Market Overview

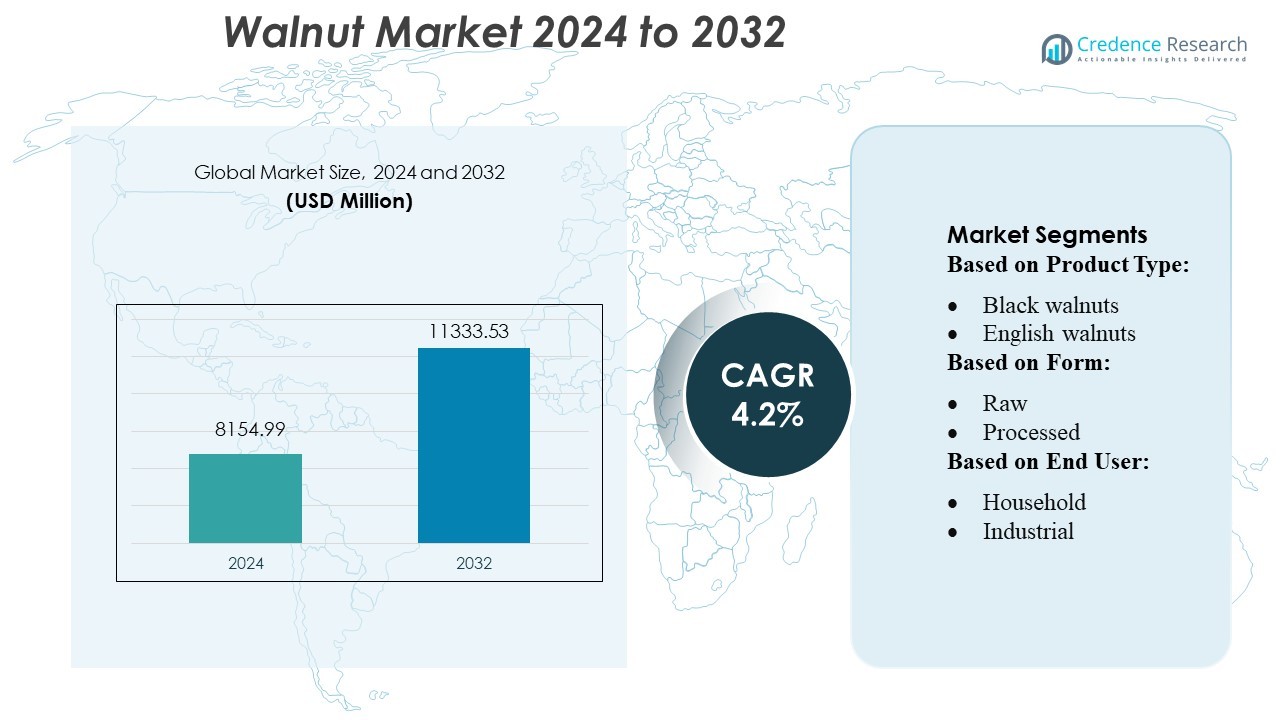

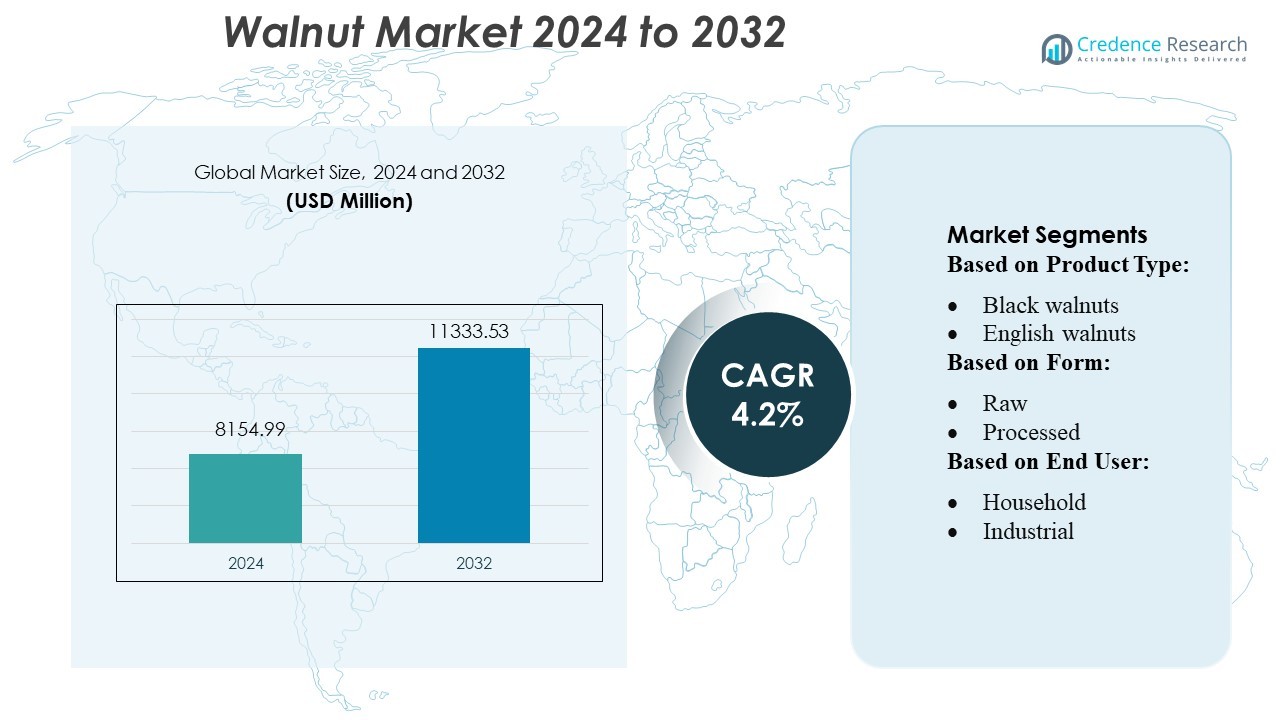

Walnut Market size was valued USD 8154.99 million in 2024 and is anticipated to reach USD 11333.53 million by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Walnut Market Size 2024 |

USD 8154.99 Million |

| Walnut Market, CAGR |

4.2% |

| Walnut Market Size 2032 |

USD 11333.53 Million |

The walnut market features strong participation from major food manufacturers that integrate walnuts into snacks, bakery items, confectionery products, and packaged foods, driving steady product innovation and global distribution reach. Leading players actively shaping the market include Unilever Plc, Mars, Inc., Conagra Brands, Inc., Kraft Foods, The Hershey Company, Hormel Foods Corporation, Oetker Group, Kellogg Company, Associated British Foods plc, and J.M. Smucker Company. These companies focus on premium formulations, clean-label ingredients, and sustainable sourcing to strengthen brand positioning. North America leads the global walnut market with an exact market share of 37%, supported by advanced production systems, extensive exports, and strong domestic consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The walnut market was valued at USD 8154.99 million in 2024 and is projected to reach USD 11333.53 million by 2032, expanding at a CAGR of 4.2%, driven by rising demand for nutrient-rich and plant-based food products.

- Growing consumer preference for clean-label, omega-3 rich snacks and bakery ingredients continues to drive market expansion, supported by wider retail penetration and increased use of walnuts in functional foods.

- Market trends highlight strong product innovation from major players focusing on premium formulations, sustainable sourcing, and value-added walnut products such as oils, spreads, and snack blends.

- The market faces restraints related to climate variability, fluctuating production cycles, and supply chain disruptions that impact raw material availability and price stability.

- North America holds 37% of the global market, leading due to advanced production systems and strong exports, while the kernels segment maintains the largest share globally, driven by high usage in food processing and packaged consumer products.

Market Segmentation Analysis:

By Product Type

English walnuts dominate the product type segment, accounting for the largest market share due to their mild flavor profile, high kernel yield, and widespread use in packaged food, bakery, and snacking applications. Their global availability and strong integration into both household and industrial processing channels further reinforce their dominance. Demand is driven by rising consumer preference for nutrient-dense nuts rich in omega-3 fatty acids and antioxidants. Black walnuts continue to grow steadily, supported by niche applications in premium bakery items and specialty flavor formulations.

- For instance, Mars, Inc. recently opened a 44,000-square-foot Snacking R&D hub in Chicago dedicated to nut research, including tree nuts, where 300 R&D associates develop next-gen processes for nuts used in brands like SNICKERS and M&M’S.

