Market Overview

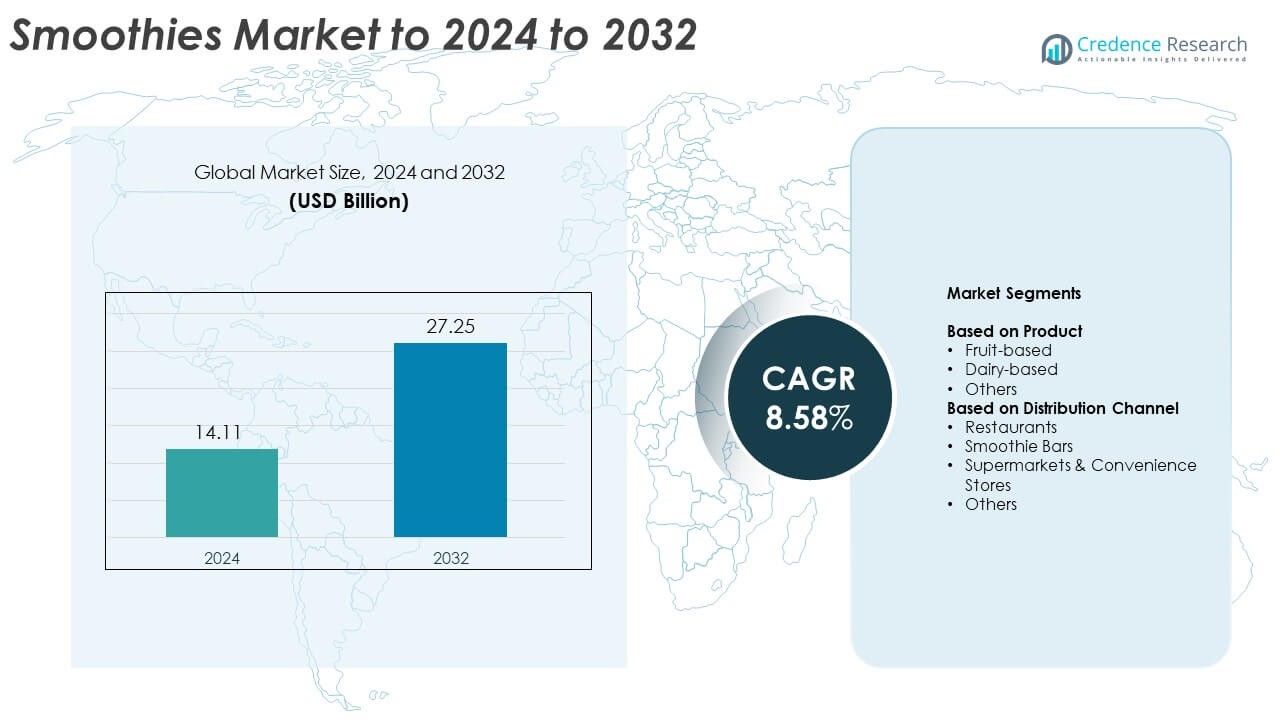

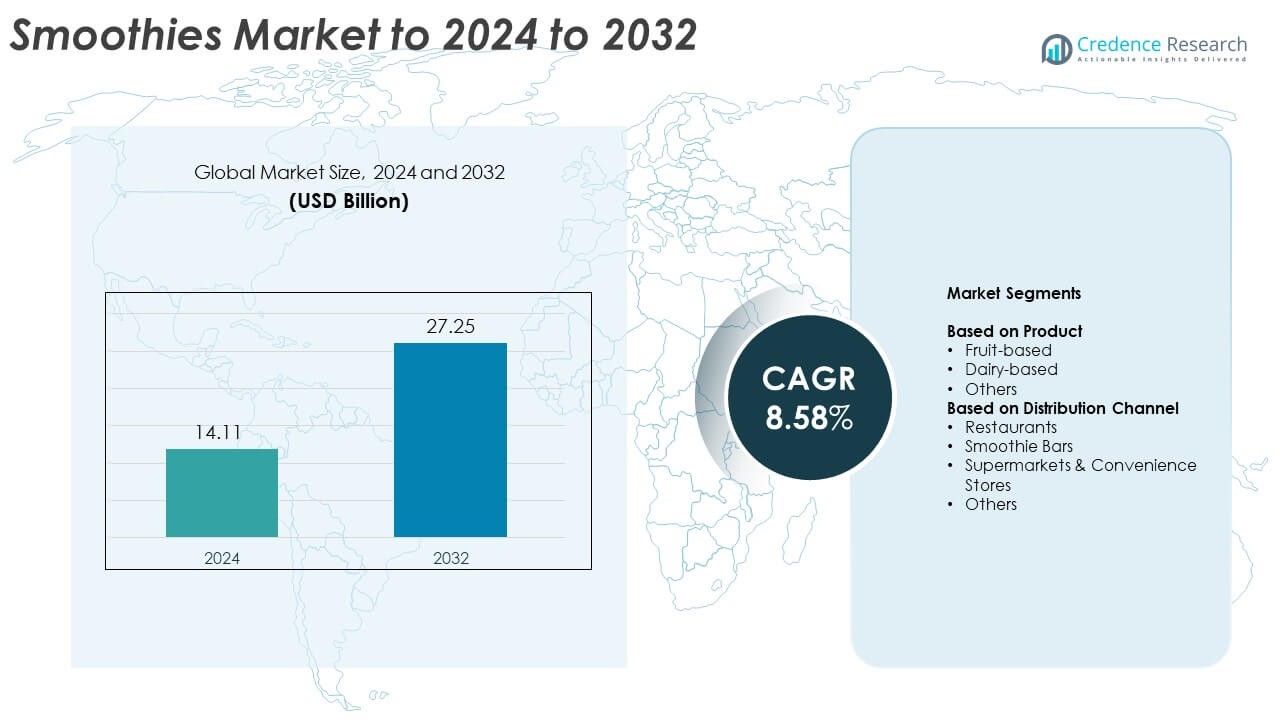

Smoothies Market size was valued at USD 14.11 Billion in 2024 and is anticipated to reach USD 27.25 Billion by 2032, at a CAGR of 8.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smoothies Market Size 2024 |

USD 14.11 Billion |

| Smoothies Market , CAGR |

8.58% |

| Smoothies Market Size 2032 |

USD 27.25 Billion |

The smoothies market includes major players such as Suja Juice, Maui Wowi Hawaiian Coffees & Smoothies, Tropical Smoothie Café, innocent ltd, Smoothie King, Ella’s Kitchen Ltd, The Smoothie Company, Jamba Juice LLC, Barfresh Food Group, Inc., and Bolthouse Farms, each contributing to strong product innovation and broader retail penetration. These companies compete through clean-label blends, functional ingredients, and expansion of ready-to-drink portfolios. North America leads the global market with about 38% share in 2024, driven by high demand for natural beverages, strong smoothie bar networks, and widespread availability of premium bottled offerings across supermarkets, cafés, and convenience stores.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Smoothies market size reached USD 14.11 Billion in 2024 and is projected to reach USD 27.25 Billion by 2032, growing at a CAGR of 8.58%.

- Rising demand for clean-label, low-sugar, and nutrient-rich beverages drives strong adoption, with fruit-based products holding about 58% share due to wide flavor variety and strong health appeal.

- Key trends include rapid expansion of ready-to-drink formats, growth of plant-based and functional blends, and rising preference for customizable smoothie options in foodservice outlets.

- The market remains competitive as major brands improve cold-pressed lines, expand retail networks, and invest in sustainable packaging, while smoothie bars strengthen presence in urban locations.

