Market Overview

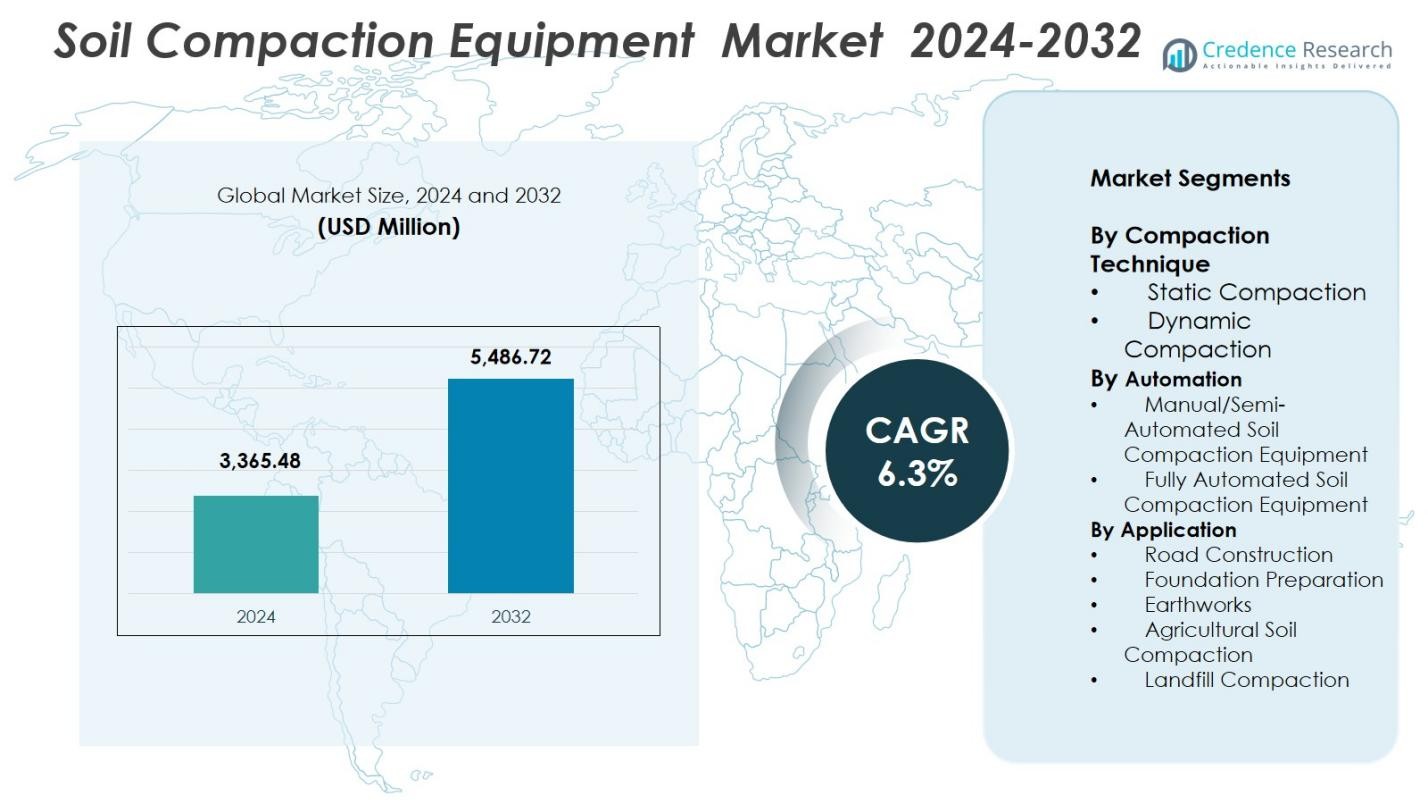

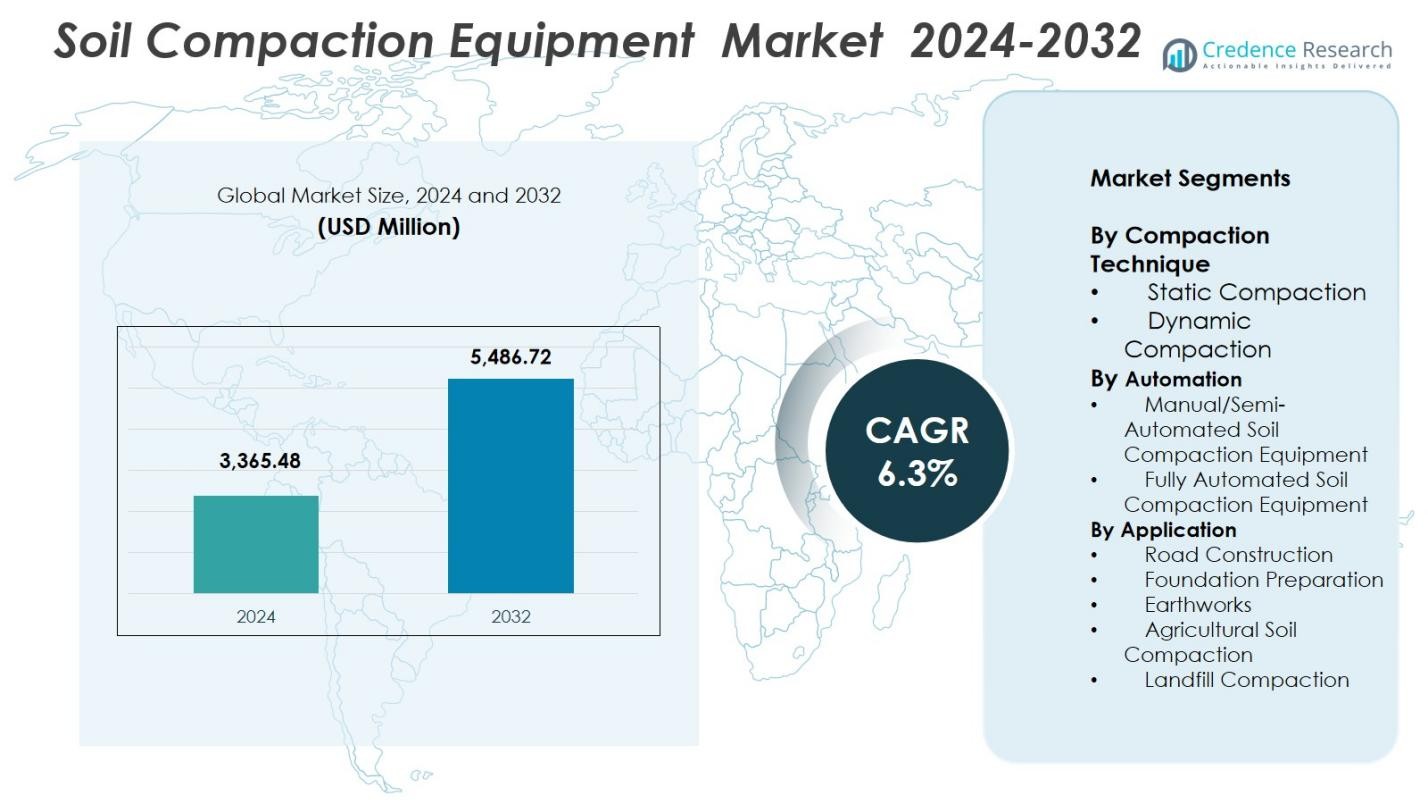

Soil Compaction Equipment Market size was valued at USD 3,365.48 Million in 2024 and is anticipated to reach USD 5,486.72 Million by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Soil Compaction Equipment Market Size 2024 |

