Key Growth Drivers

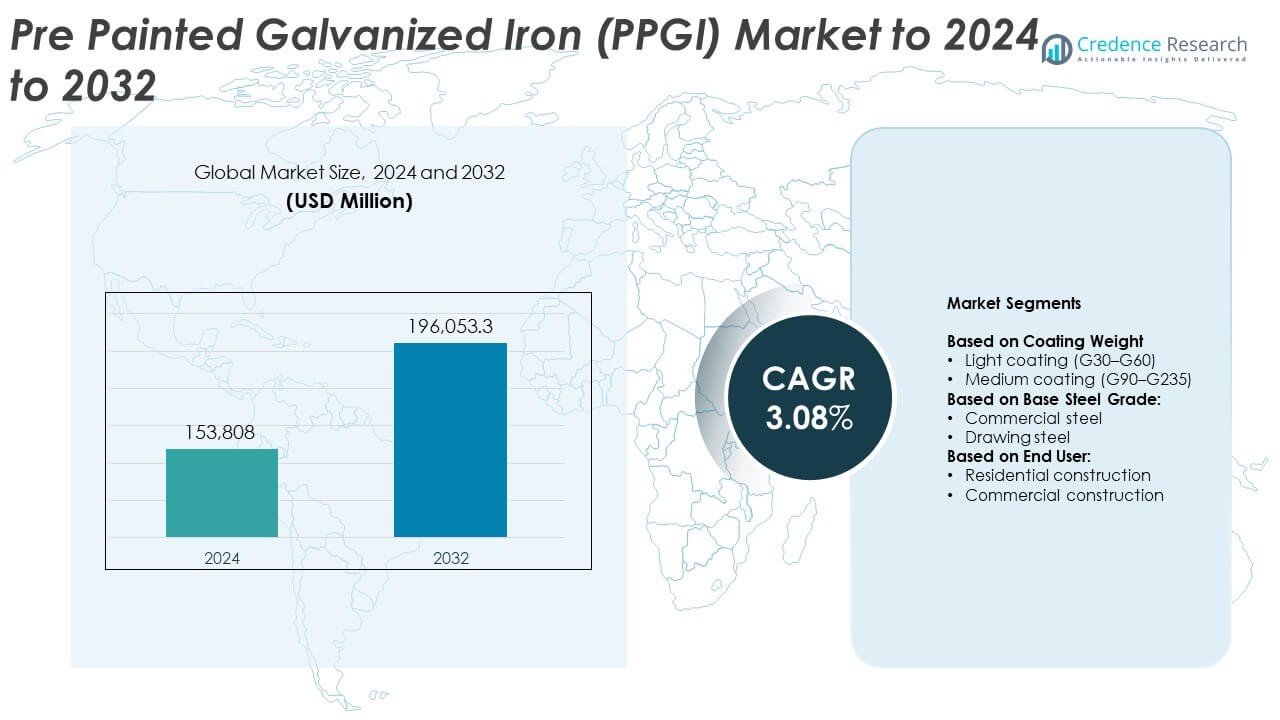

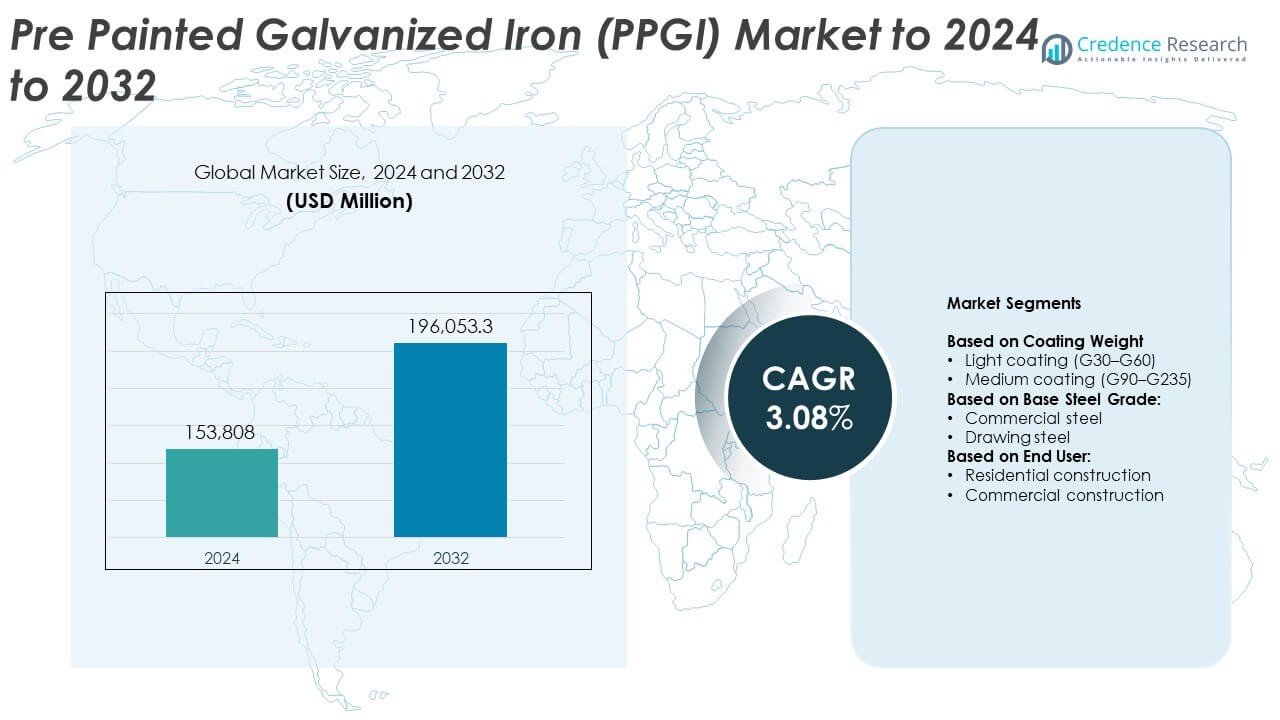

Pre Painted Galvanized Iron (PPGI) Market size was valued at USD 153,808 million in 2024 and is anticipated to reach USD 196,053.3 million by 2032, at a CAGR of 3.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pre Painted Galvanized Iron (PPGI) Market Size 2024 |

USD 153,808 Million |

| Pre Painted Galvanized Iron (PPGI) Market, CAGR |

3.08% |

| Pre Painted Galvanized Iron (PPGI) Market Size 2032 |

USD 196,053.3Million |

The pre painted galvanized iron (PPGI) market is led by major steel producers such as JSW Steel Limited, Tata Steel, ArcelorMittal, NLMK Group, JFE Steel Corporation, POSCO Holdings Inc., Jiangsu Shagang Group, Steel Dynamics Inc., thyssenkrupp, and Nippon Steel Corporation, all of which compete through advanced coating technologies, broad product portfolios, and strong regional distribution networks. Asia Pacific stands as the leading region, holding about 38% share in 2024 due to rapid construction growth and large-scale manufacturing capacity. Europe follows with nearly 26% share, while North America accounts for around 22%, reflecting steady demand across residential, commercial, and industrial applications.

Market Insights

- The pre painted galvanized iron (PPGI) market reached USD 153,808 million in 2024 and is projected to hit USD 196,053.3 million by 2032, growing at a CAGR of 3.08%.

- Rising demand from roofing and cladding in residential construction drives growth, with residential applications holding about 58% share due to high adoption in fast-developing economies.

- Trends include the expansion of energy-efficient reflective coatings and rising use of PPGI in modular and prefabricated buildings across Asia Pacific and the Middle East.

- The market remains competitive as major steel producers scale coating capacities and invest in high-durability, corrosion-resistant finishes to differentiate products amid pressure from low-cost regional manufacturers.

