Market Overview

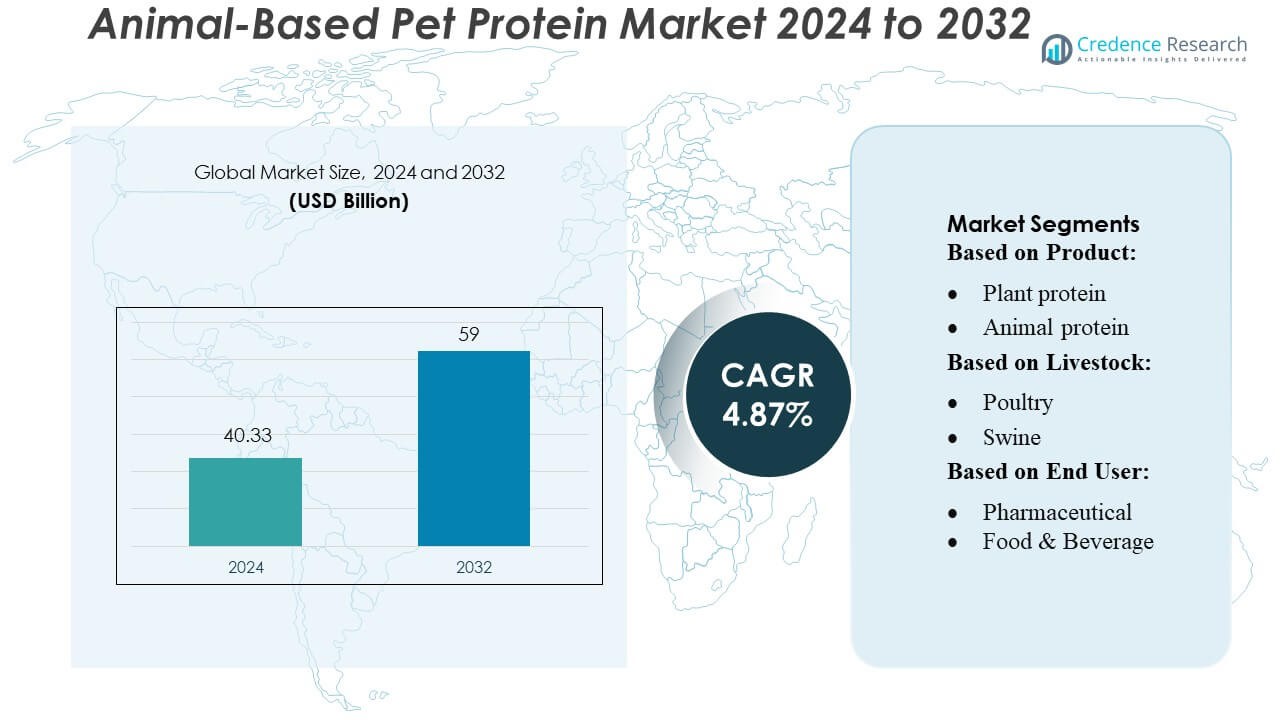

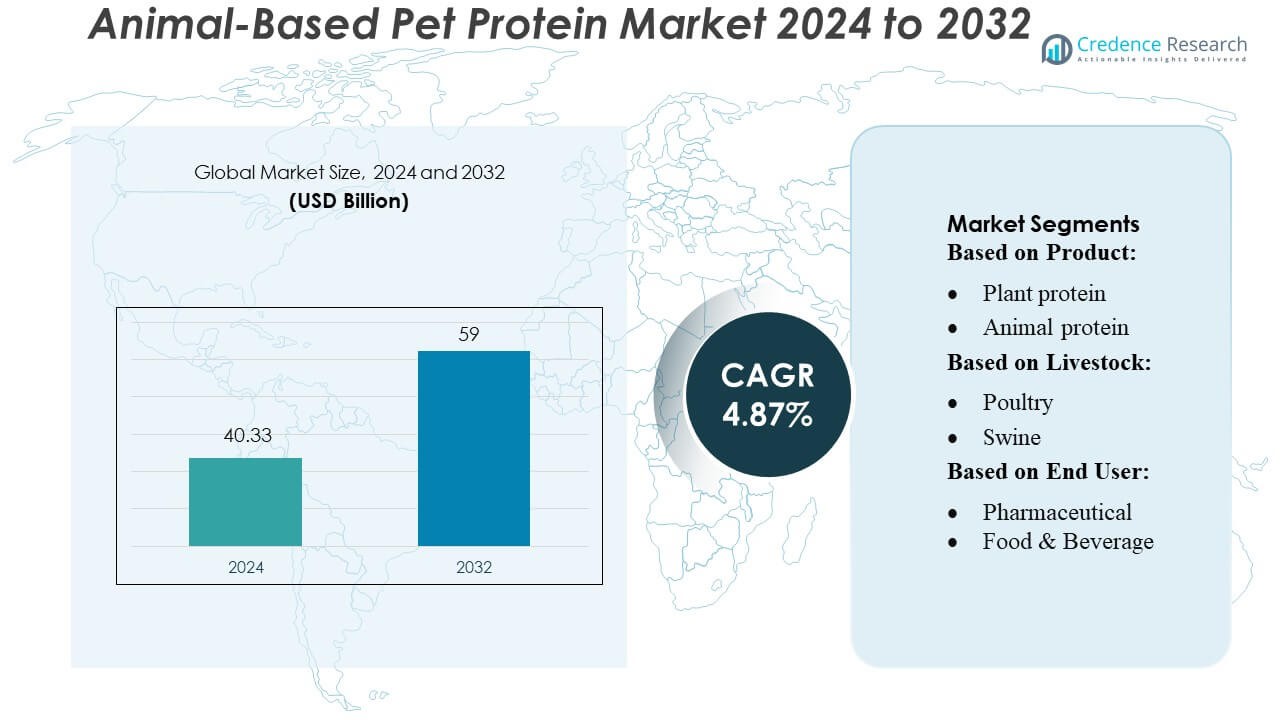

Animal-Based Pet Protein Market size was valued USD 40.33 billion in 2024 and is anticipated to reach USD 59 billion by 2032, at a CAGR of 4.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Animal-Based Pet Protein Market Size 2024 |

USD 40.33 Billion |

| Animal-Based Pet Protein Market, CAGR |

4.87% |

| Animal-Based Pet Protein Market Size 2032 |

USD 59 Billion |

The Animal-Based Pet Protein Market is highly competitive, with top players such as Nutri-Pea, DuPont, COSUCRA, Roquette Frères, SOTEXPRO, Burcon, Ingredion, Shandong Jianyuan Group, Axiom Foods, Inc., and The Scoular Company driving innovation and expansion. These companies focus on developing high-quality, sustainable, and ethically sourced animal proteins to meet the growing demand for premium pet foods. Strategic initiatives, including product innovation, capacity expansion, and regional partnerships, are enabling these players to strengthen their market presence and enhance distribution networks. North America emerges as the leading region in the market, accounting for approximately 39% of the global share, supported by high pet ownership rates, strong consumer spending, and well-established regulatory frameworks that ensure quality and safety. The combination of established market leaders and a dominant regional presence underscores the robust growth trajectory of the global animal-based pet protein market.

Market Insights

Market Insights

- The Animal-Based Pet Protein Market was valued at USD 40.33 billion in 2024 and is projected to reach USD 59 billion by 2032, growing at a CAGR of 4.87% during the forecast period.

