Market Overview

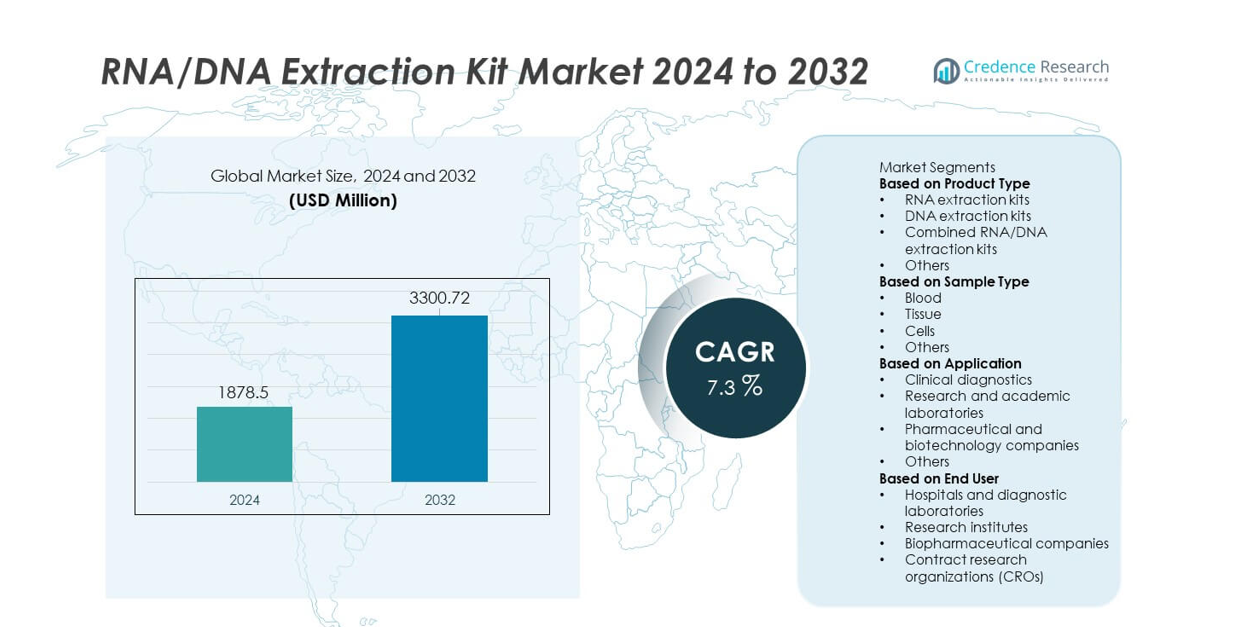

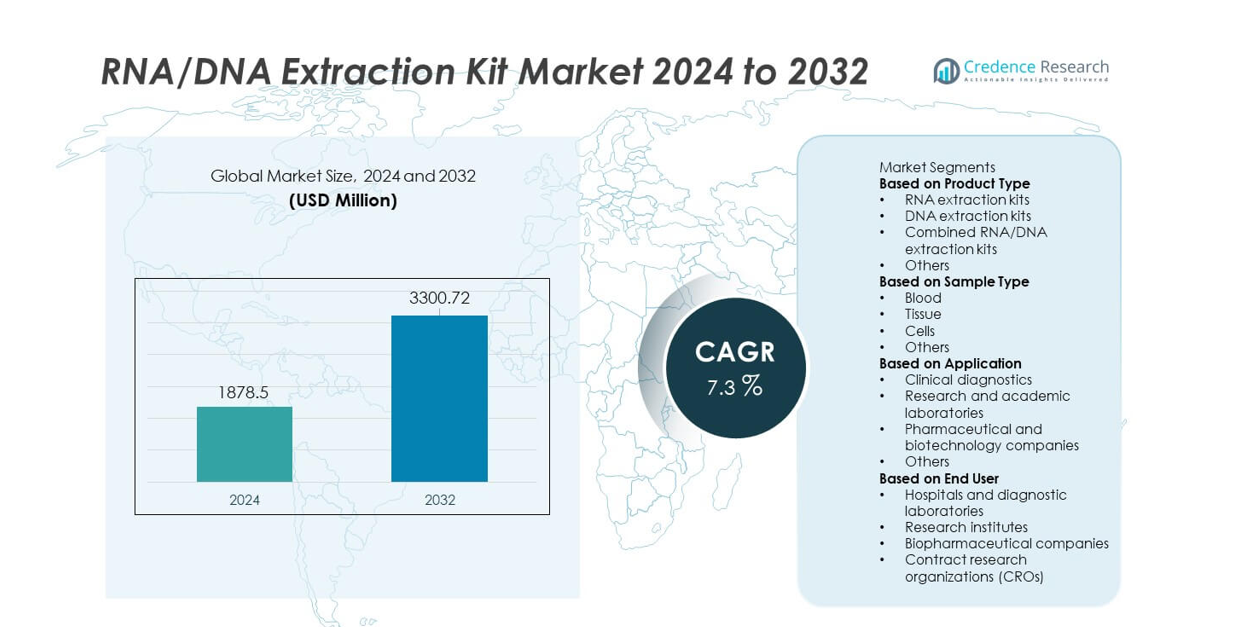

The RNA/DNA Extraction Kit market was valued at USD 1,878.5 million in 2024 and is projected to reach USD 3,300.72 million by 2032, registering a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| RNA/DNA Extraction Kit Market Size 2024 |

USD 1,878.5 million |

| RNA/DNA Extraction Kit Market, CAGR |

7.3% |

| RNA/DNA Extraction Kit Market Size 2032 |

USD 3,300.72 million |

The top players in the RNA/DNA Extraction Kit market include Qiagen N.V., Thermo Fisher Scientific Inc., Promega Corporation, Roche Diagnostics, Bio-Rad Laboratories Inc., Agilent Technologies Inc., Takara Bio Inc., New England Biolabs, Zymo Research Corporation, and PerkinElmer Inc. These companies lead the industry with high-efficiency extraction chemistries, automation-ready kits, and strong global distribution networks. North America dominates the market with a 40% share, supported by advanced molecular diagnostic adoption and strong research funding. Europe follows with a 28% share, driven by established genomic programs and strict quality standards, while Asia Pacific holds a 23% share as the fastest-growing region.

Market Insights

- The RNA/DNA Extraction Kit market reached USD 1,878.5 million in 2024 and will reach USD 3,300.72 million by 2032 at a CAGR of 7.3%, driven by expanding molecular testing needs.

- Strong growth comes from rising demand for high-purity nucleic acid extraction, with DNA extraction kits holding a 42% share and blood samples leading with 46%, supported by widespread use in diagnostics and research.

- Key trends include rapid adoption of magnetic bead–based technologies and automation-ready kits as laboratories shift toward high-throughput and contamination-free workflows.

- Competitive intensity increases as leading companies enhance chemistries, improve extraction yields, and expand automation platforms, while cost pressures and workflow variability remain notable restraints.

- Regional performance is led by North America at 40%, followed by Europe at 28% and Asia Pacific at 23%, reflecting strong diagnostic infrastructure, genomic research growth, and rising investment across clinical and academic settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

DNA extraction kits lead this segment with a 42% share, driven by their essential role in clinical diagnostics, infectious disease testing, and genomic analysis. Laboratories rely on DNA kits for high-purity yields that support PCR, sequencing, and molecular profiling. RNA extraction kits see rising demand due to growth in transcriptomics and viral detection workflows. Combined RNA/DNA extraction kits gain adoption in labs seeking faster processing and reduced sample volume requirements. Other product types support specialized workflows in microbiology and forensic testing. Expansion of molecular testing platforms continues to push demand for reliable, high-efficiency extraction solutions.

