Market Overview

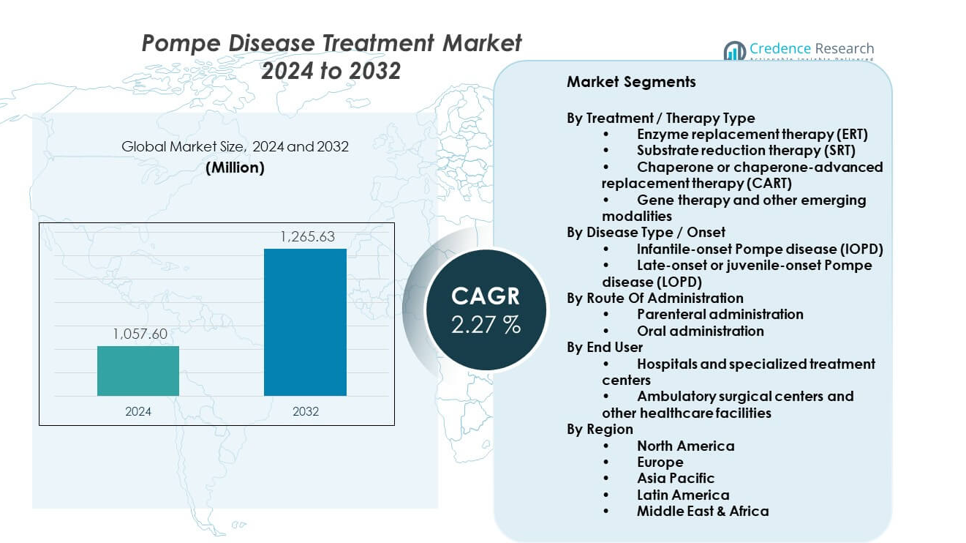

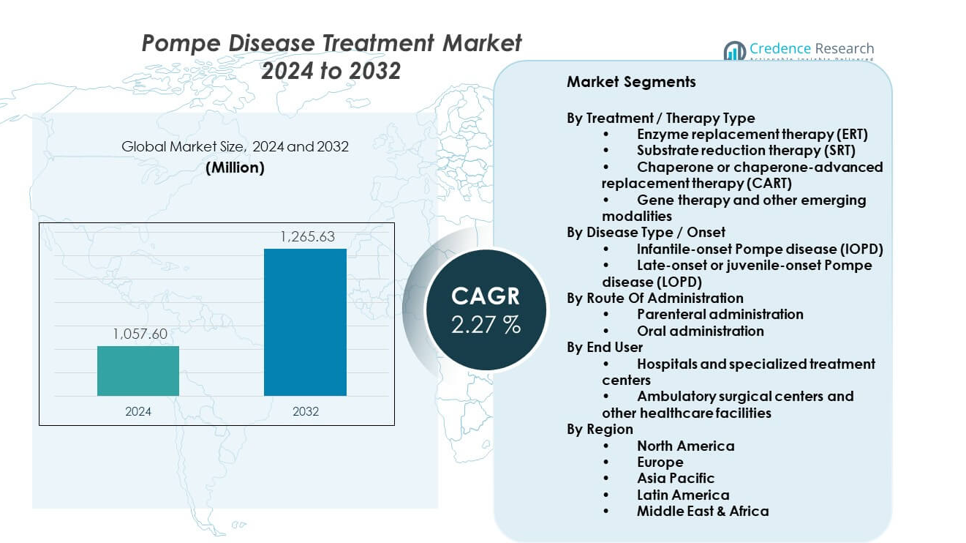

The Pompe Disease Treatment Market is projected to grow from USD 1057.6 million in 2024 to an estimated USD 1265.63 million by 2032, with a CAGR of 2.27% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pompe Disease Treatment Market Size 2024 |

USD 1057.6 million |

| Pompe Disease Treatment Market, CAGR |

2.27% |

| Pompe Disease Treatment Market Size 2032 |

USD 1265.63 million |

Market growth is driven by rising disease awareness and improved diagnostic accuracy. Expanded newborn screening programs enable earlier detection and faster treatment initiation. Pharmaceutical companies invest in advanced enzyme formulations to improve muscle uptake. Active clinical pipelines support innovation in gene and adjunct therapies. Better patient survival increases long-term therapy demand. Supportive reimbursement frameworks encourage therapy adoption. Collaboration between research centers and drug developers accelerates treatment progress.

North America leads the market due to strong screening programs and advanced care access. The United States benefits from rare disease funding and specialist availability. Europe follows with established treatment guidelines and public healthcare support. Asia Pacific is emerging with improving diagnostics and policy focus on rare diseases. Japan shows strong clinical adoption due to early screening efforts. China gains momentum through expanding specialty centers. Other regions grow gradually with awareness initiatives.

