Market Overview

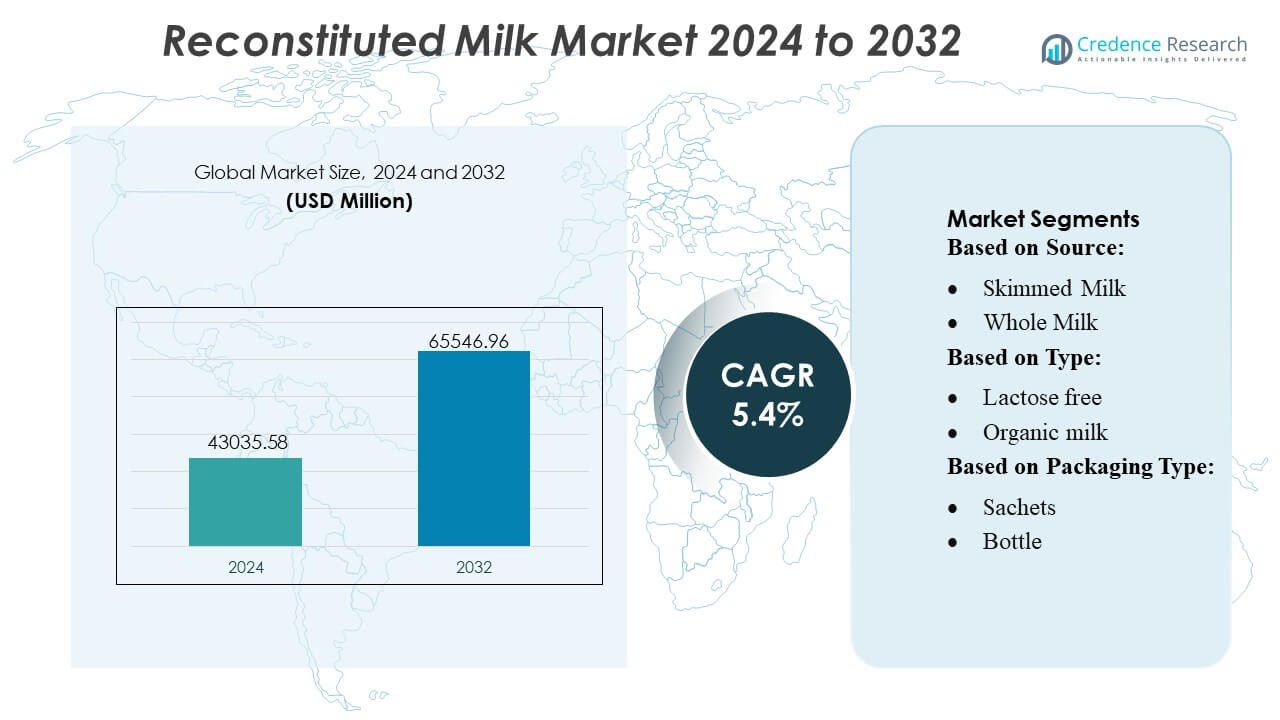

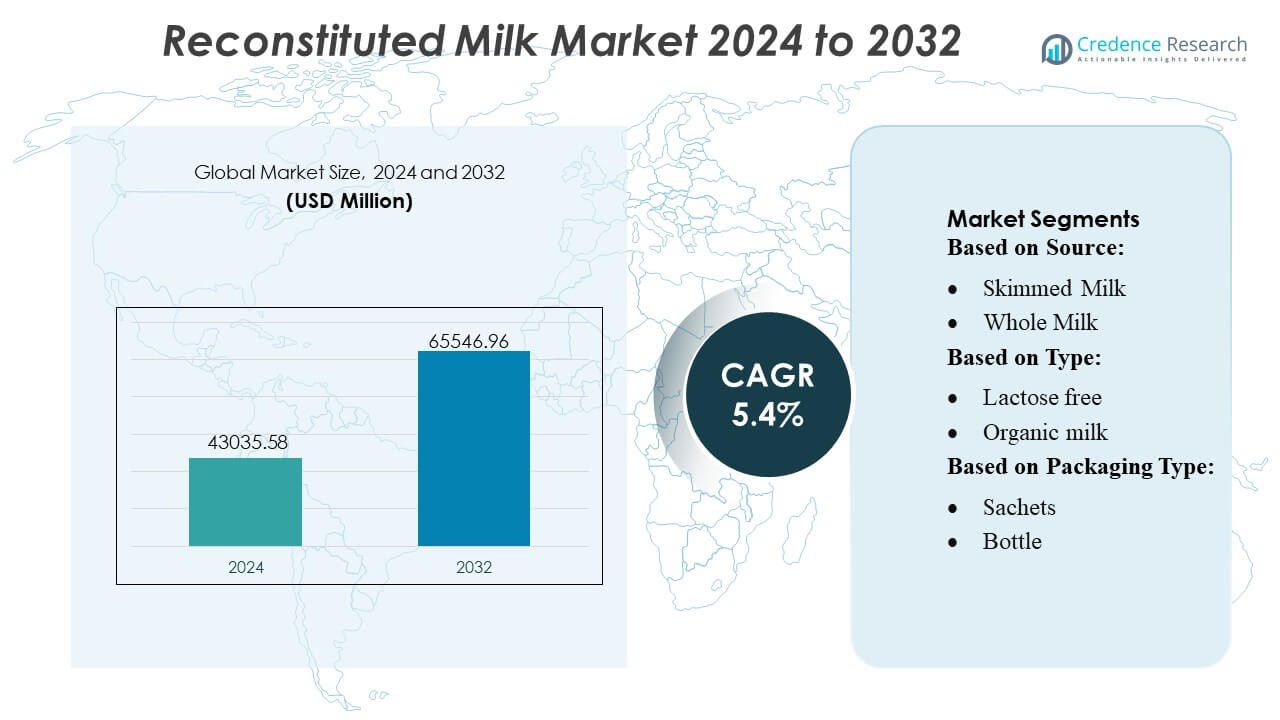

Reconstituted Milk Market size was valued USD 43035.58 million in 2024 and is anticipated to reach USD 65546.96 million by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Reconstituted Milk Market Size 2024 |

USD 43035.58 Million |

| Reconstituted Milk Market, CAGR |

5.4% |

| Reconstituted Milk Market Size 2032 |

USD 65546.96 Million |

The reconstituted milk market is dominated by globally established dairy processors that leverage large-scale milk powder production, advanced spray-drying technologies, and strong distribution networks to support both industrial and retail demand. These companies reinforce competitiveness through fortified formulations, lactose-free variants, and packaging innovations that enhance product stability and convenience. The market benefits further from their strategic focus on supply-chain optimization and expansion into high-growth regions. Asia-Pacific leads the global market with an exact 34% share, driven by rapid urbanization, strong demand in bakery and beverage processing, and widespread reliance on powdered dairy in regions with limited cold-chain infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Reconstituted Milk Market reached USD 43035.58 million in 2024 and is projected to attain USD 65546.96 million by 2032 at a 4% CAGR, reflecting steady demand across retail, foodservice, and industrial applications.

- Rising adoption in bakery, confectionery, and beverage processing drives market growth, supported by high demand for affordable, stable, and customizable dairy inputs.

- Trends emphasize fortified, lactose-free, and flavored formulations, alongside packaging innovations that improve solubility, portion control, and shelf stability.

- Competition intensifies as major processors expand spray-drying capacity, optimize supply chains, and strengthen product consistency, while smaller players compete through localized sourcing and cost-efficient offerings.

- Asia-Pacific holds the dominant 34% regional share, while skimmed milk powder leads product segments with the largest contribution, supported by broad use in industrial dairy manufacturing and institutional programs.

Market Segmentation Analysis:

By Source

Skimmed milk dominates the reconstituted milk market with an estimated 54–56% share, driven by its lower fat content, extended shelf stability, and suitability for large-scale foodservice, bakery, and processed food applications. Its cost efficiency and compatibility with powdered milk formulations support strong adoption across developing regions. Whole milk maintains steady demand in premium beverage and dairy-based confectionery segments, where richer texture and higher nutritional density remain key purchasing factors. Growth in whole milk usage is further supported by expanding café chains and increased consumption of value-added dairy beverages.

- For instance, Actus Nutrition acquired a 99,000‑square‑foot whey‑protein processing facility in Sparta, Wisconsin, and added it to their manufacturing network of twelve U.S. facilities.

