Market Overview

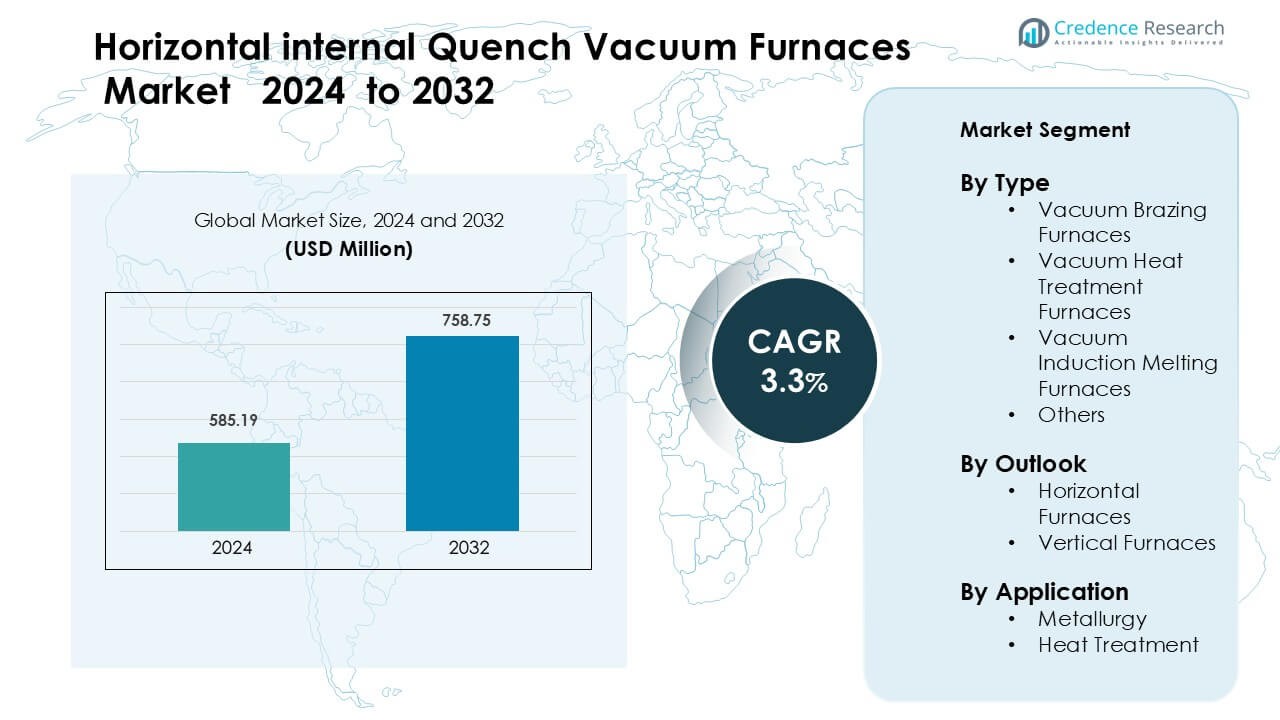

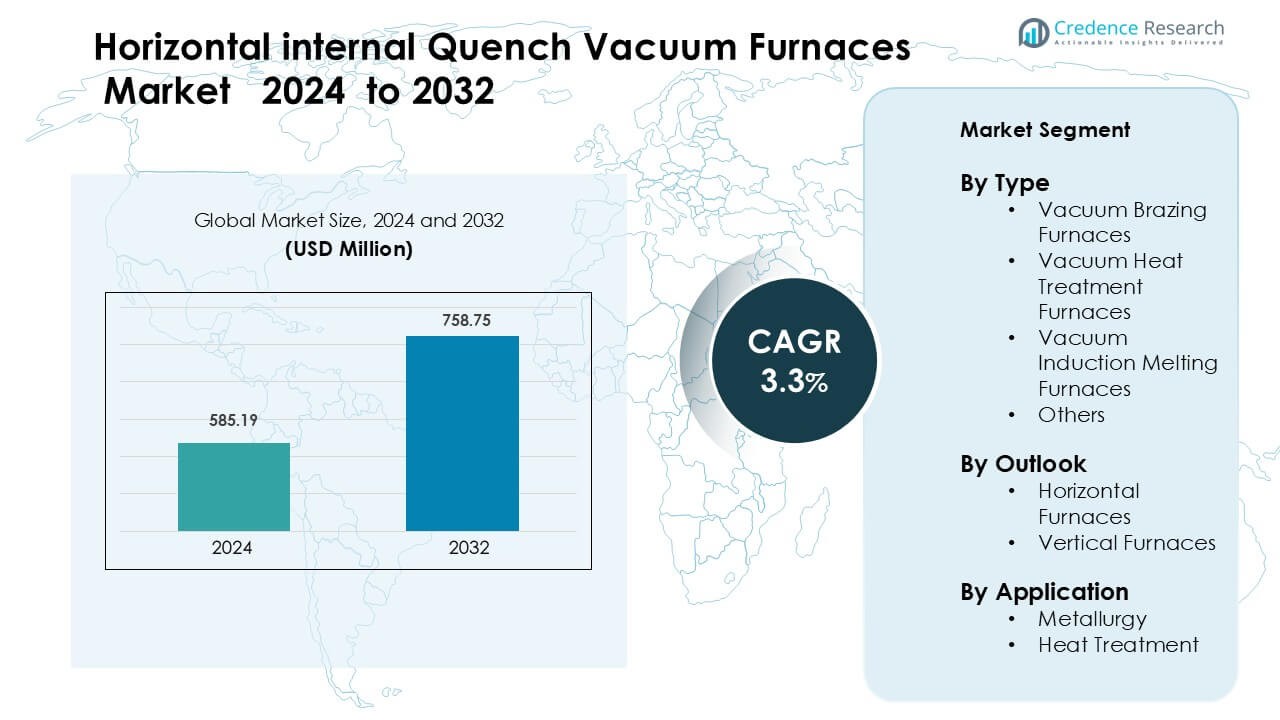

Horizontal internal Quench Vacuum Furnaces Market was valued at USD 585.19 million in 2024 and is anticipated to reach USD 758.75 million by 2032, growing at a CAGR of 3.3 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Horizontal internal Quench Vacuum Furnaces Market Size 2024 |

USD 585.19 Million |

| Horizontal internal Quench Vacuum Furnaces Market, CAGR |

3.3% |

| Horizontal internal Quench Vacuum Furnaces Market Size 2032 |

USD 758.75 Million |

The Horizontal Internal Quench Vacuum Furnaces Market is shaped by key players such as Centorr Vacuum Industries, Shanghai Gehang Vacuum Technology Co., Ltd, IVA SCHMETZ GmbH, Ipsen, T-M Vacuum Products, Inc, ALD Vacuum Technologies, Thermal Technology, ECM Technologies, Camco Furnace, and SECO/WARWICK, INC. These companies compete by offering advanced quench uniformity, automated controls, and high-precision processing for aerospace, automotive, and tooling applications. Product portfolios focus on distortion-free heat treatment, high repeatability, and cleaner processing for complex alloys. North America leads the market with about 38% share, supported by strong aerospace production, modernized heat-treatment facilities, and high adoption of digital furnace technology.

Market Insights

- Horizontal internal Quench Vacuum Furnaces Market was valued at USD 585.19 million in 2024 and is anticipated to reach USD 758.75 million by 2032, growing at a CAGR of 3.3 % during the forecast period.

