Market Overview

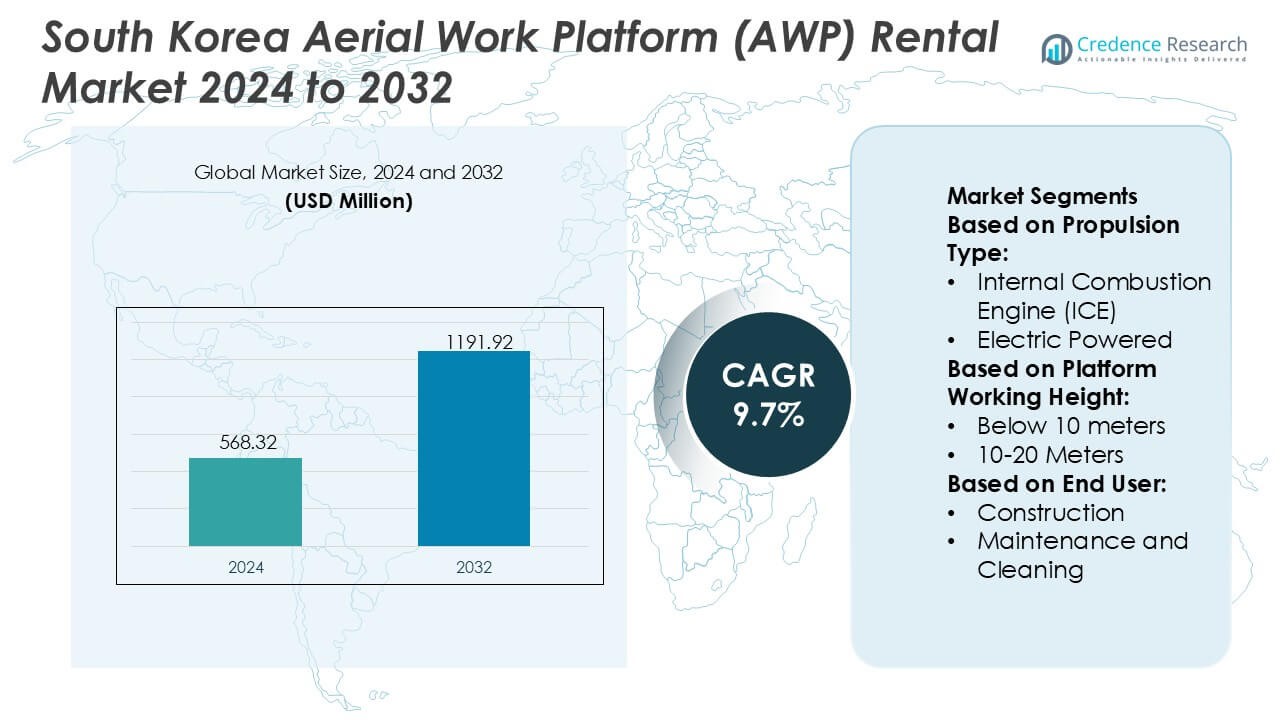

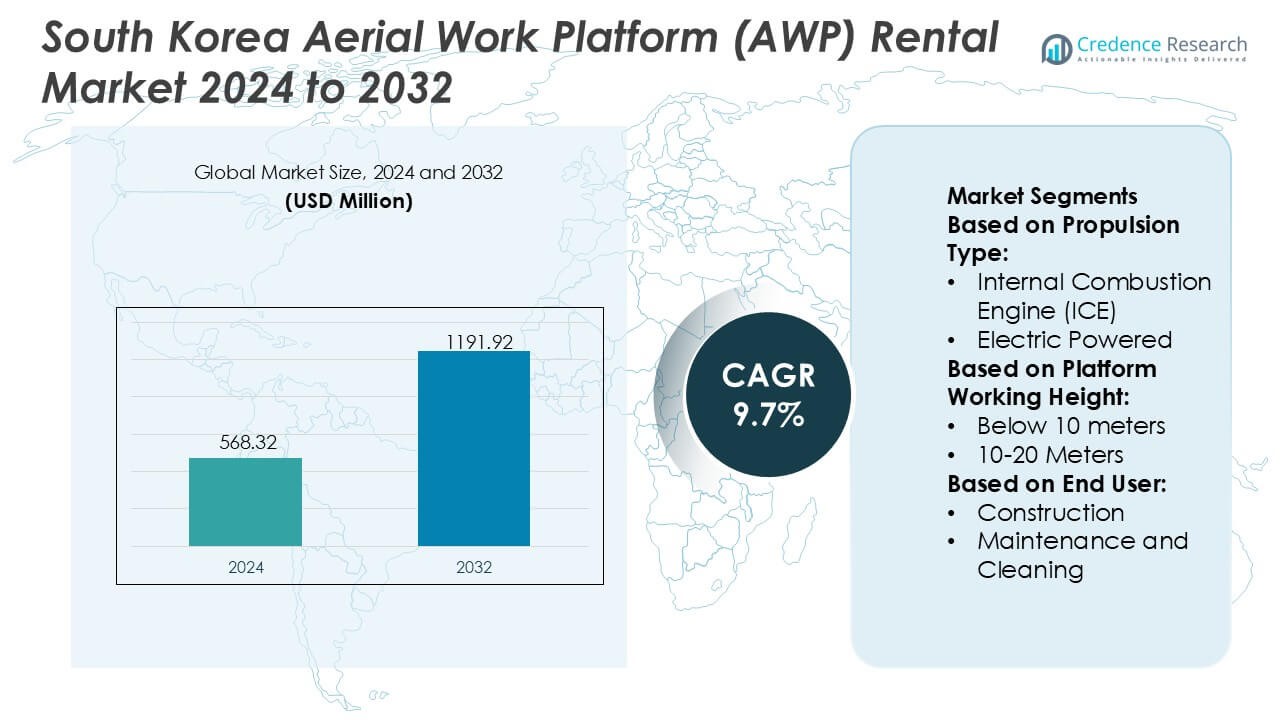

South Korea Aerial Work Platform (AWP) Rental Market size was valued USD 568.32 million in 2024 and is anticipated to reach USD 1191.92 million by 2032, at a CAGR of 9.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Korea Aerial Work Platform (AWP) Rental Market Size 2024 |

USD 568.32 Million |

| South Korea Aerial Work Platform (AWP) Rental Market, CAGR |

9.7% |

| South Korea Aerial Work Platform (AWP) Rental Market Size 2032 |

USD 1191.92 Million |

The South Korea AWP Rental Market is shaped by a competitive mix of global and regional rental specialists, OEM-affiliated providers, and diversified equipment service companies that strengthen market maturity through large fleets, strong service networks, and continuous investment in safety-compliant platforms. Leading players expand their presence by upgrading electric and hybrid AWPs, integrating telematics, and offering maintenance-inclusive rental models aligned with Korea’s safety and productivity standards. Asia-Pacific emerges as the dominant region with an exact 30% market share, supported by rapid construction activity, industrial expansion, and widespread adoption of modern access equipment across manufacturing, logistics, and infrastructure projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 568.32 million in 2024 and is projected to hit USD 1191.92 million by 2032 at a 9.7% CAGR, reflecting strong rental demand across construction, industrial maintenance, and commercial facility operations.

- Rising safety regulations, rapid electrification of fleets, and contractor preference for flexible rental models drive sustained adoption of AWP solutions across high-reach and indoor applications.

- Digital fleet management, telematics-enabled performance monitoring, and operator training services emerge as key trends strengthening competitiveness among leading rental providers.

- High capital costs for fleet modernization and price pressure from increasing competition remain key restraints, influencing rental companies to pursue efficiency-driven procurement and service strategies.

- Asia-Pacific holds the dominant 30% regional share, while scissor lifts maintain the largest segment share due to widespread use in logistics centers, manufacturing plants, and urban infrastructure development.

Market Segmentation Analysis:

By Propulsion Type

Internal combustion engine (ICE) platforms dominate the South Korea AWP rental market with an approximate 63% share, driven by their high load capacity, superior outdoor performance, and suitability for heavy-duty applications across construction and industrial sites. Rental companies continue to prefer ICE units for large infrastructure projects requiring extended operation times and robust terrain adaptability. Electric-powered AWPs gain traction in urban settings due to zero-emission performance and lower operating noise, yet their adoption remains secondary as charging availability and battery endurance constraints limit deployment in demanding field conditions.

- For instance, Cramo Plc strengthened its operational efficiency by integrating Trackunit telematics across more than 110,000 equipment assets, enabling real-time diagnostics that significantly reduced service response times and enhanced uptime for ICE-powered platforms.

