Market Overview

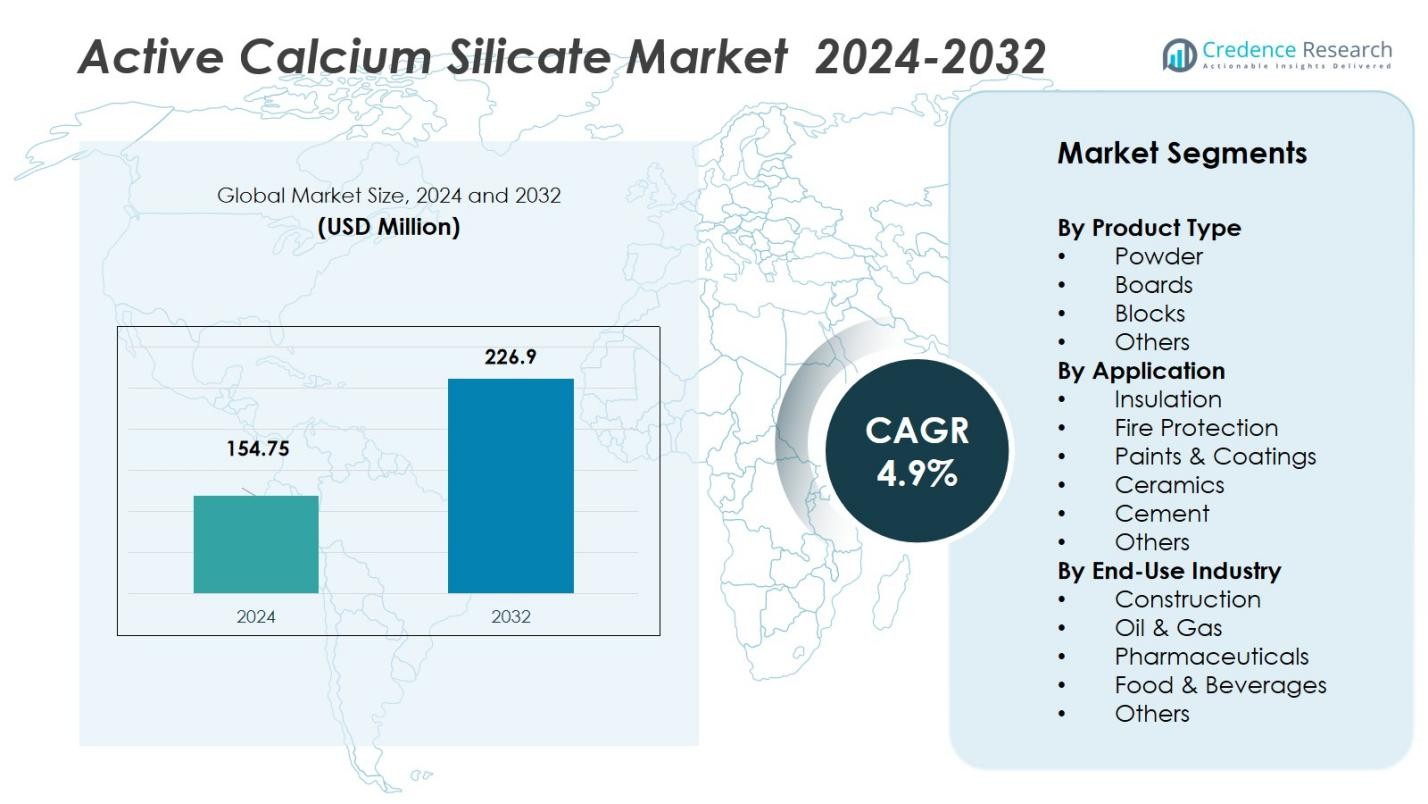

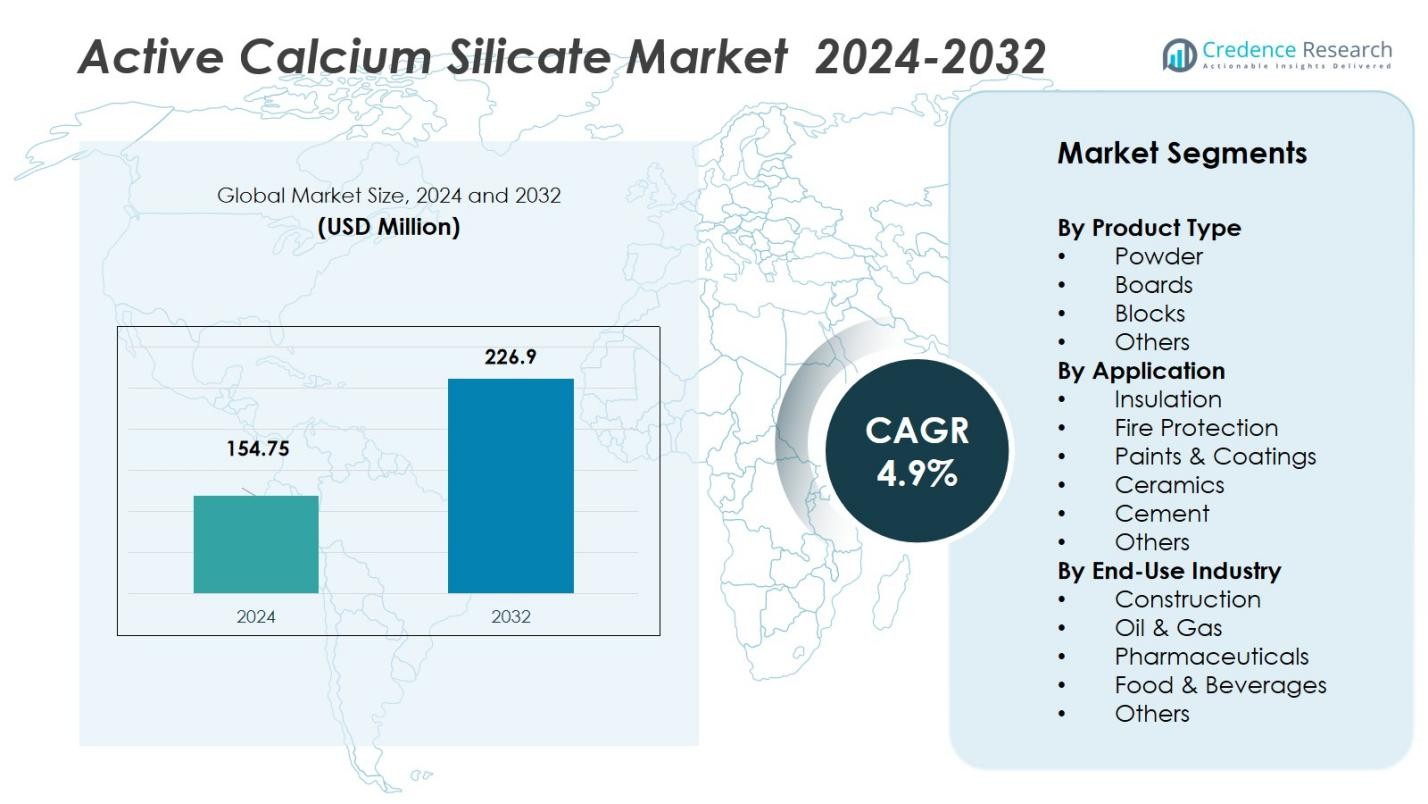

The Active Calcium Silicate Market size was valued at USD 154.75 million in 2024 and is anticipated to reach USD 226.9 million by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Active Calcium Silicate Market Size 2024 |

USD 154.75 Million |

| Active Calcium Silicate Market, CAGR |

4.9% |

| Active Calcium Silicate Market Size 2032 |

USD 226.9 Million |

The Active Calcium Silicate Market is primarily driven by key players such as Promat International, Skamol A/S, Johns Manville, Etex Group, Xella Group, and Morgan Advanced Materials. These companies dominate the market by focusing on innovation, expanding production capacity, and offering high-performance products used in insulation and fire protection applications. The European region leads the market, holding a share of 37.7% in 2024, due to stringent fire safety regulations and a strong demand for advanced building materials. The Asia-Pacific region follows closely with 38.1% of the market share, driven by rapid infrastructure development and growing demand in emerging economies. North America holds 20% of the market, supported by well-established building codes and a focus on energy-efficient solutions. These regions will continue to shape the growth trajectory of the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Active Calcium Silicate Market size reached USD 154.75 million in 2024 and is projected to grow at a CAGR of 4.9%.