By Form

The processed walnuts segment holds the dominant market share, supported by extensive utilization in bakery, confectionery, snacks, ready-to-eat mixes, and value-added food applications. Manufacturers prefer processed forms—such as roasted, chopped, flavored, and coated walnuts—because they offer extended shelf life, uniformity, and convenience for large-scale production. Growth is driven by increasing adoption in packaged food categories and higher demand for portion-controlled, ready-to-use nut ingredients. Raw walnuts maintain consistent demand in the household and health-conscious consumer segments, benefitting from their unaltered nutritional profile and suitability for home cooking.

- For instance, Conagra’s innovation teams are driving sustainability through various projects across different plants.The Maple Grove plant installed energy-efficient air units that cut natural gas use by 12%, saving approximately $36,000 annually.

By End User

The industrial segment leads the walnut market, holding the highest market share due to extensive incorporation across bakery, confectionery, snacks, desserts, and broader food and beverage applications. This dominance is driven by rising production of nut-based ingredients, protein snacks, and functional foods. Food processors increasingly use walnuts for their texture, flavor, and nutritional value, supporting demand from large-scale manufacturing. Household consumption remains significant, fueled by growing health awareness, while pharmaceuticals and personal care industries steadily expand walnut use in plant-based formulations, oils, supplements, and skin-nourishing cosmetic products.

Key Growth Drivers

1. Rising Health Awareness and Nutritional Benefits

Increasing global awareness of plant-based nutrition strongly drives walnut demand, as consumers seek foods rich in omega-3 fatty acids, antioxidants, proteins, and essential minerals. Walnuts are widely promoted for supporting heart health, cognitive function, and weight management, elevating their adoption in daily diets and functional food formulations. Growing preference for natural, clean-label, and minimally processed snacks further boosts walnut consumption across household and commercial channels. Health-focused marketing campaigns and clinical evidence supporting walnut benefits reinforce their importance in preventive nutrition.

- For instance, Kraft Heinz is using advanced AI and machine-learning systems via its “Lighthouse” supply-chain control tower to improve ingredient quality and traceability, enabling real-time decisions across 31 North American manufacturing plants.

2. Expansion of Processed and Value-Added Walnut Applications

The rapid growth of packaged foods, convenience snacks, and bakery and confectionery products fuels demand for value-added walnut formats such as roasted, chopped, flavored, coated, and powdered variants. Food manufacturers increasingly incorporate walnuts into protein bars, granola mixes, plant-based desserts, and dairy alternatives to enhance texture and nutritional appeal. Rising innovation in ready-to-eat and ready-to-cook formulations strengthens industrial procurement. The shift toward premium, gourmet, and artisanal food categories further supports the demand for quality walnut ingredients in both domestic and international markets.

- For instance, The Hershey Company has opened its first fully digitally integrated manufacturing plant: a 250,000-square-foot Reese’s chocolate processing facility in Pennsylvania, which adds about 120 new production positions and operates on advanced automation systems.

3. Growth in International Trade and Supply Chain Improvements

Enhanced walnut production capabilities in major exporting countries, combined with improved grading systems, cold-chain logistics, and post-harvest processing technologies, significantly elevate global market growth. The introduction of better drying, shelling, and packaging techniques ensures higher kernel quality, reduced contamination, and longer shelf life, making international shipments more efficient. Trade liberalization and rising import demand from Asia-Pacific and Europe strengthen global distribution networks. Consistent supply improvement enables manufacturers to adopt walnuts in broader industrial applications, ensuring stable year-round availability.

Key Trends & Opportunities

1. Rising Demand for Organic and Premium-Grade Walnuts

The organic food movement continues to reshape demand as consumers prioritize chemical-free, sustainably grown nuts. Organic walnuts command a premium due to their clean-label positioning, higher nutritional perception, and environmentally responsible cultivation practices. Producers are expanding certified organic acreage to meet growing retail and export needs. Increasing popularity of premium-grade kernels—favored in gourmet snacks, artisanal bakery products, and high-end confectionery—creates opportunities for suppliers offering superior kernel color, size, and flavor consistency.