- For instance, Qiagen’s QIAamp DNA Mini Kit is a widely used product that can purify high-quality DNA from various sample types, such as 200 µL of blood or up to 25 mg of tissue. It delivers typical nucleic acid yields of 4–12 µg for 200 µL of blood and 10–30 µg of DNA (with RNase A treatment) for 25 mg of liver tissue.

By Sample Type

Blood dominates the sample-type segment with a 46% share, supported by its widespread use in diagnostic assays, oncology screening, and genetic testing. Laboratories prefer blood samples due to high nucleic acid stability and consistent yields. Tissue samples show growing demand in cancer genomics, histopathology, and biomarker discovery. Cell-based extraction expands with increased use in stem-cell research, immunology studies, and cell-line development. Other sample types, including swabs and plasma, strengthen their presence in infectious disease testing. Rising adoption of precision medicine and high-throughput workflows drives the need for robust extraction performance across diverse sample types.

- For instance, Roche’s High Pure PCR Template Kit extracts 3–6 μg DNA from 200 μl blood samples with purity suitable for long-template PCR and Southern blotting.

By Application

Clinical diagnostics lead the application segment with a 48% share, driven by expanded molecular testing for infectious diseases, oncology, and genetic screening. Hospitals and diagnostic labs depend on extraction kits for accurate and rapid nucleic acid purification that supports PCR, NGS, and point-of-care workflows. Research and academic laboratories maintain strong usage as genomics, proteomics, and biomarker studies grow. Pharmaceutical and biotechnology companies use extraction kits in drug discovery, cell-line development, and clinical trial testing. Other applications, including forensic analysis, continue to expand. Growing reliance on molecular workflows solidifies demand across clinical and research environments.

Key Growth Drivers

Rising Demand for Molecular Diagnostics

Growing use of molecular testing strengthens demand for RNA/DNA extraction kits across hospitals, diagnostic centers, and public health labs. Infectious disease testing, oncology screening, and genetic profiling depend on high-quality nucleic acid yields, driving consistent product adoption. The rise of PCR, qPCR, and sequencing expands extraction needs as laboratories increase test volumes. Clinics rely on rapid and reliable extraction workflows to support fast diagnostic turnaround times. This shift toward precision-based diagnostics continues to elevate kit consumption and enhances the role of nucleic acid purification in modern healthcare.

- For instance, Thermo Fisher’s KingFisher Flex platform processes up to 96 nucleic acid samples per run using MagMAX extraction chemistry, typically in approximately 25 minutes.

Expansion of Genomic Research and Personalized Medicine

Increasing investment in genomic studies accelerates extraction kit usage across research and academic laboratories. Scientists require high-purity RNA and DNA to support transcriptomics, biomarker discovery, and population genetics. Personalized medicine initiatives push demand as clinicians adopt genome-guided treatment plans. Pharmaceutical companies also depend on extraction kits for drug development, cell-line studies, and clinical research. As genomic insights become central to disease understanding, the need for robust, contamination-free extraction workflows grows, strengthening long-term market expansion.

- For instance, Agilent’s SureSelect enrichment workflow supports sequencing studies by processing genomic inputs as low as 10 ng while enabling coverage above 20,000 annotated genes.

Growth of Automation and High-Throughput Workflows

Automated extraction systems increase adoption as labs seek faster processing, reduced manual errors, and higher sample throughput. Automated platforms support consistent nucleic acid yields, making them essential for large diagnostic laboratories and biotech manufacturing setups. High-throughput sequencing workflows further boost the need for standardized extraction processes. The shift toward integrated robotic systems encourages procurement of automation-compatible kits. This focus on efficiency and scalability positions automated extraction as a major driver of market growth.

Key Trends & Opportunities

Shift Toward Magnetic Bead–Based and High-Purity Extraction Technologies

Magnetic bead–based extraction becomes a major trend as labs demand higher purity, improved sensitivity, and compatibility with automation. These systems reduce contamination risks and support cleaner nucleic acid isolation for next-generation sequencing and advanced PCR applications. Manufacturers introduce optimized chemistries that enhance yield from low-volume or degraded samples. This shift creates strong opportunities for companies offering advanced beads, improved binding buffers, and optimized purification workflows. Growth in high-sensitivity diagnostics further strengthens demand for premium extraction formats.

