Market Overview

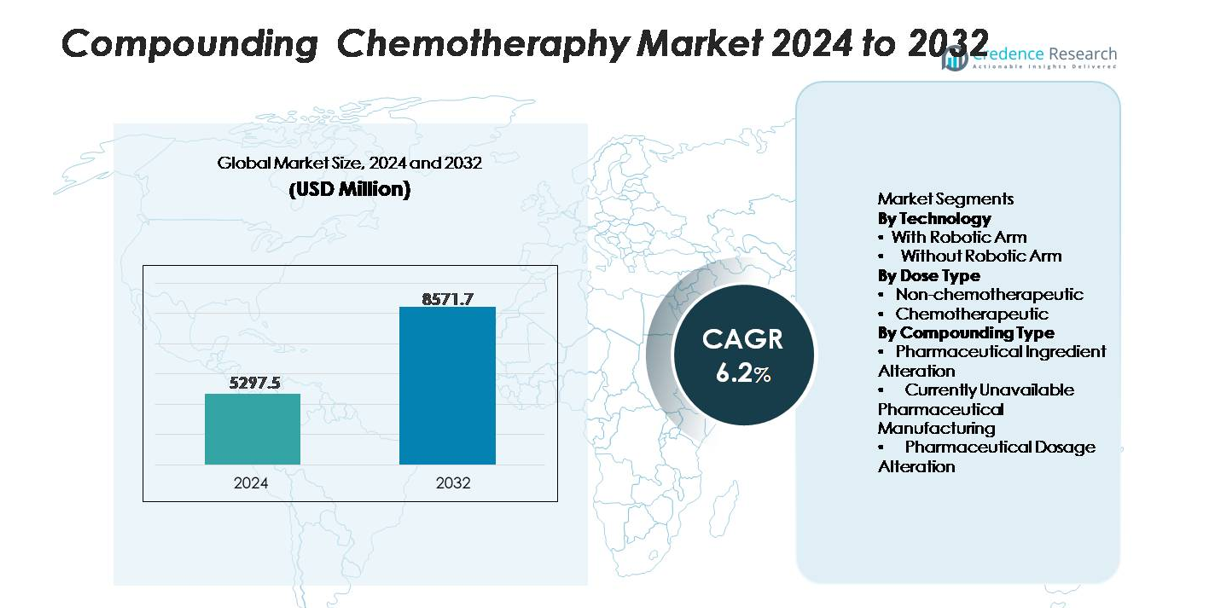

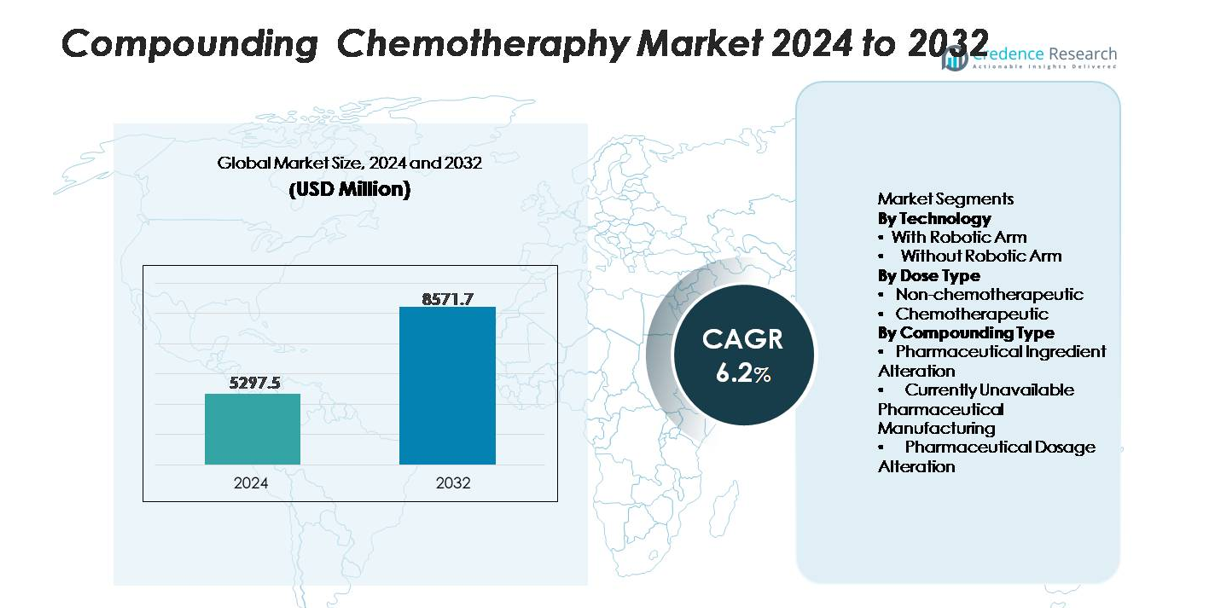

The Compounding Chemotherapy Market was valued at USD 5,297.5 million in 2024 and is projected to reach USD 8,571.7 million by 2032, expanding at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compounding Chemotherapy Market Size 2024 |

USD 5,297.5 million |

| Compounding Chemotherapy Market, CAGR |

6.2% |

| Compounding Chemotherapy Market Size 2032 |

USD 8,571.7 million |

The compounding chemotherapy market is led by specialized pharmacy automation and sterile preparation technology providers such as Baxter International, B. Braun Melsungen, Fresenius Kabi, Omnicell, Grifols, and Equashield, each offering advanced systems for aseptic chemotherapy preparation, closed-system drug transfer, and digital verification. These players compete on robotic precision, contamination-control innovation, and regulatory compliance capabilities. North America remains the leading region with 38% market share, supported by advanced oncology infrastructure and early adoption of robotic compounding platforms. Europe holds a strong position driven by stringent safety standards, while Asia-Pacific continues expanding rapidly through investments in cancer care modernization.

Market Insights

- The compounding chemotherapy market reached USD 5,297.5 million in 2024 and is projected to hit USD 8,571.7 million by 2032 at a 6.2% CAGR, supported by rising global oncology caseloads and expansion of personalized dosing requirements.

- Market growth is driven by increasing demand for precision-based chemotherapy preparation, stronger adherence to USP <797>/<800> standards, and accelerated adoption of robotic compounding systems, which dominate the technology segment due to superior accuracy and contamination control.

- Key trends include rapid automation of sterile pharmacies, increasing use of gravimetric and barcode verification, and expansion of centralized outsourcing facilities offering high-volume sterile chemotherapeutic preparations.

- Competitive activity remains strong as major players enhance robotic platforms, contamination-control technologies, and advanced workflow software, while market restraints include high capital investment, training gaps, and complex regulatory compliance for hazardous drug handling.

