Market Overview:

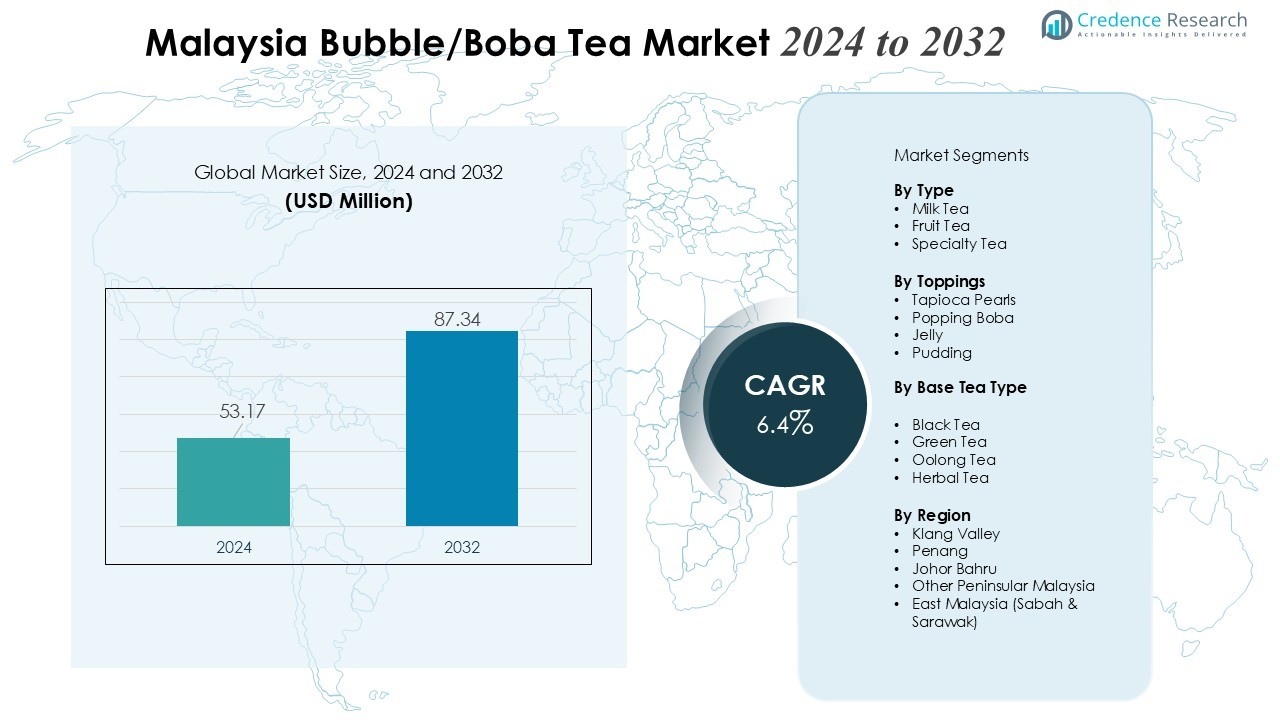

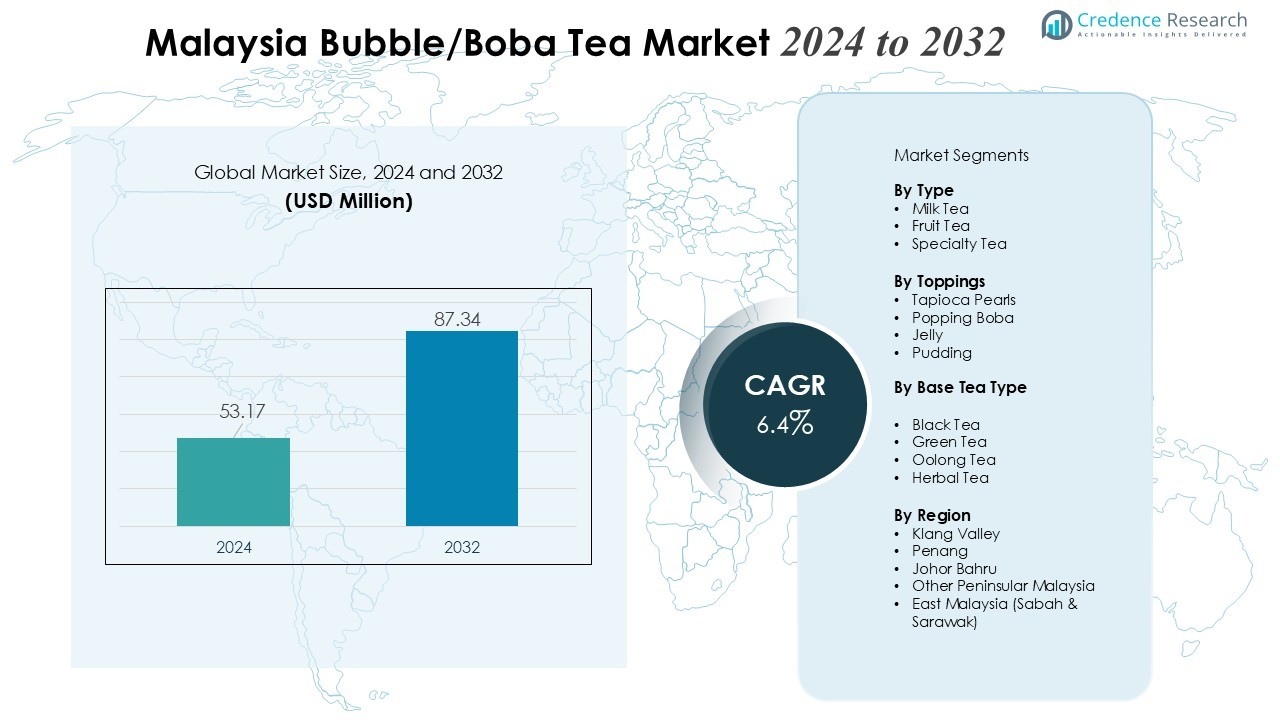

The Malaysia Bubble/Boba Tea Market size was valued at USD 53.17 million in 2024 and is anticipated to reach USD 87.34 million by 2032, at a CAGR of 6.4% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Malaysia Bubble/Boba Tea Market Size 2024 |

USD 53.17 Million |

| Malaysia Bubble/Boba Tea Market, CAGR |

6.4% |

| Malaysia Bubble/Boba Tea Market Size 2032 |

USD 87.34 Million |

Key market drivers include the rising café culture, changing consumer preferences toward customizable and health-conscious beverages, and the growing influence of social media trends. The introduction of novel flavors, plant-based milk options, and sugar-free variants has further fueled demand. Additionally, the proliferation of delivery platforms and cloud kitchens has made bubble tea more accessible, contributing to higher consumption rates across various demographics.

Regionally, the market is most concentrated in major urban centers where international franchises and established local brands dominate. However, expansion into smaller cities and semi-urban areas through kiosks, food trucks, and online ordering has broadened market reach. This urban-to-semi-urban expansion indicates increasing market penetration and highlights the potential for sustained growth across Malaysia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Malaysia Bubble/Boba Tea Market size was valued at USD 53.17 million in 2024 and is projected to reach USD 87.34 million by 2032, growing at a CAGR of 6.4% during the forecast period.

- Rising demand for customizable and innovative beverage offerings supports steady market growth.

- Young and urban consumers, particularly Millennials and Gen Z, drive growth through café culture and lifestyle-oriented beverage consumption.

- Health-conscious trends encourage brands to offer low-sugar, plant-based, and natural sweetener options, expanding the consumer base to wellness-oriented buyers.

- Flexible outlet formats, including kiosks, cloud kitchens, and delivery-only stores, increase accessibility and penetration across metro, semi-urban, and suburban areas.

- High sugar content and calorie concerns create challenges, prompting brands to balance classic flavors with healthier alternatives to retain customer loyalty.

- Dependence on specific ingredients like tapioca pearls and specialty teas introduces supply chain vulnerabilities, requiring consistent quality and robust logistics.

- Urban centers, especially Kuala Lumpur and Klang Valley, dominate market consumption, while expansion into secondary cities and suburban regions supports nationwide growth.