Market Insights:

- The market stood at USD 1057.6 million in 2024 and is projected to reach USD 1265.63 million by 2032, registering a CAGR of 2.27% due to chronic therapy demand and limited alternatives.

- North America leads with about 45% share due to early diagnosis, strong reimbursement, and specialized centers, while Europe follows with nearly 30% supported by public healthcare systems and rare-disease frameworks.

- Asia Pacific holds around 18% share and represents the fastest-growing region, driven by improving diagnostics, policy focus on rare diseases, and expanding specialty care in key countries.

- By therapy type, enzyme replacement therapy accounts for roughly 70% share due to established clinical use, while gene therapy and advanced modalities collectively represent about 15% with pipeline-driven growth.

- By disease type, late-onset Pompe disease contributes nearly 65% share because of larger patient numbers, whereas infantile-onset cases account for about 35% due to lower incidence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Disease Awareness And Improved Diagnostic Coverage Across Healthcare Systems

Growing awareness of rare neuromuscular disorders supports earlier identification of Pompe disease. Healthcare providers now recognize symptoms faster across age groups. Expanded newborn screening programs detect cases before severe progression. Early diagnosis improves treatment timing and outcomes. The Pompe Disease Treatment Market benefits from this shift toward proactive care. Medical education initiatives strengthen physician confidence in rare disease diagnosis. Patient advocacy groups also promote symptom awareness. Public health agencies support screening inclusion policies.

- For instance, the U.S. Secretary of Health and Human Services accepted the federal advisory committee’s recommendation to add Pompe disease to the Recommended Uniform Screening Panel (RUSP) in March 2015. As of late 2024/early 2025, 47 U.S. states and the District of Columbia screen newborns for the condition. All but one state (Alaska) have plans to implement screening by the end of 2026, meaning universal screening is not yet fully implemented in every state.

Advancement Of Enzyme Replacement Therapies With Improved Clinical Outcomes

Continuous innovation in enzyme replacement therapy strengthens treatment reliability. Manufacturers enhance enzyme stability and tissue targeting. Improved formulations reduce immune reactions in long-term use. These advances raise physician confidence in prescribing therapy. The Pompe Disease Treatment Market gains from consistent clinical efficacy. Treatment protocols now show better respiratory and motor outcomes. Hospitals prefer therapies with predictable safety profiles. This progress sustains long-term patient adherence.

- For instance, Sanofi’s alglucosidase alfa has demonstrated sustained improvements in survival and motor outcomes in infantile-onset Pompe disease, with long-term follow-up data published in peer-reviewed journals.

Expansion Of Reimbursement Support For High-Cost Rare Disease Therapies

Supportive reimbursement policies drive therapy access in developed markets. Governments recognize the lifelong burden of Pompe disease. Payers approve coverage for high-cost biologic treatments. This reduces financial barriers for patients and families. The Pompe Disease Treatment Market responds positively to coverage clarity. Insurance approvals encourage treatment initiation without delay. Stable funding improves therapy continuity. Healthcare systems prioritize rare disease support frameworks.

Strengthening Of Clinical Research And Drug Development Pipelines

Ongoing clinical research expands therapeutic options for Pompe disease. Biopharmaceutical companies invest in next-generation therapies. Research centers support trials across pediatric and adult populations. Pipeline depth increases confidence in long-term innovation. The Pompe Disease Treatment Market benefits from diversified treatment approaches. Regulatory agencies support orphan drug development pathways. Faster trial designs improve development timelines. Scientific collaboration accelerates therapeutic progress.

Market Trends:

Shift Toward Next-Generation And Combination-Based Treatment Approaches

Treatment strategies evolve beyond single-therapy dependence. Developers explore combination regimens to enhance effectiveness. These approaches target multiple disease mechanisms. Clinicians seek therapies with broader muscle impact. The Pompe Disease Treatment Market reflects this therapeutic shift. Combination use supports personalized treatment planning. Research data guides regimen selection. Clinical adoption grows with evidence maturity.

- For instance, Amicus Therapeutics reported positive Phase III PROPEL subgroup trial results showing statistically significant improved six-minute walk distance with cipaglucosidase alfa plus miglustat compared with standard enzyme therapy in patients who had previously been receiving standard of care alglucosidase alfa.

Growing Focus On Gene Therapy And Disease-Modifying Solutions

Gene therapy research gains strategic focus in rare diseases. Developers target long-term enzyme production within cells. This approach aims to reduce lifelong infusion dependence. Clinical trials advance cautiously with safety oversight. The Pompe Disease Treatment Market tracks these developments closely. Investors view gene therapy as transformative potential. Regulatory bodies support structured trial frameworks. Long-term outcome data remains a key focus.