- Rising demand for distortion-free heat treatment in aerospace, automotive, and tooling drives adoption, with heat-treatment applications holding nearly 58% share due to strict tolerance and cleanliness needs.

- Automation, predictive-maintenance software, and digitally controlled quenching shape key trends as manufacturers shift toward Industry 4.0–enabled furnace systems.

- Competition intensifies among Centorr Vacuum Industries, Ipsen, ALD Vacuum Technologies, ECM Technologies, and others as they expand product reliability, quench uniformity, and energy-efficient furnace designs.

- North America leads with 38% share, followed by Europe at 29%, while Asia-Pacific grows fastest. Vacuum heat-treatment furnace types dominate the type segment with 54% share, supported by high-precision alloy processing.

Market Segmentation Analysis:

By Type

Vacuum heat treatment furnaces lead this segment with about 54% share in 2024. These systems gain strong demand due to precise temperature control, uniform quenching, and suitability for high-strength alloy processing. Manufacturers in aerospace and automotive sectors rely on these furnaces to improve hardness, fatigue resistance, and microstructural stability in critical components. Vacuum brazing furnaces follow because of rising use in compact heat exchangers and turbine assemblies, while vacuum induction melting furnaces support controlled alloy production. Other types hold a smaller share and serve niche thermal-processing needs.

- For instance, Carbolite Gero offers vacuum chamber furnaces (used in brazing) with hot zones that can reach up to 3,000 °C, allowing extremely clean and precise brazed joints for critical aerospace heat exchanger components.

