Market Overview

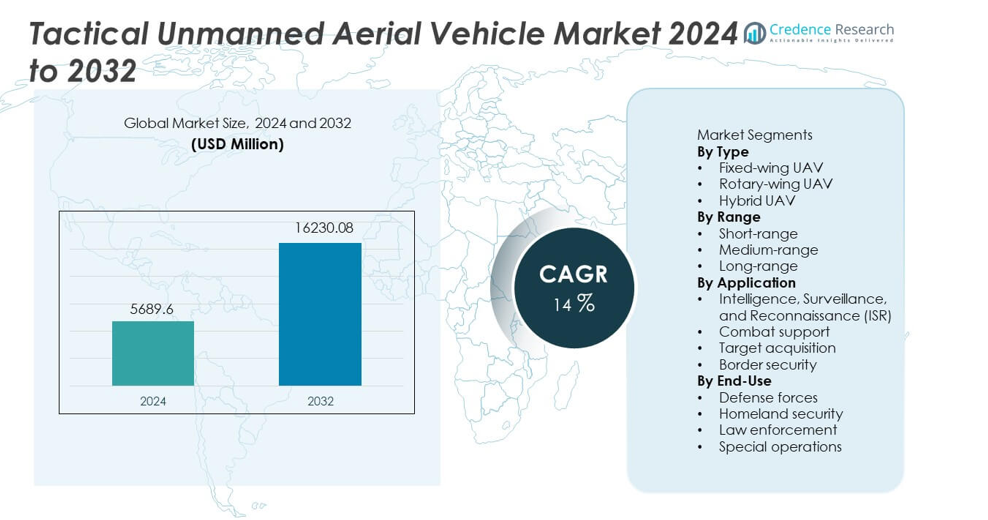

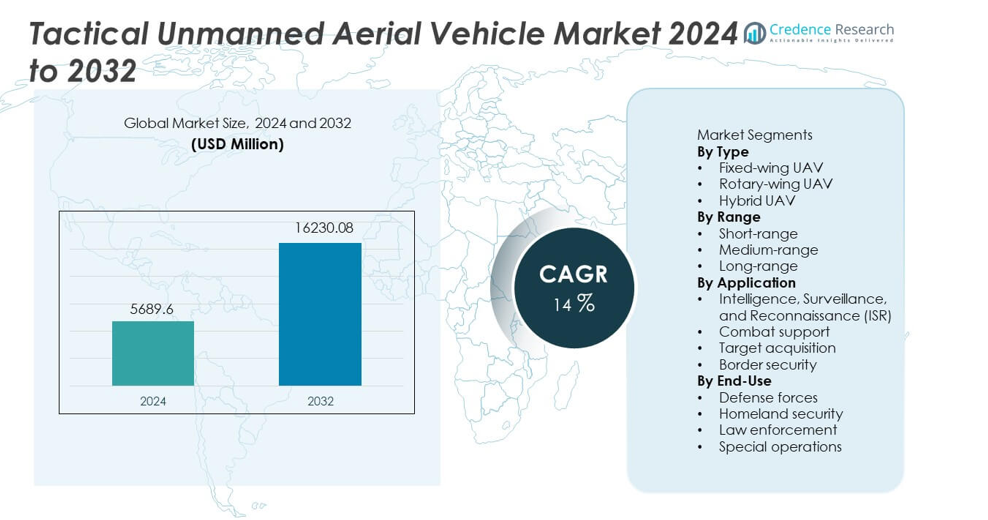

Tactical Unmanned Aerial Vehicle market size was valued at USD 5,689.6 million in 2024 and is projected to reach USD 16,230.08 million by 2032, registering a CAGR of 14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tactical Unmanned Aerial Vehicle market Size 2024 |

USD 5,689.6 million |

| Tactical Unmanned Aerial Vehicle market, CAGR |

14% |

| Tactical Unmanned Aerial Vehicle market Size 2032 |

USD 16,230.08 million |

The top players in the Tactical Unmanned Aerial Vehicle market include Northrop Grumman Corporation, General Atomics Aeronautical Systems, Elbit Systems, Aerovironment Inc., Textron Systems, Thales Group, Israel Aerospace Industries, Lockheed Martin Corporation, Boeing Defense, and Saab AB. These companies lead the market through advanced UAV technologies, strong defense partnerships, and continuous innovation in ISR payloads, autonomous navigation, and long-endurance capabilities. North America remains the dominant region with a 38% market share, driven by high defense spending and large-scale UAV modernization programs. Europe and Asia Pacific follow with significant investments in border surveillance, multi-mission UAV fleets, and indigenous development programs.