- For instance, Beckman Coulter’s RNAdvance Viral Kit processes 96 samples in one batch and supports elution volumes down to 20 µL for high-purity outputs.

Rising Use of Point-of-Care and Decentralized Testing Platforms

The expansion of decentralized molecular testing creates major opportunities for compact and rapid extraction kits. Portable and simplified extraction systems support near-patient diagnostics in clinics, remote centers, and emergency settings. Manufacturers design faster workflows that require minimal equipment and training. This trend aligns with growing demand for rapid infectious disease screening and mobile health initiatives. As point-of-care diagnostics expand globally, extraction kits optimized for speed, portability, and ease of use gain strong market traction.

- For instance, Cepheid’s GeneXpert platform integrates extraction and amplification within a single cartridge, delivering diagnostic results in 30 minutes using less than 2 mL sample input.

Key Challenges

High Cost of Automated Systems and Reagent Consumables

Automation improves accuracy and speed, but high equipment and reagent costs challenge adoption in smaller laboratories. Many facilities face budget limitations that restrict access to automated extraction platforms. Frequent use of consumables also increases operational expenses. These financial barriers slow technology penetration in emerging markets and resource-limited healthcare settings. As cost pressures persist, affordability remains a critical concern for wider adoption of advanced extraction solutions.

Variability in Sample Quality and Workflow Standardization

Extraction performance depends heavily on sample type, preparation quality, and operator skill, creating challenges in maintaining consistent results. Variability in blood, tissue, and cell samples affects yield and purity, impacting downstream applications. Laboratories face difficulties in standardizing protocols across diverse workflows, especially when handling large volumes. Inconsistent execution can reduce diagnostic accuracy and research reliability. Ensuring proper training, process validation, and optimized kit design remains essential to overcome these workflow challenges.

Regional Analysis

North America

North America leads the RNA/DNA Extraction Kit market with a 40% share, supported by strong adoption of molecular diagnostics and advanced genomic research. Hospitals, diagnostic laboratories, and biotechnology companies rely on high-purity extraction kits for PCR, sequencing, and oncology testing. The region benefits from established research funding, a large network of academic institutes, and rapid uptake of automated extraction platforms. Growing demand for infectious disease testing and precision medicine strengthens kit consumption. Continuous investment by pharmaceutical companies and widespread laboratory automation further reinforce North America’s dominant position in the global market.

Europe

Europe holds a 28% share, driven by expanding healthcare infrastructure, strong genomic research programs, and high demand for clinical diagnostic testing. Countries such as Germany, the UK, France, and Italy are major users of RNA/DNA extraction kits due to advanced laboratory capabilities and strict quality standards. Research institutions actively deploy high-purity extraction tools for genetic studies, biomarker discovery, and disease surveillance. The region also prioritizes automation in molecular workflows, boosting demand for standardized extraction systems. Growing biotechnology activity and increasing adoption of personalized medicine continue to support steady market expansion.

Asia Pacific

Asia Pacific accounts for a 23% share and represents the fastest-growing regional market due to rising investment in molecular diagnostics, infectious disease research, and genomics. China, Japan, South Korea, and India drive adoption as healthcare systems upgrade laboratory capabilities. Rapid expansion of biotechnology companies and strong government support for genomic initiatives increase extraction kit consumption. Growing demand for high-throughput testing during public health programs strengthens market penetration. The region’s large population, rising disease burden, and increasing research activity position Asia Pacific as a major contributor to future market growth.