- Asia Pacific leads the global market with 38% share, followed by Europe at 26% and North America at 22%, while light coating grades account for about 52% share, reinforcing strong demand for cost-efficient building materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Coating Weight

Light coating (G30–G60) held the dominant share in 2024 with about 52% of the pre painted galvanized iron (PPGI) market. Buyers selected light coating grades because they offer good corrosion protection at a lower price, making them suitable for large-volume roofing and cladding projects. The segment grew further due to high use in rural and semi-urban housing, where cost efficiency drives material choice. Medium coating grades (G90–G235) gained steady traction in coastal and industrial zones, but light coatings stayed ahead due to wider suitability and faster installation demand.

- For instance, JSW Steel Coated Products operates coated steel facilities with total capacity of 1.8 million tons per year, including 0.69 million tons per year of colour-coated steel, supporting large roofing and cladding demand.

By Base Steel Grade

Commercial steel led this segment in 2024 with nearly 61% share, driven by strong adoption in mass-scale construction and general fabrication work. The grade delivers stable formability and adequate strength for roofing sheets, panels, and structural covers, which supports high preference among contractors. Demand remained strong in fast-growing building projects across Asia and Africa. Drawing steel recorded moderate share, mainly used for deeper forming applications, but commercial steel stayed dominant because it meets most performance needs at a competitive cost.

- For instance, POSCO’s annual crude steel production was approximately 35.05 million tons in 2024.

By End User

Residential construction dominated the end-user category in 2024 with roughly 58% share, supported by large demand for PPGI sheets in roofing, wall panels, and home renovation activities. Growing housing starts and government-backed affordable housing programs in India, China, and Southeast Asia further strengthened residential adoption. Consumers favor PPGI sheets because they offer durable surface finish, lower maintenance needs, and better heat reflectivity. Commercial construction showed steady growth in warehouses, retail spaces, and office buildings, but residential use stayed ahead due to larger project volume.

Market Overview

Market Overview

Rising Demand from Roofing and Cladding Applications

Growing construction activity across residential and commercial sectors continues to drive strong demand for pre painted galvanized iron (PPGI). Developers favor PPGI sheets for roofing and cladding because these products provide durable surface protection, aesthetic appeal, and reduced maintenance needs. Expanding urban projects and wider adoption of lightweight building materials further support market growth. Many countries in Asia and Africa are investing in large-scale housing programs, which increases the use of coated steel sheets and strengthens this driver’s impact on long-term market expansion.

- For instance, ArcelorMittal offers product guarantees on its prepainted steel range for roofing and cladding, with certain premium products like Granite® HDXtreme offering guarantees of up to 40 years.

Shift Toward Cost-Efficient Building Materials

Contractors and builders prefer PPGI due to its cost efficiency compared with conventional painted steel or concrete-based exterior solutions. The material offers a long service life, reduced repainting cycles, and easier installation, lowering overall project expenses. Price-sensitive regions such as South Asia, Southeast Asia, and parts of Latin America rely heavily on affordable construction materials, which boosts PPGI consumption. The replacement of traditional galvanized sheets with pre-coated variants also strengthens market adoption across fast-growing infrastructure and residential projects.

- For instance, Tata BlueScope Steel’s PRISMA® pre-painted Al-Zn steel for roofing and walling is supplied in a Base Metal Thickness (BMT) range typically from 0.32 millimetres to 1.1 millimetres.

Expansion of Industrial Manufacturing and Warehousing

The rise of manufacturing hubs, logistics parks, and warehouse clusters strongly supports PPGI market growth. Companies use PPGI sheets in wall panels, facades, and utility structures due to their corrosion resistance and long-term durability. Government incentives for industrial expansion in India, Vietnam, Indonesia, and the Middle East increase demand for ready-to-install building materials. Growth in e-commerce warehousing also accelerates the use of PPGI panels, as developers require quick-to-build and weather-resistant solutions that keep project timelines shorter.

Key Trends & Opportunities

Growth of Energy-Efficient and Reflective Coatings

Energy-efficient coatings on PPGI sheets are gaining traction as builders look for materials that reduce heat absorption and improve indoor comfort. Reflective pigment technologies help lower building temperatures, cutting energy usage in warm climates. This trend is strong in developing regions where energy costs rise and sustainability policies expand. Manufacturers offering advanced coating systems with UV resistance and longer color stability gain a competitive advantage, creating an opportunity for high-value product lines tailored for modern green construction standards.

