Market Overview

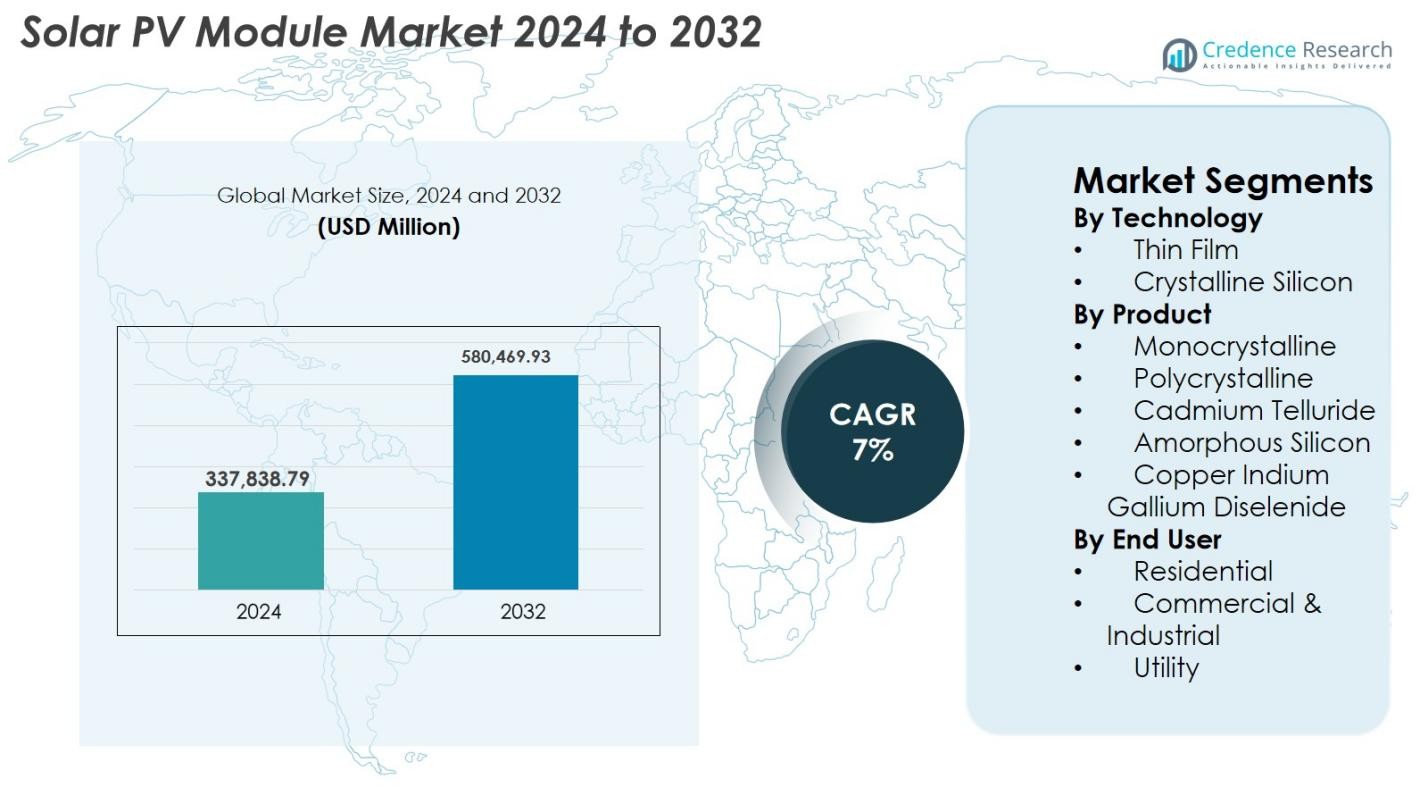

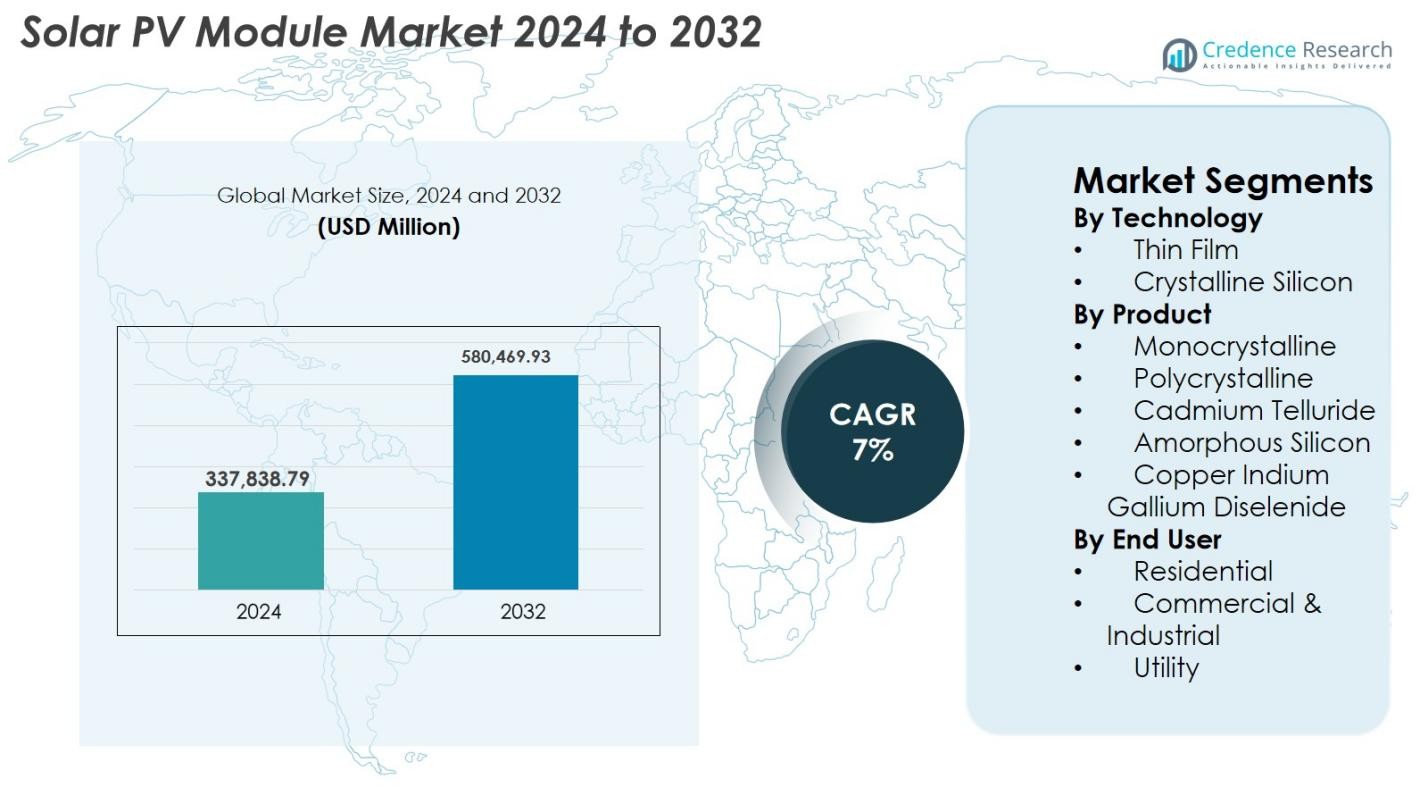

Solar PV Module Market size was valued at USD 337,838.79 Million in 2024 and is anticipated to reach USD 580,469.93 Million by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solar PV Module Market Size 2024 |

