Market Overview

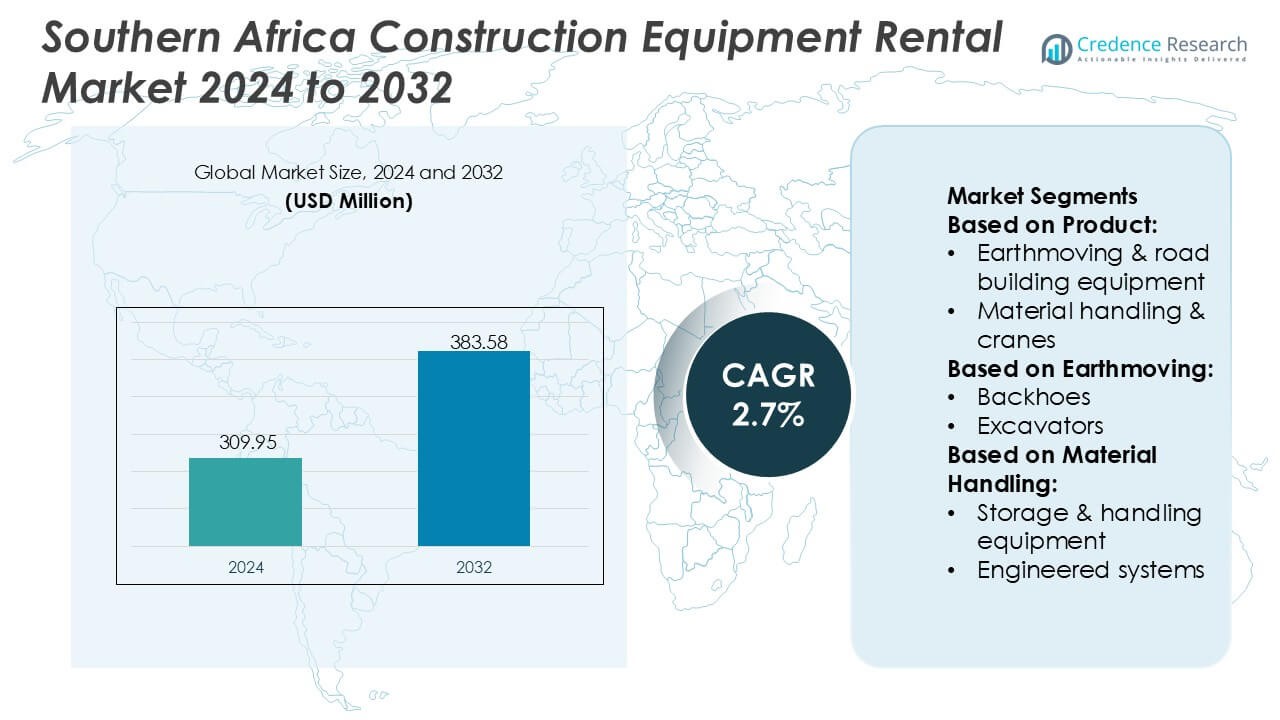

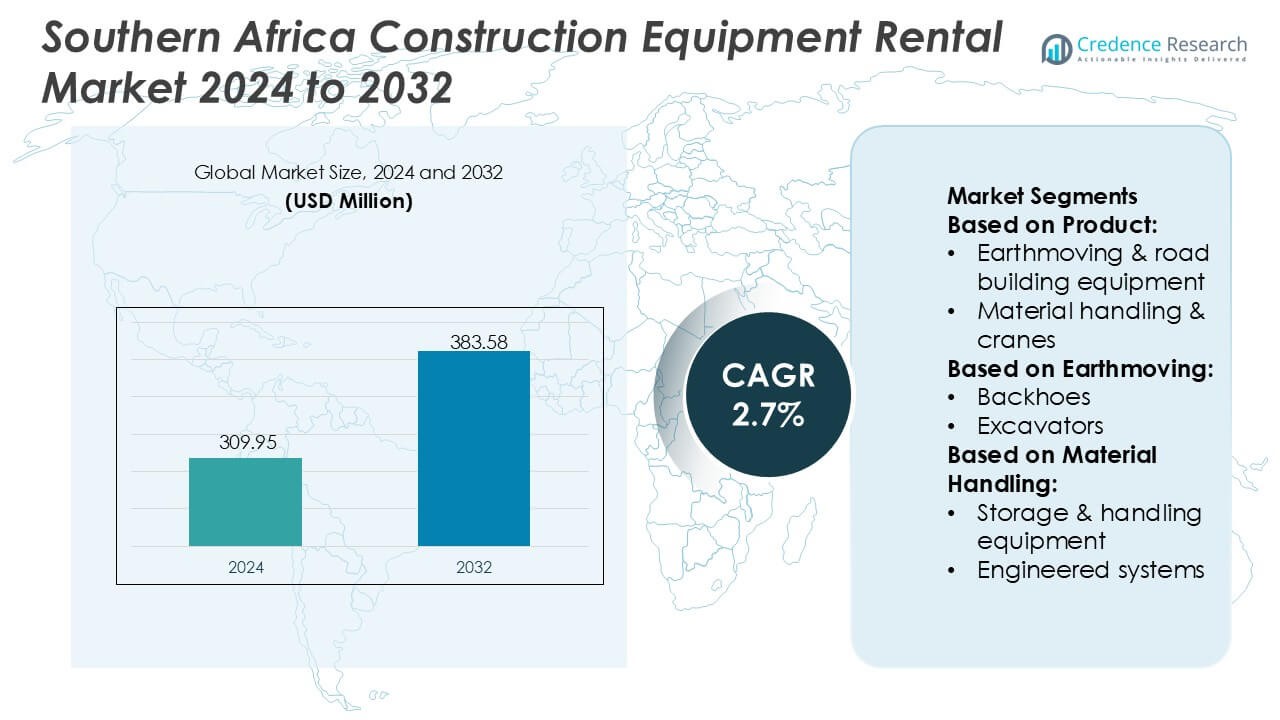

Southern Africa Construction Equipment Rental Market size was valued USD 309.95 million in 2024 and is anticipated to reach USD 383.58 million by 2032, at a CAGR of 2.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Southern Africa Construction Equipment Rental Market Size 2024 |

USD 309.95 Million |

| Southern Africa Construction Equipment Rental Market, CAGR |

2.7% |

| Southern Africa Construction Equipment Rental Market Size 2032 |

USD 383.58 Million |

The Southern Africa Construction Equipment Rental Market is shaped by a mix of multinational rental providers, regional distributors, and specialized service companies that compete through diversified fleets, strong aftermarket support, and technology-enabled maintenance capabilities. Leading players focus on expanding earthmoving, material-handling, and crane portfolios while integrating telematics and predictive diagnostics to improve operational reliability for contractors across mining and infrastructure projects. The market is geographically dominated by South Africa, which holds an exact 48% share, supported by its extensive construction pipeline, mature rental ecosystem, and well-established service networks that ensure high equipment availability and consistent project performance across the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Southern Africa Construction Equipment Rental Market was valued at USD 309.95 million in 2024 and is projected to reach USD 383.58 million by 2032, registering a CAGR of 2.7% during the forecast period.