- Growing regulations for fire safety and energy efficiency in buildings drive demand for high‑performance calcium silicate boards and powders.

- Eco‑friendly building materials and integration with smart‑building technologies support rising adoption in insulation and fire‑protection segments (boards hold around 40% share, insulation about 45%).

- Major players like Promat International, Skamol A/S, Johns Manville lead the field; product innovation and geographic expansion define the competitive scene.

- Europe holds about 37.7% of the market, Asia‑Pacific roughly 38.1%, and North America about 20%; slower uptake and lower regulation limit growth in Latin America and Middle East/Africa.

Market Segmentation Analysis:

By Product Type

The Active Calcium Silicate Market is segmented by product type into powder, boards, blocks, and others. Among these, boards dominate the market, accounting for approximately 40% of the total market share. The demand for boards is driven by their widespread application in insulation and fire protection, particularly in the construction sector. Their versatility, ease of installation, and superior fire-resistant properties have made them the preferred choice in commercial and residential buildings. As construction activities grow globally, the demand for calcium silicate boards continues to rise, propelling market growth.

- For instance, Promat’s calcium silicate boards can withstand temperatures up to 1,100°C, making them ideal for fire protection in commercial and industrial buildings, where they are used as fire-resistant wall linings and partitions to prevent fire spread and protect critical infrastructure.

By Application

In terms of application, the insulation segment holds the largest share of the Active Calcium Silicate Market, representing about 45% of the total market. The increasing need for energy-efficient building solutions and the growing construction industry have propelled the demand for insulation materials. Active calcium silicate’s high thermal resistance and durability make it ideal for insulation in industrial and commercial applications. As energy conservation regulations become more stringent, this sub-segment is expected to continue leading the market, driven by both residential and commercial building demand.

- For instance, Johns Manville’s Thermo-1200® calcium silicate product offers high-temperature resistance up to 1200°F (650°C) with a water-resistant feature that minimizes moisture absorption, extending its usability in construction projects under various weather conditions.

By End-Use Industry

The construction industry leads the Active Calcium Silicate Market, accounting for 55% of the market share. The increasing need for fire-resistant, durable, and energy-efficient building materials has significantly boosted demand within the construction sector. Active calcium silicate’s superior fire protection and insulation properties make it an essential material for both new buildings and renovations. With ongoing urbanization and infrastructure development globally, the construction industry’s continued growth is a key driver for the expansion of the active calcium silicate market in this segment.

Key Growth Drivers

Growing Demand for Fire Protection Materials

The increasing emphasis on safety and fire protection in the construction sector is a major growth driver for the Active Calcium Silicate Market. Active calcium silicate’s exceptional fire-resistant properties make it an ideal choice for fireproofing materials in both commercial and residential buildings. As fire safety regulations become more stringent worldwide, particularly in high-rise buildings, the demand for fire-resistant insulation and building materials is accelerating. This trend is expected to drive continuous growth in the market, especially in regions with high construction activity.

- For instance, Promat, a global leader in fire protection solutions, supplies calcium silicate boards used in critical passive fire protection systems such as tunnel linings and high-rise building compartmentation, which comply with international fire safety standards.

Expansion of Construction and Infrastructure Development

The ongoing urbanization and infrastructure development, especially in emerging economies, is propelling the demand for active calcium silicate in the construction industry. Calcium silicate boards and blocks are widely used in commercial, residential, and industrial buildings due to their superior thermal and sound insulation properties. As construction projects expand across regions like Asia-Pacific, Africa, and Latin America, the need for durable, energy-efficient building materials is increasing. This expansion is expected to fuel growth in the active calcium silicate market in the coming years.