By Outlook

Horizontal furnaces dominate the outlook segment with nearly 63% share in 2024. Users prefer the horizontal layout because loading is simpler, cycle uniformity is higher, and maintenance access is easier for heavy industrial components. The design supports large parts such as shafts, gears, and structural fittings, which strengthens adoption in high-volume facilities. Vertical furnaces grow steadily due to their space-saving footprint and suitability for long components, but horizontal systems remain the preferred choice for precision heat treatment across regulated industries.

- For instance, Solar Manufacturing’s HCB-84144-2EQ horizontal car bottom vacuum furnace has a work zone of 54″ × 54″ × 144″ and can carry up to 50,000 lb of load, enabling treatment of very large industrial shafts and forgings.

By Application

Heat treatment leads this segment with around 58% share in 2024. The process benefits from horizontal internal quench vacuum furnaces because these systems deliver consistent hardening, reduced distortion, and clean processing for alloy steels and superalloys. Demand rises from aerospace, tool manufacturing, and automotive suppliers seeking improved fatigue life and dimensional accuracy. Metallurgy follows with applications in alloy refining and microstructure control. Growth continues as industries push for higher component strength, tighter tolerances, and contamination-free processing conditions.

Key Growth Drivers

Growing Use of Clean and Distortion-Free Heat Treatment

Demand rises as manufacturers require clean, oxide-free surfaces and low-distortion processing for high-precision metal components. Horizontal internal quench vacuum furnaces support these needs through controlled heating, rapid quenching, and contamination-free environments that maintain part geometry. Aerospace, automotive, toolmaking, and energy sectors adopt these systems to enhance fatigue strength and dimensional stability in gears, shafts, turbine parts, and cutting tools. The shift toward tighter tolerance standards strengthens reliance on vacuum technology over conventional furnaces. Companies upgrade to improve part quality, meet global standards, and support production of lightweight, high-performance alloys used in advanced engineering applications.

- For instance, Ipsen’s VFS HIQ (Horizontal Internal Quench) vacuum furnace offers quench pressures up to 12 bar, enabling very fast, uniform cooling without oxidation ideal for aerospace turbine components.

Rising Demand from Aerospace and Automotive Manufacturing

Aerospace and automotive suppliers drive strong adoption due to the need for high-strength, heat-treated components capable of operating under extreme loads. These industries rely on vacuum furnaces for critical parts such as turbine blades, structural fasteners, injection components, and transmission systems. Increased investment in electric vehicles and fuel-efficient aircraft also boosts demand for advanced alloys and precision thermal processing. Horizontal internal quench systems offer uniform quenching and repeatability, helping manufacturers meet strict certification and quality requirements. Growing production volumes and modernization of existing heat-treatment lines further reinforce market expansion across global manufacturing hubs.

- For instance, Ipsen shipped a TurboTreater horizontal vacuum furnace with a 36″ × 36″ × 48″ (914 mm × 914 mm × 1,219 mm) work‑zone and a load capacity of 3,000 lb (1,361 kg) to process aerospace fasteners; the furnace meets Nadcap and AMS 2750E thermal‑profile requirements.

Expansion of Advanced Material and Alloy Production

The rise of superalloys, specialty steels, and high-performance metal composites supports wider use of vacuum furnaces due to their need for precise, contamination-free thermal cycles. Research labs and industrial producers use horizontal internal quench systems to achieve controlled microstructure development and enhanced mechanical properties. Growth in renewable energy, defense, medical implants, and electronics intensifies the need for materials with superior strength, wear resistance, and thermal stability. The furnace design enables high consistency for both R&D and large-scale manufacturing. As industries shift toward high-value materials, demand strengthens for advanced thermal-processing infrastructure that supports innovation and metal performance upgrades.

Key Trends and Opportunities

Shift Toward Automation and Digital Process Control

Manufacturers adopt automation, sensors, and digital controllers to achieve consistent thermal cycles, reduce errors, and support real-time monitoring. Horizontal internal quench vacuum furnaces increasingly integrate predictive-maintenance software and data-logging tools that improve quality tracking and operational efficiency. Smart automation reduces labor requirements and ensures repeatability for complex aerospace and automotive parts. The trend aligns with Industry 4.0, where AI-assisted temperature profiling and load management improve throughput. As energy costs rise, automated systems also help optimize heating efficiency. This digital transition strengthens furnace reliability while enabling factories to meet global quality and traceability standards.