By Type

Lactose-free reconstituted milk leads the segment with an approximate 40–42% market share, supported by rising lactose intolerance awareness, improved enzyme-based processing, and broader penetration in infant nutrition, ready-to-drink beverages, and dietary management products. Organic reconstituted milk sees growing preference among health-conscious consumers seeking clean-label formulations and higher perceived nutritional quality. Flavored reconstituted milk gains traction in the youth and on-the-go segments, particularly in chocolate and malt variants, while “other types,” including fortified and protein-enriched offerings, benefit from demand for functional nutrition.

- For instance, Glanbia plc’s Michigan whey‑and‑cheese processing facility recovers around 800,000 gallons of clean water daily, demonstrating advanced dairy‑ingredient processing that supports large‑scale cow‑milk‑based production lines.

By Packaging Type

Cartons dominate the packaging segment with a commanding 48–50% share, driven by their strong barrier properties, lightweight structure, and suitability for aseptic filling, which extends product shelf life without refrigeration. Carton formats also align with sustainability goals due to high recyclability and reduced material usage. Bottles retain relevance in premium and single-serve categories where convenience and visual appeal influence purchase decisions. Sachets grow rapidly in cost-sensitive markets, supported by low unit pricing and easy transport, while “other” formats cater to institutional bulk buyers requiring larger pack sizes.

Key Growth Drivers

Rising Demand for Affordable and Shelf-Stable Dairy Alternatives

Demand for reconstituted milk accelerates as manufacturers, foodservice operators, and emerging economies seek low-cost, easily transportable, and long-lasting dairy solutions. Powdered formats reduce cold-chain dependency, enabling broader penetration across regions with limited refrigeration infrastructure. Strong adoption in bakery, confectionery, and processed food applications further boosts consumption, supported by standardized composition and consistent quality. Governments and institutional buyers increasingly prefer reconstituted milk for school feeding programs and emergency nutrition, reinforcing stable long-term volume growth.

- For instance, AMCO Proteins lists a“CMP‑9000 Milk Protein Isolate 90%” product offering 90 % protein content that is designed for high‑nutrition formulations and ensures improved nutrient absorption and functionality in fortified powders.

Expansion of Industrial Applications and Functional Formulations

Reconstituted milk benefits from rising utilization in value-added dairy processing, including yogurt, cheese, UHT beverages, and nutritional blends. Manufacturers leverage its controlled fat-to-solids ratio to achieve uniform product performance and optimize batch consistency. Growing innovation in lactose-free, fortified, and flavored variants widens the addressable consumer base while supporting functional nutrition trends. Food processors increasingly integrate reconstituted milk to stabilize supply fluctuations in fresh milk, improving manufacturing efficiency and lowering overall production costs.

- For instance, Kerry’s 2024 Annual Report confirms the company employs an R&D team of over 1,200 food scientists globally. The report also mentions that Kerry operates over 70 technology and innovation centers worldwide.

Growth of E-Commerce, Foodservice, and Convenience-Driven Consumption

Rapid urbanization and expansion of online grocery platforms increase access to powdered milk formats that store well, reconstitute quickly, and offer packaging flexibility. Foodservice chains use reconstituted milk to standardize recipes and reduce wastage, particularly in high-volume beverage, bakery, and dessert categories. Rising demand for convenient, ready-to-mix products among working consumers strengthens the market outlook. Brands capitalize on digital distribution, subscription models, and direct-to-consumer channels, expanding market reach and accelerating penetration among young, health-conscious consumers.

Key Trends & Opportunities

Premiumization Through Organic, Lactose-Free, and Fortified Variants

Growing focus on health, clean-label ingredients, and specialized nutrition fuels demand for premium reconstituted milk offerings. Organic and lactose-free variants experience rapid adoption as consumers prioritize digestive health and chemical-free formulations. Fortification with vitamins, minerals, and protein creates opportunities for differentiation in infant nutrition, sports beverages, and elderly care products. Manufacturers investing in high-quality fat powders, advanced microencapsulation, and improved solubility technologies stand to capture rising demand in high-value consumer segments.

- For instance, Arla uses advanced filtration processes to produce high-protein streams from milk. These methods often involve microfiltration to separate components, with pasteurization (typically at around 72°C for 15 seconds) conducted as a separate step.