By Platform Working Height

The 10–20 meters segment leads with around 47% market share, supported by its versatility across construction finishing work, facility maintenance, warehousing operations, and public infrastructure upgrades. Korean rental fleets prioritize this height range because it provides an optimal balance of reach, maneuverability, and cost efficiency for mid-rise projects common in metropolitan regions. While below-10-meter platforms serve indoor maintenance tasks and experience steady demand, higher segments such as 20–30 meters and above 30 meters expand gradually as utilities, telecom contractors, and industrial operators adopt specialized high-reach equipment for elevated structure inspection and repair requirements.

- For instance, Maxim Crane Works, L.P. enhanced high-reach capabilities by deploying Liebherr LTM 1650-8.1 cranes with a maximum telescopic boom length of 80 meters and a luffing jib extension of 91 meters, enabling precise elevated operations across complex project environments.

By End-User

Construction remains the dominant end-user, accounting for about 52% of rentals, driven by ongoing smart-city projects, redevelopment initiatives in Seoul and Busan, and rising investments in industrial and commercial real estate. Contractors depend on articulated and scissor lifts for safe elevation during structural work, façade installation, and interior finishing activities. Maintenance and cleaning companies strengthen recurring rental demand through routine facility upkeep in airports, shopping complexes, and high-rise buildings. Logistics, manufacturing, and aerospace applications grow steadily as companies automate vertical access operations, adopt safety-compliant lifting solutions, and modernize operational workflows.

Key Growth Drivers

Infrastructure Expansion and Construction Activity

South Korea’s sustained investment in transport infrastructure, industrial complexes, and urban redevelopment drives strong demand for AWP rentals. Contractors increasingly rely on rental fleets to avoid high ownership costs and maintain operational flexibility across short project cycles. Government-backed smart city and logistics hub developments further accelerate fleet utilization, particularly for boom and scissor lifts required in elevated construction tasks. Rental providers benefit from continuous project turnover, enabling higher equipment availability, optimized asset rotation, and steady revenue generation across both public and private sector construction pipelines.

- For instance, Kanamoto Co., Ltd. strengthened its technology-enabled rental operations by expanding its ICT-construction equipment fleet and managing over 620,000 rental assets, supported by a digital equipment-management system that automates maintenance scheduling and operational tracking.

Shift Toward Safety Compliance and Standardization

Strict workplace safety regulations imposed by the Ministry of Employment and Labor strengthen the adoption of AWP rentals as contractors pivot away from scaffolding-based solutions. Demand rises for equipment with advanced load monitoring, anti-entrapment systems, and platform stability technologies that reduce accident incidence on job sites. Rental companies invest in certified fleets and operator training programs to align with evolving safety codes. This regulatory-driven transition enhances equipment replacement cycles, elevates rental penetration rates, and supports accelerated procurement of newer, compliance-ready AWP models across diverse industries.

- For instance, United Rentals, Inc. enhanced safety and fleet governance by deploying its Total Control® platform across more than 375,000 connected rental assets, enabling real-time equipment tracking, operational alerts, and predictive maintenance insights that have reduced job-site incident rates through data-driven oversight.

Growth of Electric and Eco-Efficient Platforms

South Korea’s decarbonization goals and expanding indoor facility maintenance activities propel rapid adoption of electric AWPs within rental fleets. Low noise, zero emissions, and reduced operating costs make electric scissor and articulating lifts ideal for warehouses, commercial buildings, and manufacturing plants. Government incentives for cleaner equipment further support fleet electrification. Rental firms capitalize on this shift by increasing electric AWP availability, integrating telematics for efficiency monitoring, and promoting eco-friendly models that appeal to sustainability-focused corporate clients transitioning toward greener operational standards.

Key Trends & Opportunities

Rising Digitalization Through Telematics and Fleet Analytics

AWP rental companies increasingly deploy telematics platforms to monitor utilization rates, predict maintenance needs, and optimize fleet distribution. Real-time data on machine health, fuel consumption, and operating hours enhances decision-making and reduces downtime for end users. Digital dashboards also enable dynamic pricing models and automated contract management. These innovations create opportunities for rental firms to deliver value-added services, strengthen customer retention, and differentiate through data-driven fleet management capabilities aligned with South Korea’s broader industrial digitalization trend.

- For instance, Finning International Inc. leveraged Caterpillar’s digital ecosystem by connecting more than 100,000 machines to Cat® Product Link™, enabling analytics that process over 150 million telematics data points daily to enhance maintenance accuracy and equipment availability.