- For instance, the TITAN H6 model (horizontal) has a work-zone of 915 mm × 1,220 mm × 915 mm, supports quench pressures up to 2 bar, and integrates a high-definition touchscreen control system for precise process logging.

Growing Adoption in Emerging Manufacturing Regions

Asia-Pacific, Eastern Europe, and Latin America see rising investment in precision engineering, automotive plants, aerospace component manufacturing, and tooling industries. These regions expand their heat-treatment capacities due to growing exports, industrialization, and establishment of new metal-processing clusters. Horizontal internal quench vacuum furnaces offer a critical upgrade for companies shifting from conventional furnaces to advanced vacuum systems. Lower labor costs and government support for industrial automation enhance adoption. As local suppliers scale operations, opportunities emerge for furnace manufacturers to provide customized systems that fit regional material standards and production volumes. This broadens long-term market penetration.

- For instance, SECO/WARWICK’s Chinese branch has ramped up its local production it now produces up to 8-10 vacuum furnaces annually in its 10,000 m² Tianjin facility, supporting the surge in demand in China.

Increasing Demand for Lightweight and High-Performance Parts

Industries adopt lightweight alloys to improve energy efficiency, reduce emissions, and increase mechanical performance. Horizontal internal quench vacuum furnaces support reliable heat treatment for aluminum, titanium, nickel-based alloys, and advanced steels. The opportunity grows as electric vehicles, aerospace platforms, wind-energy equipment, and medical devices require components with superior strength-to-weight ratios. Growth in 3D-printed metal parts also expands the need for precise post-processing. Vacuum furnaces help stabilize microstructures and achieve high repeatability for additive-manufactured parts. Rising research investment and product innovation create long-term demand for advanced heat-treatment solutions.

Key Challenges

High Capital Cost and Complex Installation Requirements

Horizontal internal quench vacuum furnaces require significant capital investment, which limits adoption among small and mid-sized manufacturers. Installation involves specialized infrastructure, including heavy-duty power lines, controlled gas systems, cooling units, and reinforced floor structures. These requirements increase total project cost and extend setup timelines. Companies also face expenses related to operator training, process optimization, calibration, and periodic certification. Budget constraints in emerging economies slow replacement of older furnace systems. High ownership costs remain a major barrier despite long-term operational advantages, creating hesitation among manufacturers planning facility upgrades or modernization.

Skilled Workforce Shortage and Operational Complexity

Operation of advanced vacuum furnaces requires trained technicians capable of managing temperature cycles, quench parameters, leak checks, and digital monitoring systems. Many regions lack a skilled workforce familiar with precision heat-treatment processes. Improper handling can lead to inconsistent results, part distortion, and safety risks. Manufacturers struggle to maintain continuous production due to limited technical expertise and high turnover among experienced operators. The complexity of horizontal internal quench systems increases reliance on automation and specialized training programs. Workforce shortages slow adoption and reduce efficiency in facilities transitioning from traditional thermal-processing methods to modern vacuum technologies.

Regional Analysis

North America

North America holds the largest share at about 38% in 2024, driven by strong adoption in aerospace, defense, and automotive manufacturing. The region benefits from strict heat-treatment standards that require distortion-free processing and uniform quenching, boosting demand for advanced horizontal internal quench vacuum furnaces. The U.S. leads production due to a dense base of aircraft engine suppliers, tool manufacturers, and precision-metal facilities. Investments in modernizing heat-treatment lines and expanding EV component production strengthen market growth. Canada follows with steady uptake in metallurgical R&D and specialty alloy processing, supporting long-term furnace installations.

Europe

Europe commands nearly 29% share in 2024, supported by strong industrial capabilities in Germany, France, Italy, and the U.K. Aerospace engine makers, automotive suppliers, and precision engineering firms rely on vacuum furnaces to enhance alloy performance and ensure regulatory compliance. The region sees high adoption due to strict quality norms for fatigue resistance and microstructure control. Growth continues as Europe expands electric mobility, renewable-energy systems, and high-value metal component manufacturing. Increased focus on energy-efficient furnace designs also supports equipment upgrades. Eastern Europe adds to demand through rising heat-treatment outsourcing and new metallurgical facilities.

Asia-Pacific

Asia-Pacific accounts for around 25% share in 2024 and shows the fastest growth due to industrial expansion in China, Japan, South Korea, and India. Rising production of automotive parts, electronics, machinery, and aerospace components fuels furnace adoption across manufacturing hubs. China leads with large-scale metal processing and rapid investment in advanced material technologies. Japan and South Korea support demand through precision engineering and high-strength alloy development. India’s growing aerospace and automotive sectors also contribute to market expansion. Increasing adoption of distortion-free heat treatment and modernization of local heat-treatment facilities enhance regional growth potential.

