Market Overview:

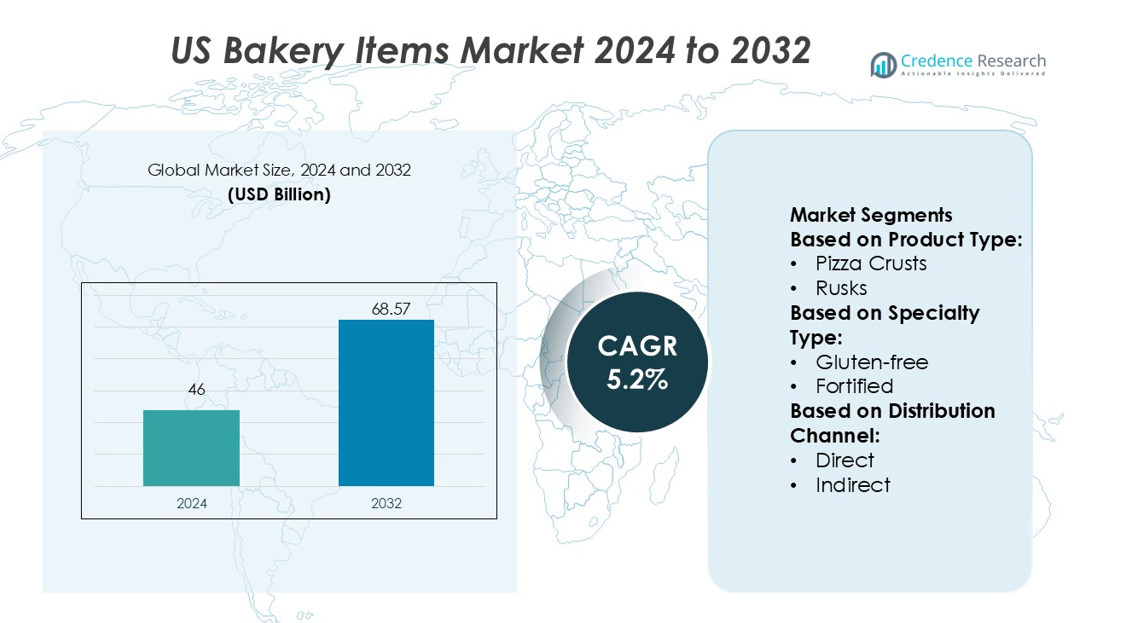

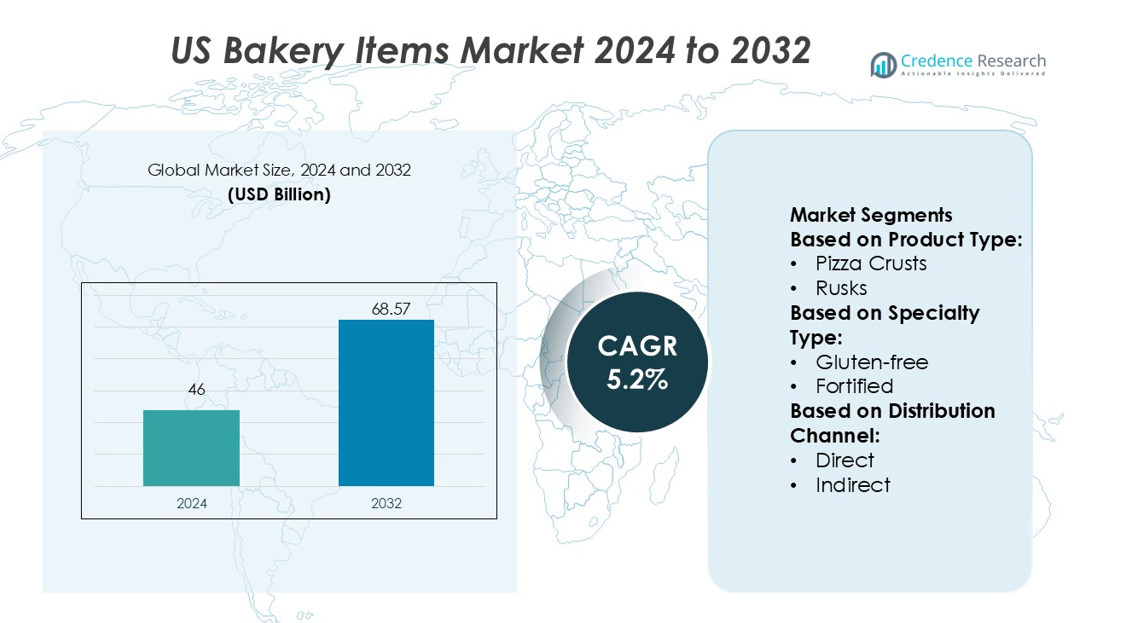

US Bakery Items Market size was valued USD 46 billion in 2024 and is anticipated to reach USD 68.57 billion by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| US Bakery Items Market Size 2024 |