USD 337,838.79 Million |

| Solar PV Module Market, CAGR |

7% |

| Solar PV Module Market Size 2032 |

USD 580,469.93 Million |

Solar PV Module Market is shaped by leading manufacturers such as LONGi, Jinko Solar, JA Solar Technology, Canadian Solar, First Solar, Hanwha Q CELLS, GCL-SI, Trina Solar, and Risen Energy, all of which compete through high-efficiency monocrystalline, bifacial, and advanced cell technologies. These companies continue expanding production capacity and global distribution networks to meet rising demand across utility, commercial, and residential sectors. Asia-Pacific remains the dominant region, commanding 41.6% of the global market in 2024, driven by large-scale installations in China and India. Europe follows with 25.7%, supported by strong sustainability mandates, while North America holds 21.4% through policy-backed deployment momentum.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Solar PV Module Market reached USD 337,838.79 million in 2024 and is projected to grow to USD 580,469.93 million by 2032, registering a CAGR of 7% during the forecast period.

- Market growth is driven by expanding utility-scale solar projects, declining module prices, and supportive government incentives promoting clean energy adoption across residential, commercial, and industrial sectors.

- Key trends include rising demand for high-efficiency monocrystalline modules, rapid adoption of bifacial and large-format panels, and increasing investment in automated, low-carbon manufacturing processes.

- The competitive landscape is led by major players such as LONGi, Jinko Solar, JA Solar Technology, Canadian Solar, First Solar, and Hanwha Q CELLS, focusing on technological innovation and global capacity expansion.

- Asia-Pacific dominates with a 41.6% share, followed by Europe at 25.7% and North America at 21.4%; the utility segment leads overall adoption with a 54.2% share due to large-scale project deployment.

Market Segmentation Analysis

Market Segmentation Analysis

By Technology

Thin Film and Crystalline Silicon technologies form the core of the Solar PV Module Market, with crystalline silicon dominating the segment with a market share of 78.4% in 2024. Its leadership is driven by high energy conversion efficiency, long operational life, and broad suitability across residential, commercial, and utility-scale deployments. Thin Film technologies such as CdTe and CIGS continue to gain traction due to their lightweight structure, superior low-light performance, and lower manufacturing costs, making them attractive for large-scale utility installations and emerging applications like BIPV and flexible solar products.

- For instance, in 2024, First Solar’s CdTe modules achieved a certified 23.1% efficiency, reinforcing the competitiveness of thin-film architectures.

By Product

Among monocrystalline, polycrystalline, cadmium telluride, amorphous silicon, and CIGS modules, monocrystalline panels lead the Solar PV Module Market with a 62.7% share in 2024. Their dominance stems from superior efficiency, higher power density, and rapidly declining manufacturing costs due to technological improvements and large-scale production. Polycrystalline modules retain relevance in cost-sensitive markets, while thin-film variants such as CdTe and CIGS are favored for utility-scale deployments and projects requiring better temperature tolerance. The shift toward high-efficiency n-type TOPCon and HJT monocrystalline modules further reinforces their market leadership.

- For instance, First Solar’s Series 7 CdTe modules delivered up to 540 W output with enhanced thermal performance, making them the top choice for utility-scale plants.

By End User

The residential, commercial & industrial, and utility sectors collectively drive demand, with the utility segment commanding a 54.2% share in 2024, the highest within the Solar PV Module Market. Growth is driven by large-scale solar parks, favorable auction mechanisms, and rapid adoption of high-wattage bifacial and monocrystalline modules that maximize energy yield. The commercial & industrial segment expands steadily due to rising rooftop solar adoption, corporate decarbonization targets, and cost-saving initiatives. Residential demand benefits from supportive net-metering policies, energy independence goals, and increased affordability of distributed solar solutions.

Key Growth Drivers

Rising Global Renewable Energy Targets and Policy Support

Governments worldwide are accelerating solar adoption through ambitious renewable-energy targets, tax incentives, net-metering programs, and large-scale solar procurement auctions. These policy frameworks significantly reduce capital costs and offer long-term financial visibility for investors, driving the deployment of high-efficiency PV modules across residential, commercial, and utility-scale sectors. Countries such as China, India, and the U.S. continue to expand solar capacity additions, encouraged by climate commitments, decarbonization mandates, and energy security objectives. Additionally, the declining cost per watt of PV modules, improvement in manufacturing efficiencies, and expansion of domestic production under subsidy-driven schemes strengthen market growth. Subsidized rooftop programs, feed-in tariffs, and low-interest financing further enhance consumer adoption. Collectively, these regulatory and financial enablers create a favorable ecosystem that accelerates solar module demand globally and positions solar as a mainstream power source.