Packaging Innovation and Single-Serve Format Expansion

The market sees strong opportunities in sachets, pouches, and lightweight cartons designed for portability, portion control, and extended shelf life. Single-serve packaging appeals to on-the-go consumers, low-income households, and institutional buyers requiring controlled dispensing and reduced spoilage risk. Brands adopt moisture-barrier films, resealable systems, and digitally traceable packaging to enhance freshness, convenience, and supply-chain transparency. These innovations support market penetration across travel retail, e-commerce, and disaster-relief distribution channels.

- For instance, Danone’s R&D documentation confirms ADPI and other academic/industry documents reference established standards for dairy ingredients. The standard mandates a minimum protein content of 34.0 grams per 100 grams of powder (or 34.0% protein on a solids-not-fat basis) for products classified as Skimmed Milk Powder or Nonfat Dry Milk.

Sustainability-Driven Supply Chain and Dairy Ingredient Optimization

Sustainability initiatives create opportunities for manufacturers to shift toward energy-efficient spray-drying, low-carbon logistics, and responsible sourcing of skimmed and whole milk inputs. Advances in precision dairy processing enable improved solids recovery, lower wastage, and reduced environmental footprints. Brands promoting carbon-neutral milk powders, recyclable packaging, and sustainable procurement gain a competitive edge as consumers and regulators increasingly evaluate dairy products through an environmental lens.

Key Challenges

Volatility in Raw Milk Prices and Supply-Chain Disruptions

Fluctuating farm-gate milk prices, seasonal production variability, and rising feed and energy costs pressure manufacturing margins. Supply disruptions caused by climate fluctuations, logistics bottlenecks, and geopolitical uncertainties further complicate procurement planning. Manufacturers relying heavily on imported dairy ingredients face additional exposure to currency volatility and trade barriers. These uncertainties force CDMOs, processors, and branded players to adopt hedging strategies, diversify sourcing, and invest in long-term supplier partnerships to stabilize operations.

Competition from Fresh Milk and Plant-Based Alternatives

Reconstituted milk competes directly with fresh dairy and rapidly expanding plant-based beverages that appeal to consumers seeking natural, minimally processed, or dairy-free options. Strong marketing by oat, almond, and soy beverage brands challenges traditional dairy’s value perception, especially in urban and premium retail segments. Fresh milk’s sensory appeal and shorter ingredient lists further influence consumer choice. To remain competitive, manufacturers must emphasize nutritional consistency, affordability, fortified benefits, and versatile applications while enhancing taste and solubility performance.

Regional Analysis

North America

North America leads the reconstituted milk market with a 32% share, supported by strong adoption across bakery, confectionery, and ready-to-drink dairy processing. Foodservice chains and institutional buyers rely on reconstituted formats to standardize recipes and reduce supply volatility. High penetration of lactose-free and fortified blends strengthens demand in health-focused consumer segments. Advanced packaging technologies and robust cold-chain alternatives also enhance product stability and distribution efficiency. The region benefits from strong e-commerce integration, enabling better market reach and consistent growth across both retail and industrial applications.

Europe

Europe holds a 28% market share, driven by mature dairy processing infrastructure, stringent quality standards, and rising use of reconstituted milk in cheese, yogurt, and bakery applications. Demand is reinforced by growing preference for organic and clean-label formulations, particularly in Western Europe. Manufacturers adopt sustainable production methods and recyclable packaging to align with EU environmental regulations, supporting category premiumization. Institutional programs and food manufacturers use reconstituted milk to stabilize supply amid fluctuating fresh milk availability. Strong retail presence and rising uptake in powdered beverage mixes further contribute to steady market expansion.

Asia-Pacific

Asia-Pacific dominates the global reconstituted milk market with a 34% share, driven by high consumption in emerging economies, expanding middle-income demographics, and rapid urbanization. Powdered formats remain essential due to limited refrigeration infrastructure in rural areas and strong demand from bakery, confectionery, and infant nutrition segments. Governments increasingly incorporate reconstituted milk into school nutrition and public health programs, boosting volume. E-commerce growth accelerates product accessibility, while rising preference for fortified and flavored variants strengthens premium category adoption. Expanding dairy processing capacity and supply-chain modernization support long-term regional growth momentum.