- North America leads with 38% share, followed by Europe at 29%, Asia-Pacific at 24%, and LAMEA at 9%, while the chemotherapeutic dose segment and robotic-arm technology segment remain the dominant contributors to overall market performance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

In the compounding chemotherapy market, systems equipped with robotic arms hold the largest share due to their superior precision, contamination control, and operator-safety advantages. Automated robotic platforms reduce manual handling of cytotoxic agents and ensure repeatable dosing accuracy, which drives strong adoption among hospital pharmacies and oncology centers. Their ability to maintain consistent aseptic conditions, integrate real-time gravimetric verification, and lower compounding error rates positions them as the preferred technology. Systems without robotic arms continue to serve lower-volume settings, but rising safety standards increasingly shift facilities toward robotic-enabled workflows.

- For instance, the KIRO Oncology robotic system developed by Grifols is capable of preparing up to 40 chemotherapy doses per hour with gravimetric accuracy within ±0.1 g, significantly reducing compounding errors and exposure risks.

By Dose Type

The chemotherapeutic dose segment dominates the overall market, driven by the rising volume of personalized oncology treatments requiring precise compounding tailored to patient-specific regimens. Increasing utilization of multi-drug protocols, weight-based dosing, and combination infusion therapies reinforces the demand for high-accuracy compounding systems capable of handling hazardous drugs. Non-chemotherapeutic preparations remain relevant for supportive care—such as antiemetics, analgesics, and hydration mixtures—but their share remains smaller due to lower handling risks and simpler preparation requirements. The complex, high-risk nature of chemotherapeutic doses continues to propel specialized compounding investments.

- For instance, the EQUASHIELD® closed-system drug-transfer device—widely used in chemotherapeutic dose preparation—demonstrated 0.0 mL surface contamination in NIOSH-aligned wipe tests and supports syringe volumes up to 60 mL, enabling safer handling of multi-agent regimens.

