Market Overview

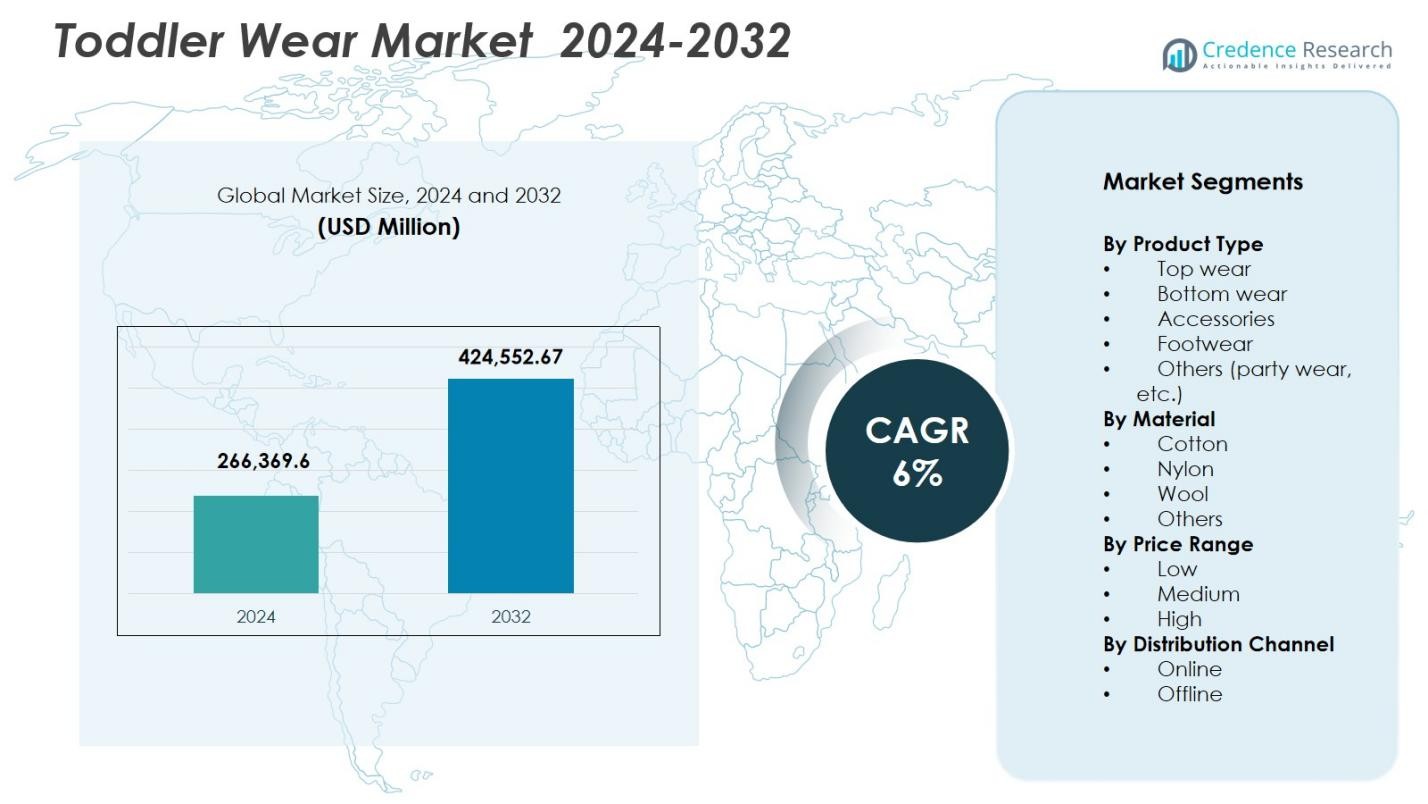

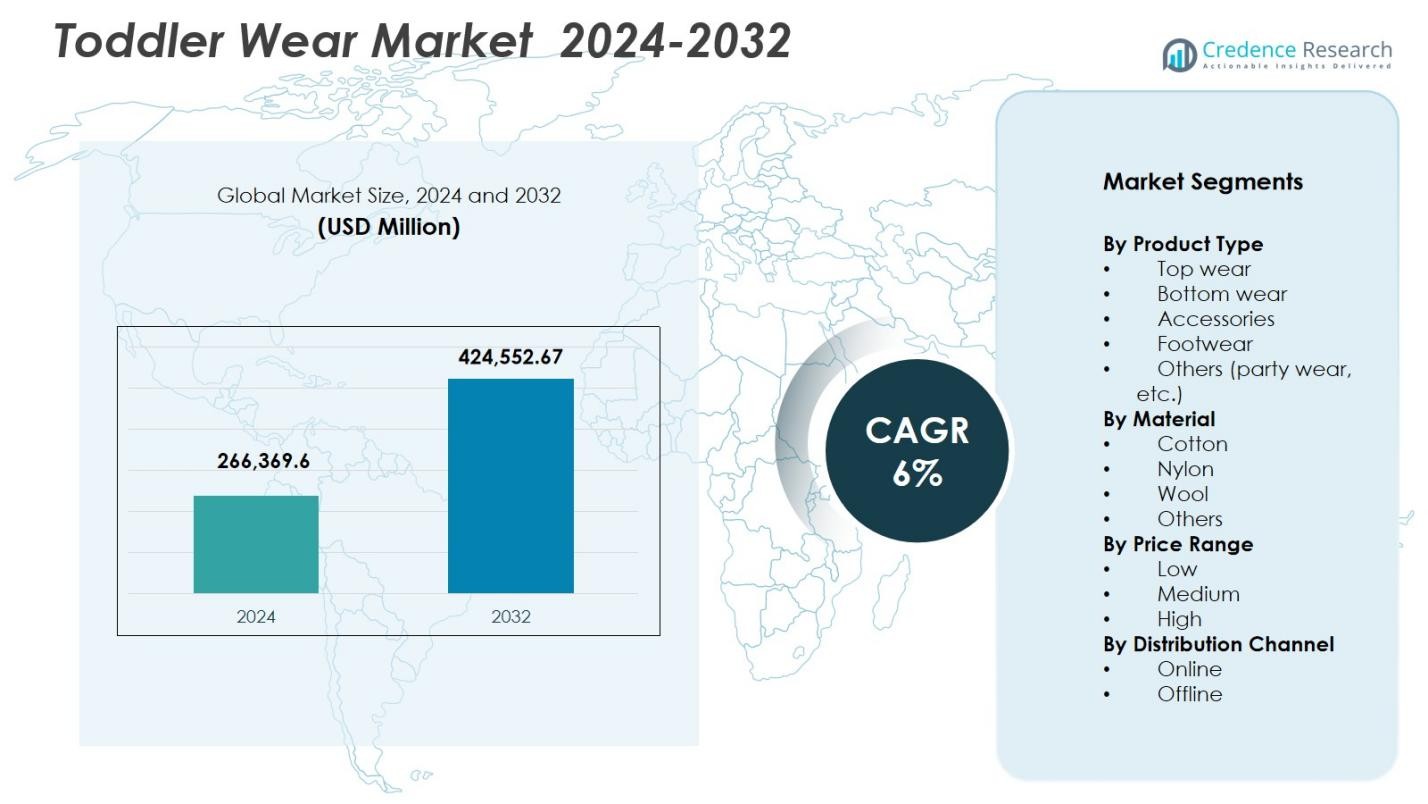

Toddler Wear Market size was valued at USD 266,369.6 million in 2024 and is anticipated to reach USD 424,552.67 million by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Toddler Wear Market Size 2024 |

USD 266,369.6 Million |

| Toddler Wear Market , CAGR |

6% |

| Toddler Wear Market Size 2032 |

USD 424,552.67 Million |

Toddler Wear Market is shaped by established global and regional brands such as Nike, Adidas, H&M, Carter’s, Gap Kids, Gerber Childrenswear, Marks & Spencer, OshKosh B’gosh, Burberry, and J. Crew Kids, which focus on product quality, safety standards, and design innovation to strengthen brand presence. These players expand cotton and organic collections while leveraging omnichannel retail strategies to improve reach and customer engagement. Asia-Pacific leads the market with a 34.8% share, supported by high birth rates, rapid urbanization, and rising disposable incomes. North America follows with a 29.6% share, driven by strong brand loyalty and premium product demand, while Europe holds 24.3%, reflecting sustainability-focused consumer preferences and developed retail infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Toddler Wear Market was valued at USD 266,369.6 million in 2024 and is projected to grow at a CAGR of 6% through 2032, driven by steady replacement demand and rising parental spending on toddler apparel.