USD 3,365.48 Million |

| Soil Compaction Equipment Market , CAGR |

6.3% |

| Soil Compaction Equipment Market Size 2032 |

USD 5,486.72 Million |

Soil Compaction Equipment Market features strong participation from global manufacturers offering advanced rollers, rammers, and plate compactors tailored for infrastructure and earthwork applications. Leading players such as Caterpillar, BOMAG, Wirtgen Group, Dynapac, JCB, Volvo Construction Equipment, Hitachi Construction Machinery, XCMG, and Wacker Neuson focus on intelligent compaction, telematics integration, and high-efficiency engines to strengthen their market presence. Asia-Pacific leads the market with a 34.8% share, driven by extensive roadbuilding and urban development projects, followed by North America at 29.4% and Europe at 27.1%. Continuous investment in digital compaction technologies and sustainable equipment platforms further enhances the competitive positioning of these companies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Soil Compaction Equipment Market was valued at USD 3,365.48 million in 2024 and is projected to reach USD 5,486.72 million by 2032, growing at a CAGR of 6.3%.

- Market growth is driven by expanding road construction, infrastructure modernization, and increasing mechanization across construction and agriculture, boosting demand for rollers, rammers, and plate compactors.

- Key trends include the adoption of intelligent compaction, telematics-enabled equipment, electric compactors, and rental-based models that offer cost-efficient access to advanced machinery.

- Leading players such as Caterpillar, BOMAG, Wirtgen Group, Dynapac, JCB, and XCMG strengthen market competitiveness through product innovation, automation, and expanded rental partnerships, while high equipment costs remain a restraint.

- Asia-Pacific dominates with a 34.8% share, followed by North America at 29.4% and Europe at 27.1%, while dynamic compaction leads the technique segment with a 62.4% share, reflecting strong demand for high-performance equipment.

Market Segmentation Analysis

By Compaction Technique

In the Soil Compaction Equipment market, dynamic compaction holds the dominant position with a 62.4% share in 2024, driven by its higher efficiency, deeper soil penetration, and suitability for large-scale civil engineering projects. Dynamic systems offer superior densification for highways, runways, and heavy-load foundations, making them the preferred choice in infrastructure-intensive economies. Static compaction continues to support landscaping, small-scale construction, and agriculture, but rising global investments in transportation corridors, urban expansion, and industrial zones reinforce the strong adoption of dynamic compaction across both developed and emerging regions.

- For Instance, the Hamm HC series from Wirtgen incorporated advanced vibration systems achieving deeper compaction layers, enabling contractors to meet stringent density requirements in expressway and airport runway projects.

By Automation

Manual and semi-automated soil compaction equipment leads this segment with a 71.8% market share in 2024, supported by affordability, ease of operation, and extensive use across small to medium-scale construction projects. Contractors prioritize these systems for their flexibility, lower maintenance costs, and compatibility with varied soil conditions. Fully automated equipment is gaining traction due to advancements in telematics, GPS-guided rollers, and real-time compaction mapping; however, high upfront costs and limited operator familiarity slow widespread adoption. Growth in digital construction technologies and smart jobsite integration is expected to accelerate automated equipment penetration over the forecast period.

- For instance, Wirtgen Group enhanced its Hamm Compaction Navigator (HCN) system, enabling real-time compaction documentation and GPS-based guidance for rollers, improving uniformity on large road projects.

By Application

Road construction emerges as the dominant application segment, capturing a 48.6% share in 2024, driven by massive investments in national highway programs, rural road expansion, airport runways, and freight corridor development. The segment benefits from stringent compaction quality standards that require high-performance rollers and advanced monitoring technologies. Foundation preparation and earthworks also contribute significantly, supported by ongoing commercial and residential construction. Agricultural soil compaction and landfill compaction remain niche but steadily expanding applications, particularly in regions modernizing their farming practices or enhancing waste management infrastructure.

Key Growth Drivers

Expanding Global Infrastructure and Road Development Programs

The Soil Compaction Equipment market benefits significantly from massive global infrastructure investments, particularly in highways, railways, airports, industrial corridors, and urban development projects. Government-backed programs such as rural road connectivity schemes, smart city missions, and logistics network expansion drive consistent demand for high-performance rollers and compactors. Developing economies in Asia-Pacific and Africa are witnessing large-scale public sector spending to improve transportation efficiency, reduce congestion, and enhance regional connectivity, further accelerating equipment procurement. Additionally, private construction companies and EPC contractors increasingly require reliable compaction machinery that ensures uniform soil density and long-term structural stability. The surge in mega-projects including industrial parks, warehousing hubs, and renewable energy installations reinforces the adoption of advanced compaction systems. Strict regulatory standards for pavement quality and compaction uniformity also push the industry toward technologically superior machines capable of delivering higher precision and productivity.

