Market Overview

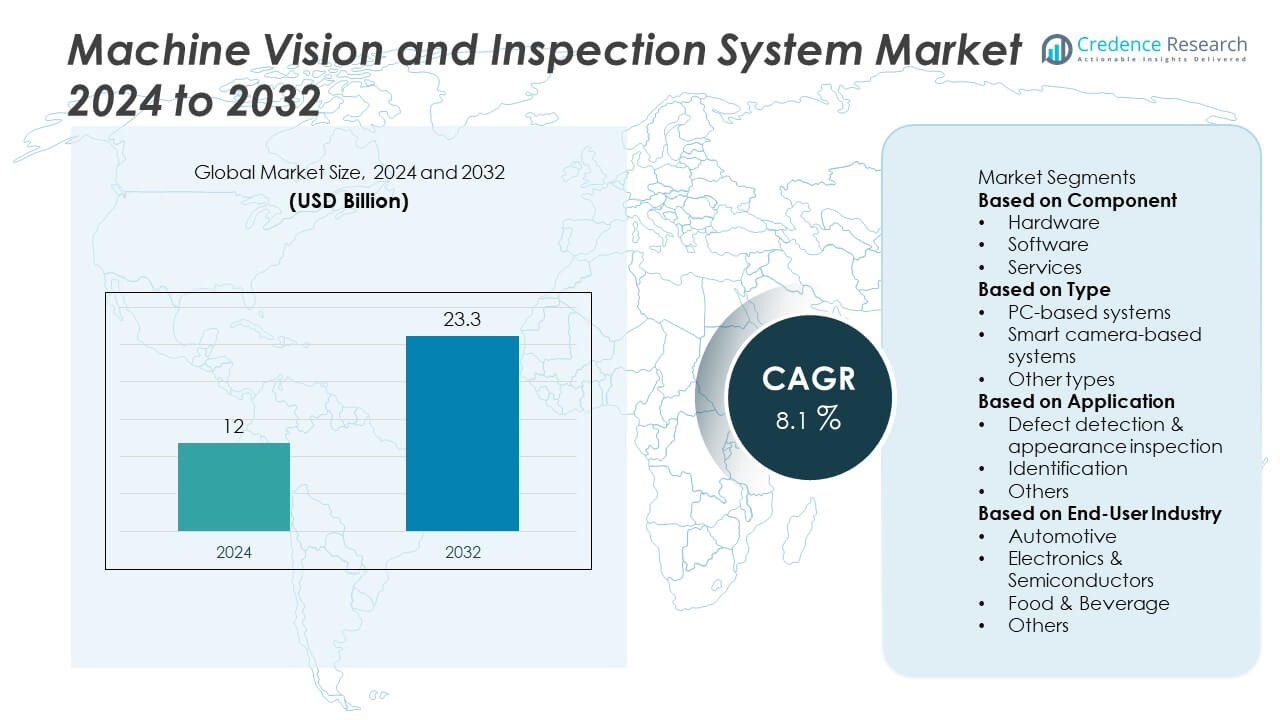

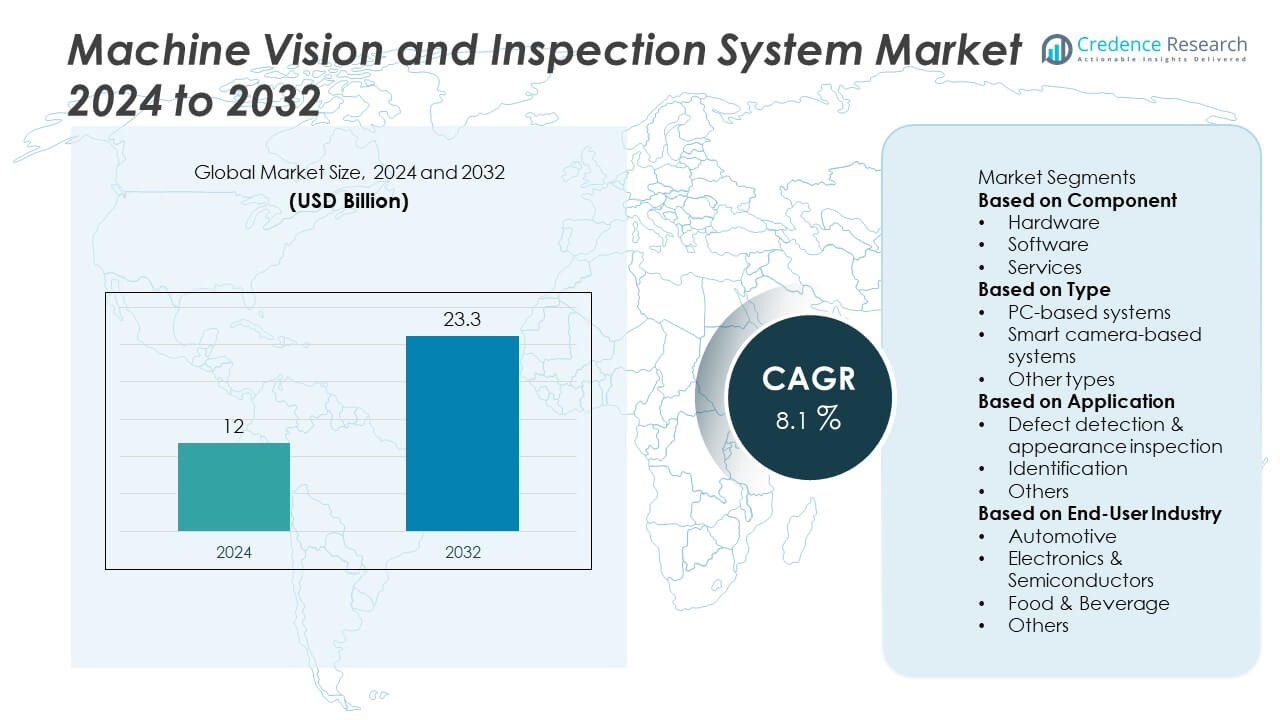

The Machine Vision and Inspection System market was valued at USD 12 billion in 2024 and is expected to reach USD 23.3 billion by 2032, growing at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Machine Vision and Inspection System Market Size 2024 |

USD 12 Billion |

| Machine Vision and Inspection System Market, CAGR |

8.1% |

| Machine Vision and Inspection System Market Size 2032 |

USD 23.3 Billion |

The top players in the machine vision and inspection system market-Cognex Corporation, KEYENCE Corporation, Teledyne Technologies Inc., Basler AG, and Omron Corporation-capitalize on advanced vision hardware, software integration and global distribution channels. Cognex leads its segment with a market share around 11.4 % in 2024. In regional terms, the Asia Pacific region dominates with a market share exceeding 43 % of the global market in 2024, driven by high manufacturing output and strong automation adoption. North America follows, bolstered by early integration of Industry 4.0 technologies and established firms. These companies leverage regional strengths, product breadth and technological innovation to strengthen their competitive positions in a dynamic market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global machine vision and inspection system market reached USD 12 billion in 2024 and is expected to grow at a CAGR of 8.1 %.

- Rising automation in manufacturing, increasing quality requirements, and strong investment in sensors and imaging drive market growth.

- Smart camera‑based systems and AI‑enabled vision software are gaining traction as trends, while hardware still constitutes about 50 % of segment share.

- A competitive landscape is visible with major players consolidating market position; however high system integration costs and lack of skilled workforce limit faster uptake.

- Regionally, Asia‑Pacific leads with a share around 44 %, followed by North America at about 24 % and Europe at approximately 18 %, driven by large manufacturing bases and automation initiatives.

