Market Overview:

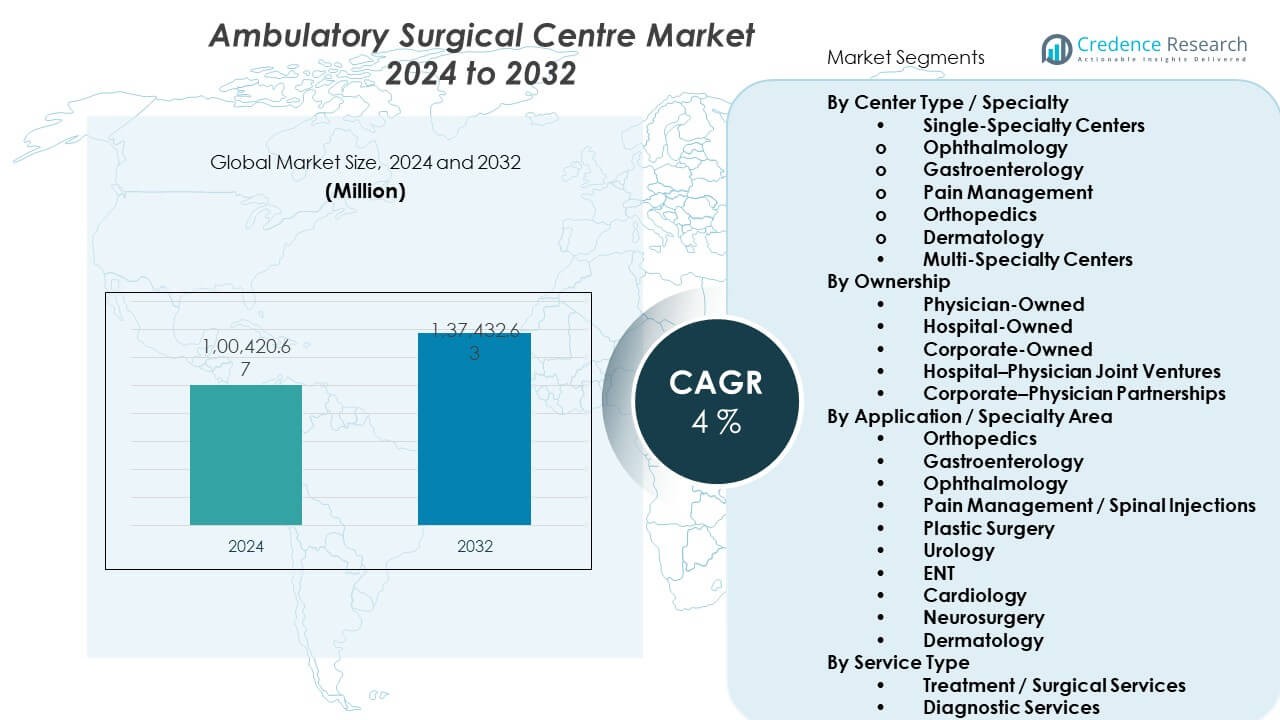

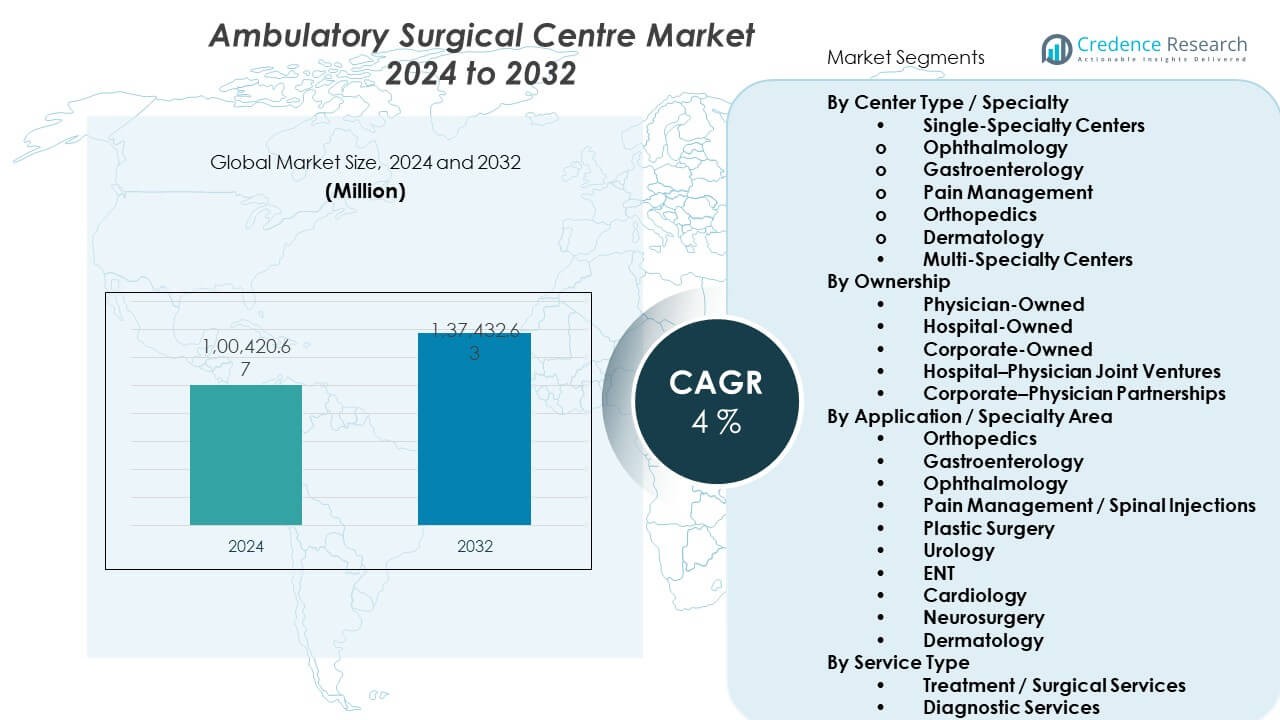

The Ambulatory Surgical Centre market is projected to grow from USD 100,420.67 million in 2024 to an estimated USD 137,432.63 million by 2032, with a CAGR of 4% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ambulatory Surgical Centre Market Size 2024 |

USD 100,420.67 Million |

| Ambulatory Surgical Centre Market, CAGR |

4% |

| Ambulatory Surgical Centre Market Size 2032 |

USD 137,432.63 Million |

The market gains strength from rising patient preference for shorter stays and quicker recovery. Surgeons adopt advanced tools that support minimally invasive methods across multiple specialties. Payers promote outpatient surgery due to lower overall spending and fewer complications. Hospitals shift procedures to outpatient hubs to manage capacity and improve workflow. Ageing populations raise the need for orthopedic and ophthalmic care. Chronic disease growth pushes higher volumes of outpatient interventions. Wider insurance coverage supports steady adoption across urban and semi-urban zones.

North America leads due to its mature outpatient ecosystem and strong payer support for same-day surgical care. Europe follows with broad acceptance of minimally invasive procedures and strong investment in ambulatory infrastructure. Asia Pacific shows fast progress due to expanding private healthcare and rising patient awareness. China and India drive growth with rapid urban expansion and higher surgical capacity. Latin America builds momentum with improved insurance penetration and new regional outpatient models. Middle East and Africa advance through private-sector investment and modern facility development. The ambulatory surgical centre market grows across both established and emerging regions due to better access and rising demand for faster care.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Ambulatory surgical centre market is valued at USD 100,420.67 million in 2024 and is projected to reach USD 137,432.63 million by 2032, advancing at a 4% CAGR.

- North America leads with 42–45% share due to its mature outpatient ecosystem, followed by Europe at 26–28% with strong clinical pathways, and Asia Pacific at 20–22% supported by expanding surgical demand.

- Asia Pacific remains the fastest-growing region with 20–22% share, driven by private healthcare expansion and wider adoption of minimally invasive procedures.

