Market Overview:

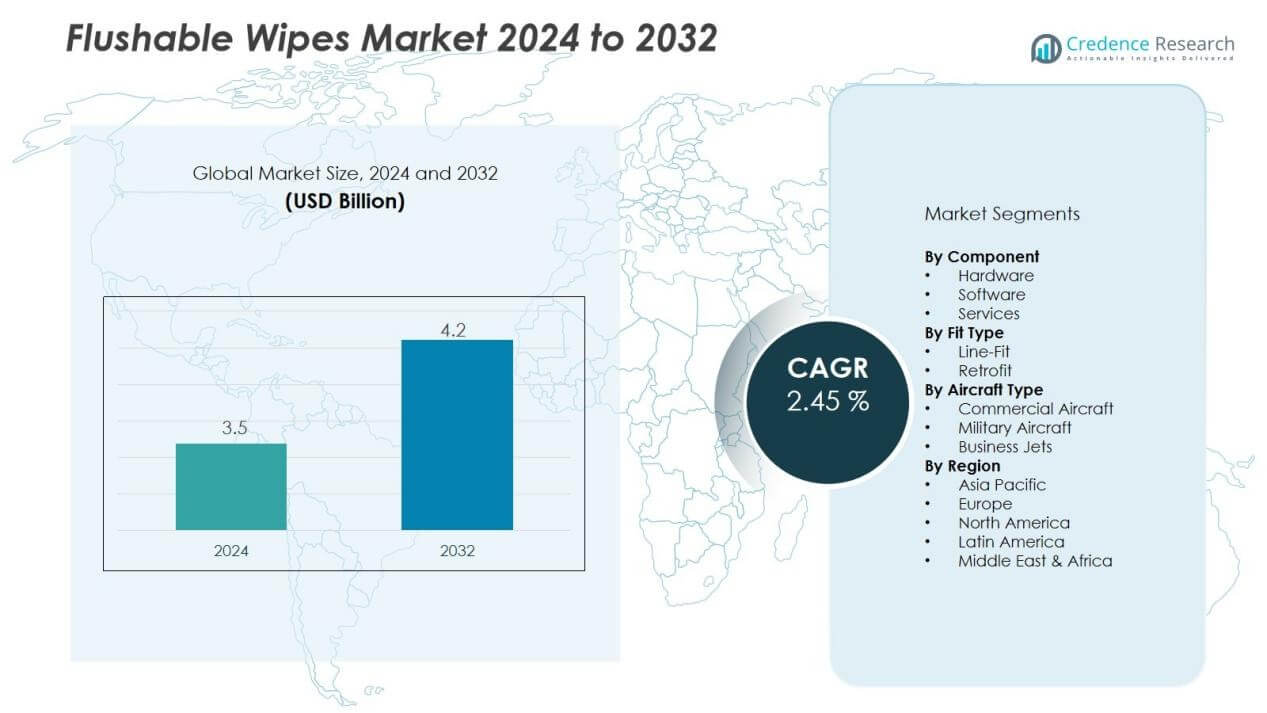

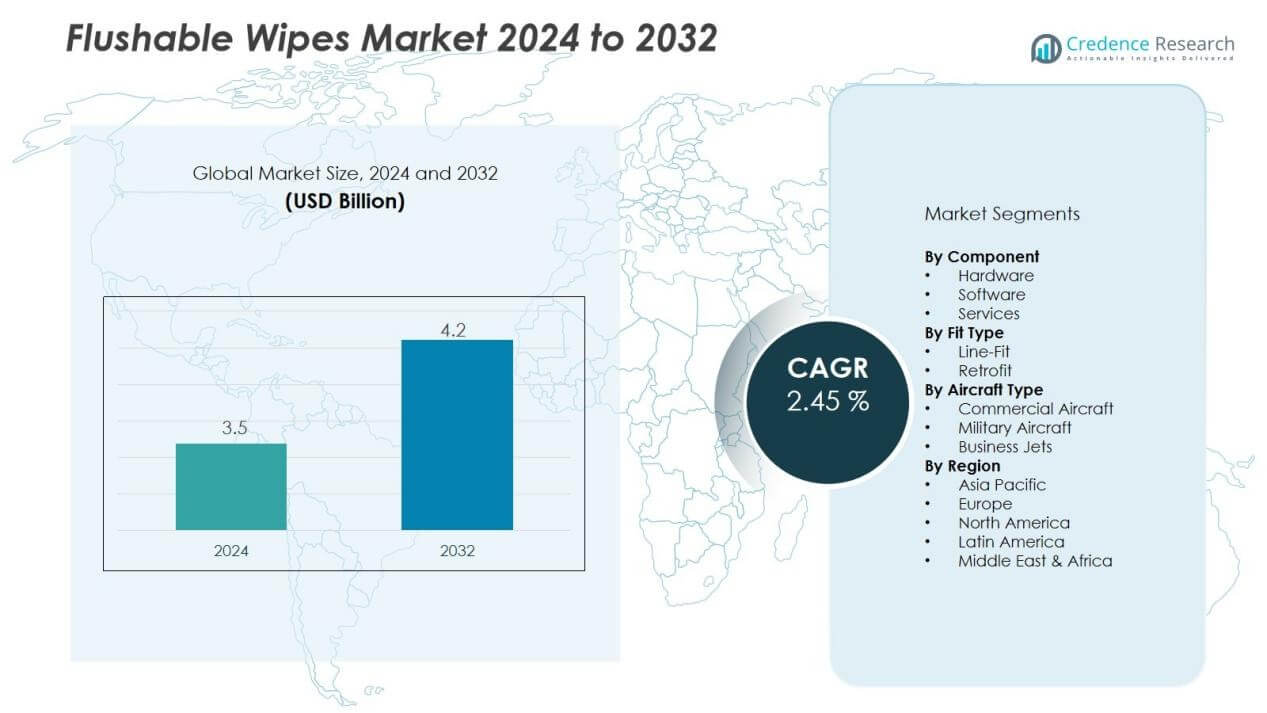

The flight management system market size was valued at USD 3.5 billion in 2024 and is anticipated to reach USD 4.2 billion by 2032, at a CAGR of 2.45 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flight Management Systems (FMS) Market Size 2024 |

USD 3.5 Billion |

| Flight Management Systems (FMS) Market, CAGR |

2.45% |

| Flight Management Systems (FMS) Market Size 2032 |

USD 4.2 Billion |

Market drivers include the rising number of air passengers, which is pushing airlines to optimize routes and fuel efficiency. The integration of next-generation technologies, such as satellite-based navigation and automation, is further enhancing flight planning capabilities. In addition, regulatory mandates for upgraded avionics and the expansion of low-cost carriers are boosting adoption. The growing focus on reducing environmental impact and operational costs is also encouraging airlines to invest in advanced flight management solutions.

Regionally, North America holds the largest market share due to the strong presence of aircraft manufacturers, advanced infrastructure, and high investment in aviation technology. Europe follows, supported by stringent aviation safety regulations and modernization programs. Asia-Pacific is projected to witness the fastest growth, driven by rising air traffic, increasing aircraft deliveries, and expanding airline networks in China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The flight management system market was valued at USD 3.5 billion in 2024 and is forecasted to reach USD 4.2 billion by 2032 at a CAGR of 2.45%.

- Rising air passenger traffic and fuel price pressures are driving airlines to adopt advanced systems for efficient route planning and cost optimization.

- The integration of next-generation technologies, including satellite-based navigation, real-time data, and automation, is transforming flight operations.

- Regulatory mandates and safety compliance standards are pushing airlines to upgrade avionics, reinforcing adoption across commercial and regional fleets.

- High implementation costs and complex integration remain challenges, particularly for low-cost carriers and operators of older aircraft.

- North America led the market with 38% share in 2024, supported by advanced infrastructure, strong OEM presence, and investments in modernization.

- Asia-Pacific accounted for 23% share and is expected to register the fastest growth, driven by expanding fleets, rising passenger demand, and growing aviation infrastructure.