- Market growth is driven by rising demand for earthmoving and material-handling equipment rentals, as contractors prioritize asset-light models to manage project variability and reduce capital commitments.

- Trends emphasize wider adoption of telematics-enabled fleet monitoring and predictive maintenance, improving uptime for mining and large infrastructure works across the region.

- Competition intensifies as rental providers expand diversified fleets and service hubs, while restraints include high maintenance costs and limited availability of skilled technicians in remote project clusters.

- Regional performance is led by South Africa with 48% share, while the earthmoving equipment segment dominates at 52%, supported by strong utilization in road-building, mining support, and logistics corridor development.

Market Segmentation Analysis:

By Product

The Southern Africa Construction Equipment Rental Market is led by the earthmoving & road-building equipment segment, holding an estimated 52% share, driven by expanding infrastructure upgrades, mining activity, and road rehabilitation programs across South Africa, Botswana, and Namibia. Contractors increasingly prefer renting excavators, graders, and compactors to reduce capital expenditure and improve fleet flexibility in fluctuating project cycles. Material handling & cranes follow as the second-largest segment due to demand from logistics hubs and port modernization, while concrete equipment gains steady traction in commercial construction and urban redevelopment projects.

- For instance, Finning International Inc. enhanced rental fleet efficiency by deploying over 50,000 connected Caterpillar assets with telematics systems capable of transmitting multiple real-time machine health parameters, significantly improving uptime across earthmoving operations.