- Market growth is driven by rising pet ownership, increasing demand for premium and high-protein pet foods, and consumer preference for sustainable and ethically sourced animal proteins.

- Key trends include the development of novel protein formulations, focus on functional and health-enhancing pet foods, and adoption of eco-friendly production practices across the industry.

- The market is highly competitive, led by companies such as Nutri-Pea, DuPont, COSUCRA, Roquette Frères, SOTEXPRO, Burcon, Ingredion, Shandong Jianyuan Group, Axiom Foods, Inc., and The Scoular Company, focusing on innovation, capacity expansion, and strategic regional partnerships.

- North America is the leading region with approximately 39% market share, followed by Europe and Asia Pacific; dry and wet pet food segments dominate the product share, reflecting strong consumer preference for high-protein formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The animal protein segment dominates the market, capturing a significant share due to its high bioavailability, essential amino acid content, and proven efficacy in promoting pet health and growth. Animal protein sources such as fish, poultry, and meat by-products are increasingly preferred in premium pet formulations. The plant protein and alternative protein segments are witnessing gradual adoption driven by consumer demand for sustainable and hypoallergenic options. Market growth is propelled by rising pet humanization trends and increased awareness of nutritional requirements, encouraging pet owners to opt for protein-rich diets that enhance immunity and overall vitality.