- For instance, Hormel Foods Corporation matched 92% of its U.S. energy demand with renewable sources in 2024, demonstrating a strong commitment to responsible sourcing.

2. Growth of Plant-Based and Functional Food Innovations

The accelerating shift toward plant-based diets presents strong opportunities for walnut integration in functional foods, health supplements, and alternative protein formulations. Walnut-based protein powders, nut butters, dairy substitutes, and clean-label energy snacks are gaining traction among fitness-conscious and vegan consumers. Manufacturers explore walnuts as natural flavoring and nutritional enhancers in cereals, beverages, spreads, and meal replacements. Rising investment in R&D for nutrient-rich, allergen-friendly, and vegan product lines further expands application possibilities across new and emerging consumer segments.

- For instance, Kellogg is pushing toward 100% reusable, recyclable, or compostable packaging by the end of 2025, with 76% of its current packaging already recyclable at scale.

3. Expanding Use of Walnut Oil in Cosmetics and Pharmaceuticals

Walnut oil’s high antioxidant content, omega-3 profile, and skin-conditioning properties create new opportunities in personal care and pharmaceutical formulations. Cosmetic brands increasingly adopt walnut oil in moisturizers, serums, exfoliants, and hair-care products targeting hydration, anti-aging, and scalp nourishment. The pharmaceutical industry leverages walnut extracts in supplements supporting brain health and cardiovascular function. Rising demand for natural, plant-derived ingredients supports broader adoption of walnut-based oils and bioactive compounds across high-growth wellness categories.

Key Challenges

1. High Production Costs and Yield Variability

Walnut cultivation is capital-intensive and sensitive to climate conditions, requiring significant investment in irrigation systems, labor, orchard management, and long maturity cycles. Weather fluctuations, water scarcity, and disease outbreaks directly impact yield consistency and kernel quality. These factors contribute to price volatility in international markets, affecting manufacturers reliant on stable raw material inputs. Smaller producers struggle to compete due to high upkeep and certification costs, limiting their profitability and scaling potential in highly competitive markets.

2. Intense Competition from Alternative Nuts and Substitutes

The walnut market faces strong competition from almonds, cashews, pistachios, and other nuts that offer similar nutritional profiles but benefit from more established supply chains or lower cost structures. Consumer preference can shift based on price changes, promotional activities, and availability of substitutes in packaged foods and snacks. Food manufacturers may reformulate products to reduce reliance on walnuts during periods of high walnut prices. This competitive pressure challenges sustained demand, especially in price-sensitive segments across developing markets.

Regional Analysis

North America

North America dominates the global walnut market with an estimated 35–38% share, driven primarily by the U.S., which remains one of the world’s largest walnut producers and exporters. The region benefits from advanced orchard management, high adoption of mechanized harvesting, and strong export demand from Europe and Asia. Rising consumer preference for nutrient-dense snacks and plant-based protein sources supports domestic consumption growth. Strict quality standards and traceability systems further enhance the region’s competitiveness. Additionally, ongoing expansion of value-added walnut products, including oils and ready-to-eat snacks, continues to strengthen market penetration across retail and food service channels.

Europe

Europe holds around 25–27% of the global walnut market, supported by strong consumption in countries such as Germany, France, Spain, and Italy. The region’s demand is driven by rising health awareness, increasing use of walnuts in bakery, confectionery, and premium snacking segments, and growing preference for omega-3 rich foods. Imports from the U.S. and Chile play a vital role in meeting demand during off-seasons. Europe’s stringent food quality regulations encourage suppliers to maintain high-grade processing standards, strengthening market reliability. Expansion of organic walnut production and rising popularity of plant-based diets further stimulate long-term consumption and market growth.

Asia-Pacific

The Asia-Pacific region accounts for roughly 28–30% of the walnut market, driven by large-scale production in China and strong consumption growth across India, Japan, and South Korea. China remains both a leading producer and consumer, heavily influencing regional pricing and supply dynamics. Rising disposable incomes, rapid urbanization, and growing adoption of Western-style bakery and confectionery products accelerate walnut demand. The health and wellness trend significantly boosts consumption as walnuts gain popularity for cognitive and cardiovascular benefits. Increasing retail penetration, expanding e-commerce distribution, and government support for high-value nut cultivation further enhance regional market performance.