Market Segmentation Analysis:

By Component

In the Machine Vision and Inspection System market, the Hardware segment holds the largest share, accounting for approximately 50% of the market in 2024. This segment includes cameras, lighting systems, and processors essential for capturing and processing images. The Software segment follows closely with a 35% share, driven by the growing demand for advanced algorithms and deep learning solutions to improve inspection accuracy. Services, which account for 15% of the market, include system integration, maintenance, and consulting. The rise in automation and the need for high-precision inspections are the key drivers for hardware and software adoption.

- For instance, the Cognex In-Sight D900 series and In-Sight 3800 series use deep learning algorithms for automated defect detection in real-time, which has been adopted widely in automotive manufacturing. Services, which account for a notable portion of the market, include system integration, maintenance, and consulting.

By Type

The PC-based systems segment leads the market with a 45% share due to their high processing power and versatility, making them ideal for complex inspection tasks in manufacturing. Smart camera-based systems follow with a 35% share, offering compact, cost-effective solutions with integrated processing capabilities. The Other types segment, which includes compact and embedded systems, holds the remaining 20% share. The demand for smart, all-in-one solutions and the increased need for high-speed, real-time inspections in industries such as automotive and electronics are fueling the growth of these systems.

- For instance, Omron’s FH-Series Smart Cameras integrate processing and vision in one unit, delivering a streamlined solution for quality control in the automotive industry.

By Application

Defect detection and appearance inspection dominate the market, accounting for nearly 50% of the share, as they are critical for quality control in industries such as automotive and electronics. Identification applications, including barcode reading and component tracking, follow with a 30% share, driven by the increasing demand for traceability and precision in logistics and supply chains. The Others segment, which includes applications like measurement and positioning, holds the remaining 20%. As industries strive for improved product quality and efficiency, the demand for defect detection and automated identification systems continues to rise.

Key Growth Drivers

Increasing Demand for Automation in Manufacturing

One of the key drivers for the Machine Vision and Inspection System market is the growing demand for automation in manufacturing processes. As industries seek to reduce labor costs, improve efficiency, and minimize human error, machine vision systems are being widely adopted for tasks such as quality control, defect detection, and process monitoring. Automation through vision and inspection systems enhances production speed and consistency, especially in high-volume manufacturing sectors like automotive, electronics, and pharmaceuticals. The ongoing trend of Industry 4.0, which integrates AI, IoT, and robotics, is further accelerating the adoption of these systems, contributing to market growth.

- For instance, FANUC’s Robodrill machines can be integrated with the proprietary iRVision systems, which use 2D, 3D, and AI-based tools to detect anomalies and perform quality checks in high-speed production lines.

Technological Advancements in AI and Deep Learning

The integration of artificial intelligence (AI) and deep learning technologies into machine vision and inspection systems has significantly enhanced their capabilities. AI-powered systems can process vast amounts of data and adapt to complex inspection tasks, making them more accurate and efficient. Deep learning enables systems to perform intricate visual inspections with a higher level of precision, which was previously difficult or impossible with traditional methods. These advancements allow manufacturers to detect minute defects, perform advanced measurements, and automate decisions, thus expanding the scope of machine vision applications across various industries.

- For instance, Keyence’s CV-X series vision system uses deep learning to detect defects as small as 0.1 mm in real-time, enabling precise defect detection in the electronics industry.

Cost Reduction and Efficiency Improvements

Machine vision systems have become more cost-effective, making them accessible to smaller manufacturers and industries with tight budgets. As the technology advances, the cost of components like cameras, processors, and lighting systems has decreased, while their performance continues to improve. This has made machine vision systems a viable option for a broader range of applications, including small and medium-sized enterprises (SMEs). The ability to improve efficiency and reduce operational costs by automating inspection processes drives widespread adoption, resulting in the expansion of the machine vision market across different industries and regions.