- For instance, Astellas Pharma’s AT845 gene therapy program for late-onset Pompe disease reported sustained transgene expression and glycogen reduction in early clinical data disclosed at major neuromuscular conferences.

Increased Integration Of Multidisciplinary Care Models In Treatment Delivery

Care delivery shifts toward integrated clinical management models. Neurologists, pulmonologists, and geneticists coordinate care plans. This improves disease monitoring across organ systems. Treatment centers adopt structured follow-up protocols. The Pompe Disease Treatment Market aligns with holistic care practices. Coordinated care improves quality of life measures. Hospitals invest in specialized rare disease clinics. Patient outcomes benefit from unified oversight.

Rising Use Of Real-World Evidence To Guide Treatment Decisions

Healthcare providers rely more on real-world treatment data. Patient registries capture long-term therapy outcomes. This data informs dosing and care optimization. Regulators accept real-world evidence in evaluations. The Pompe Disease Treatment Market gains insight from post-market studies. Clinicians adjust protocols based on observed effectiveness. Data transparency supports informed decision-making. Long-term tracking improves treatment confidence.

Market Challenges Analysis:

High Treatment Costs And Long-Term Financial Pressure On Healthcare Systems

Pompe disease therapies require complex biologic manufacturing and strict quality controls. These factors keep treatment prices high over long durations. Healthcare budgets face strain when coverage spans a patient’s lifetime. Access gaps persist in cost-sensitive regions and public systems. The Pompe Disease Treatment Market encounters payer scrutiny during reimbursement reviews. Delays in approval affect therapy initiation timelines. Financial counseling remains limited in many care centers. Cost containment discussions influence procurement decisions.

Limited Patient Pool And Operational Complexity In Rare Disease Care

Pompe disease affects a small and dispersed patient population. This limits clinical trial recruitment and real-world data volume. Specialized centers handle diagnosis, infusion, and monitoring. Operational demands increase staffing and infrastructure needs. The Pompe Disease Treatment Market must address care coordination challenges. Travel burdens affect patient adherence in remote areas. Workforce shortages constrain service expansion. Data standardization across centers remains uneven.

Market Opportunities:

Expansion Of Newborn Screening And Early Intervention Programs Globally

Public health authorities expand newborn screening panels worldwide. Early detection enables timely treatment before irreversible damage. Outcomes improve with prompt therapy initiation. Health systems invest in screening infrastructure and training. The Pompe Disease Treatment Market benefits from earlier patient entry. Long-term care pathways become more predictable. Awareness campaigns support policy adoption. Screening expansion opens sustained demand growth.

Development Of Next-Generation Therapies And Personalized Care Pathways

Innovation advances toward therapies with improved delivery and durability. Personalized dosing and monitoring gain clinical interest. Digital tools support adherence and outcome tracking. Partnerships link biotech firms with specialty centers. The Pompe Disease Treatment Market captures value from differentiated solutions. Regulatory incentives support orphan innovation. Care models evolve toward tailored management. These shifts create durable growth opportunities.

Market Segmentation Analysis:

By Treatment / Therapy Type

Enzyme replacement therapy remains the primary treatment option due to established clinical use and proven outcomes. Substrate reduction therapy gains attention for its oral potential and supportive role. Chaperone and chaperone-advanced replacement therapies focus on improving enzyme stability and activity. Gene therapy and other emerging modalities target long-term disease modification and reduced treatment burden. The Pompe Disease Treatment Market reflects gradual diversification across therapy classes. Developers pursue balanced portfolios to address varied patient needs.

- For instance, Amicus Therapeutics has published pharmacokinetic data demonstrating that miglustat stabilizes circulating enzyme exposure when used with enzyme therapy. Developers balance near-term and long-term strategies.

By Disease Type / Onset

Infantile-onset Pompe disease requires early and intensive treatment due to rapid progression. Late-onset Pompe disease represents a larger treated population with chronic management needs. Treatment duration extends across a patient’s lifetime in this segment. It drives sustained demand for maintenance therapies. Disease severity and onset timing guide therapy selection. Clinical focus remains on preserving mobility and respiratory function.

- For instance, international Pompe disease registries sponsored by Sanofi document preserved pulmonary function in late-onset patients who initiate therapy before advanced respiratory decline. Clinical focus remains on maintaining mobility and breathing capacity.

By Route Of Administration

Parenteral administration dominates due to intravenous delivery of enzyme therapies. Hospitals manage infusion protocols and monitoring. Oral administration gains interest for substrate reduction and chaperone approaches. This route aims to reduce treatment burden and improve adherence. It remains under clinical development. Route choice influences care setting and cost structure.

