Market Overview

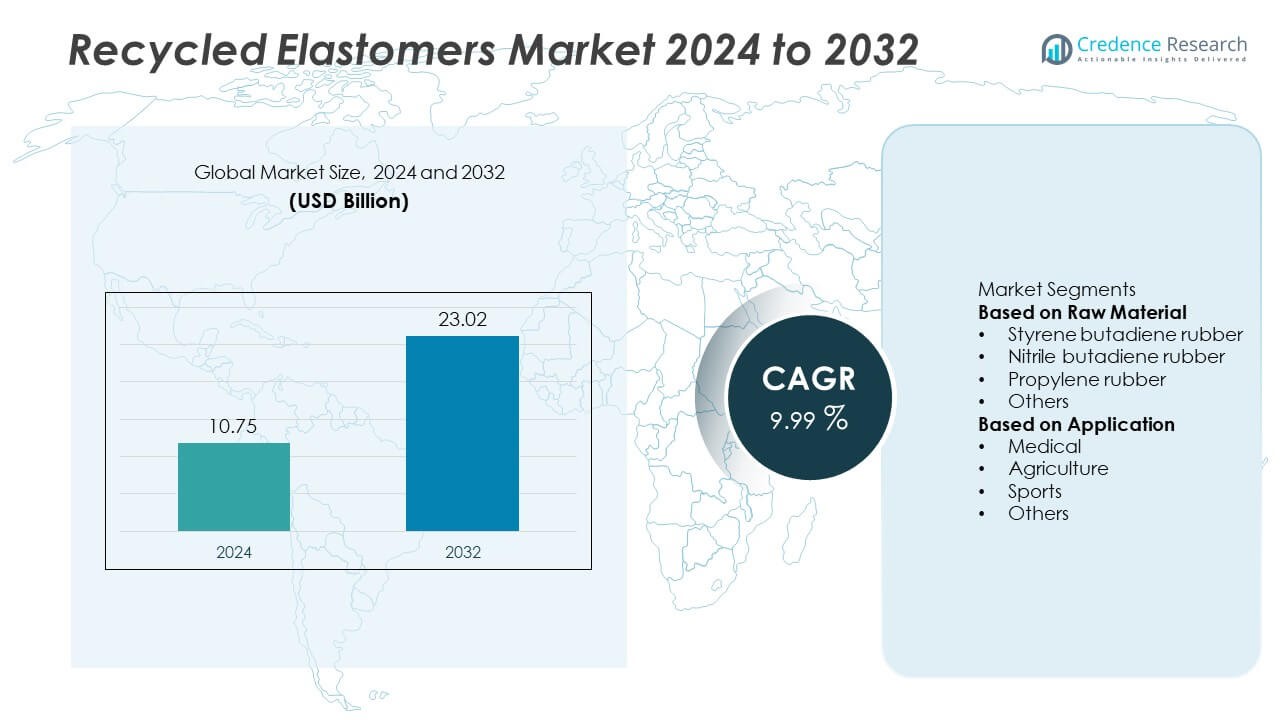

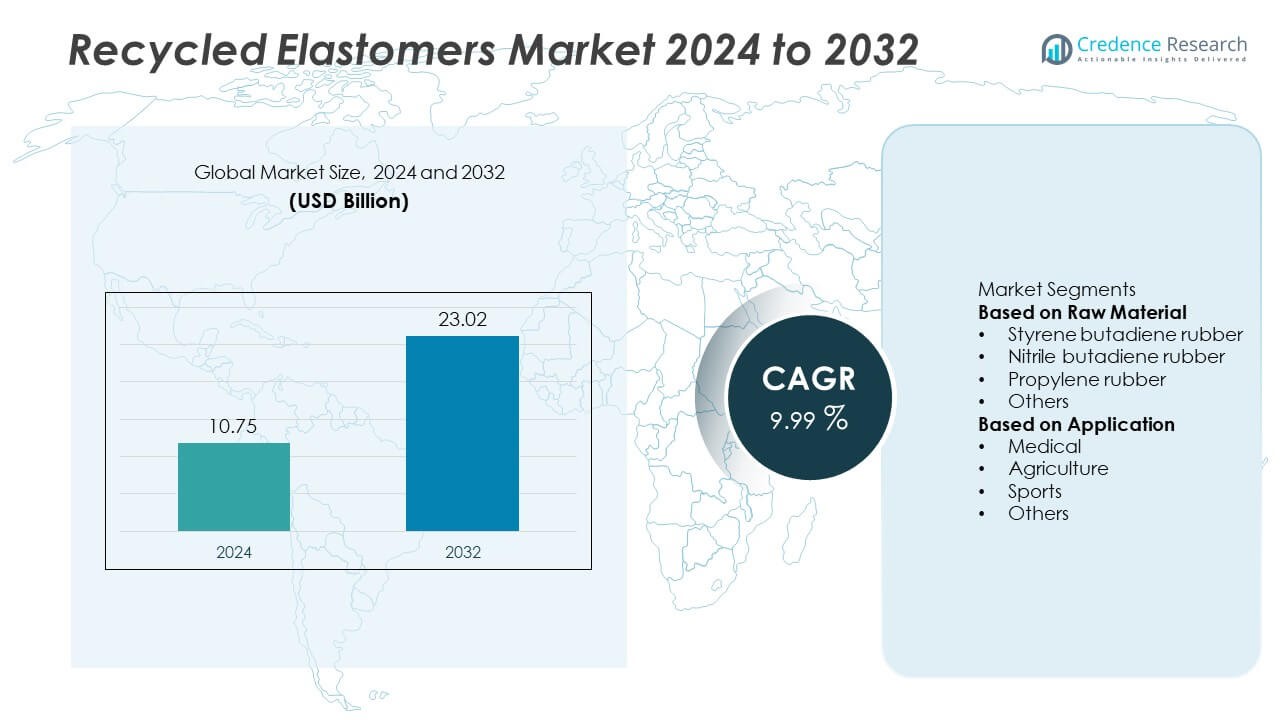

Recycled Elastomers market size reached USD 10.75 billion in 2024 and is projected to rise to USD 23.02 billion by 2032, supported by a 9.99% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Recycled Elastomers market Size 2024 |

USD 10.75 Billion |

| Recycled Elastomers market, CAGR |

9.99% |

| Recycled Elastomers market Size 2032 |

USD 23.02 Billion |

The Recycled Elastomers market is driven by leading players such as Liberty Tire Recycling, Genan Holding A/S, Entech Inc., American Tire Recycling Group, GRP Ltd. (Gujarat Reclaim & Rubber Products), Emanuel Tire LLC, Tire Disposal & Recycling Inc., CRM Rubber, Klean Industries Inc., and RubberForm Recycled Products LLC. These companies expand their presence through advanced recycling technologies, large-scale tire collection systems, and production of high-quality reclaimed rubber for sports flooring, construction materials, automotive parts, and industrial goods. Their focus on sustainable processing and circular-economy practices strengthens industry adoption across major applications. North America leads the market with a 35% share, driven by strict waste-management regulations and strong recycling infrastructure, while Europe follows with a 30% share supported by robust circular-economy policies and high demand for eco-friendly materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Recycled Elastomers market reached USD 10.75 billion in 2024 and is projected to reach USD 23.02 billion by 2032 at a 9.99% CAGR, driven by rising sustainability requirements.

- Growth is supported by strong demand for styrene butadiene rubber with a 44% share and expanding use in sports applications, which lead with a 39% share due to high adoption in playgrounds, tracks, and turf infills.

- Key trends include technological advancements in rubber devulcanization, increased use of recycled rubber in green construction projects, and rising adoption of eco-friendly industrial materials.

- Competition strengthens as major recyclers invest in high-quality crumb rubber production, expand tire-collection capabilities, and form partnerships with municipalities and construction firms, while quality variability in recycled feedstock restrains wider adoption.

- Regionally, North America holds a 35% share, followed by Europe at 30% and Asia Pacific at 28%, driven by strong recycling policies, industrial growth, and expanding circular-economy initiatives across major countries.