Key Trends & Opportunities

Rise in Smart Manufacturing and Industry 4.0

The rise of smart manufacturing and Industry 4.0 presents significant opportunities for the machine vision and inspection systems market. As manufacturers increasingly incorporate IoT, AI, and robotics into their operations, the demand for advanced vision systems that can operate seamlessly in these environments is growing. Smart machines and interconnected production lines require machine vision systems that can provide real-time data analysis, facilitate predictive maintenance, and enhance overall operational efficiency. As more industries adopt digital transformation initiatives, the need for intelligent inspection systems will continue to rise, offering substantial growth opportunities for machine vision providers.

- For instance, Rockwell Automation’s FactoryTalk InnovationSuite integrates machine vision with IIoT (Industrial Internet of Things) capabilities, enabling real-time data analysis and enhancing operational efficiency by consolidating information technology (IT) and operational technology (OT) data into a unified view.

Growing Adoption of 3D and 2D Vision Systems

Another key trend is the increasing adoption of 3D and 2D vision systems in applications that require detailed and precise inspections. 3D vision systems provide depth perception and are especially valuable in complex manufacturing processes, such as assembly, measurement, and part placement. These systems allow for more accurate spatial measurements and are becoming essential in industries like electronics, automotive, and pharmaceuticals. As product designs become more intricate and precision-driven, the demand for 3D and 2D machine vision systems will continue to rise, creating opportunities for innovation and growth in the market.

- For instance, Zivid’s 3D color camera is integrated into robotic arms in automotive assembly lines to verify parts’ exact positioning before processes like welding, with high-precision point clouds designed to enable reliable and consistent operations.

Key Challenges

High Initial Investment Costs

One of the significant challenges in the Machine Vision and Inspection System market is the high initial investment required for purchasing and implementing these systems. While the long-term benefits, such as improved efficiency, accuracy, and cost savings, are evident, the upfront capital expenditure remains a barrier, particularly for small and medium-sized enterprises (SMEs). The need for high-quality cameras, processors, software, and integration services can be expensive, and many businesses may be hesitant to invest in advanced systems without guaranteed returns. This challenge may slow the adoption of machine vision systems in certain industries, especially in emerging markets where budgets are constrained.

Lack of Skilled Workforce

Another challenge the market faces is the lack of skilled professionals capable of operating, maintaining, and troubleshooting advanced machine vision systems. These systems require expertise in areas such as computer vision, artificial intelligence, and software programming, which can be difficult to find in certain regions. The shortage of skilled personnel creates a knowledge gap, hindering the efficient implementation and use of machine vision technologies. To overcome this, companies must invest in training programs and educational initiatives to build a workforce capable of supporting the growing demand for advanced inspection systems.

Regional Analysis

Asia Pacific

The Asia Pacific region holds a market share of 41% in the machine vision and inspection system market, driven by heavy manufacturing activity in China, India, Japan and South Korea. Rapid industrialisation, the rise of electronics and semiconductor production, and strong investment in automation support growth in the region. Many manufacturers adopt vision systems to meet quality standards in mass production and high‑tech industries. These factors make Asia Pacific the dominant region and the primary growth engine in the market.

North America

North America accounts for 24% of the global market share in machine vision and inspection systems. The region’s maturity in automation, strong presence of high‑value manufacturing sectors like automotive and aerospace, and early adoption of Industry 4.0 technologies drive demand. The United States leads in spending on smart inspection solutions and vision‑guided robotics, helping firms improve productivity, reduce defects and meet stringent regulatory standards. These dynamics sustain North America’s significant role in the global market.

Europe

Europe holds an 18% market share in the machine vision and inspection system market. The region benefits from well‑established manufacturing hubs in Germany, France, Italy and the UK, strong regulatory pressure for quality assurance, and growing adoption of smart factory initiatives. European firms increasingly deploy machine vision for automated inspection, measurement and alignment tasks to enhance output and comply with environmental and safety standards. These trends maintain Europe’s steady contribution to global market revenues.