- Market growth is supported by increasing toddler population, rising focus on comfort and safety, and higher demand for cotton-based clothing, with top wear leading by product type holding a 38.6% segment share.

- Sustainability trends are strengthening demand for organic and skin-friendly fabrics, with cotton dominating by material at a 52.4% share, while licensed character apparel and customization continue to attract repeat purchases.

- Pricing pressure and raw material volatility act as key restraints, as intense brand presence across low to premium ranges increases competition and limits margin expansion for mid-priced products.

- Asia-Pacific leads with a 34.8% regional share due to high birth rates and urbanization, followed by North America at 29.6% and Europe at 24.3%, supported by strong retail infrastructure and brand adoption.

Market Segmentation Analysis:

By Product Type:

By product type, top wear dominates the Toddler Wear Market, accounting for 38.6% market share, driven by high replacement frequency, seasonal demand, and strong parental focus on comfort and daily usability. Products such as T-shirts, shirts, and sweaters experience consistent repeat purchases due to rapid toddler growth. Bottom wear follows due to everyday necessity, while footwear and accessories gain traction through coordinated outfits and gifting trends. Increasing design variety, licensed characters, and breathable fabrics further strengthen top wear demand across both mass and premium brands.

- For instance, Carter’s offers toddler T-shirts featuring licensed characters like Disney’s Mickey Mouse and Paw Patrol, designed in soft cotton for breathable daily comfort and available in packs for frequent replacements.

By Material:

By material, cotton leads the Toddler Wear Market with a 52.4% market share, supported by its softness, breathability, and hypoallergenic properties. Parents prioritize cotton garments to reduce skin irritation and ensure comfort during prolonged wear. Regulatory emphasis on child-safe textiles and rising awareness of fabric quality reinforce cotton’s dominance. Nylon and wool remain niche, used primarily for outerwear and seasonal clothing. Innovation in organic cotton and sustainable sourcing continues to expand cotton-based collections across global and regional toddler wear brands.

- For instance, Burt’s Bees Baby produces toddler apparel made from 100% organic cotton, emphasizing chemical-free, breathable materials suited for sensitive skin.

By Price Range:

By price range, the medium-priced segment holds a 46.8% market share, balancing affordability with quality, durability, and brand trust. Consumers in this segment seek well-designed, safe, and long-lasting apparel without premium pricing. Rising disposable incomes and preference for branded toddler wear drive sustained demand in this range. Low-priced products remain relevant in emerging markets, while high-priced offerings attract urban consumers seeking organic materials and designer labels. Frequent purchases due to fast growth cycles strongly favor the medium-price category.

Key Growth Drivers

Demographic Expansion and Rising Toddler Population

The Toddler Wear Market is strongly supported by steady growth in the global toddler population, particularly in Asia-Pacific, the Middle East, and parts of Latin America. Improving healthcare infrastructure and rising urbanization contribute to higher birth survival rates, expanding the consumer base. As toddlers outgrow clothing quickly, parents make frequent repeat purchases, sustaining consistent demand. This demographic expansion encourages manufacturers to diversify size ranges, seasonal collections, and gender-neutral designs, ensuring continuous product turnover and long-term market stability.

- For instance, Hopscotch launches extensive kids’ apparel collections, including over 300 styles for toddlers across themes and accessories.

Increasing Parental Emphasis on Comfort, Safety, and Quality

Growing parental awareness regarding toddler comfort and safety is a major driver of market growth. Consumers increasingly prefer soft, breathable, and hypoallergenic fabrics that support sensitive skin and active movement. Compliance with child-safety standards related to dyes, stitching, and accessories further influences purchasing decisions. Brands focusing on certified materials, ergonomic fits, and non-toxic manufacturing processes gain higher trust and repeat sales, strengthening demand across mid-range and premium toddler wear categories.