Market Insights

- The Tactical Unmanned Aerial Vehicle market reached USD 5,689.6 million in 2024 and will grow at a CAGR of 14 percent through 2032.

- Rising defense focus on ISR missions drives adoption, with fixed-wing UAVs holding a 47 percent share due to long endurance and high payload capacity.

- AI-enabled autonomy, modular payloads, and multi-mission capabilities shape market trends as militaries seek flexible and rapidly deployable UAV platforms.

- Leading players strengthen competitiveness through advanced sensors, long-range communication systems, and improved propulsion technologies for tactical UAV performance.

- North America leads with a 38 percent share, followed by Europe at 27 percent and Asia Pacific at 26 percent, supported by strong defense modernization, growing border surveillance needs, and increasing procurement of tactical UAVs across mission-critical operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Fixed-wing UAVs dominate this segment with a 47% share, driven by their long-endurance capabilities, higher payload capacity, and suitability for long-range surveillance missions. Defense agencies prefer fixed-wing systems for ISR operations, tactical reconnaissance, and border monitoring. Rotary-wing UAVs grow steadily due to their vertical takeoff ability and strong performance in urban or confined environments. Hybrid UAVs gain attention as they combine endurance with maneuverability, supporting multi-mission roles. Rising demand for adaptable platforms and expanding use of autonomous flight systems strengthen the overall segment.

- For instance, General Atomics developed the MQ-9A Reaper with an endurance of 27 hours. The platform supports a payload capacity of 1,746 kg across external and internal stations. The system operates at an altitude of 15,240 meters, supporting long-duration ISR tasks.

By Range

Long-range UAVs lead the range segment with a 44% share, supported by increasing need for extended surveillance, high-altitude monitoring, and cross-border intelligence missions. Their ability to cover wide areas without frequent refueling makes them essential for defense operations. Medium-range UAVs also see strong adoption as they support tactical missions requiring moderate endurance and mobility. Short-range UAVs remain vital for quick-response missions in confined or urban zones. Growing deployment in patrol missions, persistent ISR, and coastal security drives demand across all ranges.

- For instance, Israel Aerospace Industries developed the Heron UAV with a flight endurance of 45 hours. The system supports a mission radius exceeding 1,000 kilometers with satellite communication. The UAV operates at a service ceiling of 10,000 meters for wide-area monitoring.

By Application

ISR applications dominate the market with a 52% share, as tactical UAVs play a critical role in real-time intelligence gathering, threat detection, and battlefield awareness. Modern defense forces rely on UAV-based ISR to support mission planning and decision-making. Combat support applications grow with rising demand for precision targeting, logistics support, and electronic warfare missions. Target acquisition gains momentum as UAVs improve strike accuracy and mission coordination. Border security applications expand due to increased focus on surveillance, smuggling prevention, and perimeter monitoring.

Key Growth Drivers

Rising Demand for Advanced ISR Capabilities

Global defense forces increase investment in tactical UAVs to strengthen intelligence, surveillance, and reconnaissance operations. These systems capture high-resolution imagery, track threats, and support real-time decision-making in complex environments. Their ability to operate in high-risk zones without endangering personnel enhances operational safety. Governments adopt long-endurance UAVs to monitor borders, coastlines, and conflict zones. Expanding use of AI-driven analytics further boosts ISR efficiency, making UAVs essential for modern military operations.

- For instance, Northrop Grumman’s RQ-4 Global Hawk carries sensors with very high resolution for detailed ground observation. The platform is a high-altitude, long-endurance system, capable of sustaining flight for well over a day at high altitudes, far above typical commercial air traffic.

Growing Deployment of UAVs in Combat Support Roles

Tactical UAVs gain traction as versatile platforms that support targeting, logistics, electronic warfare, and precision strike missions. Rising demand for unmanned systems in contested environments drives procurement of platforms capable of operating with minimal risk. Their ability to transmit real-time battlefield data improves coordination between ground forces and command centers. Adoption increases as militaries seek cost-effective alternatives to manned aircraft for tactical missions. Advancements in payload integration enhance mission flexibility and expand combat capabilities.

