Market Overview

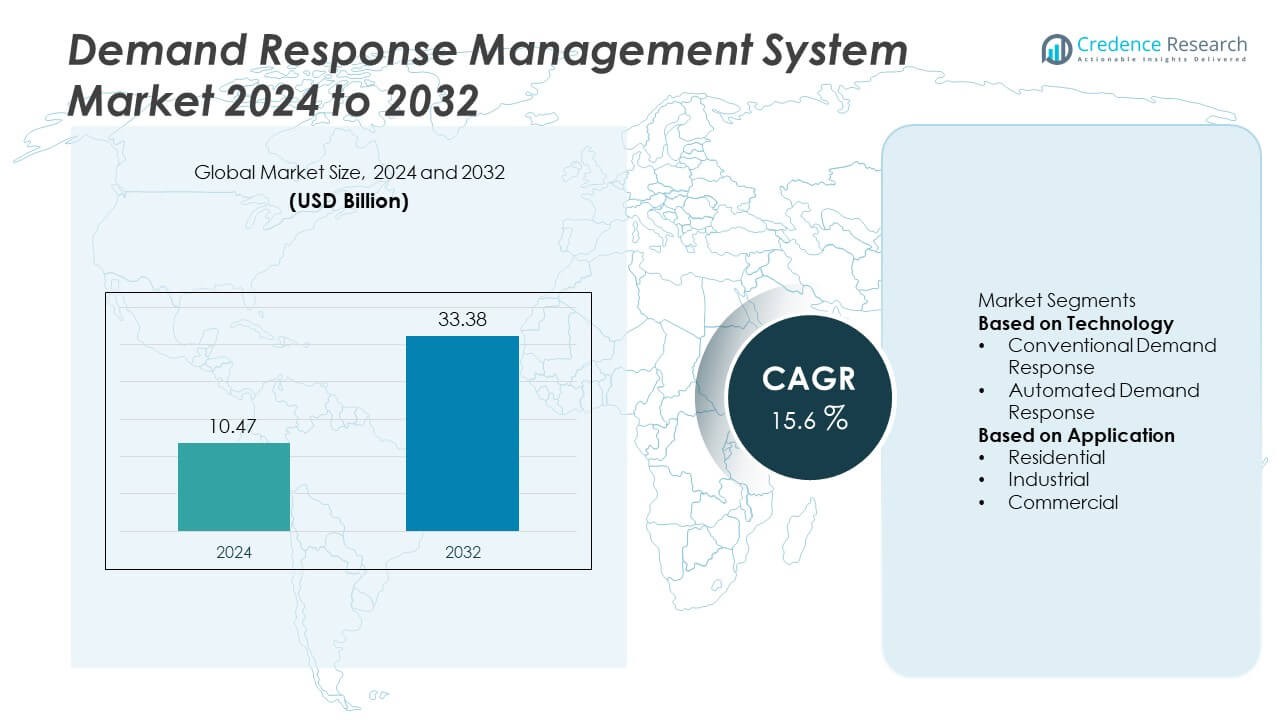

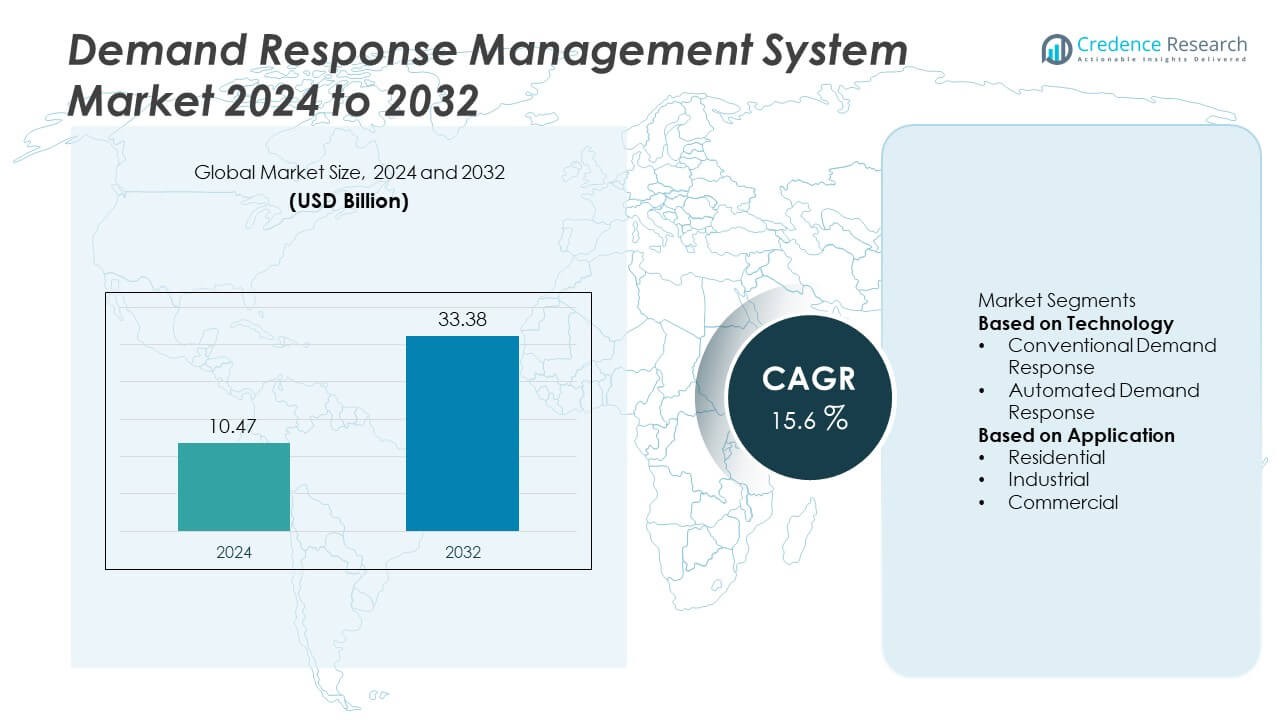

The Demand Response Management System market reached USD 10.47 billion in 2024 and is projected to grow to USD 33.38 billion by 2032, supported by a 15.6% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Demand Response Management System Market Size 2024 |

USD 10.47 Billion |

| Demand Response Management System Market, CAGR |

15.6% |

| Demand Response Management System Market Size 2032 |

USD 33.38 Billion |

The Demand Response Management System market is driven by leading players such as Enel Spa, Johnson Controls, ABB, Siemens, Eaton, ALARM.COM HOLDINGS, INC., Honeywell International Inc., Itron Inc., Schneider Electric SE, and General Electric. These companies expand their presence through automated DR platforms, grid-responsive control systems, and AI-enabled load forecasting tools that support utilities and large energy consumers. Their focus on integrating smart meters, IoT devices, and real-time communication networks strengthens demand response participation across residential, commercial, and industrial sectors. North America leads the market with a 41% share, supported by advanced smart grid infrastructure, while Europe follows with a 30% share, driven by strong regulatory support and growing renewable energy integration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Demand Response Management System market reached USD 10.47 billion in 2024 and is projected to reach USD 33.38 billion by 2032 at a 15.6% CAGR, supported by rising smart grid modernization.

- Growth is driven by the dominance of automated demand response with a 63% share, fueled by strong adoption of smart meters and IoT-enabled load control across utilities and large enterprises.

- Key trends include expansion of AI-driven forecasting, real-time load optimization, and broader integration of distributed energy resources such as EV chargers, solar systems, and battery storage.

- Competition intensifies as key players enhance cloud-based DRMS platforms, expand utility partnerships, and invest in cybersecurity, while high deployment costs and limited awareness in developing regions restrain adoption.

