Market Overview:

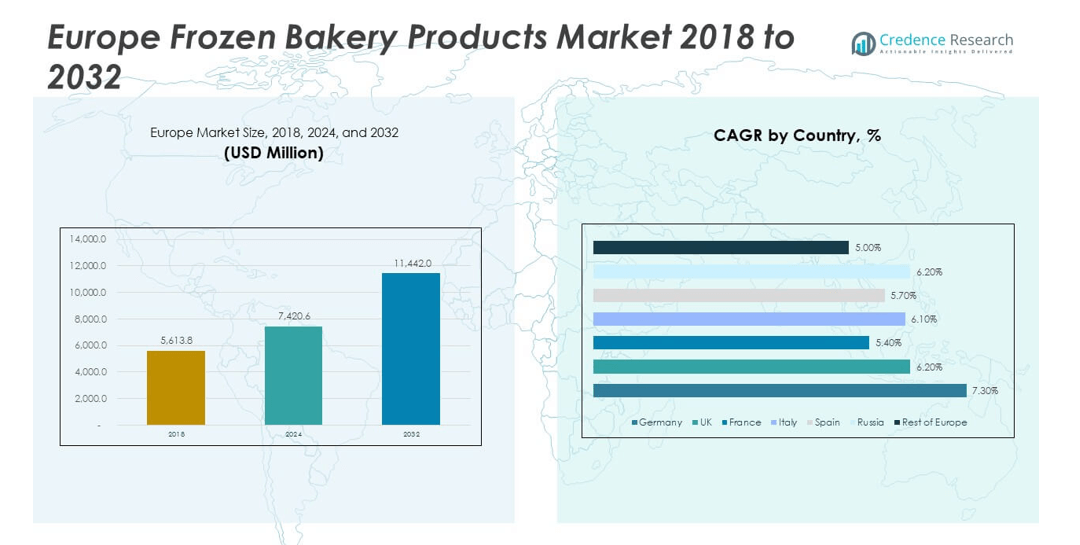

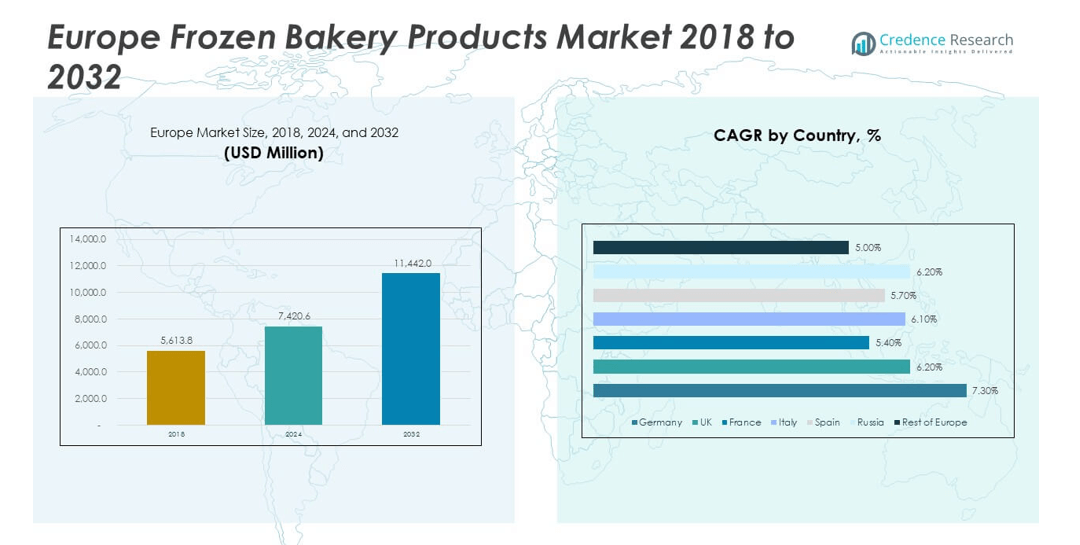

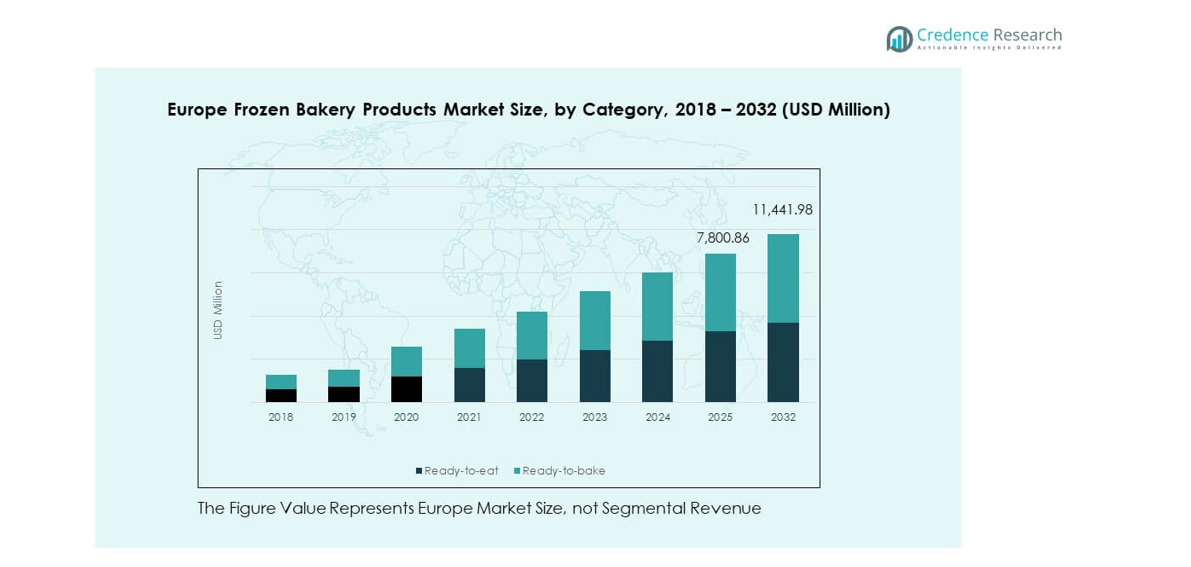

The Europe Frozen Bakery Products Market size was valued at USD 5,613.80 million in 2018 to USD 7,420.60 million in 2024 and is anticipated to reach USD 11,442.00 million by 2032, at a CAGR of 5.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Frozen Bakery Products Market Size 2024 |

USD 7,420.60 million |

| Europe Frozen Bakery Products Market, CAGR |

5.62% |

| Europe Frozen Bakery Products Market Size 2032 |

USD 11,442.00 million |

Demand rises due to busy lifestyles and a strong shift toward convenient food choices. Quick-service chains adopt frozen bakery lines to maintain consistent quality and faster service. Supermarkets expand in-store freezer aisles to offer wider bakery selections for families. Manufacturers launch clean-label, gluten-free, and artisanal variants to match evolving dietary needs. Improved freezing technology helps retain texture and flavor, lifting consumer trust. Hotels and cafés prefer frozen dough for uniform results and reduced preparation time. E-commerce channels add further momentum through bundled bakery assortments.

Europe shows diverse regional performance across mature and emerging bakery hubs. Western Europe leads due to high consumption rates, strong retail penetration, and widespread acceptance of frozen bakery items. Countries with dense urban populations show faster adoption of ready-to-bake formats. Northern Europe gains traction due to demand for specialty dough and premium pastry lines. Southern Europe attracts interest from tourism-driven foodservice networks that depend on stable supply. Central and Eastern Europe emerge as growth pockets supported by rising disposable incomes. Expanding modern retail spaces strengthen market reach across developing economies.

Market Insights:

