Market Overview:

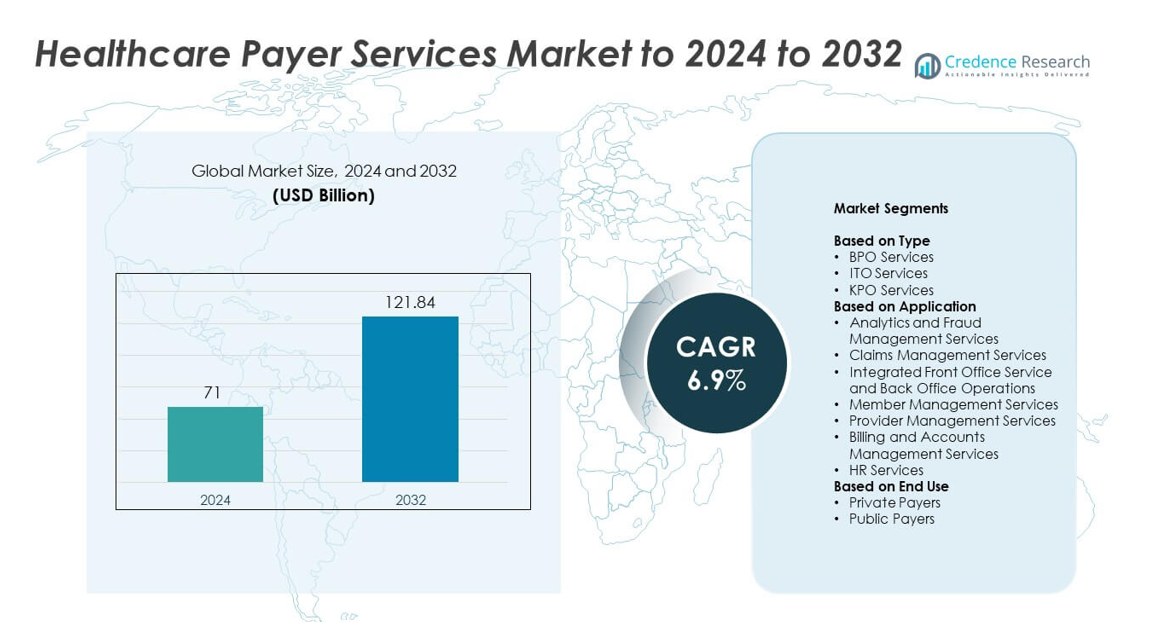

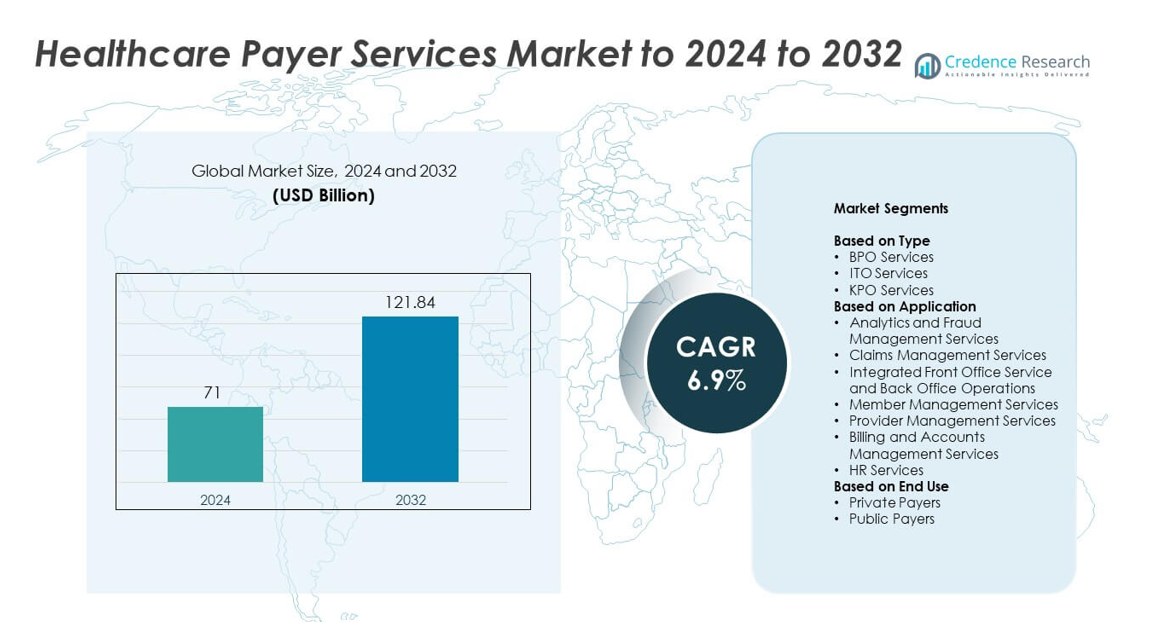

Healthcare Payer Services market size was valued at USD 71 billion in 2024 and is anticipated to reach USD 121.84 billion by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Payer Services Market Size 2024 |