- Regionally, North America leads with a 41% share, followed by Europe at 30% and Asia Pacific at 23%, supported by strong regulatory support, rising electricity demand, and large-scale smart meter rollouts.

Market Segmentation Analysis:

By Technology

Automated Demand Response (ADR) leads the technology segment with a 63% share, supported by rising adoption of smart meters, IoT-enabled devices, and real-time grid communication systems. Utilities prefer ADR because it automates load adjustments without manual intervention, enabling faster response during peak demand and improving grid reliability. Industries and commercial facilities integrate ADR platforms to optimize energy usage, reduce operational costs, and meet sustainability targets. Conventional demand response continues to serve legacy systems, but digital transformation and regulatory support for smart grids strengthen ADR dominance. Growing investments in automation and advanced control technologies further accelerate segment growth.

- For instance, Schneider Electric has deployed its EcoStruxure ADMS for utilities serving over 150 million end-customers around the world, enabling comprehensive network management, including demand-side management and improved grid efficiency.

By Application

The industrial segment dominates the market with a 48% share, driven by high energy consumption across manufacturing, mining, chemical processing, and heavy industrial operations. Large facilities adopt demand response programs to reduce peak load expenses, enhance energy savings, and maintain operational stability during grid stress events. Commercial users show strong adoption in buildings, data centers, and retail chains leveraging automated systems for HVAC control and lighting optimization. Residential applications gain momentum through smart thermostats, home energy management systems, and smart appliance integration. Rising electrification and grid modernization efforts support broader adoption across all application categories.

- For instance, Honeywell integrated its Demand Response Automation Server (DRAS) across a manufacturing cluster managing 32 MW of controllable load, enabling verified event participation across 22 facilities.