- For instance, India’s Bharatmala highway development program deployed advanced vibratory rollers from Wirtgen across multiple corridors, improving compaction efficiency under strict pavement quality specifications.

Mechanization of Construction and Agricultural Operations

Increasing mechanization across construction, mining, and agricultural sectors acts as a strong growth catalyst for the Soil Compaction Equipment market. As labor shortages rise and project timelines tighten, contractors prioritize efficient equipment that reduces manual effort and accelerates site preparation activities. Mechanized compaction enhances structural durability, supports foundation stability, and minimizes long-term maintenance costs. In agriculture, modern farming practices such as precision soil conditioning and controlled compaction encourage the adoption of walk-behind rollers and tractor-mounted compactors. Developing countries are witnessing rapid mechanization as small and mid-sized contractors upgrade from manual methods to mechanized soil preparation solutions. Government subsidies, training programs, and equipment financing schemes further support the transition by making compactors more accessible. The emphasis on productivity, safety, and consistent compaction outcomes continues to fuel the shift toward mechanized solutions across diverse end-use industries.

- For instance, in mining and earth-works applications, studies on Rolling Dynamic Compaction (RDC) a mechanized method using heavy non-circular impact rollers show that RDC can compact thicker soil layers and improve shear strength and stiffness, making it a more efficient alternative to manual or static methods especially for large-scale projects.

Advancements in Automation, Telematics, and Intelligent Compaction

Technological innovation stands as a major driver, with automation and telematics transforming how compaction equipment operates on modern job sites. Intelligent compaction systems equipped with real-time sensors, GPS mapping, and accelerometer-based feedback provide operators with continuous data on soil stiffness, compaction depth, and coverage uniformity. This enhances accuracy, reduces operational errors, and ensures compliance with quality standards. Contractors increasingly adopt fleet management platforms that track fuel consumption, machine health, utilization rate, and location to optimize deployment and maintenance schedules. Automated control features reduce operator dependency and improve productivity in large infrastructure projects. Integration with drones, BIM systems, and remote diagnostics further strengthens equipment efficiency. As construction becomes more data-driven, the demand for smart, connected compactors continues to grow, positioning technologically advanced equipment as a pivotal growth engine for the industry.

Key Trends & Opportunities

Increasing Adoption of Electric and Hybrid Compaction Equipment

A growing focus on sustainability, emissions reduction, and noise control is accelerating the adoption of electric and hybrid soil compaction machines. Urban infrastructure projects, tunnels, and environmentally sensitive zones increasingly prefer low-emission rollers that comply with stringent environmental regulations. Manufacturers are developing battery-powered rammers, plate compactors, and small rollers that offer quieter operation, lower operating costs, and reduced maintenance compared to diesel-powered models. Advancements in lithium-ion battery technology also extend machine runtime and charging efficiency, improving the feasibility of electric alternatives. Governments promoting green construction and carbon-neutral public works provide further incentives for transitioning to clean-energy equipment. This trend presents strong opportunities for OEMs to expand their eco-friendly portfolios and cater to municipalities, contractors, and rental companies seeking sustainable compaction solutions.

- For instance, Wacker Neuson expanded its zero-emission lineup with the Battery Rammer AS50e and AP1840e electric plate compactor, offering reduced vibration, low noise, and no onsite emissions for inner-city and indoor applications.

Rising Demand for Rental and Leasing Services Across Emerging Markets

The expansion of equipment rental and leasing services represents a significant opportunity for the Soil Compaction Equipment market, especially in regions where small and mid-sized contractors prefer cost-effective procurement models. High upfront purchase costs and maintenance expenses make rental solutions attractive for short-duration and specialized compaction tasks. Rental fleets increasingly include advanced rollers with telematics, automated control systems, and efficient engines, enabling widespread access to premium technology at lower cost. Companies operating in emerging economies leverage rentals to participate in large infrastructure projects without long-term capital commitments. This shifts market dynamics toward flexible ownership models, encouraging OEMs to strengthen rental partnerships and invest in durable, high-utilization equipment designed specifically for fleet operators.