Market Drivers:

Market Drivers:

Rising Demand for Customizable and Innovative Beverage Offerings

The Malaysia Bubble/Boba Tea Market benefits from strong demand for personalized drinks. Consumers increasingly seek beverages tailored to their tastes — from tea base, choice of toppings, sweetness level, and dairy or non‑dairy options. This flexibility attracts a wide range of customers, from traditional tea lovers to those who prefer novel taste experiences. The ability to customize keeps customers engaged and encourages repeat purchases, supporting steady market growth.

- For instance, Tealive, a leading Malaysian boba brand transformed from Chatime, offers over 50 customizable flavor combinations including fruit-infused teas and premium toppings, achieving 200+ outlets nationwide.

Youth‑Driven Café Culture and Lifestyle Appeal

Young and urban consumers in Malaysia, particularly Millennials and Gen Z, drive much of the bubble tea demand. They view bubble tea as more than a drink; it fits into their café‑going lifestyle and serves as a social and cultural symbol. This demographic values trendy, visually appealing beverages that double as a lifestyle statement. The proliferation of cafés, kiosks, and food‑service outlets offering boba tea reinforces this cultural shift.

- For Instance, The significant scale of the bubble tea trend among youth-driven café culture has driven growth for numerous manufacturers. In Asia, some large-scale tapioca pearl manufacturers have production capacities that reach many tonnes a day to meet the high demand across the region.

Health Consciousness and Demand for Better‑For‑You Alternatives

Growing health awareness among Malaysian consumers motivates brands to offer healthier versions of bubble tea. Producers now introduce low‑sugar formulations, plant‑based milks, and natural sweeteners to attract those cautious about calorie and sugar intake. This shift taps into a broader global trend of wellness‑oriented beverages and expands the consumer base to include health‑conscious drinkers who previously avoided sugary drinks.

Expansion Through Flexible Formats and Digital Distribution Channels

The Market’s growth also stems from wide distribution and format diversification. Franchises, kiosks, cloud‑kitchens, and delivery‑only outlets make bubble tea more accessible beyond traditional cafés. Partnerships with delivery platforms increase reach into metro, semi‑urban, and suburban markets. This broad availability supports consumption across different demographics and geographic areas, accelerating market penetration across Malaysia.

Market Trends:

Expansion of Health‑Oriented and Functional Beverage Variants

The Malaysia Bubble/Boba Tea Market shows a growing shift toward health‑aware consumption. Many brands offer sugar‑reduced recipes, plant‑based milks such as oat or almond, and functional ingredients like antioxidant-rich teas or herbal infusions. This approach attracts consumers who previously avoided traditional sugary bubble teas because of health or dietary concerns. It broadens the market beyond young, indulgence-seeking buyers to include health-conscious adults and working professionals. The trend toward better‑for‑you options strengthens long-term demand stability by aligning with global wellness preferences.

- For Instance, The significant scale of the bubble tea trend among youth-driven café culture has driven growth for numerous manufacturers. In Asia, some large-scale tapioca pearl manufacturers have production capacities that reach many tonnes a day to meet the high demand across the region.

Flavor Innovation, Localization, and Experience‑Driven Customization

Beverage providers increasingly introduce creative flavors, local ingredient blends, and varied toppings to stand out in a crowded market. They pair classic milk tea offerings with fruit teas, regional tastes, or alternative pearls and toppings. It gives consumers a broader palette of choices and encourages experimentation over repeat visits. Many shops emphasize aesthetic presentation and interactive, customizable drink creation, which fuels social-media sharing and word-of-mouth appeal. Such experiential and localized offerings help the market remain dynamic and responsive to evolving taste preferences.

- For Instance, YiFang Taiwan Fruit Tea emphasizes its use of fresh, localized fruit ingredients in its marketing and has experienced global expansion, particularly appealing to health-conscious consumers in markets like Northern California.