Market Drivers:

Rising Demand for Fuel Efficiency and Cost Optimization :

The flight management system market benefits from the strong need to reduce fuel consumption and operating costs. Airlines face rising fuel prices and strict emission standards, which push them to adopt advanced systems. Flight management systems support optimal route planning, altitude adjustment, and efficient speed control to lower costs. It helps operators achieve significant savings while meeting sustainability goals.

- For Instance, Boeing’s Direct Routes system, introduced commercially in 2011, delivers real-time advisories that can save a medium-sized U.S. operator tens of thousands of flight minutes yearly. This technology has the potential to save commercial airlines a total of 20 million gallons of fuel per year across the industry, though a single operator would not realize that full amount

Growing Air Passenger Traffic and Fleet Expansion :

The surge in global air travel has led to rapid expansion of airline fleets. The flight management system market grows as airlines upgrade and modernize avionics to handle higher traffic safely. It ensures smoother operations, reduced delays, and improved scheduling efficiency. Increased aircraft deliveries across both commercial and regional airlines continue to support demand.

- For instance, Airbus delivered 67 commercial aircraft in July 2025 alone, which included 54 narrowbodies (49 from the A320neo family and 5 A220s), reflecting strong fleet growth to meet traffic demand

Integration of Next-Generation Technologies in Avionics:

Technological innovation is transforming avionics systems with satellite-based navigation, real-time data, and automation. The flight management system market adopts these innovations to improve accuracy, performance, and operational safety. It enables pilots to manage complex flight operations with precision and reduced workload. Rising adoption of 4D trajectory management and advanced navigation systems further strengthens growth.

Regulatory Mandates and Emphasis on Safety Compliance :

Aviation authorities worldwide have introduced regulations that require airlines to upgrade avionics for compliance. The flight management system market expands as operators invest in systems that meet performance-based navigation standards. It supports enhanced safety through accurate guidance, reduced risk of errors, and compliance with international protocols. Strong focus on airspace modernization and safety assurance reinforces system adoption.

Market Trends:

Increasing Adoption of Advanced Automation and Digitalization in Aviation:

The flight management system market is experiencing a strong shift toward advanced automation and digital capabilities. Airlines and aircraft manufacturers are integrating artificial intelligence, machine learning, and predictive analytics into flight management systems. These upgrades enhance operational decision-making, reduce pilot workload, and improve route optimization. It enables real-time updates on weather, traffic, and performance parameters to ensure safe and efficient operations. Growing focus on cockpit digitalization aligns with the aviation industry’s strategy to achieve seamless connectivity and improved situational awareness. The adoption of cloud-based data exchange further supports collaboration between pilots, ground control, and maintenance teams.

- For instance, Honeywell’s cloud-based Flight Efficiency platform—which provides AI-driven fuel-burn analytics and predictive maintenance insights—is now deployed on over 3,000 aircraft worldwide.

Rising Demand for Next-Generation Navigation and Environmental Sustainability:

Airspace modernization programs and stricter sustainability targets are shaping the flight management system market. Airlines are adopting systems with performance-based navigation and satellite communication capabilities to handle congested routes and optimize fuel usage. It plays a vital role in reducing carbon emissions by supporting precision flight paths and minimizing unnecessary fuel burn. The push for greener aviation has led to demand for lightweight and energy-efficient systems. Advancements in trajectory-based operations and 4D navigation are becoming key trends in enhancing flight efficiency. Integration of eco-friendly technologies ensures compliance with international emission standards and strengthens airline competitiveness.

- For instance, Boeing’s 787 Dreamliner, equipped with advanced Performance-Based Navigation (PBN) capabilities, achieves lateral navigation accuracy of 95% compliance during flights, enabling more efficient routing and fuel savings per trip.

Market Challenges Analysis:

High Implementation Costs and Complex Integration with Aircraft Systems:

The flight management system market faces challenges due to high installation and maintenance costs. Airlines, especially low-cost carriers and regional operators, find it difficult to allocate budgets for advanced systems. Integration with existing aircraft platforms often requires technical expertise and extended downtime, which increases operational expenses. It creates barriers for smaller operators aiming to modernize their fleets. The complexity of upgrading older aircraft further delays adoption across several markets. Rising costs in avionics components and software upgrades continue to pressure profitability.