- For instance, Diamond Pet Foods operates 6 advanced production facilities across the United States (with a seventh under construction), utilizing precision extrusion systems to produce high-quality dry pet food, ensuring rigorous quality-control processes and high volume output.

By Livestock

Among livestock, poultry-based protein leads with the largest market share, owing to its cost-effectiveness, digestibility, and broad availability for inclusion in pet food formulations. Swine and cattle proteins are also significant, supplying functional nutrients and supporting large-scale production. Aquaculture-based proteins are emerging due to high-quality omega-3 content, while equine protein remains niche but specialized for performance-oriented pet feeds. Growth in this segment is driven by rising pet adoption, expanding premium pet food offerings, and increasing demand for species-specific formulations that cater to digestive health, energy, and weight management.

- For instance, General Mills, Inc. reported that its team of data scientists has scaled from running roughly 2,000 analytic models per month to running over 6 million models per month that generate in excess of 500 million individual predictions, enabling optimized supply-chain alignment for its dog-food brand Blue Buffalo.

By End-User

The animal feed end-user segment commands the highest share, reflecting the widespread integration of pet protein in commercial feed production for companion animals and livestock. Pharmaceutical and food & beverage applications are expanding, with proteins used in nutraceuticals and functional treats to support immunity and joint health. Cosmetic applications remain niche but are gaining traction in pet grooming and skin-care products. Drivers include the growing pet care industry, rising awareness of protein’s role in disease prevention, and the development of fortified pet products that align with human-grade nutrition standards and premium positioning in competitive markets.

Key Growth Drivers

Rising Pet Humanization

The growing trend of pet humanization is a primary driver, as owners increasingly seek high-quality, nutrient-rich diets for their pets. Animal-based proteins provide essential amino acids, vitamins, and minerals critical for pet health, supporting immunity, muscle development, and overall wellness. Premium pet food brands leverage this demand by offering meat, poultry, and fish-based formulations tailored to specific health needs. As consumers treat pets as family members, willingness to invest in superior nutrition is fueling consistent market growth across developed and emerging regions.

- For instance, Freshpet reports that its in-house R&D team now comprises 16 full-time professionals and operates over 6,000 sq ft of laboratory and testing facilities, including a dedicated pilot plant to enable new product development without disrupting main production lines.

Expansion of Premium Pet Food Market

The surge in premium and specialized pet food products is driving demand for animal-based proteins. Manufacturers are incorporating high-quality proteins such as chicken, salmon, and beef to create targeted formulations for weight management, digestive health, and active lifestyles. This trend is reinforced by increasing disposable income and urban lifestyles that prioritize convenience and quality nutrition. Investments in research and development to improve protein digestibility and bioavailability further strengthen market adoption, positioning animal-based protein as the preferred ingredient in premium pet food portfolios globally.

- For instance, Hill’s Pet Nutrition, Inc. reports that its newest manufacturing facility in Tonganoxie, Kansas spans 365,000 square-feet on more than 80 acres and integrates AI-driven food-safety vigilance, full automation and robotics, and end-to-end digital monitoring to enhance global production capabilities.

Increasing Awareness of Nutritional Benefits

Awareness of protein’s role in maintaining pets’ health is accelerating market growth. Animal-based proteins are recognized for their superior amino acid profile, enhanced palatability, and functional benefits like improved coat quality and joint health. Pet owners and veterinarians increasingly advocate diets enriched with animal proteins to address specific health concerns, including obesity, aging, and immune support. Educational campaigns, veterinary endorsements, and social media influence contribute to informed purchasing decisions, encouraging widespread adoption of high-protein formulations across diverse pet categories.

