performance in medical UV and analytical systems used across the UK.

Key Challenges

High Production Costs and Energy Intensity

High production costs present a major challenge for the UK quartz tubing market. Quartz processing requires extreme temperatures and energy input. Energy price volatility directly affects manufacturing margins. Raw material purity requirements increase processing complexity. Capital-intensive equipment limits rapid capacity expansion. Smaller producers face cost disadvantages against global suppliers. Environmental regulations add compliance expenses. Cost pressures restrict pricing flexibility in competitive segments. Producers must balance quality with cost efficiency. Without process optimization, profitability remains exposed. Managing energy consumption becomes critical for long-term sustainability.

Supply Chain Constraints and Import Dependence

Supply chain constraints pose another key challenge for the market. High-purity quartz raw materials often rely on imports. Global supply disruptions impact lead times and pricing stability. Transportation delays affect just-in-time delivery models. Semiconductor customers demand consistent and timely supply. Import dependence increases exposure to geopolitical risks. Currency fluctuations also influence procurement costs. Limited domestic raw material sources restrict flexibility. Building resilient supply chains requires long-term supplier agreements. Inventory buffering raises working capital needs. These factors create operational risks for UK quartz tubing manufacturers.

Regional Analysis

England (including Greater London & South East)

England dominates the UK quartz tubing market with an estimated 48–50% share. The region benefits from strong semiconductor research, advanced manufacturing, and laboratory clusters. Greater London supports demand from research institutes and medical technology firms. The South East hosts precision engineering and materials science users. High-purity and transparent tubing see strong adoption. Equipment upgrades drive replacement demand. Proximity to ports improves import logistics. Skilled labor supports customization services. Customers value tight tolerances and traceability. This region sustains premium pricing due to quality expectations and consistent demand.

Scotland & Northern England

Scotland and Northern England account for about 22–24% market share. The region benefits from electronics manufacturing and university-led research. Scotland supports semiconductor tooling and photonics activity. Northern England hosts furnace, glass, and materials processing users. Industrial applications drive volume demand. Cost-sensitive buyers favor durable tubing grades. Regional incentives support advanced manufacturing investment. Supply chains link closely with European partners. Replacement cycles remain steady. Growth remains stable, supported by industrial reliability needs and ongoing process modernization.

Wales & West Midlands

Wales and the West Midlands hold roughly 16–18% market share. The West Midlands anchors heavy industry and thermal processing demand. Automotive and materials engineering sustain industrial usage. Wales supports specialty manufacturing and research facilities. Quartz tubing serves furnaces, reactors, and testing systems. Opaque and translucent tubes see higher penetration. Energy-intensive operations drive replacement demand. Regional manufacturers value consistent supply. Infrastructure investment supports equipment upgrades. The region maintains steady growth through diversified industrial applications.

Northern Ireland, East Midlands & Other Regions

Northern Ireland, the East Midlands, and other regions represent about 10–12% market share. Demand remains fragmented across smaller industrial users. The East Midlands supports ceramics, chemicals, and laboratory applications. Northern Ireland shows niche demand from research and electronics assembly. Volumes remain lower than other regions. Buyers emphasize cost control and delivery reliability. Import dependence shapes purchasing decisions. Growth remains moderate but stable. Specialty and custom orders support margins. Regional demand benefits from gradual industrial modernization and research activity.

Market Segmentations:

By Type

- Opaque and Translucent Tubes

- Transparent Tubes

By Application

- Industrial Applications

- Semiconductor

- Lighting

By Geography

- England (including Greater London & South East)

- Scotland & Northern England

- Wales & West Midlands

- Northern Ireland, East Midlands & Other Regions

Competitive Landscape

The UK quartz tubing market shows moderate concentration, led by global suppliers and specialized European producers. International players such as Heraeus, TOSOH, and WONIK Quartz Europe leverage scale, high-purity production, and semiconductor-grade capabilities. UK-based and regional firms like John Moncrieff Ltd and Multi-Lab Ltd compete through customization, short lead times, and application-specific engineering. Asian suppliers, including Aoxin Quartz and Fudong Lighting, participate mainly through imports and price-competitive offerings. Competition centers on purity levels, dimensional accuracy, and thermal performance. Customers prioritize suppliers with strong quality control and traceability. Technical support and co-development capabilities influence supplier selection. Long-term contracts remain common in semiconductor and industrial segments. Energy efficiency and process reliability also shape purchasing decisions. Overall, differentiation relies more on technical performance and service depth than price alone.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- John Moncrieff Ltd

- Heraeus

- Sung Rim Europe GmbH

- TOSOH

- Fudong Lighting

- Aoxin Quartz

- Sentro Tech

- proQuarz GmbH

- WONIK Quartz Europe

- Multi-Lab Ltd

Recent Developments

- In Jan 2025, Heraeus combined high-performance materials units into Heraeus Covantics to expand its technology leadership in high-purity quartz and fused silica products.

- In Nov 2024, Momentive Technologies promoted two long-serving executives into global quartz and ceramics leadership roles, strengthening its quartz business focus.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will benefit from continued investment in semiconductor research and pilot fabrication lines.

- Demand for high-purity quartz tubing will increase as process tolerances tighten.

- Transparent tubing will retain dominance due to semiconductor and laboratory usage.

- Industrial furnace upgrades will support steady replacement demand.

- Custom-made tubing will gain importance across specialized applications.

- Suppliers will invest more in automated and digital quality control systems.

- Energy efficiency pressures will encourage process optimization in manufacturing.

- Import reliance will drive focus on supply chain resilience.

- Regional demand will remain strongest in England and the South East.

- Technical support and co-development will shape long-term supplier partnerships.