- North America leads with about 38% share in 2024, followed by Europe at 28% and Asia Pacific at 24%, supported by strong retail penetration, high wellness awareness, and growing consumption of on-the-go nutrition across key countries.

Market Segmentation Analysis:

By Product

Fruit-based smoothies dominate this segment with about 58% share in 2024 due to strong demand for natural flavors, clean-label formulas, and vitamin-rich blends. Consumers prefer fruit-based options because these recipes support daily nutrition and offer broad flavor variety from berries to tropical mixes. Dairy-based smoothies maintain steady traction among buyers seeking protein-focused beverages, while other blends grow as brands add plant-based ingredients and functional additives. Growth also comes from rising interest in immunity-boosting drinks and expanding launches of ready-to-drink formats.

- For instance, Dole plc is a global leader in fresh produce, operating across 30 countries with approximately 110,000 acres of farms and other land holdings.

By Distribution Channel

Smoothie bars lead this segment with nearly 41% share in 2024 as consumers choose fresh, customizable blends prepared on demand. Growth at smoothie bars is driven by expansion of urban outlets, rising fitness culture, and preference for nutrient-dense grab-and-go options. Restaurants contribute steady volume as menus include premium shakes and wellness drinks. Supermarkets and convenience stores show rising sales through bottled smoothies supported by wider refrigeration space and growing availability of functional and low-sugar variants across retail shelves.

- For instance, Jamba publicly reports operating over 850 stores globally, verified through Focus Brands’ 2023 Franchise Disclosure Document.