By Compounding Type

Within compounding types, pharmaceutical dosage alteration holds the dominant share as oncology practices frequently require dose adjustments based on toxicity profiles, renal/hepatic function, and performance status. This segment benefits from its widespread application across infusion centers, where modifying concentration, volume, or strength is routine for individualized chemotherapy regimens. Pharmaceutical ingredient alteration and currently unavailable pharmaceutical manufacturing serve more specialized needs—such as creating alternative formulations or addressing supply gaps—but occur less frequently. The centrality of dosage personalization in cancer care ensures consistent demand for advanced systems that support accurate modification workflows.

Key Growth Drivers

Rising Oncology Burden and Expansion of Precision Medicine Protocols

The growing prevalence of cancer worldwide is a primary driver accelerating the adoption of compounding chemotherapy systems. Oncology care increasingly depends on personalized dosing models, where treatment regimens vary based on tumor genetics, patient weight, organ function, and toxicity response. This shift intensifies the demand for precise, standardized, and contamination-free compounding processes that manual workflows cannot consistently provide. As hospitals expand infusion centers and integrate multidisciplinary oncology programs, they require automated systems capable of managing complex multi-drug combinations and minimizing cytotoxic exposure. The proliferation of weight-based and body surface area–based dosing further increases workload complexity, compelling facilities to deploy advanced compounding platforms that ensure traceability, repeatability, and compliance with stringent USP <797> and <800> standards. Together, these factors reinforce continuous investments in high-performance compounding infrastructure.

- For instance, the APOTEC Achemo robotic platform achieved preparation of 3,851 doses representing 69.7% of total routinely compounded antineoplastic preparations in a UK community cancer centre during one year.

Heightened Focus on Worker Safety and Regulatory Compliance

Growing regulatory pressure to protect pharmacy staff from hazardous drug exposure is driving the rapid modernization of chemotherapy compounding practices. Compliance mandates related to closed-system drug-transfer devices, cleanroom standards, and environmental monitoring are now central to institutional decision-making. Facilities increasingly adopt automated and semi-automated compounding systems that reduce manual interventions, limit aerosolized drug release, and improve environmental isolation. These technologies support consistent documentation, real-time gravimetric verification, and electronic workflows that align with regulatory audits. As occupational safety agencies intensify oversight and publish stricter exposure thresholds, healthcare institutions are prioritizing capital investments that lower operator risk and ensure consistent quality. The industry’s shift toward robotics-based compounding further reduces ergonomic strain, error rates, and contamination incidents, making compliance-driven modernization a crucial growth catalyst.

- For instance, Baxter’s EXACTAMIX® automated compounding system integrates a gravimetric accuracy tolerance of ±1% and supports up to 24 ingredient ports, enabling highly controlled sterile preparation aligned with USP <797> mandates.

Rapid Automation and Integration of Digital Pharmacy Technologies

Advances in pharmacy automation, digital health platforms, and compounding robotics significantly influence market growth. Hospitals and oncology centers increasingly deploy integrated software solutions that synchronize prescribing systems, compounding equipment, and verification databases to improve efficiency and accuracy. Automated compounding systems enhance throughput by optimizing workflows, enabling consistent batch preparation, and reducing preparation times for complex regimens. Digital tracking capabilities—such as barcode matching, real-time dosing analytics, and electronic batch records—strengthen medication safety and eliminate documentation inconsistencies. These technological improvements support scalable operations, especially in high-volume oncology units where managing multiple patient-specific regimens is a daily challenge. As interoperability with electronic health records, AI-supported dose calculators, and predictive scheduling tools becomes more prevalent, institutions recognize automation as essential for improving productivity, reducing medication waste, and ensuring audit-ready compliance.

Key Trends & Opportunities

Growing Adoption of Robotic Compounding Platforms in Oncology Pharmacies

A major trend shaping the market is the increasing acceptance of robotic compounding systems for high-risk chemotherapeutic preparations. Modern robotic platforms deliver precision at micro-gram levels, maintain stable aseptic environments, and reduce manual exposure to cytotoxic vapors, making them attractive for advanced oncology pharmacies. Their integration with AI-based verification modules and gravimetric measurement tools ensures consistent dosing accuracy and supports predictive error prevention. The opportunity lies in expanding these solutions beyond tertiary care hospitals into regional cancer centers and specialty pharmacies where demand for automated compounding is rising. As robotics become more cost-competitive, facilities view automation as a long-term strategy for improving safety, accelerating turnaround times, and supporting higher treatment volumes.