Key Growth Drivers

Rising Need for Grid Stability and Peak Load Management

Utilities increasingly adopt demand response management systems to stabilize grids during high-demand periods and reduce dependence on costly peak-time power generation. Growing electricity consumption from industrial loads, HVAC systems, and EV charging infrastructure heightens the need for flexible energy management. Automated demand response enables faster load curtailment, helping utilities prevent outages and achieve operational efficiency. Governments promote DR programs to enhance energy security and support transition toward smarter grids. These factors collectively accelerate adoption across industrial, commercial, and residential sectors.

- For instance, Enel X deployed its Virtual Power Plant in the U.S. with a 150 MW aggregated demand response portfolio, delivering verified load curtailment across more than 3,500 commercial sites during peak grid events.

Expanding Deployment of Smart Meters and IoT-Enabled Devices

The rapid installation of smart meters, connected sensors, and IoT-based home energy management systems drives strong demand for automated demand response platforms. These technologies offer real-time data exchange, enabling faster decision-making and precise load adjustments. Industrial and commercial users benefit from automated scheduling, remote control, and energy forecasting capabilities. As utilities digitize grid infrastructure, ADR becomes central to improving demand forecasting and reducing operational inefficiencies. Increasing IoT penetration in homes and buildings further strengthens system integration and program participation.

- For instance, Itron’s collaboration with Pepco Holdings (PHI) on their “Energy Wise Rewards” program and AMI deployment involved PHI managing data from nearly 2 million meters across its service territories.

Growing Focus on Energy Cost Savings and Sustainability Goals

Demand response solutions help users reduce energy bills by shifting or reducing consumption during peak tariff periods. Industrial and commercial participants achieve significant cost reductions through automated curtailment strategies. Sustainability programs encourage adoption as DR directly supports carbon reduction, renewable integration, and efficient energy use. Companies adopt DR platforms to meet corporate ESG goals and minimize environmental impact. Rising emphasis on green buildings and energy-efficient operations further boosts implementation across major end-use sectors.

Key Trends & Opportunities

Integration of AI, Analytics, and Predictive Demand Forecasting

Artificial intelligence and advanced analytics enhance demand response performance by improving load prediction accuracy and optimizing response strategies. Predictive tools help utilities anticipate demand spikes, automate control actions, and optimize customer participation. AI-driven platforms enable real-time decision-making, adaptive learning, and enhanced grid reliability. As digital twins, big data analytics, and machine learning evolve, new opportunities emerge for intelligent, self-optimizing DR systems. These advancements support deeper integration into smart grid ecosystems.

- For instance, Siemens deployed its “Spectrum Power” energy management platform, which uses advanced analytics to process large volumes of grid data and apply machine learning automation to improve load forecasting and enable predictive control actions across utility zones.

Expansion of DR Programs Through Smart Homes and Distributed Energy Resources

The rise of smart thermostats, EV chargers, rooftop solar, and battery storage opens new opportunities for residential and commercial demand response participation. Customers use automated systems to adjust loads and store excess energy for peak periods. Distributed energy resources support load balancing and enable two-way energy interaction with the grid. Growth in connected appliances and home automation platforms strengthens residential engagement. These developments expand program reach and increase grid flexibility.

- For instance, Google Nest’s demand response network integrated more than 100 million thermostat adjustments annually across enrolled homes and delivered verified load reductions exceeding 1.3 GW through automated coordination with utility partners.

Key Challenges

High Implementation Costs and Limited Awareness in Developing Regions

Adopting advanced DR systems requires investment in smart meters, automation equipment, communication networks, and analytics platforms. Many utilities in developing regions face budget constraints, slowing adoption. Limited awareness of DR benefits among consumers and small businesses also affects participation rates. Training needs and technical complexities further challenge implementation. These factors restrict widespread adoption despite the growing need for grid efficiency.

Cybersecurity Risks and Data Privacy Concerns

Demand response programs depend on continuous data exchange between utilities, facilities, and smart devices, increasing exposure to cyber threats. Unauthorized access, data breaches, and system manipulation pose risks to grid stability. Utilities must invest in strong encryption, secure communication protocols, and monitoring tools to safeguard operations. Growing regulatory scrutiny around consumer data protection adds to compliance challenges. These concerns influence user trust and slow adoption in sensitive sectors.

Regional Analysis

North America

North America leads the Demand Response Management System market with a 41% share, driven by strong smart grid adoption, high penetration of smart meters, and supportive regulatory frameworks promoting peak load management. Utilities across the U.S. and Canada invest heavily in automated demand response platforms to enhance grid stability and integrate renewable energy sources. Industrial and commercial users participate actively in DR programs to reduce energy costs and improve operational efficiency. Growth in EV charging networks further increases the need for flexible load management. Advanced digital infrastructure and strong government incentives continue to strengthen regional leadership.