- For instance, Elbit Systems’ Hermes 900 supports a payload capacity of 350 kilograms. The UAV sustains endurance for 36 hours with multi-sensor and electronic warfare suites. The platform integrates laser designation for precision targeting support. These features strengthen combat support and strike coordination missions.

Increased Investment in Border and Homeland Security

Governments strengthen surveillance and security operations to manage rising cross-border threats, smuggling, and illegal infiltration. Tactical UAVs offer persistent monitoring, wide-area coverage, and rapid deployment for difficult terrains. Homeland security agencies use UAVs for patrol missions, emergency response, and perimeter protection. Their ability to integrate night vision, thermal sensors, and communication systems improves operational effectiveness. This growing need for continuous situational awareness accelerates investments in advanced UAV fleets.

Key Trends & Opportunities

Integration of AI and Autonomous Flight Technologies

AI-enabled navigation, object detection, and autonomous decision systems transform tactical UAV performance. Automated route planning and real-time data analysis improve mission accuracy and reduce operator workload. AI-driven threat recognition enhances situational awareness during ISR and combat missions. This trend opens opportunities for next-generation UAV platforms that adapt to dynamic environments, support swarm operations, and deliver predictive intelligence to command centers.

- For instance, Boeing integrated autonomous mission management into the MQ-25 Stingray test platform. The system executed autonomous aerial refueling with probe engagement accuracy within 25 centimeters. Onboard AI processed sensor data in under 200 milliseconds for flight adjustments.

Expansion of Multi-Mission and Modular UAV Designs

Defense agencies prefer UAVs that support multiple roles through modular payloads, enabling rapid configuration for ISR, target acquisition, or combat support tasks. This flexibility reduces fleet costs and increases operational readiness. Advances in lightweight materials, improved endurance, and hybrid propulsion systems further expand mission capabilities. Growth in joint-force operations creates strong opportunities for interoperable UAV designs compatible with land, air, and naval platforms.

- For instance, SAAB’s Skeldar V-200 supports modular payload integration up to 40 kilograms. The UAV sustains endurance of 5 hours while operating from naval decks without launch systems. The platform supports ISR, electronic surveillance, and communication relay payloads.

Key Challenges

Regulatory and Airspace Integration Barriers

Integrating tactical UAVs into controlled military and civilian airspace remains challenging due to strict regulations and safety requirements. Issues related to collision avoidance, communication reliability, and flight permissions delay large-scale deployment. Coordinating UAV operations with manned aircraft demands advanced traffic management systems. These barriers slow adoption, especially in regions with evolving aviation frameworks.

High Development, Procurement, and Maintenance Costs

Advanced UAVs require significant investment in sensors, communication systems, propulsion technologies, and autonomous software. Maintenance costs rise due to complex components and mission-critical reliability requirements. Budget constraints in developing regions limit procurement opportunities. Continuous upgrades needed to counter emerging threats further increase life-cycle costs. These financial challenges affect adoption rates among smaller military forces.

Regional Analysis

North America

North America holds a 38% share, driven by strong defense spending, rapid adoption of UAV-based ISR systems, and large-scale modernization programs across the United States. The region leads in developing advanced fixed-wing and hybrid UAV platforms with enhanced endurance, autonomous capabilities, and high-altitude performance. Expanding use of tactical UAVs in border security, counterterrorism, and coastal monitoring strengthens demand. Government investments in AI-enabled mission systems and improved communication networks further support market growth. Collaboration between defense agencies and UAV manufacturers accelerates deployment of next-generation tactical platforms across diverse mission areas.

Europe

Europe accounts for a 27% share, supported by increased defense cooperation among EU and NATO members and rising investment in reconnaissance and border surveillance programs. Countries adopt tactical UAVs for ISR, target acquisition, and battlefield monitoring to enhance situational awareness in evolving threat environments. Ongoing military modernization in France, Germany, and the United Kingdom boosts procurement of long-endurance and modular UAV platforms. Strong focus on joint-force interoperability and counterterrorism also advances UAV deployment. Government initiatives aimed at developing indigenous UAV technologies strengthen regional market expansion.