Key Trends & Opportunities

Sustainable Protein Sourcing

Sustainability is emerging as a key opportunity, with companies exploring responsibly sourced animal proteins, including by-products and aquaculture-based ingredients. Brands are adopting eco-friendly sourcing and traceable supply chains to reduce environmental impact while maintaining nutritional quality. This trend appeals to environmentally conscious consumers and opens avenues for innovative products that balance premium nutrition with sustainability. Companies investing in this approach differentiate their offerings, creating competitive advantage while meeting regulatory and consumer demands for transparency and ethical sourcing practices in the pet protein market.

- For instance, Mars Petcare, in collaboration with partners including Big Idea Ventures, AAK, and the Bühler Group, launched the “Next Generation Pet Food Program”. The program received a total of 165 applications from 39 countries for its 2025 cohort.

Functional and Fortified Pet Foods

Functional pet foods fortified with animal-based proteins are gaining traction, addressing specific health needs such as digestive wellness, immunity, and joint support. Innovations include hydrolyzed proteins, collagen-enriched formulations, and omega-3-rich fish proteins that enhance overall pet health. This trend is driven by growing awareness of preventive healthcare for pets, mirroring human nutrition trends. Companies focusing on research-backed functional products can capture premium segments, while partnerships with veterinarians and nutritionists help build credibility and consumer trust, expanding market penetration globally.

- For instance, Purina’s manufacturing automation efforts in its Clinton, Iowa, dry-food facility achieved approximately a 90% reduction in system-failure incidents during a machine-learning pilot, with the technology now rolled out across other dry-food plants achieving about 70% of that improvement so far.

Diversification Across Pet Categories

Manufacturers are exploring opportunities by diversifying protein formulations across different pet types, including cats, dogs, equine, and exotic pets. Tailored formulations for life stage, breed, and activity level create niche markets, allowing companies to capture higher margins. Emerging markets offer growth potential as pet ownership rises and consumer preferences shift towards specialized nutrition. Diversification enhances brand visibility, encourages product loyalty, and addresses gaps in the market for species-specific and health-oriented diets, positioning animal-based protein as a versatile ingredient across the pet care ecosystem.

Key Challenges

Supply Chain Constraints

Fluctuations in raw material availability, rising costs of meat and fish proteins, and regulatory restrictions on animal sourcing pose significant challenges. Supply chain disruptions can impact production schedules, pricing strategies, and product consistency. Companies must navigate complex logistics, maintain sustainable sourcing, and optimize inventory management to mitigate risks. Ensuring high-quality, traceable animal proteins while managing cost pressures remains a critical concern, particularly as demand for premium and functional products continues to rise globally.

Health and Safety Concerns

Concerns around contamination, allergens, and antibiotic residues in animal-based proteins present a challenge for manufacturers. Regulatory compliance, rigorous quality control, and adherence to safety standards are essential to maintain consumer trust. Product recalls or negative publicity can significantly impact brand reputation. Companies are investing in advanced testing, certifications, and traceable sourcing to ensure safe, high-quality protein ingredients, but ongoing vigilance is required to address consumer health concerns while sustaining market growth in an increasingly quality-conscious pet nutrition landscape.

Regional Analysis

North America

North America leads the animal-based pet protein market with a 38–40% share, driven by high pet ownership and strong demand for premium pet foods. Consumers in the U.S. and Canada prefer high-quality, minimally processed animal proteins, encouraging manufacturers to focus on ethically sourced ingredients. The region benefits from established retail networks, advanced distribution channels, and strict food safety regulations, ensuring product quality and consumer confidence. Innovations in protein formulations and new product launches continue to strengthen market growth, making North America the largest and most mature market globally.

Europe

Europe holds about 28–29% of the global market. Countries like Germany, the UK, and France show high demand for premium animal-based pet proteins due to strong consumer awareness of pet health and nutrition. Strict regulations ensure product quality and safety, reinforcing trust among pet owners. Sustainability and transparency in sourcing are increasingly important, driving manufacturers to adopt eco-friendly practices. Although growth is slower than in emerging regions, Europe remains a key market, with stable demand for high-quality proteins and steady innovation in pet food formulations.

Asia Pacific

Asia Pacific accounts for roughly 22–23% of the market and is growing rapidly. Rising urbanization, increasing disposable incomes, and greater pet adoption in countries like China, India, and Japan fuel demand for premium pet foods. Consumers prefer fresh, high-quality animal proteins, and manufacturers are expanding production and imports to meet needs. Improving regulations and food safety standards support market expansion. The region offers strong growth potential as more middle-class households prioritize pet nutrition and are willing to pay for high-protein, quality pet food products.