Europe

Europe holds a 30% share, supported by strict energy efficiency policies and rising emphasis on decarbonization across major economies such as Germany, the UK, and France. The region integrates renewable energy at a rapid pace, increasing the need for demand response to balance intermittent generation. Utilities adopt ADR platforms to optimize consumption during peak periods and comply with EU energy directives. Commercial buildings and industrial facilities use DR solutions to meet sustainability targets and reduce operational costs. Growing deployment of smart meters, coupled with government-funded grid modernization programs, supports continuous market expansion across Europe.

Asia Pacific

Asia Pacific accounts for a 23% share, driven by rising electricity demand, expanding industrial activity, and strong investments in smart grid development across China, Japan, India, and South Korea. Governments promote demand response programs to manage growing peak load pressures and support large-scale renewable integration. Industrial users adopt ADR systems to control energy expenses and stabilize operations. Increasing urbanization and deployment of IoT-enabled smart meters enhance market penetration. Rapid growth in data centers and commercial buildings further drives adoption of automated load management solutions across the region.

Latin America

Latin America holds a 4% share, influenced by growing focus on grid modernization and rising electricity consumption in countries such as Brazil, Mexico, and Chile. Utilities adopt demand response solutions to address grid congestion and reduce reliance on costly peak-time generation. Industrial and commercial facilities show increasing participation due to cost-saving benefits and improved energy reliability. Limited digital infrastructure restricts adoption in some areas, but government-led smart meter initiatives support gradual progress. Renewed investment in renewable energy integration strengthens the region’s long-term demand for flexible load management systems.

Middle East & Africa

The Middle East & Africa represent a 2% share, shaped by increasing energy demand, rapid infrastructure development, and rising interest in smart energy management across the Gulf region. Countries such as UAE and Saudi Arabia adopt demand response platforms to manage high electricity loads from commercial complexes, cooling systems, and industrial operations. Renewable energy expansion further boosts the need for flexible grid solutions. In Africa, adoption grows slowly due to limited digital infrastructure, but urban development and smart meter programs support emerging opportunities. Government initiatives promoting energy efficiency continue to enhance regional adoption.

Market Segmentations:

By Technology

- Conventional Demand Response

- Automated Demand Response

By Application

- Residential

- Industrial

- Commercial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Demand Response Management System market features major players such as Enel Spa, Johnson Controls, ABB, Siemens, Eaton, ALARM.COM HOLDINGS, INC., Honeywell International Inc., Itron Inc., Schneider Electric SE, and General Electric. These companies strengthen their positions through advanced automated demand response platforms, real-time load forecasting tools, and strong integration capabilities with smart meters and IoT-enabled devices. Leading vendors focus on scaling cloud-based DRMS solutions that support fast load adjustments, renewable energy integration, and grid balancing during peak demand. Strategic partnerships with utilities, energy retailers, and industrial enterprises expand their deployment footprint across diverse markets. Several players also invest in AI-driven analytics to enhance system intelligence, improve participation accuracy, and optimize energy cost savings for end users. Continuous R&D, cybersecurity enhancements, and global expansion initiatives support strong competitiveness as utilities accelerate digital transformation and grid modernization efforts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Enel Spa

- Johnson Controls, Inc.

- ABB

- Siemens

- Eaton

- COM HOLDINGS, INC.

- Honeywell International Inc

- Itron Inc.

- Schneider Electric SE

- General Electric

Recent Developments

- In November 2025, Schneider Electric debuted its “One Digital Grid” AI-enabled grid-platform with embedded DR capabilities.

- In December 2024, Schneider Electric announced new solutions to address the energy and sustainability challenges related to AI, including new AI-ready data center solutions.

- In February 2024, Itron Inc. and Schneider Electric joined forces to digitalize supply and demand management for grid flexibility.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automated demand response adoption will rise as utilities prioritize faster, real-time load control.

- AI and predictive analytics will enhance demand forecasting and improve grid flexibility.

- Integration of EV charging networks will create new opportunities for dynamic load management.

- Smart home devices will drive higher residential participation in DR programs.

- Industrial users will expand DR adoption to reduce peak load costs and meet sustainability goals.

- Cloud-based DRMS platforms will grow as utilities shift away from legacy systems.

- Renewable energy expansion will increase the need for flexible grid balancing solutions.

- Cybersecurity investment will become essential to protect connected DR infrastructures.

- Utilities will strengthen partnerships with technology providers to support large-scale DR deployments.

- Emerging economies will adopt DR programs as smart meter penetration and grid digitalization improve.