Asia Pacific

Asia Pacific holds a 26% share, driven by rising geopolitical tensions, expanding defense budgets, and accelerated military modernization across China, India, Japan, and South Korea. Regional forces adopt tactical UAVs for ISR missions, border management, and maritime patrol operations. Rapid growth of indigenous UAV manufacturing programs enhances availability and affordability of advanced systems. Increased use of UAVs for real-time intelligence and surveillance strengthens operational readiness. Investments in AI, autonomous navigation, and long-range capabilities further drive widespread adoption across defense agencies.

Latin America

Latin America captures a 5% share, with countries deploying tactical UAVs for border protection, counter-narcotics operations, and internal security missions. Adoption grows as governments enhance surveillance coverage in remote areas and coastal regions. Budget limitations restrict large-scale procurement, yet selected nations invest in medium-range and rotary-wing UAVs for ISR and tactical support. Growing interest in UAV-assisted disaster response and infrastructure monitoring also contributes to steady demand. Partnerships with global UAV manufacturers help expand access to modern technologies across the region.

Middle East & Africa

The Middle East & Africa region holds a 4% share, supported by rising defense spending and increased adoption of UAVs for surveillance, counterterrorism, and border monitoring. Gulf countries invest heavily in next-generation tactical UAVs with advanced sensors and long-range capabilities to strengthen situational awareness. African nations adopt UAVs for perimeter security, anti-poaching missions, and reconnaissance, though procurement remains limited by budget constraints. Expansion of regional conflicts and growing security needs drive continued deployment of UAV-based ISR systems across both military and homeland security sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

- Fixed-wing UAV

- Rotary-wing UAV

- Hybrid UAV

By Range

- Short-range

- Medium-range

- Long-range

By Application

- Intelligence, Surveillance, and Reconnaissance (ISR)

- Combat support

- Target acquisition

- Border security

By End-Use

- Defense forces

- Homeland security

- Law enforcement

- Special operations

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Tactical Unmanned Aerial Vehicle market is shaped by leading companies such as Northrop Grumman Corporation, General Atomics Aeronautical Systems, Elbit Systems, Aerovironment Inc., Textron Systems, Thales Group, Israel Aerospace Industries, Lockheed Martin Corporation, Boeing Defense, and Saab AB. These players compete by advancing UAV endurance, enhancing autonomous flight capabilities, and integrating high-performance ISR payloads. Many firms focus on modular designs that support multiple mission profiles, including surveillance, target acquisition, and combat support. Defense modernization programs worldwide drive strong demand for next-generation UAV platforms with improved communication systems, AI-enabled analytics, and secure data links. Companies strengthen their market presence through government contracts, international partnerships, and continuous R&D investment aimed at developing lightweight airframes, long-range propulsion systems, and advanced sensor integration. This competitive environment fuels rapid innovation and accelerates the global deployment of tactical UAV solutions.

Key Player Analysis

Recent Developments

- In December 2025, Northrop Grumman unveiled Project Talon, a new autonomous loyal-wingman combat drone designed to fly with crewed fighters. The company aims to lower costs and accelerate tactical drone builds.

- In December 2025, General Atomics (GA) outlined plans for Collaborative Combat Aircraft (CCA) and MQ-9 upgrades, including evolving unmanned systems like CCA drones and discussing a strategy to ensure the MQ-9’s relevance in a high-threat environment through ‘standoff protection’ using long-range sensors.

- In November 2025, General Atomics showcased the Gambit 6 strike variant, expanding its modular autonomous drone family for air-to-surface missions.

Report Coverage

The research report offers an in-depth analysis based on Type, Range, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for long-endurance tactical UAVs will increase as defense missions expand.

- AI-enabled autonomy will enhance navigation, threat detection, and mission decision-making.

- Multi-mission UAV platforms will gain traction due to modular payload flexibility.

- Adoption of swarm UAV capabilities will grow for coordinated battlefield operations.

- Border surveillance agencies will continue to invest in advanced ISR UAV fleets.

- Hybrid propulsion systems will improve flight efficiency and operational range.

- Secure communication and anti-jamming technologies will become essential for mission safety.

- Indigenous UAV development programs will rise across emerging economies.

- Tactical UAVs will play a larger role in electronic warfare and target acquisition.

Increased collaboration between defense agencies and manufacturers will accelerate next-generation UAV deployment.