USD 71 billion |

| Healthcare Payer Services Market, CAGR |

6.9% |

| Healthcare Payer Services Market Size 2032 |

USD 121.84 billion |

The top players in the healthcare payer services market include Wipro Limited, Xerox Corporation, HCL Technologies Limited, McKesson Corporation, Cognizant Technology Solutions Corporation, Genpact Limited, UnitedHealth Group Incorporated, Concentrix Corporation, Accenture plc, HP Development Company L.P., ExlService Holdings Inc., and Hinduja Global Solutions Limited. These companies dominate the market by offering a wide range of outsourcing services, including claims processing, fraud management, and analytics. North America leads the market with a 44.6% share in 2024, driven by high insurance penetration and advanced healthcare infrastructure. Europe follows with 26.3%, benefiting from expanding healthcare digitization and regulatory reforms. The Asia-Pacific region, with 18.7% of the market share, is the fastest-growing, spurred by rising healthcare spending and digital adoption in countries like India, China, and Japan. These regions offer strong growth potential as healthcare systems modernize and demand for efficient payer services increases.

Market Insights

- The global healthcare payer services market was valued at USD 71 billion in 2024 and is projected to grow at a CAGR of 6.9% to reach USD 121.84 billion by 2032.

- A primary growth driver is the rising outsourcing of administrative functions like claims processing and member support to reduce operational costs and enhance efficiency.

- Key industry trends include increased adoption of AI‑powered analytics and cloud‑based platforms, which enable predictive fraud detection and end‑to‑end workflow automation.

- Competitive dynamics are driven by major service providers leveraging large portfolios of BPO, ITO and KPO services, with BPO leading at about 61.4% share in 2024 and claims management representing approximately 33.8% of application share.

- Regional analysis shows North America commanding around 44.6% of the market, Europe at 26.3%, and Asia‑Pacific growing fastest with approximately 18.7% share, supported by expanding insurance coverage and outsourcing hubs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

BPO services dominate the Healthcare Payer Services market with an estimated 61.4% share in 2024. Their leadership is driven by rising outsourcing of claims processing, member enrollment, and customer support to reduce administrative costs. Healthcare payers increasingly rely on BPO vendors for scalable, end-to-end service delivery and compliance management. Growing adoption of automation, AI-based workflow optimization, and cloud-based platforms further enhance process efficiency. ITO and KPO services follow as payers invest in data-driven analytics, IT infrastructure modernization, and knowledge process solutions for risk and cost management.

- For instance, Wipro’s implementation of a data-driven and outcome-based claims transformation for an insurance client resulted in a 33% faster claims resolution process and a 20% reduction in overall costs.

By Application

Claims management services lead the market with around 33.8% share in 2024. This dominance results from the growing need to streamline claim adjudication, reduce fraud, and improve accuracy in reimbursements. Payers increasingly adopt automated claims systems to enhance turnaround time and transparency. Analytics and fraud management are expanding rapidly due to AI and predictive analytics adoption for anomaly detection. Integrated front and back-office operations gain traction as insurers seek end-to-end workflow visibility, while member and provider management services support stronger engagement and network coordination.

- For instance, HealthEdge Software Inc.’s (specifically, its ‘Source’ company’s) Payment Accountability platform for a large southeast health plan reduced the volume of claims needing re-keying by 40%, trimmed processing time by 25%, and achieved annual savings in the 6-figure range

By End Use

Private payers hold the largest share of approximately 68.2% in 2024. Their dominance stems from rising enrollment in private health insurance plans and the outsourcing of payer services to manage operational complexity. Private insurers focus on cost efficiency, customer retention, and regulatory compliance through digital transformation. Public payers also adopt outsourced services for claims and member management to support large beneficiary volumes. Increasing government healthcare spending and expansion of national health schemes continue to boost demand for technology-driven, outcome-based service delivery across the sector.

Key Growth Drivers

Rising Demand for Cost Optimization

Healthcare payers are increasingly outsourcing operational and administrative functions to reduce costs and improve efficiency. BPO and ITO services streamline claims management, enhance accuracy, and accelerate member onboarding. Growing complexity in reimbursement structures and compliance requirements has encouraged payers to adopt automation-led outsourcing. This approach enables scalable, compliant, and cost-effective workflows, allowing organizations to focus on strategic business areas while maintaining quality service delivery.