- For instance, in 2024, India’s PM-Surya Ghar initiative offered rooftop solar subsidies covering up to 40% of system costs, accelerating household installations.

Advancements in High-Efficiency Module Technologies

Continuous innovation in module design such as the evolution from p-type to n-type architectures, bifacial designs, and advanced cell technologies like TOPCon and HJT significantly boosts energy yield and performance in diverse climatic conditions. These high-efficiency modules reduce the levelized cost of electricity (LCOE), enabling more competitive solar projects, particularly in space-constrained installations where power density is critical. Manufacturers are scaling up larger module formats, increasing cell counts, and integrating multi-busbar and half-cut configurations to minimize resistive losses and enhance durability. Such innovations not only improve power output but also extend module lifespan and reduce degradation rates. Utility developers increasingly prefer high-efficiency modules for maximizing return on investment, while commercial and residential users benefit from lower installation costs and improved system productivity. The ongoing R&D focus ensures continuous performance gains that accelerate market adoption.

- For instance, JA Solar introduced DeepBlue 4.0 Pro modules with reinforced multi-busbar layouts to reduce resistance and enhance long-term reliability.

Expanding Utility-Scale Solar Projects and Corporate Sustainability Commitments

The rapid global rise in utility-scale solar developments represents one of the strongest demand catalysts for PV modules. Governments and private developers are commissioning gigawatt-scale solar parks to diversify energy portfolios, reduce fossil-fuel dependency, and meet long-term climate obligations. Simultaneously, corporate sustainability initiatives driven by ESG mandates and net-zero targets are accelerating investment in large commercial solar installations and power purchase agreements (PPAs). Major industries such as data centers, manufacturing, logistics, and retail are deploying on-site and off-site solar solutions to optimize energy costs and reduce carbon footprints. The integration of bifacial, high-wattage monocrystalline modules further enhances project viability by increasing yield per acre. As solar becomes a strategic asset for businesses and national grids, the sustained expansion of large-scale deployments significantly drives module demand worldwide.

Key Trends & Opportunities

Increasing Shift Toward Bifacial and Large-Format Modules

A major trend reshaping the Solar PV Module Market is the rapid transition to bifacial and large-format modules that deliver superior energy generation at lower LCOE. Bifacial modules capture sunlight from both sides, increasing energy output by 5–20% depending on installation conditions, making them highly attractive for utility-scale developers. Simultaneously, large-format modules such as 182 mm and 210 mm wafer-based designs enable higher wattage ratings, reduced BOS costs, and improved installation efficiencies. This shift also creates opportunities for innovations in module glass, encapsulants, and tracker systems. As global projects seek higher operational efficiency and lower lifecycle costs, demand for these advanced module formats continues to grow. The trend aligns with the increasing adoption of digital monitoring systems, smart inverters, and AI-driven optimization tools.

- For instance, in 2024, Trina Solar’s Vertex N 210 mm bifacial modules delivered up to 700 W output, improving energy yield for large utility plants.

Growing Role of Building-Integrated Photovoltaics (BIPV)

BIPV is emerging as a high-potential opportunity as urban infrastructure evolves toward sustainability and energy self-sufficiency. Solar modules integrated into building facades, rooftops, skylights, and shading structures transform architectural components into energy-generating assets, reducing grid dependence while improving aesthetics. The development of semi-transparent, colored, and customizable PV glass expands adoption possibilities for commercial buildings, metro stations, airports, and residential high-rises. This trend aligns strongly with green building certifications and net-zero construction mandates in regions such as Europe, North America, and Asia. Advancements in thin-film and perovskite materials further enhance BIPV viability by improving low-light performance and enabling lightweight designs. As cities accelerate the shift toward carbon-neutral infrastructure, BIPV offers a strong long-term growth opportunity for module manufacturers.