Key Growth Drivers

Rising Demand for Healthy and Natural Beverages

Health-focused consumers drive strong demand for smoothies as they seek nutrient-rich drinks with clean ingredients. Growth rises as more buyers replace high-sugar beverages with fruit, vegetable, and protein blends. Brands respond with low-calorie, no-added-sugar, and functional options that support digestion, energy, and immunity. The shift toward wellness lifestyles, supported by wider retail availability, strengthens adoption across urban and semi-urban regions.

- For instance, the Innocent Drinks “Blender” facility in the Port of Rotterdam, which became operational in late 2021/early 2022, has a total annual production capacity of up to 300 million liters of chilled juices and smoothies for the European market

Expansion of Ready-to-Drink Smoothie Products

Ready-to-drink formats boost market growth by offering convenience and long shelf life. Consumers prefer bottled smoothies for on-the-go nutrition during work, travel, or fitness routines. Manufacturers expand production with advanced cold-press and HPP technologies that keep flavor and nutrients intact. The rise of busy lifestyles and wider placement of chilled RTD beverages in supermarkets and convenience stores further accelerates demand.

- For instance, Suja Life processes and bottles from 750,000 to 1,000,000 packages per week, according to a Beverage Industry profile on its HPP juice operations.

Growing Popularity of Plant-Based and Functional Ingredients

Plant-based blends gain strong traction as buyers shift away from dairy toward vegan and allergen-friendly options. Growth strengthens as brands add functional boosters such as probiotics, antioxidants, adaptogens, and high-fiber ingredients. These additions appeal to consumers seeking targeted health benefits like gut support and immunity enhancement. The trend aligns with rising interest in sustainable food choices and clean-label products across global markets.

Key Trends and Opportunities

Innovation in Customizable and On-Demand Smoothie Formats

Customization emerges as a major trend as consumers look for tailored blends to match personal taste and nutrition goals. Smoothie bars expand menus with options that allow users to choose fruits, vegetables, milks, proteins, and functional add-ins. This trend grows due to rising fitness culture and demand for fresh, made-to-order beverages. Brands gain opportunities by integrating digital ordering and loyalty programs that enhance customer engagement.

- For instance, as of late 2024, Smoothie King operates more than 1,200 stores nationwide in the U.S. and over 1,300 units worldwide, according to company reports released in Q4 2024 and Q1 2025

Growth of Low-Sugar, High-Protein, and Functional Smoothies

Clean-label preferences fuel development of low-sugar and high-protein smoothies designed for weight management and sports nutrition. Brands introduce natural sweeteners, fiber sources, and plant proteins to meet dietary requirements. Functional blends featuring immunity-boosting, anti-inflammatory, and digestive health ingredients create new opportunities across retail and foodservice. The shift toward balanced nutrition drives ongoing innovation in both RTD and freshly prepared formats.

- For instance, Huel reports having sold over 500 million meals globally since launch in 2015, according to its official brand communications and partner disclosures.

Rising Influence of E-Commerce and D2C Channels

Online platforms create strong opportunities as consumers order ready-made smoothies, subscription packs, and DIY kits. E-commerce supports wide product discovery and convenience for busy households. Direct-to-consumer brands leverage social media and personalized nutrition models to build strong engagement. Expanding cold-chain logistics improves delivery of frozen fruit packs and functional blends, strengthening long-term online adoption.

Key Challenges

High Sugar Content and Growing Regulatory Pressure

Many smoothies contain concentrated sugars from fruits, syrups, and bases, raising health concerns. Regulators push stricter labeling rules and sugar-reduction guidelines, affecting product formulations. Consumers also become more aware of hidden sugars, which slows adoption in some regions. Brands must reformulate with natural sweeteners and balanced ingredient mixes to address compliance and meet health-conscious expectations.

Supply Chain Volatility for Fruits and Raw Ingredients

Smoothie production depends heavily on consistent fruit supply, which fluctuates due to climate conditions, transport delays, and seasonality. Rising costs of berries, tropical fruits, and plant-based proteins strain margins for manufacturers and retailers. Disruptions increase dependency on frozen imports and processed ingredients, which can affect flavor and freshness. Companies must secure diversified sourcing and improve supply chain resilience to maintain quality and availability.

Regional Analysis

North America

North America holds about 38% share of the smoothies market in 2024, driven by strong demand for healthy, natural beverages across the U.S. and Canada. Growth is supported by high consumption of ready-to-drink blends, premium smoothie bar chains, and rising adoption of plant-based ingredients. Consumers choose smoothies as meal replacements and fitness-focused nutrition options. Wide retail availability and strong innovation in low-sugar, protein-rich formulas also strengthen regional leadership. Expanding distribution in supermarkets, cafés, and fast-casual outlets continues to push steady growth across major cities.