Latin America

Latin America captures nearly 6–8% of the global walnut market, supported by expanding production in Chile and Argentina. Chile serves as the region’s primary producer and a major global exporter due to its favorable climate, long growing season, and high kernel quality. Rising participation in international trade agreements helps strengthen export competitiveness, particularly in Europe, the Middle East, and Asia. Domestic consumption is growing gradually as awareness of walnut-based nutritional benefits increases. Investment in orchard modernization and post-harvest processing further improves yield consistency and export-grade standards, supporting the region’s long-term market presence.

Middle East & Africa

The Middle East & Africa region holds around 3–4% of the walnut market, driven mainly by import-dependent countries such as the UAE, Saudi Arabia, and South Africa. Rising demand for premium nuts in retail, gifting, and food service applications supports gradual market expansion. The region’s healthy snacking trend and preference for nutrient-rich foods also drive walnut consumption. Although production remains limited, improving cold-chain logistics and diversified supply sourcing from the U.S., China, and Chile strengthen market availability. Growing retail modernization, especially in GCC countries, creates opportunities for packaged walnut products and value-added nut blends.

Market Segmentations:

By Product Type:

- Black walnuts

- English walnuts

By Form:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global walnut market’s competitive landscape features a diverse mix of multinational food manufacturers, including Unilever Plc, Mars, Inc., Conagra Brands, Inc., Kraft Foods, The Hershey Company, Hormel Foods Corporation, Oetker Group, Kellogg Company, Associated British Foods plc, and J.M. Smucker Company. The global walnut market reflects steady consolidation, rising product innovation, and heightened focus on supply chain efficiency. Established food manufacturers and nut processors continue to expand their walnut-based portfolios, driven by increasing consumer demand for nutrient-rich snacks, clean-label ingredients, and plant-based protein sources. Companies are enhancing processing capabilities, including advanced sorting, shelling, and cold-storage technologies, to maintain kernel quality and reduce post-harvest losses. Strategic investments in sustainable sourcing, orchard partnerships, and certification programs strengthen market reliability. Additionally, firms are leveraging e-commerce channels, functional food trends, and premium packaging solutions to differentiate their offerings and secure stronger global market positions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Unilever Plc

- Mars, Inc.

- Conagra Brands, Inc.

- Kraft Foods

- The Hershey Company

- Hormel Foods Corporation

- Oetker Group

- Kellogg Company

- Associated British Foods plc

- M. Smucker Company

Recent Developments

- In May 2025, India’s suspension of trade ties with Pakistan has boosted Kashmir’s walnut industry, halting the influx of cheaper. Among the affected commodities were dry fruits, including Afghan walnuts, which were being imported into India via Pakistan.

- In January 2025, VitaTek entered into a distribution partnership with Chamfr to launch an initiative to simplify access to VitaCoat’s open-source hydrophilic coatings. This collaboration expands VitaTek’s presence in the pharma-tech and medical device component sector, showcasing their multifunctionality in providing easy-to-access, off-the-shelf components for engineers.

- In May 2024, Jif has introduced its first major flavor innovation in nearly ten years: the Jif Peanut Butter & Chocolate Flavored Spread. This latest creation aims to harmoniously meld Jif’s signature creamy peanut butter essence with a touch of chocolate sweetness.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to expand steadily as global demand for nutrient-dense and plant-based foods continues to rise.

- Producers will increasingly adopt modern orchard technologies to improve yield efficiency and kernel quality.

- Sustainable sourcing practices will gain stronger emphasis as buyers prioritize traceability and environmentally responsible cultivation.

- Growth in functional foods and clean-label products will drive higher incorporation of walnuts across multiple food categories.

- Value-added walnut products, including oils, snacks, and ingredients, will see accelerated innovation and retail penetration.

- Export opportunities will strengthen as major producing countries enhance processing capabilities and quality standards.

- E-commerce and direct-to-consumer channels will play a larger role in shaping walnut purchasing behavior.

- Climate-resilient farming practices will become essential as producers respond to weather variability and water constraints.

- Emerging markets in Asia and the Middle East will exhibit rising consumption supported by expanding retail infrastructure.

- Strategic partnerships between growers, processors, and food manufacturers will increase to secure stable long-term supply.