USD 46 billion |

| US Bakery Items Market, CAGR |

5.2% |

| US Bakery Items Market Size 2032 |

USD 68.57 billion |

The U.S. bakery items market is shaped by the strong presence of established manufacturers that drive product innovation and brand differentiation. Leading players such as Grupo Bimbo, Hostess Brands, Kellogg Company, Campbell Soup Company, Lantmannen Unibake, General Mills, Conagra Brands, Finsbury Food Group, Associated British Foods, and Aryzta dominate through extensive distribution networks, strategic acquisitions, and diversified product lines. These companies emphasize health-focused formulations, sustainable packaging, and premium product categories to meet evolving consumer preferences. North America remains the leading region in this market, holding a 38% share, supported by high per-capita consumption, advanced retail infrastructure, and consistent innovation in artisanal, frozen, and functional bakery products.

Market Insights

- The U.S. Bakery Items Market was valued at USD 46 billion in 2024 and is projected to reach USD 68.57 billion by 2032, growing at a CAGR of 5.2%.

- Rising consumer demand for healthier, organic, and gluten-free bakery options drives market expansion across all product categories.

- Trends such as premium artisanal baking, sustainable packaging, and online bakery retail platforms are reshaping industry dynamics.

- Market competition intensifies as leading companies focus on acquisitions, automation, and innovation to strengthen brand loyalty and supply chain efficiency.

- North America leads with a 38% share, supported by high per-capita consumption, while the bread and rolls segment dominates product demand due to consistent household and foodservice usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Biscuits dominate the U.S. bakery items market, holding a 38% share in 2024, driven by consistent consumer demand for convenient snacks. Within this segment, cookies lead due to their wide flavor range, longer shelf life, and rising demand for indulgent yet portable treats. The increasing presence of premium and health-focused variants, such as protein or fiber-enriched cookies, further supports growth. Bread and rolls also maintain steady consumption, with packaged bread favored for convenience and shelf stability, while artisanal and in-store variants attract consumers seeking freshness and authenticity.

- For instance, Grupo Bimbo’s U.S. subsidiary, Bimbo Bakeries USA, delivers products to more than 11,000 sales routes across North America, emphasising cookie and snack-cake distribution.

By Specialty Type

he gluten-free sub-segment holds the dominant 32% market share, fueled by rising awareness of celiac disease and dietary preferences for wheat alternatives. Major brands are reformulating traditional bakery items using rice, almond, and tapioca flours to enhance texture and taste. Organic bakery products are also growing due to consumer preference for clean-label and chemical-free ingredients. Low-calorie and sugar-free bakery items appeal to health-conscious consumers aiming for calorie control without compromising taste, driving steady sales through innovation in natural sweeteners like stevia and erythritol.

- For instance, Kellogg’s Australia offers a dedicated Gluten Free range which is endorsed by Coeliac Australia and includes Sultana Bran Gluten Free, which delivers a high-wholegrain formulation and “provides 15% of your daily fibre needs”.

By Distribution Channel

Indirect sales channels account for the dominant 71% share, with hypermarkets and supermarkets serving as key distribution points due to product variety and promotional discounts. Bakery stores and artisanal bakeries attract urban consumers seeking freshness and customization. The online retail channel shows rapid expansion, supported by digital grocery platforms and home-delivery models. Direct sales remain smaller in scale but are significant for local and artisanal producers catering to niche and premium customer bases, strengthening brand identity and consumer trust through personalized engagement.

Key Growth Drivers

Rising Demand for Convenient and On-the-Go Foods

Busy lifestyles in the U.S. are fueling demand for bakery items that offer quick meal or snack options. Packaged cookies, muffins, and breadsticks are gaining popularity due to portability and long shelf life. Food manufacturers are introducing ready-to-eat and portion-controlled bakery products to meet evolving consumer needs. Increasing availability in convenience stores and vending outlets further supports this demand, driving steady sales across both urban and suburban markets.