Market Challenges Analysis:

Health Concern and Growing Consumer Awareness of Nutrition Risks

The Malaysia Bubble/Boba Tea Market faces pressure because many traditional recipes carry high sugar and calorie content. Consumers increasingly associate heavy sugar usage with health problems such as obesity, diabetes, and tooth decay, which may reduce frequent consumption. It forces brands to rethink formulations — low‑sugar or more nutritionally transparent options might appeal to health‑aware audiences, but they risk alienating customers who value the classic taste. Rising scrutiny over sugary beverages could slow demand growth and shrink the core consumer base.

Supply Chain Vulnerabilities, Ingredient Freshness and Operational Consistency

Bubble tea depends heavily on specific ingredients like tapioca pearls, specialty tea leaves, syrups, and toppings. Fluctuations in raw‑material availability, price volatility or supply‑chain disruptions can raise costs and impair menu stability. Perishable components such as fresh toppings or dairy‑based mixtures require robust cold‑chain logistics; failure to maintain such standards may compromise taste, safety, or quality — especially in remote areas or during expansion. For franchises operating many outlets, maintaining consistent product quality, hygiene standards, and customer experience across all stores becomes difficult. Inconsistent service or taste across stores could damage brand reputation and erode customer loyalty.

Market Opportunities:

Rising Demand for Premium and Health‑Friendly Beverage Alternatives

The Malaysia Bubble/Boba Tea Market presents an opportunity to target health‑conscious consumers through premium, better‑for‑you beverages. Brands can expand offerings with sugar‑reduced, dairy‑free, or plant‑based milk options along with natural sweeteners and functional ingredients. This shift can attract a broader demographic that seeks healthier drink alternatives without foregoing indulgence. It can also elevate the perceived value of bubble tea by positioning it as a lifestyle beverage rather than just a treat.

Expansion into Underserved Segments and Alternative Sales Channels

Urban centres in Malaysia already host many bubble tea outlets, but substantial opportunity lies in penetrating semi‑urban and suburban regions where adoption remains limited. Growth can come via kiosk‑format shops, small independent cafés, and cloud‑kitchen models that reduce setup costs and adapt to local demand. Establishing strategic partnerships with digital delivery platforms can further ease market access and tap into convenience‑oriented consumers. This approach can significantly expand market reach beyond metropolitan hotspots and support sustained growth across diverse regions.

Market Segmentation Analysis:

By Type

The Malaysia Bubble/Boba Tea Market divides primarily into milk tea, fruit tea, and specialty tea. Milk tea dominates due to its rich flavor and wide consumer familiarity, attracting both young and adult customers. Fruit tea captures demand from health-conscious and flavor-seeking consumers who prefer lighter, refreshing options. Specialty teas, including herbal and functional variants, appeal to niche segments focused on wellness benefits. It allows brands to diversify portfolios and address varied consumer preferences.

- For instance, The Alley introduced its signature “Deerioca” tapioca pearls, which are often prepared fresh in-store to ensure a consistent and desirable chewy texture, enhancing product quality across its outlets.

By Toppings

Tapioca pearls, popping boba, jelly, and pudding represent key topping segments. Tapioca pearls hold the largest share, reflecting their iconic status and consistent consumer preference. Popping boba and jelly attract younger audiences seeking novelty and interactive textures. Pudding and other premium toppings appeal to premium‑segment consumers who value indulgence and richer mouthfeel. It enables outlets to differentiate offerings and encourage repeat purchases through customizable options.

- For instance, tapioca pearls greater than 8 mm diameter are favored in upscale cafes and dessert applications for their distinct chewiness and mouthfeel, as adopted by many premium bubble tea chains to differentiate and upgrade their menus.

By Base Tea Type

Black tea, green tea, oolong tea, and herbal tea form the primary base types in the market. Black tea remains dominant due to strong flavor and compatibility with milk and sweeteners. Green tea and oolong tea target health-conscious consumers seeking antioxidants and lighter taste profiles. Herbal and specialty bases appeal to wellness-oriented segments looking for unique functional benefits. It allows brands to innovate and meet diverse consumer expectations while maintaining core product relevance.