Market Segmentation Analysis:

By Raw Material

Styrene butadiene rubber (SBR) leads the raw material segment with a 44% share, supported by its strong availability from end-of-life tires and its wide adaptability in recycled elastomer processing. Industries prefer recycled SBR due to its durability, cost efficiency, and compatibility with flooring, mats, adhesives, and molded products. Nitrile butadiene rubber shows steady demand because of its oil-resistant properties, making it suitable for industrial components. Propylene rubber gains traction in automotive and construction applications as manufacturers seek sustainable material alternatives. Rising regulatory pressure to reduce landfill waste further strengthens demand for recycling SBR-rich scrap streams.

- For instance, Genan processes 400,000 tons of scrap tires each year and recovers more than 280,000 tons of rubber granulate, powder, and steel.

By Application

Sports applications dominate this segment with a 39% share, driven by high consumption of recycled elastomers in playground surfaces, athletic tracks, gym flooring, and artificial turf infills. Recycled rubber offers strong shock absorption, weather resistance, and cost advantages, making it ideal for large-scale sports infrastructure projects. Agriculture follows with rising use in mulch films, livestock mats, and equipment components that require long-lasting and flexible material solutions. Medical applications grow steadily due to increased adoption of non-toxic, safe, and compliant elastomer-based products. Expansion of sustainable construction projects also boosts demand across other application areas.

- For instance, a major U.S. manufacturer, Liberty Tire, is expanding its footprint in Alabama with two new facilities to meet growing regional recycling needs, as the state phases out landfilling whole tires.

Key Growth Drivers

Rising Focus on Waste Reduction and Circular Economy

Global regulations targeting tire waste reduction and sustainable material usage drive strong demand for recycled elastomers. Governments and industries adopt circular economy practices that encourage recycling of rubber from end-of-life tires, industrial scrap, and automotive components. Manufacturers benefit from lower raw material costs and reduced environmental impact. Infrastructure, construction, and industrial sectors increasingly prefer recycled elastomers for applications such as flooring, mats, modifiers, and molded products. Growing emphasis on lowering carbon emissions and diverting rubber waste from landfills further accelerates market growth across developed and emerging regions.

- For instance, Liberty Tire Recycling processes over 190 million scrap tires each year and converts more than 3 billion pounds of material into usable rubber.

Expanding Use Across Sports and Construction Industries

Growing investment in sports infrastructure fuels high adoption of recycled elastomers due to their durability, shock absorption, and cost effectiveness. Athletic tracks, playground surfaces, gym flooring, and artificial turf infills increasingly rely on recycled rubber granules. Construction applications benefit from improved flexibility, weather resistance, and long service life offered by recycled elastomer materials. Builders and municipal authorities choose recycled rubber for pavements, insulation layers, and impact-resistant components. The trend aligns with green building initiatives, which encourage use of sustainable and recycled materials to reduce environmental footprints.

- For instance, leading global crumb rubber manufacturers like Liberty Tire Recycling and Tinna Rubber are major suppliers for various applications. North America leads in tire recycling, converting over 1.2 million tons into crumb rubber annually, which is used in over 55,000 synthetic turf fields globally.

Increasing Demand for Cost-Efficient and High-Performance Materials

Rising raw material prices push manufacturers toward recycled elastomers as economical alternatives in industrial and consumer applications. Recycled rubber blends offer reliable mechanical strength, abrasion resistance, and thermal stability at lower cost compared to virgin elastomers. Automotive suppliers adopt recycled elastomers for non-critical components to optimize production expenses. Agriculture and manufacturing sectors also prefer recycled materials for mats, hoses, gaskets, and vibration-control parts. Consistent improvements in processing technologies enhance quality, enabling recycled elastomers to meet performance standards in wider end-use segments.

Key Trends & Opportunities

Technological Advancements in Rubber Recycling Processes

Advanced devulcanization methods, cryogenic grinding, and surface-modification technologies improve the quality and consistency of recycled elastomers. These innovations help manufacturers produce finer granules and cleaner reclaimed rubber with enhanced bonding capability. Improved processing expands applications in adhesives, sealants, automotive parts, and high-performance sports surfaces. Companies explore chemical recycling solutions that recover elastomers with mechanical properties closer to virgin rubber. Continued R&D investment fosters opportunities for premium recycled products and supports integration into more demanding industrial applications.