Europe

Europe accounts for nearly 28% share in 2024, supported by strong interest in clean-label beverages and rising preference for natural fruit blends. Consumers in countries such as the U.K., Germany, and France show high adoption of plant-based and functional smoothies for daily nutrition. Growth is driven by expanding cold-pressed offerings, demand for reduced-sugar options, and wider distribution of bottled blends in retail chains. Smoothie bars also gain traction due to rising wellness culture. Sustainability initiatives and recyclable packaging further shape product innovation across the region.

Asia Pacific

Asia Pacific captures about 24% share in 2024 and records the fastest growth due to rising urbanization, changing diets, and strong demand among younger consumers. Expanding café culture and preference for fruit-rich beverages drive adoption across China, Japan, India, and Southeast Asia. Brands introduce tropical and local fruit blends to match regional tastes. Growth also benefits from rising health awareness, increasing gym memberships, and wider entry of international smoothie chains. Supermarkets expand chilled sections for ready-to-drink formats, strengthening overall market penetration.

Latin America

Latin America represents around 6% share in 2024, supported by abundant fruit availability and growing interest in natural beverages. Countries such as Brazil, Mexico, and Chile show rising demand for fruit-based blends due to their strong health and wellness movements. Street vendors, cafés, and modern retail outlets contribute to wider access. Consumption increases as consumers adopt smoothies as energy-boosting and refreshing options in warm climates. Expanding production of ready-to-drink beverages and introduction of functional ingredients help broaden regional appeal.

Middle East & Africa

Middle East & Africa account for roughly 4% share in 2024, driven by demand in urban centers such as the UAE, Saudi Arabia, and South Africa. Growth rises as consumers seek healthier beverage alternatives and adopt smoothies as hydration and nutrition options suited to warm climates. International smoothie chains expand across major cities, boosting visibility. Retailers increase availability of bottled smoothies as cold-chain networks improve. Rising interest in fitness, clean eating, and plant-based options continues to support gradual market expansion across the region.

Market Segmentations:

By Product

- Fruit-based

- Dairy-based

- Others

By Distribution Channel

- Restaurants

- Smoothie Bars

- Supermarkets & Convenience Stores

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The smoothies market features established companies such as Suja Juice, Maui Wowi Hawaiian Coffees & Smoothies, Tropical Smoothie Café, innocent ltd, Smoothie King, Ella’s Kitchen Ltd, The Smoothie Company, Jamba Juice LLC, Barfresh Food Group, Inc., and Bolthouse Farms. The industry remains highly competitive as brands innovate with clean-label formulas, reduced-sugar blends, and functional ingredients to meet shifting consumer preferences. Companies focus on expanding ready-to-drink lines, enhancing cold-pressed offerings, and improving nutrition density to capture a larger audience. Retail presence strengthens through wider placement in supermarkets, convenience stores, and online platforms, while foodservice chains continue upgrading menus with customizable blends. Many brands invest in digital engagement, loyalty programs, and targeted marketing to differentiate in a crowded space. Sustainability also becomes a critical competitive factor as producers adopt recyclable packaging and ethical sourcing practices. Continuous product innovation and rapid distribution expansion define competition across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Suja Juice

- Maui Wowi Hawaiian Coffees & Smoothies

- Tropical Smoothie Café

- innocent ltd

- Smoothie King

- Ella’s Kitchen Ltd

- The Smoothie Company

- Jamba Juice LLC

- Barfresh Food Group, Inc.

- Bolthouse Farms

Recent Developments

- In 2025, Innocent Drinks (Innocent Ltd) launched a new line of high-vegetable content smoothies called Green Goodness and Red Goodness.

- In 2025, Generous Brands, a portfolio company of the private equity firm Butterfly and owner of Bolthouse Farms, announced its agreement to acquire the kombucha brand Health-Ade.

- In 2022, Barfresh Food Group, Inc. Launched a series of environmentally-friendly 7.6oz Smoothie Cartons aimed at offering economic and ecological benefits.

Report Coverage

The research report offers an in-depth analysis based on Product, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The smoothies market will grow as consumers continue choosing healthier beverage options.

- Ready-to-drink formats will expand due to rising demand for convenience and portability.

- Plant-based and dairy-free blends will gain more traction across global retail shelves.

- Brands will focus on low-sugar and clean-label formulations to meet health expectations.

- Smoothie bars will increase in major cities as fitness and wellness culture strengthens.

- Functional smoothies with probiotics, antioxidants, and adaptogens will see wider adoption.

- E-commerce and subscription models will play a larger role in product distribution.

- Innovation in frozen fruit packs and DIY kits will support at-home consumption.

- Sustainable packaging and eco-friendly materials will become a stronger industry priority.

- Emerging markets in Asia Pacific and Latin America will drive the next phase of expansion.