- Single-specialty centres dominate structure distribution with 61.22% share, supported by strong focus in ophthalmology, gastroenterology, and pain management.

- Orthopedics leads application demand with 26.97% share, strengthened by rising volumes of joint, spine, and sports injury procedures.

Market Drivers:

Rising Demand for Same-Day Surgical Care and Shift Toward Outpatient Efficiency

Growth rises due to wider acceptance of same-day procedures across key specialties. Patients choose outpatient centres to avoid long inpatient stays and reduce recovery burdens. Surgeons prefer advanced tools that support faster interventions while keeping strong care quality. Payers promote outpatient settings to lower costs and reduce unnecessary hospital use. Regulatory bodies support clinical pathways that favour shorter stays and minimal complications. Hospitals transfer selected surgeries to outpatient hubs to manage capacity issues. Ageing populations push higher demand for eye, joint, and pain-related care. The Ambulatory surgical centre market gains momentum due to strong preference for timely and accessible procedures.

- For instance, an independent study on the implementation of the Alcidion Miya Precision platform at Alfred Health identified a wide range of benefits attributed to the adoption of electronic patient journey boards to facilitate inpatient clinical workflows. Other research has shown that various interventions can reduce operating room delays, such as standardizing preoperative communication and paperwork or utilizing quality improvement methodologies.

Expansion of Minimally Invasive Procedures Across Multiple Specialties

Growth strengthens due to rising adoption of minimally invasive tools that reduce surgical strain. Patients choose these procedures due to lower pain, shorter downtime, and better comfort. Surgeons expand service scopes through advanced imaging and precision support systems. Payers recognise stable outcomes and support outpatient reimbursement models. Providers integrate modern equipment to increase surgical throughput in busy centres. Chronic disease growth drives more cardiology, urology, and gastroenterology procedures. Hospitals shift lower-risk interventions to outpatient campuses to free operating rooms. The market benefits from a strong rise in precision-driven procedures across urban regions.

- For instance, Olympus publicly reported that its EVIS X1 endoscopy system achieved higher adenoma detection performance in clinical trials, supported by AI-enabled imaging enhancements.

Increasing Payer Support for Cost-Effective Outpatient Surgical Models

Insurers expand coverage for outpatient care due to clear financial benefits and better patient outcomes. Payers approve more same-day procedures due to predictable cost structures and fewer complications. Providers align care pathways with payer-driven efficiency mandates. Patients choose centres with transparent pricing and minimal administrative hurdles. Hospitals face cost pressure and shift suitable procedures to outpatient settings. Policy reforms favour outpatient models to manage national healthcare budgets. Clinicians adopt evidence-backed protocols that support short recovery cycles. The Ambulatory surgical centre market gains support due to payer-driven cost optimisation.

Growing Preference for Faster Recovery and Patient-Centric Surgical Experiences

Patients choose outpatient facilities due to quicker discharge and minimal disruption to daily life. Surgeons adopt technology that supports safe recovery without extended hospital monitoring. Providers improve patient flow through digital scheduling and streamlined triage systems. Payers promote patient-centric models that lower overall treatment burden. Hospitals build dedicated outpatient units to improve their competitive edge. Chronic diseases drive higher volumes of repeat or follow-up procedures. Clinical bodies standardise outpatient guidelines to ensure safe care delivery. The market advances due to a strong shift toward comfort, speed, and accessible surgical care.

Market Trends:

Adoption of Advanced Surgical Technologies and Smart Workflow Systems

Modern centres adopt robotics, AI-supported imaging, and precision-guided tools to improve outcomes. Providers upgrade operating rooms to support better workflow and reduce delays. Patients choose centres with modern systems due to better comfort and shorter wait times. Surgeons rely on real-time data tools to improve accuracy during short procedures. Providers digitise patient journeys to reduce administrative load. Hospitals integrate remote monitoring options for post-procedure stability. Payers support technology-driven consistency across outpatient pathways. The Ambulatory surgical centre market gains visibility due to rapid tech integration.

- For instance, Intuitive Surgical disclosed in its 2023 annual report that over 2.2 million surgical procedures were performed with the da Vinci system worldwide. This represents a 22% growth compared to 2022. The total number of procedures using the da Vinci system since its inception surpassed 14 million by the end of 2023.

Rising Expansion of Specialty-Focused Ambulatory Centres Worldwide

Providers build centres dedicated to eye care, orthopedics, oncology, or pain management. Patients choose these units due to specialised teams and predictable recovery paths. Surgeons benefit from dedicated tools designed for specific surgical fields. Payers support these facilities due to controlled cost patterns. Hospitals refer high-volume cases to specialty centres to manage pressure. Private players invest in franchise-style outpatient networks. Clinical guidelines support standardised pathways for niche surgeries. The market grows due to increased interest in single-specialty capacity building.

Increasing Use of Value-Based Surgical Models in Outpatient Settings

Payers encourage outcomes-based contracts to ensure strong patient recovery. Providers design care bundles that reduce waste and improve clinical predictability. Surgeons align their methods with measurable clinical indicators. Patients gain access to stable outcomes due to structured recovery plans. Hospitals redesign pathways to meet value-focused benchmarks. Centres adopt digital tools that measure outcomes in real time. Policy frameworks expand to include incentive-based surgical care. The Ambulatory surgical centre market sees wider acceptance of value-based models.

Growth of Retail-Backed and Corporate Healthcare Networks in Outpatient Surgery

Large healthcare chains invest in outpatient networks to reach urban and semi-urban zones. Patients trust these brands due to strong quality assurance and service consistency. Surgeons choose these centres due to better equipment and support staff. Investors fund new centres in high-volume cities. Providers design patient-friendly environments to improve surgical journeys. Digital portals support easier scheduling and pre-operative guidance. Hospitals collaborate with retail-backed centres for select procedures. The market expands due to rising interest in network-driven outpatient care.

Market Challenges Analysis:

Rising Compliance Pressure, Workforce Shortages, and High Regulatory Oversight

Providers face strict compliance rules that raise operational burden across centres. Regulators demand consistent safety standards that require ongoing staff training. Many regions face shortages of skilled surgical nurses and technicians. Competition for specialists raises hiring difficulties and wage pressure. Patients expect consistent outcomes, pushing the need for continuous quality upgrades. Smaller centres struggle with technology adoption due to cost constraints. Hospitals retain complex cases, limiting service mix opportunities. The Ambulatory surgical centre market experiences pressure due to regulatory and staffing hurdles.

Intense Competitive Landscape and Limited Access to Advanced Capital Investment

Private chains expand aggressively, creating intense pricing and service pressure. Independent centres face cost challenges when upgrading digital tools. Providers struggle to access capital for robotics or smart workflow systems. Patients choose larger centres with broader capability sets. Payers negotiate strict contracts, limiting revenue margins. Technology adoption becomes uneven across regions. Hospitals protect their procedure volumes through strategic referrals. The market manages rising competition while facing barriers to modernisation.

Market Opportunities:

Growing Scope for Technology Integration and High-Volume Specialty Services

Centres gain opportunities through precision tools, AI-backed imaging, and smart workflow systems. Providers can expand specialty units that target orthopedics, ophthalmology, or oncology. Patients seek modern care settings that support faster recovery. Surgeons benefit from purpose-built outpatient suites for short procedures. Investors support expansions in high-demand zones. Hospitals partner with centres to expand outpatient coverage. The Ambulatory surgical centre market can leverage wider digital transformation for growth.

Strong Expansion Potential Across Emerging Regions and Private Healthcare Networks

Urbanisation drives demand for efficient surgical pathways across developing economies. Private groups expand franchise-style outpatient models in major cities. Patients choose reliable and cost-effective options for routine surgeries. Payers support outpatient care due to predictable outcomes. Hospitals collaborate with private centres to handle excess volume. Investors fund facilities with scalable models and tech readiness. The market grows through strong emerging-region penetration and network expansion.

Market Segmentation Analysis:

Center Type / Specialty

The Ambulatory surgical centre market expands through strong adoption of single-specialty and multi-specialty formats. Single-specialty centres grow due to clear clinical focus and predictable patient flow across ophthalmology, gastroenterology, pain management, orthopedics, and dermatology. These centres benefit from streamlined workflows that support high-volume procedures. Multi-specialty centres gain traction through broader service portfolios and higher utilisation rates. Providers choose these centres to manage diverse procedures in one setting. Investors support both formats due to stable demand in urban and semi-urban regions. Payers recognise efficient delivery models that support consistent outcomes. The segment structure strengthens market competitiveness across different clinical fields.

- For instance, United Surgical Partners International (USPI), a subsidiary of Tenet Healthcare Corporation, has interests in over 500 surgery centers and 25 surgical hospitals across 37 states. The company had ownership interests in 518 ambulatory surgery centers and 25 surgical hospitals as of December 31, 2024.

Ownership

Ownership patterns shape strategic growth across physician-owned, hospital-owned, and corporate-owned centres. Physician-owned facilities lead due to strong clinical autonomy and efficient decision cycles. Hospital-owned units expand through integration with existing surgical networks. Corporate ownership grows due to scalable models and strong capital backing. Joint ventures between hospitals and physicians support shared control and risk balancing. Corporate–physician partnerships create hybrid models that improve operational reach. Investors favour ownership frameworks that support faster expansion and stable reimbursement pathways.

- For instance, HCA Healthcare reports operating more than 150 outpatient surgery centres across its network, many structured as joint ventures with physicians to strengthen service capability and governance.

Application and Service Type

Application segments such as orthopedics, gastroenterology, ophthalmology, pain management, and ENT lead due to high outpatient suitability. Cardiology and neurosurgery gain momentum through improved minimally invasive tools. Plastic surgery, urology, and dermatology maintain steady uptake. Treatment and surgical services dominate due to high case volume and stronger reimbursement support. Diagnostic services grow steadily through improved pre-procedural evaluation and follow-up pathways.

Model Type

Hospital-based ASCs expand through integrated care pathways and strong referral networks. Freestanding centers grow due to flexible operations and wider patient access. Both models support diversified service delivery across regional markets.

Segmentation:

By Center Type / Specialty

- Single-Specialty Centers

- Ophthalmology

- Gastroenterology

- Pain Management

- Orthopedics

- Dermatology

- Multi-Specialty Centers

By Ownership

- Physician-Owned

- Hospital-Owned

- Corporate-Owned

- Hospital–Physician Joint Ventures

- Corporate–Physician Partnerships

By Application / Specialty Area

- Orthopedics

- Gastroenterology

- Ophthalmology

- Pain Management / Spinal Injections

- Plastic Surgery

- Urology

- ENT

- Cardiology

- Neurosurgery

- Dermatology

By Service Type

- Treatment / Surgical Services

- Diagnostic Services

By Model

- Hospital-Based ASCs

- Freestanding ASCs

Regional Analysis:

North America

North America leads the ambulatory surgical center market with an estimated 42–45% share due to its mature outpatient ecosystem and strong insurance coverage. Growth rises through wide adoption of minimally invasive procedures across orthopedic, ophthalmology, and gastroenterology segments. Hospitals expand outpatient programs to manage inpatient pressure and improve surgical efficiency. Corporate operators scale networks across high-density states to meet rising procedural demand. Patients choose ASCs for shorter stays and predictable outcomes. Payers support outpatient pathways to control escalating healthcare spending. The ambulatory surgical centre market maintains strong dominance in this region due to consistent investment and strong regulatory clarity.

Europe

Europe holds an estimated 26–28% market share, supported by structured clinical guidelines and strong focus on procedure quality. Countries improve outpatient capacities to reduce surgical backlogs and increase patient throughput. Providers build integrated care pathways that support ophthalmology, orthopedics, and gastrointestinal interventions. Private centres expand across Western Europe due to rising demand for quick-access specialty services. Patients choose ASCs for efficient recovery and reduced hospital exposure. Governments encourage outpatient models to optimise national healthcare resources. The market benefits from policy alignment and growing trust in modern outpatient care formats.