Latin America

Latin America holds about 5% share in 2024, with gradual adoption driven by automotive parts manufacturing, mining equipment production, and industrial component processing in Brazil and Mexico. Growth remains steady as manufacturers upgrade from conventional furnaces to vacuum-based systems to improve component cleanliness and dimensional accuracy. The region benefits from expanding investment in metallurgical research and export-oriented manufacturing. Mexico’s close integration with North American supply chains supports higher adoption of advanced heat-treatment equipment. Although market size remains modest, rising industrial automation and new metalworking facilities create opportunities for future furnace installations.

Middle East & Africa

The Middle East & Africa region represents nearly 3% share in 2024, supported by increasing demand in energy, aerospace maintenance, and heavy industrial components. Countries such as the UAE and Saudi Arabia invest in advanced manufacturing as part of industrial diversification plans, driving uptake of vacuum furnaces for high-reliability metal parts. South Africa contributes through mining equipment and metallurgical processing. Adoption continues to rise as industries shift toward precision machining and cleaner heat-treatment practices. Despite slower growth than other regions, targeted investments in high-performance components strengthen long-term market potential.

Market Segmentations:

By Type

- Vacuum Brazing Furnaces

- Vacuum Heat Treatment Furnaces

- Vacuum Induction Melting Furnaces

- Others

By Outlook

- Horizontal Furnaces

- Vertical Furnaces

By Application

- Metallurgy

- Heat Treatment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Horizontal Internal Quench Vacuum Furnaces Market features strong participation from leading furnace manufacturers such as Centorr Vacuum Industries, Shanghai Gehang Vacuum Technology Co., Ltd, IVA SCHMETZ GmbH, Ipsen, T-M Vacuum Products, Inc, ALD Vacuum Technologies, Thermal Technology, ECM Technologies, Camco Furnace, and SECO/WARWICK, INC. These companies compete by enhancing quench uniformity, improving energy efficiency, and integrating advanced automation and digital controls. Key players focus on aerospace, automotive, tooling, and specialty alloy applications where precision heat treatment and distortion-free processing remain essential. Many manufacturers expand portfolios with customizable chamber sizes, faster cooling systems, and predictive-maintenance software to meet global quality standards. Strategic collaborations, new product launches, and service-based maintenance programs strengthen market presence. Companies also invest in R&D to support advanced alloys and additive manufacturing post-processing, which increases furnace demand. As industries modernize heat-treatment operations, competition intensifies around reliability, repeatability, and long-term operating efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Centorr Vacuum Industries

- Shanghai Gehang Vacuum Technology Co., Ltd

- IVA SCHMETZ GmbH

- Ipsen

- T-M Vacuum Products, Inc

- ALD Vacuum Technologies

- Thermal Technology

- ECM Technologies

- Camco Furnace

- SECO/WARWICK, INC

Recent Developments

- In November 2024, Ipsen announced modernization of its VHFC high-vacuum furnaces for Siemens AG and the delivery of three new VHFC high-vacuum brazing systems to Siemens plants in Goa (India) and Wuxi (China). These systems support energy-infrastructure components such as vacuum interrupters and reflect broader investment in high-vacuum and internal-quench-type furnace technology used in grid and power equipment supply chains.

- In 2024, Shanghai Gehang Vacuum Technology appeared as a vacuum-equipment exhibitor at the Heat Treatment 2024 international specialized exhibition, highlighting its vacuum furnace and quenching portfolio to Eurasian customers. Participation in this dedicated heat-treatment show supports brand visibility in horizontal and internal-quench vacuum furnace projects across automotive and general engineering markets.

Report Coverage

The research report offers an in-depth analysis based on Type, Outlook, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as industries seek cleaner and distortion-free heat-treatment processes.

- Aerospace and automotive production growth will support wider furnace adoption.

- Advanced alloys and superalloys will increase the need for precise thermal-processing systems.

- Digital controls and automation will become standard across new furnace installations.

- Predictive maintenance tools will improve uptime and reduce operational failures.

- Energy-efficient furnace designs will gain preference due to tightening sustainability norms.

- Asia-Pacific will expand its share as manufacturing investments increase.

- Additive manufacturing growth will drive demand for accurate post-processing heat treatment.

- Customizable furnace designs will help meet diverse part sizes and performance needs.

- Long-term upgrades in global heat-treatment facilities will strengthen replacement demand.