- For instance, in 2024, Onyx Solar installed semi-transparent PV glass at the Boston Logan Airport terminal, generating onsite renewable energy while maintaining natural daylighting.

Key Challenges

Volatility in Raw Material Prices and Supply Chain Constraints

The Solar PV Module Market faces significant pressure from fluctuations in raw materials such as polysilicon, silver, aluminum, and specialty glass, all of which strongly influence production costs. Supply chain disruptions driven by geopolitical tensions, logistics bottlenecks, and concentrated manufacturing hubs create uncertainty for developers and manufacturers. Price volatility affects long-term project planning, tender pricing, and procurement strategies, sometimes delaying project execution. Moreover, high dependence on a limited number of global polysilicon suppliers increases vulnerability during demand surges. These challenges call for diversified sourcing, alternative metallization technologies like copper, and expanded regional manufacturing to improve supply resilience and stabilize costs across the solar value chain.

Land Availability, Grid Integration, and Intermittency Issues

As solar installations expand rapidly, developers face increasing constraints in securing suitable, extensive land parcels for utility-scale projects, especially in densely populated regions. Grid integration challenges including transmission congestion, limited substation capacity, and the need for advanced grid-balancing infrastructure pose additional obstacles. Intermittency issues require supplementary investments in energy storage, hybrid systems, or modernized grid technologies to maintain reliability. Regulatory delays, environmental approvals, and community concerns can extend project timelines. These limitations highlight the need for coordinated grid expansion, improved policy frameworks, and accelerated adoption of storage technologies. Addressing these issues is critical for sustaining the long-term growth of large-scale solar deployment.

Regional Analysis

North America

North America holds 21.4% of the Solar PV Module Market in 2024, driven by strong federal incentives, renewable portfolio standards, and the rapid expansion of utility-scale solar projects in the U.S. The Inflation Reduction Act continues to catalyze domestic manufacturing, reducing import dependency and supporting large project pipelines. Growing corporate procurement of clean energy, rising residential rooftop adoption, and state-level net-metering programs further accelerate demand. Canada strengthens deployment through decarbonization commitments, while Mexico’s industrial sector increasingly adopts solar to lower energy costs. Technological advancements and grid modernization efforts reinforce steady growth.

Europe

Europe accounts for 25.7% of the Solar PV Module Market in 2024, supported by aggressive carbon-neutrality goals, rising electricity prices, and strong investments in distributed solar systems. Germany, Spain, the Netherlands, and France lead installations due to supportive feed-in tariffs, rebates, and sustainability mandates. The EU’s Green Deal and solar manufacturing resilience initiatives are encouraging regional production and reducing reliance on Asian imports. Rooftop solar adoption is rising across residential, commercial, and industrial sectors, while large-scale solar parks gain momentum. Demand for bifacial and BIPV modules continues to expand across the region.

Asia-Pacific

Asia-Pacific dominates the Solar PV Module Market with a 41.6% share in 2024, driven by massive solar expansion efforts in China, India, Japan, South Korea, and Australia. China leads global manufacturing and utility-scale deployment, supported by strong government incentives and low-cost production capabilities. India’s tender-driven installations, corporate PPAs, and rooftop programs continue accelerating adoption. Japan and South Korea favor high-efficiency modules for limited land environments, while Australia sees strong residential uptake. Rapid urbanization, expanding industrial demand, and supportive policy frameworks make Asia-Pacific the fastest-growing and most influential regional market.

Latin America

Latin America holds 6.8% of the Solar PV Module Market in 2024, with Brazil, Chile, and Mexico driving most installations. Competitive auction schemes, excellent solar resources, and rising private-sector investment support robust utility-scale deployment. Brazil’s distributed generation policy strongly boosts rooftop and commercial installations, while Chile advances toward carbon neutrality through large-scale solar development in the Atacama Desert. Mexico’s industrial sector increasingly adopts solar to reduce long-term energy costs. Falling module prices and expanding grid infrastructure improve regional project economics, supporting continued market expansion across Latin America.