- For instance, Campbell reports that its innovation pipeline exceeds US $1,000 million, with new snack launches initially contributing 2 % of net sales in 2023 and targeting over 3 % in 2024.

Shift Toward Health and Wellness Products

Consumers are prioritizing healthier bakery alternatives, pushing brands to reformulate products with whole grains, reduced sugar, and gluten-free ingredients. Growing awareness of dietary health and rising incidences of obesity and diabetes encourage adoption of fortified and low-calorie bakery goods. Manufacturers are incorporating natural fibers, plant-based proteins, and clean-label ingredients to enhance nutritional profiles. This shift toward functional and better-for-you products sustains strong market growth in both traditional and emerging bakery categories.

- For instance, Lantmännen Unibake reported that in 2024 their bread and rye-bread grain ingredients reached 28% wholegrains, working toward a 2030 target of 33%.

Innovation in Packaging and Shelf-Life Enhancement

Technological advancements in packaging are boosting product freshness and appeal. Modified atmosphere packaging (MAP) and resealable pouches help extend shelf life and prevent spoilage. Leading brands are investing in eco-friendly materials and smart-labeling technologies to align with sustainability goals and consumer transparency demands. These innovations reduce product waste, maintain quality, and enhance consumer trust, strengthening brand competitiveness in retail channels.

Key Trends & Opportunities

Expansion of E-Commerce and Direct-to-Consumer Channels

Online grocery platforms and home-delivery services are revolutionizing how bakery items reach consumers. Subscription boxes and D2C models allow brands to offer fresh, customized products with minimal intermediaries. Digital promotions, influencer collaborations, and mobile-based ordering systems are expanding visibility and consumer reach. This trend supports premium and artisanal bakeries seeking to tap into tech-savvy urban demographics.

- For instance, General Mills’ digital and data-science team increased 40-fold since 2018 to over 6 million models per month, enabling more than 500 million predictions monthly to support e-commerce and supply-chain decisions.

Growth of Artisanal and Premium Offerings

Consumer preference is shifting toward premium, handcrafted bakery products emphasizing quality and authenticity. Artisanal bakeries offering small-batch, preservative-free bread, and pastries are thriving. Brands highlight local sourcing and transparency, appealing to conscious consumers. This trend also opens opportunities for collaborations with cafes and restaurants focusing on gourmet and niche bakery segments.

- For instance, Conagra deployed its advanced analytics platform to accelerate innovation across its premium portfolio, processing over 600 million consumer-behaviour data points annually to identify niche artisan trends and fast-track product development.

Key Challenges

Rising Raw Material and Production Costs

Volatile prices of key inputs like wheat, sugar, and dairy impact production margins. Inflationary pressures, coupled with logistics and energy costs, add strain to bakery manufacturers. Smaller producers face challenges in maintaining profitability while ensuring quality and affordability. Companies are adopting efficiency-driven strategies, including automation and bulk sourcing, to mitigate cost volatility.

Increasing Competition and Product Saturation

The U.S. bakery market is highly fragmented, with numerous global and local players competing for shelf space. Frequent product launches and limited differentiation result in market saturation. Maintaining brand loyalty in a price-sensitive environment is challenging. Continuous innovation and targeted marketing are essential to sustain growth and capture consumer attention amid intense competition.

Regional Analysis

North America

North America dominates the global bakery items market with a 38% share. The region’s growth stems from strong demand for convenient breakfast products, premium cookies, and healthy bread alternatives. The U.S. and Canada lead consumption through a well-established retail bakery network and innovation in gluten-free, organic, and low-sugar options. Leading players invest in automation, sustainability, and packaging upgrades to enhance production efficiency. Rising consumer preference for clean-label ingredients and artisanal offerings further drives market expansion, supported by the increasing adoption of online bakery retail platforms across the region.

Europe

Europe holds a 30% share of the global bakery items market, supported by a long-standing baking culture and innovation in specialty bread, pastries, and confectionery. Countries such as Germany, France, and the U.K. drive strong consumption through established brands and artisanal bakeries. The market focuses on health-oriented products, including multigrain and vegan options, aligning with sustainability and clean-label trends. European manufacturers invest in plant-based formulations and energy-efficient baking systems, enhancing competitiveness. The region’s advanced logistics and cold-chain infrastructure strengthen its export capabilities across developed markets.