- For instance, Klean Industries applies advanced pyrolysis reactors in various projects, including an Australian facility designed to process up to 240 tons of tires per day and a reference plant in Poland that recovers high-purity, ASTM-rated carbon black with certified performance metrics.

Growing Adoption in Eco-Friendly Consumer and Industrial Products

Sustainability trends drive demand for recycled elastomers in footwear, lifestyle goods, mats, protective equipment, and eco-friendly packaging components. Brands integrate recycled rubber into consumer products to align with environmental goals and rising buyer preference for green materials. Industrial manufacturers adopt recycled elastomers in noise-control systems, shock-absorbing pads, and anti-vibration components. Governments and corporates promote procurement of recycled-content products, expanding market opportunities. The shift toward low-carbon materials creates long-term space for innovative elastomer blends with improved design and performance.

- For instance, RubberForm manufactures more than 2 million pounds of recycled rubber products every year for industrial, commercial, and consumer applications.

Key Challenges

Quality Variability Across Recycled Rubber Streams

Inconsistent quality of recovered rubber remains a challenge as feedstock composition varies based on tire type, wear level, and contamination. Differences in vulcanization, fillers, and additives affect processing behavior and end-product performance. Manufacturers may struggle to maintain uniformity in applications requiring tight specifications. Additional treatment processes increase production costs, reducing some of the economic advantage of recycling. Limited standardization across regions further complicates large-scale adoption. Consistent supply of high-grade recycled rubber remains essential for wider acceptance in advanced industrial applications.

Limited Awareness and Slow Adoption in Certain End-Use Industries

Some industries remain cautious about adopting recycled elastomers due to perceived performance issues compared to virgin materials. Lack of awareness about modern recycling improvements and advanced devulcanization technologies slows market penetration. Concerns related to long-term durability, adhesion, and compatibility with existing manufacturing systems restrict usage in premium automotive and engineering applications. Regulatory support varies across regions, reducing incentives in less-developed markets. Overcoming these barriers requires continuous education, product certification, and demonstration of performance reliability across diverse applications.

Regional Analysis

North America

North America leads the Recycled Elastomers market with a 35% share, supported by strong tire recycling programs, advanced processing technologies, and strict environmental regulations that promote sustainable material use. The U.S. drives demand through extensive adoption of recycled rubber in sports surfaces, playgrounds, construction materials, and automotive components. Government-backed initiatives to reduce landfill waste and expand circular economy practices further accelerate market growth. High investment in infrastructure renovation also boosts consumption of recycled elastomer-based flooring, mats, and modifiers. Rising interest in eco-friendly consumer goods strengthens long-term demand across the region.

Europe

Europe holds a 30% share, driven by stringent environmental policies, strong circular economy mandates, and well-established rubber recycling infrastructure. Countries such as Germany, France, and the Netherlands lead adoption through advanced devulcanization technologies and high-quality reclaimed rubber production. Sports infrastructure, automotive manufacturing, and industrial applications remain major demand drivers. EU initiatives focusing on reducing tire waste and improving recycled content in products further support market expansion. Increasing consumer preference for sustainable materials in footwear, flooring, and protective goods also boosts regional growth. Strong collaboration between recyclers and manufacturers enhances material availability.

Asia Pacific

Asia Pacific accounts for a 28% share, driven by rising automotive production, large volumes of end-of-life tires, and growing industrialization across China, India, and Southeast Asia. Expanding construction and sports infrastructure projects fuel strong demand for recycled elastomer surfaces, insulation layers, and molded components. Governments promote tire recycling to address waste management challenges, supporting new processing plants and technology adoption. Rapid growth in consumer goods and footwear manufacturing strengthens use of recycled rubber blends. Increasing environmental awareness and improved recycling regulations further expand market penetration across diverse applications.