By Earthmoving

Within earthmoving machinery, excavators dominate with nearly 45% share, supported by high utilization in mining overburden removal, trenching, and large-scale civil engineering works. Rental penetration rises as contractors seek access to multiple tonnage classes without long-term financing commitments. Loaders represent the next significant category, benefiting from quarrying, aggregates handling, and urban construction tasks. Backhoes remain relevant for mid-scale municipal works, while compaction equipment and other utility machines demonstrate consistent demand in road construction, pipeline installation, and maintenance projects that require short-term, project-specific fleet deployment.

- For instance, Maxim Crane Works, L.P. strengthened heavy-equipment project capability by operating a fleet of crawler cranes with lifting capacities reaching 2,535 metric tons, supported by boom lengths extending up to 188 meters, enabling high-precision earthmoving and infrastructure support activities.

By Material Handling

In the material-handling segment, industrial trucks lead with approximately 48% share, driven by their essential role in warehousing, mining logistics, and construction material movement across distribution centers and industrial zones. Growing investments in regional logistics corridors and special economic zones accelerate the uptake of rental forklifts and lift trucks. Storage & handling equipment follows due to rising inventory capacities in retail and manufacturing. Engineered systems gain niche traction amid automation-focused upgrades, while bulk material handling equipment shows steady demand in mining belts requiring efficient movement of ores, aggregates, and construction inputs.

Key Growth Drivers

Growing Preference for Asset-Light Construction Models

Contractors across Southern Africa increasingly shift toward rental models to reduce upfront capital expenditure, limit long-term financing risks, and improve fleet flexibility. Rising project fragmentation in road rehabilitation, municipal infrastructure upgrades, and housing development increases reliance on short-term and medium-term rentals for excavators, loaders, and cranes. Firms leverage rentals to scale fleet size according to workload while avoiding maintenance and depreciation burdens. This asset-light approach strengthens demand for modern, fuel-efficient rental machinery that supports faster project execution and minimizes operational disruptions.

- For instance, United Rentals, Inc. company strengthened its digital leadership by running the largest telematics-enabled rental fleet globally, with over 375,000 connected equipment units enabling remote monitoring of runtime, location, fuel usage, and maintenance alerts through its proprietary platform.

Expansion of Infrastructure and Mining Activities

Large-scale mining expansions in South Africa, Botswana, and Zambia, combined with ongoing transportation and energy corridor investments, significantly accelerate equipment rental demand. Excavators, compaction machines, and material-handling units experience high utilization as governments prioritize road upgrades, renewable energy installations, and logistics network expansion. Rental companies benefit from project-based procurement cycles, where contractors require diverse machinery classes without committing to outright purchases. Growing emphasis on productivity, uptime reliability, and safety compliance further drives preference for professionally maintained rental fleets across mining and infrastructure domains.

- For instance, Byrne Equipment Rental enhanced its operational capability by deploying more than 14,000 rental assets across its network, including power systems engineered to deliver continuous outputs up to 1,250 kVA, supported by remote monitoring units capable of transmitting operational diagnostics, enabling high-reliability performance for mining and infrastructure workloads.

Shift Toward Technology-Enabled Rental Fleet Management

Digitalization strengthens rental market performance as equipment providers integrate telematics, GPS tracking, fuel monitoring, and predictive maintenance tools into their fleets. Contractors increasingly value real-time insights into machine utilization, idle time, and performance metrics to reduce project delays and operating costs. Remote diagnostics improve maintenance scheduling and minimize breakdown risks, enhancing rental fleet reliability for mission-critical mining and construction tasks. Technology-enabled transparency supports cost benchmarking and strengthens customer trust, reinforcing the competitive advantage of rental companies offering digitally managed and data-driven fleet solutions.

Key Trends & Opportunities

Rising Adoption of Eco-Efficient and Low-Emission Equipment

Sustainability priorities create opportunities for rental providers offering energy-efficient excavators, hybrid loaders, and low-emission compaction machinery. Regulatory pressure to curb fuel consumption and reduce carbon footprints influences contractors to rent newer-generation equipment rather than using older owned fleets. Rental firms investing in Tier-3/Tier-4 compliant machinery and alternative-fuel units gain competitive differentiation. The shift toward greener project contracting especially in urban construction opens avenues for premium rental packages linked to lower environmental impact and improved operational economics.

- For instance, Caterpillar demonstrated a hybrid retrofit of the 55,000-lb Cat 972 Wheel Loader completed in just 12 weeks illustrating how its Electrified Machine (EREM) solution delivers near-diesel performance in an electrified format, supporting job-site electrification without requiring DC charging infrastructure.