Segmentations:

By Type

- Milk Tea

- Fruit Tea

- Specialty Tea

By Toppings

- Tapioca Pearls

- Popping Boba

- Jelly

- Pudding

By Base Tea Type

- Black Tea

- Green Tea

- Oolong Tea

- Herbal Tea

By Region

- Klang Valley

- Penang

- Johor Bahru

- Other Peninsular Malaysia

- East Malaysia (Sabah & Sarawak)

Regional Analysis:

Strong Urban Concentration in Key Metropolitan Areas

Urban centers account for 79% of the Malaysia Bubble/Boba Tea Market, with Kuala Lumpur and Klang Valley leading consumption. Major conurbations serve as hubs for cafés, outlets, and franchise expansions, offering high visibility and easy access to young, urban consumers. These areas attract both domestic and international bubble tea brands, driving competitive offerings and premium pricing. Consumer preference for convenience, aesthetics, and social experiences strengthens demand in these regions. High foot traffic locations within shopping malls and transport hubs further contribute to sustained revenue generation.

Expanding Reach to Secondary Cities and Suburban Areas

Secondary cities and suburban areas contribute 15% of the Malaysia Bubble/Boba Tea Market, reflecting growing adoption beyond primary metros. Brands adapt with lower-cost formats such as kiosks, food-truck style outlets, and cloud kitchens to increase accessibility. Consumers in these regions seek convenience, affordability, and localized flavor options. Expanding into these areas helps diversify revenue streams and reduces reliance on saturated urban markets. Strategic placement near schools, offices, and residential complexes boosts brand visibility and sales.

Regional Variation in Consumer Access and Market Maturity

Peninsular Malaysia dominates 85% of the Malaysia Bubble/Boba Tea Market, driven by higher urbanization, disposable incomes, and retail infrastructure. In contrast, rural and remote regions contribute 5% due to limited outlet presence and logistical challenges. Operators face difficulties maintaining product quality, freshness, and consistency in these areas. Tailored strategies, such as regional partnerships and delivery-focused models, can help bridge the accessibility gap. Successful expansion into these regions supports long-term nationwide market growth.

Key Player Analysis:

- Tealive

- Chatime

- Gong Cha

- KOI Thé

- The Alley

- Xing Fu Tang

- Daboba

- Tiger Sugar

- CoCo Fresh Tea & Juice

- Happy Lemon

- Quickly

- Kung Fu Tea

Competitive Analysis:

The Malaysia Bubble/Boba Tea Market features intense competition among domestic and international players. Tealive maintains a dominant presence with an extensive outlet network across the country. International brands such as Gong Cha, Chatime, KOI Thé, and The Alley compete by offering premium tea blends, authentic ingredients, and innovative menus to attract quality-conscious and brand-loyal consumers. Smaller and emerging players focus on niche strategies, including specialty flavors, local preferences, and alternative outlet formats to appeal to specific customer segments. Price competition remains strong between budget-oriented and premium brands. It drives continuous investment in product innovation, marketing, and customer engagement to retain loyalty and expand market share in a highly dynamic environment.

Recent Developments:

- In December 2024, KOI Thé’s founder was named to Forbes China’s 2025 Top 100 Most Influential Chinese list, emphasizing the brand’s sustainability and diversity efforts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Toppings, Base Tea Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Malaysia Bubble/Boba Tea Market will continue to expand into secondary cities and suburban regions, increasing accessibility for a wider consumer base.

- Health-conscious and wellness-oriented products will gain stronger adoption, including low-sugar, plant-based, and functional beverage options.

- Brands will emphasize flavor innovation, incorporating local tastes and seasonal ingredients to maintain consumer interest.

- Customization and interactive beverage experiences will drive repeat purchases and enhance brand loyalty.

- Digital ordering platforms and delivery services will play a key role in reaching convenience-oriented consumers.

- Outlet formats such as kiosks, cloud kitchens, and pop-up stores will support cost-effective expansion and market penetration.

- International franchise presence will intensify competition, prompting local players to strengthen brand differentiation.

- Sustainability initiatives, including eco-friendly packaging and sourcing practices, will influence consumer preference and brand perception.

- Marketing strategies leveraging social media, influencer collaborations, and visually appealing product presentation will remain critical to attract young consumers.

- Partnerships with retail chains, malls, and lifestyle outlets will enhance visibility and accessibility, supporting long-term market growth.

Market Drivers:

Market Drivers: