Market Overview:

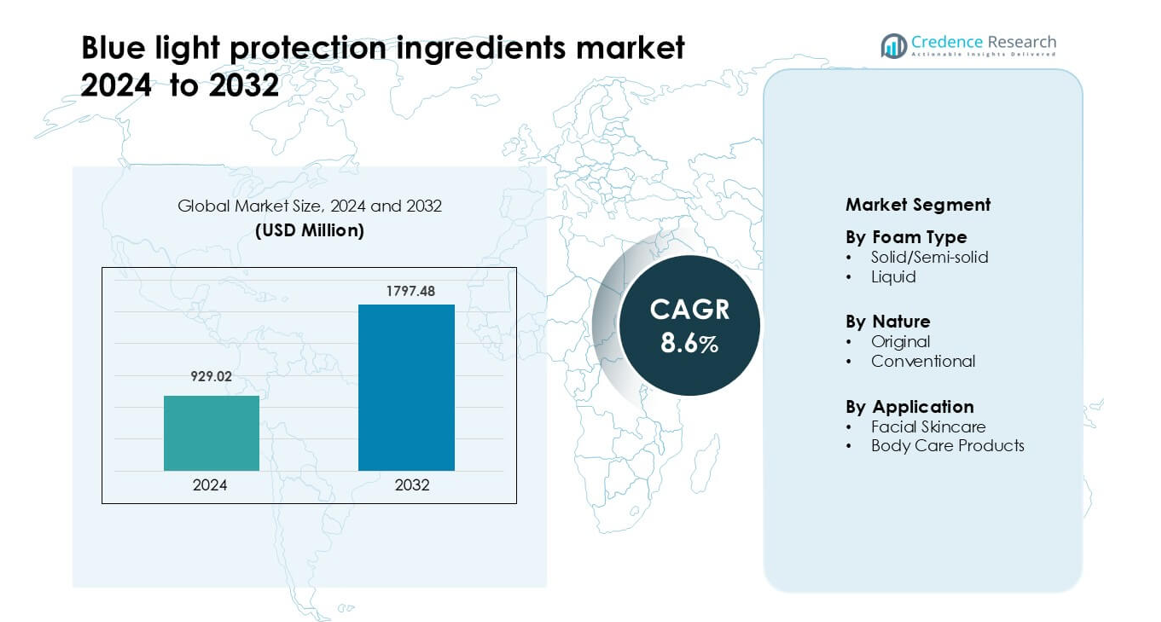

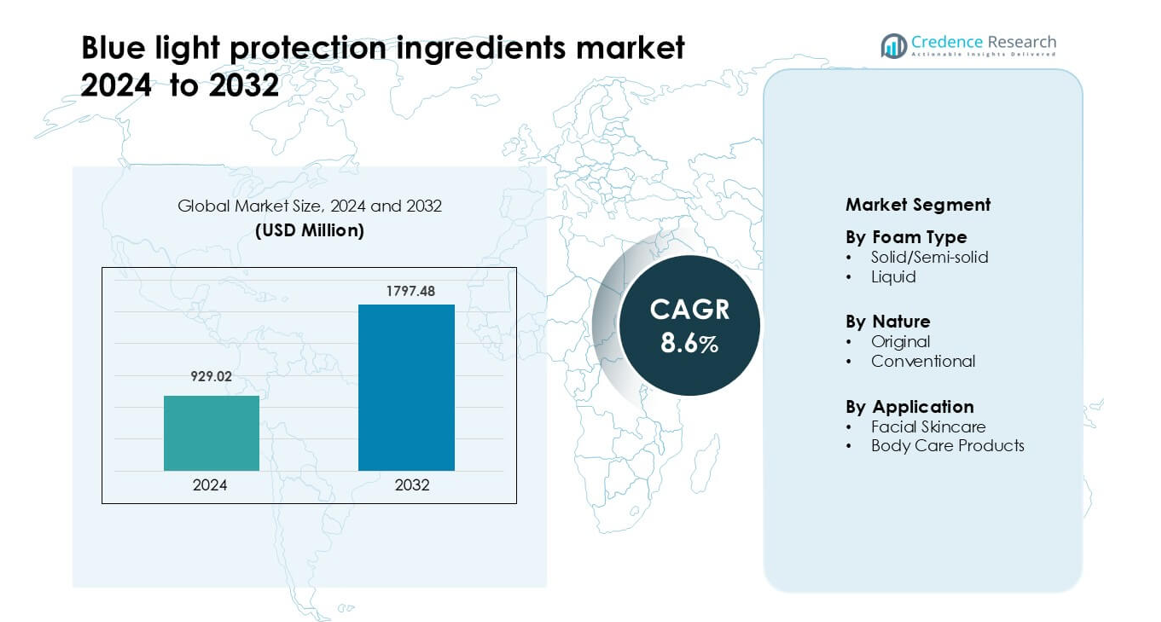

Blue light protection ingredients market was valued at USD 929.02 million in 2024 and is anticipated to reach USD 1797.48 million by 2032, growing at a CAGR of 8.6 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Blue Light Protection Ingredients Market Size 2024 |

USD 929.02 million |

| Blue Light Protection Ingredients Market, CAGR |

8.6% |

| Blue Light Protection Ingredients Market Size 2032 |

USD 1797.48 million |

The Blue Light Protection Ingredients Market features strong competition among RAHN AG, SkinCeuticals International, Kobo Products, Inc., Croda International Plc, Lonza Group, Evonik Industries, Clariant International Ltd, BASF Group, Ashland Global Specialty Chemicals Inc., and DSM Nutritional Products, LLC. These companies lead innovation in antioxidant complexes, microalgae extracts, and carotenoid-based actives targeting digital aging concerns. They invest in clinical testing, formulation stability, and clean-label development to strengthen brand partnerships and expand global reach. North America remains the leading region with about 34% share in 2024, supported by high awareness of blue light damage and strong adoption of advanced skincare formulations.

Market Insights

- Blue light protection ingredients market was valued at USD 929.02 million in 2024 and is anticipated to reach USD 1797.48 million by 2032, growing at a CAGR of 8.6 % during the forecast period.

- Demand grows due to rising digital screen exposure, strong focus on anti-aging solutions, and higher adoption of clean beauty formulations using microalgae, lutein, and botanical antioxidants.

- Trends include expansion of multi-functional skincare, increased use of clinically validated actives, and growing opportunities in body care and professional-grade formulations.

- The market remains competitive with companies such as RAHN AG, SkinCeuticals International, Kobo Products, Croda, Lonza, Evonik, Clariant, BASF, Ashland, and DSM advancing stabilized ingredient systems; restraints include low consumer awareness and stability challenges in natural actives.

- North America leads with 34% share, followed by Europe at 29% and Asia-Pacific at 27%; facial skincare holds the largest segment share at 68% due to stronger demand for blue-light-protective creams and serums.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form Type

The solid/semi-solid category leads the Blue Light Protection Ingredients Market with about 57% share in 2024 due to strong use in creams, balms, and hybrid skincare formats. Brands prefer this form because solid and semi-solid bases hold blue-light-filtering actives such as lutein, zinc oxide, and microalgae extracts with higher stability. Demand grows as consumers look for thicker textures that offer longer surface retention and improved barrier repair. The liquid segment expands at a steady pace, driven by serums and essence-based products targeting fast absorption and layered skincare routines.

- For instance, a cosmetic company reported formulating a serum with 0.05% Tisochrysis lutea microalgae extract in nanostructured lipid carriers; when stored at 40 °C and 75% relative humidity, the carrier size remained stable (average diameter ~ 150 nm) over 30 days, indicating strong colloidal stability under stress.

By Nature

The original (naturally derived) category dominates this segment with nearly 61% share in 2024 due to rising preference for plant-based antioxidants and clean-label formulations. Consumers trust natural ingredients like marigold-derived lutein, carotenoids, and botanical flavonoids for safer and long-term digital light protection. Brands promote original variants to align with sustainability goals and regulatory pressure for greener formulations. Conventional options continue to serve mass-market needs, supported by stable synthetic filters and cost-effective production, but they grow slower as natural-positioned products gain visibility.

- For instance, Katra Phytochem Pvt Ltd does engage in the cultivation of marigold (Tagetes erecta) through contract farming with local farmers for the production of lutein and zeaxanthin products (such as XanMaX).

By Application

Facial skincare holds the largest share with about 68% in 2024, driven by high usage of blue-light-shielding creams, serums, and moisturizers aimed at protecting digital-exposed skin. Increased screen time, early aging concerns, and strong marketing of anti-photoaging benefits fuel this dominance. Body care products gain traction as brands expand blue-light claims into lotions and targeted treatments, though adoption remains lower due to limited consumer awareness. Growth in body care is supported by wider retail penetration and the rise of multifunctional products offering hydration plus digital-radiation protection.

Key Growth Drivers

Rising Digital Screen Exposure

Growing screen time pushes strong demand for blue light protection ingredients. Many consumers spend long hours on phones, laptops, and TVs, raising concerns about digital aging. Brands respond by investing in stronger actives that block high-energy visible light and support skin repair. The shift toward remote work boosts this demand further and shapes new skincare routines. Manufacturers develop advanced antioxidant blends that slow oxidative stress. The growing awareness of premature aging encourages faster adoption across premium and mass skincare lines. Continuous digital dependence makes this driver one of the strongest forces in the market.

- For instance, a survey found that remote workers spend roughly 13 hours per day looking at screens about two hours more than their on-site counterparts.

Accelerating Clean Beauty Movement

Natural blue light protection ingredients gain strong acceptance across global markets. Consumers choose plant-based lutein, carotenoids, and microalgae due to safety and sustainability needs. Clean beauty regulations also encourage brands to replace synthetic filters with eco-friendly actives. This shift pushes companies to expand natural ingredient sourcing and develop stable botanical extracts. Certifications and green labels further increase consumer trust. As awareness grows, more brands introduce vegan and cruelty-free formulations. The clean beauty trend continues to elevate the demand for original, less processed blue light protection compounds.

- For instance, Sunpure Extracts produces its LUTIsight™ lutein and bright™ zeaxanthin from Tagetes erecta petals.

Expansion of Multi-Functional Skincare

Blue light protection becomes a core feature in modern hybrid skincare. Consumers prefer products that combine hydration, anti-aging, SPF, and digital defense. This preference drives strong innovation in serums, creams, and daily moisturizers. Brands integrate blue-light-shielding antioxidants with peptides and barrier-support actives. Retailers promote multi-functional products due to higher value perception. This expansion encourages ingredient suppliers to create blends that work across textures and formats. The rise of multi-step routines strengthens this driver and boosts product penetration in premium and mass channels.

Key Trend & Opportunity

Growth of Tech-Aware Beauty Consumers

Tech-aware consumers reshape market demand for digital protection. Younger users seek products that protect skin from screen exposure due to lifestyle habits. Brands respond with ingredient stories that highlight visible light defense. This shift creates an opportunity to expand into gaming communities and digital workers. Companies also use digital campaigns that educate buyers about long-term skin damage. The trend supports premiumization and encourages advanced ingredient research. As awareness grows, brands gain more scope to launch targeted blue-light-protection lines across global markets.

- For instance, Pilgrim, a D2C beauty brand in India, found through its survey that 80% of women believe skincare products can protect their skin from blue-light damage, driving the company to create blue-light defense formulations specifically for screen-intensive users.

Rising Demand for Professional-Grade Formulations

Professional skincare brands add strong blue light filters to meet clinic and spa needs. Dermatologists highlight visible light risks, increasing consumer confidence. Ingredient suppliers create medical-grade antioxidant complexes to suit clinical treatments. This trend supports higher-priced formulations and encourages scientific claims. The professional sector offers opportunities for data-backed product launches. More brands partner with skin clinics for testing and validation. The growing preference for evidence-based skincare strengthens this trend and drives market expansion.

- For instance, Dermaenergy s Black Label Revive Rich moisturizer, sold exclusively through skin clinics, includes their digital antioxidant system to counteract blue-light damage this advanced formula is formulated for mature skin with pre- and probiotics, reflecting a clinical-grade effort.

Product Expansion Beyond Facial Skincare

Blue light protection ingredients shift from facial products to wider categories. Companies now target body care, lip care, and haircare with specialized actives. This expansion helps brands enter untouched segments with strong market potential. Developers create lighter textures that fit body lotions and daily-use items. Retailers promote broader protection benefits for full-body exposure. This trend encourages suppliers to design flexible ingredient systems. Expanding into non-facial formats offers strong growth opportunities for new brands.

Key Challenge

Limited Consumer Knowledge of Blue Light Damage

Many buyers still lack clear understanding of blue light’s long-term skin effects. This gap slows adoption in several regions. Brands must invest heavily in awareness campaigns to explain visible light damage. Scientific claims need stronger communication to gain trust. Retailers struggle to showcase benefits without complex explanations. This limits growth in price-sensitive markets where education remains low. Manufacturers face challenges in differentiating products without overwhelming consumers. Overcoming this knowledge gap remains a major barrier for market expansion.

Stability Issues with Natural Active Ingredients

Natural blue light protection ingredients face formulation challenges. Botanical extracts often degrade under heat, light, or oxidation. This instability increases production costs and limits long shelf life. Manufacturers need advanced encapsulation and stabilization technologies to maintain performance. Smaller brands struggle with these costs, affecting product consistency. Regulatory pressure for clean formulas adds more complexity. The challenge slows expansion of natural variants in mass-market products. Ensuring stability remains critical for wider adoption across global categories.

Regional Analysis

North America

North America holds about 34% share of the Blue Light Protection Ingredients Market in 2024, driven by strong adoption of digital-focused skincare and high consumer awareness of screen-induced aging. Brands in the US and Canada invest in advanced antioxidant blends and natural actives to meet demand for clean and multi-functional products. Retailers highlight blue light defense as a key claim across premium and mass skincare. Growth accelerates due to high device penetration, strong influence of dermatologists, and rapid product innovation. The region benefits from mature regulatory systems and strong R&D capabilities.

Europe

Europe accounts for nearly 29% share in 2024, supported by strict cosmetic regulations, high safety standards, and rapid acceptance of natural blue-light-protection ingredients. Consumers favor botanical lutein, microalgae extracts, and carotenoid-rich blends due to rising eco-conscious preferences. Germany, France, and the UK lead innovation with strong demand for anti-aging and digital pollution protection. Brands benefit from established distribution networks and growing interest in dermocosmetics. The region’s focus on sustainability and clean beauty enhances product visibility and encourages the launch of certified formulations across major EU markets.

Asia-Pacific

Asia-Pacific leads growth momentum and captures about 27% share in 2024, driven by massive digital device usage and strong beauty culture across China, Japan, and South Korea. Consumers actively seek products addressing digital aging, pigmentation, and skin barrier issues. K-beauty and J-beauty brands promote blue light protection as part of daily skincare routines. Ingredient suppliers introduce high-performance microalgae, niacinamide blends, and antioxidant complexes. Expanding e-commerce and increasing awareness among younger consumers strengthen market penetration. The region’s fast-paced innovation cycle accelerates new product development and amplifies adoption across facial and body skincare.

Latin America

Latin America holds around 6% share in 2024, supported by rising awareness of digital skin damage and growing interest in multi-functional skincare. Brazil and Mexico lead demand with stronger influence from beauty influencers and dermatology clinics. Consumers seek cost-effective blue light protection in daily moisturizers and sunscreens. Local brands integrate antioxidant-rich botanical ingredients to align with natural beauty trends. Market expansion is supported by improving retail infrastructure and increasing smartphone usage. However, limited awareness outside major cities restricts higher penetration, yet long-term growth remains promising as education and affordability improve.