Cybersecurity Risks and Regulatory Compliance Constraints:

Growing digitalization in aviation introduces risks related to cybersecurity and data protection. The flight management system market must address threats that could disrupt navigation, communication, or operational data. It requires airlines to adopt advanced security frameworks, which add cost and complexity. Regulatory compliance with international standards also presents challenges, as rules differ across regions. Meeting diverse certification processes can delay deployment timelines for manufacturers and operators. Balancing safety, compliance, and cost efficiency remains a critical concern for the industry.

Market Opportunities:

Expansion of Next-Generation Aircraft and Urban Air Mobility Platforms:

The flight management system market has strong opportunities with the rise of next-generation aircraft and urban air mobility platforms. Airlines and OEMs are investing in advanced avionics to support electric aircraft, hybrid propulsion systems, and autonomous flight solutions. It creates demand for lightweight, efficient, and highly automated systems tailored for emerging platforms. Growing interest in electric vertical takeoff and landing (eVTOL) aircraft expands the need for compact and intelligent flight management systems. The trend supports innovation in design and integration, opening new revenue streams for manufacturers. Increasing aircraft deliveries worldwide further amplify this opportunity.

Rising Demand for Sustainable Aviation and Advanced Navigation Capabilities:

Global sustainability initiatives and stricter emission regulations open opportunities for eco-friendly avionics. The flight management system market is positioned to benefit from demand for systems that enable fuel-efficient routing, optimized airspace use, and reduced carbon footprints. It supports airlines in meeting regulatory targets while lowering operational costs. Integration of satellite-based navigation, 4D trajectory management, and real-time flight optimization enhances long-term adoption. Emerging markets in Asia-Pacific and the Middle East are investing heavily in aviation infrastructure, creating favorable conditions for suppliers. Partnerships between avionics providers and airlines will play a key role in capturing these opportunities.

Market Segmentation Analysis:

By Component:

The flight management system market by component is divided into hardware, software, and services. Hardware holds a strong share due to the critical role of sensors, processors, and navigation units. It ensures accuracy and reliability in flight operations. Software is gaining traction with demand for advanced route optimization and automation tools. Services such as upgrades, maintenance, and integration support long-term adoption. It drives recurring revenue opportunities for manufacturers and service providers.

- For instance, Dassault Aviation’s FalconWays flight-planning app enabled Falcon pilots to reduce fuel consumption by 7 percent during evaluation flights between the U.S. and Europe.

By Fit Type:

The market by fit type includes line-fit and retrofit segments. Line-fit dominates due to continuous aircraft deliveries from commercial and defense manufacturers. Airlines prefer factory-installed systems for improved efficiency and reduced integration challenges. Retrofit demand is growing as operators modernize older fleets to meet new safety and emission regulations. It allows airlines to extend aircraft service life while improving operational performance. Both segments will continue to expand with evolving avionics standards.

- For example, Genesys Aerosystems upgraded over 530 legacy Sikorsky UH-60A/L Black Hawk helicopters with a modern IFR glass cockpit and stability augmentation system, extending their operational viability without the cost of new aircraft.

By Aircraft Type:

The market by aircraft type covers commercial aircraft, military aircraft, and business jets. Commercial aircraft account for the largest share driven by rising passenger traffic and airline fleet expansion. Military aircraft adoption is supported by advanced navigation needs in defense operations. Business jets require compact and efficient systems for route precision and safety. It highlights the broad application of flight management systems across aviation segments. Growing air traffic worldwide supports sustained demand across all aircraft types.

Segmentations:

By Component:

- Hardware

- Software

- Services

By Fit Type:

By Aircraft Type:

- Commercial Aircraft

- Military Aircraft

- Business Jets

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America:

North America accounted for 38% market share in the flight management system market in 2024. The region maintains dominance due to strong aviation infrastructure, advanced research, and presence of key aircraft manufacturers. It benefits from high adoption of modern avionics by major airlines and military operators. Growing investments in airspace modernization programs, such as NextGen in the U.S., reinforce demand for advanced flight management systems. The emphasis on reducing carbon emissions drives airlines to adopt systems that improve fuel efficiency. Regulatory mandates from the Federal Aviation Administration further accelerate system upgrades.