Middle East & Africa (MEA)

The Middle East & Africa region captures 4.5% of the Solar PV Module Market in 2024, driven by major utility-scale projects in the UAE, Saudi Arabia, Egypt, Morocco, and South Africa. GCC nations prioritize solar to diversify energy systems and lower dependence on fossil fuels, with mega solar parks achieving world-leading tariff levels. Africa’s market grows through electrification programs, off-grid solar kits, and emerging commercial installations. Increasing investment in hybrid systems, declining module costs, and supportive government initiatives accelerate adoption across both urban and rural markets.

Market Segmentations

By Technology

- Thin Film

- Crystalline Silicon

By Product

- Monocrystalline

- Polycrystalline

- Cadmium Telluride

- Amorphous Silicon

- Copper Indium Gallium Diselenide

By End User

- Residential

- Commercial & Industrial

- Utility

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Solar PV Module Market features a highly dynamic and consolidated competitive landscape dominated by global manufacturers with extensive production capacities and strong technological capabilities. Leading players including LONGi, Jinko Solar, JA Solar Technology, Canadian Solar, First Solar, Hanwha Q CELLS, GCL-SI, Trina Solar, Risen Energy, and EMMVEE Solar compete through advancements in high-efficiency monocrystalline modules, bifacial technologies, and next-generation cell architectures such as TOPCon and HJT. Many companies are expanding manufacturing footprints across Asia, Europe, and North America to strengthen supply chain resilience and leverage emerging policy incentives. Strategic partnerships, capacity expansions, and investments in automated production lines remain central to maintaining cost competitiveness. Additionally, increasing focus on sustainability, low-carbon manufacturing, and recycling initiatives is shaping long-term competitive differentiation. As utility-scale, commercial, and residential demand accelerates, key players continue prioritizing innovation, global distribution networks, and integrated service offerings to secure greater market share.

Key Player Analysis

- JA SOLAR Technology

- Indosolar

- LONGi

- Hanwha Group

- GCL-SI

- Canadian Solar

- First Solar

- Jinko Solar

- CsunSolarTech

- EMMVEE SOLAR

Recent Developments

- In January 2025, Trina Solar set a new world record by achieving 25.44% conversion efficiency for its n-type fully passivated heterojunction (HJT) solar cell, highlighting the ongoing innovation potential within silicon-based solar technologies.

- In May 2024, LONGi launched the Hi-MO 5 Ice-Shield module, engineered to deliver superior durability and resilience against extreme hail and high-wind events. The design enhances overall reliability, maintains high energy output, and lowers both the levelized cost of energy and balance-of-system expenses compared with previous Hi-MO 5 models.

- In January 2024, First Solar, Inc. opened India’s first fully vertically integrated solar manufacturing facility, covering six acres with an annual output capacity of 3.3 GW and employing around 1,000 people.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Technology, Product, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as countries accelerate solar adoption to meet long-term decarbonization and net-zero commitments.

- High-efficiency technologies such as TOPCon, HJT, and perovskite tandem modules will gain wider commercial adoption.

- Bifacial and large-format modules will increasingly dominate utility-scale installations due to higher energy yield and lower LCOE.

- Domestic manufacturing expansion will intensify as governments promote supply chain localization and reduce import dependency.

- Integration of energy storage with solar projects will rise, improving grid stability and enabling round-the-clock renewable power.

- Building-integrated photovoltaics will create new opportunities in urban infrastructure and green construction.

- Recycling and circular-economy initiatives will expand as end-of-life module volumes grow, driving sustainable material recovery.

- Digitalization through AI-based monitoring and predictive maintenance will enhance system performance and operational efficiency.

- Corporate renewable procurement will continue to surge, supporting commercial and industrial solar adoption.

- Emerging markets in Africa, Southeast Asia, and Latin America will become key contributors to global solar module demand.

Market Segmentation Analysis

Market Segmentation Analysis