- For instance, the Grifols Kiro Oncology system operates in a certified ISO Class 5 isolator environment and uses gravimetric controls at each step to ensure high dose accuracy to the prescribed dose. It achieves a verified production throughput of up to 40 chemotherapy preparations per hour.

Expansion of Outsourced Compounding Services and Centralized Sterile Facilities

Another significant trend is the growing reliance on outsourced compounding services, particularly 503B outsourcing facilities that specialize in sterile chemotherapy preparations. These centralized units use advanced environmental controls, high-capacity automation, and validated sterility workflows to produce standardized doses at scale. Healthcare systems increasingly contract these facilities to reduce internal compounding risks, address workforce shortages, and ensure uninterrupted supply of individualized chemotherapeutic units. The opportunity expands as outsourcing improves cost predictability, lowers operational burden, and enhances product consistency. Growth in regional oncology networks and home-based infusion programs further boosts demand for reliable external compounding partners.

Innovation in Cleanroom Infrastructure and Contamination-Control Technologies

Continuous innovation in cleanroom systems—ranging from smart biosafety cabinets to HEPA-controlled isolators and real-time environmental monitoring—presents substantial opportunities. Facilities are upgrading their sterile compounding environments to meet evolving regulatory expectations and reduce contamination events. Sensor-enabled airflow systems, pressure-differential monitoring, and automated particle counters help maintain controlled conditions throughout compounding cycles. As oncology regimens become more complex and handling risks intensify, institutions investing in advanced contamination-control technologies achieve higher compliance rates, improved safety, and reduced batch rejection. The trend opens pathways for equipment manufacturers to deliver modular, scalable cleanroom solutions tailored to oncology pharmacies.

Key Challenges

High Capital Investment and Operational Costs of Advanced Compounding Systems

Despite strong adoption drivers, high acquisition and maintenance costs of automated and robotic compounding systems pose a major challenge for many healthcare institutions. These platforms require specialized infrastructure, dedicated cleanroom space, and ongoing calibration, which significantly increases operational expenditure. Smaller hospitals and regional oncology centers often struggle to justify the initial investment, especially in markets where reimbursement for compounded chemotherapy is limited. Additionally, integrating advanced systems with existing electronic health systems and validation protocols adds complexity and cost. Budget constraints, uneven technology access, and long return-on-investment timelines continue to impede widespread adoption, particularly in resource-constrained healthcare environments.

Workforce Shortages and Training Gaps in Sterile Compounding Practices

The market faces challenges associated with limited availability of trained pharmacy staff experienced in sterile compounding and hazardous drug handling. Implementing advanced systems requires technicians and pharmacists to undergo specialized training in robotics operation, validation, and quality assurance procedures. High staff turnover, rising workload in oncology units, and gaps in professional training programs exacerbate these challenges. Without consistent skill development, facilities risk compounding delays, workflow errors, and compliance issues. Additionally, adapting to evolving USP standards and maintaining audit-ready documentation demand continuous education, which many institutions struggle to provide systematically. Workforce development remains a critical bottleneck in scaling compounding modernization efforts.

Regional Analysis

North America

North America dominates the compounding chemotherapy market with 38% share, driven by advanced oncology infrastructure, strong adoption of robotic compounding platforms, and strict enforcement of USP <797> and <800> regulations. Large hospital networks and specialized cancer centers invest heavily in automation to improve safety and workflow efficiency. Widespread integration of digital pharmacy systems, expanding infusion center capacity, and the presence of leading sterile compounding solution providers further strengthen regional leadership. Growing demand for personalized cancer therapies and expanding outpatient chemotherapy programs continue to reinforce North America’s position as the most mature regional market.

Europe

Europe accounts for 29% of the global market, supported by extensive oncology care capacities, strong regulatory frameworks, and accelerated modernization of sterile compounding facilities. Countries such as Germany, France, and the U.K. lead adoption of automated and semi-automated compounding technologies due to workforce safety regulations and stringent contamination-control requirements. Investments in robotic systems, centralized hospital pharmacies, and cross-border outsourced compounding services fuel market expansion. Rising cancer incidence, increasing preference for personalized dosing, and continuous upgrades in hospital cleanroom infrastructure collectively sustain Europe’s substantial share in the compounding chemotherapy landscape.