Asia-Pacific

Asia-Pacific accounts for 22% of the global bakery items market, driven by rising urbanization, Western lifestyle adoption, and growing disposable incomes. China, Japan, and India lead growth through high demand for packaged and ready-to-eat bakery products. The region sees a surge in convenience-focused retail formats and local production expansion by multinational bakery chains. Innovation in flavor profiles and product miniaturization attracts younger consumers. Government efforts to promote domestic food processing industries further boost bakery output, making Asia-Pacific one of the fastest-growing regions globally.

Latin America

Latin America captures a 6% share of the bakery items market, supported by expanding urban populations and a growing preference for convenient snacks. Brazil and Mexico are key contributors due to strong bread and pastry consumption. Regional bakeries focus on cost-effective ingredients and local flavor innovation to appeal to mass-market consumers. Economic fluctuations and price-sensitive demand influence the market’s growth pace. However, the rising adoption of packaged bakery goods and investments by global brands continue to support steady regional development.

Middle East & Africa

The Middle East and Africa collectively represent a 4% share of the bakery items market. Rising tourism, population growth, and increasing western dietary influence drive product demand, particularly in Saudi Arabia, the UAE, and South Africa. The market is witnessing growing interest in frozen dough, premium pastries, and fortified bakery goods. Local manufacturers are investing in modern baking facilities to meet hygiene and quality standards. Retail modernization and expanding café culture continue to enhance market visibility and accessibility across major cities.

Market Segmentations:

By Product Type:

By Specialty Type:

By Distribution Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The U.S. bakery items market features major players such as Grupo Bimbo, Hostess Brands, Kellogg Company, Campbell Soup Company, Lantmannen Unibake, General Mills, Conagra Brands, Finsbury Food Group, Associated British Foods, and Aryzta. The U.S. bakery items market demonstrates intense competition marked by innovation, brand loyalty, and technological advancement. Companies focus on expanding their product portfolios through healthier, clean-label, and premium bakery categories that cater to evolving consumer preferences. Market players invest heavily in automation, supply chain efficiency, and sustainable packaging to improve production quality and reduce operational costs. The rise of online grocery platforms and private-label bakery products has intensified market dynamics, encouraging manufacturers to diversify distribution strategies. Continuous product innovation, coupled with mergers and acquisitions, strengthens competitiveness and helps brands maintain market presence in an evolving retail environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Grupo Bimbo

- Hostess Brands

- Kellogg Company

- Campbell Soup Company

- Lantmannen Unibake

- General Mills

- Conagra Brands

- Finsbury Food Group

- Associated British Foods

- Aryzta

Recent Developments

- In January 2025, Flowers Foods announced its agreement to acquire Simple Mills in a deal valued. This acquisition was aimed at strengthening Flowers Foods’ portfolio by integrating Simple Mills’ innovative and health-focused product offerings.

- In September 2024, Rise Baking Company (‘Rise’) announced that it has been acquired by global investment firms Platinum Equity and Butterfly.This acquisition was aimed at strengthening the company’s market position and expanding its operational capabilities.

- In May 2024, Bimbo Bakeries USA, a subsidiary of Grupo Bimbo SAB de CV, added Hawaiian bakery bread and buns to its Sara Lee Artesano portfolio. The two new bread products are made without any artificial flavors, preservatives, or high-fructose corn syrup.

- In July 2023, Starbucks has only one certified gluten-free bakery item on its menu, which is surprising when you consider how many of its beverages are, or made, gluten-free. The Marshmallow Dream Bar comes in its own packaging, with a gluten-free certification right on the label

Report Coverage

The research report offers an in-depth analysis based on Product Type, Specialty Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for healthier bakery alternatives will continue to grow with rising health awareness.

- Manufacturers will adopt automation and robotics to improve production efficiency and consistency.

- Online bakery sales will expand as e-commerce and delivery platforms gain consumer trust.

- Sustainable and eco-friendly packaging solutions will become a key focus for producers.

- Artisanal and premium bakery products will gain traction among urban consumers.

- Plant-based and gluten-free bakery innovations will attract a broader customer base.

- Companies will invest more in localized production to reduce logistics costs and ensure freshness.

- The influence of ethnic and regional flavors will rise, diversifying bakery offerings.

- Retail bakeries and quick-service restaurants will collaborate for product innovation and cross-selling.

- Continuous investment in R&D will drive the development of new textures, flavors, and functional bakery products.