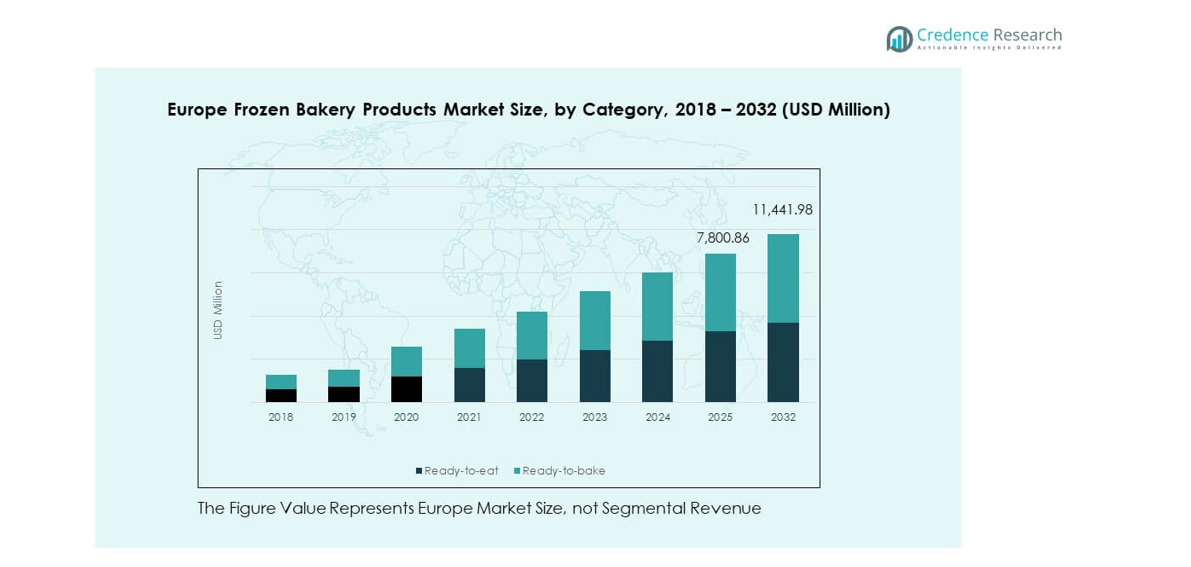

- The Europe Frozen Bakery Products Market was valued at USD 5,613.80 million in 2018, reached USD 7,420.60 million in 2024, and is projected to hit USD 11,441.98 million by 2032, supported by a 62% CAGR driven by rising demand for convenient frozen formats.

- Western Europe (42%), Northern & Southern Europe (38%), and Central & Eastern Europe (20%) lead regional contribution, with dominance shaped by strong retail networks, tourism-linked foodservice demand, and expanding modern trade channels.

- Central & Eastern Europe, holding 20% share, emerges as the fastest-growing region due to rising household adoption, urbanization, and broader access to organized retail.

- Ready-to-bake formats account for 2% of the 2032 category share, supported by strong uptake from restaurants, cafés, and high-volume commercial kitchens seeking uniform preparation.

- Ready-to-eat formats represent 8% of total category distribution, driven by retail snacking demand and wider frozen placement across supermarkets and convenience stores.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Shift Toward Convenient Bakery Consumption

Growing lifestyle pressure lifts demand for easy meal formats across households. Families choose frozen bakery lines for quick preparation needs during busy days. Retail chains stock wider assortments that support frequent home use. Cafés depend on frozen dough to maintain uniform quality. Hotels prefer controlled portion sizes that optimize kitchen planning. Rising foodservice traffic drives steady purchases across major chains. The Europe Frozen Bakery Products Market strengthens its growth through broad adoption. It benefits from dependable supply and consistent product texture.

- For instance, Lantmännen Unibake operates 36 bakeries across 20 countries, enabling consistent frozen dough supply for cafés and hotels.

Strong Penetration of Modern Retail and In-Store Freezer Expansion

Supermarkets expand freezer aisles to meet rising bakery demand. Chains promote frozen pastries and bread through bundled offers. Shoppers find better variety, which boosts category visibility. Discount retailers push strong private label ranges with competitive pricing. Convenience stores keep frozen formats for on-the-go buyers. Organized retail enhances cold storage reliability across regions. The Europe Frozen Bakery Products Market gains scale from these developments. It grows due to stable retail support and wider consumer access.

- For instance, Carrefour runs over 14,000 stores in more than 40 countries, supporting wide frozen bakery placement across European retail networks.

Growing Preference for Clean-Label and Specialty Frozen Bakery Lines

Shoppers search for products with simpler ingredient profiles. Clean-label claims attract health-conscious groups across urban zones. Gluten-free pastries gain traction among sensitive consumers. Artisanal dough formats appeal to premium buyers wanting unique taste. Vegan variants record steady traction in younger populations. Brands introduce natural flavors to match shifting dietary choices. The Europe Frozen Bakery Products Market adapts to these preferences. It supports new product lines that lift category acceptance.