Asia Pacific

Asia Pacific accounts for approximately 20–22% share and remains the fastest advancing regional cluster. Urban hospitals expand outpatient wings to support rising surgical loads in China, India, and Southeast Asia. Private operators invest in freestanding centres to meet rapid demand for orthopedic, ophthalmology, and pain management procedures. Patients prefer affordable outpatient services that reduce hospitalisation time. Technology upgrades enable safer minimally invasive interventions across key cities. Payers in several markets adopt structured reimbursement to support outpatient care. The ambulatory surgical centre market gains strong momentum here due to expanding healthcare access and rising clinical awareness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- United Surgical Partners International (USPI) – Tenet Healthcare

- SCA Health (Surgical Care Affiliates) – Optum/UnitedHealth Group

- AmSurg Corporation

- Surgery Partners

- HCA Healthcare

Competitive Analysis:

Competition in the Ambulatory surgical centre market intensifies due to rapid expansion of national operators and strong investment in specialty-focused centres. Large groups such as USPI, SCA Health, AmSurg, Surgery Partners, and HCA Healthcare scale their networks across major regions to capture higher procedure volumes. It maintains strong competitive activity through strategic acquisitions, capacity expansion, and technology adoption. Physician-owned centres defend market share through clinical autonomy and efficient decision cycles. Corporate-backed chains strengthen their position through digital workflow systems and broader service portfolios. Hospital-owned centres expand outpatient capacity to shift selected surgical loads outside inpatient environments. The competitive field strengthens through improved reimbursement models and ongoing investments in advanced surgical infrastructure.

Recent Developments:

- As of November 2025, HCA Healthcare continued its strategy of expanding ambulatory services by investing in the development and acquisition of new surgery centers. The company now operates approximately 2,500 ambulatory sites of care, including hundreds of freestanding ASCs. In 2025, HCA reported strong operational and financial performance, with continued growth in admissions, surgeries, and expansions through selected acquisitions, maintaining its status as one of the largest ambulatory care operators in the United States.

- In August 2025, SCA Health (formerly Surgical Care Affiliates), owned by Optum/UnitedHealth Group, completed its acquisition of U.S. Digestive Health, which operates 24 ASCs and over 40 gastroenterology practice sites in Pennsylvania and Delaware. This acquisition significantly expands SCA Health’s presence and its portfolio of gastrointestinal outpatient facilities in the Northeastern United States.

- In June 2025, AmSurg Corporation reached an acquisition agreement with Ascension Health, one of the largest nonprofit health systems in the country. This milestone deal brings more than 250 ASCs across 34 states into Ascension’s network, allowing AmSurg to enhance its community-based, physician-led care model and expand into new markets with comprehensive outpatient services including gastroenterology, ophthalmology, and orthopedics.

- In May 2025, Surgery Partners expanded its reach in California with the acquisition of multiple San Jose-based ambulatory surgery centers, including Montpelier Surgery Center and Advanced Surgery Center. These centers rank among the largest in the region and strengthen Surgery Partners’ position as the largest ASC provider in California’s South Bay area. These acquisitions are part of Surgery Partners’ ongoing national platform expansion through targeted acquisitions and specialty growth initiatives.

Report Coverage:

The research report offers an in-depth analysis based on By Center Type / Specialty, By Ownership, By Application / Specialty Area, By Service Type, and By Model. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of minimally invasive surgery will expand outpatient volumes.

- Large operators will scale national ASC networks across urban clusters.

- Physician-owned facilities will retain strong share due to clinical autonomy.

- Technology integration will improve workflow efficiency and patient outcomes.

- Multispecialty centres will gain traction due to wider procedure capabilities.

- Partnerships between hospitals and corporate groups will increase.

- Freestanding centres will expand in mid-size cities with higher procedure demand.

- Cardiology and neurosurgery will gain momentum through improved tools.

- Digital platforms will strengthen scheduling, monitoring, and pre-operative pathways.

- Payer policies will support sustained shift toward outpatient surgical models.