- For instance, Etex Group supplied Promat calcium silicate panels for major hospital and airport construction projects in Latin America, citing improved fire resistance and durability as key benefits.

Rising Focus on Energy-Efficient Buildings

The growing global focus on energy-efficient and sustainable buildings is another major growth driver for the Active Calcium Silicate Market. As energy conservation becomes a key priority, building materials that improve thermal insulation are in high demand. Active calcium silicate materials offer excellent thermal resistance, reducing heating and cooling costs for buildings. With governments and institutions enforcing green building standards, the adoption of calcium silicate products as an energy-efficient solution continues to rise, contributing to the market’s expansion.

Key Trends & Opportunities

Shift Towards Sustainable and Eco-Friendly Materials

There is a growing trend toward sustainable and eco-friendly building materials, which is creating significant opportunities for the Active Calcium Silicate Market. Consumers, developers, and government bodies are increasingly demanding materials that reduce environmental impact. Active calcium silicate, being a naturally occurring material with low carbon emissions during production, aligns well with these sustainability goals. The market is expected to see greater adoption as the push for green construction grows, providing opportunities for manufacturers to innovate and expand their eco-friendly product offerings.

- For instance, Ramco Industries Limited in India produces Ramco HILUX calcium silicate boards, which are specifically designed for green building applications.

Integration of Smart Building Technologies

The integration of smart building technologies presents a unique opportunity for the Active Calcium Silicate Market. As smart buildings become more prevalent, the demand for materials that contribute to the overall efficiency and safety of these structures is rising. Active calcium silicate materials, with their ability to provide excellent insulation and fire resistance, are well-suited for use in smart buildings. These materials can enhance energy efficiency and safety, making them attractive for integration into the next generation of smart, energy-efficient homes and commercial buildings.

- For instance, a triboelectric nanogenerator (TENG) using a composite of calcium silicate and carbon black has been developed to harvest energy from foot traffic, demonstrating enhanced power output by more than tenfold, making it suitable for smart flooring systems that convert mechanical energy into electricity and enable motion detection.

Key Challenges

High Production Costs

A major challenge facing the Active Calcium Silicate Market is the high production cost of calcium silicate materials. The manufacturing process involves high-energy consumption and the use of specialized equipment, which drives up costs. As the demand for these products grows, manufacturers may struggle to maintain competitive pricing while managing the rising costs of raw materials and production. This cost barrier can hinder the widespread adoption of active calcium silicate, particularly in price-sensitive markets, and may limit its growth potential.

Limited Awareness in Emerging Markets

Limited awareness of the benefits of active calcium silicate materials in emerging markets presents a challenge to market expansion. While the material is widely used in developed regions, its adoption is still relatively low in many developing economies. Lack of awareness regarding its superior insulation, fire resistance, and environmental benefits can slow its penetration into these markets. Educational campaigns and targeted marketing efforts are required to overcome this challenge and expand the market footprint in emerging regions.

Regional Analysis

Europe

The European region accounts for a market share of 37.7% in the global Active Calcium Silicate market in 2024. The region’s dominance stems from strict fire‑safety and building‑performance regulations that drive demand for high‑performance boards and insulation products. Renovation and retrofitting of commercial and residential buildings also strengthen adoption of calcium silicate materials. Strong manufacturing infrastructure and factory expansion further support growth. While mature, the region continues to lead owing to high standards in construction and industrial sectors.

Asia‑Pacific

The Asia‑Pacific region holds a significant share, estimated around 38.1% in 2023 of the active calcium silicate market. Rapid urbanisation, large‑scale infrastructure development in China and India, and growing industrialisation drive demand. Rising energy‑efficiency mandates and fire protection standards in the region amplify the use of boards, blocks and powders of calcium silicate. The presence of expanding end‑use industries such as construction, ceramics and oil & gas further bolsters growth. The region is expected to maintain strong momentum through the forecast period.