Latin America

Latin America contributes a 9% share of the global market for machine vision and inspection systems. Growth in the region is supported by expanding manufacturing in Brazil, Mexico and Chile, increased investment in automated production lines, and rising demand for quality control solutions in agricultural processing and consumer goods. While infrastructure and investment levels vary, emerging industries in this region are increasingly using machine vision to upgrade traditional manufacturing, driving gradual market expansion.

Middle East & Africa

The Middle East & Africa region captures 8% of the global machine vision and inspection system market share. Water‑scarce and resource‑driven industries such as oil & gas, mining and infrastructure are increasingly adopting automated vision inspection to enhance efficiency and reliability. Growth is supported by government investments in industrial automation and smart manufacturing within Gulf countries and South Africa. While adoption is uneven across countries, the push for digitalisation and quality assurance drives rising uptake in this region.

Market Segmentations:

By Component

- Hardware

- Software

- Services

By Type

- PC-based systems

- Smart camera-based systems

- Other types

By Application

- Defect detection & appearance inspection

- Identification

- Others

By End-User Industry

- Automotive

- Electronics & Semiconductors

- Food & Beverage

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape for the Machine Vision and Inspection System market is anchored by major key players such as Cognex Corporation, KEYENCE Corporation, Teledyne Technologies Inc., Basler AG, and Omron Corporation. These companies maintain strong global positions by leveraging extensive product portfolios, innovation in AI‑enabled vision software, and robust distribution networks across major manufacturing hubs. They regularly pursue strategic acquisitions and partnerships to expand capabilities in smart vision sensors, embedded systems, and cloud‑based analytics. Smaller regional players compete by focusing on niche applications, cost‑competitive offerings, and service models tailored to local markets. As the market evolves, differentiation increasingly relies on software platforms, recurring service revenue, and integration with Industry 4.0 ecosystems rather than purely hardware sales. This dynamic environment intensifies competition while pushing consolidation and partnerships across geographies and technology segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cognex Corporation

- KEYENCE Corporation

- Teledyne Technologies Inc.

- Basler AG

- Omron Corporation

- SICK AG

- National Instruments Corporation

- Datalogic S.p.A.

- ISRA VISION GmbH

- Sony Corporation

Recent Developments

- In October 2025, OMRON Corporation enhanced its FH Vision System by adding new AI features that eliminate over‑detection and support up to eight camera inputs from a single controller.

- In June 2025, Cognex Corporation launched OneVision™, a cloud‑based platform designed for AI‑powered machine vision applications on its In‑Sight® 3800 and 8900 systems.

- In April 2024, Cognex introduced the In‑Sight® L38 3D Vision System, which integrates AI, 2D and 3D vision to enable new inspection and measurement tasks.

Report Coverage

The research report offers an in-depth analysis based on Component, Type, Application, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of edge computing will expand, enabling machine vision systems to process data locally and reduce latency in industrial environments.

- Integration of generative AI and deep‑learning algorithms will enhance defect detection accuracy and adapt to complex inspection tasks with less manual configuration.

- Stand‑alone smart camera systems will gain wider use, offering flexible, plug‑and‑play inspection solutions ideal for small and medium‑sized operations.

- Collaboration between vision systems and robots will accelerate, enabling vision‑guided robots to perform pick‑and‑place, assembly, and inspection without human oversight.

- Growth in electric vehicles and semiconductors will escalate demand for high‑precision vision inspection across these industries, driving market expansion.

- Use of 3D vision technology will increase, supporting shape measurement and volumetric inspection essential for advanced manufacturing and packaging.

- Subscription‑based and “vision‑as‑a‑service” business models will emerge, reducing upfront investment barriers and broadening adoption among cost‑sensitive users.

- Sustainability and zero‑defect manufacturing goals will push firms to deploy machine vision systems to minimise waste and guarantee product quality.

- Expansion into emerging markets in Asia‑Pacific, Latin America and Middle East will offer new growth corridors as automation gains traction in these regions.

- Cyber‑security and data integrity requirements will elevate, prompting vision‑system providers to embed secure design and encrypted analytics capabilities in their solutions.