Latin America

Latin America contributes around 8–8.5% of the global market. Brazil is the largest market, supported by growing pet ownership and rising interest in premium pet foods. The region benefits from abundant livestock supply, making animal-based proteins more accessible. Increasing disposable income and urbanization are encouraging consumers to choose higher-quality pet nutrition. While the market is smaller than North America or Europe, it shows steady growth as awareness of pet health increases and manufacturers introduce more premium protein options.

Middle East & Africa

Middle East & Africa holds 6–7% of the market. Pet adoption is increasing, especially in urban areas, along with demand for high-quality animal proteins. While infrastructure and regulatory frameworks are still developing, imports of premium pet food are rising. Growing disposable incomes and awareness of pet nutrition are supporting market growth. The region offers opportunities for manufacturers to expand, particularly by providing ethically sourced and high-protein pet foods, as consumers gradually prioritize pet health and quality nutrition.

Market Segmentations:

By Product:

- Plant protein

- Animal protein

By Livestock:

By End User:

- Pharmaceutical

- Food & Beverage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The animal-based pet protein market, including Nutri-Pea, DuPont, COSUCRA, Roquette Frères, SOTEXPRO, Burcon, Ingredion, Shandong Jianyuan Group, Axiom Foods, Inc., and The Scoular Company. The animal-based pet protein market is highly competitive, driven by innovation, product differentiation, and strategic expansions. Companies focus on developing high-quality, sustainable, and ethically sourced animal proteins to cater to growing consumer demand for premium pet foods. Investment in research and development enables the introduction of novel protein formulations with enhanced nutritional profiles and functional benefits. Market participants are also leveraging mergers, partnerships, and regional expansions to strengthen their distribution networks and enhance market presence. Competitive advantage is increasingly shaped by product quality, traceability, regulatory compliance, and sustainability practices. Firms that prioritize transparency, innovation, and premium offerings are better positioned to capture market share and respond effectively to evolving consumer preferences in the global pet protein industry.

Key Player Analysis

- Nutri-Pea

- DuPont

- COSUCRA

- Roquette Frères

- SOTEXPRO

- Burcon

- Ingredion

- Shandong Jianyuan Group

- Axiom Foods, Inc.

- The Scoular Company

Recent Developments

- In February 2025, Marsapet and Calysta launched MicroBell, the first dog food featuring FeedKind Pet protein—an innovative, land-free cultured protein. This vegan, grain-free, and gluten-free kibble supports dogs with allergies and is now available in Europe. It offers a high nutrient profile as a sustainable alternative to traditional animal protein, marking a major step in eco-friendly pet nutrition.

- In July 2024, Ingredion Incorporated announced the launch of Vitessence Pea 100 HD, a new pea protein enhanced for cold-pressed bars for the Canada and U.S. markets. It delivers softness throughout the shelf life of cold-pressed bars.

- In February 2024, Cargill announced its expansion in Brazil by partnering with Bom Negócio to boost mineral supplement production for cattle and acquiring the Anhambi factory in Minas Gerais. This move is intended to increase production for pasture-raised cattle in Brazil’s large beef cattle market.

- In March 2023, Nepra Foods and Scoular announced a manufacturing and distribution partnership for specialized plant-based products. The agreement specifies that Nepra will lead product development through its R&D team, utilizing specialty ingredients from both companies. This collaboration will also leverage Scoular’s global supply chain to distribute the new products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Livestock, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-quality animal proteins in pet foods will continue to rise globally.

- Innovation in protein formulations will drive the development of premium and functional pet foods.

- Sustainable and ethically sourced animal proteins will gain greater consumer preference.

- Expanding pet ownership in emerging regions will create new market opportunities.

- Investments in research and development will lead to novel protein products with enhanced nutritional benefits.

- Regulatory standards will increasingly shape product quality and safety requirements.

- Companies will focus on improving supply chain efficiency and distribution networks.

- Mergers, acquisitions, and strategic partnerships will intensify market competition.

- Consumer awareness of pet health and wellness will continue to influence product trends.

- Digital marketing and e-commerce channels will play a growing role in market expansion.

Market Insights

Market Insights