Technological Advancements in Freezing and Texture Preservation

Manufacturers invest in advanced freezing systems that enhance product feel. Improved processes help retain softness across pastries and bread. Cold chain upgrades protect goods during long-distance transport. Better packaging keeps aroma and shape intact. Bakeries depend on reliable preservation for extended shelf life. Technology raises product consistency across high-volume outlets. The Europe Frozen Bakery Products Market advances with these capabilities. It leverages innovation to support broader commercial supply.

Market Trends:

Rising Demand for Premium Pastry and Gourmet Frozen Bakery Lines

Premium pastries gain strong traction in café chains. Consumers search for richer flavors and layered textures. Gourmet croissants and puff items show rising popularity in cities. Foodservice players adopt premium dough to lift menu appeal. Shoppers try specialty variants with infused fillings. Tourism zones push higher uptake of gourmet bakery assortments. The Europe Frozen Bakery Products Market aligns with evolving taste patterns. It supports upscale formats across retail and hospitality users.

- For instance, Europastry produces over 600 frozen bakery SKUs and supplies gourmet pastries to more than 90 countries, lifting premium product availability.

Growing Integration of Automated Production and Frozen Dough Handling

Factories adopt automation for consistent bakery output. Robots streamline mixing and shaping tasks for large batches. Automated lines reduce operational errors in dough management. Uniform processing lifts product reliability for chain outlets. Cold storage integration accelerates supply across regions. Large producers invest in digital control systems for better efficiency. The Europe Frozen Bakery Products Market benefits from these upgrades. It improves stability through optimized production cycles.

- For instance, Aryzta AG uses high-capacity automated lines that produce over one million bakery units per day in its largest European facilities.

Expansion of On-the-Go and Snack-Sized Frozen Bakery Formats

Urban buyers search for compact snacks during daily travel. Frozen mini croissants and snack rolls perform well in transport hubs. Students prefer small packs for school and college use. Offices stock snack-sized pastries for quick breaks. Retailers highlight portable products on dedicated shelves. Foodservice brands launch smaller formats to widen menu reach. The Europe Frozen Bakery Products Market supports these emerging snack trends. It strengthens its consumer base through flexible portioning.

Growth of Online Bakery Delivery and Frozen Product Subscription Models

Digital channels push frozen bakery visibility among younger users. Online marketplaces promote bulk pastry assortments. Subscription models deliver ready-to-bake packs to homes. Families use digital platforms for flexible ordering. Frozen dough kits gain traction in home baking groups. E-commerce logistics support reliable delivery for all categories. The Europe Frozen Bakery Products Market expands through rising digital demand. It gains momentum from stronger household adoption.

Market Challenges Analysis:

High Competition, Price Pressure, and Strong Private Label Expansion

Competitive intensity limits profit margins for major players. Private labels offer low-cost frozen bakery options across Europe. Premium brands face difficulty expanding without targeted positioning. Small bakeries struggle with scale disadvantages in frozen formats. Retail buyers demand tighter pricing for shelf placement. Supply chain costs create added pressure for many producers. The Europe Frozen Bakery Products Market must balance quality with affordability. It navigates margin strain while trying to retain brand strength.

Complex Cold Chain Requirements and Rising Sustainability Expectations

Cold chain breaks reduce texture and taste reliability. Transport delays create deterioration risks for bulk shipments. Energy usage rises due to strict freezing requirements. Sustainability rules place pressure on packaging choices. Brands face scrutiny from eco-conscious consumers. Waste reduction becomes difficult for high-volume producers. The Europe Frozen Bakery Products Market contends with these structural barriers. It adjusts operations to meet modern environmental expectations.

Market Opportunities:

Rapid Growth of Health-Focused Frozen Bakery Alternatives Across Regions

Health-focused buyers search for fortified frozen bakery options. Producers create high-fiber and low-sugar varieties for daily use. Clean-label interest expands demand for natural ingredient lines. Vegan and plant-based pastries gain strong traction among new consumers. Brands target niche preferences through diversified ranges. Retail chains promote wellness-focused bakery assortments across aisles. The Europe Frozen Bakery Products Market gains room to innovate. It attracts wider demographics through better nutritional appeal.