Europe:

Europe held 29% market share in the flight management system market in 2024. The region benefits from robust regulatory frameworks that enforce safety compliance and sustainability in aviation. It supports adoption of advanced avionics across both commercial and regional fleets. Programs such as the Single European Sky initiative push airlines to modernize systems for efficient air traffic management. Growing demand for eco-friendly technologies aligns with the European Union’s emission reduction goals. Airlines in Germany, France, and the UK lead adoption supported by strong aerospace manufacturing. Rising aircraft modernization efforts strengthen long-term growth in the region.

Asia-Pacific:

Asia-Pacific accounted for 23% market share in the flight management system market in 2024. The region is projected to register the fastest growth due to rising aircraft deliveries and surging passenger traffic. It benefits from increasing investments in aviation infrastructure across China, India, and Southeast Asia. Airlines in the region focus on expanding fleets to serve growing demand, which drives adoption of modern avionics. Rapid urbanization and growing middle-class populations increase the demand for safe and efficient air travel. Regional initiatives to develop sustainable aviation practices also create opportunities for advanced systems. It positions Asia-Pacific as a key growth engine for global suppliers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Airbus SE

- Garmin Ltd.

- Boeing

- General Electric Company

- L3Harris Technologies

- Honeywell International Inc.

- Leonardo S.p.A.

- Rockwell Collins

- NAITEC S.R.L.

- Safran Electronics & Defense

Competitive Analysis:

The flight management system market is highly competitive, driven by strong demand for advanced avionics and navigation solutions. Key players include Airbus SE, Garmin Ltd., Boeing, General Electric Company, L3Harris Technologies, and Honeywell International Inc. These companies focus on innovation, strategic partnerships, and integration of next-generation technologies to maintain leadership. It emphasizes product reliability, efficiency, and compliance with global aviation regulations. Competitive strategies include expanding product portfolios, enhancing automation features, and investing in sustainable designs. Rising aircraft deliveries and modernization programs worldwide create opportunities for these players to strengthen their presence. Collaboration with airlines and aircraft OEMs supports long-term growth and positions these companies at the forefront of market expansion.

Recent Developments:

- In June 2025, Airbus signed a major defense contract for Flexrotor uncrewed aerial systems with Perth-based Drone Forge, along with additional agreements for up to 26 aircraft and helicopters in defense segment.

- In August 2025, Garmin announced new partnerships for its inaugural Garmin Marathon Series, collaborating with Brooks, Dexcom, Maurten, Shokz, and Therabody, with the series beginning in September in Toledo, Ohio.

- In August 2025, Boeing and Korean Air announced an agreement for Korean Air’s largest-ever purchase of 103 widebody jets, including the first 777-8F, to support their fleet modernization and the upcoming merger with Asiana Airlines.

Report Coverage:

The research report offers an in-depth analysis based on Component, Fit Type, Aircraft Type and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The flight management system market will witness growing demand from next-generation aircraft programs and eVTOL platforms.

- Airlines will increasingly adopt systems that support fuel efficiency and lower operating costs.

- Advancements in satellite navigation and trajectory-based operations will enhance adoption across regions.

- Integration of artificial intelligence and machine learning will improve route planning and real-time decision-making.

- Cybersecurity solutions will become critical as digitalization in avionics continues to expand.

- Emerging markets in Asia-Pacific and the Middle East will create strong opportunities for suppliers.

- Sustainability goals will drive innovation in lightweight and eco-friendly avionics designs.

- Regulatory bodies will continue enforcing stricter safety and compliance standards, encouraging system upgrades.

- Collaborations between avionics manufacturers and aircraft OEMs will accelerate technological development.

- The long-term outlook points toward higher integration of flight management systems in both commercial and defense fleets.