Latin America

Latin America holds a 4% share, influenced by growing focus on tire waste reduction and rising use of recycled rubber in sports, agriculture, and industrial products. Brazil and Mexico drive regional demand through expanding construction activities and increased adoption of cost-efficient elastomer solutions. Government efforts to enhance recycling systems and reduce landfill accumulation support gradual market growth. Agricultural applications, including livestock mats and equipment components, contribute significantly to demand. Limited technology access in some countries slows progress, but rising sustainability initiatives create long-term opportunities.

Middle East & Africa

Middle East & Africa represent a 3% share, driven by growing awareness of sustainable material use and rising infrastructure development across Gulf countries. The region adopts recycled elastomers in sports fields, playgrounds, flooring, and construction projects. Countries such as UAE and Saudi Arabia promote recycling initiatives to reduce waste and improve resource efficiency. In Africa, market growth is gradual due to limited recycling facilities, but increasing tire waste and urban development support rising demand. Government-led sustainability programs and international partnerships help strengthen long-term market potential.

Market Segmentations:

By Raw Material

- Styrene butadiene rubber

- Nitrile butadiene rubber

- Propylene rubber

- Others

By Application

- Medical

- Agriculture

- Sports

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Recycled Elastomers market features key players such as Liberty Tire Recycling, Genan Holding A/S, Entech Inc., American Tire Recycling Group, GRP Ltd. (Gujarat Reclaim & Rubber Products), Emanuel Tire LLC, Tire Disposal & Recycling Inc., CRM Rubber, Klean Industries Inc., and RubberForm Recycled Products LLC. These companies strengthen their positions by expanding tire collection networks, upgrading processing facilities, and adopting advanced devulcanization and grinding technologies to improve material quality. Leading recyclers focus on producing high-performance granules, crumb rubber, and reclaim rubber that meet stringent specifications for sports surfaces, construction products, automotive components, and industrial applications. Strategic partnerships with municipalities, construction firms, and rubber product manufacturers support wider market penetration. Companies also invest in sustainable manufacturing practices to align with environmental regulations and circular economy goals. Growing emphasis on innovative elastomer blends and value-added recycled products enhances competitive differentiation across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Liberty Tire Recycling

- Genan Holding A/S

- Entech Inc.

- American Tire Recycling Group

- GRP Ltd. (Gujarat Reclaim & Rubber Products)

- Emanuel Tire, LLC

- Tire Disposal & Recycling, Inc.

- CRM Rubber

- Klean Industries Inc.

- RubberForm Recycled Products LLC

Recent Developments

- In October 2025, Liberty Tire Recycling entered into a definitive agreement to be acquired by I Squared Capital from Energy Capital Partners, strengthening its infrastructure for tyre-recycling and recycled elastomer feedstock.

- In May 2025, Klean Industries Inc. signed a Heads of Terms agreement with KBR Inc. to jointly develop integrated solutions to recover sustainable commodities (such as recovered carbon black and pyrolysis oil) from end-of-life tyres.

- In March 2025, Klean Industries and Viva Energy Australia signed a Memorandum of Understanding (MOU) to conduct a pre-feasibility study for a potential tyre-recycling facility in Melbourne.

- In March 2025, Liberty Tire Recycling applauded a draft study by the Office of Environmental Health Hazard Assessment (OEHHA) confirming no significant health risks from using recycled crumb rubber in synthetic turf.

Report Coverage

The research report offers an in-depth analysis based on Raw Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for recycled elastomers will rise as global circular-economy initiatives strengthen.

- Advanced devulcanization technologies will enhance material quality and expand high-value applications.

- Sports infrastructure projects will continue driving large-scale adoption of recycled rubber products.

- Construction firms will increasingly use recycled elastomers in flooring, insulation, and impact-resistant materials.

- Automotive suppliers will adopt more recycled elastomers for non-critical components to reduce production costs.

- Consumer brands will integrate recycled rubber into footwear, mats, and lifestyle goods to meet sustainability goals.

- Governments will introduce stricter waste-reduction policies, boosting tire-recycling capacity.

- Partnerships between recyclers and material manufacturers will support innovation in premium elastomer blends.

- Online distribution and direct-to-consumer channels will expand for recycled rubber products.

- Growing environmental awareness in emerging markets will accelerate recycling investments and market penetration.