Rising Expansion of HoReCa and Travel-Linked Foodservice Networks

Hotels broaden menu choices through frozen dough consistency. Airports and stations push demand for reliable bakery items. Quick-service chains adopt frozen pastries for faster output. Tourism hubs prefer frozen formats for steady visitor flows. Cafés rely on structured dough supplies for efficient baking. Central kitchens use frozen goods to align production with demand. The Europe Frozen Bakery Products Market captures fresh opportunities in these networks. It strengthens its role across expanding hospitality zones.

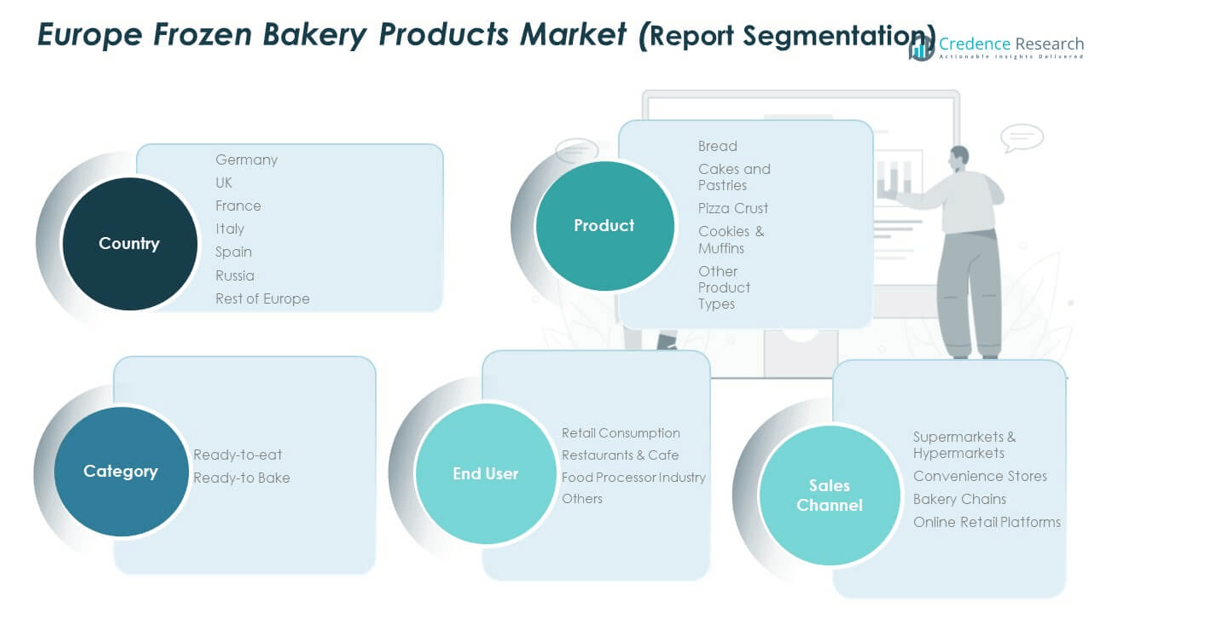

Market Segmentation Analysis:

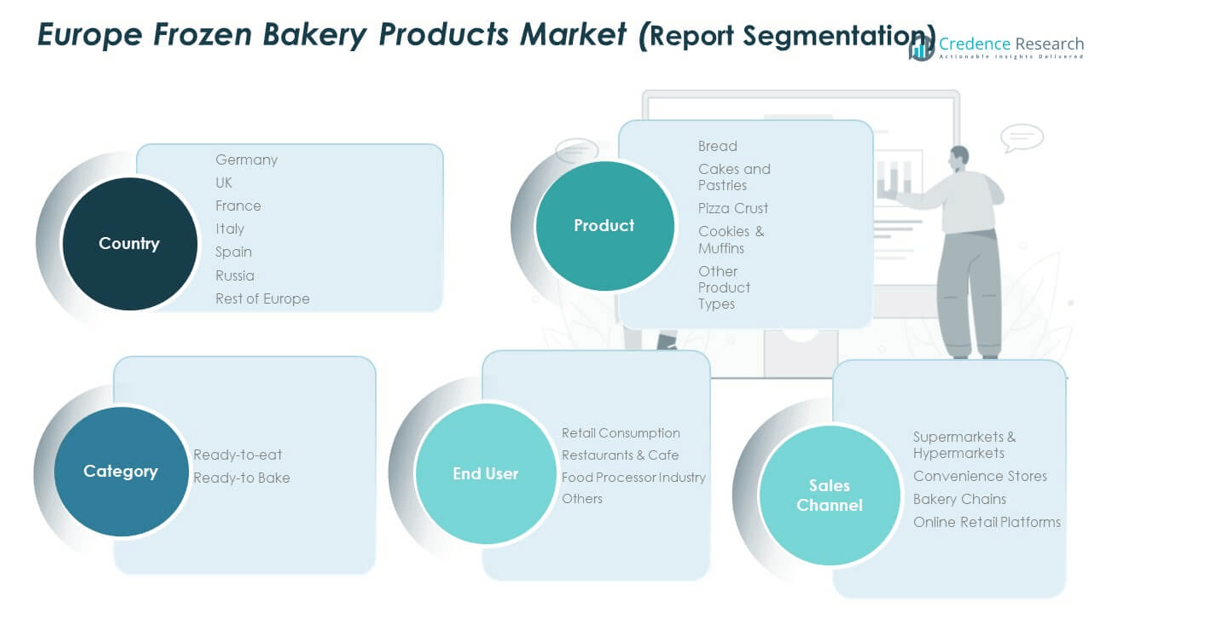

By Product Type

Bread leads demand due to strong household use and steady foodservice intake. Cakes and pastries gain traction across café chains and tourism zones seeking variety. Pizza crust attracts stable demand from quick-service outlets and home bakers. Cookies and muffins appeal to younger buyers who prefer convenient snacking formats. Other product types support niche preferences and seasonal menus. Producers focus on texture stability and longer shelf life across all variants. The Europe Frozen Bakery Products Market benefits from wide product diversification across major supply chains.

- For instance, General Mills’ Pillsbury division manufactures millions of refrigerated and frozen dough products annually, which are sold in specific European markets as part of a globally recognized brand portfolio. While General Mills has a significant global presence, the product lines and availability vary by country, with a particularly broad range in North America and a focused range in European countries like the UK, France, and Germany.

By Category

Ready-to-eat products attract buyers who prefer instant consumption during busy routines. Ready-to-bake formats support restaurants, cafés, and families seeking fresh-out-of-oven texture. Retail shelves highlight both categories to meet broad consumer needs. Foodservice operators rely on ready-to-bake lines to maintain uniformity in fast-moving kitchens. Demand for ready-to-eat variants grows across transport hubs and workplace cafeterias. Brands promote category innovation through flavored and premium options.

- For instance, Bridgford Foods produces a wide line of frozen food products, including ready-to-eat and ready-to-bake lines, supplying both retail and foodservice customers throughout the United States and other markets.

By End User

Retail consumption dominates due to frequent household purchases. Restaurants and cafés depend on frozen dough to maintain quality in peak hours. The food processor industry uses frozen inputs to streamline production cycles. Others segment includes institutional kitchens and travel-linked outlets that rely on reliable bakery supply. User groups value consistency, controlled portioning, and ease of storage across formats.

By Sales Channel

Supermarkets and hypermarkets hold strong influence due to wide freezer placement. Convenience stores cater to on-the-go shoppers seeking quick bakery choices. Bakery chains use frozen inputs to standardize product output across branches. Online retail platforms expand reach through doorstep delivery of ready-to-bake assortments.

Segmentation:

By Product Type

- Bread

- Cakes and Pastries

- Pizza Crust

- Cookies & Muffins

- Other Product Types

By Category

- Ready-to-eat

- Ready-to-bake

By End User

- Retail Consumption

- Restaurants & Café

- Food Processor Industry

- Others

By Sales Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Bakery Chains

- Online Retail Platforms

Regional Analysis:

Western Europe:

Western Europe leads the Europe Frozen Bakery Products Market with a market share of 42%. Strong retail penetration supports steady product movement across urban clusters. Foodservice chains depend on frozen dough to maintain quality and speed. Consumers show high acceptance of frozen pastries, bread, and pizza crust across daily use occasions. Tourism zones push higher demand for premium frozen bakery assortments. Western producers invest in better freezing technology to support product freshness. The region maintains dominance due to mature infrastructure and consistent product innovation.