Expansion of Integrated Rental Solutions and On-Site Services

Customers increasingly prefer end-to-end rental packages that include operator training, on-site technical support, safety inspections, and equipment logistics. This shift enables rental companies to move beyond transactional equipment leasing into solution-oriented service models. Providers offering bundled services gain advantages in large-scale construction, shipbuilding, and facility management projects that demand predictable uptime. This trend creates opportunities to diversify revenue streams, deepen customer relationships, and strengthen long-term contract portfolios with enterprises seeking operational simplicity.

- For instance, Byrne Equipment Rental operates a fleet of more than 14,000 rental assets across 20 operational hubs, supported by integrated service teams that deliver on-site maintenance and technical assistance for complex multi-equipment project requirements.

Growing Adoption of High-Capacity and Specialty Platforms

Demand grows for AWPs tailored to complex industrial environments such as shipyards, semiconductor plants, and heavy manufacturing facilities. High-capacity boom lifts, narrow-access lifts, and rough-terrain models see rising rental traction due to specialized height and maneuverability requirements. This shift offers rental companies opportunities to invest in differentiated fleets that address niche applications. Manufacturers increasingly introduce compact yet high-reach platforms, encouraging rental firms to upgrade inventories and capture unmet demand across South Korea’s technologically advanced industrial sectors.

Key Challenges

High Capital Expenditure and Fleet Replacement Burden

AWP rental companies face significant financial pressure due to high equipment acquisition costs and rapid technology-driven replacement cycles. Maintaining a modern, safety-compliant, and diverse fleet requires continuous capital infusion, particularly as demand shifts toward electric and telematics-enabled models. Smaller rental players struggle to compete with large providers capable of large-scale fleet renewal. This cost burden constrains expansion, limits geographic reach, and may slow adoption of advanced platforms among budget-sensitive operators.

Intensifying Competition and Price Pressure

The South Korean AWP rental market experiences rising competition from expanding domestic rental firms and global players strengthening their local presence. Fleet commoditization leads to aggressive pricing strategies, reducing margins for rental providers. Customers increasingly negotiate lower rental rates and flexible contract terms, further pressuring profitability. Companies that fail to differentiate through service quality, fleet specialization, or digital capabilities face declining market share. This challenge reinforces the need for strategic investment and operational optimization across the rental ecosystem.

Regional Analysis

North America

North America accounts for 34% of the global AWP rental market and acts as a benchmark region influencing fleet modernization trends in South Korea. The United States drives innovation through high adoption of electric AWPs, advanced telematics, and stringent OSHA safety regulations, which shape Korean rental fleet standards. Major rental consolidations and structured service contracts in North America also guide South Korean firms seeking efficiency-driven leasing models. Strong R&D investment by OEMs in boom and scissor lift technologies promotes the transfer of best practices, enabling Korean providers to expand service quality and equipment reliability.

Europe

Europe holds a 28% share and significantly impacts South Korea’s AWP rental ecosystem through its leadership in sustainability-focused equipment and emissions-compliant lift platforms. EU regulations have accelerated electric and hybrid AWP adoption, prompting Korean rental companies to mirror similar fleet upgrades to meet indoor maintenance and green-building requirements. High rental penetration rates in Western Europe provide operational insights into scalable service models. Additionally, Europe’s focus on operator safety training and machine automation influences Korean rental firms to enhance certification programs, strengthen compliance frameworks, and adopt digital fleet-management systems for performance monitoring.

Asia-Pacific

Asia-Pacific represents 30% of the global AWP rental market and remains the most influential region for South Korea due to shared industrial structures, rapid construction growth, and expanding manufacturing investments. Strong demand from China, Japan, and Southeast Asia accelerates regional equipment circulation and drives competitive pricing strategies that impact Korean rental decisions. South Korea benefits from proximity to leading OEM manufacturing hubs, enabling faster access to specialized equipment and reduced logistical costs. The region’s shift toward electric platforms, high-reach boom lifts, and safety-compliant models further strengthens alignment with Korea’s infrastructure modernization and industrial maintenance needs.

Latin America

Latin America captures a 5% market share and provides niche but relevant comparative insights for South Korea, particularly in the adoption of AWPs for infrastructure upgrades and utility maintenance. The region’s gradual transition from scaffolding to mechanized access solutions mirrors earlier trends seen in Korea, reinforcing the long-term growth trajectory of rental-based equipment models. Rental companies in Brazil and Mexico increasingly prioritize fleet standardization and preventive maintenance practices, offering reference points for Korean operators refining cost-efficiency and uptime performance. Although smaller in scale, Latin America’s evolving contractor preferences support global learning in rental optimization strategies.