Asia-Pacific

Asia-Pacific holds 24% of the market, driven by rapid expansion of oncology services across China, India, South Korea, and Japan. Rising cancer prevalence, growth of tertiary care hospitals, and increasing government investment in cancer treatment infrastructure accelerate adoption of advanced compounding systems. While many facilities still rely on manual processes, the region is witnessing fast uptake of automated aseptic technologies as safety and quality standards tighten. Expanding pharmaceutical manufacturing ecosystems, growing medical tourism, and the emergence of high-volume oncology centers further boost demand for precision compounding solutions within the region.

Latin America, Middle East & Africa (LAMEA)

The LAMEA region represents 9% of the global market, supported by progressive upgrades in oncology care across major economies such as Brazil, Mexico, Saudi Arabia, and the UAE. Many facilities are transitioning from manual to partially automated compounding systems to improve safety and reduce cytotoxic exposure risks. Government-led cancer control initiatives, expansion of private hospital networks, and increasing collaborations with international sterile compounding providers fuel adoption. However, high capital costs, limited specialist training, and uneven regulatory enforcement constrain broader penetration, keeping the region at an emerging stage of market development.

Market Segmentations:

By Technology

- With Robotic Arm

- Without Robotic Arm

By Dose Type

- Non-chemotherapeutic

- Chemotherapeutic

By Compounding Type

- Pharmaceutical Ingredient Alteration

- Currently Unavailable Pharmaceutical Manufacturing

- Pharmaceutical Dosage Alteration

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the compounding chemotherapy market is characterized by strong participation from automation leaders, sterile compounding technology providers, and oncology-focused pharmacy solution vendors. Key players such as Baxter International, B. Braun Melsungen, Fresenius Kabi, Grifols, Omnicell, and Equashield compete by advancing robotic compounding platforms, contamination-control systems, and closed-system drug-transfer technologies that enhance dose accuracy and operator safety. These companies are increasingly integrating digital verification, gravimetric checks, and electronic batch documentation to strengthen compliance with USP <797> and <800> standards. Strategic investments focus on expanding automated sterile preparation capacity, improving interoperability with pharmacy information systems, and developing solutions that reduce hazardous drug exposure. Partnerships with hospital networks, upgrades to oncology cleanroom infrastructure, and growing demand for personalized chemotherapy regimens further intensify competition. As facilities transition from manual to automated workflows, industry leaders differentiate through reliability, precision engineering, and regulatory-aligned compounding innovations, solidifying their position in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Teva entered a license and supply agreement with Prestige Biopharma for commercialization of the biosimilar Tuznue® (trastuzumab) across major European markets.

- In 2025, Sandoz outlined its strategic roadmap and highlighted key pipeline catalysts at the 43rd Annual J.P. Morgan Healthcare Conference, reinforcing its focus on oncology and biosimilar development.

- In 2024, Baxter announced the “continued growth of its pharmaceuticals portfolio,” including new injectable product launches and expansion of its compounding and sterile injectable business

Report Coverage

The research report offers an in-depth analysis based on Technology, Dose type, Compounding type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated and robotic compounding systems will accelerate as oncology centers prioritize precision, safety, and workflow efficiency.

- Adoption of advanced contamination-control technologies and closed-system drug-transfer devices will strengthen compliance with evolving safety regulations.

- Personalized chemotherapy protocols will continue driving the need for dose-flexible and high-accuracy compounding platforms.

- Integration of digital verification tools, gravimetric measurement, and smart software will enhance traceability and reduce preparation errors.

- Centralized sterile compounding facilities will expand, supporting hospitals facing capacity limits and workforce shortages.

- AI-driven decision support and predictive scheduling will increasingly optimize chemotherapy preparation workflows.

- Investments in cleanroom upgrades and aseptic infrastructure will rise across emerging oncology markets.

- Outsourcing partnerships between health systems and specialized compounding providers will gain momentum.

- Workforce training programs for hazardous drug handling and robotics operation will become more standardized.

- Regulatory tightening around hazardous drug exposure will accelerate the transition from manual to automated compounding.