Northern & Southern Europe

Northern and Southern Europe together hold a combined share of 38%. Northern Europe shows strong traction for clean-label frozen bakery lines driven by health-focused consumers. Southern Europe records rising demand from hotels, cafés, and tourism-linked foodservice operators. Frozen dough enables consistent texture, which aligns with hospitality requirements across coastal cities. Retailers expand freezer sections to meet growing interest in ready-to-bake formats. The Europe Frozen Bakery Products Market gains stability from these consumption patterns. Both subregions show rising preference for artisanal and specialty bakery variants.

Central & Eastern Europe

Central and Eastern Europe account for 20% of total share. Rising disposable income strengthens demand for frozen bakery lines across expanding retail networks. Urbanization pushes higher consumption of quick-preparation bakery items. Foodservice operators adopt frozen dough to maintain predictable operations across growing outlets. Supermarkets promote value-driven frozen categories to attract new buyers. The Europe Frozen Bakery Products Market benefits from wider product accessibility in emerging cities. It shows strong potential due to rising household adoption and stronger modern retail penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Flowers Foods Inc.

- Aryzta AG

- Europastry S.A.

- General Mills Inc.

- Associated British Foods plc

- Grupo Bimbo

- Cargill, Incorporated

- Bridgford Foods Corporation

- Lantmännen Unibake

- Conagra Brands, Inc.

- Other Key Players

Competitive Analysis:

The Europe Frozen Bakery Products Market reflects strong competition driven by diversified product portfolios and broad retail penetration. Leading players focus on premium pastries, specialty dough, and efficient cold-chain networks to secure wider reach. Private labels create price pressure across major retail chains. Multinational brands strengthen supply through automated facilities and regional distribution centers. Medium-scale producers target niche categories to gain presence in tourism and café segments. The market sees tight competition in ready-to-bake formats where consistency and freshness matter most. It maintains a balanced landscape shaped by innovation, branding, and strong retail partnerships.

Recent Developments:

- On September 1, 2025, Lantmännen Unibake completed the acquisition of Boboli Benelux B.V., a Dutch specialist in Mediterranean flatbreads such as focaccia and pizza crusts. This acquisition marks Unibake’s entry into the Dutch market with a state-of-the-art facility and supports its strategy to strengthen offerings in the fast-growing European “savoury bake-off” segment. Boboli Benelux brings industry-leading expertise, capacity, and technological advancement to Lantmännen Unibake’s portfolio.

- In August 2025, Associated British Foods plc (ABF) announced a landmark agreement to acquire Hovis Group Limited—an integrated bakery business—enhancing its UK bakery division. The acquisition will help synergize production and distribution operations, increase innovation, and offer new product ranges for changing consumer needs in frozen and fresh bakery. ABF also increased its investment stake in Cook Trading Ltd, a premium UK-based frozen ready-meals producer, signaling further alignment with premium and convenience-oriented frozen products.

- In February 2025, Flowers Foods, Inc. completed the acquisition of Simple Mills, a fast-growing better-for-you brand specializing in crackers, cookies, snack bars, and baking mixes.

- In December 2024, Aryzta AG reinforced its commitment to the European bakery market by investing heavily in its Eisleben production facility in Germany. Notable projects include a new product innovation center and the construction of a 100-ton stone oven line for artisanal bread, with advanced sustainability features.

Report Coverage:

The research report offers an in-depth analysis based on product type, category, end user, and sales channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for convenient frozen bakery lines will strengthen retail expansion across core cities.

- Ready-to-bake formats will gain traction across restaurants and cafés seeking consistent output.

- Online channels will capture higher share due to rising interest in home baking kits.

- Premium pastries and artisanal dough will attract buyers pursuing diverse flavor profiles.

- Clean-label frozen bakery options will rise in popularity among health-focused consumers.

- Automation in dough preparation will improve product consistency for large producers.

- Tourism-linked foodservice hubs will expand demand for high-volume frozen assortments.

- Private labels will intensify competition through value-driven frozen bakery lines.

- Cold-chain upgrades will improve product stability across regional distribution networks.

- Market growth will gain support from stronger modern retail penetration in emerging areas.