North America

North America contributes approximately 20% of the global active calcium silicate market. The region benefits from well‑established building codes, high fire safety standards and growing demand for energy‑efficient insulation materials in both residential and commercial sectors. Infrastructure renovation, retrofits in old buildings and investment in high‑performance materials further support the market. The moderate growth is driven by substitution of older materials with active calcium silicate products in niche applications requiring high thermal and fire resistance.

Latin America

In Latin America, the active calcium silicate market share is estimated around 5%. The market is driven by urban expansion, rising construction activity and increasing awareness of fire safety and energy‑efficient materials. However, slower regulatory enforcement and lower per‑capita investment in advanced building materials keep growth subdued compared to mature regions. Improvement of building codes, government incentives and foreign investment in infrastructure projects represent potential levers for future market acceleration.

Middle East & Africa

The Middle East & Africa region accounts for an estimated 4% share of the active calcium silicate market. Key drivers include mega‑projects in construction, expanding oil & gas infrastructure and increased emphasis on fire and thermal protection materials. However, adoption is limited by availability of alternatives, cost sensitivity and less advanced regulatory frameworks. With growing economic development and rising sustainability requirements in countries such as UAE and Saudi Arabia, this region offers emerging opportunity for producers of calcium silicate products.

Market Segmentations:

By Product Type

- Powder

- Boards

- Blocks

- Others

By Application

- Insulation

- Fire Protection

- Paints & Coatings

- Ceramics

- Cement

- Others

By End-Use Industry

- Construction

- Oil & Gas

- Pharmaceuticals

- Food & Beverages

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the active calcium silicate market sees major players such as Promat International, Skamol A/S, Johns Manville, Weifang Hongyuan Chemical Co. Ltd., Etex Group, Xella Group, Morgan Advanced Materials, 2K Technologies and Ramco Industries Limited. These firms compete on product innovation, production capacity and geographic reach. Many invest in advanced manufacturing technologies and build regional plants to meet rising demand in insulation and fire‑protection applications. Strategic moves include alliances, capacity expansions and targeted marketing campaigns. Pricing pressures remain moderate because of differentiated performance attributes of boards, powders and blocks. Overall market concentration is low to moderate, with room for specialised niche players to gain traction.

Key Player Analysis

- Johns Manville

- 2K Technologies

- Shandong Lutai Building Material Science and Technology Group Co., Ltd.

- Xella Group

- Ramco Industries Limited

- Promat International

- Morgan Advanced Materials

- Skamol A/S

- Etex Group

- Weifang Hongyuan Chemical Co., Ltd.

Recent Developments

- In January 2025, PQ Corporation completed the acquisition of Sibelco’s specialty silicate business in Sweden to strengthen its European market presence.

- In October 2025, Holcim Group agreed to acquire Xella International (owner of calcium silicate block and insulation brands) for approximately €1.85 billion.

- In May 2023, Etex Group completed its acquisition of Skamol A/S, a leading expert in specialty insulation known for its calcium silicate boards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see stronger demand from energy‑efficient buildings as thermal insulation becomes more essential.

- Wider infrastructure development in emerging regions will drive growth in construction‑related applications.

- Fire‑safety regulations will stimulate higher adoption of calcium silicate materials in boards, blocks and powders.

- Manufacturers will invest in low‑carbon production methods and sustainable product lines to meet green building codes.

- New application areas, such as automotive thermal management and electric‑vehicle battery systems, will unlock fresh growth.

- Expansion in food‑and‑beverage and pharmaceutical end‑uses (for anti‑caking, carrier systems) will open additional markets.

- Companies will focus on geographic growth by increasing capacity in Asia‑Pacific, Latin America and Middle East regions.

- Enhanced product performance via R&D (e.g., improved fire resistance, acoustic insulation) will differentiate portfolios.

- Pricing pressure from substitute materials (mineral wool, composite insulations) will challenge established players to innovate.

- Awareness and technical training in developing markets will be vital to expand adoption and market penetration.