- For instance, Kingspan achieved Net Zero Energy status across all its global manufacturing sites in 2019, primarily by generating renewable electricity on-site using large-scale integrated rooftop solar PV systems. A key example is their 80,000-square-metre manufacturing facility in Stigamo, Sweden, which highlights the shift toward energy-efficient building envelopes that drastically reduce energy requirements, and the use of integrated roof systems to generate necessary power.

Increasing Adoption in Modular and Prefabricated Buildings

The shift toward modular and prefabricated construction opens new opportunities for PPGI usage. Developers prefer factory-made PPGI panels because they shorten construction timelines and ensure consistent quality. Growing demand for quick-build schools, hospitals, and industrial structures fuels this trend, especially in Asia Pacific and the Middle East. Lightweight PPGI sheets fit well in portable cabins, container homes, and prefabricated roof systems, creating a strong market opportunity as governments and private developers scale modular building adoption.

- For instance, Fabex Steel Structures’ new plant near Hyderabad adds 50,000 metric tons per year of pre-engineered building capacity, raising its total capacity to 100,000 metric tons per year for factories, warehouses and logistics structures built with prefabricated steel systems.

Advances in Digital Color Coating Technologies

Improvements in digital printing and precision coating lines allow manufacturers to deliver customized textures, wood patterns, and premium finishes on PPGI sheets. This trend expands demand in architectural applications where aesthetics matter. Growth in modern housing and commercial facades increases adoption of decorative PPGI variants. The ability to match brand-specific colors and surface effects creates new opportunities for premium offerings, helping suppliers differentiate their products in competitive markets.

Key Challenges

Volatility in Steel and Coating Material Prices

Price fluctuations in raw materials, especially steel coils and coating chemicals, create major cost pressures for PPGI manufacturers. Sudden spikes in zinc, paint resins, or pigments reduce profit margins and disrupt production planning. Many small and mid-sized manufacturers struggle to manage these variations, leading to inconsistent supply and pricing. The challenge grows in regions that depend heavily on imported raw materials, where currency swings further raise costs and limit the ability to offer stable market pricing.

Competition from Low-Cost Unorganized Manufacturers

Unorganized and small-scale manufacturers create strong price competition in many Asian and African markets. These producers often sell low-cost, lower-quality PPGI sheets that appeal to budget-sensitive buyers, reducing market share for established brands. Quality inconsistencies and weaker adherence to standards remain concerns, yet buyers in rural or semi-urban areas may still choose cheaper options. This challenge pressures recognized manufacturers to justify higher pricing through product durability, warranty support, and advanced coating performance.

Regional Analysis

North America

North America held about 22% share of the pre painted galvanized iron (PPGI) market in 2024, supported by strong adoption in residential roofing, commercial façades, and light industrial structures. Demand grew as builders preferred coated steel sheets for their long life, low maintenance, and stable performance in varied climates. The United States led usage due to rising home renovation activity and warehouse construction. Canada contributed steady growth through infrastructure upgrades and expanding modular building projects. Replacement of older galvanized sheets with modern pre-coated variants also strengthened regional consumption.

Europe

Europe accounted for nearly 26% share of the PPGI market in 2024, driven by stricter building standards, higher focus on energy-efficient materials, and strong demand for premium coated surfaces. Germany, France, and the United Kingdom led consumption as commercial projects adopted durable façade cladding and corrosion-resistant roofing sheets. The region’s preference for sustainable construction boosted the use of advanced coatings with longer color retention. Growth in industrial refurbishments and logistics infrastructure added further momentum. Eastern Europe showed rising adoption due to expanding housing projects and cost-efficient construction needs.

Asia Pacific

Asia Pacific dominated the global PPGI market with around 38% share in 2024, driven by rapid urbanization, large-scale construction activity, and strong residential demand in China, India, and Southeast Asia. Governments invested heavily in housing, infrastructure, and industrial zones, which boosted consumption of coated steel sheets for roofs, walls, and factory buildings. The region also benefited from competitive manufacturing, large steel production capacity, and advanced coating lines. Growing adoption of modular structures and cold-formed steel systems pushed demand higher. Rising disposable income supported wider use of aesthetically improved PPGI panels.