- For instance, OEKO‑TEX® STANDARD 100 certifies that every component of a textile product (including threads, labels, and fasteners) is tested for harmful substances, and it applies its strictest requirements to products for babies and toddlers up to age 3 (Product Class I).

Expansion of Organized Retail and Digital Sales Channels

The rapid expansion of organized retail formats and e-commerce platforms significantly boosts the Toddler Wear Market. Specialty baby stores, brand-exclusive outlets, and department stores enhance product accessibility and brand visibility. In parallel, online platforms offer wider assortments, convenient shopping, and flexible return policies. Digital marketing, virtual sizing tools, and targeted promotions increase consumer engagement, enabling brands to reach broader demographics while improving purchase frequency and overall market penetration.

Key Trends and Opportunities

Rising Demand for Sustainable and Organic Toddler Apparel

Sustainability has emerged as a key trend and opportunity in the Toddler Wear Market. Parents increasingly seek apparel made from organic cotton, eco-friendly dyes, and responsibly sourced materials. Transparent supply chains and sustainability certifications strengthen brand credibility and support premium pricing. Manufacturers investing in environmentally responsible production benefit from higher consumer trust and long-term brand loyalty, particularly among environmentally conscious urban families.

- For instance, Colored Organics produces tees, sweaters, and leggings for toddlers sized 0M–6Y from 100% organic cotton using GOTS-certified facilities in India that ensure sweatshop-free production and fair wages.

Growth of Customization and Licensed Character Clothing

Customization and licensed character apparel present strong opportunities for market expansion. Parents favor personalized designs and clothing featuring popular cartoon or entertainment characters, enhancing emotional appeal and gifting value. Licensed collaborations increase brand visibility and impulse purchases. Advancements in digital printing and flexible manufacturing enable cost-effective customization, helping brands differentiate offerings, improve margins, and align with evolving consumer preferences.

- For instance, Disney partnered with H&M and Zara to release limited-edition children’s collections featuring Mickey Mouse, Frozen, and Marvel themes collaborations that strengthened the brands’ emotional connection with families.

Key Challenges

Raw Material Price Fluctuations and Cost Pressures

Volatility in raw material prices, particularly cotton and synthetic fibers, poses a significant challenge for the Toddler Wear Market. Price instability affects production costs, inventory planning, and profit margins. Manufacturers in the low- and mid-price segments face difficulty passing cost increases to consumers. Managing sourcing efficiency and maintaining consistent product quality remain critical challenges, especially for smaller and regional players with limited supplier diversification.

Intense Competition and Market Fragmentation

The Toddler Wear Market is highly competitive, with numerous global, regional, and local brands operating across price segments. Market fragmentation increases pricing pressure and shortens product life cycles. Consumers frequently switch brands based on design trends, promotions, or pricing, limiting long-term loyalty. To remain competitive, companies must invest continuously in product innovation, marketing, and supply chain efficiency, raising operational complexity and costs.

Regional Analysis

North America

North America holds a 29.6% market share in the Toddler Wear Market, driven by high disposable incomes, strong brand loyalty, and consistent spending on premium and mid-priced toddler apparel. Parents emphasize safety standards, fabric quality, and comfort, supporting demand for cotton and organic clothing. Well-established retail networks, including specialty baby stores and large-format retailers, ensure product availability. E-commerce further strengthens sales through convenience and wide assortments. Frequent replacement purchases due to rapid toddler growth sustain steady demand across both online and offline channels.

Europe

Europe accounts for a 24.3% market share, supported by strong consumer awareness of sustainability, ethical sourcing, and regulatory compliance in children’s clothing. Parents prefer durable, eco-friendly materials and certified fabrics, driving demand for organic and premium toddler wear. Fashion-conscious purchasing behavior and seasonal collections encourage repeat buying. Developed retail infrastructure and growing omnichannel strategies enhance accessibility. Key markets such as Germany, the UK, and France continue to lead regional consumption through strong brand presence and private-label offerings.