- For instance, United Rentals expanded its compaction equipment offerings with advanced vibratory rollers and plate compactors featuring telematics-enabled monitoring, allowing contractors to track performance and utilization without purchasing the machines.

Key Challenges

High Equipment Costs and Limited Adoption of Advanced Technologies

The Soil Compaction Equipment market faces challenges stemming from high procurement costs, which limit adoption among small contractors and cost-sensitive markets. Modern rollers equipped with intelligent compaction, automation, and telematics often require substantial upfront investment, restricting penetration in developing regions. Additionally, many contractors lack the technical expertise required to operate advanced systems, resulting in slower adoption of automated compaction technologies. Training gaps, high maintenance costs, and limited availability of skilled operators further hinder widespread implementation. Economic fluctuations and budget constraints in public infrastructure projects also delay equipment upgrades. These factors collectively challenge market expansion, particularly for premium and technologically advanced models.

Operational Bottlenecks, Regulatory Compliance, and Environmental Constraints

Soil compaction activities often face operational constraints due to varying soil conditions, adverse weather, and regulatory restrictions on noise and emissions. In regions with strict environmental controls, diesel-powered equipment may require additional compliance measures, increasing operating costs. Unpredictable soil behavior in certain terrains demands multiple passes and higher fuel consumption, reducing efficiency and increasing wear on machinery. Additionally, contractors must adhere to stringent compaction quality standards, requiring meticulous monitoring and documentation. Delays caused by equipment breakdowns, supply chain disruptions, or lack of standardized testing protocols can further impact project timelines. These operational and regulatory challenges create substantial barriers for both manufacturers and end users.

Regional Analysis

North America

North America holds a 29.4% share of the Soil Compaction Equipment market in 2024, supported by extensive investments in highway rehabilitation, airport expansions, and commercial infrastructure. The U.S. leads demand due to strict compaction quality standards and rapid adoption of telematics-enabled rollers for large-scale projects. Canada’s growing focus on sustainable construction and remote jobsite automation further boosts equipment uptake. High labor costs and advanced construction practices accelerate the transition toward mechanized and semi-automated compactors. Strong rental penetration and continuous equipment upgrades by contractors also reinforce North America’s position as a technologically advanced market.

Europe

Europe accounts for a 27.1% market share, driven by robust construction activity, modernization of transportation corridors, and stringent environmental regulations. Countries such as Germany, France, and the U.K. adopt electric and hybrid compaction equipment to meet emission compliance targets. The region benefits from mature infrastructure development cycles that emphasize soil stability, pavement durability, and precision compaction. Public investments in rail networks, renewable energy installations, and urban redevelopment drive steady demand. Europe’s strong presence of global OEMs and rapid adoption of intelligent compaction technologies reinforce its leadership in sustainability-focused equipment innovation.

Asia-Pacific

Asia-Pacific dominates the Soil Compaction Equipment market with a 34.8% share, making it the largest regional contributor in 2024. Massive infrastructure development programs in China, India, and Southeast Asia including national highways, metro rail networks, industrial corridors, and airport expansions drive substantial equipment demand. Rapid urbanization and government-backed construction initiatives encourage widespread adoption of both mechanical and automated compactors. The region also benefits from growing construction equipment manufacturing hubs and increasing mechanization in agriculture. Expanding rental fleets, rising labor shortages, and a shift toward technologically advanced rollers further accelerate market growth across emerging economies.

Latin America

Latin America represents a 5.6% share of the market, with demand influenced by ongoing road-building programs, mining activities, and urban infrastructure upgrades. Brazil, Mexico, and Chile lead adoption as governments emphasize logistics development and improved rural connectivity. Economic fluctuations slow long-term investments but create opportunities for rental-based equipment solutions. Contractors increasingly prefer versatile, fuel-efficient compactors suited to mixed soil conditions across large work zones. Growth in residential construction and land redevelopment projects supports consistent demand, while modernization of waste management sites drives adoption of landfill compactors.