Latin America

Latin America held close to 8% share of the PPGI market in 2024, supported by growing residential construction and gradual recovery in commercial projects. Brazil and Mexico led regional demand due to increasing investments in warehouses, retail spaces, and renovation activities. Builders favored PPGI sheets for their corrosion resistance and lower maintenance needs, especially in humid coastal zones. Infrastructure modernization and industrial expansion created steady demand, while rising adoption of prefabricated structures added new opportunities. Economic fluctuations moderated growth, yet long-term interest in cost-efficient coated steel products remained stable.

Middle East & Africa

The Middle East and Africa captured about 6% share of the PPGI market in 2024, driven by rising demand for durable roofing and cladding materials in extreme climates. Gulf countries supported consumption through large-scale commercial and industrial developments, including logistics hubs and smart city projects. Africa showed growing adoption in low-cost housing and small commercial structures, where PPGI offered affordability and long service life. Expanding retail infrastructure and rising urban migration also supported usage. Despite slower economic cycles in some nations, the region continued to invest in weather-resistant and energy-efficient building materials.

Market Segmentations:

By Coating Weight

- Light coating (G30–G60)

- Medium coating (G90–G235)

By Base Steel Grade

- Commercial steel

- Drawing steel

By End User

- Residential construction

- Commercial construction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the pre painted galvanized iron (PPGI) market is shaped by major global producers such as JSW Steel Limited, Tata Steel, ArcelorMittal, NLMK Group, JFE Steel Corporation, POSCO Holdings Inc., Jiangsu Shagang Group, Steel Dynamics Inc., thyssenkrupp, and Nippon Steel Corporation. Market rivalry remains intense as leading manufacturers focus on expanding coating capacities, improving product durability, and enhancing color performance to meet growing construction and industrial demand. Companies compete through advanced coil-coating technologies, wider grade flexibility, and consistent quality standards across regional markets. Many producers invest in automated coating lines and energy-efficient curing systems to increase throughput and reduce operational costs. Strategic moves such as backward integration in steelmaking, product customization, and entry into high-growth Asian and African geographies further strengthen competitive positioning. Rising demand for premium finishes, reflective coatings, and corrosion-resistant sheets continues to push manufacturers toward innovation-driven differentiation in this market.

Key Player Analysis

- JSW Steel Limited

- Tata Steel

- ArcelorMittal

- NLMK Group

- JFE Steel Corporation

- POSCO Holdings Inc.

- Jiangsu Shagang Group

- Steel Dynamics Inc.

- thyssenkrupp

- Nippon Steel Corporation

Recent Developments

- In 2025, ArcelorMittal has completed the acquisition of Nippon Steel Corporation’s stake in AM/NS Calvert. Renamed as ArcelorMittal Calvert, the facility is recognized as one of the most advanced steel finishing plants in North America, featuring state-of-the-art assets such as galvanized lines, which significantly strengthen the galvanized steel market.

- In 2025, Jindal Steel commissioned its first continuous galvanizing line, CGL 1, at its Angul plant in Odisha to produce galvanized and galvalume steel products.

- In 2024, ArcelorMittal Launched its first coated coil at its Brazil plant, announced a new ‘Sustainable Solutions’ segment focusing on value-added construction products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Coating Weight, Base Steel Grade, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as construction activity increases across developing regions.

- Adoption of energy-efficient and reflective coatings will rise due to sustainability needs.

- Demand for PPGI in modular and prefabricated buildings will grow rapidly.

- Manufacturers will invest more in advanced coil-coating technologies to improve durability.

- Premium aesthetic finishes will gain traction in residential and commercial façades.

- Industrial and warehouse construction will continue to boost large-format PPGI sheet demand.

- Supply chain integration and automation will improve production efficiency among major producers.

- Competition will intensify as new regional manufacturers enter emerging markets.

- Regulations focused on corrosion resistance and environmental performance will shape product development.

- Asia Pacific will remain the dominant growth center due to strong housing and industrial expansion.

Market Overview

Market Overview