- For instance, Wipro’s work with the U.S. payer achieved a productivity improvement of 11 % and reduced defects by 5 % in claims‑processing operations.

Increasing Focus on Digital Transformation

Digital transformation is reshaping payer operations through the adoption of AI, robotic process automation, and cloud computing. These technologies improve fraud detection, claims accuracy, and data-driven insights for decision-making. Cloud-based systems enhance collaboration among payers, providers, and members by ensuring seamless data exchange. The use of analytics-driven automation enhances transparency, reduces manual errors, and accelerates turnaround times across core administrative and financial processes.

- For instance, HealthEdge customers regularly achieve first‑pass auto‑adjudication rates of 90‑97 % and at least 99 % accuracy, demonstrating the impact of automation and AI in payer operations.

Expanding Healthcare Coverage and Insurance Enrollment

The expansion of healthcare insurance globally is fueling demand for payer service providers. Government-backed health schemes and rising private insurance enrollments have led to an increase in claims processing and policy administration requirements. Payers are partnering with specialized vendors to manage large datasets, complex plan designs, and compliance obligations efficiently. This trend strengthens service delivery while ensuring accessibility and affordability in healthcare management systems.

Key Trends and Opportunities

Integration of Advanced Analytics and AI

Artificial intelligence and analytics are transforming payer operations by enabling predictive modeling, fraud detection, and process optimization. Machine learning helps identify cost leakages and optimize reimbursement processes in real time. These tools empower payers with proactive insights, supporting value-based care models and improving patient outcomes. The growing integration of AI enhances accuracy, operational intelligence, and overall productivity across payer networks.

- For instance, HGS International’s cloud acceleration initiative demonstrates rapid platform migration: 3,000 workloads (applications/systems) migrated in 4 weeks, underscoring the scalability and speed of cloud-based payer systems.

Growth of Cloud-Based Platforms

Cloud-based platforms are becoming vital for efficient, scalable payer operations. They enable real-time data sharing, improve compliance management, and reduce infrastructure costs. Payers are rapidly migrating to secure cloud environments to integrate analytics and automation tools, leading to improved collaboration between stakeholders. The flexibility of cloud systems also supports remote workforce models and accelerates digital transformation in payer ecosystems.

- For instance, Gaine’s data-management platform (Coperor) for MedCost achieved over 30% de-duplication of provider data and over 40% improvement in provider address accuracy, which bolsters claims automation and analytics.

Expansion of Value-Based Care Models

The shift toward value-based care is creating new growth opportunities for healthcare payer services. Payers are increasingly focusing on patient outcomes and cost efficiency rather than service volume. Value-based models support efficient reimbursement, data sharing, and contract management between payers and providers. This transition encourages innovation in analytics-driven systems and enhances long-term sustainability in healthcare financing.

Key Challenges

Data Privacy and Security Concerns

Handling sensitive health and financial information makes cybersecurity a top concern for payers. Evolving regulations such as HIPAA and GDPR demand stronger data protection measures, increasing operational complexity. Any breach can cause financial penalties, reputational harm, and disruption of payer operations. The growing reliance on digital and cloud-based platforms intensifies the need for robust encryption, authentication, and compliance systems.

Shortage of Skilled Workforce

A limited pool of professionals skilled in AI, data analytics, and health IT poses a major challenge for the payer services industry. The ongoing digital transition requires specialized expertise to manage automation tools and regulatory processes. However, talent shortages, high training costs, and workforce turnover hinder technological adoption and scalability. This challenge drives payers to invest in upskilling programs and partnerships to build long-term workforce capabilities.

Regional Analysis

North America

North America dominates the healthcare payer services market with an estimated 44.6% share in 2024. The region’s leadership is driven by strong adoption of outsourcing models, advanced healthcare infrastructure, and high insurance penetration. Major payers leverage AI-driven analytics, automation, and digital platforms to improve claims accuracy and operational efficiency. The United States leads due to the growing emphasis on value-based care and compliance with regulatory frameworks such as HIPAA. Canada also contributes through increased investment in administrative outsourcing to streamline payer operations and manage rising healthcare costs.

Europe

Europe accounts for around 26.3% share of the healthcare payer services market in 2024. The region’s growth is supported by expanding healthcare digitization and the implementation of electronic health record systems. European payers increasingly collaborate with outsourcing providers to enhance claims processing, fraud detection, and policy administration. Countries such as Germany, the United Kingdom, and France are major contributors, driven by growing private health insurance enrollment and regulatory modernization. The rising focus on cost containment and cross-border healthcare management continues to strengthen market expansion across the region.