Asia-Pacific

Asia-Pacific dominates the Toddler Wear Market with a 34.8% market share, fueled by high birth rates, rapid urbanization, and expanding middle-class populations. Rising disposable incomes and increasing brand awareness drive demand for both mass-market and mid-priced toddler clothing. Countries including China and India contribute significantly through large population bases and growing e-commerce penetration. Local manufacturing capabilities improve affordability, while digital retail platforms expand reach. Frequent apparel replacement and strong online sales momentum position the region as the primary growth engine.

Latin America

Latin America holds a 6.2% market share, supported by improving economic stability, urban expansion, and rising access to organized retail. Parents increasingly invest in practical and affordable toddler clothing, favoring mid- and low-priced segments. Offline retail remains the dominant sales channel, though e-commerce adoption continues to grow. Brazil and Mexico lead regional demand due to population size and retail development. Growing brand visibility and expanding distribution networks sustain gradual but consistent market growth.

Middle East & Africa

The Middle East & Africa region accounts for a 5.1% market share, driven by high birth rates and a young demographic profile. Demand is concentrated in urban areas where international brands and modern retail formats are expanding. Parents prioritize breathable fabrics and climate-appropriate designs, supporting cotton-based toddler wear. Premium products gain traction in Gulf countries, while affordability remains critical in African markets. Improving retail infrastructure and digital commerce adoption continue to support regional market expansion.

Market Segmentations:

By Product Type

- Top wear

- Bottom wear

- Accessories

- Footwear

- Others (party wear, etc.)

By Material

By Price Range

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Toddler Wear Market features key players such as Adidas, Nike, H&M, Carter’s, Gap Kids, Gerber Childrenswear, Marks & Spencer, OshKosh B’gosh, Burberry, and J. Crew Kids. The market remains highly competitive, with companies focusing on product differentiation through fabric quality, safety compliance, and design innovation. Leading brands strengthen their positions by expanding cotton and organic product lines, addressing growing parental concerns around comfort and skin safety. Pricing strategies span low to premium ranges, enabling broad consumer reach across developed and emerging regions. Companies actively invest in omnichannel retail models, combining brand-owned stores with strong e-commerce platforms to improve accessibility and customer engagement. Licensing partnerships, seasonal collections, and character-based apparel support higher sales volumes. Continuous marketing investment, supply chain optimization, and sustainability initiatives remain critical strategies for maintaining brand relevance and long-term competitiveness in the global toddler wear industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Carter’s launched its new toddler-focused apparel brand Otter Avenue™, enhancing its product portfolio with comfortable, stylish outfits designed specifically for toddlers and reinforcing its market presence through targeted offerings.

- In October 2025, Loomkins introduced an innovative kidswear range paired with BIS-certified plush toys, combining premium toddler apparel with play-oriented accessories to differentiate in the children’s fashion segment.

- In December 2025, Apparel Group India announced a strategic partnership with Levi Strauss & Co. to launch Levi’s Kids in the Indian market, introducing durable denim collections for toddlers through e-commerce and planned standalone stores.

- In December 2025, Centric Brands acquired the Vingino Group, a Netherlands-based children’s fashion brand offering toddler apparel with a focus on denim and multi-category designs, to expand its global kids division.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Price Range, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will continue to rise due to steady growth in the global toddler population and frequent clothing replacement cycles.

- Parents will increasingly prioritize comfort, safety, and skin-friendly fabrics when purchasing toddler apparel.

- Cotton and organic materials will gain stronger preference as awareness of sustainability and health impacts grows.

- Mid-priced toddler wear will remain the most attractive segment due to its balance of quality and affordability.

- E-commerce adoption will expand further, supported by convenience, wider assortments, and flexible return policies.

- Offline retail will retain importance through physical inspection of fabric quality and size accuracy.

- Licensed character and themed apparel will drive impulse buying and seasonal sales growth.

- Product customization and personalization options will strengthen brand differentiation and customer loyalty.

- Emerging markets will contribute higher volume growth due to urbanization and rising disposable incomes.

- Brands investing in sustainable practices and omnichannel strategies will achieve stronger long-term positioning.