Middle East & Africa

The Middle East & Africa region captures about 4% share in 2024, driven by rising screen time and interest in anti-aging skincare among urban consumers. The UAE and Saudi Arabia lead demand due to higher purchasing power and fast adoption of global beauty trends. Brands offer blue light protection in lightweight formats suited to warm climates. Ingredient suppliers focus on heat-stable antioxidants to maintain formulation performance. Awareness campaigns from dermatology clinics support growth. Limited market maturity and price sensitivity in several African nations slow wider penetration, but increasing digital exposure encourages steady future adoption.

Market Segmentations

By Foam Type

By Nature

By Application

- Facial Skincare

- Body Care Products

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Blue Light Protection Ingredients Market features strong participation from leading players such as RAHN AG, SkinCeuticals International, Kobo Products, Inc., Croda International Plc, Lonza Group, Evonik Industries, Clariant International Ltd, BASF Group, Ashland Global Specialty Chemicals Inc., and DSM Nutritional Products, LLC. These companies focus on advanced antioxidant systems, microalgae-derived actives, carotenoid complexes, and stabilized botanical extracts to strengthen product performance. Many players invest in clinical validation and in-vitro testing to support efficacy claims and differentiate ingredients in a crowded market. Partnerships with skincare brands and dermatology-led product development remain key growth strategies. Companies also expand global distribution, enhance clean-label portfolios, and develop multifunctional actives compatible with serums, creams, and hybrid skincare formats. Growing demand for digital-aging protection drives continuous innovation, encouraging firms to improve ingredient stability, sensory compatibility, and sustainability profiles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- RAHN AG

- SkinCeuticals International

- Kobo Products, Inc.

- Croda International Plc

- Lonza Group

- Evonik Industries

- Clariant International Ltd

- BASF Group

- Ashland Global Specialty Chemicals Inc.

- DSM Nutritional Products, LLC

Recent Developments

- In June 2025, Vaseline collaborated with Ogilvy Singapore and Ogilvy Canada to address the rising but often overlooked concern of blue light exposure through its new Asian campaign titled ‘Screen Block’, launched in Thailand. Targeting gamers who can spend up to 12 hours daily in front of screens, the campaign highlights the urgent need for protective skincare solutions in digitally intensive lifestyles. This initiative is expected to significantly enhance awareness and consumer engagement in Southeast Asia, reinforcing the demand for blue light protection ingredients in daily-use skincare products.

- In May 2025, Emcutix Biopharmaceuticals Limited, a subsidiary of Emcure Pharmaceuticals Ltd., expanded its presence in the sun and digital protection market with the launch of SOLGLO Hybrid Sunscreen SPF 70 PA++++ and SOLGLO Invisible Sunscreen Gel SPF 50+ PA++++. These advanced broad-spectrum sunscreens defend against UVA and UVB rays and also nourish the skin, reflecting a growing market shift toward multifunctional products. Their launch is expected to fuel demand for hybrid formulations that incorporate blue light defense, particularly in dermatology-backed skincare lines.

- In April 2025, Evonik Industries showcased new daily-sun-care ingredient concepts at in-cosmetics Global 2025, highlighting formulations with demonstrated anti-blue-light benefits. The company positioned these innovations to meet fast-growing demand for digital-exposure protection

Report Coverage

The research report offers an in-depth analysis based on Foam Type, Nature, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as global screen time continues to increase across all age groups.

- Brands will expand blue light protection into body care, lip care, haircare, and hybrid formulations.

- Natural ingredients such as lutein, carotenoids, and microalgae extracts will gain stronger preference.

- Clinical validation and dermatology-backed studies will play a bigger role in product positioning.

- Multi-functional skincare with combined antioxidant, anti-aging, and digital defense features will dominate launches.

- More companies will invest in encapsulation and stabilization technologies to improve ingredient performance.

- Regulatory bodies will encourage safer and cleaner formulations, boosting plant-based actives.

- Growth will accelerate in Asia-Pacific as K-beauty and J-beauty influence global product innovation.

- Professional skincare brands and clinics will adopt high-potency blue-light-defense ingredients for targeted treatments.

- Increased collaboration between ingredient suppliers and skincare brands will drive faster innovation cycles.