Growth of Integrated Rental Services and Project Support Solutions

Rental companies increasingly differentiate by offering bundled services such as on-site technicians, operator training, fleet planning assistance, and maintenance-inclusive rental contracts. Demand grows for turnkey rental solutions that ensure equipment readiness and minimize downtime during large civil engineering and mining projects. Companies offering flexible leasing models, multi-equipment packages, and performance monitoring dashboards capture expanding opportunities as contractors seek operational simplicity and predictable cost structures. This trend enhances long-term customer relationships and drives recurring revenue streams for established rental players.

- For instance, Henry Schein’s Blood Control IV Catheter 20 Gauge has a 1-inch beveled tip and comes 50 units per box, 4 boxes per case, ensuring standardization and ease of supply chain handling.

Expansion of Cross-Border Construction and Regional Collaboration

As Southern African countries pursue collaborative infrastructure programs and harmonized development frameworks, opportunities expand for rental firms capable of serving cross-border projects. Road corridor upgrades, border post modernization, and regional logistics infrastructure create sustained demand for mobile fleets that can be redeployed across markets. Rental providers with strong distribution networks and multi-country service capabilities gain strategic advantage. This trend encourages fleet standardization, operational partnerships, and expansion of service hubs aligned with regional economic integration initiatives.

Key Challenges

High Equipment Maintenance Costs and Limited Skilled Technicians

Rental companies face rising maintenance costs due to harsh operating conditions in mining and infrastructure sites that accelerate wear and tear on machines. Limited availability of skilled technicians in several Southern African markets increases service delays and impacts fleet utilization. Providers must invest heavily in preventive maintenance programs, technician training, and spare parts inventory to maintain uptime reliability. These operational burdens strain profitability, particularly for smaller rental operators with restricted fleet sizes and limited access to technical talent.

Market Fragmentation and Intense Price Competition

The market remains highly fragmented, with numerous small and mid-sized rental firms competing alongside established distributors. Price competition pressures margins as contractors often prioritize short-term cost savings over premium equipment offerings. Smaller players struggle to differentiate due to limited digital capabilities, smaller fleets, and inconsistent service quality. Larger providers must continuously upgrade machinery and expand service offerings to retain customers, further increasing cost structures. This competitive environment challenges long-term scalability and requires strategic consolidation to achieve operational efficiency and market stability.

Regional Analysis

North America

North America holds a 32% share in the broader construction equipment rental landscape and serves as a key benchmark for Southern Africa due to its advanced rental practices, strong digital fleet management, and highly professionalized rental networks. The region’s leadership in telematics-enabled equipment, maintenance-inclusive rental models, and stringent safety standards influences procurement behavior among Southern African contractors seeking operational efficiency. North American OEMs and rental providers also supply a substantial share of imported machinery into Southern Africa, shaping market expectations around fuel efficiency, uptime reliability, and emissions-compliant fleet offerings.

Europe

Europe maintains an estimated 28% market share globally and plays an important role in shaping equipment rental trends adopted across Southern Africa. The region’s emphasis on low-emission fleets, electrified compact machinery, and regulatory-driven sustainability standards accelerates demand for modern, fuel-efficient rental units in African markets. European suppliers dominate categories such as earthmoving, compaction, and material-handling equipment, influencing local rental fleet composition. Growing collaboration between European OEMs and Southern African distributors strengthens access to advanced machines, while expertise in circular rental models enhances operational efficiency and lifecycle management practices adopted by regional rental providers.

Asia-Pacific

Asia-Pacific accounts for around 24% of the global equipment rental market, supported by strong manufacturing capacity and competitive pricing that significantly influences Southern Africa’s rental ecosystem. The region’s dominance in producing excavators, loaders, cranes, and compact equipment creates cost-efficient sourcing channels for Southern African rental firms. China, Japan, and South Korea continue to supply high-demand models suited for mining, road-building, and infrastructure projects across Africa. Rental providers benefit from APAC’s wide machine availability, faster delivery cycles, and expanding aftersales support partnerships, enabling scalable fleet expansion across Southern African construction and agriculture sectors.

Latin America

Latin America holds roughly 9% market share and offers comparable emerging-market conditions that mirror Southern Africa’s rental growth trajectory. Both regions face similar challenges economic cyclicality, infrastructure gaps, and heavy dependence on mining and public-sector projects which makes Latin American rental strategies relevant benchmarks for Southern African operators. The rise of flexible leasing models, contractor preference for asset-light operations, and growth in mid-tier rental firms in Latin America parallel Southern Africa’s shift toward cost-optimized equipment access. Shared climate and terrain profiles also inform equipment selection patterns, including demand for durable earthmoving and material-handling machinery.