Latin America

Latin America holds a 5% share, supported by growing use of molecular testing in public health programs, infectious disease surveillance, and hospital diagnostics. Brazil and Mexico lead regional adoption as laboratories expand genomic and PCR-based testing capabilities. Investment in research institutions and improved access to modern diagnostic tools help increase extraction kit usage. However, cost constraints and uneven distribution of advanced laboratory infrastructure limit broader adoption. Despite these challenges, rising awareness of disease detection technologies and expanding biotech activity contribute to steady long-term demand.

Middle East & Africa

The Middle East & Africa region holds a 4% share, influenced by growing demand for molecular testing in hospitals and public health centers. The UAE, Saudi Arabia, and Qatar drive adoption through investments in advanced diagnostic laboratories and genomic initiatives. Increased focus on infectious disease management and expanding healthcare modernization programs support extraction kit usage. In Africa, adoption grows gradually as countries enhance laboratory capacity, though resource limitations slow widespread penetration. Rising government focus on diagnostic capability building continues to shape steady, incremental growth across the region.

Market Segmentations:

By Product Type

- RNA extraction kits

- DNA extraction kits

- Combined RNA/DNA extraction kits

- Others

By Sample Type

- Blood

- Tissue

- Cells

- Others

By Application

- Clinical diagnostics

- Research and academic laboratories

- Pharmaceutical and biotechnology companies

- Others

By End User

- Hospitals and diagnostic laboratories

- Research institutes

- Biopharmaceutical companies

- Contract research organizations (CROs)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes major players such as Qiagen N.V., Thermo Fisher Scientific Inc., Promega Corporation, Roche Diagnostics, Bio-Rad Laboratories Inc., Agilent Technologies Inc., Takara Bio Inc., New England Biolabs, Zymo Research Corporation, and PerkinElmer Inc. These companies strengthen their market position by offering high-purity extraction kits, automation-ready solutions, and advanced magnetic bead–based technologies. Many players focus on enhancing workflow speed, yield accuracy, and contamination control to support PCR, sequencing, and clinical diagnostic applications. Strategic initiatives include product upgrades, expansion of automated extraction platforms, and partnerships with research institutions to drive innovation. Companies also invest in R&D to develop next-generation chemistries that optimize extraction from diverse sample types. As competition intensifies, differentiation centers on performance reliability, sample compatibility, regulatory compliance, and global distribution strength.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Qiagen N.V.

- Thermo Fisher Scientific Inc.

- Promega Corporation

- Roche Diagnostics

- Bio-Rad Laboratories Inc.

- Agilent Technologies Inc.

- Takara Bio Inc.

- New England Biolabs

- Zymo Research Corporation

- PerkinElmer Inc.

Recent Developments

- In December 2024, Thermo Fisher Scientific Inc. launched the Applied Biosystems MagMAX Sequential DNA/RNA kit, combining DNA and RNA isolation into a single streamlined workflow for blood and bone marrow samples, enhancing lab productivity and supporting hematological cancer research.

- In January 2024, Thermo Fisher Scientific Inc. introduced the next-generation Invitrogen TaqMan Cells-to-CT Express Kit, enabling direct cell lysis for RT-qPCR in five minutes without traditional RNA purification, reducing plastic waste and accelerating gene expression analysis.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Sample Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for RNA/DNA extraction kits will grow as molecular diagnostics expand worldwide.

- Automation-ready kits will see higher adoption as laboratories shift to high-throughput workflows.

- Magnetic bead–based technologies will gain strong momentum due to higher purity and sensitivity.

- Research growth in genomics, oncology, and infectious diseases will boost kit consumption.

- Personalized medicine initiatives will increase demand for high-quality nucleic acid extraction.

- Manufacturers will develop faster, simplified extraction formats for decentralized and point-of-care testing.

- Pharmaceutical and biotech companies will rely more on extraction kits for drug discovery and clinical studies.

- Improved chemistries will enhance extraction performance from low-volume and challenging samples.

- Emerging markets will upgrade laboratory capabilities, supporting wider adoption of advanced extraction tools.

- Strong emphasis on standardization and quality assurance will shape future product development.