Middle East & Africa (MEA)

The Middle East & Africa region holds a 3.1% share, supported by infrastructure diversification, oil-funded construction programs, and large-scale urban development initiatives. Countries such as the UAE, Saudi Arabia, and Qatar invest heavily in roads, industrial parks, and smart city projects, boosting demand for high-performance compaction equipment. Africa’s adoption is rising due to expansion of road networks, mining operations, and agricultural land preparation. However, budget constraints and limited access to advanced machinery slow penetration of automated compactors. Rental services and durable mechanical compactors remain highly preferred across the region.

Market Segmentations

By Compaction Technique

- Static Compaction

- Dynamic Compaction

By Automation

- Manual/Semi-Automated Soil Compaction Equipment

- Fully Automated Soil Compaction Equipment

By Application

- Road Construction

- Foundation Preparation

- Earthworks

- Agricultural Soil Compaction

- Landfill Compaction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Soil Compaction Equipment market features a diverse and well-established competitive landscape, driven by global manufacturers expanding their portfolios with technologically advanced and fuel-efficient rollers, rammers, and plate compactors. Key players such as Caterpillar, Wirtgen Group, JCB, BOMAG, Dynapac, Volvo Construction Equipment, Hitachi Construction Machinery, XCMG, Sany Heavy Industries, and Wacker Neuson focus on intelligent compaction systems, telematics integration, and automation to strengthen their market presence. Companies increasingly emphasize electric and hybrid compactors to meet emission regulations and urban construction requirements. Strategic initiatives including product launches, rental fleet partnerships, and regional manufacturing expansions enhance competitiveness. Many OEMs also invest in digital platforms for real-time machine monitoring and predictive maintenance, improving fleet efficiency for contractors. With rising demand across infrastructure, agriculture, and waste management projects, competition intensifies as manufacturers innovate toward compact, high-performance, and cost-efficient equipment tailored to diverse soil and project conditions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Wirtgen Group

- J C Bamford Excavators Ltd. (JCB)

- Sany Heavy Industries

- MBW, Inc.

- XCMG

- Weber Maschinentechnik GmbH

- Terex

- Caterpillar

- Zoomlion Heavy Industries

- Dynapac

Recent Developments

- In September 2025, SANY India introduced the SSR110C-10 PRO an 11-ton vibratory soil compactor built at its Pune facility, aimed at boosting infrastructure and road-building projects in India.

- In July 2025, JCB launched the 12-tonne VM118D soil compactor the world’s first soil compactor over 10 tonnes to meet EU Stage V emissions standards without requiring Diesel Exhaust Fluid (DEF).

- In December 2024, CASE Construction Equipment launched a “rental-ready” compactor lineup with simplified controls and telematics support, aimed at rental firms and small contractors.

Report Coverage

The research report offers an in-depth analysis based on Compaction Technique, Automation, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong adoption of intelligent compaction systems as digital construction practices become standard across major infrastructure projects.

- Automation and telematics integration will expand, enabling real-time performance monitoring and higher compaction accuracy.

- Electric and hybrid compactors will gain momentum as governments tighten emission norms and urban projects demand low-noise equipment.

- Rental and leasing services will grow significantly, especially in emerging markets where contractors prefer flexible ownership models.

- Demand for high-frequency and high-impact compactors will rise with the expansion of highways, airports, and industrial corridors.

- Manufacturers will focus on compact, fuel-efficient, and multifunctional equipment suited for diverse soil and terrain conditions.

- Predictive maintenance technology will enhance fleet reliability and reduce downtime for construction contractors.

- Growing mechanization in agriculture will drive demand for small and mid-sized compactors tailored for soil conditioning.

- Emerging economies will prioritize large-scale road connectivity programs, strengthening regional market expansion.

- Competitive intensity will increase as global and regional players introduce advanced, cost-efficient models for both construction and waste management applications.