Middle East & Africa

The Middle East & Africa region collectively accounts for 27% share, with Southern Africa serving as one of its fastest-growing submarkets due to mining intensification and infrastructure modernization. High equipment utilization in energy, transport, and industrial construction projects strengthens demand for excavators, cranes, and compaction machinery. Gulf-region rental practices such as long-term leasing, maintenance contracts, and high-spec fleet adoption increasingly influence Southern African rental standards. Access to regional capital, stronger OEM presence, and cross-border rental partnerships supports market maturity. Southern Africa benefits from shared procurement channels, regional training hubs, and standardized fleet management practices.

Market Segmentations:

By Product:

- Earthmoving & road building equipment

- Material handling & cranes

By Earthmoving:

By Material Handling:

- Storage & handling equipment

- Engineered systems

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Southern Africa Construction Equipment Rental Market players such as Finning International Inc., Maxim Crane Works, L.P., Kanamoto Co., Ltd., Cramo Plc, United Rentals, Inc., Byrne Equipment Rental, AKTIO Corporation, Liebherr-International AG, Caterpillar Inc., and Ahern Rentals Inc. the Southern Africa Construction Equipment Rental Market reflects a mix of multinational rental providers, regional distributors, and specialized crane and earthmoving service companies that compete on fleet depth, equipment reliability, and value-added support services. Market participants prioritize expanding their portfolios with advanced excavators, loaders, material-handling units, and compaction equipment suited for demanding mining and infrastructure environments. Digital adoption accelerates differentiation as rental firms integrate telematics, real-time utilization monitoring, and predictive maintenance tools to enhance uptime and operational efficiency. Companies strengthen their regional presence through strategically located service hubs, maintenance-inclusive rental contracts, and flexible leasing models that address contractor requirements for cost optimization and project-specific adaptability. Growing competition encourages continuous fleet modernization, safety compliance upgrades, and the introduction of environmentally efficient machinery to align with emerging sustainability expectations across construction and mining sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Finning International Inc.

- Maxim Crane Works, L.P.

- Kanamoto Co., Ltd.

- Cramo Plc

- United Rentals, Inc.

- Byrne Equipment Rental

- AKTIO Corporation

- Liebherr-International AG

- Caterpillar Inc.

- Ahern Rentals Inc.

Recent Developments

- In May 2025, Vandalia Rental launched its “Specialized Onsite Services (SOS)” for trench shoring expanding its offerings to include a full range of safety equipment like trench boxes, road plates, and hydraulic shores to help contractors prevent cave-ins and improve job site safety.

- In April 2025, CASE Construction Equipment launched new products and tech updates for the rental market, including specific new models of compact wheel loaders (one electric) and a small articulated loader with a telescopic boom.

- In December 2024, United Rentals launched its interactive “Excavation Safety Training for Competent Persons Program” (developed with Mosaic Learning) to teach OSHA’s 1926 Subpart P standards, covering soil evaluation, protective systems (shoring, shielding), and more, using engaging methods like VR and the United Rentals Trench Safety app to boost jobsite safety for supervisors and workers.

- In October 2023, Komatsu began introducing new 20-ton class electric excavators (PC200LCE-11/PC210LCE-11) in Japan and Europe as rental units, with plans for gradual expansion to Asia, North America, and Australia as part of its 2050 carbon neutrality goal to electrify construction equipment.

Report Coverage

The research report offers an in-depth analysis based on Product, Earthmoving, Material Handling and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to experience steady rental penetration as contractors increasingly adopt asset-light operational models.

- Digital fleet management solutions will gain wider adoption, improving equipment utilization and reducing downtime.

- Demand for fuel-efficient and lower-emission equipment will accelerate as sustainability priorities expand across the region.

- Infrastructure upgrades in transport, energy, and urban development will continue to drive high utilization of earthmoving and material-handling fleets.

- Mining sector expansion will create recurring demand for heavy-duty rental machinery across multiple tonnage categories.

- Rental firms will strengthen service networks with additional maintenance hubs and mobile technical support units.

- Flexible leasing models and maintenance-inclusive contracts will become more widely preferred by contractors.

- Regional cross-border rental partnerships will increase, enabling fleet mobility for large infrastructure projects.

- Adoption of operator training programs and safety-focused services will rise to meet regulatory and project compliance needs.

- Fleet modernization will accelerate as rental providers replace aging machines with technologically advanced, telematics-enabled units.