Middle East & Africa

The Middle East & Africa region holds a 3% share and influences South Korea’s AWP rental market through its reliance on high-capacity, rough-terrain AWPs used in oil, gas, and mega-infrastructure projects. Demand for durability, extended-reach platforms, and strict site safety compliance shapes OEM product enhancements that later diffuse into Asian markets, including Korea. Gulf nations’ preference for long-term rental contracts and fleet partnerships offers operational parallels for Korean firms targeting industrial and energy-sector clients. Despite relatively low market contribution, MEA provides insights into specialized high-performance fleet utilization under challenging environmental and operational conditions.

Market Segmentations:

By Propulsion Type:

- Internal Combustion Engine (ICE)

- Electric Powered

By Platform Working Height:

- Below 10 meters

- 10-20 Meters

By End User:

- Construction

- Maintenance and Cleaning

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape in the South Korea AWP Rental Market players such as Cramo Plc, Maxim Crane Works L.P., Ahern Rentals Inc., Kanamoto Co., Ltd., United Rentals, Inc., Finning International Inc., Byrne Equipment Rental, Liebherr-International AG, Caterpillar Inc., and AKTIO Corporation. the South Korea AWP Rental Market is shaped by a blend of global rental leaders, specialized regional providers, and OEM-backed service networks competing through fleet capability, safety compliance, and technology-driven efficiency. Companies increasingly invest in electric and hybrid AWPs, predictive maintenance tools, and operator training programs to meet rising safety regulations and sustainability expectations. Digital fleet management, telematics integration, and customized rental packages strengthen differentiation as customers seek cost-efficient, uptime-focused solutions for construction, maintenance, and industrial applications. Market competition continues to intensify as providers expand service footprints, upgrade high-reach platforms, and adopt data-driven rental models that enhance operational responsiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cramo Plc

- Maxim Crane Works, L.P.

- Ahern Rentals Inc.

- Kanamoto Co., Ltd.

- United Rentals, Inc.

- Finning International Inc.

- Byrne Equipment Rental

- Liebherr-International AG

- Caterpillar Inc.

- AKTIO Corporation

Recent Developments

- In October 2025, Blade Platforms is a large, truck-mounted aerial lift launched in for heavy-duty utility and infrastructure work, offering 187 feet of reach for tasks like transmission line maintenance, demonstrating innovation in the Mobile Elevated Work Platform (MEWP) market, which is seeing growth for specialized equipment.

- In February 2025, JLG Industries, one of Oshkosh Corporation’s businesses, launched a newly designed aviation package for its electric-drive scissor lifts, JLG ES2646. The package is intended for aircraft manufacturing and maintenance requirements and includes cutting-edge sensor technology, enhanced safety capabilities, contact-free maintenance capacity.

- In September 2024, Skyjack launched the new micro XStep for its SJ3213 micro and SJ3219 micro scissor lifts, an accessory designed to provide extra reach (around 19 inches) in tight spaces like ceilings or HVAC work, boosting operator productivity without needing a new machine, and it’s easily stowable or removable.

Report Coverage

The research report offers an in-depth analysis based on Propulsion Type, Platform Working Height, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as construction, logistics, and industrial facilities increase demand for safe and efficient elevated access solutions.

- Electric and hybrid AWPs will see accelerated adoption as companies prioritize low-emission and noise-free operations.

- Digital fleet management using telematics and analytics will become standard across rental providers to improve utilization and reduce downtime.

- Safety regulations will tighten, pushing contractors to rely more heavily on certified rental fleets rather than owned or traditional access equipment.

- High-reach and specialty platforms will gain traction as complex industrial projects require advanced maneuverability and stability.

- Rental firms will broaden service portfolios with on-site support, operator training, and maintenance-inclusive contracts.

- Fleet modernization cycles will intensify as companies replace older units with more efficient, compliance-ready platforms.

- Partnerships between OEMs and rental providers will strengthen to ensure faster equipment availability and technical support.

- Indoor maintenance applications will boost demand for compact and narrow-access electric lifts.

- Increased urban redevelopment and industrial automation will support long-term, steady growth in rental fleet utilization.