Latin America

Latin America accounts for approximately 4% of the reconstituted milk market, supported by rising demand in foodservice, bakery, and affordable household dairy consumption. Economic variability and uneven cold-chain infrastructure make powdered and reconstituted milk attractive, especially in low- and middle-income segments. Adoption increases in Brazil, Mexico, and Colombia, where manufacturers expand distribution networks and introduce fortified and flavored offerings. Government-led nutrition programs also incorporate reconstituted formats due to cost efficiency. However, competition from fresh milk in urban centers moderates overall growth, requiring brands to emphasize affordability, convenience, and extended shelf life.

Middle East & Africa

The Middle East & Africa region holds a 2% share, driven primarily by reliance on imported powdered milk due to limited local dairy production and challenging climatic conditions. Reconstituted milk is widely used in household consumption, institutional catering, and processed food applications. Rising urbanization and population growth fuel demand, particularly in Gulf countries and East Africa. Brands expand market presence through low-cost sachets, fortified formulations, and distribution partnerships with local retailers. While affordability and shelf stability support consumption, supply-chain dependency and currency fluctuations continue to influence long-term market performance.

Market Segmentations:

By Source:

By Type:

- Lactose free

- Organic milk

By Packaging Type:

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The reconstituted milk market is shaped by globally established dairy processors and regional specialists, with key players including Meiji Holdings, Pine Hill Dairy, Arla Foods, Fonterra, Schreiber Foods, Saputo, Mengniu Dairy, Lactalis, Nestlé, and Dairy Farmers of America. the reconstituted milk market reflects a blend of large multinational dairy processors and agile regional producers that focus on efficiency, product consistency, and broad application versatility. Companies strengthen their positions by expanding milk powder production capacity, improving spray-drying technology, and optimizing fat-to-solids ratios to meet diverse industrial and retail requirements. Growing demand for fortified, lactose-free, and flavored formulations encourages deeper investment in product innovation and nutrition-focused research. Market participants also enhance competitiveness through advanced packaging, energy-efficient processing, and integrated distribution networks. Strategic partnerships, digitalized supply chains, and regional expansion strategies further support sustained global market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Nova Dairy launched a new skimmed milk powder specifically targeting health-conscious consumers needing a low-fat, convenient milk option, offering essential nutrients like protein and calcium without the fat, making it versatile for drinks, baking, and cooking, and providing a long shelf life and easy storage for families and individuals focused on health.

- In February 2025, Dairy Farmers of America (DFA) launched Milk50, a real dairy milk with only 50 calories, 75% less sugar than skim milk, and 9g protein per serving, using ultra-filtration to remove sugar while retaining nutrients, available in original, vanilla, and chocolate flavors to compete with plant-based options.

- In October 2024, Britannia Industries and the Bel Group inaugurated a new cheese manufacturing plant in Ranjangaon, Maharashtra, significantly boosting local production of their joint venture’s “Britannia The Laughing Cow” cheese, with an investment of around to meet India’s growing demand and support local dairy farmers.

- In May 2024, Lactalis Canada launched Enjoy!, a new plant-based milk brand, following their conversion of a Sudbury facility into a vegan production hub, expanding their Canadian portfolio with high-protein, dairy-free oat, almond, and hazelnut beverages, complementing their traditional dairy brands like Astro, Black Diamond, and Cracker Barrel.

Report Coverage

The research report offers an in-depth analysis based on Source, Type, Packaging Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as demand rises for affordable, shelf-stable dairy solutions across emerging economies.

- Foodservice and bakery industries will increase reliance on reconstituted milk to ensure consistency and cost efficiency.

- Fortified, lactose-free, and functional formulations will gain stronger penetration in premium nutrition segments.

- Packaging innovations such as single-serve sachets and moisture-barrier pouches will enhance consumer convenience and product shelf life.

- E-commerce channels will accelerate distribution and broaden market access in urban and semi-urban regions.

- Sustainability initiatives will drive investment in energy-efficient drying technologies and eco-friendly packaging.

- Government nutrition programs will continue supporting high-volume adoption, particularly in developing countries.

- Manufacturers will diversify sourcing strategies to mitigate volatility in raw milk supply and pricing.

- Brands will increase focus on taste optimization and improved solubility to strengthen consumer acceptance.

- Regional players will expand capacity and partnerships to compete more effectively with multinational dairy processors.