Asia Pacific

Asia Pacific holds approximately 18.7% share in 2024 and is the fastest-growing region in the healthcare payer services market. Expanding insurance coverage, increasing healthcare expenditure, and rapid digital transformation drive regional growth. India, China, and Japan are emerging as major outsourcing hubs, attracting global payers due to their skilled workforce and cost advantages. Government-led initiatives to promote universal healthcare and public-private partnerships further stimulate demand for payer services. The growing integration of automation and analytics enhances operational transparency and efficiency across payer networks in the region.

Latin America

Latin America represents about 6.4% share of the healthcare payer services market in 2024. The region is witnessing steady growth as healthcare systems modernize and private insurance coverage expands. Brazil and Mexico dominate due to the adoption of digital claims processing and rising collaboration with outsourcing vendors. Growing efforts to improve healthcare accessibility and manage administrative inefficiencies boost service demand. However, regulatory fragmentation and budget constraints limit market penetration, creating opportunities for cost-efficient service providers offering tailored payer solutions.

Middle East and Africa

The Middle East and Africa region holds a 4% share in 2024, driven by expanding healthcare infrastructure and rising insurance adoption. Gulf countries such as the United Arab Emirates and Saudi Arabia lead due to their increasing investments in digital health and claims management solutions. African nations are gradually embracing outsourced payer services to improve efficiency and reduce administrative overhead. Government-led insurance schemes and the growth of private healthcare providers further support regional market growth, though challenges remain in standardizing regulations and technology adoption.

Market Segmentations:

By Type

- BPO Services

- ITO Services

- KPO Services

By Application

- Analytics and Fraud Management Services

- Claims Management Services

- Integrated Front Office Service and Back Office Operations

- Member Management Services

- Provider Management Services

- Billing and Accounts Management Services

- HR Services

By End Use

- Private Payers

- Public Payers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The key players in the healthcare payer services market include Wipro Limited, Xerox Corporation, HCL Technologies Limited, McKesson Corporation, Cognizant Technology Solutions Corporation, Genpact Limited, UnitedHealth Group Incorporated, Concentrix Corporation, Accenture plc, HP Development Company L.P., ExlService Holdings Inc., and Hinduja Global Solutions Limited. These companies are leading the competitive landscape by leveraging cutting‑edge technologies such as AI, robotic process automation, and cloud‑based solutions. They continue to enhance their market positions by offering comprehensive services that span claims processing, member and provider management, fraud detection, and advanced analytics. Through strategic partnerships, geographic expansion, and a focus on delivering scalable, cost‑effective solutions, these players are well‑positioned to capture opportunities in both private and public payer sectors. Their strong emphasis on regulatory compliance and improving operational efficiency allows them to maintain a competitive edge in a rapidly evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Wipro Limited

- Xerox Corporation

- HCL Technologies Limited

- McKesson Corporation

- Cognizant Technology Solutions Corporation

- Genpact Limited

- UnitedHealth Group Incorporated

- Concentrix Corporation

- Accenture plc

- HP Development Company L.P.

- ExlService Holdings Inc.

- Hinduja Global Solutions Limited

Recent Developments

- In 2025, McKesson announced its plan to separate its Medical-Surgical Solutions segment into an independent company to focus on specialized growth and operational excellence.

- In 2025, Accenture plc Acquired Decho to scale Palantir and gen-AI solutions for health and public-service clients, strengthening payer analytics and data platforms.

- In 2024, Genpact emphasized healthcare payer operations transformation via AI, generative AI (such as CodeGenY on their Cora platform), healthcare decision intelligence platforms, and process mining to enhance claims management, member engagement, and provider services.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow with increasing outsourcing of administrative and operational functions.

- Adoption of AI and automation technologies will enhance accuracy and reduce claim processing time.

- Cloud-based platforms will dominate due to scalability, cost efficiency, and improved compliance management.

- Value-based care models will gain momentum, promoting outcome-driven reimbursement systems.

- Integration of predictive analytics will strengthen fraud detection and decision-making capabilities.

- Partnerships between payers and technology providers will expand to support digital transformation.

- The demand for end-to-end BPO and ITO solutions will rise among private insurers.

- Cybersecurity and data governance will remain key focus areas for sustainable growth.

- Emerging markets will experience strong adoption due to expanding health insurance coverage.

- Workforce development and training in digital healthcare skills will shape future competitiveness.