Market Overview:

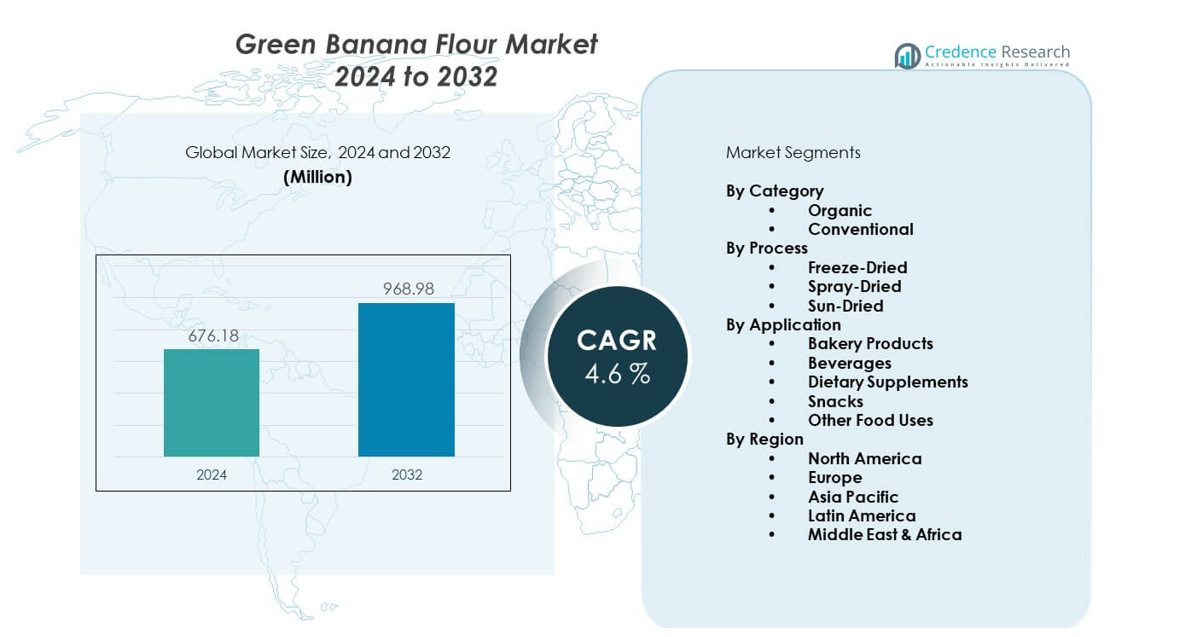

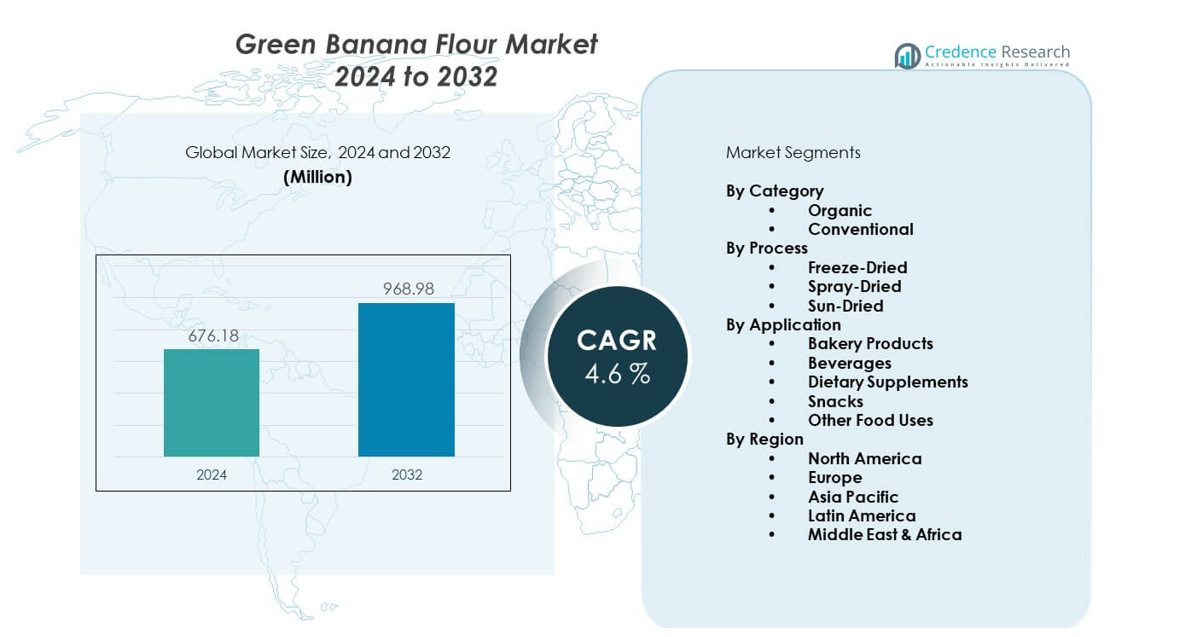

The Green Banana Flour Market is projected to grow from USD 676.18 million in 2024 to an estimated USD 968.98 million by 2032, with a compound annual growth rate (CAGR) of 4.6% from 2024 to 2032. Demand rises due to its clean-label appeal, gluten-free profile, and wide use in bakery, snacks, and dietary supplements. Growth also reflects stronger adoption in sports nutrition and gut-health products due to high resistant starch content.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Green Banana Flour Market Size 2024 |

USD 676.18 million |

| Green Banana Flour Market, CAGR |

4.6% |

| Green Banana Flour MarketSize 2032 |

USD 968.98 million |

Growing focus on healthy and natural ingredients drives wider use in food production. Brands adopt green banana flour to replace wheat and synthetic thickeners in everyday items. Manufacturers benefit from strong interest in fiber-rich alternatives for better digestion. The rising vegan and paleo population boosts clean-label demand. Food processors use this flour to lower sugar loads in new products. Expanding awareness of low-GI diets further supports steady growth.

North America and Europe lead adoption due to strong gluten-free demand and high clean-label awareness. These regions benefit from large functional food industries and rising preference for plant-based products. Asia Pacific emerges as a fast-growing market driven by large banana production, wider access to raw materials, and rising health-focused consumers. Latin America holds steady growth momentum supported by its strong agricultural base. The Middle East and Africa show improving adoption as awareness of natural flours expands across foodservice and packaged food categories.

Market Insights:

- The Green banana flour market is valued at USD 676.18 million in 2024 and is projected to reach USD 968.98 million by 2032, growing at a 6% CAGR driven by rising clean-label and gluten-free demand.

- North America (32%), Europe (28%), and Asia Pacific (30%) lead the market due to strong product awareness, regulatory support for clean-label foods, and large-scale raw material availability.

- Asia Pacific is the fastest-growing region with 30% share, supported by abundant banana cultivation, cost-effective processing, and expanding health-conscious consumer segments.

- The bakery products segment holds the largest share at about 35%, driven by strong demand for gluten-free and alternative flour formulations.

- Organic and conventional categories together shape segment distribution, with conventional holding nearly 60% share due to broader industrial usage and cost efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Use of Clean-Label and Gluten-Free Ingredients Across Food Categories

The Green banana flour market grows due to rising interest in natural ingredients. Food producers shift toward wheat alternatives for cleaner formulations. The flour offers a natural source of resistant starch that strengthens digestive health claims. Brands adopt this ingredient to reduce synthetic binders in bakery and snack items. Growing intolerance to gluten supports faster demand from health-focused buyers. It helps producers meet strict labelling norms in major food markets. Fitness consumers prefer products with lower sugar impact. Strong preference for plant-based ingredients pushes wider product development.

- For instance, Myprotein lists under 2 g of sugar per serving across many functional baking mixes, verified on its official product pages. Strong interest in plant-based ingredients pushes wide product development.

Expansion of Functional Food and Beverage Applications in Growth-Oriented Industries

The Green banana flour market sees strong traction from the functional food segment. Manufacturers use the flour to improve fiber levels in beverages and powdered mixes. It brings a mild flavor profile that works well across multiple food systems. Diet-focused brands use it to support weight-control formulas. Growth in sports nutrition strengthens demand for high-resistant starch sources. Companies test new formulations to improve texture in protein bars. It supports better stability in dry-mix products. Rising interest in natural performance ingredients expands its industrial relevance.

- For instance, Clif Bar continues to use plant-based, organic ingredients in its products and has previously announced minor recipe changes to reduce sugar in some bars and new product launches like the BUILDERS Reduced Sugar Crispy Protein bars in recent years.

Growing Consumer Demand for Low-Glycemic and High-Fiber Alternatives in Daily Diets

The Green banana flour market expands due to interest in low-GI diets. Health-conscious users value the slow-digesting starch profile. Food brands replace refined flour with greener ingredients to improve nutritional value. It supports blood sugar control in new product lines. Producers focus on gut wellness trends that require natural fiber sources. Weight-control programs use the flour to extend satiety. Restaurants experiment with gluten-free menu items to meet rising demand. Clean lifestyle diets help build steady market momentum.

Strong Adoption in Vegan, Paleo, and Plant-Based Product Development Across Regions

The Green banana flour market benefits from the rise of plant-based lifestyles. Developers seek fruit-based flours that maintain label simplicity. The flour supports paleo, vegan, and allergen-free formulation needs. Growing use in protein-rich plant mixes boosts its adoption. It helps create nutrient-dense snacks with fewer artificial fillers. Regional brands invest in natural flours to meet lifestyle-led preferences. Food start-ups experiment with grain-free mixes for premium consumers. Broader wellness movements support long-term product uptake.

Market Trends:

Rising Innovation in Bakery, Snack, and Dessert Applications with Texture-Focused Formulations

The Green banana flour market follows strong innovation in new textures. Brands experiment with the flour to build denser bakery structures. Developers focus on replacing refined ingredients for better health appeal. It supports dessert mixes that require stable viscosity. Snack brands explore fruit-based powders for next-gen clean products. Dairy alternatives adopt the flour to stabilize plant-based textures. Low-allergen formulations gain ground with wider flour use. Producers fine-tune blending ratios to meet evolving consumer expectations.

- For instance, Danone’s Alpro brand offers over 130 plant-based products worldwide and uses natural plant fibers to maintain stable texture. Low-allergen formulations gain share. Producers refine blends to match evolving expectations.

Expansion of Prebiotic and Gut-Health Positioning Across Retail and Foodservice Segments

The Green banana flour market aligns with the rise of gut-health messaging. Brands highlight resistant starch for digestive balance. Retailers promote products with natural prebiotic benefits. Foodservice chains include high-fiber options to satisfy healthy diners. It supports claims that resonate strongly with wellness-driven consumers. New launches feature improved microbiome support. Dieticians express interest in fruit-based functional ingredients. Awareness of natural digestive aids increases product visibility.

- For instance, Pret A Manger has significantly expanded its plant-based and “bowl” offerings as part of its menu innovation strategy, particularly since acquiring rival chain EAT in 2019 to convert many of its sites into “Veggie Pret” locations.

Growing Penetration in Infant Nutrition, Elderly Nutrition, and Clinical Food Applications

The Green banana flour market gains traction in specialized nutrition. Infant food producers explore natural fruit flours for gentle digestion. Elderly nutrition brands value mild flavors and high fiber levels. It offers stability for clinical food formulations. Hospitals seek clean carbohydrate sources for dietary programs. Manufacturers design simple ingredient lists to meet strict standards. Powdered meals incorporate the flour for smoother textures. Regulatory clarity in several regions supports broader adoption.

Shift Toward Sustainable Sourcing and Upcycling of Banana Byproducts for New Product Lines

The Green banana flour market aligns with sustainability-driven innovation. Producers upcycle unripe bananas to lower waste levels. Factories explore energy-efficient drying systems for greener output. It helps reduce environmental pressure in banana-growing regions. Brands market the ingredient as a low-impact alternative. Eco-conscious consumers support products with reduced waste footprints. Supply chains incorporate better traceability systems. Sustainability certifications gain importance in product branding.

Market Challenges Analysis:

Limited Processing Infrastructure and High Production Complexity Across Key Banana-Growing Regions

The Green banana flour market faces hurdles due to limited processing capacity. Producers handle high moisture content that demands advanced drying systems. Investment requirements reduce entry from small firms. It limits regional coverage in emerging markets. Supply chain delays occur when processing plants run below scale. Farmers struggle with inconsistent raw material transport. Product quality swings when handling practices vary. Technical expertise shortages slow broader adoption.

Low Consumer Awareness and Limited Standardization Across International Food Markets

The Green banana flour market faces gaps in consumer understanding. Buyers remain unfamiliar with the flour’s functional benefits. Regional markets lack unified quality standards. It restricts faster penetration in mainstream categories. Brands struggle with marketing costs to educate users. Retail visibility varies by country due to slow shelf adoption. Food manufacturers test limited volumes before scaling. Confusion with regular banana powder creates further delays.

Market Opportunities:

Expansion in High-Value Functional Food Categories Across Health-Focused Consumer Groups

The Green banana flour market holds strong opportunities in new functional foods. Developers use the flour to support metabolic health formulas. It aligns with diet plans seeking natural fiber. Brands expand plant-based lines with fruit-derived ingredients. Health stores highlight the flour’s nutritional profile. Snack makers test energy-dense concepts with clean labels. Demand rises for nutrient-rich mixes with simple formulations. Broader wellness interest supports rapid category expansion.

Rising Adoption in Bakery, Sports Nutrition, and Specialty Dietary Segments Across Global Markets

The Green banana flour market benefits from growing use in protein snacks. Athletes prefer natural carbohydrate sources for gut comfort. It supports grain-free mixes for allergen-sensitive buyers. Bakeries integrate the flour into premium gluten-free goods. Regional producers explore export opportunities for niche ingredients. Diet food manufacturers value smooth blending performance. Growing foodservice innovation encourages wider adoption. Lifestyle-driven demand strengthens long-term market potential.

Market Segmentation Analysis:

By Category

The Green banana flour market divides into organic and conventional segments. Organic flour gains strong attention from clean-label buyers and premium food brands. It offers chemical-free sourcing that supports wellness-focused positioning. Conventional flour secures higher share in industrial and bulk applications due to stable pricing. It supports bakery and snack manufacturers that need scalable volumes. Organic varieties expand across health stores and specialty channels. Conventional grades maintain broader distribution in mainstream markets. Both categories support diverse formulation needs across food sectors.

By Process

The market includes freeze-dried, spray-dried, and sun-dried formats. Freeze-dried flour offers high nutrient retention and suits clinical and premium applications. It provides fine texture with strong stability in powdered mixes. Spray-dried flour supports large-scale industrial use due to consistent output. Sun-dried flour attracts small producers with traditional processing benefits. It appeals to cost-sensitive markets with simple production requirements. Freeze-dried variants expand across sports nutrition formulations. Spray-dried types dominate commercial supply chains.

- For instance, GEA Group’s spray dryers operate in 65+ countries and support capacities above 1,000 kg/h, confirmed in equipment specifications.

By Application

Key applications include bakery products, beverages, dietary supplements, snacks, and other food uses. Bakery items drive strong consumption due to rising interest in gluten-free mixes. Beverages adopt the flour for fiber enrichment and natural thickening. Dietary supplements use the ingredient for resistant starch content. Snacks incorporate the flour to enhance texture in clean-label launches. Other food uses span sauces, infant nutrition, and functional food lines. It supports versatile performance across dry and wet formulations.

Segmentation:

By Category

By Process

- Freeze-Dried

- Spray-Dried

- Sun-Dried

By Application

- Bakery Products

- Beverages

- Dietary Supplements

- Snacks

- Other Food Uses

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The Green banana flour market shows strong presence in North America, holding around 32% share. Demand grows due to high adoption of gluten-free and clean-label products. Consumers prefer natural fiber sources that support digestive wellness. It gains traction in bakery mixes and sports nutrition categories. Food companies expand formulations to meet rising health-focused trends. Retailers support the category with wider shelf placement. The region maintains steady growth due to strong product awareness.

Europe

Europe accounts for nearly 28% share of the Green banana flour market. The region benefits from strict clean-label standards that support natural ingredient adoption. It gains solid demand from bakery producers targeting wheat-free alternatives. Functional food developers use the flour for fiber enrichment and low-GI claims. Rising vegetarian and plant-based diets strengthen category acceptance. It sees wider use in meal replacement and wellness beverages. Regional manufacturers invest in high-quality processing to match regulatory expectations.

Asia Pacific, Latin America, and Middle East & Africa

Asia Pacific leads global production with about 30% share supported by strong banana cultivation. Local processors benefit from easy access to raw materials and cost-effective sourcing. Latin America holds roughly 7% share and supplies both regional and export markets. It strengthens its role in industrial-scale production due to favorable climate and crop availability. Middle East & Africa account for about 3% share with rising interest in functional flours. The Green banana flour market grows in these regions due to expanding health awareness. It gains visibility through bakery, beverage, and supplement categories across emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Green banana flour market features a mix of regional producers and specialized health-focused brands that compete on purity, processing quality, and distribution reach. Leading companies strengthen their portfolios with clean-label ingredients and stable supply chains. It sees active product differentiation based on nutrient retention and flavor consistency. Smaller firms focus on organic and premium variants to secure niche demand. Larger processors expand global distribution through retail, specialty stores, and online platforms. Innovation in drying methods helps companies improve texture and nutritional profiles. Stronger emphasis on sustainability enhances brand positioning across major markets.

Recent Developments:

- In November 2025, Natural Evolution Pty Ltd showcased the continued innovation and versatility of its green banana flour, highlighting breakthrough research into the product’s antimicrobial and phytochemical properties for use in new ingredient and ointment formulations, reinforcing its leadership in the pharmaceutical-grade banana flour segment.

Report Coverage:

The research report offers an in-depth analysis based on By Category and By Process. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for clean-label ingredients is expected to rise across key food categories.

- New product launches will strengthen adoption in gluten-free bakery lines.

- Resistant starch benefits will drive interest from health and wellness brands.

- Organic variants may gain stronger penetration in premium retail channels.

- Process innovations will improve texture and nutritional stability.

- Major producers may expand supply capacity in banana-growing regions.

- Wider acceptance in beverages and supplements will support long-term growth.

- Growing plant-based diets will improve product positioning globally.

- Sustainability-focused consumers may favor upcycled banana-based flours.

- Foodservice chains could expand use in healthy meal and snack offerings.