By End User

Hospitals and specialized treatment centers account for the largest share due to complex care needs. These centers provide diagnosis, infusion, and long-term monitoring. Ambulatory surgical centers and other facilities support follow-up and supportive services. Care coordination remains critical across settings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Treatment / Therapy Type

- Enzyme replacement therapy (ERT)

- Substrate reduction therapy (SRT)

- Chaperone or chaperone-advanced replacement therapy (CART)

- Gene therapy and other emerging modalities

By Disease Type / Onset

- Infantile-onset Pompe disease (IOPD)

- Late-onset or juvenile-onset Pompe disease (LOPD)

By Route Of Administration

- Parenteral administration

- Oral administration

By End User

- Hospitals and specialized treatment centers

- Ambulatory surgical centers and other healthcare facilities

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the global market, accounting for about 45% of total revenue. The region benefits from early diagnosis through expanded newborn screening programs. Strong reimbursement frameworks support long-term therapy access. The United States drives most demand due to specialized treatment centers and active clinical research. The Pompe Disease Treatment Market gains stability from established enzyme replacement therapy use. High awareness among clinicians supports timely treatment initiation. Canada contributes through public healthcare coverage and rare disease programs.

Europe

Europe represents nearly 30% of the global market share and maintains steady demand. Public healthcare systems support rare disease treatment access across major countries. Germany, France, Italy, and the United Kingdom lead due to structured care pathways. Regulatory support for orphan drugs encourages therapy availability. The Pompe Disease Treatment Market benefits from coordinated referral networks in Europe. Treatment guidelines support consistent clinical practice. Regional collaboration improves patient tracking and long-term care outcomes.

Asia Pacific, Latin America, And Middle East & Africa

Asia Pacific accounts for around 18% of the market and shows the fastest expansion pace. Japan and China lead due to improving diagnostics and policy focus on rare diseases. India and South Korea increase access through specialized centers. The Pompe Disease Treatment Market gains traction as awareness improves in urban hospitals. Latin America holds about 5% share, led by Brazil and Mexico. The Middle East & Africa contribute nearly 2%, supported by gradual healthcare infrastructure development. Access remains uneven but continues to improve.

Key Player Analysis:

- Sanofi (Genzyme)

- Amicus Therapeutics

- Astellas Pharma

- BioMarin Pharmaceutical

- Oxyrane

- Maze Therapeutics

- AVROBIO Inc

- Genethon

- Audentes Therapeutics (Astellas)

- Valerion Therapeutics

- EpiVax Inc

- Actus Therapeutics

- Sanofi (Genzyme)

- Amicus Therapeutics

- Astellas Pharma

- BioMarin Pharmaceutical

- Oxyrane

- Maze Therapeutics

Competitive Analysis:

The Pompe Disease Treatment Market shows high concentration with a limited number of specialized players. Established companies lead through approved enzyme replacement therapies and strong clinical experience. It favors firms with orphan drug expertise and global regulatory capability. Competitive positioning depends on therapy efficacy, safety profile, and reimbursement access. Pipeline strength plays a key role in long-term differentiation. Companies invest in next-generation biologics and gene-based solutions. Strategic collaborations support faster development and clinical reach. Market competition remains focused on innovation rather than price pressure.

Recent Developments:

- Maze Therapeutics entered into an exclusive worldwide license agreement with Japanese pharmaceutical company Shionogi on May 10, 2024, for its investigational oral Pompe disease therapy MZE001. Under the deal, Shionogi agreed to pay Maze $150 million upfront, with additional milestone payments based on development, regulatory, and commercial achievements plus tiered royalties on future net sales. MZE001 is an oral glycogen synthase 1 (GYS1) inhibitor with the potential to become the first oral therapy for Pompe disease.

- Amicus Therapeutics received FDA approval on September 28, 2023, for Pombiliti (cipaglucosidase alfa-atga) plus Opfolda (miglustat), making it the first and only two-component therapy approved for adults living with late-onset Pompe disease (LOPD) who are not improving on their current enzyme replacement therapy (ERT). Following this approval, Amicus secured a $430 million strategic financing deal from Blackstone Life Sciences and Blackstone Credit. This deal was announced on October 2, 2023. The deal included a $400 million loan for debt refinancing and a $30 million strategic investment in the company’s common stock. The company launched the treatment immediately in the United States at a widely reported list price of $650,000 per patient annually (for a patient of median weight).

Report Coverage:

The research report offers an in-depth analysis based on treatment and therapy type, disease onset, route of administration, end user, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Continued focus on early diagnosis through newborn screening programs

- Steady innovation in enzyme replacement therapy formulations

- Growing clinical interest in gene therapy approaches

- Expansion of personalized treatment strategies

- Wider adoption of multidisciplinary care models

- Increased reliance on real-world clinical evidence

- Gradual improvement in access across emerging markets

- Strong regulatory support for orphan drug development

- Deeper collaboration between biotech firms and research centers

- Long-term emphasis on improving patient quality of life